Professional Documents

Culture Documents

Admin Cases Pas

Admin Cases Pas

Uploaded by

KLOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Admin Cases Pas

Admin Cases Pas

Uploaded by

KLCopyright:

Available Formats

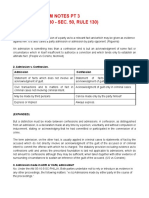

GENERAL PRINCIPLES

1. LIBAN V GORDON

FACTS:

The Court held that respondent did not forfeit his seat in the Senate when he accepted the

chairmanship of the PNRC Board of Governors, as "the of3ce of the PNRC Chairman is not a government

of3ce or an office in a government owned or controlled corporation for purposes of the prohibition in

Section 13, Article VI of the 1987 Constitution." 5 The Decision, however, further declared void the PNRC

Charter "insofar as it creates the PNRC as a private corporation".

ISSUE:

RULING:

The passage of several laws relating to the PNRC's corporate existence notwithstanding the

effectivity of the constitutional proscription on the creation of private corporations by law, is a

recognition that the PNRC is not strictly in the nature of a private corporation contemplated by the

aforesaid constitutional ban.

A National Society partakes of a sui generis character. It is a protected component of the Red

Cross movement under Articles 24 and 26 of the First Geneva Convention, especially in times of armed

confLict. The auxiliary status of [a] Red Cross Society means that it is at one and the same time a private

institution and a public service organization because the very nature of its work implies cooperation

with the authorities, a link with the State.

The purpose of the constitutional provision prohibiting Congress from creating private corporations

was to prevent the granting of special privileges to certain individuals, families, or groups, which were

denied to other groups. The PNRC Charter does not come within the spirit of this constitutional

provision, as it does not grant special privileges to a particular individual family, or group, but creates an

entity that strives to serve the common good.

The PNRC, as a National Society of the International Red Cross and Red Crescent Movement, can

neither "be classi3ed as an instrumentality of the State, so as not to lose its character of neutrality" as

well as its independence, nor strictly as a private corporation since it is regulated by international

humanitarian law and is treated as an auxiliary of the State.

2. BSP B COA

FACTS:

Res. No. 99-011 was issued classifying BSP among the government corporations belonging to the

Educational, Social, Scienti7c, Civic and Research Sector under the Corporat Audit Office I, to be

audited, similar to the subsidiary corporations, by employing the tea audit approach.

1 ADMIN CASES LMIM, 2017

BSP argued that through RA 7278, the "substantial government participation" in the National

Executive Board was removed thereby weakening the conclusion in BSP v NLRC that the BSP is a

government-controlled corporation and that the Government does not have funds invested in the

BSP. What R 7278 only provides is that the Government or any of its subdivisions, branches, offices

agencies and instrumentalities can from time to time donate and contribute funds to the BSP. It was

furthered contended that the BSP is not an "agency" of the Government. The 1987 Administrative

Code, merely referred the BSP as an "attached agency" of the DECS as distinguished from an actual

line agency of departments that are included in the National Budget. The BSP believes that an

"attached agency" is different from an "agency." Agency, as defined in Section 2(4) of the

Administrative Code, is de7ned as any of the various units of the Government including a

department, bureau, of7ce, instrumentality, government-owned or controlled corporation or local

government or distinct unit therein. Under the above definition, the BSP is neither a unit of the

Government; a department which refers to an executive department as created by law (Section 2[7]

of the Administrative Code); nor a bureau which refers to any principal subdivision or unit of any

department (Section 2[8], Administrative Code).

The COA General Counsel opined that Republic Act No. 7278 did not supersede the Court's

ruling in Boy Scouts of the Philippines v. National Labor Relations Commission, even though said law

eliminated the substantial government participation in the selection of members of the National

Executive Board of the BSP. Other considerations include the character of the BSP's purposes and

functions which has a public aspect and the statutory designation of the BSP as a "public

corporation". These grounds have not been deleted by R.A. No. 7278. Further, BSP is regarded as,

both a "government-controlled corporation with an original charter" and as an "instrumentality" of

the Government. Likewise, it is not disputed that the Administrative Code of 1987 designated the

BSP as one of the attached agencies of DECS. Being an attached agency, however, it does not change

its nature as a government-controlled corporation with original charter and, necessarily, subject to

COA audit jurisdiction. The COA contends that any attempt to classify the BSP as a private

corporation would be incomprehensible since no less than the law created it had designated it as a

public corporation and its statutory mandate embraces performance of sovereign functions.

ISSUE: WON BSP is under COA’s jurisdiction

RULING: YES. BSP is a public corporation and is within COA’s jurisdiction.

CA 111 created BSP as a public corporation. BSP falls under the 2nd category of juridical persons

under Art. 44 of the CC. The BSP, which is a corporation created for a public interest or purpose, is

subject to the law creating it under Article 45 of the Civil Code.

The public, rather than private, character of the BSP is recognized by the fact that, along with

the Girl Scouts of the Philippines, it is classified as an attached agency of the DECS under Executive

Order No. 292, or the Administrative Code of 1987.

Article XII, Section 16 bans the creation of "private corporations" by special law. The said

constitutional provision should not be construed so as to prohibit the creation of public corporations

or a corporate agency or instrumentality of the government intended to serve a public interest or

purpose.

2 ADMIN CASES LMIM, 2017

Not all corporations, which are not government owned or controlled, are ipso facto to be

considered private corporations as there exists another distinct class of corporations or chartered

institutions which are otherwise known as "public corporations." These corporations are treated by

law as agencies or instrumentalities of the government which are not subject to the tests of

ownership or control and economic viability but to different criteria relating to their public

purposes/interests or constitutional policies and objectives and their administrative relationship to

the government or any of its Departments or Offices.

Assuming for the sake of argument that the BSP ceases to be owned or controlled by the

government because of reduction of the number of representatives of the government in the BSP

Board, it does not follow that it also ceases to be a government instrumentality as it still retains all

the characteristics of the latter as an attached agency of the DECS under the Administrative Code.

Even though the amended BSP charter did away with most of the governmental presence in the BSP

Board, this was done to more strongly promote the BSP's objectives and were not done with the

view of changing the character of the BSP into a privatized corporation.

3. PHIL SOC FOR THE PREVENTION OF CRUELTY TO ANIMALS B COA

FACTS:

The petitioner was incorporated as a juridical entity over one hundred years ago by virtue of Act

No. 1285, enacted on January 19, 1905, by the Philippine Commission. At the time of the enactment of

Act No. 1285, the original Corporation Law, Act No. 1459 was not yet in existence. Act No. 1285

antedated both the Corporation Law and the constitution of the Securities and Exchange Commission.

Petitioner was initially imbued under its charter with the power to apprehend violators of animal

welfare laws. In addition, the petitioner was to share one-half (1/2) of the 0nes imposed and collected

through its efforts for violations of the laws related thereto. The petitioner demurred on the ground that

it was a private entity not exercising any governmental function and is therefore not under the

jurisdiction of COA.

Petitioner argues that, first, even though it was created by special legislation in 1905 as there

was no general law then existing under which it may be organized or incorporated, it exercises no

governmental functions because these have been revoked by C.A. No. 148 and E.O. No. 63; second,

nowhere in its charter is it indicated that it is a public corporation, third, if it were a government body,

there would have been no need for the State to grant it tax exemptions under Republic Act No. 1178

fourth, the employees of the petitioner are registered and covered by the Social Security System at the

latter's initiative and not through the Government Service Insurance System, which should have been

the case had the employees been considered government employees; fifth, the petitioner does not

receive any form of 0nancial assistance from the government, no government appointee or

representative sits on the board of trustees of the petitioner; eighth, a reading of the provisions of its

charter (Act No. 1285) fails to show that any act or decision of the petitioner is subject to the approval of

or control by any government agency, except to the extent that it is governed by the law on private

corporations in general.

3 ADMIN CASES LMIM, 2017

The respondents contend that since the petitioner is a "body politic" created by virtue of a

special legislation and endowed with a governmental purpose, then, indubitably, the COA may audit the

0nancial activities of the latter.

