Professional Documents

Culture Documents

National Saving Bank

National Saving Bank

Uploaded by

jackseenOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

National Saving Bank

National Saving Bank

Uploaded by

jackseenCopyright:

Available Formats

National Saving Bank (NSB)

Process 01 - Open New Account

Objective

The primary objective of the procedures is to provide legal authority for transaction the money

with NSB bank. This process occurs in manually in any branch of NSB.

Any citizen of Sri Lanka over 7 years of age could open an ordinary Savings Account in any

branch of the NSB which consists over 152 branches, 12 postal banking branches, 06 loan

centers and 01 ridee rekha center throughout the island. And also customer have the option of

opening the account as an individually, jointly or as a minor account.

NSB savings accounts can be opened for Category of people/organizations

Like special funds, social organizations, deposits, bank guarantees or legal compensation.

• Documents Required Opening a Savings Account

Account opening application

National Identity Card or any other identity acceptable to the bank

• Account opening procedure

Obtain application Banking Officer of any NSB branch

Complete the application form Hand over the duly completed application form with

identity card to the Banking Officer who will endorse the opening of the account.

Deposit the initial deposit requirement at the counter which is Rs.100/- or any amount

above the limit.

Submit the deposit acknowledgement to the Banking Officer who will issue the savings

pass book immediately.

The following are the key features that entail the scheme.

Simplified account opening procedure.

Longer business hours for transactions.

Attractive interest payment to the minimum balance held monthly.

Interest for a minimum balance of Rs. 100/-

Loans against deposits at a lesser interest rate.

Life cover up to One Million according to the account balance.

ATM / Master Debit / Shopping card facility.

100% government guarantee on all your savings and interest earned thereon

Standing order facility

Interest will be calculated daily and credited to the account monthly.

Special Benefits that receive for the Account holders

The salient feature of this account is free funds transfer to any NSB Account.

ATM / Master Debit / Shopping card which enables you to transact with up to ten

accounts

VIP priority

Account holders are entitled to nomination facility.

The Interest will be calculated daily and credited to the account monthly.

NSB offers 100% Government Guarantee on all your deposits.

Type of Account that NSB offer for the customer

Saving Account: Ordinary Savings, Post Office Savings, Happy Saving, NSB pension+,

Extra XL Bonus

Minor Accounts: Hapan Prarthana

Teenage Accounts: Ithuru mithuru

Ladies Accounts: Sthree Accounts

Senior Citizens Accounts: Gaurawa Pensioners Account

Input Process Output

Application Check details Issue pass

And approve Book

application

http://www.nsb.lk/Ordinary_savings.php

You might also like

- F D Bond GeneraterDocument1 pageF D Bond GeneraterJayprakash VermaNo ratings yet

- Check Writing TemplateDocument10 pagesCheck Writing TemplateAmelia Fizer100% (1)

- Current AccountDocument21 pagesCurrent AccountSan Awale33% (3)

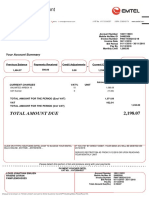

- Statement of Account VAT Invoice: Total Amount DueDocument1 pageStatement of Account VAT Invoice: Total Amount DueJonathan EmilienNo ratings yet

- FM Current Account 1Document9 pagesFM Current Account 1varinder_saroaNo ratings yet

- Banking Should Be Effortless. With HDFC Bank, The Efforts AreDocument28 pagesBanking Should Be Effortless. With HDFC Bank, The Efforts AreashokscribdaNo ratings yet

- Casa PresentationDocument25 pagesCasa PresentationGupta Bhawna GuptaNo ratings yet

- Current AccountDocument3 pagesCurrent AccountAmey BundeleNo ratings yet

- Savings AccountDocument27 pagesSavings AccountkjlgururajNo ratings yet

- Cbo 2Document46 pagesCbo 2CHARLIENo ratings yet

- Chapter 3 - Retail DepositsDocument115 pagesChapter 3 - Retail Depositssudpost4uNo ratings yet

- Marketing Mix OldDocument15 pagesMarketing Mix OldAisha rashidNo ratings yet

- Regular Savings Account - India Post Payments BankDocument2 pagesRegular Savings Account - India Post Payments Bankkaran kolheNo ratings yet

- Saving AccountDocument29 pagesSaving AccountramshaNo ratings yet

- HDFC ServicesDocument16 pagesHDFC ServicesVenkateshwar Dasari NethaNo ratings yet

- HDFC - Saving AccountsDocument11 pagesHDFC - Saving Accountsপ্রিয়াঙ্কুর ধরNo ratings yet

