Professional Documents

Culture Documents

BIR Ruling No. 010-00, 5 Jan 2000

BIR Ruling No. 010-00, 5 Jan 2000

Uploaded by

Jani MisterioOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR Ruling No. 010-00, 5 Jan 2000

BIR Ruling No. 010-00, 5 Jan 2000

Uploaded by

Jani MisterioCopyright:

Available Formats

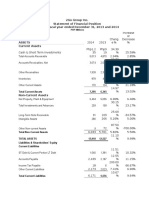

Computation of Proper Estate Tax

BIR Ruling No. 010-00

January 5, 2000

ESTATE TAX; Family Home - For purposes of the estate tax, the value of the house and lot shall be included as part

of the gross estate. The one-half share of the surviving spouse in the conjugal dwelling is then deducted from the total

gross estate to arrive at the total net estate of the decedent. Thereafter, the one-half share of the decedent to the

family home (house and lot) is allowed as a deduction from the net estate provided that if the current fair market value

of that one-half portion exceeds one million pesos, the excess shall be subject to estate tax. As a sine qua non condition

for the exemption or deduction, said family home must have been the decedent's family home as certified by the

barangay captain of the locality pursuant to Section 86(A)(4). (BIR Ruling No. 010-2000 dated January 5, 2000)

You might also like

- DEED OF SALE - PERSONAL PROPERTY in INSTALLMENTDocument2 pagesDEED OF SALE - PERSONAL PROPERTY in INSTALLMENTJani Misterio100% (1)

- Cir vs. Amex, GR No. 152609Document5 pagesCir vs. Amex, GR No. 152609Jani MisterioNo ratings yet

- Managing Corporate Governance:: Legal/Regulatory Environment and Corporate Governance Practices in The PhilippinesDocument17 pagesManaging Corporate Governance:: Legal/Regulatory Environment and Corporate Governance Practices in The Philippinesmayank.sabharwal6317No ratings yet

- 4 BIR Ruling 344-16 - Req Extension of Time To File Estate Tax Return & Pay Estate Tax (Dominga Villaluz) - BalucanagDocument1 page4 BIR Ruling 344-16 - Req Extension of Time To File Estate Tax Return & Pay Estate Tax (Dominga Villaluz) - BalucanagVikki AmorioNo ratings yet

- 01 Ching Kian Chuan V CADocument12 pages01 Ching Kian Chuan V CAWeesam EscoberNo ratings yet

- Philippines Ifrs ProfileDocument6 pagesPhilippines Ifrs Profilejsus22No ratings yet

- International Financial Reporting Standards (IFRS)Document10 pagesInternational Financial Reporting Standards (IFRS)soorajsooNo ratings yet

- IAS 21 - Effects of Changes in Foreign Exchange PDFDocument22 pagesIAS 21 - Effects of Changes in Foreign Exchange PDFJanelle SentinaNo ratings yet

- New Tax Rates (TRAIN LAW) PDFDocument1 pageNew Tax Rates (TRAIN LAW) PDFphoebemariealhambra1475No ratings yet

- INDIVIDUALSDocument6 pagesINDIVIDUALSAnne KimNo ratings yet

- Legitime Legitimate Children and Descendants Legitimate Parents and AscendantsDocument4 pagesLegitime Legitimate Children and Descendants Legitimate Parents and AscendantsVel JuneNo ratings yet

- Gross Income and DeductionsDocument126 pagesGross Income and DeductionsFCNo ratings yet

- Special Rules On Capital Transactions (Capital Gains and Losses)Document40 pagesSpecial Rules On Capital Transactions (Capital Gains and Losses)AngeliqueGiselleCNo ratings yet

- Local TaxesDocument5 pagesLocal TaxesDaphnie BoloNo ratings yet

- Republic vs. Court of Appeals, Apr. 15, 1988Document1 pageRepublic vs. Court of Appeals, Apr. 15, 1988Gamar AlihNo ratings yet

- Gross Incom TaxationDocument32 pagesGross Incom TaxationSummer ClaronNo ratings yet

- Case Digests 3Document15 pagesCase Digests 3Mary Ann ChoaNo ratings yet

- W.S. Kirkpatrick & Co. v. Environmental Tectonics Corp. InternationalDocument1 pageW.S. Kirkpatrick & Co. v. Environmental Tectonics Corp. Internationalcrlstinaaa100% (2)

- Pilipinas Shell V Commissioner of Customs 195876 CompressDocument3 pagesPilipinas Shell V Commissioner of Customs 195876 CompressEdwino Nudo Barbosa Jr.No ratings yet

- 212 Us 449Document6 pages212 Us 449Rey John Ren PachoNo ratings yet

- TCCP v. CMTADocument40 pagesTCCP v. CMTAIvan LuzuriagaNo ratings yet

- Session 1 Exercise DrillDocument5 pagesSession 1 Exercise DrillABBIE GRACE DELA CRUZNo ratings yet

