Professional Documents

Culture Documents

File and Pay Electronically: Electronic Filing and Payment System (EFPS)

File and Pay Electronically: Electronic Filing and Payment System (EFPS)

Uploaded by

mmeeeoww0 ratings0% found this document useful (0 votes)

87 views26 pagesThe document summarizes Revenue Regulations that mandate certain taxpayers to file tax returns and pay taxes electronically through the Electronic Filing and Payment System (EFPS) or online eBIRForms system. It identifies taxpayers required to use electronic filing systems, such as large corporations, government agencies, importers, and accredited tax agents. The regulations allow manual filing and payment for electronic filers after unsuccessful electronic filing attempts, if they provide proof of attempts and report the issues within 15 days of the deadline.

Original Description:

eFPS eBIRForms

Original Title

eFPS_eBIRForms

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes Revenue Regulations that mandate certain taxpayers to file tax returns and pay taxes electronically through the Electronic Filing and Payment System (EFPS) or online eBIRForms system. It identifies taxpayers required to use electronic filing systems, such as large corporations, government agencies, importers, and accredited tax agents. The regulations allow manual filing and payment for electronic filers after unsuccessful electronic filing attempts, if they provide proof of attempts and report the issues within 15 days of the deadline.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

87 views26 pagesFile and Pay Electronically: Electronic Filing and Payment System (EFPS)

File and Pay Electronically: Electronic Filing and Payment System (EFPS)

Uploaded by

mmeeeowwThe document summarizes Revenue Regulations that mandate certain taxpayers to file tax returns and pay taxes electronically through the Electronic Filing and Payment System (EFPS) or online eBIRForms system. It identifies taxpayers required to use electronic filing systems, such as large corporations, government agencies, importers, and accredited tax agents. The regulations allow manual filing and payment for electronic filers after unsuccessful electronic filing attempts, if they provide proof of attempts and report the issues within 15 days of the deadline.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 26

Electronic Filing and Payment System (EFPS)

- File and Pay Electronically

Online eBIRForms System

- File Electronically and Pay Manually

Taxpayer Account Management

Program (TAMP) Taxpayers

(RR No. 10-2014)

Accredited Importer and

Prospective Importer required to

secure the BIR-ICC and BIR-BCC

(RR No. 10-2014)

National Government Agencies

(NGAs) (RR No. 1-2013)

All Licensed Local Contractors

(RR No. 10-2012))

Enterprises Enjoying Fiscal Incentives

(PEZA,BOI, Various Zone authorities,

Etc) (RR No 1-2010)

Top 5,000 Individual Taxpayers

(RR No. 6-2009)

Corporations with Paid-Up Capital

Stock of P10 Million and above

(RR No. 10-2007)

Corporations with Complete

Computerized System

(RR No. 10-2007)

Procuring Government Agencies with

respect to Withholding of VAT and

Percentage Taxes

(RR No. 3-2005)

Government Bidders

(RR No. 3-2005)

Large Taxpayers

(RR No. 2-2002 as amended)

Top 20,000 Private Corporations

(RR No. 2-98 as amended)

Accredited Tax Agents/Practitioners

and all its client-taxpayers

(RR No. 6-2014)

Accredited Printers of Principal and

Supplementary Receipts/Invoices

(RR No. 6-2014)

One-Time Transaction (ONETT)

Taxpayers

(RR No. 6-2014)

Those who shall file a

“No-Payment” Return

(RR No. 6-2014)

Government-Owned or –Controlled

Corporations (GOCCS)

(RR No. 6-2014)

Local Government Units (LGUs)

except barangays

(RR No. 6-2014)

Cooperatives, registered with National

Electrification Administration (NEA)

and Local Water Utilities

Administration (LWUA)

(RR No. 6-2014)

Amended Revenue Regulations No. 6- 2014

dated September 5, 2014 by imposing

Penalties for Failure to FILE Returns

Under the Electronic Systems of the BIR

for those Taxpayers Mandatorily Covered

by eBIRForms or eFPS

• Allows the manual filing and payment of certain

tax returns by eFPS/Electronic eBIRForms taxpayers

AFTER several attempts of unsuccessful e-filing

subject to the following:

-Print evidence/proof of attempts (print screen with the message);

- Report/call HELPDESK and get Trouble Ticket Log

on or before due date;

- Report to BIR CONTACT CENTER 981-8888 and get

reference number of the call;

- RE-FILE ELECTRONICALLY WITHIN FIFTEEN (15)

DAYS AFTER THE STATUTORY DEADLINES

“Life is best for those who want to

live it;

difficult for those who analyze it;

and worse for those who criticize it.

Our attitudes define life”

You might also like

- TAMP BriefingDocument17 pagesTAMP Briefingdragon 999999100% (1)

- Lto MC - 2018-2157 PDFDocument19 pagesLto MC - 2018-2157 PDFmmeeeoww100% (1)

- Writ of Replevin Remedy To Recover PropertyDocument2 pagesWrit of Replevin Remedy To Recover Propertymmeeeoww100% (2)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Operations Memo 2016-04-01Document7 pagesOperations Memo 2016-04-01Renniel DimalantaNo ratings yet

- Assignment No. 1 - If Extra Practice ProblemDocument4 pagesAssignment No. 1 - If Extra Practice ProblemTejas Joshi100% (1)

- RMC 19-2015Document9 pagesRMC 19-2015reseljanNo ratings yet

- E ServicesDocument52 pagesE ServicesRheneir MoraNo ratings yet

- REVENUE MEMORANDUM CIRCULAR NO. 14-2015 Issued On April 6, 2015 PrescribesDocument1 pageREVENUE MEMORANDUM CIRCULAR NO. 14-2015 Issued On April 6, 2015 PrescribesGdares YakitNo ratings yet

- BIR Citizens Charter 2020 2nd Edition RR RDODocument228 pagesBIR Citizens Charter 2020 2nd Edition RR RDOJessa TadeoNo ratings yet

- RMO No. 5-2002Document13 pagesRMO No. 5-2002lantern san juanNo ratings yet

- 29133rmo 10-2006Document15 pages29133rmo 10-2006Denzel Edward CariagaNo ratings yet

- EservicesDocument52 pagesEservicesClotheshoppe ForhimherNo ratings yet

- BIR Ease of Doing BusinessDocument25 pagesBIR Ease of Doing BusinessCess MelendezNo ratings yet

- 68120RR 1-2013Document6 pages68120RR 1-2013Allan AlcantaraNo ratings yet

- RMC No. 4-2021 Revised - v2Document5 pagesRMC No. 4-2021 Revised - v2jesieNo ratings yet

- BIR - Invoicing RequirementsDocument17 pagesBIR - Invoicing RequirementsCkey ArNo ratings yet

- Guidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Document9 pagesGuidelines and Instruction For BIR Form No. 1702-RT (JUNE 2013)Reynold Briones Azusano ButeresNo ratings yet

- Receiv: Bureau Internal RevenueDocument1 pageReceiv: Bureau Internal Revenuew8ndblidNo ratings yet

- Bir Forms: Electronic ManualDocument11 pagesBir Forms: Electronic Manualcris lu salemNo ratings yet

- LAwhahahhaDocument21 pagesLAwhahahhaJeselle BagsicanNo ratings yet

- BIR Citizen - S Charter 2021 EditionDocument999 pagesBIR Citizen - S Charter 2021 EditionRosalie FeraerNo ratings yet

- 68120RR 1-2013 PDFDocument6 pages68120RR 1-2013 PDFandrew estimoNo ratings yet

- Persons Required To File and Pay Under EfpsDocument2 pagesPersons Required To File and Pay Under EfpsTokha YatsurugiNo ratings yet

- Digest of Revenue Issuances April 2015Document4 pagesDigest of Revenue Issuances April 2015RolDeejNo ratings yet

