Professional Documents

Culture Documents

Barrick Gold Corporation: Grade

Barrick Gold Corporation: Grade

Uploaded by

derek_2010Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Barrick Gold Corporation: Grade

Barrick Gold Corporation: Grade

Uploaded by

derek_2010Copyright:

Available Formats

February 28, 2016

Barrick Gold Corporation

NYSE: ABX - Precious Metals

Grade Earnings Quick Facts

36.4 Last Earnings Release

Last Qtr. Actual vs. Est.

10/29/2015 Dividend Yield

$0.11 / $0.11 52 Wk High

1.03%

$13.58

Next Release 02/18/2016 N/A 52 Wk Low $5.94

$13.53

02/26/2016

Year Ending 12/31/2015 $0.29 Short Interest 3% of float

Rated 'SELL' since Aug 3rd, 2013, when it

Year Ending 12/31/2016 $0.36 Market Cap $15.8B

was downgraded from 'HOLD'

Overview

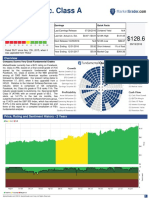

Company Scores Very Poor Fundamental Grades

MarketGrader currently has a SELL rating on Barrick

Gold Corporation (ABX), based on a final overall grade

of 36.4 scored by the company's fundamental analysis.

Barrick Gold Corporation scores at the 45th percentile

among all 6040 North American equities currently

followed by MarketGrader. Our present rating dates to

August 3, 2013, when it was downgraded from a HOLD.

Relative to the Precious Metals sub-industry, which is

comprised of 184 companies, Barrick Gold

Corporation's grade of 36.4 ranks 58th. The industry

grade leader is Perseus Mining Limited (PRU.CA) with

an overall grade of 82.0. The stock, up 83.63% in the

last six months, has outperformed both the Precious

Metals group, up 31.05% and the S&P 500 Index, which

has returned -3.52% in the same period. Please go to

pages two and three of this report for a complete

breakdown of ABX's fundamental analysis.

Price, Rating and Sentiment History - 2 Years

MarketGrader.com ©2010. MarketGrader.com Corp. All Rights Reserved. 1

February 28, 2016

Barrick Gold Corporation

NYSE: ABX - Precious Metals 36.4

Investors Betting on a Turnaround Must Be Cautious as Company's

Growth C Growth Record is Still Very Weak

Barrick Gold Corporation's sales growth continued its ongoing long term

Market Growth LT Fdecline last quarter. Total revenue for the period was $2.26 billion,

12.81% below the $2.59 billion booked by the company a year ago. Its

Market Growth ST D12-month trailing revenue, which also included last quarter's results, was

EPS Growth $9.09 billion, 37.45% lower than the 12 months ended three years ago.

A+

As sales continue to slide the company will need to cut costs in order to

Growth Potential Fprotect its margins and its cash reserves. However, unless business

conditions improve soon, more drastic restructuring measures may be Revenue Qtrly. 12/31/2015 $2.3B

Earnings Momentum B-

required. It also reported a healthy jump in profits last quarter from the Revenue Qtrly. Year Ago $2.6B

comparable period a year earlier, a marked contrast to its long term profit Revenue 1 Yr. Chg. (12.81%)

Earnings Surprise Fdecline. We measure long term profit growth by comparing the latest full Revenue 12 Mo. Tr. Latest $9.1B

year (12-month trailing) results to the equivalent period three years before. Barrick Gold Corporation's Fourth Revenue 12 Mo. Tr. 3Y Ago $14.5B

quarter profit rose to $2.62 billion from $-2.85 billion (excluding extraordinary items) a year earlier, a 8.03% Revenue 12 Mo. Tr. 3Y Chg. (37.45%)

increase, which contrasts with its 12-month trailing loss of $2.84 billion, for the period ended also last quarter,

326.77% worse than the $-665.00 million loss it posted three years before. The company reported a significant

margin contraction in its latest quarter, extending an ongoing trend; even though the pace of the decline slowed

down from the two preceding periods, these results suggest problems with its business model. Its EBITDA,

operating and net margins fell an average 16.54% relative to the year earlier period.

The company's latest earnings report of $0.11 per share, announced on October 29, 2015, which met the

consensus analyst estimate, had no effect on the price of the stock, which remained unchanged from the trading

day before the announcement to the trading day immediately following it. Despite meeting the latest consensus

estimate its average earnings surprise record is very poor; it has missed analysts' estimates by an average of

12.94% over the last six reports.

