Professional Documents

Culture Documents

Macroscope: Nov18 Trade Result Could Trigger (Another) Front-Loaded Rate Hike

Macroscope: Nov18 Trade Result Could Trigger (Another) Front-Loaded Rate Hike

Uploaded by

Kurnia NindyoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Macroscope: Nov18 Trade Result Could Trigger (Another) Front-Loaded Rate Hike

Macroscope: Nov18 Trade Result Could Trigger (Another) Front-Loaded Rate Hike

Uploaded by

Kurnia NindyoCopyright:

Available Formats

Macroscope

Macroscope

Economic | 18 December

Research 2018 2018

| 18 December

Nov18 Trade Result Could Trigger (Another) Front-loaded Rate Hike

Nov18 trade balance printed a deficit of –USD 2.1bn, broadly in line with our

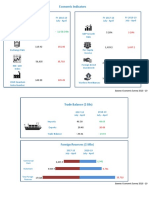

Economic Forecasts estimate at –USD 1.6bn (vs. consensus -USD 735mn) (see exhibit 1). The figure is the

largest trade deficit since Jul13 or five years ago. As expected, exports deteriorated

2016 2017 2018F

compared to imports, and the former worsened more than our forecast. Exports

Real GDP (%) 5.0 5.1 5.16 contracted for the first time since Jun18, at -3.2% YoY (vs. 4.3% in Oct18), while imports

GDP/capita (US$) 3,589 3,827 3,888 decelerated to 11.7% (vs. 24.1% in Oct18).

Inflation (%) 3.00 3.61 3.60

7-DRRR 4.75 4.25 6.25 Imports eased both in terms of aggregate price (4.4% from 14.5%) and volume (6.9%

CAD/GDP (%) -1.8 -1.7 -2.45 from 8.3%). Oil & gas imports eased to 28.6% YoY in Nov18 from 32.2% YoY in Oct18, in

Exc. Rate (Rp/US) 13,492 13,588 14,635 line with lower oil price. Even more, capital goods contracted for the first time in 17

months at -2.2% YoY from 25.7% YoY in Oct18. The contributions of import machineries

were much lower in Nov18, around 0.7ppt compared to the previous month at 6.8ppt (see

exhibit 6). It seems that this was due to the lagging effect of rupiah depreciation, the

finished capex recycling, and the lower public capital spending (the government’s capital

expenditure contracted by -3.6% in 11M18). Only a few import goods recorded an

increase, such as beverages and vegetables, which generated positive contributions and

were accelerating in terms of year-on-year, likely driven by the year-end festivity.

Unfortunately, export contracted by-3.2YoY in Nov18. Exports deteriorated in context

of price (-8.7% from -6.6%) and volume (5.9% from 11.6%) (see exhibit 5). In details, the

year-on-year exports contraction was contributed mostly from the decline of CPO (-18.9%

YoY in Nov18 vs. -2.9% in Oct18) and wood (-48.9% vs. -18.8). Interestingly, despite coal

exports having declined in monthly terms, the annual figure still grew by 5.3% (see exhibit

6). This suggests the annual coal export could drop in Dec18, as the impact of China’s coal

import ban is fully effective. All in all, the fact that trade deficit continues to widen when oil

price has dropped significantly by 18.2% in Nov18 and non-oil & gas imports has slowed

further (see exhibit 3) suggest that the risk of a slower exports ahead needs to be

recognized amid the possible slower global growth and trade war escalation.