0rst, the test to determine whether an entity is a government

corporation lies in the manner of its creation, and, since the petitioner was created by

virtue of a special charter, it is thus a government corporation subject to respondents'

auditing power; second, the petitioner exercises "sovereign powers," that is, it is tasked to

enforce the laws for the protection and welfare of animals which "ultimately redound to the

public good and welfare," and, therefore, it is deemed to be a government "instrumentality"

as de0ned under the Administrative Code of 1987, the purpose of which is connected with

the administration of government, as purportedly af0rmed by American jurisprudence;

third, by virtue of Section 23, 11 Title II, Book III of the same Code, the Of0ce of the

President exercises supervision or control over the petitioner; fourth, under the same

Code, the requirement under its special charter for the petitioner to render a report to the

Civil Governor, whose functions have been inherited by the Of0ce of the President, clearly

reBects the nature of the petitioner as a government instrumentality; 0fth, despite the

passage of the Corporation Code, the law creating the petitioner had not been abolished,

nor had it been re-incorporated under any general corporation law; and 0nally, sixth,

Republic Act No. 8485, otherwise known as the "Animal Welfare Act of 1998," designates

the petitioner as a member of its Committee on Animal Welfare which is attached to the

Department of Agriculture.

ISSUE: whether the petitioner quali0es as a government agency that may be subject to audit by

respondent COA

RULING:

The charter test may not apply. The charter test had been introduced by the 193 Constitution and not

earlier, it follows that the test cannot apply to the petitioner, which was incorporated by virtue of Act

No. 1285, enacted on January 19, 1905. Where the charter test doctrine cannot be applied, the mere

4 ADMIN CASES LMIM, 2017

fact that a corporation has been created by virtue of a special law does not necessarily qualify it as a

public corporation.

There being neither a general law on the formation and organization of private corporations nor a

restriction on the legislature to create private corporations by direct legislation, the Philippine

Commission at that moment in history was well within its powers in 1905 to constitute the petitioner as

a private juridical entity.

Second, a reading of petitioner's charter shows that it is not subject to control or supervision by any

agency of the State, unlike government-owned and –controlled corporations. No government

representative sits on the board of trustees of the petitioner. Third. The employees of the petitioner are

registered and covered by the Social Security System at the latter's initiative, and not through the

Government Service Insurance System, which should be the case if the employees are considered

government employees. This is another indication of petitioner's nature as a private entity.

The fact that a certain juridical entity is impressed with public interest does not, by that

circumstance alone, make the entity a public corporation, inasmuch as a corporation may be private

although its charter contains provisions of a public character, incorporated solely for the public good.

This class of corporations may be considered quasi-public corporations, which are private corporations

that render public service, supply public wants, 21 or pursue other eleemosynary objectives. It must be

stressed that a quasi-public corporation is a species of private corporations, but the qualifying factor is

the type of service the former renders to the public: if it performs a public service, then it becomes a

quasi-public corporation.

The true criterion, therefore, to determine whether a corporation is public or private is found in the

totality of the relation of the corporation to the State. If the corporation is created by the State as the

latter's own agency or instrumentality to help it in carrying out its governmental functions, then that

corporation is considered public; otherwise, it is private.

By virtue of the 0ction that all corporations owe their very existence and powers to the State, the

reportorial requirement is applicable to all of whatever nature, whether they are public, quasi-public, or

private corporations — as creatures of the State, there is a reserved right in the legislature to investigate

the activities of a corporation to determine whether it acted within its powers. In other words, the

reportorial requirement is the principal means by which the State may see to it that its creature acted

according to the powers and functions conferred upon it. It would be a strange anomaly to hold that a

state, having chartered a corporation to make use of certain franchises, could not, in the exercise of

sovereignty, inquire how these franchises had been employed, and whether they had been abused, and

demand the production of the corporate books and papers for that purpose

4. PROVINCE OF NORTH COTABATO v REP PEACE PANEL

FACTS:

ISSUE:

5 ADMIN CASES LMIM, 2017

RULING:

Association as the envisioned relationship between the BJE and the Central Government-

characterized by shared authority and responsibility

o association is formed when t w o states of unequal power voluntarily establish durable

links. In the basic model, one state, the associate, delegates certain responsibilities to

the other, the principal, while maintaining its international status as a state

o in U.S. constitutional and international practice, free association is understood as an

international association between sovereigns

o associated state" arrangement has usually been used as a transitional device of former

colonies on their way to full independence

the MOA-AD, it contains many provisions which are consistent with the international legal

concept of association

o No province, city, or municipality, not even the ARMM, is recognized under our laws as

having an "associative" relationship with the national government

o It also implies the recognition of the associated entity as a state. The Constitution,

however, does not contemplate any state in this jurisdiction other than the Philippine

State, much less does it provide for a transitory status that aims to prepare any part of

Philippine territory for independence

BJE is a state in all but name as it meets the criteria of a state laid down in the Montevideo

Convention, 154 namely, a permanent population, a de<ned territory, a government, and a

capacity

o association — runs counter to the national sovereignty and territorial integrity of the

Republic.

o An associative arrangement does not uphold national unity

o the act of placing a portion of Philippine territory in a status which, in international

practice, has -+generally been a preparation for independence, is certainly not

conducive to national unity.

Again on the premise that the BJE may be regarded as an autonomous region, the MOA-AD

would require an amendment that would expand Art. X S20 (9)

6 ADMIN CASES LMIM, 2017

PRINCIPLES OF LOCAL AUTONOMY

1. BASCO V PAGCOR

FACTS:

Petitioner seeks to annul the PAGCOR Charter on the ground that:

contrary to morals, public policy and order;

waiver of a right prejudicial to a third person with a right recognized by law since it waived the

Manila City government's right to impose taxes and license fees, which is recognized by law; and is

therefore a violation of local autonomy;

violates the equal protection clause of the constitution in that it legalizes PAGCOR’s gambling;

It violates the avowed trend of the Cory government away from monopolistic and crony economy,

and toward free enterprise and privatization."

ISSUE:

RULING:

PAGCOR) was created by virtue of P.D. 1067-A dated January 1, 1977 and was granted a

franchise under P.D. 1067-B. PAGCOR was created under P.D. 1869 to enable the Government to

regulate and centralize all games of chance authorized by existing franchise or permitted by law. To

attain these objectives PAGCOR is given territorial jurisdiction all over the Philippines. Under its

Charter's repealing clause, all laws, decrees, executive orders, rules and regulations, inconsistent

therewith, are accordingly repealed.

Gambling in all its forms, unless allowed by law, is generally prohibited. But the prohibition of

gambling does not mean that the Government cannot regulate it in the exercise of its police power.

With the creation of PAGCOR and the direct intervention of the Government, the evil practices and

corruptions that go with gambling will be minimized if not totally eradicated. Public welfare, then, lies at

the bottom of the enactment of PD 1896.

The City of Manila, being a mere Municipal corporation has no inherent right to impose Taxes.

Thus, "the Charter or statute must plainly show an intent to confer that power or the municipality

cannot assume it". ts "power to tax" therefore must always yield to a legislative act which is superior

having been passed upon by the state itself which has the "inherent power to tax".

The Charter of the City of Manila is subject to control by Congress. It should be stressed that

"municipal corporations are mere creatures of Congress" which has the power to "create and abolish

municipal corporations" due to its "general legislative powers". Congress, therefore, has the power of

control over Local governments. And if Congress can grant exemptions or even take back the power.

Local governments have no power to tax instrumentalities of the National Government.

PAGCOR is a government owned or controlled corporation with an original charter, PD 1869. All of its

7 ADMIN CASES LMIM, 2017

shares of stocks are owned by the National Government. PAGCOR has a dual role, to operate and to

regulate gambling casinos. The latter role is governmental, which places it in the category of an agency

or instrumentality of the Government. Being an instrumentality of the Government, PAGCOR should be

and actually is exempt from local taxes. Otherwise, its operation might be burdened, impeded or

subjected to control by a mere Local government. The power to tax which was called by Justice Marshall

as the "power to destroy" (Mc Culloch v. Maryland, supra) cannot be allowed to defeat an

instrumentality or creation of the very entity which has the inherent power to wield it.

