Professional Documents

Culture Documents

Insured Benefits: Scenario 1: Entity A's Retirement Benefit Plan Is Funded. Entity A

Insured Benefits: Scenario 1: Entity A's Retirement Benefit Plan Is Funded. Entity A

Uploaded by

DarrelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Insured Benefits: Scenario 1: Entity A's Retirement Benefit Plan Is Funded. Entity A

Insured Benefits: Scenario 1: Entity A's Retirement Benefit Plan Is Funded. Entity A

Uploaded by

DarrelCopyright:

Available Formats

Insured benefits

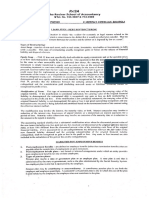

An employer may pay insurance premiums to fund a postemployment benefit plan. Such plan is

classified as either defined contribution plan or defined benefit plan.

However such a plan shall be accounted for as a defined benefit plan if the employer retains

the obligation to either pay directly the benefits to the employee or make good any deficiency

if the insurer fails to pay in full the benefits.

Accounting for defined contribution plan

The accounting for defined contribution plans is straightforward.

Recognizes contribution as expense

and liability (if unpaid) when employees have rendered service during a period.

If the amount contributed exceeds the fixed amount of contribution, the excess is treated as a

prepaid asset.

Illustration:

Under Entity A’s defined contribution plan, it agrees to make fixed

annual contributions of Php 200,000 to a retirement fund for the

benefit of its employees.

Scenario 1: Entity A’s retirement benefit plan is funded. Entity A

contributes Php 200,000 to the fund held by a trustee.

Dec.31, Retirement benefit expense 200,000

20x1 Cash 200,000

Scenario 2: Because of poor results of operations, Entity A was only

able to contribute Php 80,000 to the fund.

Dec.31, Retirement benefit expense 200,000

20x1 Cash 80,000

Accrued retirement contributions 120, 000

Scenario 3: Because of profitable operations , Entity A decided to

contribute Php 230,000 during the period.

Dec.31, Retirement benefit expense Prepaid 200,000

20x1 retirement contributions 30,000

Accrued retirement contributions 230,000

Scenario 4: An employee retired and was eligible to Php 30,000

retirement benefits based on the operating efficiency and investment

earnings to the fund.

Dec.31, No entry

20x1

You might also like

- To Accrue Advertising Expense: I PXRXTDocument6 pagesTo Accrue Advertising Expense: I PXRXTShane Nayah78% (9)

- Problem 8 14 To To 8 18Document24 pagesProblem 8 14 To To 8 18Hendriech Del Mundo62% (13)

- Intermediate Acctg 2 - MillanDocument6 pagesIntermediate Acctg 2 - MillanJuliana Ipo100% (1)

- Activity 1 Employee Benefits AKDocument7 pagesActivity 1 Employee Benefits AKRalph Rivera SantosNo ratings yet

- Answer-F UNIT 2 - Practice and Exercises Answer-F UNIT 2 - Practice and ExercisesDocument3 pagesAnswer-F UNIT 2 - Practice and Exercises Answer-F UNIT 2 - Practice and ExercisesDaniella Mae ElipNo ratings yet

- AFAR May2021 1st Preboard With AnswerDocument28 pagesAFAR May2021 1st Preboard With Answerlllll100% (3)

- Chapter 5 - Employee Benefits Part 1Document7 pagesChapter 5 - Employee Benefits Part 1XienaNo ratings yet

- L 1Document5 pagesL 1Elizabeth Espinosa ManilagNo ratings yet

- Employee Benefits Part 1: Name: Date: Professor: Section: Score: Quiz 1Document4 pagesEmployee Benefits Part 1: Name: Date: Professor: Section: Score: Quiz 1Jamie Rose Aragones83% (6)

- Cebu Cpar Current LiabilitiesDocument9 pagesCebu Cpar Current LiabilitiesDarrel100% (1)

- Quiz 4 Chapter 7 and 8Document5 pagesQuiz 4 Chapter 7 and 8June Antony Lim HechanovaNo ratings yet

- Module 4 Assessment Task - Employee BenefitsDocument2 pagesModule 4 Assessment Task - Employee BenefitsRonnah Mae FloresNo ratings yet

- FMCC225 - Financial Accounting 3 Final Examination 1 Sem. S/Y 2020-20221 Name: - Section: - Multiple ChoiceDocument3 pagesFMCC225 - Financial Accounting 3 Final Examination 1 Sem. S/Y 2020-20221 Name: - Section: - Multiple ChoiceChristian QuidipNo ratings yet

- FR QB Part 2Document11 pagesFR QB Part 2AkhilNo ratings yet

- CHAPTER 5 Employee Benefits Part 1Document68 pagesCHAPTER 5 Employee Benefits Part 1Kisha Kaye Del ValleNo ratings yet

- Aug. 18, 2020 Employee Benefits QuestionsDocument2 pagesAug. 18, 2020 Employee Benefits QuestionsLj Diane TuazonNo ratings yet

- Reviewer For Mid Term ExamDocument12 pagesReviewer For Mid Term ExamJannelle SalacNo ratings yet

- PAS20 Government Grants PAS23 Borrowing CostDocument11 pagesPAS20 Government Grants PAS23 Borrowing CostKristine Kyle AgneNo ratings yet

- Drill 2 (Employee Benefits) Instruction: Solve and Answer The Following Questions. Please Make A Summary of Your FinalDocument2 pagesDrill 2 (Employee Benefits) Instruction: Solve and Answer The Following Questions. Please Make A Summary of Your FinalYANIII12345No ratings yet

- Chapter 19 Ia2Document11 pagesChapter 19 Ia2JM Valonda Villena, CPA, MBANo ratings yet

- FAR ProblemsDocument7 pagesFAR ProblemsClaire GarciaNo ratings yet

- IAS 20 Accounting For Government Grants and Disclosure of Government AssistanceDocument5 pagesIAS 20 Accounting For Government Grants and Disclosure of Government Assistancemanvi jain100% (1)

- IAS 20 Accounting For Government Grants and Disclosure of Government AssistanceDocument5 pagesIAS 20 Accounting For Government Grants and Disclosure of Government Assistancemanvi jainNo ratings yet

- AK1 - PensionDocument4 pagesAK1 - Pensionclara_patricia_2No ratings yet

- Adjusting Entries: Fifth Step of The Accounting CycleDocument12 pagesAdjusting Entries: Fifth Step of The Accounting CyclealtaNo ratings yet

- Poem PoemDocument5 pagesPoem PoemElizabeth Espinosa ManilagNo ratings yet

- Q2 Employee Benefits Pt.2Document4 pagesQ2 Employee Benefits Pt.2francine del rosarioNo ratings yet

- Unit 03Document9 pagesUnit 03bobo tangaNo ratings yet

- Unit Number/ Heading Learning Outcomes: Intermediate Accounting Ii (Ae 16) Learning Material: Other Employee BenefitsDocument7 pagesUnit Number/ Heading Learning Outcomes: Intermediate Accounting Ii (Ae 16) Learning Material: Other Employee BenefitsJason MablesNo ratings yet

- 5TH.B Provisions, Contingent Liabilities and Contingent AssetsDocument4 pages5TH.B Provisions, Contingent Liabilities and Contingent AssetsAnthony DyNo ratings yet

- Employee Benefits Part 1Document12 pagesEmployee Benefits Part 1Khiks ObiasNo ratings yet

- Bachelor of Science in Accountancy Aec14-Conceptual Framework and Accounting Standards Midterm ExaminationDocument5 pagesBachelor of Science in Accountancy Aec14-Conceptual Framework and Accounting Standards Midterm ExaminationMelwin CalubayanNo ratings yet

- Employee Benefits: Defined Benefit PlansDocument4 pagesEmployee Benefits: Defined Benefit PlansMHARTIN DAENNIELLE ORSALNo ratings yet

- 18 - IND AS 19 - Employee Benefit - Final (R)Document28 pages18 - IND AS 19 - Employee Benefit - Final (R)S Bharhath kumarNo ratings yet

- Employee Benefits: PAS 19 Corpuz, Mary Lorie Anne ODocument38 pagesEmployee Benefits: PAS 19 Corpuz, Mary Lorie Anne OMarylorieanne CorpuzNo ratings yet

- Impairment of ReceivablesDocument15 pagesImpairment of ReceivablesNicole Daphne FigueroaNo ratings yet

- Activity 1.6.2Document1 pageActivity 1.6.2Stephen JohnNo ratings yet

- Exercise Ni ValewDocument4 pagesExercise Ni ValewALMA MORENANo ratings yet

- Acca SBR 691 698 PDFDocument8 pagesAcca SBR 691 698 PDFYudheesh P 1822082No ratings yet

- IA3 5copiesDocument6 pagesIA3 5copiesChloe CataluñaNo ratings yet

- Tax1 (T31920)Document82 pagesTax1 (T31920)Charles TuazonNo ratings yet

- Far Review - Notes and Receivable AssessmentDocument6 pagesFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenNo ratings yet

- ACC 113 - SAS - Day - 18Document12 pagesACC 113 - SAS - Day - 18Joy QuitorianoNo ratings yet