Our view: wider CAD risk could trigger BI to front-load next year’s rate increase to

this month. Based on the Nov18 result, we believe the current account deficit could reach

Leo Putera Rinaldy between -3.3% to -3.6% of GDP in 4Q18, suggesting that FY18 current account deficit

Chief Economist could reach around -3.0% to -3.1% of GDP. We do believe the trade balance will improve in

+6221 5296 9406 Dec18, yet it will not be enough to offset the already-high Oct-Nov18 trade deficit of

leo.rinaldy@mandirisek.co.id –USD3.8bn (vs. 3Q18 trade deficit at –USD 3.0bn). This is especially considering the month-

to-date trend of export commodities has remained declining, whereas the full impact of

China’s import ban on coal will be seen in Dec18. Thus, taking into account that the central

Aziza Nabila Amani bank is data driven on its policy and BI’s effort to bring down the current account deficit to

Research Assistant -2.5% of GDP next year, we see that Bank Indonesia could front-load the 2019 policy

+6221 5296 9651 increase to Dec18 by 25 bps to 6.25% in this week’s governor board meeting. One factor

aziza.amani@mandirisek.co.id

that could hold BI from hiking the policy rate this week, in our opinion, is if the new Fed

dot plot introduced in the FOMC meeting this Thursday comes out more “dovish” than

anticipated (read: guiding a Fed Fund rate increase of lower than two times next year).

Page 1 Please see important disclosures at the back of this report

Macroscope | 18 December 2018

EXHIBIT 1. TRADE SUMMARY

Oct-18 Nov-18

MS Forecast Market Consensus Actual

Exports (% YoY) 1.7 1.5 3.0 -3.3

Imports (% YoY) 14.2 13.5 9.7 11.7

Trade balance (US$ mn) 227 -1600 -735 -2050

Sources: Bloomberg, Mandiri Sekuritas estimates

EXHIBIT 2. TRADE DATA DEVELOPMENT EXHIBIT 3. ALL IMPORT GOODS CLASSIFICATION MARKED

DOWNTRENDS

Trade data development Import trends (%YoY, 3MMA)

60% 2.5 40%

50% 2.0 35%

40% 1.5

30%

30% 1.0

20% 0.5 25%

10% 0.0 20%

0% ‐0.5 15% Consumer goods

‐10% ‐1.0

Trade balance (US$ bn) ‐ RHS 10% Raw materials

‐20% ‐1.5

‐30% Exports (%YoY) ‐2.0 5% Capital goods

‐40% Imports (%YoY) ‐2.05 ‐2.5 0%

Sep‐17

Sep‐18

Feb‐15

Feb‐16

Feb‐17

Feb‐18

Mar‐17

Jul‐17

Mar‐18

Jul‐18

Aug‐15

Aug‐16

Aug‐17

Aug‐18

Jan‐17

Nov‐17

Jan‐18

Nov‐18

May‐17

May‐18

Nov‐15

Nov‐16

Nov‐17

Nov‐18

May‐15

May‐16

May‐17

May‐18

‐5%

Source: CEIC Source: CEIC

EXHIBIT 4. INDONESIA’S EXPORTS TO CHINA CONTRACTED IN EXHIBIT 5. EXPORT TRENDS DECLINED BOTH IN PRICE AND

THE LAST TWO MONTHS VOLUME

Indonesia's exports to China (%YoY) Export trends

80 73.1 30%

Aggregate price (%YoY)

