Professional Documents

Culture Documents

CIRED2015 1572 Final DTXR

CIRED2015 1572 Final DTXR

Uploaded by

Sing Yew LamCopyright:

Available Formats

You might also like

- Liebherr Engine Service ManualDocument2 pagesLiebherr Engine Service Manualpurnima40% (5)

- Earlywatch Alert - P01 1 Service SummaryDocument78 pagesEarlywatch Alert - P01 1 Service Summaryr4432fr4No ratings yet

- Electrical Power Equipment Maintenance and TestingDocument2 pagesElectrical Power Equipment Maintenance and TestingSing Yew LamNo ratings yet

- IEEE 802 StandardsDocument18 pagesIEEE 802 StandardsKim Castro AntonioNo ratings yet

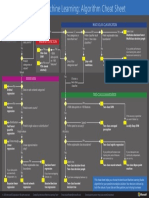

- Microsoft Machine Learning Algorithm Cheat Sheet v2 PDFDocument1 pageMicrosoft Machine Learning Algorithm Cheat Sheet v2 PDFamitag007100% (1)

- Implementation of Condition Based Maintenance For MediumDocument4 pagesImplementation of Condition Based Maintenance For Medium__kami__No ratings yet

- ImprovedDocument8 pagesImprovedLaura RoseroNo ratings yet

- IET Electric Power Appl - 2017 - Ballal - Online Condition Monitoring System For Substation and Service TransformersDocument10 pagesIET Electric Power Appl - 2017 - Ballal - Online Condition Monitoring System For Substation and Service TransformersbenlahnecheNo ratings yet

- CIRED2009 0028 PaperDocument4 pagesCIRED2009 0028 PaperkotiniNo ratings yet

- RCM Application For Turkish National Power Transmission SystemDocument5 pagesRCM Application For Turkish National Power Transmission SystemNoé Rafael Colorado SósolNo ratings yet

- State-Of-The-Art Review On Asset Management Methodologies For Oil-Immersed Power TransformersDocument18 pagesState-Of-The-Art Review On Asset Management Methodologies For Oil-Immersed Power TransformersAdrian SieNo ratings yet

- Cesc O&mDocument8 pagesCesc O&mghosal123No ratings yet

- Electrical Power and Energy Systems: Anusha Pillay, S. Prabhakar Karthikeyan, D.P. KothariDocument8 pagesElectrical Power and Energy Systems: Anusha Pillay, S. Prabhakar Karthikeyan, D.P. KothariHAMZA KHANNo ratings yet

- Energy Management Systems: Ii - HistoryDocument5 pagesEnergy Management Systems: Ii - HistoryUjjwal PCE/15/ME/102No ratings yet

- Simulation of Substation Integrated MonitoringDocument5 pagesSimulation of Substation Integrated MonitoringCV Karawiyin BogorNo ratings yet

- Asset Management Techniques For TransforDocument9 pagesAsset Management Techniques For TransforSimon van BentenNo ratings yet

- ConclusionDocument6 pagesConclusionMaria CafeNo ratings yet

- A Practical Approach To Modelling LNG Train Design For Minimizing Measurement - Allocation Uncertainty PDFDocument12 pagesA Practical Approach To Modelling LNG Train Design For Minimizing Measurement - Allocation Uncertainty PDFUJJWALNo ratings yet

- 2017 03 31 4th International Colloquium FinalDocument11 pages2017 03 31 4th International Colloquium FinalDante FilhoNo ratings yet

- Internet of EverthingDocument25 pagesInternet of EverthingPyusNo ratings yet

- 2 1 1633607149 5ijaerddec20215Document8 pages2 1 1633607149 5ijaerddec20215TJPRC PublicationsNo ratings yet

- Optimization Techniques To Enhance The Performance of Induction Motorhannan2017 PDFDocument16 pagesOptimization Techniques To Enhance The Performance of Induction Motorhannan2017 PDFYasir AlameenNo ratings yet

- Electric Power Systems Research: Burnet O'Brien Mkandawire, Nelson Ijumba, Akshay SahaDocument7 pagesElectric Power Systems Research: Burnet O'Brien Mkandawire, Nelson Ijumba, Akshay Sahajosefrank98No ratings yet

- 101109TPWRS2004840449Document8 pages101109TPWRS2004840449api-3697505No ratings yet

- Elysium VLSI 2010Document21 pagesElysium VLSI 2010elysiumtechnologiesNo ratings yet

- Optimizing Maintenance Policies For A Yaw System Using Reliability-Centered Maintenance and Data-Driven Condition MonitoringDocument9 pagesOptimizing Maintenance Policies For A Yaw System Using Reliability-Centered Maintenance and Data-Driven Condition MonitoringclarkyeahNo ratings yet

- Reliability Centered Maintenance Distribution Underground SystemsDocument6 pagesReliability Centered Maintenance Distribution Underground SystemsHộpQuà TriÂnNo ratings yet

- Energies 15 03379Document32 pagesEnergies 15 03379KishoreNo ratings yet

- CIGRE-Ciclo de Vida de InterruptoresDocument8 pagesCIGRE-Ciclo de Vida de InterruptoresRoland AvlsNo ratings yet

- Basic Principles of MPCDocument13 pagesBasic Principles of MPCÉdgar StaveNo ratings yet

- Review and Classification of Control Systems in Grid Tied InvertersDocument10 pagesReview and Classification of Control Systems in Grid Tied InvertersmanNo ratings yet

- Deisal EngineDocument35 pagesDeisal EngineAZAMNo ratings yet

- Torben 1998Document6 pagesTorben 1998arifurdescoNo ratings yet

- TMS 2Document8 pagesTMS 2rendezvous2k23No ratings yet

- Technical Issues On Distributed Generation (DG) Connection and GuidelinesDocument4 pagesTechnical Issues On Distributed Generation (DG) Connection and GuidelinesKristiano RonaldoNo ratings yet

- Cigre - Paper - Substation - Residual - Life - Estimation 0Document6 pagesCigre - Paper - Substation - Residual - Life - Estimation 0Maein AbreenNo ratings yet

- Keep Advanced Control Systems OnlineDocument29 pagesKeep Advanced Control Systems OnlineBisto MasiloNo ratings yet

