Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

42 viewsExercises Insurance Loss Notice-Of-loss Double-Insurance Reinsurance For-Distribution

Exercises Insurance Loss Notice-Of-loss Double-Insurance Reinsurance For-Distribution

Uploaded by

Francis Louie Allera HumawidMr. X's ship sank during a voyage from Manila to Malaysia due to engine trouble and large waves. All cargo was jettisoned but could not save the ship. Mr. X seeks to recover the value of the ship and cargo from his marine insurer.

Mr. X insured his ship and the crew with ABC Insurance. The ship sank and the crew died. ABC refused to pay benefits to the crew's heirs. Mr. X may be jointly liable to ABC for unpaid benefits.

Mr. X's insured ship sank carrying bottles of Coke that were too heavy and shifted during large waves. ABC paid Coke for lost bottles. ABC claims against Mr. X, arguing the ship was unseaworthy.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Pre-Trial Script Characters:: Stipulations and AdmissionsDocument6 pagesPre-Trial Script Characters:: Stipulations and AdmissionsFrancis Louie Allera Humawid100% (16)

- Commercial Law Quamto 2021: Questions Asked More Than OnceDocument145 pagesCommercial Law Quamto 2021: Questions Asked More Than OnceJustitia Et Prudentia89% (18)

- TranspoDocument2 pagesTranspoFrancisNo ratings yet

- BAR Q's INSURANCEDocument29 pagesBAR Q's INSURANCETenshi OideNo ratings yet

- TranspoDocument2 pagesTranspoClarissa Malig-onNo ratings yet

- Insurance Finals Week 5 Isabela Roque and Ong Chiong Vs Intermediate Appelate Court and Pioneer Insurance and Surety Corporation FactsDocument9 pagesInsurance Finals Week 5 Isabela Roque and Ong Chiong Vs Intermediate Appelate Court and Pioneer Insurance and Surety Corporation FactslckdsclNo ratings yet

- Roque V Iac - Atienza-F (d2017)Document2 pagesRoque V Iac - Atienza-F (d2017)Kulit_Ako1No ratings yet

- Transpo Feb 14 CasesDocument4 pagesTranspo Feb 14 CasesDanielleNo ratings yet

- Insurance FINALSDocument20 pagesInsurance FINALSWild BuTandihngNo ratings yet

- B. Obligations of The Common Carrier (Online Digest Cases) : Trans Asia Vs Court of Appeals, Atty. ArroyoDocument6 pagesB. Obligations of The Common Carrier (Online Digest Cases) : Trans Asia Vs Court of Appeals, Atty. ArroyoTweenieSumayanMapandiNo ratings yet

- Aboitiz Shipping Vs New India AssuranceDocument1 pageAboitiz Shipping Vs New India AssuranceDi ko alam100% (2)

- Transpo Law Final Exam 2020Document2 pagesTranspo Law Final Exam 2020Karlo OfracioNo ratings yet

- TRANSPO Bar Q'sDocument10 pagesTRANSPO Bar Q'sJenCastilloNo ratings yet

- MCQ TransportationDocument4 pagesMCQ Transportationbam zeppeleinNo ratings yet

- 273 Scra 262 (1997)Document9 pages273 Scra 262 (1997)japsonsinisterNo ratings yet

- Problem Qustion and AnswersDocument4 pagesProblem Qustion and AnswersShilly deviNo ratings yet

- Phil. American General Insurance Vs CADocument6 pagesPhil. American General Insurance Vs CAPrecious RubaNo ratings yet

- Vasquez Vs CADocument3 pagesVasquez Vs CANFNL100% (1)

- 2 Vasquez Vs CADocument1 page2 Vasquez Vs CAraizaNo ratings yet

- Transportation Law - Chapters 2-4 QADocument34 pagesTransportation Law - Chapters 2-4 QAjearnaezNo ratings yet

- 00 Collated Week 16Document17 pages00 Collated Week 16Sean ContrerasNo ratings yet

- MIRAVITEDocument27 pagesMIRAVITEDutchsMoin MohammadNo ratings yet

- Cebu Salvage Corporation vs. Philippine Home Assurance CorporationDocument1 pageCebu Salvage Corporation vs. Philippine Home Assurance CorporationRhea CalabinesNo ratings yet

- 11 Englishcore Ncert Hornbill ch2 PDFDocument6 pages11 Englishcore Ncert Hornbill ch2 PDFRahul AaryaNo ratings yet

