Professional Documents

Culture Documents

Harriets Hats Fall 2018

Harriets Hats Fall 2018

Uploaded by

Nguyen Quincy (myprettysting)14%(7)14% found this document useful (7 votes)

572 views10 pages1. Harriet's Hats is a hat retailer that buys hats from a manufacturer and sells them in stores. It provides transactions for 2017 to analyze.

2. Key transactions include sales of $80 per hat, cash collections of $980,000, writing off $40,250 in uncollectible receivables, inventory purchases and payments, property/equipment purchases and sales, paying and receiving notes payable, rent and other expenses payments, and income tax payments.

3. The document requests journal entries to record 2017 transactions, preparation of 2017 year-end financial statements, and closing entries.

Original Description:

Harriets Hats

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. Harriet's Hats is a hat retailer that buys hats from a manufacturer and sells them in stores. It provides transactions for 2017 to analyze.

2. Key transactions include sales of $80 per hat, cash collections of $980,000, writing off $40,250 in uncollectible receivables, inventory purchases and payments, property/equipment purchases and sales, paying and receiving notes payable, rent and other expenses payments, and income tax payments.

3. The document requests journal entries to record 2017 transactions, preparation of 2017 year-end financial statements, and closing entries.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

14%(7)14% found this document useful (7 votes)

572 views10 pagesHarriets Hats Fall 2018

Harriets Hats Fall 2018

Uploaded by

Nguyen Quincy (myprettysting)1. Harriet's Hats is a hat retailer that buys hats from a manufacturer and sells them in stores. It provides transactions for 2017 to analyze.

2. Key transactions include sales of $80 per hat, cash collections of $980,000, writing off $40,250 in uncollectible receivables, inventory purchases and payments, property/equipment purchases and sales, paying and receiving notes payable, rent and other expenses payments, and income tax payments.

3. The document requests journal entries to record 2017 transactions, preparation of 2017 year-end financial statements, and closing entries.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 10

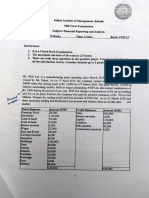

NAME: ________________________

Harriet’s Hats, Inc.

Harriet’s Hats is a fictional company. The following information includes the balance sheet as of

December 31, 2016, and the details of the transactions that occurred during 2017.

Background: Harriet’s Hats is a hat retailer (in other words, Harriet’s buys hats from a hat

manufacturer and then sells them in their stores). Transactions for 2017 are representative of such a

company’s business activities. HINT: Read through the entire assignment at least twice before

beginning to do any work. This will help you familiarize yourself with all of the important facts.

Transactions for 2017:

1. Sales and Accounts Receivable

a. Harriet’s hats during 2017 had a sales price of $80 per hat. All sales were made on

account.

b. Cash collections on account amounted to $980,000.

c. On July 1, 2017, Harriet’s identified $40,250 of receivables as being uncollectible and wrote

them off.

d. Harriet’s follows a percentage-of-receivables approach to estimate their accounts

receivable that will become uncollectible. As of the end of 2017, Harriet’s estimates that

10% of their receivables will be uncollectible.

2. Inventory

a. Harriet’s began 2017 with 1,900 hats which had a cost of $40 each. Employees physically

counted 2,690 hats remaining in the warehouse at the end of 2017. Harriet’s uses a

periodic LIFO inventory system to cost their inventory. The following purchases (all on

account) were made during 2017:

i. January 15th – 4,250 hats @ $43.00 each

ii. March 22nd – 2,900 hats @ $45.00 each

iii. August 5th – 3,420 hats @ $47.00 each

iv. October 26th – 6,020 hats @ $50.00 each

b. During 2017, Harriet’s made cash payments to inventory suppliers on the following dates:

i. January 29th – $146,200

ii. April 16th – $156,600

iii. October 2nd – $160,740

iv. November 30th – $270,900

3. Property, Plant and Equipment

a. Harriet’s uses straight-line depreciation for all of its store fixtures and office equipment.

b. Below is a schedule of the store fixtures and office equipment Harriet’s had in place at the

end of 2017.

FIXTURES AND EQUIPMENT (as of December 31, 2017)

ID # Historical Estimated Estimated Date acquired

Cost Useful Life Salvage Value

1256 $60,000 12 years $0 Jan. 1, 2007

1876 $100,000 10 years $15,000 Jan. 1, 2008

4299 $92,000 15 years $5,000 Jan. 1, 2009

c. On April 1, 2017 new store fixtures were purchased for $42,000 in cash. Harriet’s expects

the fixtures to have a 10 year useful life and a $4,000 salvage value.

d. On October 1, 2017 office equipment (ID#1876) was sold for $16,825.

