Professional Documents

Culture Documents

Question Bank Business Law

Question Bank Business Law

Uploaded by

Neha BhatiaCopyright:

Available Formats

You might also like

- Biqs Oct 2017Document139 pagesBiqs Oct 2017carlo kaztillo83% (6)

- Business OrganisationDocument87 pagesBusiness OrganisationVictor Boateng100% (2)

- Gmail - International Investment Law (Quiz Test-1)Document11 pagesGmail - International Investment Law (Quiz Test-1)Ishwar MeenaNo ratings yet

- On Corporate Governance Under Companies ActDocument14 pagesOn Corporate Governance Under Companies ActPawan Kmuar Yadav100% (1)

- Critical ChainDocument24 pagesCritical ChainAlejandro MorettNo ratings yet

- Pre-Requisites For Successful Implementation of ProjectDocument17 pagesPre-Requisites For Successful Implementation of ProjectAseem1100% (9)

- Business Law BBA: 206-B Bba 4 SEM Question Bank: Unit-1Document2 pagesBusiness Law BBA: 206-B Bba 4 SEM Question Bank: Unit-1monikaNo ratings yet

- BUSINESS LAW and EthicsDocument2 pagesBUSINESS LAW and EthicsSowjanya TalapakaNo ratings yet

- Business Law Full NotesDocument63 pagesBusiness Law Full NotesBhaskaran BalamuraliNo ratings yet

- Bachelor of Commerce - InternalDocument3 pagesBachelor of Commerce - InternalNkugwa Mark WilliamNo ratings yet

- Advanced Industrial Relations Model Question PapersDocument4 pagesAdvanced Industrial Relations Model Question PapersViraja Guru100% (1)

- Unit 1 Electronic Commerce: What Is E-Commerce Explain The Types of E-Commerce?Document53 pagesUnit 1 Electronic Commerce: What Is E-Commerce Explain The Types of E-Commerce?Mustafa TatiwalaNo ratings yet

- CT9 Business Awareness Module PDFDocument4 pagesCT9 Business Awareness Module PDFVignesh SrinivasanNo ratings yet

- Business Law Assignment PDFDocument4 pagesBusiness Law Assignment PDFamit90ish100% (1)

- Tandon Committee Report On Working CapitalDocument4 pagesTandon Committee Report On Working CapitalMohitAhujaNo ratings yet

- QUESTION BANK For Banking and Insurance MBA Sem IV-FinanceDocument2 pagesQUESTION BANK For Banking and Insurance MBA Sem IV-FinanceAgnya PatelNo ratings yet

- Bba Income Tax QuestionsDocument2 pagesBba Income Tax Questionssubba1995333333No ratings yet

- Case Study of Wagering AgrrementDocument1 pageCase Study of Wagering Agrrementankita modi100% (1)

- MQP For Business Law of RCU 5 SemDocument3 pagesMQP For Business Law of RCU 5 Semazam49100% (1)

- BBA 3rd Sem Business CommunicationDocument1 pageBBA 3rd Sem Business CommunicationINDRESH PATELNo ratings yet

- Companies Act 1956 Notes PDFDocument73 pagesCompanies Act 1956 Notes PDFsandows19No ratings yet

- Industrial Relation and Labour Law Solved MCQs (Set-1)Document6 pagesIndustrial Relation and Labour Law Solved MCQs (Set-1)Ankita singhNo ratings yet

- DETERMINANTS OF EXPORT & IMPORT - TonyDocument20 pagesDETERMINANTS OF EXPORT & IMPORT - Tonyrohit singhNo ratings yet

- Business Law McqsDocument2 pagesBusiness Law McqsHaseeb ShaikhNo ratings yet

- BUSINESS STATISTICS Notes UNIT 2Document6 pagesBUSINESS STATISTICS Notes UNIT 2Sherona ReidNo ratings yet

- Questions Paper 399-406Document8 pagesQuestions Paper 399-406s4sahithNo ratings yet

- 307 International Business-EnvironmentDocument31 pages307 International Business-EnvironmentDineshNo ratings yet

- Case Study - VCDocument5 pagesCase Study - VCapi-3865133No ratings yet

- Theoretical Foundation of ContractDocument14 pagesTheoretical Foundation of ContractAlowe EsselNo ratings yet

