Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

82 viewsInternet Banking in India

Internet Banking in India

Uploaded by

Kunal KhannaThe document discusses internet banking in India and emerging challenges. It notes that internet banking is still nascent in India, with only 50 banks offering basic services. Foreign and private banks are more advanced. The main concerns with internet banking are security and privacy. By 2002, it is predicted that India will have a more competitive internet banking market driven by customer demand for low cost electronic services and global players. Banks must respond effectively to the challenges of internet banking or risk becoming marginalized.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Executive Summary of e BankingDocument24 pagesExecutive Summary of e BankingKiranShetty0% (1)

- Mba Project ONLINE BANKING SERVICES IciciDocument56 pagesMba Project ONLINE BANKING SERVICES IciciAnita Sona100% (5)

- Internet Banking Project DocumentationDocument24 pagesInternet Banking Project Documentationani_198883% (75)

- DraftDocument8 pagesDraftJeffery MillefioreNo ratings yet

- BankingDocument4 pagesBankingakshaybalgotra1175_4No ratings yet

- The Effect of The Internet Banking On Local BanksDocument3 pagesThe Effect of The Internet Banking On Local BanksddevNo ratings yet

- BM Notes (Modern Banking)Document28 pagesBM Notes (Modern Banking)Ranvir SinghNo ratings yet

- Banking and Insurance LawDocument10 pagesBanking and Insurance Lawnishantarya283No ratings yet

- Project SsDocument24 pagesProject SsmailtoshekharshivamNo ratings yet

- Project Report On Online BankingDocument24 pagesProject Report On Online BankingDrSanjeev K Chaudhary100% (3)

- My Main ProjectDocument29 pagesMy Main ProjectRahul VermaNo ratings yet

- A B C D of E-BankingDocument75 pagesA B C D of E-Bankinglove tannaNo ratings yet

- A Study On Virtual FinanceDocument5 pagesA Study On Virtual FinanceThe Rookie GuitaristNo ratings yet

- Role of IT in BankingDocument8 pagesRole of IT in Bankingsaurabhgoel66No ratings yet

- Essay # 1. Meaning of Internet Banking:: ContentsDocument8 pagesEssay # 1. Meaning of Internet Banking:: ContentsdfgsgfywNo ratings yet

- 10 - Chapter 3Document24 pages10 - Chapter 3Eloysa CarpoNo ratings yet

- Project e BankingDocument88 pagesProject e BankingAbhijit MohantyNo ratings yet

- Project Report On e Banking PDFDocument88 pagesProject Report On e Banking PDFSagarNo ratings yet

- An Assignment On Services MarketingDocument8 pagesAn Assignment On Services MarketingKhawar Munir GorayaNo ratings yet

- 1.1 Executive Summary: The Ever Increasing Speed of Internet Enabled Phones & Personal AssistantDocument59 pages1.1 Executive Summary: The Ever Increasing Speed of Internet Enabled Phones & Personal AssistantTejas GohilNo ratings yet

- Challeneges and Issues in Digital BankingDocument4 pagesChalleneges and Issues in Digital BankingHarshikaNo ratings yet

- Customer Perception On E-Banking Services - A Study With Reference To Private and Public Sector BanksDocument12 pagesCustomer Perception On E-Banking Services - A Study With Reference To Private and Public Sector BanksVenkat 19P259No ratings yet

- Project Report On e BankingDocument88 pagesProject Report On e BankingDhirender Chauhan73% (11)

- Online BankingDocument16 pagesOnline BankingParul Tyagi0% (1)

- P P P P P P: C - Æ - C C - C - Ñ Æñ C - C C - Ñ Æñc C - Æñc C - Cæ Æñc C - Æñ C - Æ CDocument10 pagesP P P P P P: C - Æ - C C - C - Ñ Æñ C - C C - Ñ Æñc C - Æñc C - Cæ Æñc C - Æñ C - Æ CvehlijantaNo ratings yet

- An Assignment On Services MarketingDocument8 pagesAn Assignment On Services MarketingSaurabh JetlyNo ratings yet

- Executive SummaryDocument51 pagesExecutive SummaryDhawal TankNo ratings yet

- A Report onE-BankingDocument123 pagesA Report onE-Bankingsachin91% (74)