- #156. Magsaysay, Inc. v. Agan, G.R. No. L-6393. Jan. 31, 1955Document1 page#156. Magsaysay, Inc. v. Agan, G.R. No. L-6393. Jan. 31, 1955Xyy CariagaNo ratings yet

- Seventh Lecture VideoDocument9 pagesSeventh Lecture VideoKing AlduezaNo ratings yet

- 135) La Razon Social Go Tiaoco V Union InsuranceDocument2 pages135) La Razon Social Go Tiaoco V Union InsuranceAlfonso Miguel LopezNo ratings yet

- Class XI Chapter 2 We Are Not Afraid To Die If We All Are TogetherDocument3 pagesClass XI Chapter 2 We Are Not Afraid To Die If We All Are TogetherShreyans SinghNo ratings yet

- Emilio D. Castellanes For Petitioners. Apolinario A. Abantao For Private RespondentsDocument5 pagesEmilio D. Castellanes For Petitioners. Apolinario A. Abantao For Private RespondentsChiang Kai-shekNo ratings yet

- Trans-Asia Shipping Lines vs. CADocument1 pageTrans-Asia Shipping Lines vs. CARhea CalabinesNo ratings yet

- (G.r. No. 116940. June 11, 1997) The Philippine American General Insurance CompanyDocument8 pages(G.r. No. 116940. June 11, 1997) The Philippine American General Insurance CompanyChatNo ratings yet

- 4 PI v. Phil Steamship Co., Inc., 44 Phil 359 (1923)Document2 pages4 PI v. Phil Steamship Co., Inc., 44 Phil 359 (1923)kathreenmonjeNo ratings yet

- TranspoDocument3 pagesTranspoRinielNo ratings yet

- Commrev Topic Roque V Iac GR No. L-66935 Date: November 11, 1985 Ponente: GUTIERREZ, JDocument3 pagesCommrev Topic Roque V Iac GR No. L-66935 Date: November 11, 1985 Ponente: GUTIERREZ, JKor CesNo ratings yet

- Case Digests (TRANSPO)Document8 pagesCase Digests (TRANSPO)Jose Antonio BarrosoNo ratings yet

- 137 Roque V IACDocument3 pages137 Roque V IACJovelan V. EscañoNo ratings yet

- EFOMM 2010 2011 Dia1 Port InglesDocument20 pagesEFOMM 2010 2011 Dia1 Port InglesMichelle TorresNo ratings yet

- 08 Barrios v. Go ThongDocument3 pages08 Barrios v. Go ThongPatricia SulitNo ratings yet

- Important Questions Class 11 English Hornbill Chapter 2Document9 pagesImportant Questions Class 11 English Hornbill Chapter 2Barath KumarNo ratings yet

- Phil. American General Insurance Co. v. CA, G.R. No. 116940, June 11, 1997Document8 pagesPhil. American General Insurance Co. v. CA, G.R. No. 116940, June 11, 1997Kharol EdeaNo ratings yet

- We're Not Afraid To DieDocument4 pagesWe're Not Afraid To Dievedha.mahendra1No ratings yet

- Commercial Law NotesDocument3 pagesCommercial Law NotesJuris GempisNo ratings yet

- TRANSPO Qs C17-20Document7 pagesTRANSPO Qs C17-20Dee LMNo ratings yet

- 17 Trans-Asia Shipping Lines v. CADocument1 page17 Trans-Asia Shipping Lines v. CALaura R. Prado-LopezNo ratings yet

- Government of The Phil Islands V. Philippine Steamship CoDocument2 pagesGovernment of The Phil Islands V. Philippine Steamship CoJames Evan I. ObnamiaNo ratings yet

- We're Not AFraid To Die... NOTESDocument4 pagesWe're Not AFraid To Die... NOTESiamrushabhshethNo ratings yet

- Class 11 English Hornbill Chapter 2Document6 pagesClass 11 English Hornbill Chapter 2Alpha StarNo ratings yet

- Were Not Afraid To Die Q&ADocument6 pagesWere Not Afraid To Die Q&Aayan5913No ratings yet

- We Are Not Afraid To DieDocument7 pagesWe Are Not Afraid To DieRamya C.MNo ratings yet

- Chap 2 and 3 TRANSPO Case DigestDocument10 pagesChap 2 and 3 TRANSPO Case DigestNaiza Mae R. BinayaoNo ratings yet