- Note On Public IssueDocument9 pagesNote On Public IssueKrish KalraNo ratings yet

- Principles of InsuranceDocument2 pagesPrinciples of Insurancepsawant77No ratings yet

- Lebe ImpDocument10 pagesLebe Impvikky717No ratings yet

- Dupaul Wood Treatment v. AsareDocument21 pagesDupaul Wood Treatment v. AsareGifty Boehye50% (2)

- MCQsDocument16 pagesMCQsShreyansh ChopraNo ratings yet

- Business Ethics MCQ With Answers PDFDocument20 pagesBusiness Ethics MCQ With Answers PDFArmanNo ratings yet

- Case Study - Capital Market - 1Document8 pagesCase Study - Capital Market - 1Piyhoo GuptaNo ratings yet

- IPCC - 33e - Differences & True or False Statements in Indian Contract ActDocument58 pagesIPCC - 33e - Differences & True or False Statements in Indian Contract Actmohan100% (3)

- Question Bank For BUSINESS LAWDocument4 pagesQuestion Bank For BUSINESS LAWrahulNo ratings yet

- Professional Ethics - Question Bank Professional EthicsDocument22 pagesProfessional Ethics - Question Bank Professional EthicsDinesh KumarNo ratings yet

- Service MarketingDocument3 pagesService MarketingAnindya ChandraNo ratings yet

- AnsDocument9 pagesAnsblessedman01No ratings yet

- Ptu Question PapersDocument2 pagesPtu Question PapersChandan Kumar BanerjeeNo ratings yet

- Legal Aspects of Business 2 MarksDocument7 pagesLegal Aspects of Business 2 MarksSivagnanaNo ratings yet

- Nirmala College of Commerce Malad (E) : T.Y.BCOM SEM-VI (Regular) Subject - Indirect Tax Question Bank-2020Document17 pagesNirmala College of Commerce Malad (E) : T.Y.BCOM SEM-VI (Regular) Subject - Indirect Tax Question Bank-2020Prathmesh KadamNo ratings yet

- 17Uco6Mc04 Modern Banking Pratices Question Bank Unit - 1: Introduction To BankingDocument4 pages17Uco6Mc04 Modern Banking Pratices Question Bank Unit - 1: Introduction To BankingSimon JosephNo ratings yet

- BA7032 Entrepreneurship DevelopmentDocument5 pagesBA7032 Entrepreneurship DevelopmentSelva Senthil Prabhu CNo ratings yet

- The Advantages and Disadvantages of Small Scale ProductionDocument10 pagesThe Advantages and Disadvantages of Small Scale ProductionGøräksh Ñäík100% (1)

- Global Controlling & Global Challenges: Prof. Baiju B.S, MEA Engineering CollegeDocument2 pagesGlobal Controlling & Global Challenges: Prof. Baiju B.S, MEA Engineering CollegeSanuprabha100% (1)

- HRM Question Bank (BBA)Document5 pagesHRM Question Bank (BBA)DipankarNo ratings yet

- Very Short Answer Type Questions:: Unit-4 Chapter-3: Winding-Up of CompaniesDocument32 pagesVery Short Answer Type Questions:: Unit-4 Chapter-3: Winding-Up of CompaniesAanu GappaNo ratings yet

- Balance Sheet Vs Fund Flow StatementDocument19 pagesBalance Sheet Vs Fund Flow StatementsuasiveNo ratings yet

- Indicative MCQS: For Limited Insolvency ExaminationDocument13 pagesIndicative MCQS: For Limited Insolvency ExaminationAbhinay KumarNo ratings yet

- Fybms Business Law Wid AnswersDocument11 pagesFybms Business Law Wid AnswersnilNo ratings yet

- Business Law Mcqs 2Document42 pagesBusiness Law Mcqs 2Abhay RajputNo ratings yet

- MCQ Banking QuizDocument8 pagesMCQ Banking QuizRajivNo ratings yet

- Department of Mba Ba5031 - International Trade Finance Part ADocument5 pagesDepartment of Mba Ba5031 - International Trade Finance Part AHarihara PuthiranNo ratings yet