- E Banking ProjectDocument123 pagesE Banking ProjectRavi MoriNo ratings yet

- Introduction - (25838)Document28 pagesIntroduction - (25838)Anonymous itZP6kzNo ratings yet

- Internet Banking: Development and Prospects in BangladeshDocument18 pagesInternet Banking: Development and Prospects in BangladeshHossen M MNo ratings yet

- Analysis of Internet Banking Along With Legal Aspects in India Dr. KavitaDocument17 pagesAnalysis of Internet Banking Along With Legal Aspects in India Dr. KavitaSheetal SaylekarNo ratings yet

- Black Book ChaptersDocument60 pagesBlack Book ChaptersVedant DandekarNo ratings yet

- An Assignment On Services MarketingDocument8 pagesAn Assignment On Services MarketingValentina MendesNo ratings yet

- Management Information System at THE CITY BANK LIMITED BangladeshDocument17 pagesManagement Information System at THE CITY BANK LIMITED BangladeshSimmons Ozil67% (3)

- Adobe Scan 29 May 2021Document20 pagesAdobe Scan 29 May 2021Saheb DasNo ratings yet

- Banking and Operation Assignment: Submitted By: Prashant Ghimire 17021141125 Batch: 2017-19Document10 pagesBanking and Operation Assignment: Submitted By: Prashant Ghimire 17021141125 Batch: 2017-19Prashant GhimireNo ratings yet

- Mentorship Report On Digitization in BankingDocument46 pagesMentorship Report On Digitization in BankingravneetNo ratings yet

- E Banking FerozpurDocument7 pagesE Banking FerozpurGunjan JainNo ratings yet

- Bob Internet BankingDocument12 pagesBob Internet BankingSweta PandeyNo ratings yet

- Impact of Internet Banking On CustomerDocument20 pagesImpact of Internet Banking On CustomerAmar Nath VermaNo ratings yet

- Introduction of Electronic BankingDocument20 pagesIntroduction of Electronic BankingPardeep BhadwalNo ratings yet

- A Presentation On Internet Banking: Prepared byDocument17 pagesA Presentation On Internet Banking: Prepared byTrivedi OmNo ratings yet

- Online Banking Services Icici BankDocument51 pagesOnline Banking Services Icici BankMubeenNo ratings yet

- K FinishDocument63 pagesK FinishPrakash ChauhanNo ratings yet

- Internet Banking: DR Kavita Srivastava Dr. Kavita Srivastava Department of Management Its GH BD ITS, GhaziabadDocument34 pagesInternet Banking: DR Kavita Srivastava Dr. Kavita Srivastava Department of Management Its GH BD ITS, GhaziabadChandanMatoliaNo ratings yet

- PPB Module 4Document38 pagesPPB Module 4RAJNo ratings yet

- Project On E-BankingDocument50 pagesProject On E-BankingSamdani TajNo ratings yet

- IJCRT2105956Document5 pagesIJCRT2105956Suny PaswanNo ratings yet

- E Generation of Banking in IndiaDocument2 pagesE Generation of Banking in IndiaSharath Srinivas BudugunteNo ratings yet

- Alternate Channel BankingDocument51 pagesAlternate Channel BankingfruitnutsNo ratings yet

- EIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsFrom EverandEIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsNo ratings yet

- E-commerce Evolution : Navigating Trends and Innovations in Digital MarketingFrom EverandE-commerce Evolution : Navigating Trends and Innovations in Digital MarketingNo ratings yet

- Unleashing E-commerce Potential : Harnessing the Power of Digital MarketingFrom EverandUnleashing E-commerce Potential : Harnessing the Power of Digital MarketingNo ratings yet

- Marketplace Analysis For E-CommerceDocument18 pagesMarketplace Analysis For E-CommerceAbdullah AlmushrefNo ratings yet

- Sam Matla - YouTube Channel For Take ActionDocument2 pagesSam Matla - YouTube Channel For Take Actionamycreative01No ratings yet

- Antivirus Softwares ComparisonDocument2 pagesAntivirus Softwares ComparisonneelNo ratings yet

- Semrush-Domain Overview (Canada) - Qctcollege Com-17 Juil. 2023Document8 pagesSemrush-Domain Overview (Canada) - Qctcollege Com-17 Juil. 2023Aamir MalikNo ratings yet