- EXAM TIME: 6:00 TO 7:30 Time Allowance For Mailing of 30 MinDocument12 pagesEXAM TIME: 6:00 TO 7:30 Time Allowance For Mailing of 30 MinNikky Bless LeonarNo ratings yet

- Cae05-Chapter 4 Notes Receivables & Payable Problem DiscussionDocument12 pagesCae05-Chapter 4 Notes Receivables & Payable Problem DiscussionSteffany RoqueNo ratings yet

- Q1Document6 pagesQ1Ray Pop0% (2)

- Employees BenefitsDocument2 pagesEmployees BenefitsorillosachristoperjohnNo ratings yet

- Assignment 3Document8 pagesAssignment 3Denny ChakauyaNo ratings yet

- Acc 108 Emp Bene. Bonus Debt RestrDocument2 pagesAcc 108 Emp Bene. Bonus Debt Restrbrmo.amatorio.uiNo ratings yet

- Audit 2, PENSION-EQUITY-INVESTMENT-LONG-QUIZDocument3 pagesAudit 2, PENSION-EQUITY-INVESTMENT-LONG-QUIZShaz NagaNo ratings yet

- PAS20 Government Grants PAS23 Borrowing Cost V2Document21 pagesPAS20 Government Grants PAS23 Borrowing Cost V2Leddie Bergs Villanueva VelascoNo ratings yet

- IllustrationDocument10 pagesIllustrationAmaris AyeshaNo ratings yet

- Government GrantsDocument6 pagesGovernment GrantspreciousegualanNo ratings yet

- Module 5 Packet: College of CommerceDocument23 pagesModule 5 Packet: College of CommerceDexie Jane MayoNo ratings yet

- Global Reciprocal College Inctax-1 Final Examination 1st Semester, SY 2020-2021 Problem 1Document4 pagesGlobal Reciprocal College Inctax-1 Final Examination 1st Semester, SY 2020-2021 Problem 1sharielles /No ratings yet

- RetainedDocument66 pagesRetainedJhonalyn Montimor GaldonesNo ratings yet

- Quiz - Chapter 2 - Business Combinations (Part 2)Document4 pagesQuiz - Chapter 2 - Business Combinations (Part 2)Pearly Jean ApuradorNo ratings yet

- The Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsFrom EverandThe Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- At 11Document4 pagesAt 11DarrelNo ratings yet

- DOCUMENTATIONDocument2 pagesDOCUMENTATIONDarrelNo ratings yet

- P1 Liabilities - LectureDocument4 pagesP1 Liabilities - LectureDarrelNo ratings yet

- NCPAR HQ02 Contracts DominggoDocument17 pagesNCPAR HQ02 Contracts DominggoDarrel100% (1)

- Samples of Games WallpaperDocument2 pagesSamples of Games WallpaperDarrelNo ratings yet

- Welcome To The Ifrs For Smes UpdateDocument7 pagesWelcome To The Ifrs For Smes UpdateDarrelNo ratings yet

- Liabilities Arising From Participating in A Specific Market-Waste Electrical and Electronic EquipmentDocument6 pagesLiabilities Arising From Participating in A Specific Market-Waste Electrical and Electronic EquipmentDarrelNo ratings yet

- Welcome To The Ifrs For Smes UpdateDocument3 pagesWelcome To The Ifrs For Smes UpdateDarrelNo ratings yet

- Welcome To The Ifrs For Smes UpdateDocument4 pagesWelcome To The Ifrs For Smes UpdateDarrelNo ratings yet

- IFRS For SMEs Update December 2016Document3 pagesIFRS For SMEs Update December 2016DarrelNo ratings yet

- Welcome To The Ifrs For Smes UpdateDocument3 pagesWelcome To The Ifrs For Smes UpdateDarrelNo ratings yet

- IFRS For SMEs Update June 2015Document3 pagesIFRS For SMEs Update June 2015DarrelNo ratings yet

- Welcome To The Ifrs For Smes UpdateDocument3 pagesWelcome To The Ifrs For Smes UpdateDarrelNo ratings yet

- IFRS For SMEs Update May 2014Document3 pagesIFRS For SMEs Update May 2014DarrelNo ratings yet

- IFRS For SMEs Update September 2015Document3 pagesIFRS For SMEs Update September 2015DarrelNo ratings yet

- IFRS For SMEs Update AprilDocument2 pagesIFRS For SMEs Update AprilDarrelNo ratings yet

- Ifrs For Smes: UpdateDocument4 pagesIfrs For Smes: UpdateDarrelNo ratings yet

- Welcome To The Ifrs For Smes UpdateDocument4 pagesWelcome To The Ifrs For Smes UpdateDarrelNo ratings yet