Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

13 viewsAttribution Performance

Attribution Performance

Uploaded by

kren24The portfolio performance evaluation compares the return of a managed portfolio to a benchmark portfolio over a period. The managed portfolio outperformed the benchmark by 1.37%. Attribution analysis shows that asset allocation contributed 0.31% of the excess return, while security selection contributed 1.06% primarily from outperformance in equity holdings.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You might also like

- Group 3 CFEV 5th Assignment-Hansson-Private-LabelDocument10 pagesGroup 3 CFEV 5th Assignment-Hansson-Private-LabelShashwat JhaNo ratings yet

- Coinbase IPO Financial ModelDocument61 pagesCoinbase IPO Financial ModelHaysam TayyabNo ratings yet

- NYSF Leveraged Buyout Model Solution Part ThreeDocument23 pagesNYSF Leveraged Buyout Model Solution Part ThreeBenNo ratings yet

- PerformanceDocument4 pagesPerformanceAshutosh BiswalNo ratings yet

- Portfolio Performance Evaluation Attribution Analysis Excess Return: Managed Portfolio Vs BenchmarkDocument4 pagesPortfolio Performance Evaluation Attribution Analysis Excess Return: Managed Portfolio Vs BenchmarkAshutosh BiswalNo ratings yet

- Sun Pharmaceutical IndustriesDocument2 pagesSun Pharmaceutical Industriessharmasumeet1987No ratings yet

- Ratio Practice QuestionDocument1 pageRatio Practice Question7dvybtdg8rNo ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- Calculation of Cost of Equity 3. Calculation For Equity CapitalDocument4 pagesCalculation of Cost of Equity 3. Calculation For Equity Capitalshivam chughNo ratings yet

- Analysis (In Millions) 2007 2006 InformationDocument18 pagesAnalysis (In Millions) 2007 2006 InformationGustin PrayogoNo ratings yet

- Analysis (In Millions) 2007 2006 InformationDocument18 pagesAnalysis (In Millions) 2007 2006 InformationGustin PrayogoNo ratings yet

- Industry Median 2018 2017 2016 2015 2014 2013 2012Document10 pagesIndustry Median 2018 2017 2016 2015 2014 2013 2012AnuragNo ratings yet

- Chapter 24Document7 pagesChapter 24JosuaNo ratings yet

- DCF Modelling - WACC - CompletedDocument1 pageDCF Modelling - WACC - Completed2203037No ratings yet

- Discounted Cash Flow-Model For ValuationDocument9 pagesDiscounted Cash Flow-Model For ValuationPCM StresconNo ratings yet

- Pe RatiosDocument6 pagesPe RatiosRakesh SharmaNo ratings yet

- Earnings Quality Score 28 20: State Bank of India - Income Statement 11-Sep-2021 21:30Document36 pagesEarnings Quality Score 28 20: State Bank of India - Income Statement 11-Sep-2021 21:30Naman KalraNo ratings yet

- Ratio Analysis TemplateDocument3 pagesRatio Analysis Templateعمر El KheberyNo ratings yet

- DCF Modelling - WACC - CompletedDocument6 pagesDCF Modelling - WACC - Completedkukrejanikhil70No ratings yet

- Hisar Spinning Mills LTD Ratios Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Per Share RatiosDocument5 pagesHisar Spinning Mills LTD Ratios Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Per Share Ratiossmartmegha8116947No ratings yet

- Exercise On Factor AnalysisDocument4 pagesExercise On Factor AnalysisFCNo ratings yet

- BoeingDocument11 pagesBoeingPreksha GulatiNo ratings yet

- Masonite Corp DCF Analysis FinalDocument5 pagesMasonite Corp DCF Analysis FinaladiNo ratings yet

- Finratio BTW F1Document2 pagesFinratio BTW F1saptophs.fatNo ratings yet

- Particulars Amount ($ Millions) Interest Rate (%) Long Term DebtDocument10 pagesParticulars Amount ($ Millions) Interest Rate (%) Long Term DebtShrishti GoyalNo ratings yet