- Blog Oportunidades Checklist Con ContactosDocument120 pagesBlog Oportunidades Checklist Con ContactosLUCIA SABINANo ratings yet

- Bike ExchangeDocument184 pagesBike ExchangeJuan PerezNo ratings yet

- (IJET-V1I2P7) Authors :mr. Harjot Kaur, Mrs - Daljit KaurDocument5 pages(IJET-V1I2P7) Authors :mr. Harjot Kaur, Mrs - Daljit KaurInternational Journal of Engineering and TechniquesNo ratings yet

- Yield If y Fashion e Book 2015Document25 pagesYield If y Fashion e Book 2015crristtinaaNo ratings yet

- SEO Pinacle Web IndiaDocument2 pagesSEO Pinacle Web IndiaJenny FlexNo ratings yet

- Weibo InitiationDocument22 pagesWeibo InitiationInvisible FriendNo ratings yet

- HUAWEI USG6600 Series Next-Generation Firewall BrochureDocument2 pagesHUAWEI USG6600 Series Next-Generation Firewall BrochureRochdi BouzaienNo ratings yet

- FIDO U2F UAF Tutorial v1 PDFDocument79 pagesFIDO U2F UAF Tutorial v1 PDFChayan GhoshNo ratings yet

- (Business Ebook) - 101 Money Secrets PDFDocument59 pages(Business Ebook) - 101 Money Secrets PDFaok13100% (1)

- Eset Nod32 Antivirus 11 License Key 2020Document4 pagesEset Nod32 Antivirus 11 License Key 2020Rafael Antonio Taleno CamposoNo ratings yet

- Impact of e Commerce On BusinessDocument3 pagesImpact of e Commerce On BusinessMaira Hussain100% (1)

- Micro Small and Medium Enterprises MsmeDocument5 pagesMicro Small and Medium Enterprises MsmeSatyabrata roulNo ratings yet

- 2-HR-A New Dimension-For ClassDocument8 pages2-HR-A New Dimension-For ClassMuhammad Tahmid HossainNo ratings yet

- Commerce NotesDocument73 pagesCommerce NotesAgrippa Mungazi100% (1)

- Courseproject Websecurity Final LeviwelshansDocument11 pagesCourseproject Websecurity Final Leviwelshansapi-282901577No ratings yet

- MCQsDocument48 pagesMCQsSujeetDhakalNo ratings yet

- Tomboy Style BrandsDocument16 pagesTomboy Style Brandsapi-510321403No ratings yet

- Online Shopping CartDocument16 pagesOnline Shopping CartChristy JohnsonNo ratings yet

- Chapter 4 Procurement Supply MGMTDocument79 pagesChapter 4 Procurement Supply MGMTisang100% (1)

- POM II Final Report On SCM of Flipkart PDFDocument18 pagesPOM II Final Report On SCM of Flipkart PDFraazNo ratings yet

- Poland Doing Bussineseg PL 047519Document159 pagesPoland Doing Bussineseg PL 047519Ovidiu LunguNo ratings yet

- JNT KPIs & Business Value SlidesDocument11 pagesJNT KPIs & Business Value SlidesJishnu MithreNo ratings yet

- MainDocument32 pagesMainHoang Minh AnhNo ratings yet

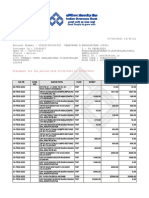

- Statement 028201000028352Document6 pagesStatement 028201000028352Saravanan 75No ratings yet

- Retail and EcommerceDocument33 pagesRetail and EcommerceDurgesh MishraNo ratings yet

Internet Banking in India

Internet Banking in India

Uploaded by

Kunal Khanna0 ratings0% found this document useful (0 votes)

82 views3 pagesThe document discusses internet banking in India and emerging challenges. It notes that internet banking is still nascent in India, with only 50 banks offering basic services. Foreign and private banks are more advanced. The main concerns with internet banking are security and privacy. By 2002, it is predicted that India will have a more competitive internet banking market driven by customer demand for low cost electronic services and global players. Banks must respond effectively to the challenges of internet banking or risk becoming marginalized.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses internet banking in India and emerging challenges. It notes that internet banking is still nascent in India, with only 50 banks offering basic services. Foreign and private banks are more advanced. The main concerns with internet banking are security and privacy. By 2002, it is predicted that India will have a more competitive internet banking market driven by customer demand for low cost electronic services and global players. Banks must respond effectively to the challenges of internet banking or risk becoming marginalized.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