4. Debt

a. On August 1, 2017, Harriet’s paid-off the note payable that was outstanding at the

beginning of the period. The note had an 10% interest rate, had been issued on August 1,

2016, and required semiannual interest payments on Jan 31, 2017 and July 31, 2017.

b. On October 1, 2017, Harriet’s borrowed $120,000 on a new note payable. The new note

carries a 6% interest rate with semiannual interest payments required on March 31, 2018

and September 30, 2018.

5. Operations

a. Harriet’s made a rent payment of $51,000 on August 1, 2017. The payment was for rent on

the store building and was prepaid for one year. The balance in the prepaid account at the

end of 2016 represents the rent for January through July 31, 2017 that was paid for on

August 1, 2016.

b. Cash paid out during 2017 for wages totaled $142,000. Records indicate that salaries for

the last week of December 2017 amounted to $25,000 and will be paid at the end of the

first week in January 2018 (a two-week pay period).

c. Other expenses (paid in cash) totaled $38,000.

6. Income Taxes

a. On March 15, 2017, Harriet’s paid their 2016 income taxes. Harriet’s will pay their 2017

income taxes on March 15, 2018. Harriet’s has a 40% income tax rate for both 2016 and

2017.

7. Common Stock

a. On December 1, 2017, dividends of $35,000 were declared and paid.

b. On January 1, 2017, Harriet’s issued 10,000 additional shares of common stock for $10 per

share.

Required:

1. Using the journal and T-accounts provided, record the transactions that occurred during 2017.

If no specific date is provided for a transaction, leave the date column blank. IMPORTANT:

Since there are several transactions for which no date is given, the journal entries do NOT

need to be in chronological order. All adjusting and closing entries should have December 31,

2017 as the date.

2. Prepare the balance sheet, statement of retained earnings and income statement for Harriet’s

Hats, Inc. for the year ended December 31, 2017.

3. Record the closing entries for the company (this step is often skipped, don’t lose these points).

Check Figures:

2017 Gross Profit Percentage: 41.375%

2017 Current Ratio: 1.9799

2017 Profit Margin: 9.376%

Harriet's Hats

Balance Sheet

For the Year Ended December 31, 2016

Assets

Cash $ 64,000

Accounts Receivable 187,000

Less: Allowance for Doubtful Accounts (18,700)

Net Accounts Receivable 168,300

Prepaid Rent 25,200

Inventory 76,000

Total Current Assets $ 333,500

Property, Plant, and Equipment 252,000

Less: Accumulated Depreciation (172,900)

