Professional Documents

Culture Documents

The IMF Stabilisation Program

The IMF Stabilisation Program

Uploaded by

Lalit SharmaCopyright:

Available Formats

You might also like

- Musical Acoustics PDFDocument26 pagesMusical Acoustics PDFGino Mendoza0% (1)

- To Make Flip Flop Led Flasher Circuit Using Transistor Bc547Document17 pagesTo Make Flip Flop Led Flasher Circuit Using Transistor Bc547ananyabedekar83No ratings yet

- Feedback Control Systems by S C Goyal U A Bakshi PDFDocument2 pagesFeedback Control Systems by S C Goyal U A Bakshi PDFHeather29% (7)

- Solutions RoughDocument10 pagesSolutions Roughsana abbasNo ratings yet

- SapsDocument5 pagesSapsromkhanNo ratings yet

- Structural Adjustment Programmes: Composition AND Effects: DR Ghulam Moeen Ud DinDocument44 pagesStructural Adjustment Programmes: Composition AND Effects: DR Ghulam Moeen Ud DinSyeda Sana Batool RizviNo ratings yet

- TIỂU LUẬN KIH TẾ VĨ MÔ C4Document6 pagesTIỂU LUẬN KIH TẾ VĨ MÔ C4Duy VănNo ratings yet

- IFO SAPs EssayDocument4 pagesIFO SAPs EssayMandieNo ratings yet

- Structural Adjustment: Structural Adjustments Are The Policies Implemented by TheDocument13 pagesStructural Adjustment: Structural Adjustments Are The Policies Implemented by Theanon_246766821No ratings yet

- Macroeconomics Task 3Document5 pagesMacroeconomics Task 3buenop373No ratings yet

- South East Crisis 1997: The Strategy Used in The Face of The CrisisDocument6 pagesSouth East Crisis 1997: The Strategy Used in The Face of The CrisisJorge Yeshayahu Gonzales-LaraNo ratings yet

- Angel Conworld Mod.7Document8 pagesAngel Conworld Mod.7angelNo ratings yet

- Saps, Imf & PakistanDocument7 pagesSaps, Imf & PakistanMaya AinNo ratings yet

- Structural Adjustment Programmes: Composition and Effects: Chapter 14: Akbar ZaidiDocument45 pagesStructural Adjustment Programmes: Composition and Effects: Chapter 14: Akbar Zaidirabia liaqatNo ratings yet

- Interactions Between Macroeconomic Policy and Financial MarketsDocument4 pagesInteractions Between Macroeconomic Policy and Financial MarketsIjahss JournalNo ratings yet

- What Policy Options Existed To Mitigate The Financial and Economic Distress of ContainmentDocument3 pagesWhat Policy Options Existed To Mitigate The Financial and Economic Distress of ContainmentAnupriya SharmaNo ratings yet

- Gender Exploitation: From Structural Adjustment Policies To Poverty Reduction StrategiesDocument23 pagesGender Exploitation: From Structural Adjustment Policies To Poverty Reduction StrategiesmaryamsanjraniNo ratings yet

- IMF & Developing CountriesDocument6 pagesIMF & Developing Countriesmadnansajid8765No ratings yet

- Final Exam-ECO720-2112-1&2 VSDocument4 pagesFinal Exam-ECO720-2112-1&2 VSanurag soniNo ratings yet

- Structural Adjustment ProgramsDocument2 pagesStructural Adjustment ProgramsjoharNo ratings yet

- Five Debates by Jatin Ravi N MaheshDocument33 pagesFive Debates by Jatin Ravi N Maheshyajuvendra7091No ratings yet

- Recession Chapter 5Document43 pagesRecession Chapter 5Gfi ConexionNo ratings yet

- Questions For 2015 LCE English Editors - ONUDocument33 pagesQuestions For 2015 LCE English Editors - ONUpilcheritoNo ratings yet

- Lesson 13Document3 pagesLesson 13Maurice AgbayaniNo ratings yet

- Is Conventional Monetary Policy DyingDocument9 pagesIs Conventional Monetary Policy DyingSpandan BandyopadhyayNo ratings yet

- G20 Policy Paper 2-14-12 FINAL - 0Document6 pagesG20 Policy Paper 2-14-12 FINAL - 0InterActionNo ratings yet

- Jamaica IMF Agreement PDFDocument47 pagesJamaica IMF Agreement PDFRichardo WilliamsNo ratings yet

