Professional Documents

Culture Documents

PCDA Guidelines - Defence Civilians PDF

PCDA Guidelines - Defence Civilians PDF

Uploaded by

prabhakarpv1Copyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Siridhanyalatho Sampoorna ArogyamDocument52 pagesSiridhanyalatho Sampoorna Arogyamprabhakarpv197% (38)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Petition of AnnulmentDocument6 pagesPetition of AnnulmentCzarDuranteNo ratings yet

- Catholic Diocese of Salt Lake City Final Clergy Allegations ListDocument5 pagesCatholic Diocese of Salt Lake City Final Clergy Allegations ListAdam ForgieNo ratings yet

- 5.1 Verb List Book PDFDocument7 pages5.1 Verb List Book PDFprabhakarpv1100% (1)

- 4.1 Test 1-2-3 Exercises + Answers PDF Sheets PDFDocument7 pages4.1 Test 1-2-3 Exercises + Answers PDF Sheets PDFprabhakarpv1No ratings yet

- Echs Gov in Img Contact Bang HTMLDocument4 pagesEchs Gov in Img Contact Bang HTMLprabhakarpv1100% (1)

- 4.1 Test 1-2-3 Exercises + Answers PDF Sheets PDFDocument7 pages4.1 Test 1-2-3 Exercises + Answers PDF Sheets PDFprabhakarpv1No ratings yet

- Try MeDocument1 pageTry Meprabhakarpv1No ratings yet

- Terminal and Gate Difference at AirportDocument3 pagesTerminal and Gate Difference at Airportprabhakarpv1No ratings yet

- Echs Gov in Img Contact Hyd HTMLDocument3 pagesEchs Gov in Img Contact Hyd HTMLprabhakarpv1No ratings yet

- Millet Book Inner (2nd Print May 2018)Document58 pagesMillet Book Inner (2nd Print May 2018)g.chandan89% (56)

- Army/Navy/Air Force/Coast Guard/DSC/SFF (As Applicable)Document2 pagesArmy/Navy/Air Force/Coast Guard/DSC/SFF (As Applicable)prabhakarpv1No ratings yet

- Agricultural Road MapDocument75 pagesAgricultural Road Mapprabhakarpv1No ratings yet

- Milletssiridhanya Book c2b7 Version 1Document29 pagesMilletssiridhanya Book c2b7 Version 1lakshmiescribd94% (36)

- WWW Echs Gov inDocument6 pagesWWW Echs Gov inprabhakarpv1No ratings yet

- Milletssiridhanya Book c2b7 Version 1Document29 pagesMilletssiridhanya Book c2b7 Version 1lakshmiescribd94% (36)

- SBI Hospital CashDocument1 pageSBI Hospital Cashprabhakarpv1No ratings yet

- She Is Easy On The EyesDocument1 pageShe Is Easy On The Eyesprabhakarpv1No ratings yet

- Nehru Family - Truth You Should Know About Nehru FamilyDocument3 pagesNehru Family - Truth You Should Know About Nehru FamilyNehru Family100% (1)

- Unit 2 Test. Challenge LevelDocument3 pagesUnit 2 Test. Challenge LevelThe English TeacherNo ratings yet

- Form ESCIDocument3 pagesForm ESCIHimanshu KumarNo ratings yet

- Andal Vs MacaraigDocument1 pageAndal Vs Macaraigamareia yap100% (1)

- Wedding Reception ProgrammeDocument4 pagesWedding Reception ProgrammeAllan Palma GilNo ratings yet

- Fun Home: The Role of Literature in Shaping Alison's HomosexualityDocument5 pagesFun Home: The Role of Literature in Shaping Alison's HomosexualitySushmitha KrishnamoorthyNo ratings yet

- Bach Ricercare Offerta Mus BWV 1079 SAB Trio (Parts) PDFDocument16 pagesBach Ricercare Offerta Mus BWV 1079 SAB Trio (Parts) PDFGiulio GianìNo ratings yet

- Indira GandhiDocument12 pagesIndira GandhiJITENDRA VISHWAKARMANo ratings yet

- Barney'S: I Love You SongDocument23 pagesBarney'S: I Love You SongJun CabsNo ratings yet

- How Deep Is Your Love Tab - Bee Gees (By Jorell Prospero)Document3 pagesHow Deep Is Your Love Tab - Bee Gees (By Jorell Prospero)Trisha ArgaoNo ratings yet

- Reflection PaperDocument1 pageReflection Paperkororo mapaladNo ratings yet

- Thesis DivorceDocument6 pagesThesis Divorcedeniselopezalbuquerque100% (2)

- DLP Valencia PDFDocument5 pagesDLP Valencia PDFR Niels Car RentalNo ratings yet