- SeaworthyDocument2 pagesSeaworthyseymourwardNo ratings yet

- Reviewer On Transport CasesDocument2 pagesReviewer On Transport CasesIyah RoblesNo ratings yet

- 2 - We're Not Afraid To Die - Solved Questions and AnswersDocument6 pages2 - We're Not Afraid To Die - Solved Questions and AnswersKamaljit SinghNo ratings yet

- Eastern Shipping Lines IncDocument1 pageEastern Shipping Lines IncJasielle Leigh UlangkayaNo ratings yet

- CH 2 HornbillDocument2 pagesCH 2 HornbillPooja RohillaNo ratings yet

- Vasquez Vs CADocument1 pageVasquez Vs CAHafsah Dmc'goNo ratings yet

- Ofracio, Karlo RicaplazaDocument7 pagesOfracio, Karlo RicaplazaKarlo OfracioNo ratings yet

- The Western Flyer: Steinbeck's Boat, the Sea of Cortez, and the Saga of Pacific FisheriesFrom EverandThe Western Flyer: Steinbeck's Boat, the Sea of Cortez, and the Saga of Pacific FisheriesNo ratings yet

- What a Ride!: HIGH SEAS, OUTRAGEOUS PARTIES, AND HUGE BILLS. THE LESSONS LEARNED FROM OWNING A NINETY-FOOT YACHTFrom EverandWhat a Ride!: HIGH SEAS, OUTRAGEOUS PARTIES, AND HUGE BILLS. THE LESSONS LEARNED FROM OWNING A NINETY-FOOT YACHTNo ratings yet

- Tax Declaration of Real Property: Humawid, Francis LouieDocument10 pagesTax Declaration of Real Property: Humawid, Francis LouieFrancis Louie Allera HumawidNo ratings yet

- People of The Philippines. Crim. Case No. R-Tac-20-00001-CrDocument1 pagePeople of The Philippines. Crim. Case No. R-Tac-20-00001-CrFrancis Louie Allera HumawidNo ratings yet

- Change of Engine & Body: Joint Affidavit ReDocument2 pagesChange of Engine & Body: Joint Affidavit ReFrancis Louie Allera HumawidNo ratings yet

- 1st Mock Bar Tax Review February 27 20211Document9 pages1st Mock Bar Tax Review February 27 20211Francis Louie Allera HumawidNo ratings yet

- Merc Law MT Suggested Answers - 146991554Document9 pagesMerc Law MT Suggested Answers - 146991554Francis Louie Allera HumawidNo ratings yet

- Civil Digest 2Document5 pagesCivil Digest 2Francis Louie Allera HumawidNo ratings yet

- Affidavit of Consent: Republic of The Philippines) City of Tacloban) S.SDocument1 pageAffidavit of Consent: Republic of The Philippines) City of Tacloban) S.SFrancis Louie Allera HumawidNo ratings yet

- Joint Affidavit of Cohabitation: Republic of The Philippines) City of Tacloban) S.SDocument1 pageJoint Affidavit of Cohabitation: Republic of The Philippines) City of Tacloban) S.SFrancis Louie Allera HumawidNo ratings yet

- Confirmation of Deed of Absolute Sale: AcknowledgmentDocument2 pagesConfirmation of Deed of Absolute Sale: AcknowledgmentFrancis Louie Allera HumawidNo ratings yet

- Petition To Cancel Statutory LienDocument2 pagesPetition To Cancel Statutory LienFrancis Louie Allera HumawidNo ratings yet

- Notice of Adverse Claim: The Register of DeedsDocument2 pagesNotice of Adverse Claim: The Register of DeedsFrancis Louie Allera HumawidNo ratings yet

- Affidavit of Admission of Paternity: Republic of The Philippines) City of Tacloban) S.SDocument1 pageAffidavit of Admission of Paternity: Republic of The Philippines) City of Tacloban) S.SFrancis Louie Allera HumawidNo ratings yet

- Affidavit of Support and Guaranty: Republic of The Philippines) City of Tacloban) SsDocument2 pagesAffidavit of Support and Guaranty: Republic of The Philippines) City of Tacloban) SsFrancis Louie Allera HumawidNo ratings yet

- Unlawful Detainer - SOLAJESDocument8 pagesUnlawful Detainer - SOLAJESFrancis Louie Allera HumawidNo ratings yet