- Government Saving Has Not Grown Much in The Developing Countries and Corporate Saving Is Relatively SmallDocument6 pagesGovernment Saving Has Not Grown Much in The Developing Countries and Corporate Saving Is Relatively SmalljoooNo ratings yet

- Política EconómicaDocument26 pagesPolítica Económicajorge lNo ratings yet

- Asia Financial SituationDocument4 pagesAsia Financial SituationTabish BhatNo ratings yet

- Operational Plan 2011-2015 Dfid VietnamDocument12 pagesOperational Plan 2011-2015 Dfid VietnamedselsawyerNo ratings yet

- Fiscal PolicyDocument5 pagesFiscal PolicyVidhi AgarwalNo ratings yet

- POL 346 Paper - Ghana and IMFDocument19 pagesPOL 346 Paper - Ghana and IMFGian-Paolo MendozaNo ratings yet

- Relations Between PFM and PRGFDocument27 pagesRelations Between PFM and PRGFProfessor Tarun DasNo ratings yet

- Structural Adjustment ProgramsDocument2 pagesStructural Adjustment ProgramsKeshni goelNo ratings yet

- AP PublicfinanceDocument96 pagesAP PublicfinanceAster GebreaNo ratings yet

- IMF BailoutsDocument7 pagesIMF BailoutsPalwasha HidayatNo ratings yet

- Book Review: Trinity College, Hartford, CT, USADocument3 pagesBook Review: Trinity College, Hartford, CT, USASantiago PérezNo ratings yet

- A Critical Analysis of IMFDocument31 pagesA Critical Analysis of IMFvssm123No ratings yet

- Week 10 NotesDocument4 pagesWeek 10 NotesClement WaituikaNo ratings yet

- Chapter 11 National Macroeconomic PolicyDocument28 pagesChapter 11 National Macroeconomic PolicyLuis SilvaNo ratings yet

- Contoh BeritaDocument6 pagesContoh BeritaWindy Marsella ApriliantyNo ratings yet

- Eco Dev MidtermDocument6 pagesEco Dev MidtermGlenn VeluzNo ratings yet

- MimoDocument4 pagesMimozaNo ratings yet

- Q 1Document40 pagesQ 1Gaurav AgarwalNo ratings yet

- Under The Influence of The World Bank Lay OutDocument6 pagesUnder The Influence of The World Bank Lay OutMohammedOnuesekeNo ratings yet

- Chipping Away at Public Debt: Sources of Failure and Keys to Success in Fiscal AdjustmentFrom EverandChipping Away at Public Debt: Sources of Failure and Keys to Success in Fiscal AdjustmentRating: 1 out of 5 stars1/5 (1)

- Fiscal PolicyDocument7 pagesFiscal PolicySara de la SernaNo ratings yet

- Topic: Understanding The IMF Conditionalities: A Case of PakistanDocument6 pagesTopic: Understanding The IMF Conditionalities: A Case of PakistanMalik Tufassal NaeemNo ratings yet

- Reading Lesson 1Document9 pagesReading Lesson 1AnshumanNo ratings yet

- Nurfarhanah Binti Abd Aziz IPE Policy Report - 5521286 6069918 1534314148Document14 pagesNurfarhanah Binti Abd Aziz IPE Policy Report - 5521286 6069918 1534314148Aidah Md SaidNo ratings yet

- The Impact of Structural Adjustment On The PoorDocument12 pagesThe Impact of Structural Adjustment On The PoorShania AlexanderNo ratings yet

- Topic 9. Macroeconomic Policies and Poverty - XEA 406Document6 pagesTopic 9. Macroeconomic Policies and Poverty - XEA 406Anita BoboNo ratings yet

- Exec SumDocument2 pagesExec SumAgnes DizonNo ratings yet

- Frontline Defense of The Economy: Annual ReportDocument40 pagesFrontline Defense of The Economy: Annual ReportJayroy VillagraciaNo ratings yet

- Eafm - 27 May 2020 - 1600Document11 pagesEafm - 27 May 2020 - 1600emon hossainNo ratings yet

- Monetary Policy & Fiscal PolicyDocument6 pagesMonetary Policy & Fiscal PolicyMitesh KumarNo ratings yet