- 5 6226516373657356654Document230 pages5 6226516373657356654Sangeeta HatwalNo ratings yet

- Retail InfoDocument6 pagesRetail InfoRajeshNo ratings yet

- Kokan BankDocument20 pagesKokan BankramshaNo ratings yet

- Managing Your Day To Day MoneyDocument1 pageManaging Your Day To Day MoneyEarvin PaulNo ratings yet

- Soneri Bank Internship ReportDocument24 pagesSoneri Bank Internship ReportOvaIs MoInNo ratings yet

- BCM Anmol SakshiDocument19 pagesBCM Anmol SakshiSakshi GargNo ratings yet

- Deposit Schemes: Savings Plus AccountDocument17 pagesDeposit Schemes: Savings Plus AccountMAnmit SIngh DadraNo ratings yet

- Details Description About Work PerformedDocument3 pagesDetails Description About Work Performedsagar kaleNo ratings yet

- Steps 4 Opening A.CDocument20 pagesSteps 4 Opening A.CBipinNo ratings yet

- Soth Indian Bank Final ProjectDocument62 pagesSoth Indian Bank Final ProjectManisha ShivhareNo ratings yet

- Module 10 (Abhishek)Document12 pagesModule 10 (Abhishek)abhishek gautamNo ratings yet

- General BankingDocument59 pagesGeneral BankingKhaleda AkhterNo ratings yet

- Lession 3 OperationsDocument13 pagesLession 3 Operationssusma susmaNo ratings yet

- Retail BankingDocument71 pagesRetail Bankingswati_rathourNo ratings yet

- PARAGRAPHDocument8 pagesPARAGRAPHAjajur RoshidNo ratings yet

- HDFC Bank Current AccountDocument11 pagesHDFC Bank Current AccountRashi virkudNo ratings yet

- Deposit SchemesDocument7 pagesDeposit SchemesTarun Garg100% (1)

- Axix Bank AccountsDocument18 pagesAxix Bank AccountsSindhu PriyaNo ratings yet

- A Guide About Bank AccountsDocument6 pagesA Guide About Bank AccountsHelloprojectNo ratings yet

- Immersion: Presented byDocument20 pagesImmersion: Presented bySathish DNo ratings yet

- Thomas 05.31.23Document32 pagesThomas 05.31.23Deuntae ThomasNo ratings yet

- FM 202 Finals3Document34 pagesFM 202 Finals3sudariodaisyre19No ratings yet

- 1 Introduction To BankingDocument8 pages1 Introduction To BankingGurnihalNo ratings yet

- Bank of BarodaDocument99 pagesBank of BarodaYash Parekh100% (2)

- Products of SoneriDocument17 pagesProducts of SoneriRafay JamshaidNo ratings yet

- Opening Bank Account Unit 4Document30 pagesOpening Bank Account Unit 4ShaifaliChauhanNo ratings yet

- Assignment 1 - Banking OperationDocument72 pagesAssignment 1 - Banking OperationRAVI JAISWANI Student, Jaipuria IndoreNo ratings yet

- Commerce 1 GRD 12 ProjectDocument12 pagesCommerce 1 GRD 12 ProjectNeriaNo ratings yet

- Retail BankingDocument14 pagesRetail BankingAkansha DasNo ratings yet

- Current AccountsDocument8 pagesCurrent AccountsAnonymous fcqc0EsXHNo ratings yet

- Current AccountsDocument8 pagesCurrent AccountsAnonymous fcqc0EsXHNo ratings yet

- CCBSDocument27 pagesCCBSNarender SinghNo ratings yet

- Difference Between Islamic Banking and Conventional Banking: Account OpeningDocument15 pagesDifference Between Islamic Banking and Conventional Banking: Account OpeningHammad AnwarNo ratings yet

- Prestige Institute of Management and Research, IndoreDocument20 pagesPrestige Institute of Management and Research, IndoreSakshi GargNo ratings yet

- InternshipDocument28 pagesInternshipSowmiya SriniNo ratings yet

- Small Business Banking BasicsDocument23 pagesSmall Business Banking BasicsThe North Alabama African American Chamber of CommerceNo ratings yet

- File 1641790871 0004738 BLPDocument118 pagesFile 1641790871 0004738 BLPwww.ishusingh4420No ratings yet

- CBS P2Document11 pagesCBS P2sam vargheseNo ratings yet

- 12 Bad Ep Worked During InternshipDocument4 pages12 Bad Ep Worked During InternshipRabeea AsifNo ratings yet

- Cash Management ReportDocument117 pagesCash Management ReportKinjal UpadhyayNo ratings yet