- Asset ManagementDocument4 pagesAsset ManagementJohan TadlasNo ratings yet

- 1LAB000613 Life ManagementDocument2 pages1LAB000613 Life ManagementAKGH2024No ratings yet

- Roytelman 1995Document7 pagesRoytelman 1995Asja AvdićNo ratings yet

- ERO Enterprise CMEP Practice Guide - CIP-002-5.1a R1 - Generation SegmentationDocument5 pagesERO Enterprise CMEP Practice Guide - CIP-002-5.1a R1 - Generation Segmentationabdulkadir aliNo ratings yet

- Voltage Management A Hidden Energy Efficiency ResourceDocument3 pagesVoltage Management A Hidden Energy Efficiency ResourceAbdulyunus AmirNo ratings yet

- Maintenance and Refurbishment Strategies For M.V. SubstationsDocument7 pagesMaintenance and Refurbishment Strategies For M.V. SubstationsazizNo ratings yet

- JNTUK 4-1 CSE R20 CC UNIT-IVDocument22 pagesJNTUK 4-1 CSE R20 CC UNIT-IVsreenuNo ratings yet

- Hydraulic Excavators - HannahDocument11 pagesHydraulic Excavators - HannahMahmoud BayatNo ratings yet

- Paper AM ConferenceDocument7 pagesPaper AM ConferenceKang MaNo ratings yet

- Uniten Arsepe 08 L16Document56 pagesUniten Arsepe 08 L16Walid SonjiNo ratings yet

- Application of A Uniform Testing BatteryDocument5 pagesApplication of A Uniform Testing BatteryDoan Anh TuanNo ratings yet

- Ojsadmin,+jarte 1-1 13740Document11 pagesOjsadmin,+jarte 1-1 13740HugoNo ratings yet

- Condition Based MaintenanceDocument12 pagesCondition Based MaintenanceashokparikhNo ratings yet

- Model Predictive Control of Voltages in Active Distribution NetworksDocument10 pagesModel Predictive Control of Voltages in Active Distribution NetworksDiogo MarujoNo ratings yet

- 2014 Demsee SDocument8 pages2014 Demsee SДенис ЛяпуновNo ratings yet

- Sustainable DMA Management To Monitor and Reduce LeakageDocument6 pagesSustainable DMA Management To Monitor and Reduce LeakageJohn SmithNo ratings yet

- Relay Coordina Distribution Netwo Ation and Harmonic Ana Ork With Over 20% Renew Alysis in A Wable SourcesDocument6 pagesRelay Coordina Distribution Netwo Ation and Harmonic Ana Ork With Over 20% Renew Alysis in A Wable SourcesAnikendu MaitraNo ratings yet

- Congestion Management in Deregulated Power System: A ReviewDocument7 pagesCongestion Management in Deregulated Power System: A ReviewGJESRNo ratings yet

- Gupta 2019Document5 pagesGupta 2019jva.barrosNo ratings yet

- A Decomposition Approach To Unit Maintenance SchedulingDocument8 pagesA Decomposition Approach To Unit Maintenance SchedulingSisawad XayyasithNo ratings yet

- R 4-45 PDFDocument4 pagesR 4-45 PDFAhmed WestministerNo ratings yet

- Typification of Load Curves For DSM in Brazil For A Smart Grid EnvironmentDocument6 pagesTypification of Load Curves For DSM in Brazil For A Smart Grid EnvironmentM. Nishom, S.KomNo ratings yet

- Transformer ChalangesDocument5 pagesTransformer ChalangesArvindBhadoliyaNo ratings yet

- Reliability Centered Maintenance Optimization For Power Distribution Systems 2014 International Journal of Electrical Power Energy SystemsDocument8 pagesReliability Centered Maintenance Optimization For Power Distribution Systems 2014 International Journal of Electrical Power Energy SystemsJAVIERNo ratings yet

- 5-1 DPR - Project Development and DPRDocument19 pages5-1 DPR - Project Development and DPRSayed NagyNo ratings yet

- EE392n Lecture5GE PDFDocument21 pagesEE392n Lecture5GE PDFycchiranjeeviNo ratings yet

- Yang2016 Ahorro Energia PDFDocument10 pagesYang2016 Ahorro Energia PDFmvasquez2011No ratings yet

- ADA284039Document81 pagesADA284039Sing Yew LamNo ratings yet

- Wiring Requirements in Hazardous Locations - IAEI MagazineDocument11 pagesWiring Requirements in Hazardous Locations - IAEI MagazineSing Yew LamNo ratings yet

- Electrical Power Equipment Maintenance and TestingDocument3 pagesElectrical Power Equipment Maintenance and TestingSing Yew LamNo ratings yet

- Gloves Catalogue RSDocument23 pagesGloves Catalogue RSSing Yew LamNo ratings yet

- Selection of Explosion Protected Equipment For Hazardous LoctionsDocument32 pagesSelection of Explosion Protected Equipment For Hazardous LoctionsSing Yew LamNo ratings yet

- Killark VSL Series Utility LightDocument5 pagesKillark VSL Series Utility LightSing Yew LamNo ratings yet

- Uk Specialty Chemicals r2Document6 pagesUk Specialty Chemicals r2Sing Yew LamNo ratings yet

- Transmission and Distribution TechnologyDocument92 pagesTransmission and Distribution TechnologySing Yew LamNo ratings yet

- Failure Rate Analysis of Power Circuit Breaker in High Voltage SubstationDocument6 pagesFailure Rate Analysis of Power Circuit Breaker in High Voltage SubstationSing Yew LamNo ratings yet

- Hazards of Hydrogen Sulfide (H2S)Document15 pagesHazards of Hydrogen Sulfide (H2S)Sing Yew LamNo ratings yet

- Medium-Voltage Circuit Breaker Maintenance: Special FeatureDocument2 pagesMedium-Voltage Circuit Breaker Maintenance: Special FeatureSing Yew LamNo ratings yet

- Corrosion in The Pulp and Paper Industry-1Document14 pagesCorrosion in The Pulp and Paper Industry-1Sing Yew LamNo ratings yet

- The Story of Kuala Lumpur - J. M. GullickDocument193 pagesThe Story of Kuala Lumpur - J. M. GullickSing Yew Lam100% (1)