Net Income Qtrly. 12/31/2015 ($2.6B)

Net Income Qtrly. Year Ago ($2.9B)

Net Income 1 Yr. Chg. (191.97%)

Net Income 12 Mo. Tr. Latest ($2.8B)

Net Income 12 Mo. Tr. 3Y Ago ($665M)

Net Income 12 Mo. Tr. 3Y Chg. (526.77%)

Stock's Valuation Already Reflects Past Financial Results and Isn't

Value B Without Risk at this Point

Barrick Gold Corporation's current P/E ratio is not meaningful given that

Capital Structure F

the company has lost $2.04 per share in the last four quarters. Our P/E

analysis compares the stock's 12-month trailing P/E to our own calculated

P/E Analysis F

optimum P/E, which is based on the company's three-year EPS growth

Price/Book Ratio rate. Our grade is then determined based on whether the stock is trading

A-

at a discount or a premium to the optimum P/E. Barrick Gold

Price/Cash Flow Ratio A

Corporation's earnings per share have fallen at an annualized rate of -

54.63% in the last three years. This growth rate is likely to deteriorate P/E Ratio 12 Mo. Tr. 12/31/2015 -6.63

Price/Sales Ratio A+

further in light of the company's most recent margin contraction, unless it

Optimum P/E Ratio 15.00

is reversed very soon and its Profitability grades improve. The stock's

Market Value F

forward P/E of 37.95, based on the next twelve months' estimated Forward P/E Ratio 37.95

S&P 500 Forward P/E Ratio 15.20

earnings per share, is higher than its trailing P/E as well as the S&P 500's forward P/E of 15.20. Such valuation

seems out of line with the company's financial performance and EPS growth prospects, making the stock highly Price to (Tangible) Book Ratio 6.60

speculative. Price-to-Cash Flow Ratio 5.89

Price/Sales Ratio 1.73

Barrick Gold Corporation's current share price seems inexpensive compared to its book value, trading at a 2.21

price to book ratio. However, when intangible assets such as goodwill, which account for a full 66.53% of the

company's total shareholders' equity, are subtracted from its total assets, the stock's price to book ratio increases

quite significantly to 6.60, a richer multiple. The company's low price to cash flow ratio of 5.89, based on the

$2.30 it generated in cash flow per share over the last four quarters, would be an attractive valuation if its overall

fundamentals weren't so poor. Therefore such a low ratio could mean investors aren't willing to pay much for the

company's earnings prospects. Its price to sales ratio of 1.73, based on trailing 12-month sales, is 99.98% lower

than the Precious Metals's average ratio of 7671.67, a very large discount to its peers. Our final value indicator

looks at the relationship between the company's current market capitalization and its operating profits after

deducting taxes. By this measure Barrick Gold Corporation's $15.76 billion market cap is excessively high

considering it is 15.70 times its most recently reported net income plus depreciation (added back since it's a non-

cash charge).

MarketGrader.com ©2010. MarketGrader.com Corp. All Rights Reserved. 2

February 28, 2016

Barrick Gold Corporation

NYSE: ABX - Precious Metals 36.4

Company's Weak Profitability Grades Underscore a Difficult

Profitability C Operating Environment

While Barrick Gold Corporation's operating margins were higher than the

Asset Utilization F

industry average based on 12-month trailing results, the company actually

had a net loss of $X in the period, resulting in a very poor return on

Capital Utilization F

equity and a low profitability composite grade. This suggests that either

Operating Margins the company had a large non-recurring charge during this period or that

B+

its entire peer group operates in a weak business environment and is not

Relative Margins A+

very profitable. Operating income during that same period accounted for

16.06% of sales, 685.60% higher than the average operating margin for

Return on Equity F

the Precious Metals industry, which was 2.04%. Barrick Gold

Corporation's dismal return on equity of -39.75% based on its last four

Quality of Revenues F

quarter's results marks a deterioration from the year earlier period, in

which the return on equity was -28.48%. This pattern indicates either a questionable business model or extremely

difficult operating conditions.