Net Property, Plant, and Equipment 79,100

Total Assets $ 412,600

Liabilities and Owner’s Equity

Accounts Payable $ 54,000

Wages Payable 18,000

Interest Payable 3,750

Income Taxes Payable 32,500

Notes Payable 90,000

Total Current Liabilities $ 198,250

Common Stock (5,000 shares outstanding, $1 par) 5,000

Additional Paid In Capital 15,000

Retained Earnings 194,350

Total Liabilities and Owner’s Equity $ 412,600

Harriet's Hats

Journal Entries

Date Account Debit Credit

Harriet's Hats

Journal Entries

Date Account Debit Credit

Harriet's Hats

Journal Entries

Date Account Debit Credit

Harriet's Hats

Journal Entries

Date Account Debit Credit

CLOSING ENTRIES

Cash Accounts Receivable Allowance for Doubtful Accounts

$ 64,000 $ 187,000 $ 18,700

Prepaid Rent Inventory Property, Plant, and Equipment

$ 25,200 $ 76,000 $ 252,000

Accumulated Depreciation Accounts Payable Wages Payable

$ 172,900 $ 54,000 $ 18,000

Interest Payable Income Taxes Payable Notes Payable

$ 3,750 $ 32,500 $ 90,000

Common Stock Additional Paid In Capital Retained Earnings

$ 5,000 $ 15,000 $ 194,350

Sales Revenue Purchases Cost of Goods Sold

Rent Expense Interest Expense Bad Debts Expense

Depreciation Expense Wages Expense Other Expenses

Gain/Loss on Sale of Equipment Income Tax Expense Dividends

Harriet's Hats Harriet's Hats

Income Statement Balance Sheet

For the Year Ended December 31, 2017 As of December 31, 2017

Sales Assets

Less: Cost of Goods Sold Cash

Gross Profit Accounts Receivable

Less: Allowance for Doubtful Accounts

Operating Expenses Net Accounts Receivable

Rent Expense Prepaid Rent

Interest Expense Inventory

Bad Debts Expense Total Current Assets

Depreciation Expense

Wages Expense Property, Plant, and Equipment

Other Operating Expenses Less: Accumulated Depreciation

Total Operating Expenses Net Property, Plant, and Equipment

Total Assets

Other gains and losses

Gain/Loss on sale of equipment Liabilities and Owner’s Equity

Accounts Payable

Income before income taxes Wages Payable

Income taxes Interest Payable

Net Income Income Taxes Payable

Notes Payable

Basic Earnings Per Share $ Total Current Liabilities

Harriet's Hats Common Stock (__________ Shares Outstanding, ___ par)

Statement of Retained Earnings Additional Paid In Capital

For the Year Ended December 31, 2017 Retained Earnings

Beginning Retained Earnings Total Liabilities and Owner’s Equity

Plus: Net Income

Less: Dividends

Ending Retained Earnings

You might also like

- HRM732 Individual Assignment 1 FINALDocument6 pagesHRM732 Individual Assignment 1 FINALShirley Cho100% (5)

- Rethink Property Investing: Become Financially Free with Commercial Property InvestingFrom EverandRethink Property Investing: Become Financially Free with Commercial Property InvestingNo ratings yet

- BusCom AssetAcquisitionDocument5 pagesBusCom AssetAcquisitionDanna Claire0% (1)

- Kohler Co. (A)Document18 pagesKohler Co. (A)Juan Manuel GonzalezNo ratings yet

- Problems: Set C: InstructionsDocument2 pagesProblems: Set C: InstructionsRabie HarounNo ratings yet

- Answer Step by Step SolutionDocument3 pagesAnswer Step by Step SolutionkomalNo ratings yet

- Group Work FA 1Document5 pagesGroup Work FA 1Phan Đỗ QuỳnhNo ratings yet

- Afar 107 - Business Combination Part 2Document4 pagesAfar 107 - Business Combination Part 2Maria LopezNo ratings yet

- Final Exam QuestionDocument4 pagesFinal Exam QuestionHồng XuânNo ratings yet

- Accounting Revision QuestionsDocument8 pagesAccounting Revision QuestionsFranswa MateteNo ratings yet

- Homework CH 3Document12 pagesHomework CH 3LNo ratings yet

- Exercises - LiabilitiesDocument2 pagesExercises - LiabilitiesMac Ferds0% (1)

- Partnership Formation, Operation, and Changes in OwnershipDocument4 pagesPartnership Formation, Operation, and Changes in OwnershipLoriNo ratings yet

- (Quiz Uas Take Home) Akl-1 PDFDocument7 pages(Quiz Uas Take Home) Akl-1 PDFStephani ElvinaNo ratings yet

- Practice Exam - QuestionsDocument5 pagesPractice Exam - QuestionsHoàng Võ Như QuỳnhNo ratings yet

- 1.introductory ExercisesDocument3 pages1.introductory ExercisesveronikaNo ratings yet

- Practice-Exam Question S22019Document4 pagesPractice-Exam Question S22019Trâm MờNo ratings yet

- Sha1 ACT 201 Final Exam-Fall 2021Document4 pagesSha1 ACT 201 Final Exam-Fall 2021Ifaz Mohammed IslamNo ratings yet

- 01.correction of Errors - 245038322 PDFDocument4 pages01.correction of Errors - 245038322 PDFMaan CabolesNo ratings yet

- Accounting Mock ExamDocument6 pagesAccounting Mock ExamKiran alex ChallagiriNo ratings yet

- Final Exam - AccountingDocument5 pagesFinal Exam - Accountingtanvi virmaniNo ratings yet

- ACCO 420 Midterm Fall 2017Document6 pagesACCO 420 Midterm Fall 2017conu studentNo ratings yet

- CH 05Document10 pagesCH 05Antonios Fahed0% (1)

- Accounting From Incomplete RecordsDocument8 pagesAccounting From Incomplete RecordsVisha JainNo ratings yet

- Practice Questions and Answers: Financial AccountingDocument18 pagesPractice Questions and Answers: Financial AccountingFarah NazNo ratings yet