- Monetary PolicyDocument5 pagesMonetary Policyrameen kamranNo ratings yet

- Eco 6 FDDocument16 pagesEco 6 FD20047 BHAVANDEEP SINGHNo ratings yet

- Global Policy Agenda 2020 IMFDocument12 pagesGlobal Policy Agenda 2020 IMFAsaad AreebNo ratings yet

- GRP 4Document18 pagesGRP 4Tipsforchange lifeNo ratings yet

- Glen Biglaiser and Ronald J. McGauvran study reportDocument28 pagesGlen Biglaiser and Ronald J. McGauvran study reportopparasharNo ratings yet

- The Power to Stop any Illusion of Problems: (Behind Economics and the Myths of Debt & Inflation.): The Power To Stop Any Illusion Of ProblemsFrom EverandThe Power to Stop any Illusion of Problems: (Behind Economics and the Myths of Debt & Inflation.): The Power To Stop Any Illusion Of ProblemsNo ratings yet

- APPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Document7 pagesAPPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Albert YsegNo ratings yet

- CBWorld August1981 PDFDocument64 pagesCBWorld August1981 PDFbobbyunlockNo ratings yet

- DoomsdayDocument29 pagesDoomsdayAsmita RoyNo ratings yet

- PROCERA: A New Way To Achieve An All-Ceramic CrownDocument12 pagesPROCERA: A New Way To Achieve An All-Ceramic CrownCúc Phương TrầnNo ratings yet

- Index: Monthly Bulletin-Dec 2022Document46 pagesIndex: Monthly Bulletin-Dec 2022Sanif KhanNo ratings yet

- Essay by MariemDocument2 pagesEssay by MariemMatthew MaxwellNo ratings yet

- OSPE DU MedicineDocument101 pagesOSPE DU MedicinesaifNo ratings yet

- Veterinary MicrobiologyDocument206 pagesVeterinary MicrobiologyHomosapienNo ratings yet

- Sculpt Unbelievable Abs: Eight Potent Exercises That Zero in On Your AbdominalsDocument8 pagesSculpt Unbelievable Abs: Eight Potent Exercises That Zero in On Your Abdominalsjesus alamillaNo ratings yet

- The Evolution of Google Search Results Pages and Their Effect On User Behaviour PDFDocument81 pagesThe Evolution of Google Search Results Pages and Their Effect On User Behaviour PDFlcm3766lNo ratings yet

- Mindanao Geothermal v. CIRDocument22 pagesMindanao Geothermal v. CIRMarchini Sandro Cañizares KongNo ratings yet

- Leo HistoryDocument14 pagesLeo HistoryJeamil Esthiff Terán ToledoNo ratings yet

- Analysis of Old Trends in Indian Wine-Making and Need of Expert System in Wine-MakingDocument10 pagesAnalysis of Old Trends in Indian Wine-Making and Need of Expert System in Wine-MakingIJRASETPublicationsNo ratings yet

- 3M Petrifilm Yeast and Mold Count Plate Raw Material Change FAQDocument3 pages3M Petrifilm Yeast and Mold Count Plate Raw Material Change FAQErwin DoloresNo ratings yet

- Chapter 8 Unit 2 - UnlockedDocument23 pagesChapter 8 Unit 2 - UnlockedSanay ShahNo ratings yet

- If ملخص قواعدDocument2 pagesIf ملخص قواعدAhmed GaninyNo ratings yet

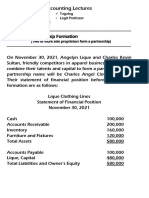

- 8 Lec 03 - Partnership Formation With BusinessDocument2 pages8 Lec 03 - Partnership Formation With BusinessNathalie GetinoNo ratings yet

- Vii-Philosophy of HPERD & SportsDocument4 pagesVii-Philosophy of HPERD & SportsAnonymous hHT0iOyQAz100% (1)

- Consultancy - Software DeveloperDocument2 pagesConsultancy - Software DeveloperImadeddinNo ratings yet

- How To Cook Pork AdoboDocument3 pagesHow To Cook Pork AdoboJennyRoseVelascoNo ratings yet

- Practical Research 2: Sampling and Probability SamplingDocument11 pagesPractical Research 2: Sampling and Probability SamplingJohn Joseph JalandoniNo ratings yet

- Chapter - 04 - Lecture Mod PDFDocument72 pagesChapter - 04 - Lecture Mod PDFtahirNo ratings yet