(Art. X S5) The power of local government to "impose taxes and fees" is always subject to

"limitations" which Congress may provide by law. Since PD 1869 remains an "operative" law until

"amended, repealed or revoked" (Sec. 3, Art. XVIII, 1987 Constitution), its "exemption clause" remains

as an exception to the exercise of the power of local governments to impose taxes and fees. It cannot

therefore be violative but rather is consistent with the principle of local autonomy. Besides, the

principle of local autonomy under the 1987 Constitution simply means "decentralization". It does not

make local governments sovereign within the state or an "imperium in imperio.

8 ADMIN CASES LMIM, 2017

2. LINA V PANO

FACTS:

Respondent Calvento was appointed by PCSO to install terminals for the operation of lotto. He

asked for Mayor Cataquiz of Laguna for a mayor’s permit which the latter denied. Subsequently, the

respondent judge, Francisco Dizon Paño, promulgated his decision enjoining the petitioners from

implementing or enforcing resolution or Kapasiyahan Blg. 508, T. 1995.

Petitioners contend that the assailed resolution is a valid policy declaration of the Provincial

Government of Laguna of its vehement objection to the operation of lotto and all forms of gambling. It

is likewise a valid exercise of the provincial government's police power under the General Welfare

Clause of Republic Act 7160. Respondent Calvento argues that the questioned resolution is, in effect, a

curtailment of the power of the state since in this case the national legislature itself had already

declared lotto as legal and permitted its operations around the country.

ISSUE: WON the denial of mayor’s permit is valid

RULING:

As a policy statement expressing the local government's objection to the lotto, such resolution is

valid. This is part of the local government's autonomy to air its views which may be contrary to that of

the national government's. However, this freedom to exercise contrary views does not mean that local

governments may actually enact ordinances that go against laws duly enacted by Congress. Given this

premise, the assailed resolution in this case could not and should not be interpreted as a measure or

ordinance prohibiting the operation of lotto.

While lotto is clearly a game of chance, the national government deems it wise and proper to

permit it. Hence, the Sangguniang Panlalawigan of Laguna, a local government unit, cannot issue a

resolution or an ordinance that would seek to prohibit permits. Stated otherwise, what the national

legislature expressly allows by law, such as lotto, a provincial board may not disallow by ordinance or

resolution.

In our system of government, the power of local government units to legislate and enact

ordinances and resolutions is merely a delegated power coming from Congress. As held in Tatel vs.

Virac, 13 ordinances should not contravene an existing statute enacted by Congress.

9 ADMIN CASES LMIM, 2017

3. LIMBONA V MANGELIN

FACTS:

Limbona was appointed as a member of the Sangguniang Pampook, Regional Autonomous

Government, Region XII, representing Lanao del Sur and elected Speaker of the Regional Legislative

Assembly or Batasang Pampook of Central Mindanao.

Congressman Matalam invited petitioner in his capacity as Speaker of the Assembly, Region XII

thus petitioner sent a telegram that there shall be no session in November. The Assembly however held

session in November in defiance of said order by petitioner. Later, the chair declared said seat of the

Speaker vacant. Petitioner now asks for a restraining order or writ of preliminary injunction be issued

enjoining respondents from proceeding with their session and that the proceedings held by respondents

be declared null and void.

ISSUE: Are the so-called autonomous governments of Mindanao, as they are now constituted, subject to

the jurisdiction of the national courts? In other words, what is the extent of self-government given to

the two autonomous governments of Region IX and XII?

RULING: YES.

PD 1618 which created the autonomous governments of Mindanao established internal

autonomy. It requires the autonomous regional governments to "undertake all internal administrative

matters for the respective regions," 19 except to "act on matters which are within the jurisdiction and

competence of the National Government,". In relation to the central government, it provides that "[t]he

President shall have the power of general supervision and control over the Autonomous Regions.

Now, autonomy is either decentralization of administration or decentralization of power. An

examination of the very Presidential Decree creating the autonomous governments of Mindanao

persuades us that they were never meant to exercise autonomy in the second sense, that is, in which

the central government commits an act of self-immolation. Presidential Decree No. 1618, in the @rst

place, mandates that "[t]he President shall have the power of general supervision and control over

Autonomous Regions."

10 ADMIN CASES LMIM, 2017

4. DISOMANGCOP V DATUMANONG

FACTS:

Republic Act No. 6734 (R.A. 6734), entitled "An Act Providing for An Organic Act for the

Autonomous Region in Muslim Mindanao," was enacted and signed into law on 1 August 1989. In

accordance with R.A. 6734, then President Corazon C. Aquino issued on 12 October 1990, Executive

Order No. 426 (E.O. 426), entitled "Placing the Control and Supervision of the OIces of the Department

of Public Works and Highways within the Autonomous Region in Muslim Mindanao under the

Autonomous Regional Government.”

(DPWH) Secretary Gregorio R. Vigilar issued D.O. 119 creating the sub-engineering office in

Marawi. RA 8999 was later passed establishing an engineering district in the first district of Lanao Del

Sur. Congress later passed Republic Act No. 9054 (R.A. 9054), entitled "An Act to Strengthen and Expand

the Organic Act for the Autonomous Region in Muslim Mindanao”.

Petitioners seek to annul DO 119 on the ground that it violates the local autonomy of the

ARMM. The OSG in defense of the constitutionality of R.A. 8999, they submit that the powers of the

autonomous regions did not diminish the legislative power of Congress.

ISSUE: WON DO 119 violates the local autonomy of ARMM

RULING: YES

The ARMM Organic Acts are deemed a part of the regional autonomy scheme. While they are

classified as statutes, the Organic Acts are more than ordinary statutes because they enjoy affirmation

by a plebiscite. Hence, the provisions thereof cannot be amended by an ordinary statute, such as R.A.

8999 in this case. The amendatory law has to be submitted to a plebiscite.

The creation of autonomous regions does not signify the establishment of a sovereignty distinct

from that of the Republic, as it can be installed only "within the framework of this Constitution and the

national sovereignty as well as territorial integrity of the Republic of the Philippines."

Regional autonomy is the degree of self-determination exercised by the local government unit

vis-à-vis the central government. In international law, the right to self-determination need not be

understood as a right to political separation, but rather as a complex net of legal-political relations

between a certain people and the state authorities. It ensures the right of peoples to the necessary level

of autonomy that would guarantee the support of their own cultural identity, the establishment of

priorities by the community's internal decision-making processes and the management of collective

matters by themselves.

A necessary prerequisite of autonomy is decentralization. Decentralization is a decision by the

central government authorizing its subordinates, whether geographically or functionally defined, to

11 ADMIN CASES LMIM, 2017

exercise authority in certain areas. It involves decision-making by subnational units. It is typically a

delegated power, wherein a larger government chooses to delegate certain authority to more local

governments.

Decentralization comes in two forms — deconcentration and devolution. Deconcentration is

administrative in nature; it involves the transfer of functions or the delegation of authority and

responsibility from the national office to the regional and local offices. This mode of decentralization is

also referred to as administrative decentralization. Devolution, on the other hand, connotes political

decentralization, or the transfer of powers, responsibilities, and resources for the performance of

certain functions from the central government to local government units. This is a more liberal form of

decentralization since there is an actual transfer of powers and responsibilities. It aims to grant greater

autonomy to local government units in cognizance of their right to self-government, to make them self-

reliant, and to improve their administrative and technical capabilities.

The creation of autonomous regions contemplates the grant of political autonomy — an

autonomy which is greater than the administrative autonomy granted to local government units. It was

held that "the constitutional guarantee of local autonomy in the Constitution (Art. X, Sec. 2) refers to

administrative autonomy of local government units or, cast in more technical language, the

decentralization of government authority. . . . On the other hand, the creation of autonomous regions in

Muslim Mindanao and the Cordilleras, which is peculiar to the 1987 Constitution, contemplates the

grant of political autonomy and not just administrative autonomy to these regions.

