Professional Documents

Culture Documents

Projected Financial Statements

Projected Financial Statements

Uploaded by

HaideBrocalesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Projected Financial Statements

Projected Financial Statements

Uploaded by

HaideBrocalesCopyright:

Available Formats

4.

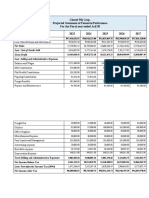

PROJECTED FINANCIAL STATEMENTS

HAPPY MUSHROOM

Pre-Operating Cash Flow

Cash Inflow:

Partners' Contribution:

Alano, Capital 400,000.00

Barretto, Capital 400,000.00

Brocales, Capital 400,000.00

Total Inflows 1,200,000.00

Cash Outflows

Factory Machineries and Equipment 47,723.21

Office Equipment 21,959.82

Office Furniture and Fixtures 12,187.50

Factory Furniture and Fixtures 5,714.29

Sales Equipment 28,508.93

Sales Furniture and Fixtures 5,401.79

Raw Materials Inventories 576,687.50

Office Supplies 1,105.36

Factory Supplies 52,829.46

Sales Supplies 1,234.38

Leasehold Improvements 35,892.86

Transportation vehicle 180,000.00

Pre-operating Expense 72,445.00

Input Tax 113,995.13

Total Outflows 1,155,685.21

Net Cash Inflow (Working Capital) 44,314.79

HAPPY MUSHROOM

Pre-Operating Balance Sheet

ASSET

Current Asset

Cash 44,314.79

Raw Materials Inventories 576,687.50

Office Supplies 1,105.36

Sales Supplies 1,234.38

Factory Supplies 52,829.46

Prepaid Rent 22,000.00

Input Tax 113,995.13

Total Current Asset 812,166.61

Non-Current Asset

Rental Deposit 34,000.00

Factory Machineries and

47,723.21

Equipment

Equipment 105,040.18

Furniture and Fixtures 23,303.57

Delivery Vehicle 160,714.29

Leasehold Improvements 35,892.86

Total Non-Current Asset 406,674.11

Total Assets 1,218,840.71

PARTNERS' EQUITY

Partners' Equity

Indefenzo, Capital 400,000.00

Rocha, Capital 400,000.00

Zulueta, Capital 400,000.00 1,200,000.00

Less:

Organizational Cost 8,595.00

Pre-Operating Expenses 72,445.00 81,040.00

Total Partners' Equity 1,281,040.00

HAPPY MUSHROOM

Statement of Cost of Goods Sold

Projected for 5 years

YEAR

PARTICULARS Schedule

1 2 3 4 5

Raw Materials, Beg. 7 576,687.50 225,596.25 213,661.12 222,022.68 232,891.67

Add: Purchase 17 1,679,275.00 1,911,014.95 2,006,565.70 2,106,893.98 2,212,238.68

Raw Materials 2,255,962.50 2,136,611.20 2,220,226.82 2,328,916.66 2,445,130.35

available for use

Less: Raw Material, 18 225,596.25 213,661.12 222,022.68 232,891.67 244,513.03

Ending

Raw Materials Used 18 2,030,366.25 1,922,950.08 1,998,204.14 2,096,025.00 2,200,617.31

Add: Direct Labor 19 246,000.00 246,000.00 246,000.00 246,000.00 246,000.00

Prime Cost 2,276,366.25 2,168,950.08 2,244,204.14 2,342,025.00 2,446,617.31

Add: Factory

Overhead

Electricity 20 99,000.00 103,950.00 109,147.50 114,604.88 120,335.12

Expense

Depreciation 21 11,219.64 11,219.64 11,219.64 11,219.64 11,219.64

Expense

Factory 22 296,027.68 355,233.21 426,279.86 511,535.83 613,842.99

Supplies

Indirect Labor 23 252,000.00 252,000.00 252,000.00 252,000.00 252,000.00

Repair & 24 4,052.50 4,174.08 4,299.30 4,428.28 4,561.12

Maintenance

Water Expense 25 3,600.00 3,780.00 3,969.00 4,167.45 4,375.82

Rent Expense 26 132,000.00 132,000.00 132,000.00 132,000.00 132,000.00

SSS 28 13,702.80 13,702.80 13,702.80 13,702.80 13,702.80

Contributionn

Philhealth 28 2,700.00 2,700.00 2,700.00 2,700.00 2,700.00

Contribution

Pag-ibig 28 3,720.00 3,720.00 3,720.00 3,720.00 3,720.00

Contribution

Total Factory 818,022.62 882,479.73 959,038.10 1,050,078.87 1,158,457.50

Overhead

Total 3,094,388.87 3,051,429.81 3,203,242.23 3,392,103.87 3,605,074.82

Manufacturing Cost

Add: Finished 154,719.44 160,307.46 168,177.48 178,014.07

Goods, Beg.

Total Goods 3,094,388.87 3,206,149.26 3,363,549.70 3,560,281.36 3,783,088.88

Available for Sale

Less: Finished 154,719.44 160,307.46 168,177.48 178,014.07 189,154.44

Goods, ending

Cost of Goods Sold 2,939,669.43 3,045,841.79 3,195,372.21 3,382,267.29 3,593,934.44

HAPPY MUSHROOM

Statement of Recognized Income and Expense

Projected for 5 years

YEAR

PARTICULARS Notes

1 2 3 4 5

Gross Sales 15 5,310,602.68 7,518,515.63 9,136,797.99 10,975,615.51 13,171,884.41

Less: Cost of Goods 2,939,669.43 3,045,841.79 3,195,372.21 3,382,267.29 3,593,934.44

Sold

Gross Profit 2,370,933.25 4,472,673.83 5,941,425.78 7,593,348.23 9,577,949.97

Selling & 428,367.24 436,175.72 444,198.42 453,326.31 463,790.74

Less: Administrative

Expense

Income before 1,942,566.01 4,036,498.11 5,497,227.36 7,140,021.92 9,114,159.22

Income Tax

Income tax 582,769.80 1,210,949.43 1,649,168.21 2,142,006.58 2,734,247.77

Less:

(30%)

Net Income After 1,359,796.21 2,825,548.68 3,848,059.15 4,998,015.34 6,379,911.46

Tax

HAPPY MUSHROOM

Statement Comprehensive Income

Projected for 5 years

PARTICULARS Notes YEAR

1 2 3 4 5

Gross Sales 15 5,310,602.68 7,518,515.63 9,136,797.99 10,975,615.51 13,171,884.41

Less: Cost of Goods

2,939,669.43 3,045,841.79 3,195,372.21 3,382,267.29 3,593,934.44

Sold

Gross Profit 2,370,933.25 4,472,673.83 5,941,425.78 7,593,348.23 9,577,949.97

Less: Selling &

Administrative 27 428,367.24 436,175.72 444,198.42 453,326.31 463,790.74

Expense

Income before

1,942,566.01 4,036,498.11 5,497,227.36 7,140,021.92 9,114,159.22

Income Tax

Less: Income tax

582,769.80 1,210,949.43 1,649,168.21 2,142,006.58 2,734,247.77

(30%)

Net Income After

1,359,796.21 2,825,548.68 3,848,059.15 4,998,015.34 6,379,911.46

Tax

HAPPY MUSHROOM

Statement of Financial Position

Projected for 5 years

YEAR

PARTICULARS

1 2 3 4 5

ASSET

Current Asset

Cash

Raw Material Inventory 18 225,596 213,661 222,023 232,892 244,513

Finished Goods 154,719 160,307 168,177 178,014 189,154

Inventory

Unused Factory Supplies 22 32,892 39,470 47,364 56,837 68,204

Unused Office Supplies 27.2 217 227 239 251 263

Unused Sales Supplies 27.1 1,174 1,565 1,956 2,446 3,057

Total Current Assets 414,598 415,232 439,760 470,440 505,193

Non-Current Asset (net)

Machineries 29 90,526 76,012 61,4981 46,9843 32,470

Leasehold Improvements 30 30,964 26,035 21,107 16,178 11,250

Delivery Vehicle 31 140,625 120,535 100,446 80,357 60,267

Furniture & Fixture 19,053 14,803 10,553 6,303 2,053

Rental Deposit 56,000 56,000 56,000 56,000 56,000

Total Non-Current Asset 315,169 271,387 227,6056 183,823 140,041

Total Asset 729,767 686,619 667,365 654,263 645,235

LIABILITIES AND PARTNERS' EQUITY

Current Liabilities

SSS Contribution 49,062 49,062 49,062 49,062 49,062

Payable

Philhealth Contribution 10,200 10,200 10,200 10,200 10,200

Payable

Pag-ibig Contribution 4,920 4,920 4,920 4,920 4,920

Payable

VAT Payable

Total Current Liabilities 64,182 64,182 64,182 64,182 64,182

Partners' Equity

Alano, Capital 453,265 995,115 1,877,801 3,143,806 4,870,441

Barretto, Capital 453,265 995,114 1,877,801 3,143,806 4,870,441

Brocales, Capital 453,265 995,114 1,877,801 3,143,806 4,870,441

Total Partners' Equity 1,359,796 2,985,344 5,633,403 9,431,418 14,611,323

Total Liabilities and 1,423,978 3,049,526 5,697,585 9,495,600 14,675,505

Partners' equity

STATEMENT OF PARTNER'S EQUITY

Year 1

Capital Alano Barretto Brocales Total

Original 400,000.00 400,000.00 400,000.00 1,200,000.00

Investment

Add: Net Income 453,265.40 453,265.40 453,265.40 1,359,796.21

Total Equity 853,265.40 853,265.40 853,265.40 2,559,796.21

Less: Withdrawal 400,000.00 400,000.00 400,000.00 1,200,000.00

Partner's Equity 453,265.40 453,265.40 453,265.40 1,359,796.21

End

Year 2

Capital Alano Barretto Brocales Total

Original 453,265.40 453,265.40 453,265.40 1,359,796.21

Investment

Add: Net Income 941,849.56 941,849.56 941,849.56 2,825,548.67

Total Equity 1,395,114.96 1,395,114.96 1,395,114.96 4,185,344.88

Less: Withdrawal 400,000.00 400,000.00 400,000.00 1,200,000.00

Partner's Equity 995,114.96 995,114.96 995,114.96 2,985,344.88

End

Year 3

Capital Alano Barretto Brocales Total

Original 995,114.96 995,114.96 995,114.96 2,985,344.88

Investment

Add: Net Income 1,282,686.26 1,282,686.26 2,126,636.94 4,692,009.45

Total Equity 2,277,801.22 2,277,801.22 3,121,751.90 7,677,354.33

Less: Withdrawal 400,000.00 400,000.00 400,000.00 1,200,000.00

Partner's Equity 1,877,801.22 1,877,801.22 2,721,751.90 6,477,354.33

End

Year 4

Capital Alano Barretto Brocales Total

Original 1,877,801.22 1,877,801.22 2,721,751.90 6,477,354.33

Investment

Add: Net Income 1,666,004.95 1,666,004.95 1,666,004.95 4,998,014.84

Total Equity 3,543,806.16 3,543,806.16 4,387,756.85 11,475,369.18

Less: Withdrawal 400,000.00 400,000.00 400,000.00 1,200,000.00

Partner's Equity 3,143,806.16 3,143,806.16 3,987,756.85 10,275,369.18

End

Year 5

Capital Alano Barretto Brocales Total

Original 3,143,806.16 3,143,806.16 3,987,756.85 10,275,369.18

Investment

Add: Net Income 2,126,635.03 2,126,635.03 2,126,635.03 6,379,905.08

Total Equity 5,270,441.19 5,270,441.19 6,114,391.87 16,655,274.25

Less: Withdrawal 400,000.00 400,000.00 400,000.00 1,200,000.00

Partner's Equity 4,870,441.19 4,870,441.19 5,714,391.87 15,455,274.25

End

5. Sources of Financing

To finance the early stages of the business, the proponents of the study

will first invest their personal cash of 400,000 each to have a total of

1,200,000 business capital. On the 6th year of operation the partnership will

borrow a term loan from Banco de Oro for expansion purposes like

purchasing new equipments to address production increase and construction

of new building.

You might also like

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Naruto Jinraiden - The Day The Wolf Howled PDFDocument73 pagesNaruto Jinraiden - The Day The Wolf Howled PDFHaideBrocalesNo ratings yet

- Pharmally Pharmaceutical Corporation Case Study AutorecoveredDocument6 pagesPharmally Pharmaceutical Corporation Case Study AutorecoveredだみNo ratings yet

- Income Statement: Year 2023 2024 2025 2026 2027Document3 pagesIncome Statement: Year 2023 2024 2025 2026 2027Bryan Dino Lester GarnicaNo ratings yet

- 14-QSP - 59 Procedure For Temporary Change of Process Controls PDFDocument1 page14-QSP - 59 Procedure For Temporary Change of Process Controls PDFsahyadri engineersNo ratings yet

- Balance SheetDocument4 pagesBalance Sheetbaron medinaNo ratings yet

- Project Cost Income Statement FormulatedDocument3 pagesProject Cost Income Statement Formulatedjohnierosialdacamay35No ratings yet

- FS Gas StationDocument25 pagesFS Gas StationKathlyn JambalosNo ratings yet

- Financia ASPECT - FeedsDocument26 pagesFinancia ASPECT - FeedsEumar FabruadaNo ratings yet

- Balance SheetDocument7 pagesBalance Sheetbaron medinaNo ratings yet

- Final Ma Jud Ni FinancialsDocument78 pagesFinal Ma Jud Ni FinancialsMichael A. BerturanNo ratings yet

- Balance SheetDocument7 pagesBalance Sheetbaron medinaNo ratings yet

- Group7 (Financial Statements)Document6 pagesGroup7 (Financial Statements)Bea Dela PeniaNo ratings yet

- Project Cash FlowDocument2 pagesProject Cash FlowMarie France OccianoNo ratings yet

- Glazed Pili Corp. Projected Statement of Financial Performnce For The Fiscal Year Ended Aril 30 2023 2024 2025 2026 2027Document11 pagesGlazed Pili Corp. Projected Statement of Financial Performnce For The Fiscal Year Ended Aril 30 2023 2024 2025 2026 2027LloydNo ratings yet

- Clarissa Computation StramaDocument29 pagesClarissa Computation StramaZejkeara ImperialNo ratings yet

- Total Project CostDocument17 pagesTotal Project Costfrescy mosterNo ratings yet

- I. Assets: 2018 2019Document7 pagesI. Assets: 2018 2019Kean DeeNo ratings yet

- Blue Green Feeds - FS 2017 - For WorkshopDocument15 pagesBlue Green Feeds - FS 2017 - For WorkshopENS SunNo ratings yet

- Musanity Financial StatementsDocument20 pagesMusanity Financial StatementsRenelyn DavidNo ratings yet

- Telchi Litel Ltda Eeff 2021Document3 pagesTelchi Litel Ltda Eeff 2021Info Riskma SolutionsNo ratings yet

- Financia ASPECT - AlarmDocument26 pagesFinancia ASPECT - AlarmEumar FabruadaNo ratings yet

- Ampalaya Ice CreamDocument12 pagesAmpalaya Ice CreamEdhel Bryan Corsiga SuicoNo ratings yet

- 5-Year Financial Plan: Forecasted RevenueDocument23 pages5-Year Financial Plan: Forecasted RevenueDũng Phạm NgọcNo ratings yet

- Verana Exhibit and SchedsDocument45 pagesVerana Exhibit and SchedsPrincess Dianne MaitelNo ratings yet

- Financial StatementsDocument33 pagesFinancial StatementsKolline Kaye SabinoNo ratings yet

- FS FINAL Copy 2Document27 pagesFS FINAL Copy 2lois martinNo ratings yet

- Base DataDocument3 pagesBase DataNakNo ratings yet

- Pro Forma Balance Sheet: Year 0 1 2 AssetsDocument39 pagesPro Forma Balance Sheet: Year 0 1 2 AssetsLala ReyesNo ratings yet

- Pinancle FinancialsDocument6 pagesPinancle FinancialsJhorghe GonzalezNo ratings yet

- FERC CAFE Final DefDocument21 pagesFERC CAFE Final DefEric John ConateNo ratings yet

- Project 3 - Ratio AnalysisDocument2 pagesProject 3 - Ratio AnalysisATANU GANGULYNo ratings yet

- Ivd. Financial StatementDocument4 pagesIvd. Financial StatementDre AclonNo ratings yet

- Annexure Fm-IiDocument35 pagesAnnexure Fm-IiNeha SinghNo ratings yet

- 5-Year Projected Financial StatementsDocument21 pages5-Year Projected Financial StatementsRoselyn LustreNo ratings yet

- Profit and Loss AccountDocument1 pageProfit and Loss AccountAnonymous HAkNRaNo ratings yet

- 5 Year Financial PlanDocument29 pages5 Year Financial PlanFrankieNo ratings yet

- Edited Fruit Bread Financial StatementDocument13 pagesEdited Fruit Bread Financial StatementMary Chris Saldon BalladaresNo ratings yet

- Chapter 5 FinallllllllllllDocument22 pagesChapter 5 Finallllllllllllsv7yyhdmkrNo ratings yet

- 1233 NeheteKushal BAV Assignment1Document12 pages1233 NeheteKushal BAV Assignment1Anjali BhatiaNo ratings yet

- 5 Year Financial PlanDocument25 pages5 Year Financial Plananwar kadiNo ratings yet

- FS SquashDocument10 pagesFS SquashDanah Jane GarciaNo ratings yet

- Chapter 6 7 Financial-study-AnalysisDocument15 pagesChapter 6 7 Financial-study-AnalysisNorwin RoxasNo ratings yet

- Sample Financial PlanDocument19 pagesSample Financial PlanAlexandria GonzalesNo ratings yet

- 5-Year Financial Feasibility Study: Company: Veggie Now S.A.LDocument27 pages5-Year Financial Feasibility Study: Company: Veggie Now S.A.LElie KhawandNo ratings yet

- Financial Final Na ToDocument18 pagesFinancial Final Na ToAsharany InovejasNo ratings yet

- INCOME STATEMENT (CTT Exam)Document1 pageINCOME STATEMENT (CTT Exam)Mharck AtienzaNo ratings yet

- Day 1 To Day 4Document186 pagesDay 1 To Day 4Sameer PadhyNo ratings yet

- ENTREPDocument14 pagesENTREProbinjohnroqueNo ratings yet

- J and J Medical ClinicDocument17 pagesJ and J Medical ClinicHarold Kent MendozaNo ratings yet

- MahindraDocument5 pagesMahindraworkf17hoursformeNo ratings yet

- Template 05 Financial ProjectionsDocument21 pagesTemplate 05 Financial Projectionsokymk13No ratings yet

- Financial Study - Garden of EdenDocument16 pagesFinancial Study - Garden of EdenEumar FabruadaNo ratings yet

- FS February 2022Document5 pagesFS February 2022Rommel GunioNo ratings yet

- Forecast Ets ExampleDocument12 pagesForecast Ets ExampleAbhinav PrakashNo ratings yet

- 5 Year Financial PlanDocument30 pages5 Year Financial Planrainesiusdohling.iitrNo ratings yet

- Aqua Spruce Corporation: Statement of Comprehensive IncomeDocument4 pagesAqua Spruce Corporation: Statement of Comprehensive Incomenicolaus copernicusNo ratings yet

- V. Financial Feasibility StudyDocument14 pagesV. Financial Feasibility StudyEumar FabruadaNo ratings yet

- Bitanea Audit ReportDocument8 pagesBitanea Audit ReportHashim TuneNo ratings yet

- Final Cookies FsDocument8 pagesFinal Cookies FsDanah Jane GarciaNo ratings yet

- The Valuation of Digital Intangibles: Technology, Marketing and InternetFrom EverandThe Valuation of Digital Intangibles: Technology, Marketing and InternetNo ratings yet

- Guidelines Re Selling and Admi Expenses - 2014Document2 pagesGuidelines Re Selling and Admi Expenses - 2014HaideBrocalesNo ratings yet

- Lung Cancer: Iii. ConclusionDocument1 pageLung Cancer: Iii. ConclusionHaideBrocalesNo ratings yet

- Reading and Writing Online Class vs. Face To FaceDocument4 pagesReading and Writing Online Class vs. Face To FaceHaideBrocales100% (1)

- 二章 chapter twoDocument2 pages二章 chapter twoHaideBrocalesNo ratings yet

- 二章 pt2Document2 pages二章 pt2HaideBrocalesNo ratings yet

- We Are The Servant of The Reign of GodDocument7 pagesWe Are The Servant of The Reign of GodHaideBrocalesNo ratings yet

- Narrative Report 7.25.2015Document2 pagesNarrative Report 7.25.2015HaideBrocalesNo ratings yet

- Schedule 28 - PAYROLL Employer's Contribution Employee's ContributionDocument1 pageSchedule 28 - PAYROLL Employer's Contribution Employee's ContributionHaideBrocalesNo ratings yet

- Problem 2Document18 pagesProblem 2HaideBrocalesNo ratings yet

- A Lessons-Learned Knowledge Management System For EngineersDocument3 pagesA Lessons-Learned Knowledge Management System For EngineersHarshavardhan D. GorakhNo ratings yet

- No Arbitrage PrincipleDocument22 pagesNo Arbitrage PrincipleNishant SangalNo ratings yet

- Major Project Report On: PRERNA CHAUHAN (Enrollment No.07521201713)Document68 pagesMajor Project Report On: PRERNA CHAUHAN (Enrollment No.07521201713)Sushil ThakurNo ratings yet

- Galvin Report Pt3Document20 pagesGalvin Report Pt3MunnkeymannNo ratings yet

- BoqDocument2 pagesBoqJohn Carlo TolentinoNo ratings yet

- MHRA Questions and Answers For Specials Manufacturer'sDocument44 pagesMHRA Questions and Answers For Specials Manufacturer'sDeepakNo ratings yet

- Elasticity of DemandDocument21 pagesElasticity of DemandPriya Kala100% (1)

- ProjectDocument3 pagesProjectScott AndersonNo ratings yet

- CT 41Document23 pagesCT 41Iordan Dan FfnNo ratings yet

- Original: Certificate of Origin Form For China-Peru FTADocument2 pagesOriginal: Certificate of Origin Form For China-Peru FTAMuñoz Sanchez EsthefanyNo ratings yet

- Notes: Total Amount (USD) 15% VAT (USD) Net Total Amount (USD)Document1 pageNotes: Total Amount (USD) 15% VAT (USD) Net Total Amount (USD)Parthiban RNo ratings yet

- Sterling ADVERT OKW EPF MAINT 27112018 REV 301118Document1 pageSterling ADVERT OKW EPF MAINT 27112018 REV 301118Avina NigNo ratings yet

- Warehouse MGTDocument57 pagesWarehouse MGTnikhilnetra100% (1)

- Dissertation Groupes SociauxDocument8 pagesDissertation Groupes SociauxWriteMyCollegePaperForMeUK100% (1)

- YU V CADocument1 pageYU V CANicoleNo ratings yet

- Supplier Evaluation: (Supplier) Evaluation ... Without Action Is Not Effective (Gordon, 2008)Document9 pagesSupplier Evaluation: (Supplier) Evaluation ... Without Action Is Not Effective (Gordon, 2008)Nyeko FrancisNo ratings yet

- Phase 1Document38 pagesPhase 1nikolas85No ratings yet

- LTCGDocument1 pageLTCGRahul SatyakamNo ratings yet

- SQL Server - SQL Getting Debit, Credit and Balance Issue - Database Administrators Stack ExchangeDocument3 pagesSQL Server - SQL Getting Debit, Credit and Balance Issue - Database Administrators Stack ExchangeZaki CadeNo ratings yet

- Icici Complete Project Mba 3Document106 pagesIcici Complete Project Mba 3Javaid Ahmad MirNo ratings yet

- Intrinsic Value of Aurobindo PharmaDocument6 pagesIntrinsic Value of Aurobindo PharmaTirth ThakkarNo ratings yet

- Pennington County Courant, June 28, 2012Document10 pagesPennington County Courant, June 28, 2012surfnewmediaNo ratings yet

- Genset Controller, Genset Control Panel, ATS Controller Direct From China (Mainland) PDFDocument2 pagesGenset Controller, Genset Control Panel, ATS Controller Direct From China (Mainland) PDFnhocti007No ratings yet

- Paypal Code of Conduct External 0716115Document58 pagesPaypal Code of Conduct External 0716115Subin RoshanNo ratings yet

- Module 13 Present ValueDocument10 pagesModule 13 Present ValueChristine Elaine LamanNo ratings yet

- Quotation Rajni Tent House PDFDocument8 pagesQuotation Rajni Tent House PDFbhavyabhasinNo ratings yet

- 22 E Money Financial Markets 5th May 2016Document4 pages22 E Money Financial Markets 5th May 2016resufahmedNo ratings yet

- AddendumToDMR For7961Document7 pagesAddendumToDMR For7961Lalchand_KNo ratings yet