- Answer Quiz 1-Ol2Document15 pagesAnswer Quiz 1-Ol2Kristina KittyNo ratings yet

- AHM13e Chapter - 01 - Solution To Problems and Key To CasesDocument19 pagesAHM13e Chapter - 01 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Multiple Choices - Computational Answer KeyDocument4 pagesMultiple Choices - Computational Answer KeyAleah kay BalontongNo ratings yet

- Exercises For Midterm PDFDocument10 pagesExercises For Midterm PDFThanh HằngNo ratings yet

- Latihan Soal KelompokDocument3 pagesLatihan Soal KelompokPutri RahmawatiNo ratings yet

- Acctg 102 Prelim Exam With SolutionsDocument12 pagesAcctg 102 Prelim Exam With SolutionsYsabel ApostolNo ratings yet

- Chapter 11 WorksheetDocument5 pagesChapter 11 Worksheet오가영No ratings yet

- Business Math (Excel)Document6 pagesBusiness Math (Excel)mobinil1No ratings yet

- AKD PB12-1B-dikonversiDocument3 pagesAKD PB12-1B-dikonversiNadyaNo ratings yet

- Acc Ex1Document2 pagesAcc Ex1Mx 997No ratings yet

- Accrual & Prepaid HW QDocument4 pagesAccrual & Prepaid HW Q小仙女哈哈哈No ratings yet

- Problem 1: Cash Flow StatementDocument1 pageProblem 1: Cash Flow StatementNafisaRafaNo ratings yet

- (ACCT2010) (2017) (F) Midterm In5mue0 38655Document4 pages(ACCT2010) (2017) (F) Midterm In5mue0 38655Pak HoNo ratings yet

- AC3202 WK2 Exercises (22:23A)Document9 pagesAC3202 WK2 Exercises (22:23A)Long LongNo ratings yet

- 1 Accounting Equation UniqueDocument3 pages1 Accounting Equation UniqueSohan AgrawalNo ratings yet

- Fata Company: Lab 9 - Current Liabilities and Payroll AccountingDocument1 pageFata Company: Lab 9 - Current Liabilities and Payroll AccountingDikaGustianaNo ratings yet

- General Accounting 2Document5 pagesGeneral Accounting 2Rheu ReyesNo ratings yet

- Klausur WS2021-22-1Document6 pagesKlausur WS2021-22-1marynayarmak.stNo ratings yet

- Final Exam Review PPTDocument14 pagesFinal Exam Review PPTJackie JacquelineNo ratings yet

- Included in December 31 Checkbook BalanceDocument1 pageIncluded in December 31 Checkbook BalanceXI MonteroNo ratings yet

- Gialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingDocument12 pagesGialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingMeidrick Rheeyonie Gialogo AlbaNo ratings yet

- Answers To Handout 1 Financial AccountingDocument40 pagesAnswers To Handout 1 Financial AccountingMohand ElbakryNo ratings yet

- Reynadya Farissa 2201749614 LA86Document3 pagesReynadya Farissa 2201749614 LA86Nurlela SafitriNo ratings yet

- Fra Mid-Term Pgp13Document3 pagesFra Mid-Term Pgp13Gauri AgarwalNo ratings yet

- Excercise Sheet Lectures 1 and 2 Spring 2022Document16 pagesExcercise Sheet Lectures 1 and 2 Spring 2022Mohamed ZaitoonNo ratings yet

- Question Compilation - 230316 - 072454Document9 pagesQuestion Compilation - 230316 - 072454Ranjan DhakalNo ratings yet

- In Class Excel - 825 - WorkingDocument98 pagesIn Class Excel - 825 - WorkingIanNo ratings yet

- Multiple Choice Questions (MCQS) : InstructionsDocument5 pagesMultiple Choice Questions (MCQS) : InstructionsMubashir HussainNo ratings yet

- Chapter 8Document17 pagesChapter 8Jamaica DavidNo ratings yet

- Akuntansi KeuanganDocument11 pagesAkuntansi KeuanganDyan NoviaNo ratings yet

- Problems On Balance SheetDocument4 pagesProblems On Balance SheetNishant DehuryNo ratings yet

- Latihan 3 PA1Document3 pagesLatihan 3 PA1Diko Rifki DelpieroNo ratings yet

- Audit of Error Correction and Cash and AccrualsDocument4 pagesAudit of Error Correction and Cash and AccrualsRafael BarbinNo ratings yet

- Auditing AssignmentDocument8 pagesAuditing AssignmentApril ManjaresNo ratings yet