R.A. 8999 has made the DPWH-ARMM effete and rendered regional autonomy illusory with

respect to infrastructure projects.

The office created under D.O. 119, having essentially the same powers, is a duplication of the

DPWH-ARMM First Engineering District in Lanao del Sur formed under the aegis of E.O. 426. The

department order, in effect, takes back powers which have been previously devolved under the said

executive order. D.O. 119 runs counter to the provisions of E.O. 426. The DPWH's order, like spring

water, cannot rise higher than its source of power — the Executive.

E.O. No. 124, upon which D.O. 119 is based, is a general law reorganizing the Ministry of Public

Works and Highways while E.O. 426 is a special law transferring the control and supervision of the

DPWH oIces within ARMM to the Autonomous Regional Government. The latter statute specifically

applies to DPWH-ARMM offices. E.O. 124 should therefore give way to E.O. 426 in the instant case.

12 ADMIN CASES LMIM, 2017

5. BATANGAS CATV INC V CA

FACTS:

Respondent Sangguniang Panlungsod enacted Resolution No. 210 granting petitioner a permit

to construct, install, and operate a CATV system in Batangas City. Section 8 of the Resolution provides

that petitioner is authorized to charge its subscribers the maximum rates specified therein, "provided,

however, that any increase of rates shall be subject to the approval of the Sangguniang Panlungsod."

Sometime in November 1993, petitioner increased its subscriber rates from P88.00 to P180.00 per

month. As a result, respondent Mayor wrote petitioner a letter threatening to cancel its permit unless it

secures the approval of respondent Sangguniang Panlungsod, pursuant to Resolution No. 210.

Petitioner filed a petition for injunction alleging that respondent no authority to regulate the

subscriber rates charged by CATV operators because under Executive Order No. 205, the National

Telecommunications Commission (NTC) has the sole authority to regulate the CATV operation in the

Philippines.

Respondent counters that the resolution was pursuant to the Local Government Code of 1983,

which authorizes LGUs to regulate businesses. The term "businesses" necessarily includes the CATV

industry.

ISSUE: may a local government unit (LGU) regulate the subscriber rates charged by CATV operators

within its territorial jurisdiction?

RULING: NO.

The general welfare clause is the delegation in statutory form of the police power of the State to

LGUs. 28 Through this, LGUs may prescribe regulations to protect the lives, health, and property of their

constituents and maintain peace and order within their respective territorial jurisdictions.

Like any other enterprise, CATV operation may be regulated by LGUs under the general welfare

clause. This is primarily because the CATV system commits the indiscretion of crossing public properties.

(It uses public properties in order to reach subscribers.) The physical realities of constructing CATV

system — the use of public streets, rights of ways, the founding of structures, and the parceling of large

regions — allow an LGU a certain degree of regulation over CATV operators. 35 This is the same

regulation that it exercises over all private enterprises within its territory.

But, while we recognize the LGUs' power under the general welfare clause, we cannot sustain

Resolution No. 210. We are convinced that respondents strayed from the well-recognized limits of its

power. The flaws in Resolution No. 210 are: (1) it violates the mandate of existing laws and (2) it violates

the State's deregulation policy over the CATV industry.

Resolution No. 210 is an enactment of an LGU acting only as agent of the national legislature.

Necessarily, its act must reflect and conform to the will of its principal. To test its validity, we must apply

the particular requisites of a valid ordinance as laid down by the accepted principles governing

13 ADMIN CASES LMIM, 2017

municipal corporations. An ordinance enacted by virtue of the general welfare clause is valid, unless it

contravenes the fundamental law of the Philippine Islands, or an Act of the Philippine Legislature, or

unless it is against public policy, or is unreasonable, oppressive, partial, discriminating, or in derogation

of common right." “ordinances passed by virtue of the implied power found in the general welfare

clause must be reasonable, consonant with the general powers and purposes of the corporation, and

not inconsistent with the laws or policy of the State."

The apparent defect in Resolution No. 210 is that it contravenes E.O. No. 205 and E.O. No. 436

insofar as it permits respondent Sangguniang Panlungsod to usurp a power exclusively vested in the

NTC, i.e., the power to fix the subscriber rates charged by CATV operators. As earlier discussed, the

fixing of subscriber rates is definitely one of the matters within the NTC's exclusive domain.

"Where there is no express power in the charter of a municipality authorizing it to adopt

ordinances regulating certain matters which are specifically covered by a general statute, a municipal

ordinance, insofar as it attempts to regulate the subject which is completely covered by a general

statute of the legislature, may be rendered invalid. . . . Where the subject is of statewide concern, and

the legislature has appropriated the field and declared the rule, its declaration is binding throughout the

State." A reason advanced for this view is that such ordinances are in excess of the powers granted to

the municipal corporation. Since E.O. No. 205, a general law, mandates that the regulation of CATV

operations shall be exercised by the NTC, an LGU cannot enact an ordinance or approve a resolution in

violation of the said law. In every power to pass ordinances given to a municipality, there is an implied

restriction that the ordinances shall be consistent with the general law.

Resolution No. 210 violated the State's deregulation policy. Deregulation is the reduction of

government regulation of business to permit freer markets and competition. When the State declared a

policy of deregulation, the LGUs are bound to follow. To rule otherwise is to render the State's policy

ineffective. Being mere creatures of the State, LGUs cannot defeat national policies through enactments

of contrary measures. Verily, in the case at bar, petitioner may increase its subscriber rates without

respondents' approval.

14 ADMIN CASES LMIM, 2017

POWER OF THE PRESIDENT OVER LGUS

1. JUDGE DADOLE V COA

FACTS:

RTC and MTC judges of Mandaue City started receiving monthly allowances of P1,260

each through the yearly appropriation ordinance enacted by the Sangguniang Panlungsod of the said

city. In 1991, Mandaue City increased the amount to P1,500 for each judge.

(DBM) subsequently issued the disputed Local Budget Circular No. 55. Which provided

for honorarium at rates not exceeding P1,000.00 in provinces and cities and P700.00 in municipalities.

the additional monthly allowances of the petitioner judges were reduced to P1,000 each. They were also

asked to reimburse the amount they received in excess of P1,000 from April to September, 1994.

Respondent COA, on the other hand, insists that the constitutional and statutory

authority of a city government to provide allowances to judges stationed therein is not absolute.

Congress may set limitations on the exercise of autonomy. It is for the President, through the DBM, to

check whether these legislative limitations are being followed by the local government units.

ISSUE: whether LBC 55 of the DBM is void foregoing beyond the supervisory powers of the President

RULING: LBC 55 is null and void.

Although our Constitution 6 guarantees autonomy to local government units, the exercise of local

autonomy remains subject to the power of control by Congress and the power of supervision by the

President (S4, A10).

The President can only interfere in the affairs and activities of a local government unit if he or

she finds that the latter has acted contrary to law. This is the scope of the President's supervisory

powers over local government units. Hence, the President or any of his or her alter egos cannot

interfere in local affairs as long as the concerned local government unit acts within the parameters of

the law and the Constitution. Any directive therefore by the President or any of his or her alter egos

seeking to alter the wisdom of a law-conforming judgment on local affairs of a local government unit is a

patent nullity because it violates the principle of local autonomy and separation of powers of the

executive and legislative departments in governing municipal corporations.

Setting a uniform amount for the grant of additional allowances is an inappropriate way of

enforcing the criterion found in Section 458, par. (a)(1)(xi), of RA 7160. The DBM overstepped its power

of supervision over local government units by imposing a prohibition that did not correspond with the

law it sought to implement. In other words, the prohibitory nature of the circular had no legal basis.

15 ADMIN CASES LMIM, 2017

2. PIMENTEL V AGUIRRE

FACTS:

AO 372 was issued, S4 of which provides “Pending the assessment and evaluation by the

Development Budget Coordinating Committee of the emerging ?scal situation, the amount equivalent to

10% of the internal revenue allotment to local government units shall be withheld.” AO 43 was

subsequently issued reducing the amount to 5%.