- Hazardous Areas 'Ex' Graduate SD25Document1 pageHazardous Areas 'Ex' Graduate SD25Sing Yew LamNo ratings yet

- DifferentialCalculusCover PDFDocument2 pagesDifferentialCalculusCover PDFahmad nazirNo ratings yet

- Neural Network Research Paper PDFDocument6 pagesNeural Network Research Paper PDFfvgbhswf100% (1)

- Chapter 05Document88 pagesChapter 05Keith Tanaka MagakaNo ratings yet

- Blockchain As A Service For IoTDocument4 pagesBlockchain As A Service For IoTAniruddha DhumalNo ratings yet

- Exercise Session 4Document4 pagesExercise Session 4jaffa123456789No ratings yet

- ABB E Learning CoursesDocument3 pagesABB E Learning Coursesshubham kulshreshthaNo ratings yet

- Balestier Hill Secondary School Mid-Year Examination 2013 Secondary One Express Mathematics Paper 2 Friday 10 May 2013 1 Hour 30 MinutesDocument4 pagesBalestier Hill Secondary School Mid-Year Examination 2013 Secondary One Express Mathematics Paper 2 Friday 10 May 2013 1 Hour 30 Minutestoh tim lamNo ratings yet

- Presales Training OfferDocument76 pagesPresales Training Offerjakal34fr100% (1)

- Goibibo Eticket PDFDocument1 pageGoibibo Eticket PDFAshok KumarNo ratings yet

- Working With Environment Variables Through AutolispDocument6 pagesWorking With Environment Variables Through AutolispGiuseppe LiniNo ratings yet

- Manual Z7IIZ6IIUMEUR - (En) 04Document76 pagesManual Z7IIZ6IIUMEUR - (En) 04Malaisteanu MihaiNo ratings yet

- Fuzzy ID3Document6 pagesFuzzy ID3Manan Agarwal100% (1)

- ADSK - BIM REVIT GUIDE - EN - v2Document153 pagesADSK - BIM REVIT GUIDE - EN - v2bolovan calinNo ratings yet

- ReadmeDocument2 pagesReadmeMuhammed Taha Al GhifariNo ratings yet

- IFPA SFPE NFPA 20 2016 and Beyond PDFDocument50 pagesIFPA SFPE NFPA 20 2016 and Beyond PDFzattie89No ratings yet

- Screenshot 2022-09-21 at 9.18.44 PMDocument24 pagesScreenshot 2022-09-21 at 9.18.44 PMKledi ZefiNo ratings yet

- WS3620-LED Coor Const LAMP - WinsemiDocument7 pagesWS3620-LED Coor Const LAMP - WinsemivmsaNo ratings yet

- 3 Axis TB6560 CNC Driver Board Users ManualDocument13 pages3 Axis TB6560 CNC Driver Board Users ManualJoão Luis Paiva JuniorNo ratings yet

- Final Datesheet Theory (Jan-2024)Document25 pagesFinal Datesheet Theory (Jan-2024)davidfieldsgoodNo ratings yet

- Unit 3 GCDocument21 pagesUnit 3 GCPapa AishuNo ratings yet

- 2010 US Mack Pinnacle Series (CXU Series) Operator's ManualDocument309 pages2010 US Mack Pinnacle Series (CXU Series) Operator's ManualMed Man100% (2)

- Social Studies Subject For Middle School - 8th Grade - Geography and Colonialism XL by SlidesgoDocument88 pagesSocial Studies Subject For Middle School - 8th Grade - Geography and Colonialism XL by SlidesgoAfonso OliveiraNo ratings yet

- Carlson 2018Document3,974 pagesCarlson 2018Lester Saquer100% (2)

- Homework Assignment Modules 14 and 16Document2 pagesHomework Assignment Modules 14 and 16Shuichi AkaiNo ratings yet

- Formal Languages and Automata Theory June July 2022Document8 pagesFormal Languages and Automata Theory June July 2022Hello HelloNo ratings yet

- Lecture 8 - Computer Application in Construction ManagementDocument43 pagesLecture 8 - Computer Application in Construction ManagementJubillee MagsinoNo ratings yet

CIRED2015 1572 Final DTXR

CIRED2015 1572 Final DTXR

Uploaded by

Sing Yew LamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CIRED2015 1572 Final DTXR

CIRED2015 1572 Final DTXR

Uploaded by

Sing Yew LamCopyright:

Available Formats

23rd International Conference on Electricity Distribution Lyon, 15-18 June 2015

Paper 1572

TNB APPROACH ON MANAGING ASSET RETIREMENT FOR DISTRIBUTION

TRANSFORMERS

Young Zaidey YANG GHAZALI Mohd Aizam TALIB Alexis MARIA SOOSAI

Tenaga Nasional Berhad – Malaysia TNB Research Sdn. Bhd. – Malaysia TNB Research Sdn. Bhd. – Malaysia

young@tnb.com.my mohdaizam@tnbr.com.my alex@tnbr.com.my

cycle management approach, the real challenge lies in

ABSTRACT managing the distribution transformers, in particular to

TNB has a population of nearly 74,000 distribution implement maintenance and retirement activities due to

transformers with rated capacity from 100 kVA to 1000 its very large population and high mortality rate. A

kVA installed in its network. Managing life cycle reliability analysis conducted based on a statistical

activities of distribution transformers, in particular to method called Life Data Analysis using Weibull-

implement maintenance and retirement programs, poses Bayesian distribution method shows premature failure of

a great challenge due to its very large population. In TNB distribution transformers installed between 2006-

addition, problem of high premature failure rate of 2012 is high with the predicted mean life of only about

distribution transformers has added to the complexity of 20 years for the entire batch installed between the period

managing the retirement of the transformers. Most of [3] as compared to the industry view of 43 years mean

these transformers have been scrapped based merely on life [4].

the results of test conducted without any economical

consideration. This has contributed to high number of Furthermore, failure modes and causes of failed

write-off which gave rise to company’s cost per unit kWh distribution transformers are often unknown as failure

generated. Furthermore, failure modes and causes of investigation was not carried out and little is known about

failed distribution transformers are often unknown as the condition prior to the failure. All failed distribution

failure investigation was not carried out. This paper transformers will be immediately replaced with new units

presents TNB approach on managing asset retirement of for fast supply restoration and are not repaired on site.