- BEFORE ME, A Notary Public For and in The (Province/City/Municipality) ofDocument1 pageBEFORE ME, A Notary Public For and in The (Province/City/Municipality) ofFrancis Louie Allera HumawidNo ratings yet

- Petition For Certiorari: Court of AppealsDocument5 pagesPetition For Certiorari: Court of AppealsFrancis Louie Allera HumawidNo ratings yet

- Summer Tax Final ExaminationsDocument14 pagesSummer Tax Final ExaminationsFrancis Louie Allera HumawidNo ratings yet

- Humawid Prelims 2020 Civil Law Review IDocument7 pagesHumawid Prelims 2020 Civil Law Review IFrancis Louie Allera HumawidNo ratings yet

- Petition To Sell in Extrajudicial Foreclosure: Page 1 of 3Document3 pagesPetition To Sell in Extrajudicial Foreclosure: Page 1 of 3Francis Louie Allera HumawidNo ratings yet

- Republic of The Philippines) City of Tacloban) SsDocument1 pageRepublic of The Philippines) City of Tacloban) SsFrancis Louie Allera HumawidNo ratings yet

- Complaint: Page 1 of 3Document3 pagesComplaint: Page 1 of 3Francis Louie Allera HumawidNo ratings yet

- Complaint: Regional Trial Court Branch 13Document7 pagesComplaint: Regional Trial Court Branch 13Francis Louie Allera HumawidNo ratings yet

- Forcible Entry SemanesDocument4 pagesForcible Entry SemanesFrancis Louie Allera HumawidNo ratings yet

- CONTEMPT - AfableDocument6 pagesCONTEMPT - AfableFrancis Louie Allera HumawidNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsRajNo ratings yet

- Reynolds - Surety Performance Bond Claims 1Document34 pagesReynolds - Surety Performance Bond Claims 1Konan Snowden100% (5)

- Aditya Birla Health Insurance Co. LimitedDocument5 pagesAditya Birla Health Insurance Co. LimitedAbdul HafeelNo ratings yet

- S1386 SCAs SingletonDocument3 pagesS1386 SCAs SingletonICNJNo ratings yet

- Sar 7 Eligibility Status ReportDocument2 pagesSar 7 Eligibility Status ReportNathan Ryan SlatenNo ratings yet

- January To May 2022 Complete CA EnglishDocument641 pagesJanuary To May 2022 Complete CA EnglishShekhar SahNo ratings yet

- Assignment 29 Indemnity Bond: Principal ObligeeDocument4 pagesAssignment 29 Indemnity Bond: Principal ObligeeAksa Rasool100% (1)

- Enriquez vs. Sun Life Insurance of Canada (G.R. No. 15895, Nov. 29, 1920)Document1 pageEnriquez vs. Sun Life Insurance of Canada (G.R. No. 15895, Nov. 29, 1920)Thoughts and More Thoughts100% (1)

- Immidiate Annuity Options Business Line June 25, 2023Document1 pageImmidiate Annuity Options Business Line June 25, 2023Madhupam KrishnaNo ratings yet

- A - Supreme Court - S Interpretation of ArbitrationDocument4 pagesA - Supreme Court - S Interpretation of ArbitrationNitish GuptaNo ratings yet

- INS3124Document2 pagesINS3124hugomalespinNo ratings yet

- Calix Docs Hillsboro PDFDocument159 pagesCalix Docs Hillsboro PDFFuck YourBullshitMandatoryAccountNo ratings yet

- Pasani Loan Terms & Condition For Baloyi Wisani CydrickDocument6 pagesPasani Loan Terms & Condition For Baloyi Wisani CydrickClint AnthonyNo ratings yet

- Guidelines For Submission of Investment (India) 2020-21Document6 pagesGuidelines For Submission of Investment (India) 2020-21sriharshamysuruNo ratings yet

- TTMF Mortgage Application PDFDocument4 pagesTTMF Mortgage Application PDFLorenzo BurnleyNo ratings yet

- Module12 Gross EstateDocument12 pagesModule12 Gross EstateKenNo ratings yet

- Hoosegow V Chubb National Insurance CompanyDocument32 pagesHoosegow V Chubb National Insurance CompanyTHROnline100% (1)

- Domingo O. Ignacio - 3251892000309Document10 pagesDomingo O. Ignacio - 3251892000309Roberto IgnacioNo ratings yet

- Curriculum Development GuideDocument6 pagesCurriculum Development GuideHafiz FathNo ratings yet