- BIR - DONOR'S TaxDocument5 pagesBIR - DONOR'S TaxKim EspinaNo ratings yet

- Module 7 Chapter 9 Input VATDocument7 pagesModule 7 Chapter 9 Input VATChris SumandeNo ratings yet

- CIR vs. CA, PajonarDocument8 pagesCIR vs. CA, PajonarPhulagyn CañedoNo ratings yet

- Final Reviewer For TAX 2Document45 pagesFinal Reviewer For TAX 2Mosarah AltNo ratings yet

- Vat On Sale of Services AND Use or Lease of PropertyDocument67 pagesVat On Sale of Services AND Use or Lease of PropertyZvioule Ma FuentesNo ratings yet

- G.R. No. 190506 Coral Bay Nickel Corporation, Petitioner, Commissioner of Internal Revenue, Respondent. Decision Bersamin, J.Document3 pagesG.R. No. 190506 Coral Bay Nickel Corporation, Petitioner, Commissioner of Internal Revenue, Respondent. Decision Bersamin, J.carlo_tabangcuraNo ratings yet

- Capital Gains TaxDocument3 pagesCapital Gains TaxAJ Santos100% (2)

- New Central Bank ActDocument15 pagesNew Central Bank ActLourleth Caraballa LluzNo ratings yet

- Bir - Train Tot - Transfer TaxesDocument14 pagesBir - Train Tot - Transfer TaxesGlo GanzonNo ratings yet

- ABS-CBN Broadcasting Corporation vs. Philippine Multi-Media System, Inc., 576 SCRA 262, G.R. Nos. 175769-70 January 19, 2009Document9 pagesABS-CBN Broadcasting Corporation vs. Philippine Multi-Media System, Inc., 576 SCRA 262, G.R. Nos. 175769-70 January 19, 2009Lyka Angelique CisnerosNo ratings yet

- Estate Tax: 86, NIRC)Document15 pagesEstate Tax: 86, NIRC)Cesyl Patricia BallesterosNo ratings yet

- 2go Group IncDocument7 pages2go Group IncSheenah FerolinoNo ratings yet

- Tax ReviewerDocument68 pagesTax Reviewerviva_33No ratings yet

- Case Digest With Questions (2016 SC Taxation Cases)Document20 pagesCase Digest With Questions (2016 SC Taxation Cases)D Del SalNo ratings yet

- Revenue Regulations No 02-40Document19 pagesRevenue Regulations No 02-40corky01No ratings yet

- DOMICIANO A. AGUAS, Petitioner, vs. CONRADO G. DE LEON and COURT OF APPEALS, RespondentsDocument38 pagesDOMICIANO A. AGUAS, Petitioner, vs. CONRADO G. DE LEON and COURT OF APPEALS, RespondentsPmbNo ratings yet

- Assignment in Tax 102 What Is Transfer?Document5 pagesAssignment in Tax 102 What Is Transfer?JenniferFajutnaoArcosNo ratings yet

- VAT CasesDocument57 pagesVAT CasesGerald RoxasNo ratings yet

- RMO 20-90 - Proper Execution of The Waiver of PrescriptionDocument2 pagesRMO 20-90 - Proper Execution of The Waiver of PrescriptionTenten ConanNo ratings yet

- Ysmael Maritime Corporation vs. AvelinoDocument6 pagesYsmael Maritime Corporation vs. AvelinoAlexNo ratings yet

- Neeco I VS ErcDocument2 pagesNeeco I VS Ercangelsu04No ratings yet

- 66.eurotech Industrial Technologies, Inc. v. Cuizon, 521 SCRA 584Document12 pages66.eurotech Industrial Technologies, Inc. v. Cuizon, 521 SCRA 584bentley CobyNo ratings yet

- #222 Tumlos V Sps FernandezDocument1 page#222 Tumlos V Sps FernandezYanna Beatriz NietoNo ratings yet

- Collector vs. HaygoodDocument5 pagesCollector vs. HaygoodAJ AslaronaNo ratings yet

- Pag-Ibig Loan Availment PDFDocument24 pagesPag-Ibig Loan Availment PDFalfx216No ratings yet

- Cir vs. CA, Soriano CorpDocument3 pagesCir vs. CA, Soriano CorpkarlonovNo ratings yet

- Paseo Realty Vs Court of AppealsDocument9 pagesPaseo Realty Vs Court of AppealsChristelle Ayn BaldosNo ratings yet

- Finals in Taxation Law ReviewDocument15 pagesFinals in Taxation Law ReviewSij Da realNo ratings yet

- Felix Ting Ho JR Vs Vicente Teng Gui PDFDocument4 pagesFelix Ting Ho JR Vs Vicente Teng Gui PDFTashNo ratings yet

- Chapter 14 - Percentage Taxes2013Document11 pagesChapter 14 - Percentage Taxes2013JB RealizaNo ratings yet

- Tax Treaty Between SG and PHDocument9 pagesTax Treaty Between SG and PHCarmel LouiseNo ratings yet

- Cir Vs HendersonDocument3 pagesCir Vs Hendersoneunicesaavedra11No ratings yet

- Revenue Recognition - Installment SalesDocument3 pagesRevenue Recognition - Installment SalesMariah Janey VicenteNo ratings yet