- V4RFP Document As Per RCOBTDocument21 pagesV4RFP Document As Per RCOBTtofik awelNo ratings yet

- InternshipDocument37 pagesInternshipMahmood KhanNo ratings yet

- Real Time Gross Settlement (RTGS)Document5 pagesReal Time Gross Settlement (RTGS)Vinit MathurNo ratings yet

- Saving Account Salary Account Current AccountDocument32 pagesSaving Account Salary Account Current AccountSamdarshi KumarNo ratings yet

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountFrom EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountRating: 2 out of 5 stars2/5 (1)

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Monzo Bank Statement 2024 01 01 2024 03 31 40 1Document10 pagesMonzo Bank Statement 2024 01 01 2024 03 31 40 1tsundereadamsNo ratings yet

- Accounting For Banking Institutions PDFDocument45 pagesAccounting For Banking Institutions PDFNchendeh ChristianNo ratings yet

- Step-by-Step Guide To Enrolling Online: Ready To Enrol? Enrolment StepsDocument11 pagesStep-by-Step Guide To Enrolling Online: Ready To Enrol? Enrolment Stepscrescentarian77No ratings yet

- DIP Financing Strategies For Distressed CompaniesDocument9 pagesDIP Financing Strategies For Distressed CompaniesThiago CâmaraNo ratings yet

- FIN 320 Money and BankingDocument4 pagesFIN 320 Money and Bankingtanvir1674No ratings yet

- Sacco PlanDocument4 pagesSacco Planmochanda100% (1)

- QuestionDocument5 pagesQuestionakhileshmoney143No ratings yet

- Demonetisation PresentationDocument21 pagesDemonetisation PresentationNawazish KhanNo ratings yet

- New Trends in Financing Working Capital by BanksDocument9 pagesNew Trends in Financing Working Capital by BanksAparna Karuvallil100% (1)

- Project Two Chainz (Dual Process - Marry or Stay Single)Document10 pagesProject Two Chainz (Dual Process - Marry or Stay Single)iron_buddhaNo ratings yet

- Bhubaneswar Circle and BranchesDocument395 pagesBhubaneswar Circle and Branchesachyut kumarNo ratings yet

- Access To Energy Services: Case StudiesDocument14 pagesAccess To Energy Services: Case StudiesmaveryqNo ratings yet

- Chartered Accountant 2 0Document3 pagesChartered Accountant 2 0RkNo ratings yet

- Scan1 PDFDocument2 pagesScan1 PDFshaumyaNo ratings yet

- Banking and Finance Project-1Document37 pagesBanking and Finance Project-1ADITYA DHONENo ratings yet

- June 14 PDFDocument4 pagesJune 14 PDFSusan Romdenne100% (1)

- Measuring Students Attitude Toward BKashDocument34 pagesMeasuring Students Attitude Toward BKashNovoraj RoyNo ratings yet

- Ria Vs Moneygram Vs Westernunion#7 Ria Vs Moneygram Vs Westernunion Transfer SpeedDocument2 pagesRia Vs Moneygram Vs Westernunion#7 Ria Vs Moneygram Vs Westernunion Transfer SpeedAmirani JvarisashviliNo ratings yet

- Scams in IndiaDocument19 pagesScams in IndiaNirbhay SinghNo ratings yet

- 34338738-e-ticket-5VNEYM PDFDocument8 pages34338738-e-ticket-5VNEYM PDFireneNo ratings yet

- Wulan Purwandari-650294101-Hotel Santika Radial Palembang-HOTEL - STANDALONEDocument2 pagesWulan Purwandari-650294101-Hotel Santika Radial Palembang-HOTEL - STANDALONEHadiyatno HalibNo ratings yet

- Credit Perspective GetRationaleFile 102751Document5 pagesCredit Perspective GetRationaleFile 102751anil1820No ratings yet

- Labuan Ibfc Financial MarketDocument11 pagesLabuan Ibfc Financial MarketHutomoDanuSNo ratings yet

- Travel Agency of The FutureDocument8 pagesTravel Agency of The FutureDavid ChristensenNo ratings yet

- Internship AbrshDocument23 pagesInternship AbrshAbrsh AbNo ratings yet

- Finalized Judicial Affidavit - Ernesto Baniqued Branch 100-May 10, 2019, 6P.MDocument14 pagesFinalized Judicial Affidavit - Ernesto Baniqued Branch 100-May 10, 2019, 6P.MVicente CruzNo ratings yet

- Study Centre 23 October 2018Document70 pagesStudy Centre 23 October 2018Joshua Black100% (1)