- Your Special Blend: Rewarding Our PartnersDocument13 pagesYour Special Blend: Rewarding Our PartnersNiklaus MichaelsonNo ratings yet

- Insurance TermsDocument11 pagesInsurance TermsRenu SyamNo ratings yet

- (Financial Accounting & Reporting 2) : Lecture AidDocument18 pages(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy PeranteNo ratings yet

- Underwriters and Brokers (Submitted)Document17 pagesUnderwriters and Brokers (Submitted)dollu mehtaNo ratings yet

- Guardian - STD & LTD Plan Summary 2022Document4 pagesGuardian - STD & LTD Plan Summary 2022Jessi ChallagullaNo ratings yet

- InvoiceDocument12 pagesInvoiceKenny XNo ratings yet

- LV Xpress Inc-CoiDocument1 pageLV Xpress Inc-CoiDinesh KumarNo ratings yet

- April 1st Script - Fronter Cheat SheetDocument3 pagesApril 1st Script - Fronter Cheat SheetJuanNo ratings yet

- Guidelines To The Diagnostic Centre For Lic Pre-Insurance Medical CheckupDocument3 pagesGuidelines To The Diagnostic Centre For Lic Pre-Insurance Medical CheckupAmita SaigalNo ratings yet

- F6mys 2012 Dec ADocument7 pagesF6mys 2012 Dec AMohd IrfanNo ratings yet

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument2 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationTontadarya PolytechnicNo ratings yet

Exercises Insurance Loss Notice-Of-loss Double-Insurance Reinsurance For-Distribution

Exercises Insurance Loss Notice-Of-loss Double-Insurance Reinsurance For-Distribution

Uploaded by

Francis Louie Allera Humawid0 ratings0% found this document useful (0 votes)

42 views2 pagesMr. X's ship sank during a voyage from Manila to Malaysia due to engine trouble and large waves. All cargo was jettisoned but could not save the ship. Mr. X seeks to recover the value of the ship and cargo from his marine insurer.

Mr. X insured his ship and the crew with ABC Insurance. The ship sank and the crew died. ABC refused to pay benefits to the crew's heirs. Mr. X may be jointly liable to ABC for unpaid benefits.

Mr. X's insured ship sank carrying bottles of Coke that were too heavy and shifted during large waves. ABC paid Coke for lost bottles. ABC claims against Mr. X, arguing the ship was unseaworthy.

Original Description:

hgfhj

Original Title

Exercises Insurance Loss Notice-Of-loss Double-Insurance Reinsurance for-distribution

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMr. X's ship sank during a voyage from Manila to Malaysia due to engine trouble and large waves. All cargo was jettisoned but could not save the ship. Mr. X seeks to recover the value of the ship and cargo from his marine insurer.

Mr. X insured his ship and the crew with ABC Insurance. The ship sank and the crew died. ABC refused to pay benefits to the crew's heirs. Mr. X may be jointly liable to ABC for unpaid benefits.

Mr. X's insured ship sank carrying bottles of Coke that were too heavy and shifted during large waves. ABC paid Coke for lost bottles. ABC claims against Mr. X, arguing the ship was unseaworthy.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

42 views2 pagesExercises Insurance Loss Notice-Of-loss Double-Insurance Reinsurance For-Distribution

Exercises Insurance Loss Notice-Of-loss Double-Insurance Reinsurance For-Distribution

Uploaded by

Francis Louie Allera HumawidMr. X's ship sank during a voyage from Manila to Malaysia due to engine trouble and large waves. All cargo was jettisoned but could not save the ship. Mr. X seeks to recover the value of the ship and cargo from his marine insurer.

Mr. X insured his ship and the crew with ABC Insurance. The ship sank and the crew died. ABC refused to pay benefits to the crew's heirs. Mr. X may be jointly liable to ABC for unpaid benefits.

Mr. X's insured ship sank carrying bottles of Coke that were too heavy and shifted during large waves. ABC paid Coke for lost bottles. ABC claims against Mr. X, arguing the ship was unseaworthy.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

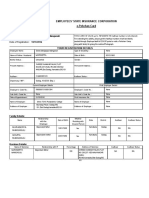

1. Mr.

X procured a marine insurance to insure his vessel from

perils of the sea for its voyage from Manila to Malaysia.

While on voyage, the ship sunk when it encountered an

engine trouble while being battered by big waves. In trying

to save the ship, all cargoes were thrown to the sea to

lighten the ship but to no avail. Is Mr. X entitled to recover

the value of the ship and the cargoes?