- MV Don Martin, Et Al v. Hon. Secretary of FinanceDocument11 pagesMV Don Martin, Et Al v. Hon. Secretary of FinanceMau Antallan100% (1)

- Miscellaneous TopicsDocument20 pagesMiscellaneous TopicsheyheyNo ratings yet

- Revenue Regulations 02-03Document22 pagesRevenue Regulations 02-03Anonymous HIBt2h6z7No ratings yet

- Tax Law Review Atty. Salvador: ANÉ Ndrade IAH UA AYE Arvin O NNE Egaspi Ildred UE UMI Illanueva Zenith Iojan TEN AP BDocument109 pagesTax Law Review Atty. Salvador: ANÉ Ndrade IAH UA AYE Arvin O NNE Egaspi Ildred UE UMI Illanueva Zenith Iojan TEN AP BRufino Gerard MorenoNo ratings yet

- Estate and Donor Rrs and RamoDocument12 pagesEstate and Donor Rrs and Ramocmv mendozaNo ratings yet

- Chapter 10 Administrative Provisions FYIDocument5 pagesChapter 10 Administrative Provisions FYIJhaybie San BuenaventuraNo ratings yet

- Estate Tax: Estate Tax Is Imposed On The Right To Transfer Property by Death. It Is Levied On TheDocument29 pagesEstate Tax: Estate Tax Is Imposed On The Right To Transfer Property by Death. It Is Levied On TheNikka Adrienne Menchavez0% (1)

- Deed of DonationDocument2 pagesDeed of DonationJani MisterioNo ratings yet

- Maruhom Vs COMELEC - JKM 1st CaseDocument1 pageMaruhom Vs COMELEC - JKM 1st CaseJani MisterioNo ratings yet

- Succession Case DigestsDocument10 pagesSuccession Case DigestsJani MisterioNo ratings yet

- Converse Rubber Corp. Vs Universal Rubber Products, Inc. GR No. L-27906 January 8, 1987Document1 pageConverse Rubber Corp. Vs Universal Rubber Products, Inc. GR No. L-27906 January 8, 1987Jani Misterio0% (1)

- Philippine First Insurance CoDocument1 pagePhilippine First Insurance CoJani MisterioNo ratings yet

- Possible Defense of COMELEC Against PEDRODocument1 pagePossible Defense of COMELEC Against PEDROJani MisterioNo ratings yet

- Filscap VsDocument2 pagesFilscap VsJani MisterioNo ratings yet

- Corporation Law Course Syllabus Part I - General ProvisionsDocument11 pagesCorporation Law Course Syllabus Part I - General ProvisionsJani MisterioNo ratings yet

- Defenses of PedroDocument3 pagesDefenses of PedroJani MisterioNo ratings yet

- GR L-5405Document27 pagesGR L-5405Jani MisterioNo ratings yet

- Cir CaseDocument1 pageCir CaseJani MisterioNo ratings yet

- Barton Vs Leyte AsphaltDocument2 pagesBarton Vs Leyte AsphaltJani Misterio100% (1)

- PNB Vs MNL Surety - Del Rosario vs. La BadeniaDocument29 pagesPNB Vs MNL Surety - Del Rosario vs. La BadeniaJani MisterioNo ratings yet

- ScraDocument2 pagesScraJani MisterioNo ratings yet

- DBP Vs Ca 449 SCRA 57Document5 pagesDBP Vs Ca 449 SCRA 57Jani MisterioNo ratings yet

- Formation of A Contract of SaleDocument2 pagesFormation of A Contract of SaleJani MisterioNo ratings yet

- Manila Memorial Park VS DSWD (GR No. 175356) 2013Document1 pageManila Memorial Park VS DSWD (GR No. 175356) 2013Jani MisterioNo ratings yet

- Rule 130 CasesDocument17 pagesRule 130 CasesJani Misterio100% (1)

- Villanueva Vs BalaguerDocument13 pagesVillanueva Vs BalaguerJani MisterioNo ratings yet

- Property - Atene Mem Aid 2001Document28 pagesProperty - Atene Mem Aid 2001Jani MisterioNo ratings yet

- DBP Vs Ca 449 SCRA 57Document3 pagesDBP Vs Ca 449 SCRA 57Jani MisterioNo ratings yet

- Domingo CaseDocument2 pagesDomingo CaseJani MisterioNo ratings yet

- DBP Vs Ca 449 SCRA 57Document2 pagesDBP Vs Ca 449 SCRA 57Jani MisterioNo ratings yet

- Tan VS CirDocument3 pagesTan VS CirJani MisterioNo ratings yet

- Araneta Vs Paterno - Case DigestDocument1 pageAraneta Vs Paterno - Case DigestJani MisterioNo ratings yet

- De Castro Vs CA (Agency)Document2 pagesDe Castro Vs CA (Agency)Jani MisterioNo ratings yet

- Domingo Vs DomingoDocument2 pagesDomingo Vs DomingoJani Misterio100% (1)