distribution transformers with the use of Asset Retirement The failed units will be credited back to the warehouses

Management System (ARMS) developed as part of the in which inspection and tests will be conducted. A

initiatives under TNB Asset Management Framework. decision for repair or scrap will then be made by an

approving committee based merely on the results of these

INTRODUCTION inspection and tests. Apart from failed units, the same

warehouses or stores will also manage and receive other

Tenaga Nasional Berhad (TNB), an electric utility distribution transformers dismantled from the network.

company in Malaysia has developed an Asset

Management (AM) System to ensure effective asset Clearly, with limited historical failure data, unknown

management and to improve performance as well as modes and causes of failures, lack of analytical tool to aid

reliability of its distribution network. In building up the decision making for repair or scrap, are among factors

overall framework to support its AM system, TNB has that hindered continual improvement program to reduce

adopted the principles within BSi PAS 55:2008 and sets number of failures of distribution transformers and

the foundation for AM policy, strategy and plan to be in number of write-off. As the consequences, in fiscal year

line with its organization objective [1]. One of the key 2012-13 for example, the total number of write-off

elements of the framework is the implementation of asset amounted to 1615 units of distribution transformers with

life cycle management which covers the complete asset the average life of 22 years and valued at RM 13.2mil

life cycle activities from acquisition, operation, (approx. US$ 3.9mil). On the other hand, the percentage

maintenance and retirement of the network assets [2]. As of repaired transformers over total number of retired

a start, focus on life cycle management has been given to distribution transformers was only in between 5% to

critical assets namely medium voltage primary equipment 10%. Thus, it is timely that a more systematic approach

such as power and distribution transformers. for managing retired transformers should be established.

TNB has a population of about 1,340 medium voltage This paper presents TNB experience and challenges

power transformers rated at 33/11kV, 22/11kV and through the use of Asset Retirement Management System

22/6.6kV in its distribution network. On the other hand, (ARMS) developed to improve the effectiveness in

there are nearly 74,000 distribution transformers rated at managing retirement of distribution transformers as part

33/0.433kV, 22/0.433, 11/0.433kV and 6.6/0.433kV of the initiatives to enhance performance and reliability

installed in the network. Though priority are given to of distribution network as outlined by TNB AM strategy

medium voltage power transformers in implementing life and plan.

CIRED 2015 1/5

23rd International Conference on Electricity Distribution Lyon, 15-18 June 2015

Paper 1572

BACKGROUND with deterioration of its condition health index ≤ 5 as

stated in TNB Distribution Asset Replacement

Distribution transformer population in TNB is Policy and Guidelines. The diagnostic techniques to

approaching 74,000 units with rated capacity from 100 determine the health index are as described in TNB

kVA to 1000 kVA installed in its distribution network. Transformer Maintenance Manual. The End of Life

Distribution transformers with capacity of 300 kVA and is also applied to transformer with high total life

below are normally installed as pole mounted whilst cycle cost due to the need for frequent maintenance

larger capacity transformers are installed as ground and repair.

mounted in an indoor or outdoor substation. All § Capacity of the distribution transformer has reached

distribution transformers are of oil immersed type with 100% and can no longer satisfy continuous load

majority are of hermetically sealed design. Since 1990 demand. On the other hand, one of the transformers

free breathing conservator design was no longer used for used in a double chamber substation can also be

new installation. The age profile of distribution retired when total capacity of both units is idle at less

transformers are as shown in fig. 1. than 50% with no prospect for future load increase.

DEVELOPMENT OF ASSET RETIREMENT

MANAGEMENT SYSTEM (ARMS)

ARMS is a web based application developed currently for

distribution transformers incorporating the asset

retirement criteria above. The development of its modules

was primarily based on the feedback and user

requirements obtained throughout the software

development stage. It is an extension to the existing TNB

Distribution Maintenance Management System (DMMS)

aiming to provide easy access to historical maintenance

data and test results.

Fig. 1: Age profile of distribution transformers

Objectives

ARMS is developed to meet the following objectives:

Maintenance strategy applied to distribution transformers § To be the source of information for reliability

are Time Based Maintenance (TBM) and Condition analysis and improvement of design and

Based Maintenance (CBM). The interval of which TBM manufacturing process to reduce number of

or CBM is conducted on a transformer depends on the distribution transformer failures.

area classification, value of load loss and criticality of the § To reduce the number of write-off for distribution

transformer based on risk assessment and life cycle cost transformers and contribute to reduce Cost per Unit

analysis of transformer fleet. In addition, condition health kWh generated.

index is also applied in CBM to determine maintenance § To provide systematic approach in managing

priority or end of life of the transformer. The main retirement of distribution transformers in accordance

objective of TBM and CBM is to prolong the life span of with financial policy and procedures.

the distribution transformer until retirement is § To provide a tool based on life cycle cost analysis

unavoidable. (LCCA) to aid decision making on repair or scrap of

retired distribution transformers.

ASSET RETIREMENT OBJECTIVE AND § To prepare for future long term planning of the

CRITERIA retirement and replacement of high ranking

distribution transformer before failure occurs.

The objective of asset retirement is to provide alternative

solutions to the dismantled asset either to be refurbished

for reuse, relocation or disposed/scrapped. Retirement of

Functionality

distribution transformer can only be executed when the ARMS consists of six key modules; namely, the

following retirement criteria are met: Network Operator (Kawasan), Warehouse, Service

§ Failure of distribution transformer to operate due to Providers/OEM, Quality Assurance, Engineering

electrical or mechanical faults such as flashover, Services and Approving Committee (known as Board

damage by third party or act of vandalism and of Survey – BOS) Reporting Modules. ARMS will be

verified through tests and inspection. used to record, track and manage the retirement

§ End of life of the transformer is reached when the processes. Fig. 2 illustrates the overall functionality of

transformer has reached 40 years of operating life ARMS software.

CIRED 2015 2/5

23rd International Conference on Electricity Distribution Lyon, 15-18 June 2015

Paper 1572

The processes involve interdepartmental as well as

external collaboration. Therefore, in order to ensure

smooth and effective implementation of the processes at

controlled service price, the service provider or OEM

appointed for testing, inspection and repair of the

transformers is managed through contractual agreement.

At the same time, tagging system is also developed at the

warehouses for better management of the retired assets.