2. Mr. X procured a marine insurance for his vessel and

personal accident insurance with ABC Insurance to insure

the crew. On its way to its destination, the vessel sunk, and

all the crews died. ABC refused to pay the heirs of the crew.

Is Mr. X solidary liable to ABC for the unpaid benefits of the

crew?

3. Mr. X is the owner of a vessel. He took a marine insurance

from ABC Insurance. During its voyage, it sunk and then

later, it was found out that the bottles of coco cola were too

heavy and shifted to the side of the ship when encountered

by big waves. ABC then paid Coca Cola for the lost bottles.

ABC filed a claim with Mr. X contending that the vessel is

not seaworthy when it loaded the bottles which is too heavy

for the ship to carry. Mr. X contended that it is not

stipulated in the policy that the vessel must be sea worthy

hence not covered by warranty. Further, he argued that the

payment of ABC to Coca Cola is an admission of the latter of

the liability in effect that the ship is seaworthy. Decide.

4. Mr. X, the owner of XYZ vessel. He took a marine insurance

to insure the ship and its cargoes for its voyage from Davao

to Manila. On its way, the captain docked at Cebu City to

picked up some cargoes because the ship designated to do

so broke down. Then it proceeded to its original voyage but

it encountered a storm and lost P1M worth of cargo. Is the

insurer liable?

5. Mr. X, the owner of XYZ Vessel, took a marine insurance to

insure the ship and the cargoes for its voyage from Davao to

Manila. Without the fault of the captain, and due to the

weather condition, the engine of the vessel broke down and

the ship was continually hammered with big waves but it

nevertheless survived and was able to dock at the

destination. After assessment, the captain and the

shipowner decided to abandon the ship because to restore

the same would be costly and impractical. The value of the

ship and the cargoes totalled P50M but the actual damage

was actually P20M only. How much Mr. X could claim from

the insurer?

6. Mr. Y is a captain of ABC Vessel. The ship which is insured

was encountered with a typhoon and threatened the ship.

Mr. Y decided to jettison the heavy cargoes to lighten up the

ship. The cargoes of Mr. F, E, G was saved. The insurer

claimed that Mr. F, E and G must share with the loss as

their cargoes were benefited when the heavy cargoes were

thrown to the sea. Is the insurer correct?

You might also like

- Pre-Trial Script Characters:: Stipulations and AdmissionsDocument6 pagesPre-Trial Script Characters:: Stipulations and AdmissionsFrancis Louie Allera Humawid100% (16)

- Commercial Law Quamto 2021: Questions Asked More Than OnceDocument145 pagesCommercial Law Quamto 2021: Questions Asked More Than OnceJustitia Et Prudentia89% (18)

- TranspoDocument2 pagesTranspoFrancisNo ratings yet

- BAR Q's INSURANCEDocument29 pagesBAR Q's INSURANCETenshi OideNo ratings yet

- TranspoDocument2 pagesTranspoClarissa Malig-onNo ratings yet

- Insurance Finals Week 5 Isabela Roque and Ong Chiong Vs Intermediate Appelate Court and Pioneer Insurance and Surety Corporation FactsDocument9 pagesInsurance Finals Week 5 Isabela Roque and Ong Chiong Vs Intermediate Appelate Court and Pioneer Insurance and Surety Corporation FactslckdsclNo ratings yet

- Roque V Iac - Atienza-F (d2017)Document2 pagesRoque V Iac - Atienza-F (d2017)Kulit_Ako1No ratings yet

- Transpo Feb 14 CasesDocument4 pagesTranspo Feb 14 CasesDanielleNo ratings yet

- Insurance FINALSDocument20 pagesInsurance FINALSWild BuTandihngNo ratings yet

- B. Obligations of The Common Carrier (Online Digest Cases) : Trans Asia Vs Court of Appeals, Atty. ArroyoDocument6 pagesB. Obligations of The Common Carrier (Online Digest Cases) : Trans Asia Vs Court of Appeals, Atty. ArroyoTweenieSumayanMapandiNo ratings yet

- Aboitiz Shipping Vs New India AssuranceDocument1 pageAboitiz Shipping Vs New India AssuranceDi ko alam100% (2)

- Transpo Law Final Exam 2020Document2 pagesTranspo Law Final Exam 2020Karlo OfracioNo ratings yet