- DCF ModelingDocument8 pagesDCF Modelingramanshekhawat719No ratings yet

- Ratio Analysis TemplateDocument3 pagesRatio Analysis TemplateTom CatNo ratings yet

- Financial Management: AssignmentDocument7 pagesFinancial Management: AssignmentAlysaad LasiNo ratings yet

- July 2009 Return SheetsDocument3 pagesJuly 2009 Return SheetsbentleyinvestmentgroupNo ratings yet

- Eps N LevrageDocument7 pagesEps N LevrageShailesh SuranaNo ratings yet

- Ratio Analysis: Growth Ratios 2016Document3 pagesRatio Analysis: Growth Ratios 2016radulescuandrei100No ratings yet

- Nerolac - On Ratio - SolvedDocument6 pagesNerolac - On Ratio - Solvedricha krishnaNo ratings yet

- ICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument2 pagesICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjNo ratings yet

- IIFL Finance Q1FY24 Data BookDocument11 pagesIIFL Finance Q1FY24 Data Bookvishwesheswaran1No ratings yet

- DCF Modelling - 12Document24 pagesDCF Modelling - 12sujal KumarNo ratings yet

- Dupont Analysis ModelDocument278 pagesDupont Analysis ModelKartikay GoswamiNo ratings yet

- RatiosDocument31 pagesRatiosAMegoz 25No ratings yet

- NYSF Leveraged Buyout Model Solution Part TwoDocument20 pagesNYSF Leveraged Buyout Model Solution Part TwoBenNo ratings yet

- Group 6 Project MADocument32 pagesGroup 6 Project MAPhạm Kỳ DuyênNo ratings yet

- Safari - 26-Feb-2018 at 3:42 PM-1Document1 pageSafari - 26-Feb-2018 at 3:42 PM-1Hesamuddin KhanNo ratings yet

- Portfolio Performance Analysis: Group 8Document8 pagesPortfolio Performance Analysis: Group 8AYUSHI NAGARNo ratings yet

- Adani Ports Financial RatiosDocument2 pagesAdani Ports Financial RatiosTaksh DhamiNo ratings yet

- Airtel DividdendDocument6 pagesAirtel DividdendRishab KatariaNo ratings yet

- AC First Project RatiosDocument1 pageAC First Project RatiosRobert IronsNo ratings yet

- Arun 1Document2 pagesArun 1Nishanth RioNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Basf RatiosDocument2 pagesBasf Ratiosprajaktashirke49No ratings yet

- Quarter Report Q3.19Document3 pagesQuarter Report Q3.19DEButtNo ratings yet

- Ratios 1Document2 pagesRatios 1Bhavesh RathodNo ratings yet

- MahindraDocument13 pagesMahindrashrikant.colonelNo ratings yet

- SENEA Financial AnalysisDocument22 pagesSENEA Financial Analysissidrajaffri72No ratings yet

- Union Bank - MP: Result TableDocument4 pagesUnion Bank - MP: Result TableManjunath ManjuNo ratings yet

- December 31 2004 2005 2006 2007 2008 2009Document2 pagesDecember 31 2004 2005 2006 2007 2008 2009adilroseNo ratings yet

- 2.valuation - TDM - WITHOUT - SOLUTIONS Slim FinalDocument55 pages2.valuation - TDM - WITHOUT - SOLUTIONS Slim FinalMeriam HaouesNo ratings yet

- Book 11Document79 pagesBook 11usman12345678No ratings yet

- The Warren Buffett Spreadsheet v16 - PreviewDocument589 pagesThe Warren Buffett Spreadsheet v16 - PreviewNikhil SharmaNo ratings yet

- Wip Ro Key Financial Ratios - in Rs. Cr.Document4 pagesWip Ro Key Financial Ratios - in Rs. Cr.Priyanck VaisshNo ratings yet

- Fixed Income Attribution AnalysisDocument21 pagesFixed Income Attribution AnalysisJaz MNo ratings yet

- DCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranDocument12 pagesDCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranSahaana VijayNo ratings yet

- CFA L3 Final Review Publication PDFDocument20 pagesCFA L3 Final Review Publication PDFkren24No ratings yet

- Flash CardDocument13 pagesFlash Cardkren24No ratings yet

- Level I Mock Exam Morning Versionb Questions 2014 PDFDocument31 pagesLevel I Mock Exam Morning Versionb Questions 2014 PDFkren24No ratings yet

- Preferred Shares - YTC TemplateDocument11 pagesPreferred Shares - YTC Templatekren24No ratings yet

- V2 2014CFA一级 企业理财 纪慧诚1 PDFDocument133 pagesV2 2014CFA一级 企业理财 纪慧诚1 PDFkren24No ratings yet

- CFA Level II Item-Set - Questions Study Session 3 June 2019: Reading 7 Correlation and RegressionDocument30 pagesCFA Level II Item-Set - Questions Study Session 3 June 2019: Reading 7 Correlation and Regressionkren24No ratings yet

- Perf LS FundDocument4 pagesPerf LS Fundkren24No ratings yet

- Ips - GfeduDocument18 pagesIps - Gfedukren24No ratings yet

- Beginning Q1 Q1 Offer Difference Proposed Weight Duration YTM Proposed WeightDocument2 pagesBeginning Q1 Q1 Offer Difference Proposed Weight Duration YTM Proposed Weightkren24No ratings yet

- 2017 Weekly Calendar - Starts With Monday: This Excel Calendar Is Blank & Designed For Easy Use As A PlannerDocument3 pages2017 Weekly Calendar - Starts With Monday: This Excel Calendar Is Blank & Designed For Easy Use As A Plannerkren24No ratings yet

- 2007 L1 Sample Exam V1 AnsDocument1 page2007 L1 Sample Exam V1 Anskren24No ratings yet

- Chapter 10 Other MultiplesDocument28 pagesChapter 10 Other Multipleskren24No ratings yet

- SPRR Framework PDFDocument2 pagesSPRR Framework PDFkren24No ratings yet

- Hedonic Value of Transit Accessibility: An Empirical Analysis in A Small Urban AreaDocument21 pagesHedonic Value of Transit Accessibility: An Empirical Analysis in A Small Urban Areakren24No ratings yet

- Corporate Bond ValuationDocument47 pagesCorporate Bond Valuationkren24No ratings yet

- Mckinsey-Model For Valuation of CompaniesDocument56 pagesMckinsey-Model For Valuation of CompaniesarjunrampalNo ratings yet

Attribution Performance

Attribution Performance

Uploaded by

kren240 ratings0% found this document useful (0 votes)

13 views4 pagesThe portfolio performance evaluation compares the return of a managed portfolio to a benchmark portfolio over a period. The managed portfolio outperformed the benchmark by 1.37%. Attribution analysis shows that asset allocation contributed 0.31% of the excess return, while security selection contributed 1.06% primarily from outperformance in equity holdings.

Original Description:

attribution

Original Title

attribution performance

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe portfolio performance evaluation compares the return of a managed portfolio to a benchmark portfolio over a period. The managed portfolio outperformed the benchmark by 1.37%. Attribution analysis shows that asset allocation contributed 0.31% of the excess return, while security selection contributed 1.06% primarily from outperformance in equity holdings.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

13 views4 pagesAttribution Performance

Attribution Performance

Uploaded by

kren24The portfolio performance evaluation compares the return of a managed portfolio to a benchmark portfolio over a period. The managed portfolio outperformed the benchmark by 1.37%. Attribution analysis shows that asset allocation contributed 0.31% of the excess return, while security selection contributed 1.06% primarily from outperformance in equity holdings.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 4

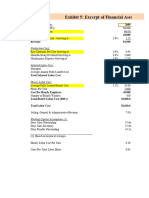

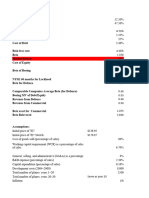

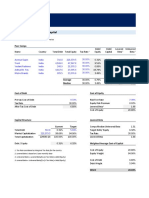

Portfolio Performance Evaluation

Attribution Analysis

Excess Return: Managed Portfolio vs Benchmark

Benchmark Return of Index

Component Weight during Period Performance

Equity (FUSEX) 60% 5.81% 3.49%

Bonds (VUSTX) 30% 1.45% 0.44%

Cash 10% 0.48% 0.05%

Bogey (Benchmark Portfolio) Return 3.97%

Return of Managed Portfolio 5.34%

Excess return of managed portfolio 1.37%

Contribution of Asset Allocation to Performance

(1) (2) (3) (4) (3)x(4)

Managed Benchmark Component

Portfolio Portfolio Excess Return minus Total Contribution to

Component Weights Weights Weight Benchmark Return Performance

Equity 70% 60% 10% 1.84% 0.184%

Bonds 7% 30% -23% -2.52% 0.579%

Cash 23% 10% 13% -3.49% -0.454%

Contribution of Asset Allocation 0.310%

Contribution of Security Selection to Performance

(1) (2) (3) (4) (3)x(4)

Managed Component

Portfolio Index Excess Managed Portfolio Contribution to

Component Performance Performance Performance Weight Performance

Equity 7.28% 5.81% 1.47% 70.00% 1.029%

Bonds 1.89% 1.45% 0.44% 7.00% 0.031%

Cash 0.48% 0.48% 0.00% 23.00% 0.000%

Contribution of Security Selection 1.060%

Portfolio Attribution Summary

Contribution

1 Asset Allocation 0.310%

2 Selection

1 Equity excess return 1.029%

2 Bonds excess return 0.031%

3 Cash excess return 0.000% 1.060%

Total excess return on portfolio 1.370%

You might also like

- Group 3 CFEV 5th Assignment-Hansson-Private-LabelDocument10 pagesGroup 3 CFEV 5th Assignment-Hansson-Private-LabelShashwat JhaNo ratings yet

- Coinbase IPO Financial ModelDocument61 pagesCoinbase IPO Financial ModelHaysam TayyabNo ratings yet

- NYSF Leveraged Buyout Model Solution Part ThreeDocument23 pagesNYSF Leveraged Buyout Model Solution Part ThreeBenNo ratings yet

- PerformanceDocument4 pagesPerformanceAshutosh BiswalNo ratings yet

- Portfolio Performance Evaluation Attribution Analysis Excess Return: Managed Portfolio Vs BenchmarkDocument4 pagesPortfolio Performance Evaluation Attribution Analysis Excess Return: Managed Portfolio Vs BenchmarkAshutosh BiswalNo ratings yet

- Sun Pharmaceutical IndustriesDocument2 pagesSun Pharmaceutical Industriessharmasumeet1987No ratings yet

- Ratio Practice QuestionDocument1 pageRatio Practice Question7dvybtdg8rNo ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- Calculation of Cost of Equity 3. Calculation For Equity CapitalDocument4 pagesCalculation of Cost of Equity 3. Calculation For Equity Capitalshivam chughNo ratings yet

- Analysis (In Millions) 2007 2006 InformationDocument18 pagesAnalysis (In Millions) 2007 2006 InformationGustin PrayogoNo ratings yet

- Analysis (In Millions) 2007 2006 InformationDocument18 pagesAnalysis (In Millions) 2007 2006 InformationGustin PrayogoNo ratings yet

- Industry Median 2018 2017 2016 2015 2014 2013 2012Document10 pagesIndustry Median 2018 2017 2016 2015 2014 2013 2012AnuragNo ratings yet

- Chapter 24Document7 pagesChapter 24JosuaNo ratings yet

- DCF Modelling - WACC - CompletedDocument1 pageDCF Modelling - WACC - Completed2203037No ratings yet

- Discounted Cash Flow-Model For ValuationDocument9 pagesDiscounted Cash Flow-Model For ValuationPCM StresconNo ratings yet