Petitioner contends that the President, in issuing AO 372, was in effect exercising the power of

control over LGUs. Petitioner further argues that the directive to withhold ten percent (10%) of their IRA

is in contravention of Section 286 of the Local Government Code and of Section 6, Article X of the

Constitution, providing for the automatic release to each of these units its share in the national internal

revenue.

ISSUE: WON said AO’s are valid exercises of the President's power of general supervision over local

governments

RULING:

Section 4 of Article X of the Constitution confines the President's power over local governments

to one of general supervision. This provision has been interpreted to exclude the power of control.

the heads of political subdivisions are elected by the people. Their sovereign powers emanate

from the electorate, to whom they are directly accountable. By constitutional fiat, they are subject to

the President's supervision only, not control, so long as their acts are exercised within the sphere of

their legitimate powers. By the same token, the President may not withhold or alter any authority or

power given them by the Constitution and the law.

The grant of autonomy is intended to "break up the monopoly of the national government over

the affairs of local governments, . . . not . . . to end the relation of partnership and interdependence

between the central administration and local government units . . ." Paradoxically, local governments

are still subject to regulation, however limited, for the purpose of enhancing self-government. 14

Decentralization simply means the devolution of national administration, not power, to local

governments. Local oLcials remain accountable to the central government as the law may provide.

Under the Philippine concept of local autonomy, the national government has not completely

relinquished all its powers over local governments, including autonomous regions. Only administrative

powers over local affairs are delegated to political subdivisions. The purpose of the delegation is to

make governance more directly responsive and effective at the local levels. Municipal governments are

still agents of the national government.

Under existing law, local government units, in addition to having administrative autonomy

16 ADMIN CASES LMIM, 2017

in the exercise of their functions, enjoy ?scal autonomy as well. Fiscal autonomy mean that local

governments have the power to create their own sources of revenue in addition to their equitable share

in the national taxes released by the national government, as well as the power to allocate their

resources in accordance with their own priorities. It extends to the preparation of their budgets, and

local oLcials in turn have to work within the constraints thereof.

Local ?scal autonomy does not however rule out any manner of national government

intervention by way of supervision, in order to ensure that local programs, ?scal and otherwise, are

consistent with national goals. Signi?cantly, the President, by constitutional ?at, is the head of the

economic and planning agency of the government.

There are therefore several requisites before the President may interfere in local ?scal matters:

(1) an unmanaged public sector de?cit of the national government; (2) consultations with the presiding

oLcers of the Senate and the House of Representatives and the presidents of the various local leagues;

and (3) the corresponding recommendation of the secretaries of the Department of Finance, Interior

and Local Government, and Budget and Management. Furthermore, any adjustment in the allotment

shall in no case be less than thirty percent (30%) of the collection of national internal revenue taxes of

the third fiscal year preceding the current one.

While the wordings of Section 1 of AO 372 have a rather commanding tone, and while we agree

with petitioner that the requirements of Section 284 of the Local Government Code have not been

satis?ed, we are prepared to accept the solicitor general's assurance that the directive to "identify and

implement measures . . . . . that will reduce total expenditures . . . by at least 25% of authorized regular

appropriation" is merely advisory in character, and does not constitute a mandatory or binding order

that interferes with local autonomy. The language used, while authoritative, does not amount to a

command that emanates from a boss to a subaltern.

In sum, while Section 1 of AO 372 may be upheld as an advisory effected in times of national

crisis, Section 4 thereof has no color of validity at all. The latter provision effectively encroaches on the

?scal autonomy of local governments. Concededly, the President was well-intentioned in issuing his

Order to withhold the LGUs' IRA, but the rule of law requires that even the best intentions must be

carried out within the parameters of the Constitution and the law. Verily, laudable purposes must be

carried out by legal methods.

17 ADMIN CASES LMIM, 2017

3. PROVINCE OF BATANGAS V ROMULO

FACTS:

Estrada issued Executive Order (E.O.) No. 48 entitled "ESTABLISHING A PROGRAM FOR

DEVOLUTION ADJUSTMENT AND EQUALIZATION." For 1998, the DBM was directed to set aside an

amount to be determined by the Oversight Committee based on the devolution status appraisal surveys

undertaken by the DILG.

Republic Act No. 8745, otherwise known as the GAA of 1999 contained the following proviso: . .

. PROVIDED, That the amount of FIVE BILLION PESOS (P5,000,000,000) shall be earmarked for the Local

Government Service Equalization Fund for the funding requirements of projects and activities arising

from the full and eIcient implementation of devolved functions and services of local government units

pursuant to R.A. No. 7160, otherwise known as the Local Government Code of 1991: PROVIDED,

FURTHER, That such amount shall be released to the local government units subject to the

implementing rules and regulations.

The petitioner submits that the assailed provisos in the GAAs and the OCD resolutions, insofar as

they earmarked the amount of 7ve billion pesos of the IRA of the LGUs for 1999, 2000 and 2001 for the

LGSEF and imposed conditions for the release thereof, violate the Constitution and the Local

Government Code of 1991.

The respondents advance the view that Section 6, Article X of the Constitution does not specify

the "just share" of the LGUs shall be determined solely by the Local Government Code of 1991.

Moreover, the phrase "as determined by law" in the same constitutional provision means that there

exists no limitation on the power of Congress to determine what is the "just share" of the LGUs in the

national taxes. In other words, Congress is the arbiter of what should be the "just share" of the LGUs in

the national taxes.

ISSUE:

RULING:

Consistent with the principle of local autonomy, the Constitution con7nes the President's power

over the LGUs to one of general supervision. 17 This provision has been interpreted to exclude the

power of control. It is mandated that (1) the LGUs shall have a "just share" in the national taxes; (2) the

"just share" shall be determined by law; and (3) the "just share" shall be automatically released to the

LGUs.

To the Court's mind, the entire process involving the distribution and release of the LGSEF is

constitutionally impermissible. The LGSEF is part of the IRA or "just share" of the LGUs in the national

taxes. To subject its distribution and release to the vagaries of the implementing rules and regulations,

including the guidelines and mechanisms unilaterally prescribed by the Oversight Committee from time

to time, as sanctioned by the assailed provisos in the GAAs of 1999, 2000 and 2001 and the OCD

resolutions, makes the release not automatic, a flagrant violation of the constitutional and statutory

18 ADMIN CASES LMIM, 2017

mandate that the "just share" of the LGUs "shall be automatically released to them." The LGUs are, thus,

placed at the mercy of the Oversight Committee.

Indeed, the Oversight Committee exercising discretion, even control, over the distribution and

release of a portion of the IRA, the LGSEF, is an anathema to and subversive of the principle of local

autonomy as embodied in the Constitution.

Local autonomy includes both administrative and fiscal autonomy. the only possible exception

to the mandatory automatic release of the LGUs' IRA is if the national internal revenue collections for

the current 7scal year is less than 40 percent of the collections of the preceding third 7scal year, in

which case what should be automatically released shall be a proportionate amount of the collections for

the current 7scal year. there is no allegation that the national internal revenue tax collections for the

7scal years 1999, 2000 and 2001 have fallen compared to the preceding three fiscal years.

The Local Government Code of 1991 is a substantive law. And while it is conceded that Congress

may amend any of the provisions therein, it may not do so through appropriations laws or GAAs. Any

amendment to the Local Government Code of 1991 should be done in a separate law, not in the

appropriations law, because Congress cannot include in a general appropriation bill matters that should

be more properly enacted in a separate legislation.

4. ACORD V ZAMORA

FACTS:

Ra 8760 or the GAA of 2000 provides P111,778,000,000 of IRA as Programmed Fund and it

appropriates a separate amount of P10 Billion of IRA under the classification of Unprogrammed Fund,

the latter amount to be released only upon the occurrence of the condition stated in the GAA.

ISSUE: whether the questioned provisions violate the constitutional injunction that the just share of

local governments in the national taxes or the IRA shall be automatically released

RULING: Yes.