70 63.2 25%

60 54.0 53.8 20% Volume

50 42.3 44.9

38.5 38.6 15%

34.8

40 31.034.2 30.2 31.2 32.4

10%

26.4 23.9 25.2

30 20.9

14.7 5%

20 12.0 12.6

0%

10

0 ‐5%

‐10 ‐4.1‐7.6 ‐10%

‐20 ‐15%

Sep‐17

Sep‐18

Mar‐17

Jul‐17

Mar‐18

Jul‐18

Jan‐17

Nov‐17

Jan‐18

Nov‐18

May‐17

Sep‐17

May‐18

Sep‐18

Jul‐17

Jul‐18

Mar‐17

Mar‐18

Jan‐17

Nov‐17

Jan‐18

Nov‐18

May‐17

May‐18

Source: CEIC Source: CEIC

Page 2 Please see important disclosures at the back of this report

Macroscope | 18 December 2018

EXHIBIT 6. OCT18 TRADE TABLE

US$ mn Nov-18 MoM Contribution YoY Contribution

Total export 14,832 -6.7% -6.7% -3.2% -3.2%

Oil & gas export 1,371 -10.8% -1.0% 5.8% 0.5%

Crude oil 381 -9.1% -0.2% -22.2% -0.7%

Oil products 118 -28.7% -0.3% -0.6% 0.0%

Gas 873 -8.4% -0.5% 26.9% 1.2%

Non-oil & gas export by commodity 13,460 -6.3% -5.6% -4.1% -3.8%

Mineral fuels excluding oil & gas products 2,026 -5.9% -0.8% 5.3% 0.7%

Animal or vegetable fats and oils and their cle 1,658 -9.8% -1.1% -18.9% -2.5%

Electrical machinery and equipment and parts 728 -7.6% -0.4% -2.1% -0.1%

Iron and steel 612 19.0% 0.6% 61.4% 1.5%

Natural and cultured pearls; precious, semi-pre 310 -52.5% -2.2% -41.4% -1.4%

Ores, slag and ash 496 80.2% 1.4% 48.2% 1.1%

Footwear; gaiters and the like 482 2.4% 0.1% -0.1% 0.0%

Organic chemicals 259 2.3% 0.0% -5.3% -0.1%

Pulp of wood or other fibrous cellulosic mater 143 -33.4% -0.5% -48.9% -0.9%

Nickel and articles thereof 72 15.1% 0.1% 54.8% 0.2%

Others 6,676 -6.4% -2.9% -4.7% -2.1%

Non-oil & gas export by country 13,460 -6.3% -5.6% -4.1% -3.8%

China 2,014 -7.1% -1.0% -9.3% -1.3%

United States 1,457 -5.0% -0.5% -3.3% -0.3%

Japan 1,358 6.1% 0.5% 2.3% 0.2%

India 1,135 -14.7% -1.2% -11.6% -1.0%

Malaysia 686 -6.4% -0.3% 0.9% 0.0%

Singapore 670 -16.7% -0.8% -19.2% -1.0%

South Korea 665 5.3% 0.2% 34.4% 1.1%

Thailand 479 -2.2% -0.1% -2.4% -0.1%

Taiwan 313 -6.9% -0.1% 2.7% 0.1%

Netherlands 290 -10.3% -0.2% -14.8% -0.3%

Germany 240 1.6% 0.0% 1.5% 0.0%

Australia 168 -16.0% -0.2% -0.1% 0.0%

Italy 95 -38.4% -0.4% -39.2% -0.4%

Others 3,890 -5.9% -9.3% -2.8% -0.7%

Total import 16,879 -4.5% -4.5% 11.7% 11.7%

Oil & gas import 2,835 -2.8% -0.5% 28.6% 4.2%

Crude oil 858 -2.4% -0.1% 62.6% 2.2%

Oil products 1,699 -1.6% -0.2% 21.9% 2.0%

Gas 279 -10.5% -0.2% -1.7% 0.0%

Non-oil & gas import by commodity 14,043 -4.8% -4.0% 8.8% 7.5%

Machinery and mechanical appliances; parts t 2,452 -3.7% -0.5% 4.7% 0.73%

Electrical machinery and equipment and parts 1,803 -10.0% -1.1% 0.1% 0.01%

Iron and steel 1,066 6.5% 0.4% 22.5% 1.30%

Cereals 270 -27.9% -0.6% 5.4% 0.09%