This decline raises some questions about the soundness of the company's capital structure, which, while still

sustainable, has too much leverage relative to its very poor return on equity. Its total debt is 1.50 times its total

equity, including long term debt that accounts for 59.57% of total capital. Barrick Gold Corporation's core

earnings have shown a significant slowdown in the company's business based on twelve month trailing EBITDA

of $3.44 billion. This represents a 17.14% decline from the same period ended a year earlier in which the

company's core operations generated $4.16 billion. EBITDA is used as a measure of earnings power because it

includes non-operating charges like interest expenses, income taxes and depreciation and amortization, which

aren't even cash expenses. All of these are included in several areas of our analysis that look at EPS and net

income.

Company's Cash Flow Analysis Shows Mixed Results and Reveals a

Cash Flow B Few Operating Weaknesses

Barrick Gold Corporation's cash flow grew considerably in its latest

Cash Flow Growth A+

quarter to $675.41 million, a 122.72% increase from $303.25 million

reported in the year earlier period. This growth seems to be accelerating

EBIDTA Margin B+

considering that in the last twelve months the company's cash flow was

Debt/Cash Flow Ratio 19.89% higher than the twelve months ended a year ago, a nice increase

A

but quite lower than the current pace. This upward trend should boost its

Interest Cov. Capacity F

margins and overall profitability in the next few quarters. The company's

net debt (total debt minus cash on hand) was $8.27 billion last quarter, Cash Flow Qtrly. 12/31/2015 $675M

Economic Value C

10.18 times its $812.00 million EBITDA. Even though the current ratio is

Cash Flow Qtrly Year Ago $303M

significantly lower than last year's 10.58, Barrick Gold Corporation

Retention Rate F

leverage relative to operating cash flow is too high and may constrain the Cash Flow 1 Yr. Chg. 122.72%

Cash Flow 12 Mo. Tr. Latest $2.7B

company's ability to manage its capital structure effectively as the business cycle changes (by paying down debt

or raising capital to fuel new growth). Barrick Gold Corporation's total debt as a percentage of total capital Cash Flow 12 Mo. Tr. 3Y Ago $5.5B

increased in the last twelve months to 60.08% from 56.24%, measured on a quarter to quarter basis, while cash Cash Flow 12 Mo. Tr. 3Y Chg. (51.2%)

on hand fell from $2.71 billion to $2.48 billion in the same period, a 8.54% drop. If this increased leverage were to Free Cash Flow Last Qtr. $301M

become a trend over the next few quarters it could jeopardize future earnings growth.

According to our Economic Value indicator, which measures a company's true economic profit, Barrick Gold

Corporation's return to its shareholders has been very poor during the last year. What's most important about this Economic Value

indicator is the fact that it takes into account not only the operating costs incurred by the company in running the Total Invested Capital $17.9B

business but also the costs of the capital it employs. Barrick Gold Corporation had $17.66 billion in invested Return on Inv. Capital 8.27%

capital as of its most recently reported quarter, including all forms of equity (common and preferred) and long term Weighted Cost of Equity (0.13%)

debt. And based on its 12-month trailing operating income it generated a 8.27% return on that invested capital Weighted Cost of Debt 4.22%

over the same period. The total after tax cost of capital was heavily weighted towards debt, with a cost of 4.22% Total Cost of Capital 4.09%

compared to the 0.13% weighted cost of equity. When deducting the resulting 4.09% total cost of capital from the Economic Value Added 4.18%

firm's return on investment, its economic value added, or EVA, was a dismal 4.18%. This is a very poor reward for

shareholders tying up their capital with this company. The company announced on March 31, 2015 that it was

cutting its quarterly common dividend 60.00% to 2.00 cents a share from 5.00 cents. Barrick Gold Corporation

has been paying a dividend to its common shareholders for at least 29 years. Including the latest payout, the

stock is currently yielding 1.03%. Barrick Gold Corporation, which lost $2.84 billion during the last 12 months, still

managed to pay out $160.00 million in dividends during the period, which accounted for 5.98% of its cash flow.

Calculating its payout ratio as a percentage of earnings is not meaningful given the company's losses. The fact

that it continues its dividend payout in the face of such losses raises questions about the business' viability,

especially as it continues to deplete its balance sheet and erode its liquidity.