- Pe RatiosDocument6 pagesPe RatiosRakesh SharmaNo ratings yet

- Earnings Quality Score 28 20: State Bank of India - Income Statement 11-Sep-2021 21:30Document36 pagesEarnings Quality Score 28 20: State Bank of India - Income Statement 11-Sep-2021 21:30Naman KalraNo ratings yet

- Ratio Analysis TemplateDocument3 pagesRatio Analysis Templateعمر El KheberyNo ratings yet

- DCF Modelling - WACC - CompletedDocument6 pagesDCF Modelling - WACC - Completedkukrejanikhil70No ratings yet

- Hisar Spinning Mills LTD Ratios Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Per Share RatiosDocument5 pagesHisar Spinning Mills LTD Ratios Mar ' 09 Mar ' 08 Mar ' 07 Mar ' 06 Per Share Ratiossmartmegha8116947No ratings yet

- Exercise On Factor AnalysisDocument4 pagesExercise On Factor AnalysisFCNo ratings yet

- BoeingDocument11 pagesBoeingPreksha GulatiNo ratings yet

- Masonite Corp DCF Analysis FinalDocument5 pagesMasonite Corp DCF Analysis FinaladiNo ratings yet

- Finratio BTW F1Document2 pagesFinratio BTW F1saptophs.fatNo ratings yet

- Particulars Amount ($ Millions) Interest Rate (%) Long Term DebtDocument10 pagesParticulars Amount ($ Millions) Interest Rate (%) Long Term DebtShrishti GoyalNo ratings yet

- DCF ModelingDocument8 pagesDCF Modelingramanshekhawat719No ratings yet

- Ratio Analysis TemplateDocument3 pagesRatio Analysis TemplateTom CatNo ratings yet

- Financial Management: AssignmentDocument7 pagesFinancial Management: AssignmentAlysaad LasiNo ratings yet

- July 2009 Return SheetsDocument3 pagesJuly 2009 Return SheetsbentleyinvestmentgroupNo ratings yet

- Eps N LevrageDocument7 pagesEps N LevrageShailesh SuranaNo ratings yet

- Ratio Analysis: Growth Ratios 2016Document3 pagesRatio Analysis: Growth Ratios 2016radulescuandrei100No ratings yet

- Nerolac - On Ratio - SolvedDocument6 pagesNerolac - On Ratio - Solvedricha krishnaNo ratings yet

- ICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument2 pagesICICI Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjNo ratings yet

- IIFL Finance Q1FY24 Data BookDocument11 pagesIIFL Finance Q1FY24 Data Bookvishwesheswaran1No ratings yet

- DCF Modelling - 12Document24 pagesDCF Modelling - 12sujal KumarNo ratings yet

- Dupont Analysis ModelDocument278 pagesDupont Analysis ModelKartikay GoswamiNo ratings yet

- RatiosDocument31 pagesRatiosAMegoz 25No ratings yet

- NYSF Leveraged Buyout Model Solution Part TwoDocument20 pagesNYSF Leveraged Buyout Model Solution Part TwoBenNo ratings yet

- Group 6 Project MADocument32 pagesGroup 6 Project MAPhạm Kỳ DuyênNo ratings yet

- Safari - 26-Feb-2018 at 3:42 PM-1Document1 pageSafari - 26-Feb-2018 at 3:42 PM-1Hesamuddin KhanNo ratings yet

- Portfolio Performance Analysis: Group 8Document8 pagesPortfolio Performance Analysis: Group 8AYUSHI NAGARNo ratings yet

- Adani Ports Financial RatiosDocument2 pagesAdani Ports Financial RatiosTaksh DhamiNo ratings yet

- Airtel DividdendDocument6 pagesAirtel DividdendRishab KatariaNo ratings yet

- AC First Project RatiosDocument1 pageAC First Project RatiosRobert IronsNo ratings yet

- Arun 1Document2 pagesArun 1Nishanth RioNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Basf RatiosDocument2 pagesBasf Ratiosprajaktashirke49No ratings yet