- A 12Document25 pagesA 12varunNo ratings yet

- PDFF EXEMPLAR AND ACTIVITY SHEET 8 MELC 3 HealthDocument13 pagesPDFF EXEMPLAR AND ACTIVITY SHEET 8 MELC 3 HealthJarnel CabalsaNo ratings yet

- Sortcodes of BanksDocument148 pagesSortcodes of BanksAdebowale JacobsNo ratings yet

- Akhand Saubhagya Yoga of Females: DQ - Myh FeykuDocument14 pagesAkhand Saubhagya Yoga of Females: DQ - Myh FeykuprathodNo ratings yet

- BAPTISM-Application English WEBSITEDocument1 pageBAPTISM-Application English WEBSITEWesley ChinNo ratings yet

- These en pdf-2Document129 pagesThese en pdf-2zemiNo ratings yet

- Mossesgeld vs. Court of AppealsDocument1 pageMossesgeld vs. Court of AppealsClark Vincent PonlaNo ratings yet

- Social Work Practice With Families A Resiliency Based Approach 3Rd Edition Mary Patricia Van Hook Full Chapter PDFDocument69 pagesSocial Work Practice With Families A Resiliency Based Approach 3Rd Edition Mary Patricia Van Hook Full Chapter PDFyovanyciunys100% (4)

- Pride and PrejudiceDocument442 pagesPride and PrejudiceVinayak TyagiNo ratings yet

- The Impossible DreamDocument1 pageThe Impossible Dreammae joy0% (1)

- London - Vicky ShiptonDocument2 pagesLondon - Vicky ShiptonGabriela GuevaraNo ratings yet

- 2013 Gretsch CatalogDocument41 pages2013 Gretsch CatalogNick1962100% (2)

- Customary Laws - ShellyDocument18 pagesCustomary Laws - ShellyShelly Arora100% (1)

- The Missing Piece Book OneDocument52 pagesThe Missing Piece Book OnedeyrekNo ratings yet

- Women in Ancient Mesopotamia Circa 4000 B.C.E.-500 B.C.EDocument11 pagesWomen in Ancient Mesopotamia Circa 4000 B.C.E.-500 B.C.ERodrigo Rossi100% (1)

PCDA Guidelines - Defence Civilians PDF

PCDA Guidelines - Defence Civilians PDF

Uploaded by

prabhakarpv1Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PCDA Guidelines - Defence Civilians PDF

PCDA Guidelines - Defence Civilians PDF

Uploaded by

prabhakarpv1Copyright:

Available Formats

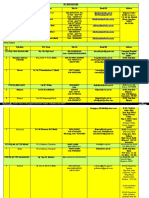

Home General Information Know Your Pension Common Problems Pension Payment Guidelines/Instructions RTI Suvigya

Superannuation Pension Defence Civilians | Home << Previous Next >>

Compulsory Retirement

Retiring Pension Family Pension

Invalid pension

Family Pension is granted to the family of a Govt. servant in the event of his death while in service and also

Industrial Employees after retirement provided he was on the date of death in receipt of a pension or compassionate allowance.

Extra Ordinary Pension

Family Pension 1. Definition of Family

2. Eligibility and Period of Grant

Commutation

3. Missing Govt. Servant / Pensioner

Know Pension Status 4. Calculation Of Family Pension

Defence Pension Adalat 5. Enhanced Family Pension

Loage a Complaint 6. Model Calculation

Guest Book 7. Minimum/Maximum Limit

Definition of Family

Search For the purpose grant of Family pension the 'Family' shall be categorised as under:

Category -I

1. Widow or widower, upto the date of death or re-marriage, whichever is earlier.

2. Son / daughter (including widowed daughter), upto the date of his / her marraige / re-marriage or till the

date he / she starts earning or till the age of 25 years, whichever is the earliest.

Category -II

3. Unmarried / Widowed / Divorced daughter, not covered by Category -I above, upto the date of

marriage / re-marriage or till the date she starts earning or upto the date of death, whichever is earliest.

4. Parents who were wholly dependent on the Government servant when he / she was alive provided the

deceased employee had left behind neither a widow nor a child. Family pension to dependent parents

unmarried/divorced/widowed daughter will continue till the date of death.

Family Pension to Unmarried/ widowed / divorced daughters in Category II and dependent parents

shall be payable only after the other eligible family memebrs in Category I have ceased to be eligible to

receive family pension and there is no disabled child to receive the family pension. Grant of family

pension to children in respective categories shall be payable in order of their date of birth and younder

of them will not be eligible for family pension unless the next above him / her has become ineligible for

grant of family pension in that category.