Proper protection of failed transformers to prevent further

destruction from rain and other environmental factors is

also being considered.

Fig. 2: ARMS overall functionality

Retirement Categories and Processes

The retirement categories or also known in financial

terms as credit categories in the software, are derived

from the asset retirement criteria to suit each process

requirement. The categories are intended to capture the

reason why the transformer is retired and credited back to

the warehouse. It is also intended to ease data tracking.

Table 1: Retirement categories for distribution transformers

Retirement

No Description

Category

Retirement of distribution transformers aged

ITC/DTC – less than 40 years in service for

1

Reusable Improve Transformer Capacity (ITC) Fig. 3: ARMS process flow for Category 1, 3, 4 and 5

or Derate Transformer Capacity (DTC)

Failure of in-service distribution transformer

Failure – Under to operate due to electrical or mechanical

2

Warranty faults. Transformer is under warranty aged 2

years and below

Failure of in-service distribution transformer

Failure - Expired

to operate due to electrical or mechanical

3 Warranty

faults. Transformer aged more than 2 years

(below 16 years)

but less than 16 years

Failure - Expired Failure of in-service distribution transformer

4 Warranty to operate due to electrical or mechanical

(above 16 years) faults. Transformer aged more than 16 years

Retirement of distribution transformers aged

Decom/Dismantle –

5 40 years in service and above and meeting

Unusable

End of Life criteria

Pre-simulation on the variety of retired units of different

capacity, age and condition using the LCCA model

showed that distribution transformers aged from 16 years

old and above were not feasible for reuse even with Fig. 4: ARMS process flow for Category 2

minor repair cost. Hence, 16 years has been chosen as the

cut off age for decision making for failed distribution Postmortem and Failure Analysis

transformers. The retirement processes applied in ARMS

for the above categories are shown in fig. 3, except for Under the new ARMS process, postmortem or post-test,

Category 2 which is shown in fig. 4. The main difference and failure investigation and analysis are mandatory for

between the new ARMS processes as compared to the all failed distribution transformers [5]. The main

previous ones is the implementation of postmortem or objective is to find failure mode and root cause of failure

post-test together with failure analysis on failed [6]. Untanking for internal inspection and electrical tests

distribution transformers and the use of LCCA for are conducted to aid the process of identifying the failure

refurbish or scrap decision making. mode and the root cause. The online failure report by the

network operator is also referred.

CIRED 2015 3/5

23rd International Conference on Electricity Distribution Lyon, 15-18 June 2015

Paper 1572

Where,

LCCTX = Life Cycle Cost of Transformer

CI = Initial Cost

CO = Operation and Maintenance Cost

CD = Disposal Cost

The net present value of transformer total life cycle cost

is normalised with respective of the usage year as shown

by equation (2).

LCC TX (2)

LCC Average =

n

Fig. 5: Determining failure mode and root cause using ARMS

The ratio known as LCC Index was established and taken

as percentage as indicated by equation (3).

LCC Average Dismantled Unit

LCC Index (%) = ´ 100% (3)

LCC Average New Unit

The use of LCC Index is further illustrated by Fig 8. The

retired distribution transformer rated at 1000 kVA

installed in 1995 was dismantled in 2012 due to failure.

The total life cycle cost of the dismantled unit inclusive

of refurbishment cost is computed and compared against

the total life cycle cost of a new transformer with the

same rating. Ratio of the average life cycle cost of the

Fig. 6: Online transformer failure report by network operator dismantled unit to the average life cycle cost of the new

unit is called the LCC Index. If LCC Index produced is

Life Cycle Cost Analysis (LCCA) 100% or above, then the new unit will replace the

dismantled unit and the dismantled unit will be scrapped.

The capability to make the correct decision is essential to However, if LCC Index is below 100%, then the

meet the goals of maximizing return on investment. dismantled unit will be refurbished.

Hence, LCCA is used to aid decision making in ARMS

on whether a retired transformer is more economical to

refurbish or scrap [7]. Fig. 7 shows the LCCA integrated

template used in ARMS.

Fig. 8: Life cycle comparison to determine LCC Index

The assumptions below are used to calculate the LCCA:

§ The operating life of a transformer is 40 years.

§ Occurrence of failure only affects the transformer

and no other installations. Hence, only the cost of

transformer is taken into account.

§ Either the repaired or new unit is to be installed at

Fig. 7: LCCA integrated template used in ARMS the same substation.

§ Transformer is oil filled hermetically sealed ground

The LCCA model adopted is shown in equation (1). mounted, applying the same maintenance strategy.

§ All dismantling or reinstallation works carried out

LCCTX = CI + CO ± CD (1)

CIRED 2015 4/5

23rd International Conference on Electricity Distribution Lyon, 15-18 June 2015

Paper 1572

through external contract services with supervision consistently updated to ensure accurate analysis.

by a TNB personnel § Unavailability of data for transformer installed

§ All future costs are subjected to incremental change before 1995 has forced a lot of estimation that may

with inflation rate. result in inaccuracy of LCCA calculation.

§ Distance of substation is within 40 km. § Tracking physical assets involve frequent

administrative review meetings to ensure speedy

THE IMPLEMENTATION OF ARMS movement of assets.

§ Time taken for conducting postmortem and

ARMS has been rolled out for use in TNB since 2013 in investigation, limited space at service provider’s

the metropolitan area involving the states of Selangor, facility and logistic problem had slowed down the

Kuala Lumpur and Putrajaya. By the end of 2014, a total speed of the process causing space constraint and

number of 508 units of retired distribution transformers increase of blocked stock at warehouses.

have been managed through ARMS. Since its application, § Increased number of refurbished transformers at

the rate of refurbishment of failed distribution warehouses also causing space contraints as netwok

transformers has gone up from around 5% - 10% operators prefer new transformer to refurbished ones.

previously to more than 60%. This has contributed to the

reduction of the total number of write-off units

CONCLUSION

nationwide for fiscal year 2013-14 to 1134 distribution

transformers valued at RM 8.3mil (US$ 2.4 mil) as Managing asset life cycle activities is the main focus of

compared to 1615 units valued at 13.2mil (approx. US$ asset management system starting from the creation of

3.9mil) in the previous fiscal year 2012-13. the asset, utilization, maintenance up to its retirement.