82 views3 pagesInternet Banking in India

Internet Banking in India

Uploaded by

Kunal KhannaThe document discusses internet banking in India and emerging challenges. It notes that internet banking is still nascent in India, with only 50 banks offering basic services. Foreign and private banks are more advanced. The main concerns with internet banking are security and privacy. By 2002, it is predicted that India will have a more competitive internet banking market driven by customer demand for low cost electronic services and global players. Banks must respond effectively to the challenges of internet banking or risk becoming marginalized.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Internet Banking in India-Part I

- Dr A. K. Mishra

[Dr Mishra is Professor at IIM Lucknow. In his Two part feature, Dr Mishra covers emerging challenges,

main concerns in Internet banking and strategies that need to be adopted by Indian banks.]

INTRODUCTION

The Internet banking is changing the banking industry and is having

the major effects on banking relationships. Even the Morgan Stanley

Dean Witter Internet research emphasised that Web is more important

for retail financial services than for many other industries.

Internet banking involves use of Internet for delivery of banking

products & services. It falls into four main categories, from Level

1 - minimum functionality sites that offer only access to deposit

account data - to Level 4 sites - highly sophisticated offerings

enabling integrated sales of additional products and access to

other financial services- such as investment and insurance. In

other words a successful Internet banking solution offers

· Exceptional rates on Savings, CDs, and IRAs

· Checking with no monthly fee, free bill payment and rebates on

ATM surcharges

· Credit cards with low rates

· Easy online applications for all accounts, including personal

loans and mortgages

· 24 hour account access

· Quality customer service with personal attention

DRIVERS OF CHANGE

Advantages previously held by large financial institutions have

shrunk considerably. The Internet has leveled the playing field and

afforded open access to customers in the global marketplace.

Internet banking is a cost-effective delivery channel for financial

institutions. Consumers are embracing the many benefits of Internet

banking. Access to one's accounts at anytime and from any location

via the World Wide Web is a convenience unknown a short time ago.

Thus, a bank's Internet presence transforms from 'brouchreware'

status to 'Internet banking' status once the bank goes through a

technology integration effort to enable the customer to access

information about his or her specific account relationship. The six

primary drivers of Internet banking includes, in order of primacy

are:

· Improve customer access

· Facilitate the offering of more services

· Increase customer loyalty

· Attract new customers

· Provide services offered by competitors

· Reduce customer attrition

INDIAN BANKS ON WEB

The banking industry in India is facing unprecedented competition

from non-traditional banking institutions, which now offer banking

and financial services over the Internet. The deregulation of the

banking industry coupled with the emergence of new technologies,

are enabling new competitors to enter the financial services market

quickly and efficiently.

Indian banks are going for the retail banking in a big way.

However, much is still to be achieved. This study which was

conducted by students of IIML shows some interesting facts:

· Throughout the country, the Internet Banking is in the nascent

stage of development (only 50 banks are offering varied kind of

Internet banking services).

· In general, these Internet sites offer only the most basic

services. 55% are so called 'entry level' sites, offering little

more than company information and basic marketing materials. Only

8% offer 'advanced transactions' such as online funds transfer,

transactions & cash management services.

· Foreign & Private banks are much advanced in terms of the number

of sites & their level of development.

EMERGING CHALLENGES

Information technology analyst firm, the Meta Group, recently

reported that "financial institutions who don't offer home banking

by the year 2000 will become marginalized." By the year of 2002, a

large sophisticated and highly competitive Internet Banking Market

will develop which will be driven by

· Demand side pressure due to increasing access to low cost

electronic services.

· Emergence of open standards for banking functionality.

· Growing customer awareness and need of transparency.

· Global players in the fray

· Close integration of bank services with web based E-commerce or

even disintermediation of services through direct electronic

payments (E- Cash).

· More convenient international transactions due to the fact that

the Internet along with general deregulation trends, eliminate

geographic boundaries.

· Move from one stop shopping to 'Banking Portfolio' i.e. unbundled

product purchases.