Eligibility and Period of Grant

1. Widow/Widower: Where a deceased Govt. servant is survived by a widow/widower, the widow/

widower shall be entitled to the award of family pension from the date following the date of death of the

Govt. servant till death or remarriage which ever is earlier.

2. More than one Widow: Where a Hindu deceased Govt. servant leaves behind more than one widow

the second and other widow are not entitled to family pension as a legally wedded wife under the

Hindu Marriage act 1955. In other cases the award of family pension will be divided among the

surviving widows in equal shares.

3. Divorced Wife: Divorced wife loses the status of a legally wedded wife and as such is not entitled to

the award of family pension. However, the eligible child/children from a divorced wife shall be entitled

to the share of family pension which the mother would have received at the time of death of her

husband had she not been divorced.

4. Child / Children: On the death of the widow / widower the family pension shall become payable to the

eligible child / children. Family Pension to children shall be payable in the order of their birth and the

younger of them shall not be eligible for family pension unless the elder next above him/her has

become in-eligible for the grant of family pension.

5. Son / Daughter: The award of family pension to son / daughter including widowed / divorced daughter

shall be payable till he / she attains the age of 25 years or upto the date of his / her

marriage/remarriage or starts earning his/her livelihood, whichever is earlier.

6. Handicapped Child/Children:If the son or daughter of a Govt. servant is suffering from any disorder

or disability of mind or is physically crippled or disabled so as to render him or her unable to earn a

living, the family pension shall be payable to such son or daughter for life. In case the handicapped

daughter gets married, her family pension will be stopped from the date of marriage.The family pension

to child who is suffering from disorder or disability of mind, is paid through a legal guardian.

The award of Family Pension in respect of Handicapped child is not notified jointly along with the

pension/Family Pension of his/her parents. It is notified as and when the contingency arises.

7. Parents: When deceased Govt. servant left behind neither widow/widower and children, family pension

shall be payable to the parents who were wholly dependent on the Govt. servant during the life time of

the deceased Govt. servant, provided their income does not exceed Rs.3500/- p.m. and DR

Missing Govt. Servant/Pensioner

The Family Pension in respect of the Government employee/pensioner whose whereabouts are not known,

can be sanctioned to the eligible family member from the date of missing after the lapse of a period of 6

month from the date of lodging the FIR with the concerned Police station.

Where an employee / pensioner disappears leaving his family, the family must lodge a FIR with the

concerned police station, and obtain a report that the employee could not been traced after all efforts have

been made by the police.

Before the payment of family pension is allowed to the family of a missing govt. servant, an Indemnity Bond

on prescribed format should be taken from the family pensioner that all payment will be adjusted against the

payments due to the employee in case he appears on the scene and makes any claim.

Next Topic : Family Pension Contd..

| Site Map | Contact Us | ©2017 PCDA(P)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Siridhanyalatho Sampoorna ArogyamDocument52 pagesSiridhanyalatho Sampoorna Arogyamprabhakarpv197% (38)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Petition of AnnulmentDocument6 pagesPetition of AnnulmentCzarDuranteNo ratings yet

- Catholic Diocese of Salt Lake City Final Clergy Allegations ListDocument5 pagesCatholic Diocese of Salt Lake City Final Clergy Allegations ListAdam ForgieNo ratings yet

- 5.1 Verb List Book PDFDocument7 pages5.1 Verb List Book PDFprabhakarpv1100% (1)

- 4.1 Test 1-2-3 Exercises + Answers PDF Sheets PDFDocument7 pages4.1 Test 1-2-3 Exercises + Answers PDF Sheets PDFprabhakarpv1No ratings yet

- Echs Gov in Img Contact Bang HTMLDocument4 pagesEchs Gov in Img Contact Bang HTMLprabhakarpv1100% (1)

- 4.1 Test 1-2-3 Exercises + Answers PDF Sheets PDFDocument7 pages4.1 Test 1-2-3 Exercises + Answers PDF Sheets PDFprabhakarpv1No ratings yet

- Try MeDocument1 pageTry Meprabhakarpv1No ratings yet

- Terminal and Gate Difference at AirportDocument3 pagesTerminal and Gate Difference at Airportprabhakarpv1No ratings yet

- Echs Gov in Img Contact Hyd HTMLDocument3 pagesEchs Gov in Img Contact Hyd HTMLprabhakarpv1No ratings yet

- Millet Book Inner (2nd Print May 2018)Document58 pagesMillet Book Inner (2nd Print May 2018)g.chandan89% (56)

- Army/Navy/Air Force/Coast Guard/DSC/SFF (As Applicable)Document2 pagesArmy/Navy/Air Force/Coast Guard/DSC/SFF (As Applicable)prabhakarpv1No ratings yet

- Agricultural Road MapDocument75 pagesAgricultural Road Mapprabhakarpv1No ratings yet