- TRANSPO Bar Q'sDocument10 pagesTRANSPO Bar Q'sJenCastilloNo ratings yet

- MCQ TransportationDocument4 pagesMCQ Transportationbam zeppeleinNo ratings yet

- 273 Scra 262 (1997)Document9 pages273 Scra 262 (1997)japsonsinisterNo ratings yet

- Problem Qustion and AnswersDocument4 pagesProblem Qustion and AnswersShilly deviNo ratings yet

- Phil. American General Insurance Vs CADocument6 pagesPhil. American General Insurance Vs CAPrecious RubaNo ratings yet

- Vasquez Vs CADocument3 pagesVasquez Vs CANFNL100% (1)

- 2 Vasquez Vs CADocument1 page2 Vasquez Vs CAraizaNo ratings yet

- Transportation Law - Chapters 2-4 QADocument34 pagesTransportation Law - Chapters 2-4 QAjearnaezNo ratings yet

- 00 Collated Week 16Document17 pages00 Collated Week 16Sean ContrerasNo ratings yet

- MIRAVITEDocument27 pagesMIRAVITEDutchsMoin MohammadNo ratings yet

- Cebu Salvage Corporation vs. Philippine Home Assurance CorporationDocument1 pageCebu Salvage Corporation vs. Philippine Home Assurance CorporationRhea CalabinesNo ratings yet

- 11 Englishcore Ncert Hornbill ch2 PDFDocument6 pages11 Englishcore Ncert Hornbill ch2 PDFRahul AaryaNo ratings yet

- #156. Magsaysay, Inc. v. Agan, G.R. No. L-6393. Jan. 31, 1955Document1 page#156. Magsaysay, Inc. v. Agan, G.R. No. L-6393. Jan. 31, 1955Xyy CariagaNo ratings yet

- Seventh Lecture VideoDocument9 pagesSeventh Lecture VideoKing AlduezaNo ratings yet

- 135) La Razon Social Go Tiaoco V Union InsuranceDocument2 pages135) La Razon Social Go Tiaoco V Union InsuranceAlfonso Miguel LopezNo ratings yet

- Class XI Chapter 2 We Are Not Afraid To Die If We All Are TogetherDocument3 pagesClass XI Chapter 2 We Are Not Afraid To Die If We All Are TogetherShreyans SinghNo ratings yet

- Emilio D. Castellanes For Petitioners. Apolinario A. Abantao For Private RespondentsDocument5 pagesEmilio D. Castellanes For Petitioners. Apolinario A. Abantao For Private RespondentsChiang Kai-shekNo ratings yet

- Trans-Asia Shipping Lines vs. CADocument1 pageTrans-Asia Shipping Lines vs. CARhea CalabinesNo ratings yet

- (G.r. No. 116940. June 11, 1997) The Philippine American General Insurance CompanyDocument8 pages(G.r. No. 116940. June 11, 1997) The Philippine American General Insurance CompanyChatNo ratings yet

- 4 PI v. Phil Steamship Co., Inc., 44 Phil 359 (1923)Document2 pages4 PI v. Phil Steamship Co., Inc., 44 Phil 359 (1923)kathreenmonjeNo ratings yet

- TranspoDocument3 pagesTranspoRinielNo ratings yet

- Commrev Topic Roque V Iac GR No. L-66935 Date: November 11, 1985 Ponente: GUTIERREZ, JDocument3 pagesCommrev Topic Roque V Iac GR No. L-66935 Date: November 11, 1985 Ponente: GUTIERREZ, JKor CesNo ratings yet

- Case Digests (TRANSPO)Document8 pagesCase Digests (TRANSPO)Jose Antonio BarrosoNo ratings yet

- 137 Roque V IACDocument3 pages137 Roque V IACJovelan V. EscañoNo ratings yet

- EFOMM 2010 2011 Dia1 Port InglesDocument20 pagesEFOMM 2010 2011 Dia1 Port InglesMichelle TorresNo ratings yet

- 08 Barrios v. Go ThongDocument3 pages08 Barrios v. Go ThongPatricia SulitNo ratings yet

- Important Questions Class 11 English Hornbill Chapter 2Document9 pagesImportant Questions Class 11 English Hornbill Chapter 2Barath KumarNo ratings yet

- Phil. American General Insurance Co. v. CA, G.R. No. 116940, June 11, 1997Document8 pagesPhil. American General Insurance Co. v. CA, G.R. No. 116940, June 11, 1997Kharol EdeaNo ratings yet