If indeed the framers intended to allow the enactment of statutes making the release of IRA

conditional instead of automatic, then Article X, Section 6 of the Constitution would have been worded

differently. Since, under Article X, Section 6 of the Constitution, only the just share of local governments

is qualiMed by the words "as determined by law," and not the release thereof, the plain implication is

that Congress is not authorized by the Constitution to hinder or impede the automatic release of the

IRA.

While "automatic release" implies that the just share of the local governments determined by

law should be released to them as a matter of course, the GAA provisions, on the other hand, withhold

its release pending an event which is not even certain of occurring. To rule that the term "automatic

release" contemplates such conditional release would be to strip the term "automatic" of all meaning.

19 ADMIN CASES LMIM, 2017

5. KIDA V SENATE OF THE PH

FACTS:

ISSUE: Whether RA No. 10153 violates the autonomy granted to the ARMM

RULING:

On President’s appointment powers

At the outset, the power to appoint is essentially executive in nature, and the limitations on or

qualifications to the exercise of this power should be strictly construed; these limitations or

qualifications must be clearly stated in order to be recognized. 73 The appointing power is embodied in

Section 16, Article VII of the Constitution. Since the President's authority to appoint OICs emanates from

RA No. 10153, it falls under the third group of officials that the President can appoint pursuant to

Section 16, Article VII of the Constitution. Thus, the assailed law facially rests on clear constitutional

basis.

Aside from its order for synchronization, it is purely and simply an interim measure responding

to the adjustments that the synchronization requires.

On autonomy

Synchronization is an interest that is as constitutionally entrenched as regional autonomy. They

are interests that this Court should reconcile and give effect to, in the way that Congress did in RA No.

10153 which provides the measure to transit to synchronized regional elections with the least

disturbance on the interests that must be respected. Particularly, regional autonomy will be respected

instead of being sidelined, as the law does not in any way alter, change or modify its governing features,

except in a very temporary manner and only as necessitated by the attendant circumstances.

In other words, the autonomy granted to the ARMM cannot be invoked to defeat national

policies and concerns. Since the synchronization of elections is not just a regional concern but a national

one, the ARMM is subject to it; the regional autonomy granted to the ARMM cannot be used to exempt

the region from having to act in accordance with a national policy mandated by no less than the

Constitution.

20 ADMIN CASES LMIM, 2017

6. VILLAFUERTE V ROBREDO

FACTS:

(COA) conducted an examination and audit on the manner the local government units (LGUs)

utilized their Internal Revenue Allotment (IRA) for the calendar years 1993-1994. The examination

yielded an oEcial report, showing that a substantial portion of the 20% development fund of some LGUs

was not actually utilized for development projects but was diverted to expenses properly chargeable

against the Maintenance and Other Operating Expenses (MOOE), in stark violation of Section 287 of R.A.

No. 7160, otherwise known as the Local Government Code of 1991 (LGC). Thus, on December 14, 1995,

the DILG issued MC No. 95-216, 5 enumerating the policies and guidelines on the utilization of the

development fund component of the IRA. It likewise carried a reminder to LGUs of the strict mandate to

ensure that public funds, like the 20% development fund, "shall be spent judiciously and only for the

very purpose or purposes for which such funds are intended."

On August 31, 2010, the respondent, in his capacity as DILG Secretary, issued the assailed MC

No. 2010-83, 9 entitled "Full Disclosure of Local Budget and Finances, and Bids and Public Offerings,"

which aims to promote good governance through enhanced transparency and accountability of LGUs.

ISSUE: WON the assailed MC violates the principle of local autonomy

RULING: No.

Local autonomy means a more responsive and accountable local government structure

instituted through a system of decentralization. To safeguard the state policy on local autonomy, the

Constitution con8nes the power of the President over LGUs to mere supervision. 39 "The President

exercises 'general supervision' over them, but only to 'ensure that local affairs are administered

according to law.' He has no control over their acts in the sense that he can substitute their judgments

with his own." S4, A10

A reading of MC No. 2010-138 shows that it is a mere reiteration of an existing provision in the

LGC. It was plainly intended to remind LGUs to faithfully observe the directive stated in Section 287 of

the LGC to utilize the 20% portion of the IRA for development projects. It was, at best, an advisory to

LGUs to examine themselves if they have been complying with the law. It must be recalled that the

assailed circular was issued in response to the report of the COA that a substantial portion of the 20%

development fund of some LGUs was not actually utilized for development projects but was diverted to

expenses more properly categorized as MOOE, in violation of Section 287 of the LGC.

Contrary to the petitioners' posturing, however, the enumeration was not meant to restrict the

discretion of the LGUs in the utilization of their funds. It was meant to enlighten LGUs as to the nature of

the development fund by delineating it from other types of expenses. It was incorporated in the assailed

circular in order to guide them in the proper disposition of the IRA and avert further misuse of the fund

by citing current practices which seemed to be incompatible with the purpose of the fund. Even then,

LGUs remain at liberty to map out their respective development plans solely on the basis of their own

21 ADMIN CASES LMIM, 2017

judgment and utilize their IRAs accordingly, with the only restriction that 20% thereof be expended for

development projects. They may even spend their IRAs for some of the enumerated items should they

partake of indirect costs of undertaking development project.

Signi8cantly, the issuance itself did not provide for sanctions. It did not particularlyestablish a

new set of acts or omissions which are deemed violations and provide the corresponding penalties

therefor. It simply stated a reminder to LGUs that there are existing rules to consider in the

disbursement of the 20% development fund and that noncompliance therewith may render them liable

to sanctions which are provided in the LGC and other applicable laws. Nonetheless, this warning for

possible imposition of sanctions did not alter the advisory nature of the issuance.

At any rate, LGUs must be reminded that the local autonomy granted to them does not

completely severe them from the national government or turn them into impenetrable states.

Autonomy does not make local governments sovereign within the state.

Thus, notwithstanding the local 8scal autonomy being enjoyed by LGUs, they are still under the

supervision of the President and maybe held accountable for malfeasance or violations of existing laws.

"Supervision is not incompatible with discipline. And the power to discipline and ensure that the laws be

faithfully executed must be construed to authorize the President to order an investigation of the act or

conduct of local oEcials when in his opinion the good of the public service so requires."

Clearly then, the President's power of supervision is not antithetical to investigation and

imposition of sanctions.

It is well to remember that 8scal autonomy does not leave LGUs with unbridled discretion in the

disbursement of public funds. They remain accountable to their constituency. For, public oEce was

created for the bene8t of the people and not the person who holds office.

A scrutiny of the contents of the mentioned issuances shows that they do not, in any manner,

violate the 8scal autonomy of LGUs. To be clear, "[f]iscal autonomy means that local governments have

the power to create their own sources of revenue in addition to their equitable share in the national

taxes released by the national government, as well as the power to allocate their resources in

accordance with their own priorities. It extends to the preparation of their budgets, and local oEcials in

turn have to work within the constraints thereof." It is inconceivable, however, how the publication of

budgets, expenditures, contracts and loans and procurement plans of LGUs required in the assailed

issuances could have infringed on the local 8scal autonomy of LGUs. Firstly, the issuances do not

interfere with the discretion of the LGUs in the speci8cation of their priority projects and the allocation

of their budgets. The posting requirements are mere transparency measures which do not at all hurt the

manner by which LGUs decide the utilization and allocation of their funds.

Finally, the Court believes that the supervisory powers of the President are broad enough to

embrace the power to require the publication of certain documents as a mechanism of transparency.