MarketGrader.com ©2010. MarketGrader.com Corp. All Rights Reserved. 3

February 28, 2016

Barrick Gold Corporation

NYSE: ABX - Precious Metals 36.4

Profile

Barrick Gold Corp. is engaged in the production and sale of gold, as well as related activities which Key Facts:

include exploration and mine development. It also produces copper from the Zaldivar and Lumwana Brookfield PlaceTD Canada Trust

mines and holds other interests, including a nickel development project located in Africa and a Toronto ,ON M5J 2S1

copper-gold project in Pakistan. It operates globally, with a portfolio of 27 operating mines and Phone:

www.barrick.com

advanced exploration and development projects located across the world, and land positions on

some of the prolific and prospective mineral trends. The company was founded by Peter D. Munk in

1983 and is headquartered in Toronto, Canada. Biggest Company in Sub-Industry

Barrick Gold Corporation

Grade 35.6

Market Cap:$21.29 billion

Smallest Company in Sub-Industry

Montan Mining Corp (MNY.CA)

Grade 15.1

Market Cap:$0.49 million

MarketGrader Dilution Analysis Income Last Qtr 12 Mo.

Statement (12/2015) Trailing

Impact of Change in Shares on EPS - Q4 2015

Dilution Summary Revenue $2.3B $9.1B

*EPS Latest ($2.25) Op. Income $355M $1.5B

*EPS Year Ago ($2.45)

Net Income ($2.6B) ($2.8B)

EPS Change 1 Yr. 8%

*EPS ($2.25) 0

C. Shares - Latest(M) 1,165

C. Shares - Yr Ago(M) 1,165 *Earnings per share are based on fully diluted net income per share

excluding extrodinary items. This number may not match the

C. Shares - 1Yr Chg. 0% headline number reported by the company.

EPS if Yr. Ago Shares ($2.25)

EPS Chg. if Yr. Ago 8%

EPS Loss from Dilution $0.00

Balance Sheet Latest

Total Assets $26.3B

*Earnings per share are based on fully diluted net income per share excluding extrodinary items. This number may not match the headline number reported by the company.

Total Debt $10.7B

Stockholders Eq. $7.1B

All numbers in millions except EPS

Ratios

Price/Earnings (12 mo. trailing) -6.63

Price/Tangible Book 6.60

Price/Cash Flow 5.89

Price/Sales 1.73

Debt/Cash Flow 401.35

Return on Equity (39.75%)

Gross Margin (12 mo. trailing) 20.63%

Operating Margin (12 mo. trailing) 16.06%

Total Assets $26.3B '11 '12 '13 '14 '15

Net Profit Margin (12 mo. trailing) (31.21%)

Intangible Assets $4.8B Qtr 1 0.12 0.20 0.20 0.05 0.05

Long Term Debt $10.5B Qtr 2 0.12 0.20 0.05 0.05 0.02

Total Debt $10.7B Qtr 3 0.15 0.20 0.05 0.05 0.02

Book Value $7.1B Qtr 4 0.15 0.20 0.05 0.05 0.02

Enterprise Value $8.3B

MarketGrader.com ©2010. MarketGrader.com Corp. All Rights Reserved. 4

February 28, 2016

Barrick Gold Corporation

NYSE: ABX - Precious Metals 36.4

Top Down Analysis

# Ticker Grade Sentiment Name Price Next EPS

1 LUC.CA 83.31 P Lucara Diamond Corp. $2.43 02/18/2016

Materials 2 CVX.CA 82.41 Cematrix Corporation $0.34 05/12/2016

N

Stocks in Sector: 479 3 PRU.CA 81.95 N Perseus Mining Limited $0.38 02/15/2016

Buys: 38 (7.93%) 4 GURE 75.89 N Gulf Resources, Inc. $1.70 03/14/2016

Holds: 51 (10.65%)

Sells: 390 (81.42%) 5 OCIP 75.71 N OCI Partners LP $6.59 03/16/2016

6 CFX.CA 75.63 N Canfor Pulp Products Inc. $11.02 02/17/2016

No. of stocks at:

7 APV.CA 75.35 N Apivio Systems Inc. $0.40 04/21/2016

52-Wk. High: 14

52-Wk. Low: 25 8 ITP.CA 73.28 N Intertape Polymer Group Inc. $16.25 03/02/2016

Above 50 & 200-day MA: 173 9 MND.CA 71.91 N Mandalay Resources Corporation $0.88 02/16/2016