- GA 04042022 - QuestionDocument3 pagesGA 04042022 - QuestionSakamoto HiyoriNo ratings yet

- Trend Percentage and Vertical - SantisasDocument4 pagesTrend Percentage and Vertical - SantisasSkermberlo Sprekitik BombomNo ratings yet

- Zenaida Solutions To Exercises Chap 14 15 IncompleteDocument8 pagesZenaida Solutions To Exercises Chap 14 15 IncompletekonyatanNo ratings yet

- Financial Sttement PreparationDocument3 pagesFinancial Sttement PreparationMIEL CAÑETENo ratings yet

- 1 Financial Statements Cash Flows and TaxesDocument13 pages1 Financial Statements Cash Flows and TaxesAyanleke Julius OluwaseunfunmiNo ratings yet

- PRTC AP 1405 Final PreboardDocument14 pagesPRTC AP 1405 Final PreboardLlyod Francis LaylayNo ratings yet

- The Effects of Changes in Foreign Exchange RatesDocument19 pagesThe Effects of Changes in Foreign Exchange RatesAlyssa CasimiroNo ratings yet

- A Study On Ratio Analysis PDFDocument97 pagesA Study On Ratio Analysis PDFDr Linda Mary SimonNo ratings yet

- 26u9ofk7l - FAR - FINAL EXAMDocument18 pages26u9ofk7l - FAR - FINAL EXAMLyra Mae De BotonNo ratings yet

- Discussion QuestionsDocument34 pagesDiscussion QuestionsCarlos arnaldo lavadoNo ratings yet

- She P1&2 - Lecture Notes & ExercisesDocument8 pagesShe P1&2 - Lecture Notes & ExercisesMich ClementeNo ratings yet

- Classroom Exercises On Consolidation With Intercompany Sale of InventoryDocument7 pagesClassroom Exercises On Consolidation With Intercompany Sale of InventoryRedNo ratings yet

- R22 FIRM Q-BankDocument8 pagesR22 FIRM Q-BankparamrajeshjainNo ratings yet

- Apuntes ContabilidadDocument206 pagesApuntes ContabilidadclaudiazdeandresNo ratings yet

- Finance - Exam 3Document15 pagesFinance - Exam 3Neeta Joshi50% (6)

- Illustrative Problems With Solution Problem 1 To 7Document10 pagesIllustrative Problems With Solution Problem 1 To 7Viky Rose EballeNo ratings yet

- 5 Intercompany Gain - PpeDocument33 pages5 Intercompany Gain - PpeElla Mae TuratoNo ratings yet

- Financial Statement Analysis: Multiple Choice QuestionsDocument36 pagesFinancial Statement Analysis: Multiple Choice QuestionsRADHIKA PURAMWARNo ratings yet

- Dividend Policy & Traditional PolicyDocument34 pagesDividend Policy & Traditional PolicyVaidyanathan RavichandranNo ratings yet

- Financial Statement AnalysisDocument63 pagesFinancial Statement AnalysisHarsh DalmiaNo ratings yet

- Introduction To Accounting: Presented by Ravi Shankar SDocument167 pagesIntroduction To Accounting: Presented by Ravi Shankar SSushil BhavsarNo ratings yet

- Audit Exam 3 Part 3 Flashcards - QuizletDocument15 pagesAudit Exam 3 Part 3 Flashcards - QuizletLilliane EstrellaNo ratings yet

- CashFlow With SolutionsDocument82 pagesCashFlow With SolutionsHermen Kapello100% (2)

- Percentage of Sales BudgetsDocument13 pagesPercentage of Sales BudgetsDavid AwuorNo ratings yet

- Foreign Currency TranslationDocument3 pagesForeign Currency TranslationGround ZeroNo ratings yet

- Case 5 Proton Full AssignmentDocument33 pagesCase 5 Proton Full Assignmentnajihah radziNo ratings yet

- Assignment 1 and 2 Solution Strategic FinanceDocument10 pagesAssignment 1 and 2 Solution Strategic FinanceAnonymous EErmsqjjpNo ratings yet

- Chapter 4 SolvedDocument4 pagesChapter 4 SolvedAsad BabbarNo ratings yet

- Reference Form 2013Document232 pagesReference Form 2013MillsRINo ratings yet

- IB1 CH 3.4 Final Accounts 2020 PDFDocument38 pagesIB1 CH 3.4 Final Accounts 2020 PDFamira zahari100% (1)