22 ADMIN CASES LMIM, 2017

You might also like

- Boy Scouts of The Philippines Vs COA DIGESTDocument2 pagesBoy Scouts of The Philippines Vs COA DIGESTTeZzieAwas92% (13)

- Case Digest For G.R. No.169752 PSPCA V COADocument4 pagesCase Digest For G.R. No.169752 PSPCA V COAClara Mae ReyesNo ratings yet

- Solved Nora Transfers To Needle Corporation Depreciable Machinery Originally Costing 18 000Document1 pageSolved Nora Transfers To Needle Corporation Depreciable Machinery Originally Costing 18 000Anbu jaromiaNo ratings yet

- Specpro Digest 2Document29 pagesSpecpro Digest 2KLNo ratings yet

- Paredes v. Verano, G.R. No. 164375, October 12, 2006Document2 pagesParedes v. Verano, G.R. No. 164375, October 12, 2006KLNo ratings yet

- Tutorial Program TABL 2741Document24 pagesTutorial Program TABL 2741hinnlub67% (3)

- Boy Scouts V COADocument3 pagesBoy Scouts V COAattyalanNo ratings yet

- Cases Pub CorpDocument18 pagesCases Pub CorpJohn Kayle BorjaNo ratings yet

- 2 BSP Vs COADocument2 pages2 BSP Vs COAtheresagriggs0% (1)

- Boy Scouts of The Philippines v. Commission On AuditDocument3 pagesBoy Scouts of The Philippines v. Commission On AuditNoreenesse SantosNo ratings yet

- Set 01 - LPC Class Case DigestDocument49 pagesSet 01 - LPC Class Case Digestemmanuel fernandezNo ratings yet

- Pubcorp DigestsDocument29 pagesPubcorp DigestsSean HinolanNo ratings yet

- Boy Scouts Vs CoaDocument11 pagesBoy Scouts Vs CoaJimcris Posadas HermosadoNo ratings yet

- Case BasisDocument8 pagesCase BasisPaulo HernandezNo ratings yet

- BSP V COA (Admin Law)Document4 pagesBSP V COA (Admin Law)einNo ratings yet

- Admin CasesDocument36 pagesAdmin CasesMaria Isabel AlbornozNo ratings yet

- 1ST AssignmentDocument17 pages1ST AssignmentZen TurrechaNo ratings yet

- BSP VS CoaDocument2 pagesBSP VS CoaCheska Christiana Villarin SaguinNo ratings yet

- Facts: This Case Is A Petition For Prohibition With Preliminary Injunction and Temporary Restraining OrderDocument4 pagesFacts: This Case Is A Petition For Prohibition With Preliminary Injunction and Temporary Restraining OrderCamille Francesca BulataoNo ratings yet

- BSP V COA DigestsDocument6 pagesBSP V COA DigestsMelgenNo ratings yet

- BSP Vs COADocument3 pagesBSP Vs COAjohn ryan anatanNo ratings yet

- PCL CasesDocument19 pagesPCL CasesMohammadNo ratings yet

- Private v. Public Corporation: Boy Scouts of The Philippines vs. Commission On Audit G.R. No. 177131.june 7, 2011 FactsDocument2 pagesPrivate v. Public Corporation: Boy Scouts of The Philippines vs. Commission On Audit G.R. No. 177131.june 7, 2011 FactsJo Jo GoyagoyNo ratings yet

- Boy Scouts of The Philippines Vs CADocument1 pageBoy Scouts of The Philippines Vs CAgianfranco0613No ratings yet

- BSP vs. COADocument3 pagesBSP vs. COATynny Roo BelduaNo ratings yet

- Syllabus-Based NotesDocument101 pagesSyllabus-Based NotesSammy EscañoNo ratings yet

- 01 Boy Scouts v. COADocument4 pages01 Boy Scouts v. COAEunice IgnacioNo ratings yet

- ADMIN 2S Pascasio Reviewer PDFDocument202 pagesADMIN 2S Pascasio Reviewer PDFMaria Isabel AlbornozNo ratings yet

- BSP Vs COADocument3 pagesBSP Vs COAElla B.No ratings yet

- Lgu CasesDocument30 pagesLgu CasesKelvin ZabatNo ratings yet

- Boys Scouts of The Philippines v. Commission On AuditDocument3 pagesBoys Scouts of The Philippines v. Commission On AuditJORLAND MARVIN BUCUNo ratings yet

- Pubcor Trans Prelims FinalsDocument175 pagesPubcor Trans Prelims FinalsJULLIAN PAOLO UMALINo ratings yet

- 01) Boy Scouts of The Philippines V CoaDocument3 pages01) Boy Scouts of The Philippines V CoaAlfonso Miguel LopezNo ratings yet

- Admin Cases Set 1Document29 pagesAdmin Cases Set 1lleiryc7No ratings yet

- Constitutional Law-II Notes For BBA - LLBDocument35 pagesConstitutional Law-II Notes For BBA - LLBShubham SharmaNo ratings yet

- BOY SCOUTS OF THE PHILIPPINES v. Commission On AuditDocument2 pagesBOY SCOUTS OF THE PHILIPPINES v. Commission On AuditApril Joy OmboyNo ratings yet

- Local Government Law Case DigestsDocument95 pagesLocal Government Law Case DigestsRessie June PedranoNo ratings yet

- Case Digest Administrative Law Ass. 1Document15 pagesCase Digest Administrative Law Ass. 1Elen CiaNo ratings yet

- Corpocases Set1Document39 pagesCorpocases Set1Ryan Emmanuel MangulabnanNo ratings yet

- Liban v. Gordon (Valeros)Document4 pagesLiban v. Gordon (Valeros)Homer SimpsonNo ratings yet

- Pubcorp Case DigestDocument6 pagesPubcorp Case DigestKaren Ryl Lozada BritoNo ratings yet

- Corporation Law ReviewerDocument77 pagesCorporation Law ReviewerAnna Angelica AbarquezNo ratings yet

- Boy Scouts v. COADocument5 pagesBoy Scouts v. COAJake PeraltaNo ratings yet

- G.R. No. 177131. June 7, 2011. Boy Scouts of The Philippines, Petitioner, vs. Commission ON AUDIT, RespondentDocument55 pagesG.R. No. 177131. June 7, 2011. Boy Scouts of The Philippines, Petitioner, vs. Commission ON AUDIT, RespondentLiee RaineNo ratings yet

- G.R. No. 177131. June 7, 2011.: - en BancDocument53 pagesG.R. No. 177131. June 7, 2011.: - en BancMariel Ann ManingasNo ratings yet

- G.R. No. 177131. June 7, 2011. Boy Scouts of The Philippines, Petitioner, vs. Commission ON AUDIT, RespondentDocument55 pagesG.R. No. 177131. June 7, 2011. Boy Scouts of The Philippines, Petitioner, vs. Commission ON AUDIT, RespondentLiee RaineNo ratings yet

- Boy Scouts of The Phil. v. COA (G.R No. 177131, (June 7, 2011), 666 PHIL 140-224)Document1 pageBoy Scouts of The Phil. v. COA (G.R No. 177131, (June 7, 2011), 666 PHIL 140-224)DMFB EDP S2No ratings yet

- Boy Scouts of The Philippines v. COA (2011)Document85 pagesBoy Scouts of The Philippines v. COA (2011)Stephanie WangNo ratings yet

- Philippine Society Vs COADocument5 pagesPhilippine Society Vs COAmauNo ratings yet

- Boy Scouts of The Philippines VSDocument6 pagesBoy Scouts of The Philippines VSHemsley Battikin Gup-ayNo ratings yet

- People v. Sandiganbayan, G.R. Nos. 147706-07, February 16, 2005Document3 pagesPeople v. Sandiganbayan, G.R. Nos. 147706-07, February 16, 2005heyy rommelNo ratings yet

- Corpo - Villanueva BasedDocument16 pagesCorpo - Villanueva BasedJohn Ramil RabeNo ratings yet

- PubCorp - Boy Scout of The PH Vs COA DigestDocument1 pagePubCorp - Boy Scout of The PH Vs COA DigestDyannah Alexa Marie RamachoNo ratings yet

- Pubcorp Midterms DigestDocument22 pagesPubcorp Midterms DigestMegan MateoNo ratings yet

- Oral NotesDocument29 pagesOral NotesRuel ReyesNo ratings yet

- Philippine Society For The Prevention of Cruelty To Animals vs. Commission On AuditDocument2 pagesPhilippine Society For The Prevention of Cruelty To Animals vs. Commission On AuditChristian Jay B. PonsicaNo ratings yet