Food industries, residues and wastes thereof 232 -35.9% -0.7% -1.4% -0.02%

Chemical products n.e.c 287 24.7% 0.3% 56.6% 0.69%

Natural and cultured pearls; precious, semi-pre 140 52.9% 0.3% 11.1% 0.09%

Mineral fuels excluding oil & gas products 112 -55.8% -0.8% N/A N/A

Vegetables and certain roots and tubers; edib 98 140.4% 0.3% 72.3% 0.27%

Beverages, spirits and vinegar 91 470.6% 0.4% 506.5% 0.50%

Others 7,492 -4.3% -1.9% 6.7% 3.1%

Consumption Goods 1,432 -4.7% -0.4% 6.8% 0.6%

Raw Materials 12,855 -4.1% -3.1% 15.6% 11.5%

Capital Goods 2,592 -5.9% -0.9% -2.1% -0.4%

Source: CEIC, Statistics Indonesia

Page 3 Please see important disclosures at the back of this report

Macroscope | 18 December 2018

MACROECONOMIC INDICATORS AND FORECAST

2014 2015 2016 2017 2018F 2019F

National Account

Real GDP (% yoy) 5.0 4.8 5.0 5.1 5.2 5.1

Real Consumption: Private (% yoy) 5.1 5.0 5.0 4.9 5.0 5.0

Real Consumption: Government (% yoy) 2.0 5.4 -0.1 2.1 5.0 4.5

Real Gross Fixed Capital Formation (% yoy) 4.1 5.1 4.5 6.2 6.5 6.2

Real Exports (% yoy) 1.0 -2.0 -1.7 9.1 7.5 7.0

Real Imports (% yoy) 2.2 -5.8 -2.3 8.1 9.0 8.0

GDP (Rp tn) - nominal 10,543 11,541 12,407.00 13,588.80 14,778.80 16,199.10

GDP (US$ bn) - nominal 888 861.9 932 1,016 1,036 1,108

GDP per capita (US$) - nominal 3,520 3,377 3,589 3,852 3,888 4,110

External Sector

Exports (% yoy) - Merchandise -3.7 -15.4 -3.2 16.9 10.5 9.9

Imports (% yoy) - Merchandise -4.5 -19.7 -4.6 16.1 14.7 11.8

Trade Balance (US$ bn) 6.9 13.3 15.4 18.9 12.2 10.3

Current Account (% of GDP) -3 -2 -1.8 -1.7 -2.4 -2.4

Current Account (US$ bn) -26.2 -17.6 -16.3 -17.3 -25.3 -26.5

External Debt (% of GDP) 29.9 35 35 31 34 33

International Reserves (US$ bn) 111.9 106 116 130 113 115

Rp/US$ (period average) 11,878 13,458 13,308 13,380 14,325 14,450

Rp/US$ (year end) 12,440 13,795 13,436 13,588 14,635 14,600

Other

BI rate (% year end) 7.75 7.5

BI 7 days reverse repo rate (% year end) 4.75 4.25 6.25 6.5

Headline Inflation (% yoy, period average) 6.4 6.4 3.5 3.8 3.4 4

Headline Inflation (% yoy, year end) 8.36 3.35 3 3.61 3.6 4.5

Fiscal Balance (% of GDP) -2.2 -2.3 -2.5 -2.5 -2.2 -2.4

S&P's Rating - FCY BB+ BB+ BB+ BBB- BBB- BBB-

S&P's Rating - LCY BBB- BBB- BBB- BBB- BBB- BBB-

Sources: CEIC, Mandiri Sekuritas estimate

Page 4 Please see important disclosures at the back of this report

Mandiri Sekuritas A subsidiary of PT Bank Mandiri (Persero) Tbk

Menara Mandiri Tower I, 25th floor, Jl. Jend. Sudirman Kav. 54 – 55, Jakarta 12190, Indonesia

General: +62 21 526 3445, Fax : +62 21 527 5701 (Debt Sales)