Thus, each aspect of the life cycle activities must be

Based on postmortem conducted on 160 units of failed strategized to optimize the usage of the asset and to strike

distribution transformers, arcing in windings (71 cases) is a balance between cost, risk and performance of the asset.

the most common failure mode found. The undetermined Consequently, management of the asset retirement should

failure mode is due to the severe condition of the also be taken seriously so that the cause for the retirement

windings which have been heavily soaked in water due to can be studied to formulate enhancement of the asset for

over exposure to rain and environment. These units are continual improvement program. In that respect, ARMS

normally failed transformers that experienced bushings’ has become an effective management tool that able to

damage or tank leaks. record, track, analyse failure and aid the decision making

of retired distribution transformers in TNB. With a few

enhancements into its maturity, ARMS will be rolled out

to the entire Distribution Division TNB in the near future

and may be used to prepare for future long term planning

of the retirement and replacement of distribution as well

as power transformers.

REFERENCES

[1] BSi PAS 55-2:2008, Publicly Available Specification,

Asset Management - Part 2: Guidelines for the

Application of PAS 55-1

[2] International Copper Association Southeast Asia, 2014

Ed., Network Asset Management Guidebook

[3] M.I. Ridwan, M. A. Talib, Y.Z.Y. Ghazali, 2014,

"Application of Weibull-Bayesian for the Reliability

Fig. 9: Failure modes of failed distribution transformers Analysis of Distribution Transformers", IEEE 8th

International Conference (PEOCO), Langkawi, Malaysia.

The application of LCCA and ARMS in general to aid [4] R. Parmella, JAK Douglas, 1996, “Optimization of

decision making and management of retired transformer Transmission and Distribution Capital Expenditure”,

has proven very useful and effective to the Approving CEPSI, Kuala Lumpur, Malaysia.

Committee and resulted in the increased number of [5] IEEE C57.125-1991, “IEEE Guide for Failure

refurbished transformers and reduction in number of Investigation, Documentation, and Analysis for Power

write-off as previously mentioned. Transformers and Shunt Reactors”

[6] Anna Franzén, Sabina Karlsson, 2007, “Failure Modes

and Effects Analysis of Transformers”, Royal Institute of

Challenges in implementing ARMS include: Technology, KTH, Stockholm, Sweden.

§ Require handling of massive historical and [7] P.R Barnes, J.W Van Dyke, 1995, The Feasibility of

operational data for LCCA calculation. Furthermore, Replacing or Upgrading Utility Distribution

data, in particular financial data, need to be Transformers During Routine Maintenance, DOE, US

CIRED 2015 5/5

You might also like

- Liebherr Engine Service ManualDocument2 pagesLiebherr Engine Service Manualpurnima40% (5)

- Earlywatch Alert - P01 1 Service SummaryDocument78 pagesEarlywatch Alert - P01 1 Service Summaryr4432fr4No ratings yet

- Electrical Power Equipment Maintenance and TestingDocument2 pagesElectrical Power Equipment Maintenance and TestingSing Yew LamNo ratings yet

- IEEE 802 StandardsDocument18 pagesIEEE 802 StandardsKim Castro AntonioNo ratings yet

- Microsoft Machine Learning Algorithm Cheat Sheet v2 PDFDocument1 pageMicrosoft Machine Learning Algorithm Cheat Sheet v2 PDFamitag007100% (1)

- Implementation of Condition Based Maintenance For MediumDocument4 pagesImplementation of Condition Based Maintenance For Medium__kami__No ratings yet

- ImprovedDocument8 pagesImprovedLaura RoseroNo ratings yet

- IET Electric Power Appl - 2017 - Ballal - Online Condition Monitoring System For Substation and Service TransformersDocument10 pagesIET Electric Power Appl - 2017 - Ballal - Online Condition Monitoring System For Substation and Service TransformersbenlahnecheNo ratings yet

- CIRED2009 0028 PaperDocument4 pagesCIRED2009 0028 PaperkotiniNo ratings yet

- RCM Application For Turkish National Power Transmission SystemDocument5 pagesRCM Application For Turkish National Power Transmission SystemNoé Rafael Colorado SósolNo ratings yet

- State-Of-The-Art Review On Asset Management Methodologies For Oil-Immersed Power TransformersDocument18 pagesState-Of-The-Art Review On Asset Management Methodologies For Oil-Immersed Power TransformersAdrian SieNo ratings yet

- Cesc O&mDocument8 pagesCesc O&mghosal123No ratings yet

- Electrical Power and Energy Systems: Anusha Pillay, S. Prabhakar Karthikeyan, D.P. KothariDocument8 pagesElectrical Power and Energy Systems: Anusha Pillay, S. Prabhakar Karthikeyan, D.P. KothariHAMZA KHANNo ratings yet

- Energy Management Systems: Ii - HistoryDocument5 pagesEnergy Management Systems: Ii - HistoryUjjwal PCE/15/ME/102No ratings yet

- Simulation of Substation Integrated MonitoringDocument5 pagesSimulation of Substation Integrated MonitoringCV Karawiyin BogorNo ratings yet

- Asset Management Techniques For TransforDocument9 pagesAsset Management Techniques For TransforSimon van BentenNo ratings yet

- ConclusionDocument6 pagesConclusionMaria CafeNo ratings yet

- A Practical Approach To Modelling LNG Train Design For Minimizing Measurement - Allocation Uncertainty PDFDocument12 pagesA Practical Approach To Modelling LNG Train Design For Minimizing Measurement - Allocation Uncertainty PDFUJJWALNo ratings yet

- 2017 03 31 4th International Colloquium FinalDocument11 pages2017 03 31 4th International Colloquium FinalDante FilhoNo ratings yet

- Internet of EverthingDocument25 pagesInternet of EverthingPyusNo ratings yet

- 2 1 1633607149 5ijaerddec20215Document8 pages2 1 1633607149 5ijaerddec20215TJPRC PublicationsNo ratings yet

- Optimization Techniques To Enhance The Performance of Induction Motorhannan2017 PDFDocument16 pagesOptimization Techniques To Enhance The Performance of Induction Motorhannan2017 PDFYasir AlameenNo ratings yet

