Professional Documents

Culture Documents

Session 1. Exercise

Session 1. Exercise

Uploaded by

SIDDHANT SINGH ( IPM 2015-20 Batch )0 ratings0% found this document useful (0 votes)

7 views3 pagesThe document outlines the financial details of a project including investments in equipment, working capital requirements, sales projections, costs, and cash flows over 3 years. It provides the equipment purchase amount, depreciation schedule, sales forecasts, variable and fixed costs, tax rate, and calculates the net present value of the projected cash flows discounted at 10%.

Original Description:

Finance II

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the financial details of a project including investments in equipment, working capital requirements, sales projections, costs, and cash flows over 3 years. It provides the equipment purchase amount, depreciation schedule, sales forecasts, variable and fixed costs, tax rate, and calculates the net present value of the projected cash flows discounted at 10%.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views3 pagesSession 1. Exercise

Session 1. Exercise

Uploaded by

SIDDHANT SINGH ( IPM 2015-20 Batch )The document outlines the financial details of a project including investments in equipment, working capital requirements, sales projections, costs, and cash flows over 3 years. It provides the equipment purchase amount, depreciation schedule, sales forecasts, variable and fixed costs, tax rate, and calculates the net present value of the projected cash flows discounted at 10%.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 3

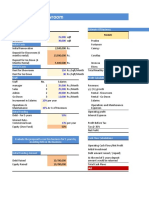

A project requires the following investments:

Gross value of equipment purchased 7,500

This equipment has useful life of 3 years.

Depreciation is 2500 per year. Salvage value is 0.

Year 0 Year 1 Year 2 Year 3

Working capital required 3,600 3,700 4,100 4,100

Minimum required return (discount rate) 10%

Tax rate 40%

Year 0 Year 1 Year 2 Year 3

Unit Sales 10,000 11,500 13,225

Sales price / unit 3.40 3.60 3.70

Variable Cost/ unit (excl. depn) 2.07 2.10 2.14

Fixed Cost (excl. depn.) 2,120 2,184 2,249

Year 0 Year 1 Year 2 Year 3 Project Free Cash Flow

Unit Sales 10,000 11,500 13,225 Sales

Growth 15% 15% Variable costs

Sales price / unit 3.40 3.60 3.70 Fixed Costs

Variable Cost/ unit (e 2.07 2.10 2.14 Depreciation

Fixed Cost (excl. depn 2,120 2,184 2,249 EBIT

Taxes - 40%

Nopat

Gross valu 7,500 Add. Depreciation

Useful life 3 years Less. Capex

Salvage va - Less. Change in Net Working Capital

Depreciati2500 per year Free cash flow (Project Net Cash flow)

Discount R 10% Present value

Working Ca 3,600 3,700 4,100 4,100 Net present value

1 2 3

Year 0 Year 1 Year 2 Year 3

34000 41400 48932.5

20700 24150 28302

2,120 2,184 2,249

2500 2500 2500

8680.00 12566.00 15882.00

3472 5026.4 6352.8

5208.00 7539.60 9529.20

2500 2500 2500

-7,500

-3,600 -100 -400 4,100

-11,100 7608.00 9639.60 16129.20

-11,100 6916.364 7966.612 12118.11

15,901

You might also like

- Baldwin CompanyDocument4 pagesBaldwin CompanyShubham TetuNo ratings yet

- Chapter 6Document28 pagesChapter 6Faisal Siddiqui0% (1)

- W10 Excel Model Cash Flow, Net Cost, and Capital BudgetingDocument5 pagesW10 Excel Model Cash Flow, Net Cost, and Capital BudgetingJuan0% (1)

- Week 3 SolutionDocument5 pagesWeek 3 SolutionI190006 Taimoor JanNo ratings yet

- Basic Model-01Document6 pagesBasic Model-01Sambit SarkarNo ratings yet

- Depreciation AnswersDocument13 pagesDepreciation AnswersGabrielle Joshebed Abarico100% (2)

- Fly Ash Brick ProjectDocument14 pagesFly Ash Brick ProjectHimana Abdul MalikNo ratings yet

- CF 11th Edition Chapter 06 Excel Master StudentDocument32 pagesCF 11th Edition Chapter 06 Excel Master StudentAdrian Gonzaga0% (1)

- FINA 3330 - Notes CH 9Document2 pagesFINA 3330 - Notes CH 9fische100% (1)

- 4.1 AFM Investment Appraisal NPV 201223Document13 pages4.1 AFM Investment Appraisal NPV 201223Kushagra BhandariNo ratings yet

- Fin440 Final Project PDFDocument30 pagesFin440 Final Project PDFAnwar Hosen OntorNo ratings yet

- "Fete N Fiesta" Management Team: Names ShareholdingDocument9 pages"Fete N Fiesta" Management Team: Names ShareholdingMuskan AliNo ratings yet

- Franchise - CarDocument14 pagesFranchise - Carshrish guptaNo ratings yet

- Chapter 8: Leases Part II: Problem 4: Multiple Choice - Computational 1. D 2. BDocument7 pagesChapter 8: Leases Part II: Problem 4: Multiple Choice - Computational 1. D 2. Bmarriette joy abadNo ratings yet

- Indicatori U.M. V1: Date Referitoare La Cele 3 Variante de Investitie Nr. CRTDocument20 pagesIndicatori U.M. V1: Date Referitoare La Cele 3 Variante de Investitie Nr. CRTCristina MiruNo ratings yet

- Cash Flow EstimationDocument6 pagesCash Flow EstimationFazul RehmanNo ratings yet

- 3.0 Strategic Finance Projections & EvaluationDocument6 pages3.0 Strategic Finance Projections & EvaluationFatin Zafirah Binti Zurila A21A3251No ratings yet