- 6.tax UpdatesDocument131 pages6.tax UpdatesfrancklineNo ratings yet

- Taxation of Salaried EmployeesDocument39 pagesTaxation of Salaried Employeessailolla30100% (1)

- RMC No 15-2015 Deferment of Implementation On Identified Withholding Tax FormsDocument2 pagesRMC No 15-2015 Deferment of Implementation On Identified Withholding Tax FormsphilippinecpaNo ratings yet

- Taxation: (1) What Is E-Filing?Document9 pagesTaxation: (1) What Is E-Filing?Jabid Ali SheikhNo ratings yet

- For Amo WebinarsDocument79 pagesFor Amo WebinarsLiezl Tizon ColumnasNo ratings yet

- Computerized Accounting ProjectDocument21 pagesComputerized Accounting ProjectEliza jNo ratings yet

- eBIR FormsDocument31 pageseBIR FormsAibo GacuLa71% (7)

- Large Taxpayer Unit (Ltu) : Concept ofDocument3 pagesLarge Taxpayer Unit (Ltu) : Concept ofswami_ratanNo ratings yet

- Taxation of Salaried EmployeesDocument41 pagesTaxation of Salaried EmployeesAbhiroop BoseNo ratings yet

- Registration, Taxation & Accounting Compliance of Construction IndustryDocument52 pagesRegistration, Taxation & Accounting Compliance of Construction IndustryJohn Erick FernandezNo ratings yet

- Confidential CTPA/GFTEI/AEOI (2016) 1/REV1Document4 pagesConfidential CTPA/GFTEI/AEOI (2016) 1/REV1rexafeNo ratings yet

- 1601E - August 2008Document4 pages1601E - August 2008HarryNo ratings yet

- Any Foreign Assets. Even Though Taxpayer May Not Have Any Taxable IncomeDocument1 pageAny Foreign Assets. Even Though Taxpayer May Not Have Any Taxable IncomeswamymotappaNo ratings yet

- BIR Form 1600Document39 pagesBIR Form 1600maeshach60% (5)

- Rmo 5-2017Document12 pagesRmo 5-2017Romer LesondatoNo ratings yet

- Alterar para Português - Passer Au Français: Face-To-FaceDocument6 pagesAlterar para Português - Passer Au Français: Face-To-Facehelal9818No ratings yet

- Peru TINDocument5 pagesPeru TINMariluz Cassa SalasNo ratings yet

- Itr Lazar PDFDocument19 pagesItr Lazar PDFLazar BhuyanNo ratings yet

- 1601E - August 2008Document3 pages1601E - August 2008lovesresearchNo ratings yet

- Taxation Laws - Ms. de CastroDocument54 pagesTaxation Laws - Ms. de CastroCC100% (1)

- Acfrogd1v3bhimwzqh3xjw9pkoisxwfbzmhkox448rfpjma0ydk9gzrgffwlpmunhku31 C Zysvbpzxw04cpcsur3jg8 7xms3crzrp 45zkvy0imh2yaqgjoe Mv6w6td8dqp Nyarsl1dworjDocument14 pagesAcfrogd1v3bhimwzqh3xjw9pkoisxwfbzmhkox448rfpjma0ydk9gzrgffwlpmunhku31 C Zysvbpzxw04cpcsur3jg8 7xms3crzrp 45zkvy0imh2yaqgjoe Mv6w6td8dqp Nyarsl1dworjŠu B ḦaNo ratings yet

- 1601e Form PDFDocument3 pages1601e Form PDFLee GhaiaNo ratings yet

- Rmo 28-07Document31 pagesRmo 28-07nathalie velasquezNo ratings yet

- Circulars 2009 Onreturnforms Final 10062009Document6 pagesCirculars 2009 Onreturnforms Final 10062009api-20002381No ratings yet

- Tot RR On It and WT RR 4 2024Document25 pagesTot RR On It and WT RR 4 2024floravielcasternoboplazoNo ratings yet