- B.B.A.Model PapersDocument3 pagesB.B.A.Model PapersHemanshu GhanshaniNo ratings yet

- Banking and Finance 3 (Chapter - Negotiable Instrument Act 1881) Solved MCQs (Set-1)Document6 pagesBanking and Finance 3 (Chapter - Negotiable Instrument Act 1881) Solved MCQs (Set-1)Mahendra SinghNo ratings yet

- Company Law Question BankDocument6 pagesCompany Law Question BankJanet GawareNo ratings yet

- Business Law Question BankDocument5 pagesBusiness Law Question BankMitali GautamNo ratings yet

- Paper V MCLDocument3 pagesPaper V MCLlegallyindiaNo ratings yet

- Law IMP QuestionsDocument5 pagesLaw IMP Questionsnisarg_No ratings yet

- Relevant Topics in Contract Law June 2017 AttemptDocument3 pagesRelevant Topics in Contract Law June 2017 AttemptpinkudasNo ratings yet

- 9 投行技术面试【估值】 valDocument6 pages9 投行技术面试【估值】 valChung Chee YuenNo ratings yet

- Doha Petroleum Construction Co. LTD Inspection & Test Plan: ElectricalDocument1 pageDoha Petroleum Construction Co. LTD Inspection & Test Plan: ElectricalmeeNo ratings yet

- ARLANXEO Keltan EPDM APAC ENDocument5 pagesARLANXEO Keltan EPDM APAC ENkarthibenNo ratings yet

- BOM Tables and QueryDocument3 pagesBOM Tables and QueryParth DesaiNo ratings yet

- 22 E Money Financial Markets 5th May 2016Document4 pages22 E Money Financial Markets 5th May 2016resufahmedNo ratings yet

- Indirect Questions BusinessDocument4 pagesIndirect Questions Businessesabea2345100% (1)

- Personal Data: Unit 1 Timmy's Business Center San Salvador St. Brgy. Sta. Cruz Palo, LeyteDocument3 pagesPersonal Data: Unit 1 Timmy's Business Center San Salvador St. Brgy. Sta. Cruz Palo, LeyteNadonza Sandoval CristieNo ratings yet

- Comparative AnalysisDocument9 pagesComparative AnalysisWenchie DiwaNo ratings yet

- Terex Machinery - Comic BookDocument46 pagesTerex Machinery - Comic BookMie DtsNo ratings yet

- ProjectDocument3 pagesProjectScott AndersonNo ratings yet

- Elasticity of DemandDocument21 pagesElasticity of DemandPriya Kala100% (1)

- TCS India (BPS) Policy - Notice PeriodDocument8 pagesTCS India (BPS) Policy - Notice PeriodBharath MadalaNo ratings yet

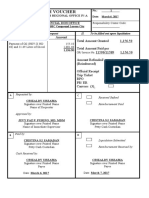

- Petty Cash VoucherDocument4 pagesPetty Cash VouchermitchrepilNo ratings yet

- VendorList BlankRowsDocument131 pagesVendorList BlankRowsAshraf JalilNo ratings yet

- An Analysis of Workmen's Right To Strike Under Industrial Disputes Act, 1947Document8 pagesAn Analysis of Workmen's Right To Strike Under Industrial Disputes Act, 1947aridaman raghuvanshiNo ratings yet

- 16 Operating Costing 1 (Autosaved)Document20 pages16 Operating Costing 1 (Autosaved)Deepak R GoradNo ratings yet

- Indian Depository ReceiptsDocument11 pagesIndian Depository Receiptsmeenakshi56100% (1)

- Dsi NewDocument22 pagesDsi NewayeshmanthabroNo ratings yet

- Unbalanced TransportationDocument24 pagesUnbalanced TransportationMeg sharkNo ratings yet

- Inequality and Economic Policy: Essays in Memory of Gary Becker, Edited by Tom Church, Chris Miller, and John B. TaylorDocument42 pagesInequality and Economic Policy: Essays in Memory of Gary Becker, Edited by Tom Church, Chris Miller, and John B. TaylorHoover InstitutionNo ratings yet

- Commercial Law Note by MK YongDocument83 pagesCommercial Law Note by MK YongM.k. YongNo ratings yet