- PASCASIO-PUBCORP - Case DoctrinesDocument24 pagesPASCASIO-PUBCORP - Case DoctrinesyanapasiliaoNo ratings yet

- Coa To Audit Philippine National Red Cross: Bayano, Hazel Cortel, Ramon JRDocument3 pagesCoa To Audit Philippine National Red Cross: Bayano, Hazel Cortel, Ramon JRlovelycruz yanoNo ratings yet

- Philippine Society For The Prevention of Cruelty To Animals v. Commission On Audit, 534 SCRADocument3 pagesPhilippine Society For The Prevention of Cruelty To Animals v. Commission On Audit, 534 SCRAKael MarmaladeNo ratings yet

- V. Classifications of Corporations 1. in Relation To The StateDocument36 pagesV. Classifications of Corporations 1. in Relation To The Stateglenda e. calilaoNo ratings yet

- G.R. No. 147706Document6 pagesG.R. No. 147706pau santosNo ratings yet

- Pubcorp Case DigestsDocument6 pagesPubcorp Case DigestsNerissa BelloNo ratings yet

- A Layman’s Guide to The Right to Information Act, 2005From EverandA Layman’s Guide to The Right to Information Act, 2005Rating: 4 out of 5 stars4/5 (1)

- Understanding the Function of the Council of Inspectors GeneralFrom EverandUnderstanding the Function of the Council of Inspectors GeneralNo ratings yet

- Securities Regulation CodeDocument9 pagesSecurities Regulation CodeKLNo ratings yet

- Remrev Digest Mod1Document111 pagesRemrev Digest Mod1KLNo ratings yet

- Specpro Case DigestDocument82 pagesSpecpro Case DigestKLNo ratings yet

- 2017 Tax Transcript PDFDocument138 pages2017 Tax Transcript PDFIelBarnacheaNo ratings yet

- ATP ReviewerDocument31 pagesATP ReviewerKLNo ratings yet

- New Central Bank ActDocument34 pagesNew Central Bank ActKLNo ratings yet

- 4C Rem Cram Notes PT 5: (Rule 131-132, Child Witness, Electronic Evidence, Dna Evidence)Document22 pages4C Rem Cram Notes PT 5: (Rule 131-132, Child Witness, Electronic Evidence, Dna Evidence)KLNo ratings yet

- 4C Rem Cram Notes PT 3Document14 pages4C Rem Cram Notes PT 3KLNo ratings yet

- SRC, Ppsa, LocDocument7 pagesSRC, Ppsa, LocKLNo ratings yet

- 48 Oposa V FactoranDocument2 pages48 Oposa V FactoranKLNo ratings yet

- 24 Go Vs CADocument2 pages24 Go Vs CAKLNo ratings yet

- SEGURA V SEGURADocument2 pagesSEGURA V SEGURAKLNo ratings yet

- Can You Sell Shares Which You Do Not Own? InsiderDocument4 pagesCan You Sell Shares Which You Do Not Own? InsiderKLNo ratings yet

- People Vs Nitafan: TopicDocument1 pagePeople Vs Nitafan: TopicKLNo ratings yet

- Remedial Law Review Case Digest Topic Case Title GR NO. G.R. No. 118438 DATE: December 4, 1998 DoctrineDocument1 pageRemedial Law Review Case Digest Topic Case Title GR NO. G.R. No. 118438 DATE: December 4, 1998 DoctrineKLNo ratings yet

- 59 Sps Telan V CADocument2 pages59 Sps Telan V CAKLNo ratings yet

- 61 Almuete V PeopleDocument2 pages61 Almuete V PeopleKLNo ratings yet

- 11 Republic V HernandezDocument2 pages11 Republic V HernandezKLNo ratings yet

- Prime White Cement Corporation vs. Intermediate Appellate Court GR 68555, 19 March 1993 FactsDocument1 pagePrime White Cement Corporation vs. Intermediate Appellate Court GR 68555, 19 March 1993 Factscarlo_tabangcuraNo ratings yet

- Difference Between OPC and SPDocument2 pagesDifference Between OPC and SPrahulkapur87No ratings yet

- Roman Catholic v. Land RegistrationDocument9 pagesRoman Catholic v. Land RegistrationMarian's PreloveNo ratings yet

- PSPC - 17-Q - Q3 2018Document43 pagesPSPC - 17-Q - Q3 2018Michael Francis Uy CastiloNo ratings yet

- Conduct, Discipline and Appeal Rules: Management EmployeesDocument29 pagesConduct, Discipline and Appeal Rules: Management Employeespawan guptaNo ratings yet

- Circualr No.216 PDFDocument51 pagesCircualr No.216 PDFsibyNo ratings yet

- CHAPTER 1 - The Goals and Activities of Financial ManagementDocument5 pagesCHAPTER 1 - The Goals and Activities of Financial ManagementKRABBYPATTY PHNo ratings yet

- Municipality of Malabang vs. BenitoDocument17 pagesMunicipality of Malabang vs. BenitoLeslie LernerNo ratings yet

- Shibu Soren Vs Dayanand Sahay & Ors. 19 July, 2001 PDFDocument18 pagesShibu Soren Vs Dayanand Sahay & Ors. 19 July, 2001 PDFPiyush KulshreshthaNo ratings yet

- Title III - Vii CorpoDocument19 pagesTitle III - Vii CorpocookiehilaryNo ratings yet

- Fria Output PaperDocument11 pagesFria Output PaperNrnNo ratings yet

- fl-41 Bid BondDocument2 pagesfl-41 Bid BondHaider ShahNo ratings yet

- Smith and Keenan's Company LawDocument609 pagesSmith and Keenan's Company LawMariam Wakili100% (3)

- Corporate Governance in India: Rajesh Chakrabarti William L. Megginson Pradeep K. YadavDocument24 pagesCorporate Governance in India: Rajesh Chakrabarti William L. Megginson Pradeep K. YadavmanupalanNo ratings yet

- Reviewer On Taxation MamalateoDocument80 pagesReviewer On Taxation MamalateoKMBH100% (2)

- INTRODUCTION TO BUSINESS AssignmentDocument10 pagesINTRODUCTION TO BUSINESS AssignmentUrooj KhanNo ratings yet

- Stoutenburgh v. Hennick - Commerce Between Citizens of States of The Union Is Not LicensableDocument21 pagesStoutenburgh v. Hennick - Commerce Between Citizens of States of The Union Is Not LicensablegoldilucksNo ratings yet

- Waterfront v. CIRDocument18 pagesWaterfront v. CIRaudreydql5No ratings yet

- PTDC Service Rules Staff 2009Document38 pagesPTDC Service Rules Staff 2009Amer HassanNo ratings yet

- Blowfield and Murray - ch02 (Origins of CSR)Document30 pagesBlowfield and Murray - ch02 (Origins of CSR)bucanokNo ratings yet

- Copo Case. BASECO Vs PCGGDocument3 pagesCopo Case. BASECO Vs PCGGJoy Carmen CastilloNo ratings yet

- Alteration of Memorandum of Association (AOA) of The Company (Company Update)Document8 pagesAlteration of Memorandum of Association (AOA) of The Company (Company Update)Shyam SunderNo ratings yet

- Ethics in Public ServiceDocument69 pagesEthics in Public ServiceLoreen DanaoNo ratings yet

- Republic Vs T.a.N. Properties Inc.Document5 pagesRepublic Vs T.a.N. Properties Inc.Michelle Marie TablizoNo ratings yet

- Alhambra Cigar vs. SECDocument2 pagesAlhambra Cigar vs. SECLilibeth Dee Gabutero67% (3)

- Shareholders Democracy (Corporate Law) 2018Document22 pagesShareholders Democracy (Corporate Law) 2018Hemant BhagatNo ratings yet

- Decentralization and Local AutonomyDocument42 pagesDecentralization and Local AutonomyChed PerezNo ratings yet