Below 50 & 200-day MA: 159

10 DOW 71.52 N Dow Chemical Company $48.74 04/28/2016

207 ABX 36.35 N Barrick Gold Corporation $13.53 04/27/2016

# Ticker Grade Sentiment Name Price Next EPS

1 PRU.CA 81.95 N Perseus Mining Limited $0.38 02/15/2016

Precious Metals 2 KSK.CA 64.66 Kiska Metals Corporation $0.03 04/26/2016

N

Stocks in Sub-Industry: 184 3 AEM.CA 64.25 N Agnico-Eagle Mines Limited $46.72 04/29/2016

Buys: 5 (2.72%) 4 OGC.CA 63.08 N OceanaGold Corporation $3.59 04/26/2016

Holds: 16 (8.70%)

Sells: 163 (88.59%) 5 KDX.CA 60.31 N Klondex Mines Ltd. $3.58 03/23/2016

6 NMI.CA 57.96 P Newmarket Gold Inc $1.88 03/04/2016

No. of stocks at:

7 RGL.CA 57.49 N Royal Gold, Inc. $60.64 04/28/2016

52-Wk. High: 9

52-Wk. Low: 11 8 GCM.CA 56.64 N Gran Colombia Gold Corp. $0.09 11/12/2015

Above 50 & 200-day MA: 115 9 RGLD 56.16 N Royal Gold, Inc. $44.82 04/28/2016

Below 50 & 200-day MA: 25

10 CEE.CA 55.35 N Centamin plc $1.66 03/21/2016

58 ABX 36.35 N Barrick Gold Corporation $13.53 04/27/2016

1. Price Trend. B 2. Price Momentum. A+

5.1

3. Earnings Guidance. F 4. Short Interest. A-

Copyright 2010 MarketGrader.com Corp. All rights reserved. Any unauthorized use or disclosure is prohibited. Neither the information nor any opinion expressed constitutes an offer to buy or sell any securities or any options, futures or other derivatives related to

such securities ("related investments"). The information herein was obtained from various sources; we do not guarantee its accuracy or completeness. This research report is prepared for general circulation and is circulated for general information only. It does not

have regards to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any securities or investment

strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities, if any, may fluctuate and that each security's price or value may

rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. MarketGrader does not make markets

in any of the securities mentioned in this report. MarketGrader does not have any investment banking relationships. MarketGrader and its employees may have long/short positions or holdings in the securities or other related investments of companies mentioned

herein. Officers or Directors of MarketGrader.com Corp. are not employees of covered companies. MarketGrader or any of its employees do not own shares equal to one percent or more of the company in this report.

MarketGrader.com ©2010. MarketGrader.com Corp. All Rights Reserved. 5

You might also like

- Wilson Lumber Company Case StudyDocument16 pagesWilson Lumber Company Case StudyHoda J. ElrayesNo ratings yet

- Business Valuation - Determining Business WorthDocument5 pagesBusiness Valuation - Determining Business WorthAnthony Sanglay, Jr.No ratings yet

- Forensic and Investigative AccountingDocument51 pagesForensic and Investigative AccountingNarendra Sengupta100% (5)

- National Oilwell Varco, Inc.: GradeDocument5 pagesNational Oilwell Varco, Inc.: Gradederek_2010No ratings yet

- MG - MDTDocument5 pagesMG - MDTderek_2010No ratings yet

- Novo Nordisk A/S Sponsored ADR Class B: GradeDocument5 pagesNovo Nordisk A/S Sponsored ADR Class B: Gradederek_2010No ratings yet

- Novo Nordisk A/S Sponsored ADR Class B: GradeDocument5 pagesNovo Nordisk A/S Sponsored ADR Class B: Gradederek_2010No ratings yet

- TJX Companies, Inc.: GradeDocument5 pagesTJX Companies, Inc.: Gradederek_2010No ratings yet

- Michael Kors Holdings LTD: GradeDocument5 pagesMichael Kors Holdings LTD: Gradederek_2010No ratings yet

- Facebook, Inc. Class A: GradeDocument5 pagesFacebook, Inc. Class A: Gradederek_2010No ratings yet

- Medtronic PLC: GradeDocument5 pagesMedtronic PLC: Gradederek_2010No ratings yet

- QUALCOMM Incorporated: GradeDocument5 pagesQUALCOMM Incorporated: Gradederek_2010No ratings yet

- Pepsico, Inc.: GradeDocument5 pagesPepsico, Inc.: Gradederek_2010No ratings yet

- TCW NoteDocument9 pagesTCW NoteForexliveNo ratings yet

- CVS Health Corporation: GradeDocument5 pagesCVS Health Corporation: Gradederek_2010No ratings yet