- A Legal Walkway For Business Success: Le IntelligensiaDocument63 pagesA Legal Walkway For Business Success: Le IntelligensiaSanjay PrakashNo ratings yet

- Deed of DonationDocument2 pagesDeed of DonationMary RockwellNo ratings yet

- Goldilocks and The Three Bears Model Text 2Document5 pagesGoldilocks and The Three Bears Model Text 2api-407594542No ratings yet

- Worksheet 1: The Terms of An AgreementDocument2 pagesWorksheet 1: The Terms of An AgreementJulieta ImbaquingoNo ratings yet

- A Biblical Philosophy of MinistryDocument11 pagesA Biblical Philosophy of MinistryDavid Salazar100% (4)

The IMF Stabilisation Program

The IMF Stabilisation Program

Uploaded by

Lalit SharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The IMF Stabilisation Program

The IMF Stabilisation Program

Uploaded by

Lalit SharmaCopyright:

Available Formats

The IMF stabilisation program

IMF imposed its conditionality medicine of tough stabilisation policies

Four basic components of the IMF stabilisation program

1. Abolition or liberalisation of foreign exchange and import controls

2. Devaluation of the official exchange rate ( to boost export led growth)

3. A stringent domestic anti-inflation program consisting of:

Control of bank credit to raise interest rates and reserve requirements

Control of the government deficit through curbs on spending, including in the areas of

social services for the poor and staple food subsidies

Increase taxation

Increases in prices of public enterprises

Control of wage increases, in particular abolish wage indexing

Promoting freer markets and dismantling price controls

4. Greater hospitality to foreign investment

In the early 1980’s numerous debtor countries e.g Mexico, Brazil, Argentina had to

turn to the IMF to secure extra foreign exchange

By 1992 10 countries had agreed to borrow $27bn from the IMF

1997 Asian crisis IMF intervened intervened with large sums of money

Thailand $3.9bn, Pakistan $1.6bn, South Korea $21bn etc

To receive these loans and to negotiate extra credits from private banks all of the

nations had to agree to some or all of the stabilisation policies

Although such policies may be successful in reducing inflation (macroeconomic

stability) and improving the LDC’s position on current account they hurt the poorest

people disproportionately

Policies aimed to improve the efficiency and discipline, responsibility of the

governments of the LDC (remember the video – ‘’these countries must get their act

together’’ World Bank representative)

Aim not to just hand out money

Important to try and see the thinking behind it

Critics argue double standards of IMF harsh treatment of debtor countries but no

adjustment for the USA – the world’s greatest debtor

Both structural adjustment and stabilisation policies have been found to contribute to

rising hardships amongst the poorest people in developing countries

This is generally due to cuts in government services, (Niger video some

government workers hadn’t been employed)

Rising unemployment

Falling real wages

Elimination of food subsidies (people will have to pay more now for food

which impacts more on the poor)

As a result numerous countries have experienced rising infant mortality rates,

malnutrition and declining school enrolment rates

Critics argue that the terms of conditionality associated with adjustment loans are

anti-developmental where they reverse or slow improvements in living conditions

amongst the very poor

Many Development agencies place greater emphasis on reducing or eradicating

poverty and stress that it is misleading to include countries with rising rates of

malnutrition among the adjustment success stories

Children are frequently the group most vulnerable to the harsh consequences imposed

by restrictive macroeconomic policies according to UNICEF

They agree that structural changes are needed for economic recovery but programs are

needed which protect the interests of the poor

Between 1982 and 1988 the IMF strategy was tested in 28 out of 32 nations of Latin

America and the Caribbean

Latin America financed $145bn in debt repayments at a cost of economic stagnation

and rising unemployment

The policies were clearly not working

World bank and IMF despite the criticism have failed to restructure adjustment

policies that hurt the poor

Compensatory programs have been ad hoc at best and little or no effort has been made

to restructure policies fundamentally

Recommendations see p632 Todaro

You might also like

- Musical Acoustics PDFDocument26 pagesMusical Acoustics PDFGino Mendoza0% (1)

- To Make Flip Flop Led Flasher Circuit Using Transistor Bc547Document17 pagesTo Make Flip Flop Led Flasher Circuit Using Transistor Bc547ananyabedekar83No ratings yet

- Feedback Control Systems by S C Goyal U A Bakshi PDFDocument2 pagesFeedback Control Systems by S C Goyal U A Bakshi PDFHeather29% (7)

- Solutions RoughDocument10 pagesSolutions Roughsana abbasNo ratings yet

- SapsDocument5 pagesSapsromkhanNo ratings yet

- Structural Adjustment Programmes: Composition AND Effects: DR Ghulam Moeen Ud DinDocument44 pagesStructural Adjustment Programmes: Composition AND Effects: DR Ghulam Moeen Ud DinSyeda Sana Batool RizviNo ratings yet

- TIỂU LUẬN KIH TẾ VĨ MÔ C4Document6 pagesTIỂU LUẬN KIH TẾ VĨ MÔ C4Duy VănNo ratings yet

- IFO SAPs EssayDocument4 pagesIFO SAPs EssayMandieNo ratings yet

- Structural Adjustment: Structural Adjustments Are The Policies Implemented by TheDocument13 pagesStructural Adjustment: Structural Adjustments Are The Policies Implemented by Theanon_246766821No ratings yet

- Macroeconomics Task 3Document5 pagesMacroeconomics Task 3buenop373No ratings yet

- South East Crisis 1997: The Strategy Used in The Face of The CrisisDocument6 pagesSouth East Crisis 1997: The Strategy Used in The Face of The CrisisJorge Yeshayahu Gonzales-LaraNo ratings yet

- Angel Conworld Mod.7Document8 pagesAngel Conworld Mod.7angelNo ratings yet

- Saps, Imf & PakistanDocument7 pagesSaps, Imf & PakistanMaya AinNo ratings yet

- Structural Adjustment Programmes: Composition and Effects: Chapter 14: Akbar ZaidiDocument45 pagesStructural Adjustment Programmes: Composition and Effects: Chapter 14: Akbar Zaidirabia liaqatNo ratings yet

- Interactions Between Macroeconomic Policy and Financial MarketsDocument4 pagesInteractions Between Macroeconomic Policy and Financial MarketsIjahss JournalNo ratings yet

- What Policy Options Existed To Mitigate The Financial and Economic Distress of ContainmentDocument3 pagesWhat Policy Options Existed To Mitigate The Financial and Economic Distress of ContainmentAnupriya SharmaNo ratings yet

- Gender Exploitation: From Structural Adjustment Policies To Poverty Reduction StrategiesDocument23 pagesGender Exploitation: From Structural Adjustment Policies To Poverty Reduction StrategiesmaryamsanjraniNo ratings yet

- IMF & Developing CountriesDocument6 pagesIMF & Developing Countriesmadnansajid8765No ratings yet

- Final Exam-ECO720-2112-1&2 VSDocument4 pagesFinal Exam-ECO720-2112-1&2 VSanurag soniNo ratings yet

- Structural Adjustment ProgramsDocument2 pagesStructural Adjustment ProgramsjoharNo ratings yet

- Five Debates by Jatin Ravi N MaheshDocument33 pagesFive Debates by Jatin Ravi N Maheshyajuvendra7091No ratings yet

- Recession Chapter 5Document43 pagesRecession Chapter 5Gfi ConexionNo ratings yet

- Questions For 2015 LCE English Editors - ONUDocument33 pagesQuestions For 2015 LCE English Editors - ONUpilcheritoNo ratings yet

- Lesson 13Document3 pagesLesson 13Maurice AgbayaniNo ratings yet

- Is Conventional Monetary Policy DyingDocument9 pagesIs Conventional Monetary Policy DyingSpandan BandyopadhyayNo ratings yet

- G20 Policy Paper 2-14-12 FINAL - 0Document6 pagesG20 Policy Paper 2-14-12 FINAL - 0InterActionNo ratings yet

- Jamaica IMF Agreement PDFDocument47 pagesJamaica IMF Agreement PDFRichardo WilliamsNo ratings yet

- Government Saving Has Not Grown Much in The Developing Countries and Corporate Saving Is Relatively SmallDocument6 pagesGovernment Saving Has Not Grown Much in The Developing Countries and Corporate Saving Is Relatively SmalljoooNo ratings yet

- Política EconómicaDocument26 pagesPolítica Económicajorge lNo ratings yet

- Asia Financial SituationDocument4 pagesAsia Financial SituationTabish BhatNo ratings yet

- Operational Plan 2011-2015 Dfid VietnamDocument12 pagesOperational Plan 2011-2015 Dfid VietnamedselsawyerNo ratings yet

- Fiscal PolicyDocument5 pagesFiscal PolicyVidhi AgarwalNo ratings yet

- POL 346 Paper - Ghana and IMFDocument19 pagesPOL 346 Paper - Ghana and IMFGian-Paolo MendozaNo ratings yet

- Relations Between PFM and PRGFDocument27 pagesRelations Between PFM and PRGFProfessor Tarun DasNo ratings yet

- Structural Adjustment ProgramsDocument2 pagesStructural Adjustment ProgramsKeshni goelNo ratings yet

- AP PublicfinanceDocument96 pagesAP PublicfinanceAster GebreaNo ratings yet

- IMF BailoutsDocument7 pagesIMF BailoutsPalwasha HidayatNo ratings yet

- Book Review: Trinity College, Hartford, CT, USADocument3 pagesBook Review: Trinity College, Hartford, CT, USASantiago PérezNo ratings yet

- A Critical Analysis of IMFDocument31 pagesA Critical Analysis of IMFvssm123No ratings yet

- Week 10 NotesDocument4 pagesWeek 10 NotesClement WaituikaNo ratings yet

- Chapter 11 National Macroeconomic PolicyDocument28 pagesChapter 11 National Macroeconomic PolicyLuis SilvaNo ratings yet

- Contoh BeritaDocument6 pagesContoh BeritaWindy Marsella ApriliantyNo ratings yet

- Eco Dev MidtermDocument6 pagesEco Dev MidtermGlenn VeluzNo ratings yet

- MimoDocument4 pagesMimozaNo ratings yet

- Q 1Document40 pagesQ 1Gaurav AgarwalNo ratings yet

- Under The Influence of The World Bank Lay OutDocument6 pagesUnder The Influence of The World Bank Lay OutMohammedOnuesekeNo ratings yet

- Chipping Away at Public Debt: Sources of Failure and Keys to Success in Fiscal AdjustmentFrom EverandChipping Away at Public Debt: Sources of Failure and Keys to Success in Fiscal AdjustmentRating: 1 out of 5 stars1/5 (1)

- Fiscal PolicyDocument7 pagesFiscal PolicySara de la SernaNo ratings yet

- Topic: Understanding The IMF Conditionalities: A Case of PakistanDocument6 pagesTopic: Understanding The IMF Conditionalities: A Case of PakistanMalik Tufassal NaeemNo ratings yet

- Reading Lesson 1Document9 pagesReading Lesson 1AnshumanNo ratings yet

- Nurfarhanah Binti Abd Aziz IPE Policy Report - 5521286 6069918 1534314148Document14 pagesNurfarhanah Binti Abd Aziz IPE Policy Report - 5521286 6069918 1534314148Aidah Md SaidNo ratings yet

- The Impact of Structural Adjustment On The PoorDocument12 pagesThe Impact of Structural Adjustment On The PoorShania AlexanderNo ratings yet

- Topic 9. Macroeconomic Policies and Poverty - XEA 406Document6 pagesTopic 9. Macroeconomic Policies and Poverty - XEA 406Anita BoboNo ratings yet

- Exec SumDocument2 pagesExec SumAgnes DizonNo ratings yet

- Frontline Defense of The Economy: Annual ReportDocument40 pagesFrontline Defense of The Economy: Annual ReportJayroy VillagraciaNo ratings yet

- Eafm - 27 May 2020 - 1600Document11 pagesEafm - 27 May 2020 - 1600emon hossainNo ratings yet

- Monetary Policy & Fiscal PolicyDocument6 pagesMonetary Policy & Fiscal PolicyMitesh KumarNo ratings yet

- Monetary PolicyDocument5 pagesMonetary Policyrameen kamranNo ratings yet

- Eco 6 FDDocument16 pagesEco 6 FD20047 BHAVANDEEP SINGHNo ratings yet

- Global Policy Agenda 2020 IMFDocument12 pagesGlobal Policy Agenda 2020 IMFAsaad AreebNo ratings yet

- GRP 4Document18 pagesGRP 4Tipsforchange lifeNo ratings yet

- Glen Biglaiser and Ronald J. McGauvran study reportDocument28 pagesGlen Biglaiser and Ronald J. McGauvran study reportopparasharNo ratings yet

- The Power to Stop any Illusion of Problems: (Behind Economics and the Myths of Debt & Inflation.): The Power To Stop Any Illusion Of ProblemsFrom EverandThe Power to Stop any Illusion of Problems: (Behind Economics and the Myths of Debt & Inflation.): The Power To Stop Any Illusion Of ProblemsNo ratings yet

- APPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Document7 pagesAPPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Albert YsegNo ratings yet

- CBWorld August1981 PDFDocument64 pagesCBWorld August1981 PDFbobbyunlockNo ratings yet

- DoomsdayDocument29 pagesDoomsdayAsmita RoyNo ratings yet

- PROCERA: A New Way To Achieve An All-Ceramic CrownDocument12 pagesPROCERA: A New Way To Achieve An All-Ceramic CrownCúc Phương TrầnNo ratings yet

- Index: Monthly Bulletin-Dec 2022Document46 pagesIndex: Monthly Bulletin-Dec 2022Sanif KhanNo ratings yet

- Essay by MariemDocument2 pagesEssay by MariemMatthew MaxwellNo ratings yet

- OSPE DU MedicineDocument101 pagesOSPE DU MedicinesaifNo ratings yet

- Veterinary MicrobiologyDocument206 pagesVeterinary MicrobiologyHomosapienNo ratings yet

- Sculpt Unbelievable Abs: Eight Potent Exercises That Zero in On Your AbdominalsDocument8 pagesSculpt Unbelievable Abs: Eight Potent Exercises That Zero in On Your Abdominalsjesus alamillaNo ratings yet

- The Evolution of Google Search Results Pages and Their Effect On User Behaviour PDFDocument81 pagesThe Evolution of Google Search Results Pages and Their Effect On User Behaviour PDFlcm3766lNo ratings yet

- Mindanao Geothermal v. CIRDocument22 pagesMindanao Geothermal v. CIRMarchini Sandro Cañizares KongNo ratings yet

- Leo HistoryDocument14 pagesLeo HistoryJeamil Esthiff Terán ToledoNo ratings yet

- Analysis of Old Trends in Indian Wine-Making and Need of Expert System in Wine-MakingDocument10 pagesAnalysis of Old Trends in Indian Wine-Making and Need of Expert System in Wine-MakingIJRASETPublicationsNo ratings yet

- 3M Petrifilm Yeast and Mold Count Plate Raw Material Change FAQDocument3 pages3M Petrifilm Yeast and Mold Count Plate Raw Material Change FAQErwin DoloresNo ratings yet

- Chapter 8 Unit 2 - UnlockedDocument23 pagesChapter 8 Unit 2 - UnlockedSanay ShahNo ratings yet

- If ملخص قواعدDocument2 pagesIf ملخص قواعدAhmed GaninyNo ratings yet

- 8 Lec 03 - Partnership Formation With BusinessDocument2 pages8 Lec 03 - Partnership Formation With BusinessNathalie GetinoNo ratings yet

- Vii-Philosophy of HPERD & SportsDocument4 pagesVii-Philosophy of HPERD & SportsAnonymous hHT0iOyQAz100% (1)

- Consultancy - Software DeveloperDocument2 pagesConsultancy - Software DeveloperImadeddinNo ratings yet

- How To Cook Pork AdoboDocument3 pagesHow To Cook Pork AdoboJennyRoseVelascoNo ratings yet

- Practical Research 2: Sampling and Probability SamplingDocument11 pagesPractical Research 2: Sampling and Probability SamplingJohn Joseph JalandoniNo ratings yet

- Chapter - 04 - Lecture Mod PDFDocument72 pagesChapter - 04 - Lecture Mod PDFtahirNo ratings yet

- A Legal Walkway For Business Success: Le IntelligensiaDocument63 pagesA Legal Walkway For Business Success: Le IntelligensiaSanjay PrakashNo ratings yet

- Deed of DonationDocument2 pagesDeed of DonationMary RockwellNo ratings yet

- Goldilocks and The Three Bears Model Text 2Document5 pagesGoldilocks and The Three Bears Model Text 2api-407594542No ratings yet

- Worksheet 1: The Terms of An AgreementDocument2 pagesWorksheet 1: The Terms of An AgreementJulieta ImbaquingoNo ratings yet

- A Biblical Philosophy of MinistryDocument11 pagesA Biblical Philosophy of MinistryDavid Salazar100% (4)