Certainly some existing brick and mortar banks will go out of

business. But that's because they fail to respond to the challenge

of the Internet. The Internet and it's underlying technologies will

change and transform not just banking, but all aspects of finance

and commerce. It represents much more than a new distribution

opportunity. It will enable nimble players to leverage their brick

and mortar presence to improve customer satisfaction and gain

share. It will force lethargic players who are struck with legacy

cost basis, out of business-since they are unable to bring to play

in the new context.

MAIN CONCERNS IN INTERNET BANKING

In a survey conducted by the Online Banking Association, member

institutions rated security as the most important issue of online

banking. There is a dual requirement to protect customers' privacy

and protect against fraud. Banking Securely: Online Banking via the

World Wide Web provides an overview of Internet commerce and how

one company handles secure banking for its financial institution

clients and their customers. Some basic information on the

transmission of confidential data is presented in Security and

Encryption on the Web. PC Magazine Online also offers a primer: How

Encryption Works. A multi-layered security architecture comprising

firewalls, filtering routers, encryption and digital certification

ensures that your account information is protected from

unauthorised access:

· Firewalls and filtering routers ensure that only the legitimate

Internet users are allowed to access the system.

· Encryption techniques used by the bank (including the

sophisticated public key encryption) would ensure that privacy of

data flowing between the browser and the Infinity system is

protected.

· Digital certification procedures provide the assurance that the

data you receive is from the Infinity system.

You might also like

- Executive Summary of e BankingDocument24 pagesExecutive Summary of e BankingKiranShetty0% (1)

- Mba Project ONLINE BANKING SERVICES IciciDocument56 pagesMba Project ONLINE BANKING SERVICES IciciAnita Sona100% (5)

- Internet Banking Project DocumentationDocument24 pagesInternet Banking Project Documentationani_198883% (75)

- DraftDocument8 pagesDraftJeffery MillefioreNo ratings yet

- BankingDocument4 pagesBankingakshaybalgotra1175_4No ratings yet

- The Effect of The Internet Banking On Local BanksDocument3 pagesThe Effect of The Internet Banking On Local BanksddevNo ratings yet

- BM Notes (Modern Banking)Document28 pagesBM Notes (Modern Banking)Ranvir SinghNo ratings yet

- Banking and Insurance LawDocument10 pagesBanking and Insurance Lawnishantarya283No ratings yet

- Project SsDocument24 pagesProject SsmailtoshekharshivamNo ratings yet

- Project Report On Online BankingDocument24 pagesProject Report On Online BankingDrSanjeev K Chaudhary100% (3)

- My Main ProjectDocument29 pagesMy Main ProjectRahul VermaNo ratings yet

- A B C D of E-BankingDocument75 pagesA B C D of E-Bankinglove tannaNo ratings yet

- A Study On Virtual FinanceDocument5 pagesA Study On Virtual FinanceThe Rookie GuitaristNo ratings yet

- Role of IT in BankingDocument8 pagesRole of IT in Bankingsaurabhgoel66No ratings yet

- Essay # 1. Meaning of Internet Banking:: ContentsDocument8 pagesEssay # 1. Meaning of Internet Banking:: ContentsdfgsgfywNo ratings yet

- 10 - Chapter 3Document24 pages10 - Chapter 3Eloysa CarpoNo ratings yet

- Project e BankingDocument88 pagesProject e BankingAbhijit MohantyNo ratings yet

- Project Report On e Banking PDFDocument88 pagesProject Report On e Banking PDFSagarNo ratings yet

- An Assignment On Services MarketingDocument8 pagesAn Assignment On Services MarketingKhawar Munir GorayaNo ratings yet

- 1.1 Executive Summary: The Ever Increasing Speed of Internet Enabled Phones & Personal AssistantDocument59 pages1.1 Executive Summary: The Ever Increasing Speed of Internet Enabled Phones & Personal AssistantTejas GohilNo ratings yet

- Challeneges and Issues in Digital BankingDocument4 pagesChalleneges and Issues in Digital BankingHarshikaNo ratings yet

- Customer Perception On E-Banking Services - A Study With Reference To Private and Public Sector BanksDocument12 pagesCustomer Perception On E-Banking Services - A Study With Reference To Private and Public Sector BanksVenkat 19P259No ratings yet

- Project Report On e BankingDocument88 pagesProject Report On e BankingDhirender Chauhan73% (11)

- Online BankingDocument16 pagesOnline BankingParul Tyagi0% (1)