- Sub.: Procedure For Electronic Filing of Central Excise and Service Tax Returns and For Electronic Payment of Excise Duty and Service Tax. Sir/madamDocument13 pagesSub.: Procedure For Electronic Filing of Central Excise and Service Tax Returns and For Electronic Payment of Excise Duty and Service Tax. Sir/madambiko137No ratings yet

- After The Previous Year ExpiryDocument4 pagesAfter The Previous Year ExpiryRaj JamadarNo ratings yet

- BIR FormsDocument30 pagesBIR FormsRoma Sabrina GenoguinNo ratings yet

- 2551QDocument3 pages2551QnelsonNo ratings yet

- 2016 Pulong PulongDocument22 pages2016 Pulong PulongJeromy VillarbaNo ratings yet

- RMC No 31-2015Document1 pageRMC No 31-2015Anonymous nYvtSgoQNo ratings yet

- EServices ReportDocument18 pagesEServices ReportMaine QuiniquiniNo ratings yet

- BIR Issuances Availability of eBIR Forms Package Version 6.3Document13 pagesBIR Issuances Availability of eBIR Forms Package Version 6.3Mark Lord Morales BumagatNo ratings yet

- Electronic Filing and Payment System (EFPS) eFPS Stands For Electronic Filing and Payment System, and It Refers To The SystemDocument6 pagesElectronic Filing and Payment System (EFPS) eFPS Stands For Electronic Filing and Payment System, and It Refers To The SystemJonathan Isaac De SilvaNo ratings yet

- Instructions For Complevvm No. 22T101Document27 pagesInstructions For Complevvm No. 22T101zzzzzzNo ratings yet

- 51931RMO 51-2010 E-ComplaintDocument4 pages51931RMO 51-2010 E-ComplaintFroilyn Doyaoen PagayatanNo ratings yet

- BP 68 Corporation Code ForeignDocument7 pagesBP 68 Corporation Code ForeignmmeeeowwNo ratings yet

- SEC Satellite Offices PDFDocument1 pageSEC Satellite Offices PDFmmeeeowwNo ratings yet

- Advisory RMC 96-2018Document1 pageAdvisory RMC 96-2018mmeeeowwNo ratings yet

- Registration of Securities: Securities and Exchange CommissionDocument6 pagesRegistration of Securities: Securities and Exchange CommissionmmeeeowwNo ratings yet

- Cta Vat CaseDocument9 pagesCta Vat CasemmeeeowwNo ratings yet

- Philippine Amusement and Gaming Corporation: Compliance Monitoring and Enforcement DepartmentDocument1 pagePhilippine Amusement and Gaming Corporation: Compliance Monitoring and Enforcement DepartmentmmeeeowwNo ratings yet

- Zero Tax JurisdictionsDocument2 pagesZero Tax JurisdictionsmmeeeowwNo ratings yet

- Form 34 - Third-Party Chipwashing and Junket Operators Notification FormDocument3 pagesForm 34 - Third-Party Chipwashing and Junket Operators Notification FormmmeeeowwNo ratings yet

- Republic Act No. 8799 The Securities Regulation Code Chapter Iii Registration of Securities Section 8. Requirement of Registration of SecuritiesDocument3 pagesRepublic Act No. 8799 The Securities Regulation Code Chapter Iii Registration of Securities Section 8. Requirement of Registration of SecuritiesmmeeeowwNo ratings yet

- F4A Video Streaming Notification FormDocument3 pagesF4A Video Streaming Notification FormmmeeeowwNo ratings yet

- RMC 102-2017 HighlightsDocument3 pagesRMC 102-2017 HighlightsmmeeeowwNo ratings yet

- I Phone: Aneja CommunicationsDocument1 pageI Phone: Aneja CommunicationsKumar Chandan JhaNo ratings yet

- Page 1 of 3Document3 pagesPage 1 of 3Chellezea UrsabiaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)ponnuNo ratings yet