- Project Synopsis (Sanjeev) 100Document8 pagesProject Synopsis (Sanjeev) 100sanjeev samNo ratings yet

- Daftar Judul DVD Kompilasi Psikologi PDFDocument103 pagesDaftar Judul DVD Kompilasi Psikologi PDFnaturafitNo ratings yet

- Belts Failure Book Final CE8149Document16 pagesBelts Failure Book Final CE8149vulpinorNo ratings yet

- Exhibit2.2Document1 pageExhibit2.2lightknowNo ratings yet

- Ch1 Financial Management Gitman 97 To 4Document41 pagesCh1 Financial Management Gitman 97 To 4Samiul MurshedNo ratings yet

- January 2020 Metro Board of Directors AgendaDocument19 pagesJanuary 2020 Metro Board of Directors AgendaMetro Los AngelesNo ratings yet

Question Bank Business Law

Question Bank Business Law

Uploaded by

Neha BhatiaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Question Bank Business Law

Question Bank Business Law

Uploaded by

Neha BhatiaCopyright:

Available Formats

Institute of Innovation in Technology and Management

Question Bank- Business law

Bcom – Sem II

Q-1 Define the term contract. Explain the essentials of a valid contract.

Q-2 Explain the meaning of the term Bailment. What are the duties of Bailor and Bailee under

the Indian Contract Act, 1872?

Q-3 what is consideration under the law of contract? State the essentials of valid consideration.

Q-4 what is contract? How is it different from agreement?

Q-5 “All agreements are not contracts, but all contracts are agreements.” Explain.

Q-6 what is quasi contracts? Narrate legal provisions of it.

Q-7 Define Agent and Principal. Discuss various modes of creation of agency.

Q-8 Define Agency. Explain different modes of termination of agency.

Q-9 Differentiate between Bailment and Pledge?

Q-10 Write a short note on:

(a) Wagering contracts

(b) Types of Bailment

(c) Damages for breach of contract

(d) Contract of indemnity

(e) Exceptions to the doctrine of consideration

(f) Difference between Coercion and undue influence

(g) Difference between Actual Breach and Anticipatory Breach

Q-10 Differentiate between Indemnity and guarantee.

Q-11 Explain various modes of discharge of a contract.

Q-12 Discuss various remedies available for breach of contract.

Q-13 What do you understand by capacities of parties? Discuss the position of a minor under the

Indian Contract Act, 1872.

Q-14 Discuss the meaning and scope of the term ‘goods’ under the sale of goods Act, 1930. State

whether the following are goods or not? A) Lottery tickets B) Electronic TV signal C) Money.

Q-15 “The right of ‘stoppage in transit’ is an extension of an unpaid seller’s right of lien”.

Comment.

Q-16 Distinguish between a Sale and Agreement to sell. In a contract for the sale of goods, state

when the property in goods sold passes from the seller to the buyer.

Q-17 Differentiate between condition and warranty in Sales of goods Act. Explain all the implied

conditions in the contract of sale of goods.

Q-18 Who is an unpaid seller. Describe the rights of an unpaid seller under the sales of goods

Act.

Q-19 Write note on the following:

a) Warranty

b) Rule of Caveat Emptor

Q-20 What do you mean by Negotiable Instruments? Discuss the difference between bill of

exchange and promissory note.

Q-21 Define cheque. Explain the types and effects of crossing made on cheques.

Q-22 Define Holder and Holder in Due Course. State and explain the priviledge of a holder in

due course

Q-23(a) Distinguish between a promissory note and bill of exchange

(b) What is a crossed cheque. Explain various modes of crossing of cheque.

Q-24 What are the requisites of a valid indorsement? Explain different kinds of indorsements

with suitable examples.

You might also like

- Biqs Oct 2017Document139 pagesBiqs Oct 2017carlo kaztillo83% (6)

- Business OrganisationDocument87 pagesBusiness OrganisationVictor Boateng100% (2)

- Gmail - International Investment Law (Quiz Test-1)Document11 pagesGmail - International Investment Law (Quiz Test-1)Ishwar MeenaNo ratings yet

- On Corporate Governance Under Companies ActDocument14 pagesOn Corporate Governance Under Companies ActPawan Kmuar Yadav100% (1)

- Critical ChainDocument24 pagesCritical ChainAlejandro MorettNo ratings yet

- Pre-Requisites For Successful Implementation of ProjectDocument17 pagesPre-Requisites For Successful Implementation of ProjectAseem1100% (9)

- Business Law BBA: 206-B Bba 4 SEM Question Bank: Unit-1Document2 pagesBusiness Law BBA: 206-B Bba 4 SEM Question Bank: Unit-1monikaNo ratings yet

- BUSINESS LAW and EthicsDocument2 pagesBUSINESS LAW and EthicsSowjanya TalapakaNo ratings yet

- Business Law Full NotesDocument63 pagesBusiness Law Full NotesBhaskaran BalamuraliNo ratings yet

- Bachelor of Commerce - InternalDocument3 pagesBachelor of Commerce - InternalNkugwa Mark WilliamNo ratings yet

- Advanced Industrial Relations Model Question PapersDocument4 pagesAdvanced Industrial Relations Model Question PapersViraja Guru100% (1)

- Unit 1 Electronic Commerce: What Is E-Commerce Explain The Types of E-Commerce?Document53 pagesUnit 1 Electronic Commerce: What Is E-Commerce Explain The Types of E-Commerce?Mustafa TatiwalaNo ratings yet

- CT9 Business Awareness Module PDFDocument4 pagesCT9 Business Awareness Module PDFVignesh SrinivasanNo ratings yet

- Business Law Assignment PDFDocument4 pagesBusiness Law Assignment PDFamit90ish100% (1)

- Tandon Committee Report On Working CapitalDocument4 pagesTandon Committee Report On Working CapitalMohitAhujaNo ratings yet

- QUESTION BANK For Banking and Insurance MBA Sem IV-FinanceDocument2 pagesQUESTION BANK For Banking and Insurance MBA Sem IV-FinanceAgnya PatelNo ratings yet

- Bba Income Tax QuestionsDocument2 pagesBba Income Tax Questionssubba1995333333No ratings yet

- Case Study of Wagering AgrrementDocument1 pageCase Study of Wagering Agrrementankita modi100% (1)

- MQP For Business Law of RCU 5 SemDocument3 pagesMQP For Business Law of RCU 5 Semazam49100% (1)

- BBA 3rd Sem Business CommunicationDocument1 pageBBA 3rd Sem Business CommunicationINDRESH PATELNo ratings yet

- Companies Act 1956 Notes PDFDocument73 pagesCompanies Act 1956 Notes PDFsandows19No ratings yet

- Industrial Relation and Labour Law Solved MCQs (Set-1)Document6 pagesIndustrial Relation and Labour Law Solved MCQs (Set-1)Ankita singhNo ratings yet

- DETERMINANTS OF EXPORT & IMPORT - TonyDocument20 pagesDETERMINANTS OF EXPORT & IMPORT - Tonyrohit singhNo ratings yet

- Business Law McqsDocument2 pagesBusiness Law McqsHaseeb ShaikhNo ratings yet

- BUSINESS STATISTICS Notes UNIT 2Document6 pagesBUSINESS STATISTICS Notes UNIT 2Sherona ReidNo ratings yet

- Questions Paper 399-406Document8 pagesQuestions Paper 399-406s4sahithNo ratings yet

- 307 International Business-EnvironmentDocument31 pages307 International Business-EnvironmentDineshNo ratings yet

- Case Study - VCDocument5 pagesCase Study - VCapi-3865133No ratings yet

- Theoretical Foundation of ContractDocument14 pagesTheoretical Foundation of ContractAlowe EsselNo ratings yet

- Note On Public IssueDocument9 pagesNote On Public IssueKrish KalraNo ratings yet

- Principles of InsuranceDocument2 pagesPrinciples of Insurancepsawant77No ratings yet

- Lebe ImpDocument10 pagesLebe Impvikky717No ratings yet

- Dupaul Wood Treatment v. AsareDocument21 pagesDupaul Wood Treatment v. AsareGifty Boehye50% (2)

- MCQsDocument16 pagesMCQsShreyansh ChopraNo ratings yet

- Business Ethics MCQ With Answers PDFDocument20 pagesBusiness Ethics MCQ With Answers PDFArmanNo ratings yet