- Electric Power Systems Research: Burnet O'Brien Mkandawire, Nelson Ijumba, Akshay SahaDocument7 pagesElectric Power Systems Research: Burnet O'Brien Mkandawire, Nelson Ijumba, Akshay Sahajosefrank98No ratings yet

- 101109TPWRS2004840449Document8 pages101109TPWRS2004840449api-3697505No ratings yet

- Elysium VLSI 2010Document21 pagesElysium VLSI 2010elysiumtechnologiesNo ratings yet

- Optimizing Maintenance Policies For A Yaw System Using Reliability-Centered Maintenance and Data-Driven Condition MonitoringDocument9 pagesOptimizing Maintenance Policies For A Yaw System Using Reliability-Centered Maintenance and Data-Driven Condition MonitoringclarkyeahNo ratings yet

- Reliability Centered Maintenance Distribution Underground SystemsDocument6 pagesReliability Centered Maintenance Distribution Underground SystemsHộpQuà TriÂnNo ratings yet

- Energies 15 03379Document32 pagesEnergies 15 03379KishoreNo ratings yet

- CIGRE-Ciclo de Vida de InterruptoresDocument8 pagesCIGRE-Ciclo de Vida de InterruptoresRoland AvlsNo ratings yet

- Basic Principles of MPCDocument13 pagesBasic Principles of MPCÉdgar StaveNo ratings yet

- Review and Classification of Control Systems in Grid Tied InvertersDocument10 pagesReview and Classification of Control Systems in Grid Tied InvertersmanNo ratings yet

- Deisal EngineDocument35 pagesDeisal EngineAZAMNo ratings yet

- Torben 1998Document6 pagesTorben 1998arifurdescoNo ratings yet

- TMS 2Document8 pagesTMS 2rendezvous2k23No ratings yet

- Technical Issues On Distributed Generation (DG) Connection and GuidelinesDocument4 pagesTechnical Issues On Distributed Generation (DG) Connection and GuidelinesKristiano RonaldoNo ratings yet

- Cigre - Paper - Substation - Residual - Life - Estimation 0Document6 pagesCigre - Paper - Substation - Residual - Life - Estimation 0Maein AbreenNo ratings yet

- Keep Advanced Control Systems OnlineDocument29 pagesKeep Advanced Control Systems OnlineBisto MasiloNo ratings yet

- Asset ManagementDocument4 pagesAsset ManagementJohan TadlasNo ratings yet

- 1LAB000613 Life ManagementDocument2 pages1LAB000613 Life ManagementAKGH2024No ratings yet

- Roytelman 1995Document7 pagesRoytelman 1995Asja AvdićNo ratings yet

- ERO Enterprise CMEP Practice Guide - CIP-002-5.1a R1 - Generation SegmentationDocument5 pagesERO Enterprise CMEP Practice Guide - CIP-002-5.1a R1 - Generation Segmentationabdulkadir aliNo ratings yet

- Voltage Management A Hidden Energy Efficiency ResourceDocument3 pagesVoltage Management A Hidden Energy Efficiency ResourceAbdulyunus AmirNo ratings yet

- Maintenance and Refurbishment Strategies For M.V. SubstationsDocument7 pagesMaintenance and Refurbishment Strategies For M.V. SubstationsazizNo ratings yet

- JNTUK 4-1 CSE R20 CC UNIT-IVDocument22 pagesJNTUK 4-1 CSE R20 CC UNIT-IVsreenuNo ratings yet

- Hydraulic Excavators - HannahDocument11 pagesHydraulic Excavators - HannahMahmoud BayatNo ratings yet

- Paper AM ConferenceDocument7 pagesPaper AM ConferenceKang MaNo ratings yet

- Uniten Arsepe 08 L16Document56 pagesUniten Arsepe 08 L16Walid SonjiNo ratings yet

- Application of A Uniform Testing BatteryDocument5 pagesApplication of A Uniform Testing BatteryDoan Anh TuanNo ratings yet

- Ojsadmin,+jarte 1-1 13740Document11 pagesOjsadmin,+jarte 1-1 13740HugoNo ratings yet

- Condition Based MaintenanceDocument12 pagesCondition Based MaintenanceashokparikhNo ratings yet

- Model Predictive Control of Voltages in Active Distribution NetworksDocument10 pagesModel Predictive Control of Voltages in Active Distribution NetworksDiogo MarujoNo ratings yet

- 2014 Demsee SDocument8 pages2014 Demsee SДенис ЛяпуновNo ratings yet

- Sustainable DMA Management To Monitor and Reduce LeakageDocument6 pagesSustainable DMA Management To Monitor and Reduce LeakageJohn SmithNo ratings yet

- Relay Coordina Distribution Netwo Ation and Harmonic Ana Ork With Over 20% Renew Alysis in A Wable SourcesDocument6 pagesRelay Coordina Distribution Netwo Ation and Harmonic Ana Ork With Over 20% Renew Alysis in A Wable SourcesAnikendu MaitraNo ratings yet

- Congestion Management in Deregulated Power System: A ReviewDocument7 pagesCongestion Management in Deregulated Power System: A ReviewGJESRNo ratings yet

- Gupta 2019Document5 pagesGupta 2019jva.barrosNo ratings yet

- A Decomposition Approach To Unit Maintenance SchedulingDocument8 pagesA Decomposition Approach To Unit Maintenance SchedulingSisawad XayyasithNo ratings yet

- R 4-45 PDFDocument4 pagesR 4-45 PDFAhmed WestministerNo ratings yet

- Typification of Load Curves For DSM in Brazil For A Smart Grid EnvironmentDocument6 pagesTypification of Load Curves For DSM in Brazil For A Smart Grid EnvironmentM. Nishom, S.KomNo ratings yet

- Transformer ChalangesDocument5 pagesTransformer ChalangesArvindBhadoliyaNo ratings yet

- Reliability Centered Maintenance Optimization For Power Distribution Systems 2014 International Journal of Electrical Power Energy SystemsDocument8 pagesReliability Centered Maintenance Optimization For Power Distribution Systems 2014 International Journal of Electrical Power Energy SystemsJAVIERNo ratings yet

- 5-1 DPR - Project Development and DPRDocument19 pages5-1 DPR - Project Development and DPRSayed NagyNo ratings yet

- EE392n Lecture5GE PDFDocument21 pagesEE392n Lecture5GE PDFycchiranjeeviNo ratings yet