- DocDocument4 pagesDocZulnu Rain AliNo ratings yet

- Statement 1577731252322 PDFDocument11 pagesStatement 1577731252322 PDFPriyanka ParidaNo ratings yet

- De 4Document4 pagesDe 4AmandaNo ratings yet

- P.V Number: 6570000246463 Buyer Code: 4240004928477: PECHS Primary III, Karachi NTN 22-13-0786158-3 BSRDocument1 pageP.V Number: 6570000246463 Buyer Code: 4240004928477: PECHS Primary III, Karachi NTN 22-13-0786158-3 BSRRabia KulsoomNo ratings yet

- Tax Invoice: Company Number: NO 991 008 683 MVADocument1 pageTax Invoice: Company Number: NO 991 008 683 MVAmorphlexalexNo ratings yet

- What Is Works Contract?Document10 pagesWhat Is Works Contract?Naga BhushanNo ratings yet

- Hotel Reservation Form: Your InformationDocument3 pagesHotel Reservation Form: Your InformationTheresia PewaliNo ratings yet

- Thirakannam NagarajaachariDocument2 pagesThirakannam NagarajaachariNaga RajNo ratings yet

- Bill FormetDocument1 pageBill Formetshuklavishal135No ratings yet

- RA 7496-Simplified Net Income Scheme For Self-Employed & Professionals...Document5 pagesRA 7496-Simplified Net Income Scheme For Self-Employed & Professionals...Crislene CruzNo ratings yet

- FS 2022 2CM - 100905Document10 pagesFS 2022 2CM - 100905Bennur Rajib Arajam BarraquiasNo ratings yet

- 60006TG220105848Document3 pages60006TG220105848VikashJangirNo ratings yet

- LogicRays Academy Payment Receiptnarendradolai1Document1 pageLogicRays Academy Payment Receiptnarendradolai1AJAY RAJPUTNo ratings yet

- Wire Reciept For DaveDocument9 pagesWire Reciept For DaveNicoleNo ratings yet

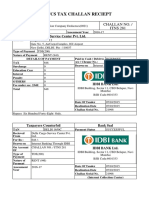

- Charges & Fee - IDBI Bank Card Products: 1) Classic Debit Card/Women's Debit Card/Being Me Card/Kids CardDocument5 pagesCharges & Fee - IDBI Bank Card Products: 1) Classic Debit Card/Women's Debit Card/Being Me Card/Kids Cardrose thomsan thomsanNo ratings yet

- Najwa Dean Hasana Ci 29 JanDocument3 pagesNajwa Dean Hasana Ci 29 JanEcommerce The ManoharaNo ratings yet

- Taxation Law Bar Examination 2019questionsandsuggested AnswersDocument5 pagesTaxation Law Bar Examination 2019questionsandsuggested Answersjude AbraganNo ratings yet

- Indirect TaxesDocument4 pagesIndirect TaxesArwa Makharia ChharchhodaNo ratings yet

- Onlinestatement - 2024-05-28T100839.648Document6 pagesOnlinestatement - 2024-05-28T100839.648ronaldaroachNo ratings yet

- CMC Veena Koshi's Appoinment (Ayman)Document2 pagesCMC Veena Koshi's Appoinment (Ayman)rana rana100% (1)

- 2019 BOC Taxation Law Reviewer PDFDocument295 pages2019 BOC Taxation Law Reviewer PDFEdu Fajardo100% (2)

- Internet Invoice - Jan 2021Document2 pagesInternet Invoice - Jan 2021Santosh NimalpuriNo ratings yet

- Taxation Dissertation SampleDocument36 pagesTaxation Dissertation SampleOnline Dissertation WritingNo ratings yet

- PDF IDBI 07-10-2015 Maj Head 0021Document237 pagesPDF IDBI 07-10-2015 Maj Head 0021sunilNo ratings yet

- TSH Sat Registration GuideDocument3 pagesTSH Sat Registration GuideJonathan SolomonNo ratings yet

- Rubber MatDocument1 pageRubber MatSUNIL PATELNo ratings yet