ECONOMIC AND FIXED INCOME RESEARCH TEAM

Handy Yunianto Leo Putera Rinaldy

Head of Fixed Income Research Chief Economist

handy.yunianto@mandirisek.co.id leo.rinaldy@mandirisek.co.id

+62 21 5296 9568 +62 21 5296 9406

Ali Hasanudin Aziza Nabila Amani

Credit Analyst Research Assistant

ali.hasanudin@mandirisek.co.id aziza.amani@mandirisek.co.id

+6221 5296 9629 +6221 5296 9651

Teddy Hariyanto

Credit Analyst

teddy.hariyanto@mandirisek.co.id

+62 21 5296 9408

Yudistira Yudadisastra

Credit Analyst

yudistira@mandirisek.co.id

+62 21 5296 9698

Ariestya Putri Adhzani

Research Assistant

ariestya.adhzani@mandirisek.co.id

+62 21 5296 9522

Mandiri Sekuritas

A subsidiary of PT Bank Mandiri (Persero) Tbk

Menara Mandiri Tower I, 25th floor,

Jl. Jend. Sudirman Kav. 54 – 55, Jakarta 12190, Indonesia

General: +62 21 526 3445

DISCLAIMER: This report is issued by PT. Mandiri Sekuritas, a member of the Indonesia Stock Exchanges (IDX) and Mandiri Sekuritas is registered and

supervised by the Financial Services Authority (OJK). Although the contents of this document may represent the opinion of PT. Mandiri Sekuritas,

deriving its judgement from materials and sources believed to be reliable, PT. Mandiri Sekuritas or any other company in the Mandiri Group cannot

guarantee its accuracy and completeness. PT. Mandiri Sekuritas or any other company in the Mandiri Group may be involved in transactions contrary to

any opinion herein to make markets, or have positions in the securities recommended herein. PT. Mandiri Sekuritas or any other company in the Mandiri

Group may seek or will seek investment banking or other business relationships with the companies in this report. For further information please contact

our number 62-21-5263445.

ANALYSTS CERTIFICATION: Each contributor to this report hereby certifies that all the views expressed accurately reflect his or her views about the

companies, securities and all pertinent variables. It is also certified that the views and recommendations contained in this report are not and will not be

influenced by any part or all of his or her compensation.

You might also like

- National University: Term PaperDocument31 pagesNational University: Term PaperMoksedul Momin80% (5)

- C C PE: 2QFY18 Real GDP Growth in Line With EstimateDocument6 pagesC C PE: 2QFY18 Real GDP Growth in Line With EstimateAchint KumarNo ratings yet

- MOLS Ecoscpe 3 Jan 2019Document8 pagesMOLS Ecoscpe 3 Jan 2019rchawdhry123No ratings yet

- Macroscope: Huge Drop On Imports Likely Not SustainableDocument5 pagesMacroscope: Huge Drop On Imports Likely Not SustainableKurnia NindyoNo ratings yet

- Investor Digest: Equity Research - 18 May 2020Document15 pagesInvestor Digest: Equity Research - 18 May 2020helmy muktiNo ratings yet

- Nvestors Utlook: (Window Takaful Operations)Document4 pagesNvestors Utlook: (Window Takaful Operations)Stif LerNo ratings yet

- India in Numbers - Oct 2019Document40 pagesIndia in Numbers - Oct 2019anjugaduNo ratings yet

- IRC DesignDocument16 pagesIRC Designshubhanshu chaurasiyaNo ratings yet

- Financial Institutions Assignment 2 FinalDocument12 pagesFinancial Institutions Assignment 2 FinalpallaviNo ratings yet

- Section 1Document9 pagesSection 1usman_maniNo ratings yet

- Vol IiDocument59 pagesVol IiprashantNo ratings yet

- Economic Indicators of PakistanDocument4 pagesEconomic Indicators of PakistanhellosaadyNo ratings yet

- Tyre Production ATMA 2018-19Document24 pagesTyre Production ATMA 2018-19HIMANSHU -No ratings yet

- Ecs2 2019Document52 pagesEcs2 2019SRIJITNo ratings yet

- ICICI Direct Balkrishna IndustriesDocument9 pagesICICI Direct Balkrishna Industriesshankar alkotiNo ratings yet

- PhillipFundFocus Dec2018Document14 pagesPhillipFundFocus Dec2018adeqfir88No ratings yet

- Qe Co ForecastDocument9 pagesQe Co ForecastJudithRavelloNo ratings yet

- Investor Digest: Equity Research - 22 December 2020Document11 pagesInvestor Digest: Equity Research - 22 December 2020Ian RizkiNo ratings yet