- Case Study - Capital Market - 1Document8 pagesCase Study - Capital Market - 1Piyhoo GuptaNo ratings yet

- IPCC - 33e - Differences & True or False Statements in Indian Contract ActDocument58 pagesIPCC - 33e - Differences & True or False Statements in Indian Contract Actmohan100% (3)

- Question Bank For BUSINESS LAWDocument4 pagesQuestion Bank For BUSINESS LAWrahulNo ratings yet

- Professional Ethics - Question Bank Professional EthicsDocument22 pagesProfessional Ethics - Question Bank Professional EthicsDinesh KumarNo ratings yet

- Service MarketingDocument3 pagesService MarketingAnindya ChandraNo ratings yet

- AnsDocument9 pagesAnsblessedman01No ratings yet

- Ptu Question PapersDocument2 pagesPtu Question PapersChandan Kumar BanerjeeNo ratings yet

- Legal Aspects of Business 2 MarksDocument7 pagesLegal Aspects of Business 2 MarksSivagnanaNo ratings yet

- Nirmala College of Commerce Malad (E) : T.Y.BCOM SEM-VI (Regular) Subject - Indirect Tax Question Bank-2020Document17 pagesNirmala College of Commerce Malad (E) : T.Y.BCOM SEM-VI (Regular) Subject - Indirect Tax Question Bank-2020Prathmesh KadamNo ratings yet

- 17Uco6Mc04 Modern Banking Pratices Question Bank Unit - 1: Introduction To BankingDocument4 pages17Uco6Mc04 Modern Banking Pratices Question Bank Unit - 1: Introduction To BankingSimon JosephNo ratings yet

- BA7032 Entrepreneurship DevelopmentDocument5 pagesBA7032 Entrepreneurship DevelopmentSelva Senthil Prabhu CNo ratings yet

- The Advantages and Disadvantages of Small Scale ProductionDocument10 pagesThe Advantages and Disadvantages of Small Scale ProductionGøräksh Ñäík100% (1)

- Global Controlling & Global Challenges: Prof. Baiju B.S, MEA Engineering CollegeDocument2 pagesGlobal Controlling & Global Challenges: Prof. Baiju B.S, MEA Engineering CollegeSanuprabha100% (1)

- HRM Question Bank (BBA)Document5 pagesHRM Question Bank (BBA)DipankarNo ratings yet

- Very Short Answer Type Questions:: Unit-4 Chapter-3: Winding-Up of CompaniesDocument32 pagesVery Short Answer Type Questions:: Unit-4 Chapter-3: Winding-Up of CompaniesAanu GappaNo ratings yet

- Balance Sheet Vs Fund Flow StatementDocument19 pagesBalance Sheet Vs Fund Flow StatementsuasiveNo ratings yet

- Indicative MCQS: For Limited Insolvency ExaminationDocument13 pagesIndicative MCQS: For Limited Insolvency ExaminationAbhinay KumarNo ratings yet

- Fybms Business Law Wid AnswersDocument11 pagesFybms Business Law Wid AnswersnilNo ratings yet

- Business Law Mcqs 2Document42 pagesBusiness Law Mcqs 2Abhay RajputNo ratings yet

- MCQ Banking QuizDocument8 pagesMCQ Banking QuizRajivNo ratings yet

- Department of Mba Ba5031 - International Trade Finance Part ADocument5 pagesDepartment of Mba Ba5031 - International Trade Finance Part AHarihara PuthiranNo ratings yet

- B.B.A.Model PapersDocument3 pagesB.B.A.Model PapersHemanshu GhanshaniNo ratings yet

- Banking and Finance 3 (Chapter - Negotiable Instrument Act 1881) Solved MCQs (Set-1)Document6 pagesBanking and Finance 3 (Chapter - Negotiable Instrument Act 1881) Solved MCQs (Set-1)Mahendra SinghNo ratings yet

- Company Law Question BankDocument6 pagesCompany Law Question BankJanet GawareNo ratings yet

- Business Law Question BankDocument5 pagesBusiness Law Question BankMitali GautamNo ratings yet

- Paper V MCLDocument3 pagesPaper V MCLlegallyindiaNo ratings yet

- Law IMP QuestionsDocument5 pagesLaw IMP Questionsnisarg_No ratings yet

- Relevant Topics in Contract Law June 2017 AttemptDocument3 pagesRelevant Topics in Contract Law June 2017 AttemptpinkudasNo ratings yet

- 9 投行技术面试【估值】 valDocument6 pages9 投行技术面试【估值】 valChung Chee YuenNo ratings yet

- Doha Petroleum Construction Co. LTD Inspection & Test Plan: ElectricalDocument1 pageDoha Petroleum Construction Co. LTD Inspection & Test Plan: ElectricalmeeNo ratings yet

- ARLANXEO Keltan EPDM APAC ENDocument5 pagesARLANXEO Keltan EPDM APAC ENkarthibenNo ratings yet

- BOM Tables and QueryDocument3 pagesBOM Tables and QueryParth DesaiNo ratings yet

- 22 E Money Financial Markets 5th May 2016Document4 pages22 E Money Financial Markets 5th May 2016resufahmedNo ratings yet

- Indirect Questions BusinessDocument4 pagesIndirect Questions Businessesabea2345100% (1)

- Personal Data: Unit 1 Timmy's Business Center San Salvador St. Brgy. Sta. Cruz Palo, LeyteDocument3 pagesPersonal Data: Unit 1 Timmy's Business Center San Salvador St. Brgy. Sta. Cruz Palo, LeyteNadonza Sandoval CristieNo ratings yet

- Comparative AnalysisDocument9 pagesComparative AnalysisWenchie DiwaNo ratings yet

- Terex Machinery - Comic BookDocument46 pagesTerex Machinery - Comic BookMie DtsNo ratings yet

- ProjectDocument3 pagesProjectScott AndersonNo ratings yet

- Elasticity of DemandDocument21 pagesElasticity of DemandPriya Kala100% (1)

- TCS India (BPS) Policy - Notice PeriodDocument8 pagesTCS India (BPS) Policy - Notice PeriodBharath MadalaNo ratings yet

- Petty Cash VoucherDocument4 pagesPetty Cash VouchermitchrepilNo ratings yet

- VendorList BlankRowsDocument131 pagesVendorList BlankRowsAshraf JalilNo ratings yet

- An Analysis of Workmen's Right To Strike Under Industrial Disputes Act, 1947Document8 pagesAn Analysis of Workmen's Right To Strike Under Industrial Disputes Act, 1947aridaman raghuvanshiNo ratings yet

- 16 Operating Costing 1 (Autosaved)Document20 pages16 Operating Costing 1 (Autosaved)Deepak R GoradNo ratings yet

- Indian Depository ReceiptsDocument11 pagesIndian Depository Receiptsmeenakshi56100% (1)

- Dsi NewDocument22 pagesDsi NewayeshmanthabroNo ratings yet

- Unbalanced TransportationDocument24 pagesUnbalanced TransportationMeg sharkNo ratings yet

- Inequality and Economic Policy: Essays in Memory of Gary Becker, Edited by Tom Church, Chris Miller, and John B. TaylorDocument42 pagesInequality and Economic Policy: Essays in Memory of Gary Becker, Edited by Tom Church, Chris Miller, and John B. TaylorHoover InstitutionNo ratings yet

- Commercial Law Note by MK YongDocument83 pagesCommercial Law Note by MK YongM.k. YongNo ratings yet

- Project Synopsis (Sanjeev) 100Document8 pagesProject Synopsis (Sanjeev) 100sanjeev samNo ratings yet

- Daftar Judul DVD Kompilasi Psikologi PDFDocument103 pagesDaftar Judul DVD Kompilasi Psikologi PDFnaturafitNo ratings yet

- Belts Failure Book Final CE8149Document16 pagesBelts Failure Book Final CE8149vulpinorNo ratings yet

- Exhibit2.2Document1 pageExhibit2.2lightknowNo ratings yet

- Ch1 Financial Management Gitman 97 To 4Document41 pagesCh1 Financial Management Gitman 97 To 4Samiul MurshedNo ratings yet

- January 2020 Metro Board of Directors AgendaDocument19 pagesJanuary 2020 Metro Board of Directors AgendaMetro Los AngelesNo ratings yet