- Yang2016 Ahorro Energia PDFDocument10 pagesYang2016 Ahorro Energia PDFmvasquez2011No ratings yet

- ADA284039Document81 pagesADA284039Sing Yew LamNo ratings yet

- Wiring Requirements in Hazardous Locations - IAEI MagazineDocument11 pagesWiring Requirements in Hazardous Locations - IAEI MagazineSing Yew LamNo ratings yet

- Electrical Power Equipment Maintenance and TestingDocument3 pagesElectrical Power Equipment Maintenance and TestingSing Yew LamNo ratings yet

- Gloves Catalogue RSDocument23 pagesGloves Catalogue RSSing Yew LamNo ratings yet

- Selection of Explosion Protected Equipment For Hazardous LoctionsDocument32 pagesSelection of Explosion Protected Equipment For Hazardous LoctionsSing Yew LamNo ratings yet

- Killark VSL Series Utility LightDocument5 pagesKillark VSL Series Utility LightSing Yew LamNo ratings yet

- Uk Specialty Chemicals r2Document6 pagesUk Specialty Chemicals r2Sing Yew LamNo ratings yet

- Transmission and Distribution TechnologyDocument92 pagesTransmission and Distribution TechnologySing Yew LamNo ratings yet

- Failure Rate Analysis of Power Circuit Breaker in High Voltage SubstationDocument6 pagesFailure Rate Analysis of Power Circuit Breaker in High Voltage SubstationSing Yew LamNo ratings yet

- Hazards of Hydrogen Sulfide (H2S)Document15 pagesHazards of Hydrogen Sulfide (H2S)Sing Yew LamNo ratings yet

- Medium-Voltage Circuit Breaker Maintenance: Special FeatureDocument2 pagesMedium-Voltage Circuit Breaker Maintenance: Special FeatureSing Yew LamNo ratings yet

- Corrosion in The Pulp and Paper Industry-1Document14 pagesCorrosion in The Pulp and Paper Industry-1Sing Yew LamNo ratings yet

- The Story of Kuala Lumpur - J. M. GullickDocument193 pagesThe Story of Kuala Lumpur - J. M. GullickSing Yew Lam100% (1)

- Hazardous Areas 'Ex' Graduate SD25Document1 pageHazardous Areas 'Ex' Graduate SD25Sing Yew LamNo ratings yet

- DifferentialCalculusCover PDFDocument2 pagesDifferentialCalculusCover PDFahmad nazirNo ratings yet

- Neural Network Research Paper PDFDocument6 pagesNeural Network Research Paper PDFfvgbhswf100% (1)

- Chapter 05Document88 pagesChapter 05Keith Tanaka MagakaNo ratings yet

- Blockchain As A Service For IoTDocument4 pagesBlockchain As A Service For IoTAniruddha DhumalNo ratings yet

- Exercise Session 4Document4 pagesExercise Session 4jaffa123456789No ratings yet

- ABB E Learning CoursesDocument3 pagesABB E Learning Coursesshubham kulshreshthaNo ratings yet

- Balestier Hill Secondary School Mid-Year Examination 2013 Secondary One Express Mathematics Paper 2 Friday 10 May 2013 1 Hour 30 MinutesDocument4 pagesBalestier Hill Secondary School Mid-Year Examination 2013 Secondary One Express Mathematics Paper 2 Friday 10 May 2013 1 Hour 30 Minutestoh tim lamNo ratings yet

- Presales Training OfferDocument76 pagesPresales Training Offerjakal34fr100% (1)

- Goibibo Eticket PDFDocument1 pageGoibibo Eticket PDFAshok KumarNo ratings yet

- Working With Environment Variables Through AutolispDocument6 pagesWorking With Environment Variables Through AutolispGiuseppe LiniNo ratings yet

- Manual Z7IIZ6IIUMEUR - (En) 04Document76 pagesManual Z7IIZ6IIUMEUR - (En) 04Malaisteanu MihaiNo ratings yet

- Fuzzy ID3Document6 pagesFuzzy ID3Manan Agarwal100% (1)

- ADSK - BIM REVIT GUIDE - EN - v2Document153 pagesADSK - BIM REVIT GUIDE - EN - v2bolovan calinNo ratings yet

- ReadmeDocument2 pagesReadmeMuhammed Taha Al GhifariNo ratings yet

- IFPA SFPE NFPA 20 2016 and Beyond PDFDocument50 pagesIFPA SFPE NFPA 20 2016 and Beyond PDFzattie89No ratings yet

- Screenshot 2022-09-21 at 9.18.44 PMDocument24 pagesScreenshot 2022-09-21 at 9.18.44 PMKledi ZefiNo ratings yet

- WS3620-LED Coor Const LAMP - WinsemiDocument7 pagesWS3620-LED Coor Const LAMP - WinsemivmsaNo ratings yet

- 3 Axis TB6560 CNC Driver Board Users ManualDocument13 pages3 Axis TB6560 CNC Driver Board Users ManualJoão Luis Paiva JuniorNo ratings yet

- Final Datesheet Theory (Jan-2024)Document25 pagesFinal Datesheet Theory (Jan-2024)davidfieldsgoodNo ratings yet

- Unit 3 GCDocument21 pagesUnit 3 GCPapa AishuNo ratings yet

- 2010 US Mack Pinnacle Series (CXU Series) Operator's ManualDocument309 pages2010 US Mack Pinnacle Series (CXU Series) Operator's ManualMed Man100% (2)

- Social Studies Subject For Middle School - 8th Grade - Geography and Colonialism XL by SlidesgoDocument88 pagesSocial Studies Subject For Middle School - 8th Grade - Geography and Colonialism XL by SlidesgoAfonso OliveiraNo ratings yet

- Carlson 2018Document3,974 pagesCarlson 2018Lester Saquer100% (2)

- Homework Assignment Modules 14 and 16Document2 pagesHomework Assignment Modules 14 and 16Shuichi AkaiNo ratings yet

- Formal Languages and Automata Theory June July 2022Document8 pagesFormal Languages and Automata Theory June July 2022Hello HelloNo ratings yet

- Lecture 8 - Computer Application in Construction ManagementDocument43 pagesLecture 8 - Computer Application in Construction ManagementJubillee MagsinoNo ratings yet