- Table 1.1: Selected Economic Indicators FY15 FY16 FY17: Growth Rate (Percent)Document7 pagesTable 1.1: Selected Economic Indicators FY15 FY16 FY17: Growth Rate (Percent)FatimaIjazNo ratings yet

- Bangladesh Economic Prospects 2019Document14 pagesBangladesh Economic Prospects 2019Silvia RozarioNo ratings yet

- Detailed ReportDocument15 pagesDetailed ReportYashra NaveedNo ratings yet

- Investment Fact Sheet: For The Month of April 2018Document7 pagesInvestment Fact Sheet: For The Month of April 2018MehboobUrRehmanNo ratings yet

- frbm1 PDFDocument4 pagesfrbm1 PDFDinesh PatilNo ratings yet

- Macro-Economic Framework Statement 2017-18: Overview of The EconomyDocument4 pagesMacro-Economic Framework Statement 2017-18: Overview of The EconomyDinesh PatilNo ratings yet

- Monthly Summary Report, November 2022Document9 pagesMonthly Summary Report, November 2022Zeehenul IshfaqNo ratings yet

- Wto 2.2Document6 pagesWto 2.2Carol DanversNo ratings yet

- India Outlook FY20: January 2019Document13 pagesIndia Outlook FY20: January 2019KISHAN KUMARNo ratings yet

- The State of Pakistan'S Economy: First Quarterly Report For FY07Document11 pagesThe State of Pakistan'S Economy: First Quarterly Report For FY07Muzzammil IbrahimNo ratings yet

- JETRO Global Trade and Investment Report 2020Document18 pagesJETRO Global Trade and Investment Report 2020Ivan GpNo ratings yet

- FMR August 2023 Shariah CompliantDocument14 pagesFMR August 2023 Shariah CompliantAniqa AsgharNo ratings yet

- Role of Minerals in The National EconomicsDocument28 pagesRole of Minerals in The National Economicspt naiduNo ratings yet

- Assignment OnDocument30 pagesAssignment OnMashruk AhmedNo ratings yet

- CS Lviii 33 19082023Document2 pagesCS Lviii 33 19082023ram917722No ratings yet

- ABL - FMR - JULY'23 ConventionalDocument14 pagesABL - FMR - JULY'23 ConventionalAniqa AsgharNo ratings yet

- Economic Highlights - Economic Activities Improved in April - 30/04/2010Document4 pagesEconomic Highlights - Economic Activities Improved in April - 30/04/2010Rhb InvestNo ratings yet

- IBB BuletinDocument27 pagesIBB Buletindaily liveNo ratings yet

- Insecticides India LTD: Stock Price & Q4 Results of Insecticides India Limited - HDFC SecuritiesDocument9 pagesInsecticides India LTD: Stock Price & Q4 Results of Insecticides India Limited - HDFC SecuritiesHDFC SecuritiesNo ratings yet

- Goodyear India 19-03-2021 IciciDocument6 pagesGoodyear India 19-03-2021 IcicianjugaduNo ratings yet

- SPDC Analytical Brief 2017-18Document4 pagesSPDC Analytical Brief 2017-18محمد قاسمNo ratings yet

- Economic Survey 2019Document11 pagesEconomic Survey 2019The Indian ExpressNo ratings yet

- Economic Highlights - Vietnam: Economic Data Showing Signs of Weakness in July - 30/07/2010Document4 pagesEconomic Highlights - Vietnam: Economic Data Showing Signs of Weakness in July - 30/07/2010Rhb InvestNo ratings yet

- Trinidad and Tobago July 2017Document1 pageTrinidad and Tobago July 2017Rossana CairaNo ratings yet

- Cadila - Health Karvy 141119Document8 pagesCadila - Health Karvy 141119Harshit SinghNo ratings yet