- Milletssiridhanya Book c2b7 Version 1Document29 pagesMilletssiridhanya Book c2b7 Version 1lakshmiescribd94% (36)

- WWW Echs Gov inDocument6 pagesWWW Echs Gov inprabhakarpv1No ratings yet

- Milletssiridhanya Book c2b7 Version 1Document29 pagesMilletssiridhanya Book c2b7 Version 1lakshmiescribd94% (36)

- SBI Hospital CashDocument1 pageSBI Hospital Cashprabhakarpv1No ratings yet

- She Is Easy On The EyesDocument1 pageShe Is Easy On The Eyesprabhakarpv1No ratings yet

- Nehru Family - Truth You Should Know About Nehru FamilyDocument3 pagesNehru Family - Truth You Should Know About Nehru FamilyNehru Family100% (1)

- Unit 2 Test. Challenge LevelDocument3 pagesUnit 2 Test. Challenge LevelThe English TeacherNo ratings yet

- Form ESCIDocument3 pagesForm ESCIHimanshu KumarNo ratings yet

- Andal Vs MacaraigDocument1 pageAndal Vs Macaraigamareia yap100% (1)

- Wedding Reception ProgrammeDocument4 pagesWedding Reception ProgrammeAllan Palma GilNo ratings yet

- Fun Home: The Role of Literature in Shaping Alison's HomosexualityDocument5 pagesFun Home: The Role of Literature in Shaping Alison's HomosexualitySushmitha KrishnamoorthyNo ratings yet

- Bach Ricercare Offerta Mus BWV 1079 SAB Trio (Parts) PDFDocument16 pagesBach Ricercare Offerta Mus BWV 1079 SAB Trio (Parts) PDFGiulio GianìNo ratings yet

- Indira GandhiDocument12 pagesIndira GandhiJITENDRA VISHWAKARMANo ratings yet

- Barney'S: I Love You SongDocument23 pagesBarney'S: I Love You SongJun CabsNo ratings yet

- How Deep Is Your Love Tab - Bee Gees (By Jorell Prospero)Document3 pagesHow Deep Is Your Love Tab - Bee Gees (By Jorell Prospero)Trisha ArgaoNo ratings yet

- Reflection PaperDocument1 pageReflection Paperkororo mapaladNo ratings yet

- Thesis DivorceDocument6 pagesThesis Divorcedeniselopezalbuquerque100% (2)

- DLP Valencia PDFDocument5 pagesDLP Valencia PDFR Niels Car RentalNo ratings yet

- A 12Document25 pagesA 12varunNo ratings yet

- PDFF EXEMPLAR AND ACTIVITY SHEET 8 MELC 3 HealthDocument13 pagesPDFF EXEMPLAR AND ACTIVITY SHEET 8 MELC 3 HealthJarnel CabalsaNo ratings yet

- Sortcodes of BanksDocument148 pagesSortcodes of BanksAdebowale JacobsNo ratings yet

- Akhand Saubhagya Yoga of Females: DQ - Myh FeykuDocument14 pagesAkhand Saubhagya Yoga of Females: DQ - Myh FeykuprathodNo ratings yet

- BAPTISM-Application English WEBSITEDocument1 pageBAPTISM-Application English WEBSITEWesley ChinNo ratings yet

- These en pdf-2Document129 pagesThese en pdf-2zemiNo ratings yet

- Mossesgeld vs. Court of AppealsDocument1 pageMossesgeld vs. Court of AppealsClark Vincent PonlaNo ratings yet

- Social Work Practice With Families A Resiliency Based Approach 3Rd Edition Mary Patricia Van Hook Full Chapter PDFDocument69 pagesSocial Work Practice With Families A Resiliency Based Approach 3Rd Edition Mary Patricia Van Hook Full Chapter PDFyovanyciunys100% (4)

- Pride and PrejudiceDocument442 pagesPride and PrejudiceVinayak TyagiNo ratings yet

- The Impossible DreamDocument1 pageThe Impossible Dreammae joy0% (1)

- London - Vicky ShiptonDocument2 pagesLondon - Vicky ShiptonGabriela GuevaraNo ratings yet

- 2013 Gretsch CatalogDocument41 pages2013 Gretsch CatalogNick1962100% (2)

- Customary Laws - ShellyDocument18 pagesCustomary Laws - ShellyShelly Arora100% (1)

- The Missing Piece Book OneDocument52 pagesThe Missing Piece Book OnedeyrekNo ratings yet

- Women in Ancient Mesopotamia Circa 4000 B.C.E.-500 B.C.EDocument11 pagesWomen in Ancient Mesopotamia Circa 4000 B.C.E.-500 B.C.ERodrigo Rossi100% (1)