- Financial Study LunaDocument9 pagesFinancial Study LunaNia LunaNo ratings yet

- FOFO Franchise Document - Cult Gym+1s, DEL NCRDocument6 pagesFOFO Franchise Document - Cult Gym+1s, DEL NCRAkshay SharmaNo ratings yet

- Unit 1 SCM Activities KEY Answer PDFDocument2 pagesUnit 1 SCM Activities KEY Answer PDFFernando III PerezNo ratings yet

- Lecture 9Document21 pagesLecture 9Hồng LêNo ratings yet

- 2 - C. Problems - DepreciationDocument76 pages2 - C. Problems - DepreciationPia Shannen OdinNo ratings yet

- Scenario Summary: Changing Cells: Result CellsDocument9 pagesScenario Summary: Changing Cells: Result CellsatpugajoopNo ratings yet

- Solved Answers For Payback PeriodDocument9 pagesSolved Answers For Payback Periodwihanga100% (2)

- FMA AssignmentDocument2 pagesFMA AssignmentGetahun MulatNo ratings yet

- BSA 314 Module 4 Output, Atillo Lyle CDocument10 pagesBSA 314 Module 4 Output, Atillo Lyle CJeth MahusayNo ratings yet

- Years Cashflows Accumulated Cashflows ResidualDocument6 pagesYears Cashflows Accumulated Cashflows ResidualKhawaja HamzaNo ratings yet

- Work SheetDocument2 pagesWork Sheetyonastade81No ratings yet

- Lesson2.1-Chapter 8-Fundamentals of Capital BudgetingDocument6 pagesLesson2.1-Chapter 8-Fundamentals of Capital BudgetingMeriam HaouesNo ratings yet

- Proposed Budget For NARC Project (AZRI Bhakkar)Document17 pagesProposed Budget For NARC Project (AZRI Bhakkar)Pak CareerNo ratings yet

- Change in Maintenance Cost (Rs. Lakhs)Document4 pagesChange in Maintenance Cost (Rs. Lakhs)gopi11789No ratings yet

- Chapter 2 SolutionsDocument19 pagesChapter 2 SolutionsSorken75No ratings yet

- G. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsDocument3 pagesG. S. College of Commerce & Economics, Nagpur: Fundamentals of Accounting StandardsRanjhana SahuNo ratings yet

- AI Amended Online Tutorial 4 Slides - Block 3Document26 pagesAI Amended Online Tutorial 4 Slides - Block 3Allan GhmNo ratings yet

- Hola-Kola ComputationsDocument7 pagesHola-Kola ComputationsKristine Nitzkie SalazarNo ratings yet

- Red Chilli WorkingsDocument10 pagesRed Chilli WorkingsImran UmarNo ratings yet

- GYM Financial ModelingDocument12 pagesGYM Financial ModelingDivyanshu SharmaNo ratings yet

- Spinning Project FeasibilityDocument19 pagesSpinning Project FeasibilityMaira ShahidNo ratings yet

- Lecture Workings - 29.03.2023Document3 pagesLecture Workings - 29.03.2023kasun SenadheeraNo ratings yet

- Ecsy Cola Question2Document8 pagesEcsy Cola Question2Dhagash SanghaviNo ratings yet

- Depreciation AnswersDocument22 pagesDepreciation AnswersGabrielle Joshebed Abarico100% (1)

- Bikash Kirtania Project Report FileDocument9 pagesBikash Kirtania Project Report FileVivek JaiswalNo ratings yet

- Ch.9 (Dec.08)Document11 pagesCh.9 (Dec.08)JAHANZAIBNo ratings yet

- MD Rafiullah Project ReportDocument9 pagesMD Rafiullah Project ReportVivek JaiswalNo ratings yet

- P1. PRO (O.L) Solution CMA June-2021 Exam.Document5 pagesP1. PRO (O.L) Solution CMA June-2021 Exam.Tameemmahmud rokibNo ratings yet

- Final CaseDocument25 pagesFinal CaseSakshi SharmaNo ratings yet

- Case01 02Document24 pagesCase01 02Sakshi SharmaNo ratings yet

- Medical-shopDocument21 pagesMedical-shopcharanthimatadathejakumaraNo ratings yet

- FM09 CH 10 Im PandeyDocument19 pagesFM09 CH 10 Im PandeyJack mazeNo ratings yet

- Answer Key ACCTG 202Document3 pagesAnswer Key ACCTG 202Sanilyn DomingoNo ratings yet

- Chapter 5 Financial Study (Part1) : A. Major AssumptionsDocument9 pagesChapter 5 Financial Study (Part1) : A. Major AssumptionsAnne XxNo ratings yet

- Capital Budgeting: Initial InvestmentDocument5 pagesCapital Budgeting: Initial InvestmentMd. Shakil Ahmed 1620890630No ratings yet

- Apartment Excel AnalysisDocument234 pagesApartment Excel AnalysisCeline TeeNo ratings yet

- Income Statement For 3 YearsDocument5 pagesIncome Statement For 3 YearsATticFistNo ratings yet

- Business Report-Flexible Packaging ProjectDocument26 pagesBusiness Report-Flexible Packaging ProjectSadia AfreenNo ratings yet

- Capital Investment Break-Up: Marketing and PromotionDocument7 pagesCapital Investment Break-Up: Marketing and PromotionDeepak RamamoorthyNo ratings yet

- 2-LCC For VEWDocument30 pages2-LCC For VEWحموده الساميNo ratings yet

- Zebra Share CompanyDocument3 pagesZebra Share Companynatnaelsleshi3No ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet