Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 viewsTax Exemption

Tax Exemption

Uploaded by

SvsSridharThe document compares two compensation structures - the original CTC package and a tweaked version. The tweaked package lowers the taxable salary by reducing some allowances and introducing other nontaxable reimbursements like conveyance, medical, mobile, and food. As a result, the tax outgo is reduced to zero in the tweaked package compared to Rs. 12,875 originally. Employees can use this approach of restructuring compensation components to minimize their tax liability.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Tata Consultancy Services PayslipDocument2 pagesTata Consultancy Services PayslipSitharth Vkr67% (6)

- Tata Consultancy Services Payslip August 2017Document2 pagesTata Consultancy Services Payslip August 2017Ajay Chowdary Ajay Chowdary79% (14)

- TCS Feb Payslip PDFDocument2 pagesTCS Feb Payslip PDFNikhilreddy SingireddyNo ratings yet

- Tata Consultancy Services PayslipDocument2 pagesTata Consultancy Services PayslipNilesh SurvaseNo ratings yet

- Amit Dec 2020 PayslipDocument1 pageAmit Dec 2020 PayslipAmit GhangasNo ratings yet

- FormDocument1 pageFormPradeep ChoudhuryNo ratings yet

- Principles of Taxation - DeductionsDocument7 pagesPrinciples of Taxation - Deductions20047 BHAVANDEEP SINGHNo ratings yet

- Income Tax Calculation Worksheet: Thermax LTD Ascent PayrollDocument1 pageIncome Tax Calculation Worksheet: Thermax LTD Ascent PayrollAnuragNo ratings yet

- AY2021-22 ANISETTY SINDHU-EFPPS3410N-ComputationDocument3 pagesAY2021-22 ANISETTY SINDHU-EFPPS3410N-Computationforty oneNo ratings yet

- S A 9s A Oo: Ngs DeductionsDocument4 pagesS A 9s A Oo: Ngs DeductionsCheck 0No ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument3 pagesIncome From Salaries: Rs. Rs. Rs. SCH - NoBilalNo ratings yet

- Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollDocument2 pagesIncome Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollShiva098No ratings yet

- CTC Structure FEB20Document2 pagesCTC Structure FEB20Wall Street Forex (WSFx)No ratings yet

- Durga Malleswara RaoDocument1 pageDurga Malleswara RaoRajesh pvkNo ratings yet

- Exam 2 Input Sheet-FinalDocument24 pagesExam 2 Input Sheet-Finalさくら樱花No ratings yet

- KBL Pay CompDocument1 pageKBL Pay Complejiga7546No ratings yet

- Employee Details Payment & Leave Details: Arrears Amount CurrentDocument2 pagesEmployee Details Payment & Leave Details: Arrears Amount CurrentRamesh yaraboluNo ratings yet

- Tata Consultancy Services Payslip JAN2023Document1 pageTata Consultancy Services Payslip JAN2023Mainak BhattacharjeeNo ratings yet

- STEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Document1 pageSTEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Amaresh NayakNo ratings yet

- June 2023 PayslipDocument2 pagesJune 2023 Payslipgomathi7777_33351404100% (1)

- Payslip For The Month of March 2024Document1 pagePayslip For The Month of March 2024LalitNo ratings yet

- Tata MD ShafeeqDocument2 pagesTata MD ShafeeqAnkit ChoudharyNo ratings yet

- Telangana State Power Generation Corporation LTD Bhadradri Thermal Power Project: ManuguruDocument2 pagesTelangana State Power Generation Corporation LTD Bhadradri Thermal Power Project: ManuguruSuresh DoosaNo ratings yet

- May 2023 Pay SlipDocument2 pagesMay 2023 Pay Slipgomathi7777_33351404No ratings yet

- K ManaDocument1 pageK Manasuresh kumar gNo ratings yet

- Carry Over Next Period (Excl. Incentive)Document5 pagesCarry Over Next Period (Excl. Incentive)Divina BidarNo ratings yet

- Compensation and Reward ManagementDocument3 pagesCompensation and Reward ManagementMeghana LohumiNo ratings yet

- Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095Document1 pageDeccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095David PenNo ratings yet

- Paystub 202109Document1 pagePaystub 202109Ankush BarheNo ratings yet

- Toaz - Info Tata Consultancy Services Payslip PRDocument2 pagesToaz - Info Tata Consultancy Services Payslip PRRLP TECHNOLOGYNo ratings yet

- Se/Omc/Nalgonda - Pay Unit Code: 5112: Pay Slip For The Month of August - 2020Document1 pageSe/Omc/Nalgonda - Pay Unit Code: 5112: Pay Slip For The Month of August - 2020babu xeroxNo ratings yet

- Mahesha HMDocument1 pageMahesha HMManjesh KumarNo ratings yet

- Tax Calculator by Tax GurujiDocument4 pagesTax Calculator by Tax GurujiSunitKumarChauhanNo ratings yet

- March 1Document2 pagesMarch 1amitsinghhhh000078666No ratings yet

- 2023 11 qWIavwwVV0gWRmwVnoUpdgDocument1 page2023 11 qWIavwwVV0gWRmwVnoUpdgnsmankr1No ratings yet

- PayslipDocument3 pagesPayslipbibhutisahu23No ratings yet

- Darshan Payslip Oct'19 PDFDocument1 pageDarshan Payslip Oct'19 PDFDarshan SubramanyaNo ratings yet

- CTC Break UpDocument6 pagesCTC Break Uppgdm 5No ratings yet

- Bhushan Chandrashekar KolapkarDocument2 pagesBhushan Chandrashekar KolapkarAditya PLNo ratings yet

- Gross Reportable Compensation Income 285,000Document3 pagesGross Reportable Compensation Income 285,000WenjunNo ratings yet

- Telangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaDocument1 pageTelangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaKANNE NITHINNo ratings yet

- March 2019Document1 pageMarch 2019Anonymous 2uvubjzzNo ratings yet

- Employee Details Payment & Leave Details Location Details: Arrears Current AmountDocument2 pagesEmployee Details Payment & Leave Details Location Details: Arrears Current Amountamitsinghhhh000078666No ratings yet

- Example of Tax PlanningDocument10 pagesExample of Tax PlanningGangothri Asok100% (1)

- Sample Payroll CalculationDocument5 pagesSample Payroll CalculationArajrubanNo ratings yet

- Campus CTC - Stack Up For 2022 Batch - VITDocument2 pagesCampus CTC - Stack Up For 2022 Batch - VITvasisth bhoumickNo ratings yet

- CTC Breakup 1Document1 pageCTC Breakup 1ayush.20jdds003No ratings yet

- UnknownDocument1 pageUnknownrahulagarwal33No ratings yet

- Salary Calculation Yearly & Monthly Break Up of Gross SalaryDocument1 pageSalary Calculation Yearly & Monthly Break Up of Gross SalarySRS ENTERPRISESNo ratings yet

- Capital Contribution: Stockholder TINDocument17 pagesCapital Contribution: Stockholder TINEddie ParazoNo ratings yet

- Developed By-Office Automation Division, IIT Kanpur Page No.1Document2 pagesDeveloped By-Office Automation Division, IIT Kanpur Page No.1Kishan OmarNo ratings yet

- 157salaryslip g5sxl3g6Document1 page157salaryslip g5sxl3g6Shakti NaikNo ratings yet

- Main TablesDocument1 pageMain Tablesvishalbharatshah2776No ratings yet

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDocument1 pagePersonal Note: This Is A System Generated Payslip, Does Not Require Any SignatureShakti NaikNo ratings yet

- Toaz - Info Tata Consultancy Services Payslip PRDocument3 pagesToaz - Info Tata Consultancy Services Payslip PRIndrasis gunNo ratings yet

- Ravi MukharjeeDocument2 pagesRavi MukharjeeDivesh RaiNo ratings yet

- Ilovepdf - MRPDocument3 pagesIlovepdf - MRPPramod ramprsad PàtidarNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Fixed Term and Temp Template LettersDocument6 pagesFixed Term and Temp Template LettersSvsSridharNo ratings yet

- Handbook On Spices and Condiments - Cultivation Processing and ExtractionDocument62 pagesHandbook On Spices and Condiments - Cultivation Processing and ExtractionSvsSridharNo ratings yet

- ToDoOwnerReport 22 Nov 22Document60 pagesToDoOwnerReport 22 Nov 22SvsSridharNo ratings yet

- The Tamil Nadu Industrial Establishments (National and Festival Holidays) Rules Form ViDocument1 pageThe Tamil Nadu Industrial Establishments (National and Festival Holidays) Rules Form ViSvsSridharNo ratings yet

- Payment of Gratuity Act & SuccessionDocument21 pagesPayment of Gratuity Act & SuccessionSvsSridharNo ratings yet

- New Employee Joining Form1Document12 pagesNew Employee Joining Form1SvsSridharNo ratings yet

- Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument3 pagesCertificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySvsSridharNo ratings yet

- Birthday Card TemplateDocument1 pageBirthday Card TemplateSvsSridharNo ratings yet

- Change in Appointment Term - FinalDocument2 pagesChange in Appointment Term - FinalSvsSridharNo ratings yet

Tax Exemption

Tax Exemption

Uploaded by

SvsSridhar0 ratings0% found this document useful (0 votes)

2 views2 pagesThe document compares two compensation structures - the original CTC package and a tweaked version. The tweaked package lowers the taxable salary by reducing some allowances and introducing other nontaxable reimbursements like conveyance, medical, mobile, and food. As a result, the tax outgo is reduced to zero in the tweaked package compared to Rs. 12,875 originally. Employees can use this approach of restructuring compensation components to minimize their tax liability.

Original Description:

tax working

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document compares two compensation structures - the original CTC package and a tweaked version. The tweaked package lowers the taxable salary by reducing some allowances and introducing other nontaxable reimbursements like conveyance, medical, mobile, and food. As a result, the tax outgo is reduced to zero in the tweaked package compared to Rs. 12,875 originally. Employees can use this approach of restructuring compensation components to minimize their tax liability.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views2 pagesTax Exemption

Tax Exemption

Uploaded by

SvsSridharThe document compares two compensation structures - the original CTC package and a tweaked version. The tweaked package lowers the taxable salary by reducing some allowances and introducing other nontaxable reimbursements like conveyance, medical, mobile, and food. As a result, the tax outgo is reduced to zero in the tweaked package compared to Rs. 12,875 originally. Employees can use this approach of restructuring compensation components to minimize their tax liability.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

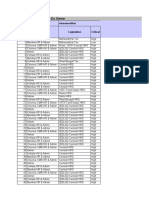

CTC CTC Tweaked

Basic Salary 2,22,000 2,22,000

HRA 1,80,000 1,50,000

Special Allowance 80,000 44,200

LTA 18,000 10,000

Conveyance allowance 19,200

Medical reimbursement 15,000

Mobile reimbursement 14,400

Food coupons 13,200

Residential phone bills 12,000

CTC 5,00,000 5,00,000

Taxable Salary CTC CTC Tweaked

Basic Salary 2,22,000 2,22,000

HRA 1,80,000 69,000

Special Allowance 80,000 44,200

LTA 18,000 10,000

Total taxable salary 5,00,000 3,45,200

Tax outgo CTC CTC Tweaked

Tax outgo 12,500 –

(FY 2017-18)

Cess 3% 375 –

Total Tax 12,875 –

As you can see earlier tax payable was Rs 12,875. It has been brought down to 0

after restructuring.

You can use any of the components mentioned in the table above to restructure your

CTC and reduce the tax paid by you. You must also try to claim 80C deduction so that

your tax outgo is minimum. Your contribution to EPF is eligible for deduction under

section 80C.

You might also like

- Tata Consultancy Services PayslipDocument2 pagesTata Consultancy Services PayslipSitharth Vkr67% (6)

- Tata Consultancy Services Payslip August 2017Document2 pagesTata Consultancy Services Payslip August 2017Ajay Chowdary Ajay Chowdary79% (14)

- TCS Feb Payslip PDFDocument2 pagesTCS Feb Payslip PDFNikhilreddy SingireddyNo ratings yet

- Tata Consultancy Services PayslipDocument2 pagesTata Consultancy Services PayslipNilesh SurvaseNo ratings yet

- Amit Dec 2020 PayslipDocument1 pageAmit Dec 2020 PayslipAmit GhangasNo ratings yet

- FormDocument1 pageFormPradeep ChoudhuryNo ratings yet

- Principles of Taxation - DeductionsDocument7 pagesPrinciples of Taxation - Deductions20047 BHAVANDEEP SINGHNo ratings yet

- Income Tax Calculation Worksheet: Thermax LTD Ascent PayrollDocument1 pageIncome Tax Calculation Worksheet: Thermax LTD Ascent PayrollAnuragNo ratings yet

- AY2021-22 ANISETTY SINDHU-EFPPS3410N-ComputationDocument3 pagesAY2021-22 ANISETTY SINDHU-EFPPS3410N-Computationforty oneNo ratings yet

- S A 9s A Oo: Ngs DeductionsDocument4 pagesS A 9s A Oo: Ngs DeductionsCheck 0No ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument3 pagesIncome From Salaries: Rs. Rs. Rs. SCH - NoBilalNo ratings yet

- Income Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollDocument2 pagesIncome Tax Calculation Worksheet: Ellucian Higher Education Systems India Private Limited Ascent PayrollShiva098No ratings yet

- CTC Structure FEB20Document2 pagesCTC Structure FEB20Wall Street Forex (WSFx)No ratings yet

- Durga Malleswara RaoDocument1 pageDurga Malleswara RaoRajesh pvkNo ratings yet

- Exam 2 Input Sheet-FinalDocument24 pagesExam 2 Input Sheet-Finalさくら樱花No ratings yet

- KBL Pay CompDocument1 pageKBL Pay Complejiga7546No ratings yet

- Employee Details Payment & Leave Details: Arrears Amount CurrentDocument2 pagesEmployee Details Payment & Leave Details: Arrears Amount CurrentRamesh yaraboluNo ratings yet

- Tata Consultancy Services Payslip JAN2023Document1 pageTata Consultancy Services Payslip JAN2023Mainak BhattacharjeeNo ratings yet

- STEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Document1 pageSTEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Amaresh NayakNo ratings yet

- June 2023 PayslipDocument2 pagesJune 2023 Payslipgomathi7777_33351404100% (1)

- Payslip For The Month of March 2024Document1 pagePayslip For The Month of March 2024LalitNo ratings yet

- Tata MD ShafeeqDocument2 pagesTata MD ShafeeqAnkit ChoudharyNo ratings yet

- Telangana State Power Generation Corporation LTD Bhadradri Thermal Power Project: ManuguruDocument2 pagesTelangana State Power Generation Corporation LTD Bhadradri Thermal Power Project: ManuguruSuresh DoosaNo ratings yet

- May 2023 Pay SlipDocument2 pagesMay 2023 Pay Slipgomathi7777_33351404No ratings yet

- K ManaDocument1 pageK Manasuresh kumar gNo ratings yet

- Carry Over Next Period (Excl. Incentive)Document5 pagesCarry Over Next Period (Excl. Incentive)Divina BidarNo ratings yet

- Compensation and Reward ManagementDocument3 pagesCompensation and Reward ManagementMeghana LohumiNo ratings yet

- Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095Document1 pageDeccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095David PenNo ratings yet

- Paystub 202109Document1 pagePaystub 202109Ankush BarheNo ratings yet

- Toaz - Info Tata Consultancy Services Payslip PRDocument2 pagesToaz - Info Tata Consultancy Services Payslip PRRLP TECHNOLOGYNo ratings yet

- Se/Omc/Nalgonda - Pay Unit Code: 5112: Pay Slip For The Month of August - 2020Document1 pageSe/Omc/Nalgonda - Pay Unit Code: 5112: Pay Slip For The Month of August - 2020babu xeroxNo ratings yet

- Mahesha HMDocument1 pageMahesha HMManjesh KumarNo ratings yet

- Tax Calculator by Tax GurujiDocument4 pagesTax Calculator by Tax GurujiSunitKumarChauhanNo ratings yet

- March 1Document2 pagesMarch 1amitsinghhhh000078666No ratings yet

- 2023 11 qWIavwwVV0gWRmwVnoUpdgDocument1 page2023 11 qWIavwwVV0gWRmwVnoUpdgnsmankr1No ratings yet

- PayslipDocument3 pagesPayslipbibhutisahu23No ratings yet

- Darshan Payslip Oct'19 PDFDocument1 pageDarshan Payslip Oct'19 PDFDarshan SubramanyaNo ratings yet

- CTC Break UpDocument6 pagesCTC Break Uppgdm 5No ratings yet

- Bhushan Chandrashekar KolapkarDocument2 pagesBhushan Chandrashekar KolapkarAditya PLNo ratings yet

- Gross Reportable Compensation Income 285,000Document3 pagesGross Reportable Compensation Income 285,000WenjunNo ratings yet

- Telangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaDocument1 pageTelangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaKANNE NITHINNo ratings yet

- March 2019Document1 pageMarch 2019Anonymous 2uvubjzzNo ratings yet

- Employee Details Payment & Leave Details Location Details: Arrears Current AmountDocument2 pagesEmployee Details Payment & Leave Details Location Details: Arrears Current Amountamitsinghhhh000078666No ratings yet

- Example of Tax PlanningDocument10 pagesExample of Tax PlanningGangothri Asok100% (1)

- Sample Payroll CalculationDocument5 pagesSample Payroll CalculationArajrubanNo ratings yet

- Campus CTC - Stack Up For 2022 Batch - VITDocument2 pagesCampus CTC - Stack Up For 2022 Batch - VITvasisth bhoumickNo ratings yet

- CTC Breakup 1Document1 pageCTC Breakup 1ayush.20jdds003No ratings yet

- UnknownDocument1 pageUnknownrahulagarwal33No ratings yet

- Salary Calculation Yearly & Monthly Break Up of Gross SalaryDocument1 pageSalary Calculation Yearly & Monthly Break Up of Gross SalarySRS ENTERPRISESNo ratings yet

- Capital Contribution: Stockholder TINDocument17 pagesCapital Contribution: Stockholder TINEddie ParazoNo ratings yet

- Developed By-Office Automation Division, IIT Kanpur Page No.1Document2 pagesDeveloped By-Office Automation Division, IIT Kanpur Page No.1Kishan OmarNo ratings yet

- 157salaryslip g5sxl3g6Document1 page157salaryslip g5sxl3g6Shakti NaikNo ratings yet

- Main TablesDocument1 pageMain Tablesvishalbharatshah2776No ratings yet

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDocument1 pagePersonal Note: This Is A System Generated Payslip, Does Not Require Any SignatureShakti NaikNo ratings yet

- Toaz - Info Tata Consultancy Services Payslip PRDocument3 pagesToaz - Info Tata Consultancy Services Payslip PRIndrasis gunNo ratings yet

- Ravi MukharjeeDocument2 pagesRavi MukharjeeDivesh RaiNo ratings yet

- Ilovepdf - MRPDocument3 pagesIlovepdf - MRPPramod ramprsad PàtidarNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Fixed Term and Temp Template LettersDocument6 pagesFixed Term and Temp Template LettersSvsSridharNo ratings yet

- Handbook On Spices and Condiments - Cultivation Processing and ExtractionDocument62 pagesHandbook On Spices and Condiments - Cultivation Processing and ExtractionSvsSridharNo ratings yet

- ToDoOwnerReport 22 Nov 22Document60 pagesToDoOwnerReport 22 Nov 22SvsSridharNo ratings yet

- The Tamil Nadu Industrial Establishments (National and Festival Holidays) Rules Form ViDocument1 pageThe Tamil Nadu Industrial Establishments (National and Festival Holidays) Rules Form ViSvsSridharNo ratings yet

- Payment of Gratuity Act & SuccessionDocument21 pagesPayment of Gratuity Act & SuccessionSvsSridharNo ratings yet

- New Employee Joining Form1Document12 pagesNew Employee Joining Form1SvsSridharNo ratings yet

- Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument3 pagesCertificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySvsSridharNo ratings yet

- Birthday Card TemplateDocument1 pageBirthday Card TemplateSvsSridharNo ratings yet

- Change in Appointment Term - FinalDocument2 pagesChange in Appointment Term - FinalSvsSridharNo ratings yet