- 2.8. GREECE: Graph 2.8: ForecastDocument1 page2.8. GREECE: Graph 2.8: ForecastLord VarioNo ratings yet

- Fund Managers' Report - Shariah Compliant - Nov 2022Document14 pagesFund Managers' Report - Shariah Compliant - Nov 2022Aniqa AsgharNo ratings yet

- Quantifying The Impact of Covid-19 On Commercial and Residential Real Estate MarketDocument4 pagesQuantifying The Impact of Covid-19 On Commercial and Residential Real Estate MarketyashNo ratings yet

- CD Equisearchpv PVT LTD: Quarterly HighlightsDocument12 pagesCD Equisearchpv PVT LTD: Quarterly HighlightsanjugaduNo ratings yet

- MPC-April 2018: HighlightsDocument4 pagesMPC-April 2018: Highlightssubhendu maharanaNo ratings yet

- Echap01 Vol2Document33 pagesEchap01 Vol2Vivek KumarNo ratings yet

- Shriram Transport Finance: CMP: INR1,043 Growth DeceleratingDocument14 pagesShriram Transport Finance: CMP: INR1,043 Growth DeceleratingDarshitNo ratings yet

- Research Report Maruti Suzuki Ltd.Document8 pagesResearch Report Maruti Suzuki Ltd.Harshavardhan pasupuletiNo ratings yet

- ABL FMR JULY 23 Shariah CompliantDocument13 pagesABL FMR JULY 23 Shariah CompliantAniqa AsgharNo ratings yet

- Flash - HM. Sampoerna: 2Q20 Volume and Key Forward-Looking StatementDocument3 pagesFlash - HM. Sampoerna: 2Q20 Volume and Key Forward-Looking Statementjnn sNo ratings yet

- Pakistan Insight - 20181001 - Economy - Start of SlowdownDocument32 pagesPakistan Insight - 20181001 - Economy - Start of SlowdownMuhammadHussainKhanNo ratings yet

- Research Pulse: February 2020Document14 pagesResearch Pulse: February 2020JeetuNo ratings yet

- Investor Digest: Equity Research - 25 November 2020Document18 pagesInvestor Digest: Equity Research - 25 November 2020Ciprut 2205No ratings yet

- ITMA Bulletin - September 2017Document11 pagesITMA Bulletin - September 2017Dhaval JobanputraNo ratings yet

- Investor Digest 03 Mei 2019Document13 pagesInvestor Digest 03 Mei 2019Rising PKN STANNo ratings yet

- Monthly Summary Report, January 2023Document9 pagesMonthly Summary Report, January 2023Zeehenul IshfaqNo ratings yet

- Fund Managers' Report - March 2023 (Shariah Compliant)Document14 pagesFund Managers' Report - March 2023 (Shariah Compliant)Aniqa AsgharNo ratings yet

- Sean Darby - JefferiesDocument18 pagesSean Darby - JefferiesKurnia NindyoNo ratings yet

- M Chatib BasriDocument15 pagesM Chatib BasriKurnia NindyoNo ratings yet

- UOBKH Plantation Online UpdateDocument18 pagesUOBKH Plantation Online UpdateKurnia NindyoNo ratings yet

- Macroscope: Huge Drop On Imports Likely Not SustainableDocument5 pagesMacroscope: Huge Drop On Imports Likely Not SustainableKurnia NindyoNo ratings yet

- Macroscope: Inflation Preview: Tame NovemberDocument4 pagesMacroscope: Inflation Preview: Tame NovemberKurnia NindyoNo ratings yet

- Peralatan Industri Kimia: Arif Rahman, ST MTDocument80 pagesPeralatan Industri Kimia: Arif Rahman, ST MTKurnia NindyoNo ratings yet

- Economy of BahrainDocument2 pagesEconomy of Bahrainocduran42004No ratings yet

- Business Environment NotesDocument48 pagesBusiness Environment NotesPriyanka Gharat AcharekarNo ratings yet