- P P P P P P: C - Æ - C C - C - Ñ Æñ C - C C - Ñ Æñc C - Æñc C - Cæ Æñc C - Æñ C - Æ CDocument10 pagesP P P P P P: C - Æ - C C - C - Ñ Æñ C - C C - Ñ Æñc C - Æñc C - Cæ Æñc C - Æñ C - Æ CvehlijantaNo ratings yet

- An Assignment On Services MarketingDocument8 pagesAn Assignment On Services MarketingSaurabh JetlyNo ratings yet

- Executive SummaryDocument51 pagesExecutive SummaryDhawal TankNo ratings yet

- A Report onE-BankingDocument123 pagesA Report onE-Bankingsachin91% (74)

- E Banking ProjectDocument123 pagesE Banking ProjectRavi MoriNo ratings yet

- Introduction - (25838)Document28 pagesIntroduction - (25838)Anonymous itZP6kzNo ratings yet

- Internet Banking: Development and Prospects in BangladeshDocument18 pagesInternet Banking: Development and Prospects in BangladeshHossen M MNo ratings yet

- Analysis of Internet Banking Along With Legal Aspects in India Dr. KavitaDocument17 pagesAnalysis of Internet Banking Along With Legal Aspects in India Dr. KavitaSheetal SaylekarNo ratings yet

- Black Book ChaptersDocument60 pagesBlack Book ChaptersVedant DandekarNo ratings yet

- An Assignment On Services MarketingDocument8 pagesAn Assignment On Services MarketingValentina MendesNo ratings yet

- Management Information System at THE CITY BANK LIMITED BangladeshDocument17 pagesManagement Information System at THE CITY BANK LIMITED BangladeshSimmons Ozil67% (3)

- Adobe Scan 29 May 2021Document20 pagesAdobe Scan 29 May 2021Saheb DasNo ratings yet

- Banking and Operation Assignment: Submitted By: Prashant Ghimire 17021141125 Batch: 2017-19Document10 pagesBanking and Operation Assignment: Submitted By: Prashant Ghimire 17021141125 Batch: 2017-19Prashant GhimireNo ratings yet

- Mentorship Report On Digitization in BankingDocument46 pagesMentorship Report On Digitization in BankingravneetNo ratings yet

- E Banking FerozpurDocument7 pagesE Banking FerozpurGunjan JainNo ratings yet

- Bob Internet BankingDocument12 pagesBob Internet BankingSweta PandeyNo ratings yet

- Impact of Internet Banking On CustomerDocument20 pagesImpact of Internet Banking On CustomerAmar Nath VermaNo ratings yet

- Introduction of Electronic BankingDocument20 pagesIntroduction of Electronic BankingPardeep BhadwalNo ratings yet

- A Presentation On Internet Banking: Prepared byDocument17 pagesA Presentation On Internet Banking: Prepared byTrivedi OmNo ratings yet

- Online Banking Services Icici BankDocument51 pagesOnline Banking Services Icici BankMubeenNo ratings yet

- K FinishDocument63 pagesK FinishPrakash ChauhanNo ratings yet

- Internet Banking: DR Kavita Srivastava Dr. Kavita Srivastava Department of Management Its GH BD ITS, GhaziabadDocument34 pagesInternet Banking: DR Kavita Srivastava Dr. Kavita Srivastava Department of Management Its GH BD ITS, GhaziabadChandanMatoliaNo ratings yet

- PPB Module 4Document38 pagesPPB Module 4RAJNo ratings yet

- Project On E-BankingDocument50 pagesProject On E-BankingSamdani TajNo ratings yet

- IJCRT2105956Document5 pagesIJCRT2105956Suny PaswanNo ratings yet

- E Generation of Banking in IndiaDocument2 pagesE Generation of Banking in IndiaSharath Srinivas BudugunteNo ratings yet

- Alternate Channel BankingDocument51 pagesAlternate Channel BankingfruitnutsNo ratings yet

- EIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsFrom EverandEIB Working Papers 2019/01 - Blockchain, FinTechs: and their relevance for international financial institutionsNo ratings yet

- E-commerce Evolution : Navigating Trends and Innovations in Digital MarketingFrom EverandE-commerce Evolution : Navigating Trends and Innovations in Digital MarketingNo ratings yet

- Unleashing E-commerce Potential : Harnessing the Power of Digital MarketingFrom EverandUnleashing E-commerce Potential : Harnessing the Power of Digital MarketingNo ratings yet

- Marketplace Analysis For E-CommerceDocument18 pagesMarketplace Analysis For E-CommerceAbdullah AlmushrefNo ratings yet

- Sam Matla - YouTube Channel For Take ActionDocument2 pagesSam Matla - YouTube Channel For Take Actionamycreative01No ratings yet

- Antivirus Softwares ComparisonDocument2 pagesAntivirus Softwares ComparisonneelNo ratings yet

- Semrush-Domain Overview (Canada) - Qctcollege Com-17 Juil. 2023Document8 pagesSemrush-Domain Overview (Canada) - Qctcollege Com-17 Juil. 2023Aamir MalikNo ratings yet

- Blog Oportunidades Checklist Con ContactosDocument120 pagesBlog Oportunidades Checklist Con ContactosLUCIA SABINANo ratings yet

- Bike ExchangeDocument184 pagesBike ExchangeJuan PerezNo ratings yet

- (IJET-V1I2P7) Authors :mr. Harjot Kaur, Mrs - Daljit KaurDocument5 pages(IJET-V1I2P7) Authors :mr. Harjot Kaur, Mrs - Daljit KaurInternational Journal of Engineering and TechniquesNo ratings yet

- Yield If y Fashion e Book 2015Document25 pagesYield If y Fashion e Book 2015crristtinaaNo ratings yet

- SEO Pinacle Web IndiaDocument2 pagesSEO Pinacle Web IndiaJenny FlexNo ratings yet

- Weibo InitiationDocument22 pagesWeibo InitiationInvisible FriendNo ratings yet

- HUAWEI USG6600 Series Next-Generation Firewall BrochureDocument2 pagesHUAWEI USG6600 Series Next-Generation Firewall BrochureRochdi BouzaienNo ratings yet

- FIDO U2F UAF Tutorial v1 PDFDocument79 pagesFIDO U2F UAF Tutorial v1 PDFChayan GhoshNo ratings yet

- (Business Ebook) - 101 Money Secrets PDFDocument59 pages(Business Ebook) - 101 Money Secrets PDFaok13100% (1)

- Eset Nod32 Antivirus 11 License Key 2020Document4 pagesEset Nod32 Antivirus 11 License Key 2020Rafael Antonio Taleno CamposoNo ratings yet

- Impact of e Commerce On BusinessDocument3 pagesImpact of e Commerce On BusinessMaira Hussain100% (1)

- Micro Small and Medium Enterprises MsmeDocument5 pagesMicro Small and Medium Enterprises MsmeSatyabrata roulNo ratings yet

- 2-HR-A New Dimension-For ClassDocument8 pages2-HR-A New Dimension-For ClassMuhammad Tahmid HossainNo ratings yet

- Commerce NotesDocument73 pagesCommerce NotesAgrippa Mungazi100% (1)

- Courseproject Websecurity Final LeviwelshansDocument11 pagesCourseproject Websecurity Final Leviwelshansapi-282901577No ratings yet

- MCQsDocument48 pagesMCQsSujeetDhakalNo ratings yet

- Tomboy Style BrandsDocument16 pagesTomboy Style Brandsapi-510321403No ratings yet

- Online Shopping CartDocument16 pagesOnline Shopping CartChristy JohnsonNo ratings yet

- Chapter 4 Procurement Supply MGMTDocument79 pagesChapter 4 Procurement Supply MGMTisang100% (1)

- POM II Final Report On SCM of Flipkart PDFDocument18 pagesPOM II Final Report On SCM of Flipkart PDFraazNo ratings yet

- Poland Doing Bussineseg PL 047519Document159 pagesPoland Doing Bussineseg PL 047519Ovidiu LunguNo ratings yet

- JNT KPIs & Business Value SlidesDocument11 pagesJNT KPIs & Business Value SlidesJishnu MithreNo ratings yet

- MainDocument32 pagesMainHoang Minh AnhNo ratings yet

- Statement 028201000028352Document6 pagesStatement 028201000028352Saravanan 75No ratings yet

- Retail and EcommerceDocument33 pagesRetail and EcommerceDurgesh MishraNo ratings yet