- SCHW - ZackDocument10 pagesSCHW - ZackJessyNo ratings yet

- Bir NaDocument8 pagesBir NaForexliveNo ratings yet

- NCSM Earnings WF May 2018Document5 pagesNCSM Earnings WF May 2018minurkashNo ratings yet

- JAZZ Sellside MA PitchbookDocument47 pagesJAZZ Sellside MA PitchbookBernardo FusatoNo ratings yet

- q1 2009 NewsDocument16 pagesq1 2009 NewsAll in OneNo ratings yet

- Contacts: Media Relations Media/Investor RelationsDocument14 pagesContacts: Media Relations Media/Investor RelationsAll in OneNo ratings yet

- Tesla Research Paper From FORD RESEARCH 11.23.23Document3 pagesTesla Research Paper From FORD RESEARCH 11.23.23physicallen1791No ratings yet

- O2 Micro - Zacks - SCR - ResearchDocument10 pagesO2 Micro - Zacks - SCR - ResearchrojNo ratings yet

- q3 2009 NewsDocument14 pagesq3 2009 NewsAll in OneNo ratings yet

- Syndicate 7 - Krakatau BDocument7 pagesSyndicate 7 - Krakatau Bheda kaleniaNo ratings yet

- Alcoa Corporation $45.80 Rating: Very NegativeDocument3 pagesAlcoa Corporation $45.80 Rating: Very Negativephysicallen1791No ratings yet

- The Kroger Co. (KR) : Price, Consensus & SurpriseDocument8 pagesThe Kroger Co. (KR) : Price, Consensus & SurprisetigaciNo ratings yet

- Q223 HP Inc Earnings SummaryDocument1 pageQ223 HP Inc Earnings Summarynicolas SpritzerNo ratings yet

- Cloud Quarterly: Americas Technology: SoftwareDocument20 pagesCloud Quarterly: Americas Technology: SoftwaresabljicaNo ratings yet

- 2020 Q 1 ReleaseDocument4 pages2020 Q 1 ReleasentNo ratings yet

- Alibaba Research From Raymond James 18 November 2021Document13 pagesAlibaba Research From Raymond James 18 November 2021Maria Virginia MarquinaNo ratings yet

- Franklin Resources Inc. $27.26 Rating: Very Positive Very PositiveDocument3 pagesFranklin Resources Inc. $27.26 Rating: Very Positive Very Positiveapdusp2No ratings yet

- O/W: Seeding More Growth in The Franchise Network: Silk Laser Australia (SLA)Document8 pagesO/W: Seeding More Growth in The Franchise Network: Silk Laser Australia (SLA)Muhammad ImranNo ratings yet

- 4Q23 - Stepan Reports Fourth Quarter and Full Year 2023 ResultsDocument9 pages4Q23 - Stepan Reports Fourth Quarter and Full Year 2023 ResultscamillaporfirioNo ratings yet

- 2023 q2 Earnings Results PresentationDocument15 pages2023 q2 Earnings Results PresentationZerohedgeNo ratings yet

- TSX Mty or Us Otc Mtyff - Passive WatchDocument8 pagesTSX Mty or Us Otc Mtyff - Passive WatchwmthomsonNo ratings yet

- The Presentation MaterialsDocument28 pagesThe Presentation MaterialsValter SilveiraNo ratings yet

- J Chappell STNG Nov 1 2022Document9 pagesJ Chappell STNG Nov 1 2022xxzezo503xxNo ratings yet

- Airxpanders, Inc.: Roadshow NotesDocument6 pagesAirxpanders, Inc.: Roadshow NotesAshokNo ratings yet

- Raymond James - GBDC - GBDC Modest NAV Share - 11 PagesDocument11 pagesRaymond James - GBDC - GBDC Modest NAV Share - 11 PagesSagar PatelNo ratings yet

- HSBC Holdings PLC 3Q21 Results: Presentation To Investors and AnalystsDocument34 pagesHSBC Holdings PLC 3Q21 Results: Presentation To Investors and Analystsnoorth 010No ratings yet

- Designed To: 2009 Annual ReportDocument78 pagesDesigned To: 2009 Annual ReportAsif HaiderNo ratings yet

- Serba Dinamik Holdings Under Review: Another Results DisappointmentDocument4 pagesSerba Dinamik Holdings Under Review: Another Results DisappointmentZhi_Ming_Cheah_8136No ratings yet

- Marathon Oil Research Paper Form FORD Research 11.23.223Document3 pagesMarathon Oil Research Paper Form FORD Research 11.23.223physicallen1791No ratings yet

- Adf Foods LTDDocument9 pagesAdf Foods LTDKrishna SamhithaNo ratings yet

- U/W: Investing To Fortify BTM Growth: Polynovo (PNV)Document7 pagesU/W: Investing To Fortify BTM Growth: Polynovo (PNV)Muhammad ImranNo ratings yet

- q4 2009 NewsDocument17 pagesq4 2009 NewsAll in OneNo ratings yet

- 2020 Q 3 ReleaseDocument4 pages2020 Q 3 ReleasentNo ratings yet

- Traders Club - Nov. 21Document5 pagesTraders Club - Nov. 21Peter ErnstNo ratings yet

- Zacks Small-Cap Research: Corecivic, IncDocument8 pagesZacks Small-Cap Research: Corecivic, IncKarim LahrichiNo ratings yet

- Tesla Inc $816.73 Rating: Negative NegativeDocument3 pagesTesla Inc $816.73 Rating: Negative Negativephysicallen1791No ratings yet

- End Term Paper FACD 2020Document4 pagesEnd Term Paper FACD 2020Saksham SinhaNo ratings yet

- 2016 Baird Conference Deck FINALDocument10 pages2016 Baird Conference Deck FINALlbaker2009No ratings yet

- Webslides Q221 FinalDocument19 pagesWebslides Q221 FinalxtrangeNo ratings yet

- 2Q18 Cat Financial ResultsDocument4 pages2Q18 Cat Financial ResultsLiang ZhangNo ratings yet

- Fixed Income Investor Presentation 11-06-13Document12 pagesFixed Income Investor Presentation 11-06-13Debi PrasadNo ratings yet

- CHGI Focus Report 5-7-09Document6 pagesCHGI Focus Report 5-7-09capitalgc100% (2)

- Alkali Metals Limited - R - 26112020Document7 pagesAlkali Metals Limited - R - 26112020Yogi173No ratings yet

- Research Report - Vipshop Holdings LimitedDocument5 pagesResearch Report - Vipshop Holdings LimitedGlen BorgNo ratings yet

- BofA The Presentation Materials - 3Q23Document43 pagesBofA The Presentation Materials - 3Q23Zerohedge100% (1)

- MBA 503 Milestone 2 - LawiDocument8 pagesMBA 503 Milestone 2 - LawiJeremy LawiNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Bmi C Amer 17 09 PDFDocument13 pagesBmi C Amer 17 09 PDFderek_2010No ratings yet

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Important Notice:: DisclaimerDocument13 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Bmi Brazil 17 10Document9 pagesBmi Brazil 17 10derek_2010No ratings yet

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Bmi C Amer 17 07Document13 pagesBmi C Amer 17 07derek_2010No ratings yet

- Bmi Andean 19 05Document13 pagesBmi Andean 19 05derek_2010No ratings yet

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Bmi Venez 18 07Document13 pagesBmi Venez 18 07derek_2010No ratings yet

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- BUY BUY BUY BUY: Pepsico IncDocument5 pagesBUY BUY BUY BUY: Pepsico Incderek_2010No ratings yet

- Bmi Brazil 16 04Document9 pagesBmi Brazil 16 04derek_2010No ratings yet

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Important Notice:: DisclaimerDocument17 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- BUY BUY BUY BUY: TJX Companies IncDocument5 pagesBUY BUY BUY BUY: TJX Companies Incderek_2010No ratings yet

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Important Notice:: DisclaimerDocument13 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Summary - Reading 23Document5 pagesSummary - Reading 23derek_2010No ratings yet

- Summary - Reading 25Document7 pagesSummary - Reading 25derek_2010No ratings yet

- Summary - Reading 24Document4 pagesSummary - Reading 24derek_2010No ratings yet

- BUY BUY BUY BUY: Pepsico IncDocument5 pagesBUY BUY BUY BUY: Pepsico Incderek_2010No ratings yet

- BUY BUY BUY BUY: Paychex IncDocument5 pagesBUY BUY BUY BUY: Paychex Incderek_2010No ratings yet

- BUY BUY BUY BUY: Skyworks Solutions IncDocument5 pagesBUY BUY BUY BUY: Skyworks Solutions Incderek_2010No ratings yet

- BUY BUY BUY BUY: Novo Nordisk A/SDocument5 pagesBUY BUY BUY BUY: Novo Nordisk A/Sderek_2010No ratings yet

- Navneet Education Ltd. Research Report Prateek - SalampuriaDocument24 pagesNavneet Education Ltd. Research Report Prateek - SalampuriaPrateek Salampuria100% (1)

- BPM Financial Modelling Fundamentals Practical Exercise SolutionsDocument19 pagesBPM Financial Modelling Fundamentals Practical Exercise SolutionsDaria YurovaNo ratings yet

- EMP - 2009 Annual Reports PDFDocument116 pagesEMP - 2009 Annual Reports PDFpuput utomoNo ratings yet

- Trimble Inc.: Investor Presentation August 2019Document21 pagesTrimble Inc.: Investor Presentation August 2019edgarmerchanNo ratings yet

- Revised CAM Format Salaried SENP Version 1 - FinalDocument58 pagesRevised CAM Format Salaried SENP Version 1 - FinalJatin PithadiyaNo ratings yet

- Fugro 2013 PDFDocument214 pagesFugro 2013 PDFJasper Laarmans Teixeira de MattosNo ratings yet

- Business Valuation IIDocument30 pagesBusiness Valuation IIsuneshdeviNo ratings yet

- Asset Management PrepDocument6 pagesAsset Management PrepCharlotte HoNo ratings yet

- H1 / Q2-Fy19 Earnings Presentation: Everest Industries LimitedDocument27 pagesH1 / Q2-Fy19 Earnings Presentation: Everest Industries LimitedMahamadali DesaiNo ratings yet

- 2002 CFA Level II Examination Morning Session - Essay: Candidate NumberDocument30 pages2002 CFA Level II Examination Morning Session - Essay: Candidate NumberSardonna FongNo ratings yet

- Carrier Draft ValuationDocument51 pagesCarrier Draft ValuationSergei MoshenkovNo ratings yet

- JPM MCPDocument11 pagesJPM MCPmmmansfiNo ratings yet

- Paper 6 C Case Studies PDFDocument219 pagesPaper 6 C Case Studies PDFSarvesh SinghNo ratings yet

- Q2 H1-FY20 Concall HighlightsDocument188 pagesQ2 H1-FY20 Concall HighlightsRazesh BoradNo ratings yet

- Never Seen BeforeDocument336 pagesNever Seen BeforepercheNo ratings yet

- Ame Research Thesis 11-13-2014Document890 pagesAme Research Thesis 11-13-2014ValueWalkNo ratings yet

- 2nd Assignment of Financial ManagementDocument6 pages2nd Assignment of Financial Managementpratiksha24No ratings yet

- Ch02 Mini CaseDocument5 pagesCh02 Mini CaseJosé Augusto BernabéNo ratings yet

- MSP Steel & PowerDocument7 pagesMSP Steel & PowerraghuNo ratings yet

- Android App Development For Dummies 3rd EditionDocument377 pagesAndroid App Development For Dummies 3rd EditionSiva KarthikNo ratings yet

- PrivCo Private Company Knowledge BankDocument85 pagesPrivCo Private Company Knowledge BankAlex Schukin100% (1)

- Answer 1.: Straight Line DepreciationDocument11 pagesAnswer 1.: Straight Line DepreciationDanish ShaikhNo ratings yet

- Horizontal & Vertical Analysis of Maruti Suzuki India LTDDocument17 pagesHorizontal & Vertical Analysis of Maruti Suzuki India LTDBerkshire Hathway coldNo ratings yet

- Rashmi Metaliks LTD - Financial Health ReportDocument9 pagesRashmi Metaliks LTD - Financial Health ReportNishant GauravNo ratings yet

- Infiniti Retail LTD (6596268Z IN) - Income StatementDocument2 pagesInfiniti Retail LTD (6596268Z IN) - Income StatementDeepak SaxenaNo ratings yet

- BAV End Term SolutionDocument2 pagesBAV End Term SolutionShreyansh SinghviNo ratings yet

- BSBFIM501 - Manage Budgets and Financial Plans: Assessment 2 - Project (Case Study)Document8 pagesBSBFIM501 - Manage Budgets and Financial Plans: Assessment 2 - Project (Case Study)Anirbit GhoshNo ratings yet