- 0252445849ed2-Simple Interest Vyapam Replace PDFDocument14 pages0252445849ed2-Simple Interest Vyapam Replace PDFPrafulla JoshiNo ratings yet

- Edexcel AS Economics AnswersDocument30 pagesEdexcel AS Economics AnswersJeanne d'Arc100% (1)

- National Income: Concepts & MeasurementDocument12 pagesNational Income: Concepts & MeasurementRajeshsharmapurangNo ratings yet

- Central Bank's Economic & Social Statistics 2017Document196 pagesCentral Bank's Economic & Social Statistics 2017SarawananNadarasaNo ratings yet

- Rising Crime and Its Impact On BusinessesDocument10 pagesRising Crime and Its Impact On BusinessesKevonSingh1No ratings yet

- Digital Transformation of Travel and Tourism in IndiaDocument6 pagesDigital Transformation of Travel and Tourism in IndiaEditor IJTSRDNo ratings yet

- Tillage Pattern For Fuel EcomoniDocument4 pagesTillage Pattern For Fuel EcomoniMunnaf M AbdulNo ratings yet

- KFCDocument82 pagesKFCPrashant Chaubey100% (3)

- Sports Industry Economic AnalysisDocument153 pagesSports Industry Economic AnalysisGaurav ChaudharyNo ratings yet

- The American Welfare State How We Spend Nearly $1 Trillion A Year Fighting Poverty - and Fail, Cato Policy Analysis No. 694Document24 pagesThe American Welfare State How We Spend Nearly $1 Trillion A Year Fighting Poverty - and Fail, Cato Policy Analysis No. 694Cato Institute100% (1)

- Mizoram Statistical Handbook 2010Document186 pagesMizoram Statistical Handbook 2010jacoblbawlteNo ratings yet

- Chapter 24Document6 pagesChapter 24khanhlttss181012No ratings yet

- Economics Relab Learner Book Grd10 Final t1-4Document146 pagesEconomics Relab Learner Book Grd10 Final t1-4Favour Emeruh100% (1)

- CI Practice Sheet Level-1Document8 pagesCI Practice Sheet Level-1Karan RoyNo ratings yet

- Numerical Reasoning Percentage Increase and Decrease - Graduatewings - CoDocument1 pageNumerical Reasoning Percentage Increase and Decrease - Graduatewings - Cocorporateboy36596No ratings yet

- Fear of God-3Document50 pagesFear of God-3Duy LêNo ratings yet

- Case Studies WebsiteDocument69 pagesCase Studies WebsitePushpinder KumarNo ratings yet

- Marketing of Services: Barun Dash Roll # IT200310374Document33 pagesMarketing of Services: Barun Dash Roll # IT200310374Gaytri JenaNo ratings yet

- Aleksandrov I Dis 1-50.ru - enDocument50 pagesAleksandrov I Dis 1-50.ru - enNabeel AdilNo ratings yet

- Macroeconomics: Lecture 4: Measurement of GDPDocument10 pagesMacroeconomics: Lecture 4: Measurement of GDPBakchodi NhiNo ratings yet

- Globalisation 2019Document33 pagesGlobalisation 2019Gerald EmmanuelNo ratings yet

- Bangladesh Development ModelDocument59 pagesBangladesh Development ModelÑìtíñ PràkáshNo ratings yet

- Chapter 2 Measuring The Cost of LivingDocument25 pagesChapter 2 Measuring The Cost of LivingHSE19 EconhinduNo ratings yet

- Industry Life CycleDocument7 pagesIndustry Life CycleAashim SinglaNo ratings yet

- 202212-Ndii - Africa AgricultureDocument38 pages202212-Ndii - Africa AgricultureKilutiNo ratings yet

- Aggregate Supply, Aggregate Demand and National OutputDocument43 pagesAggregate Supply, Aggregate Demand and National OutputChristian Jumao-as MendozaNo ratings yet

- Si Ci 100 Ques With SolnDocument20 pagesSi Ci 100 Ques With SolnJason WestNo ratings yet