- Quarter Report Q3.19Document3 pagesQuarter Report Q3.19DEButtNo ratings yet

- Ratios 1Document2 pagesRatios 1Bhavesh RathodNo ratings yet

- MahindraDocument13 pagesMahindrashrikant.colonelNo ratings yet

- SENEA Financial AnalysisDocument22 pagesSENEA Financial Analysissidrajaffri72No ratings yet

- Union Bank - MP: Result TableDocument4 pagesUnion Bank - MP: Result TableManjunath ManjuNo ratings yet

- December 31 2004 2005 2006 2007 2008 2009Document2 pagesDecember 31 2004 2005 2006 2007 2008 2009adilroseNo ratings yet

- 2.valuation - TDM - WITHOUT - SOLUTIONS Slim FinalDocument55 pages2.valuation - TDM - WITHOUT - SOLUTIONS Slim FinalMeriam HaouesNo ratings yet

- Book 11Document79 pagesBook 11usman12345678No ratings yet

- The Warren Buffett Spreadsheet v16 - PreviewDocument589 pagesThe Warren Buffett Spreadsheet v16 - PreviewNikhil SharmaNo ratings yet

- Wip Ro Key Financial Ratios - in Rs. Cr.Document4 pagesWip Ro Key Financial Ratios - in Rs. Cr.Priyanck VaisshNo ratings yet

- Fixed Income Attribution AnalysisDocument21 pagesFixed Income Attribution AnalysisJaz MNo ratings yet

- DCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranDocument12 pagesDCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranSahaana VijayNo ratings yet

- CFA L3 Final Review Publication PDFDocument20 pagesCFA L3 Final Review Publication PDFkren24No ratings yet

- Flash CardDocument13 pagesFlash Cardkren24No ratings yet

- Level I Mock Exam Morning Versionb Questions 2014 PDFDocument31 pagesLevel I Mock Exam Morning Versionb Questions 2014 PDFkren24No ratings yet

- Preferred Shares - YTC TemplateDocument11 pagesPreferred Shares - YTC Templatekren24No ratings yet

- V2 2014CFA一级 企业理财 纪慧诚1 PDFDocument133 pagesV2 2014CFA一级 企业理财 纪慧诚1 PDFkren24No ratings yet

- CFA Level II Item-Set - Questions Study Session 3 June 2019: Reading 7 Correlation and RegressionDocument30 pagesCFA Level II Item-Set - Questions Study Session 3 June 2019: Reading 7 Correlation and Regressionkren24No ratings yet

- Perf LS FundDocument4 pagesPerf LS Fundkren24No ratings yet

- Ips - GfeduDocument18 pagesIps - Gfedukren24No ratings yet

- Beginning Q1 Q1 Offer Difference Proposed Weight Duration YTM Proposed WeightDocument2 pagesBeginning Q1 Q1 Offer Difference Proposed Weight Duration YTM Proposed Weightkren24No ratings yet

- 2017 Weekly Calendar - Starts With Monday: This Excel Calendar Is Blank & Designed For Easy Use As A PlannerDocument3 pages2017 Weekly Calendar - Starts With Monday: This Excel Calendar Is Blank & Designed For Easy Use As A Plannerkren24No ratings yet

- 2007 L1 Sample Exam V1 AnsDocument1 page2007 L1 Sample Exam V1 Anskren24No ratings yet

- Chapter 10 Other MultiplesDocument28 pagesChapter 10 Other Multipleskren24No ratings yet

- SPRR Framework PDFDocument2 pagesSPRR Framework PDFkren24No ratings yet

- Hedonic Value of Transit Accessibility: An Empirical Analysis in A Small Urban AreaDocument21 pagesHedonic Value of Transit Accessibility: An Empirical Analysis in A Small Urban Areakren24No ratings yet

- Corporate Bond ValuationDocument47 pagesCorporate Bond Valuationkren24No ratings yet

- Mckinsey-Model For Valuation of CompaniesDocument56 pagesMckinsey-Model For Valuation of CompaniesarjunrampalNo ratings yet