- We're Not Afraid To DieDocument4 pagesWe're Not Afraid To Dievedha.mahendra1No ratings yet

- Commercial Law NotesDocument3 pagesCommercial Law NotesJuris GempisNo ratings yet

- TRANSPO Qs C17-20Document7 pagesTRANSPO Qs C17-20Dee LMNo ratings yet

- 17 Trans-Asia Shipping Lines v. CADocument1 page17 Trans-Asia Shipping Lines v. CALaura R. Prado-LopezNo ratings yet

- Government of The Phil Islands V. Philippine Steamship CoDocument2 pagesGovernment of The Phil Islands V. Philippine Steamship CoJames Evan I. ObnamiaNo ratings yet

- We're Not AFraid To Die... NOTESDocument4 pagesWe're Not AFraid To Die... NOTESiamrushabhshethNo ratings yet

- Class 11 English Hornbill Chapter 2Document6 pagesClass 11 English Hornbill Chapter 2Alpha StarNo ratings yet

- Were Not Afraid To Die Q&ADocument6 pagesWere Not Afraid To Die Q&Aayan5913No ratings yet

- We Are Not Afraid To DieDocument7 pagesWe Are Not Afraid To DieRamya C.MNo ratings yet

- Chap 2 and 3 TRANSPO Case DigestDocument10 pagesChap 2 and 3 TRANSPO Case DigestNaiza Mae R. BinayaoNo ratings yet

- SeaworthyDocument2 pagesSeaworthyseymourwardNo ratings yet

- Reviewer On Transport CasesDocument2 pagesReviewer On Transport CasesIyah RoblesNo ratings yet

- 2 - We're Not Afraid To Die - Solved Questions and AnswersDocument6 pages2 - We're Not Afraid To Die - Solved Questions and AnswersKamaljit SinghNo ratings yet

- Eastern Shipping Lines IncDocument1 pageEastern Shipping Lines IncJasielle Leigh UlangkayaNo ratings yet

- CH 2 HornbillDocument2 pagesCH 2 HornbillPooja RohillaNo ratings yet

- Vasquez Vs CADocument1 pageVasquez Vs CAHafsah Dmc'goNo ratings yet

- Ofracio, Karlo RicaplazaDocument7 pagesOfracio, Karlo RicaplazaKarlo OfracioNo ratings yet

- The Western Flyer: Steinbeck's Boat, the Sea of Cortez, and the Saga of Pacific FisheriesFrom EverandThe Western Flyer: Steinbeck's Boat, the Sea of Cortez, and the Saga of Pacific FisheriesNo ratings yet

- What a Ride!: HIGH SEAS, OUTRAGEOUS PARTIES, AND HUGE BILLS. THE LESSONS LEARNED FROM OWNING A NINETY-FOOT YACHTFrom EverandWhat a Ride!: HIGH SEAS, OUTRAGEOUS PARTIES, AND HUGE BILLS. THE LESSONS LEARNED FROM OWNING A NINETY-FOOT YACHTNo ratings yet

- Tax Declaration of Real Property: Humawid, Francis LouieDocument10 pagesTax Declaration of Real Property: Humawid, Francis LouieFrancis Louie Allera HumawidNo ratings yet

- People of The Philippines. Crim. Case No. R-Tac-20-00001-CrDocument1 pagePeople of The Philippines. Crim. Case No. R-Tac-20-00001-CrFrancis Louie Allera HumawidNo ratings yet

- Change of Engine & Body: Joint Affidavit ReDocument2 pagesChange of Engine & Body: Joint Affidavit ReFrancis Louie Allera HumawidNo ratings yet

- 1st Mock Bar Tax Review February 27 20211Document9 pages1st Mock Bar Tax Review February 27 20211Francis Louie Allera HumawidNo ratings yet

- Merc Law MT Suggested Answers - 146991554Document9 pagesMerc Law MT Suggested Answers - 146991554Francis Louie Allera HumawidNo ratings yet

- Civil Digest 2Document5 pagesCivil Digest 2Francis Louie Allera HumawidNo ratings yet

- Affidavit of Consent: Republic of The Philippines) City of Tacloban) S.SDocument1 pageAffidavit of Consent: Republic of The Philippines) City of Tacloban) S.SFrancis Louie Allera HumawidNo ratings yet

- Joint Affidavit of Cohabitation: Republic of The Philippines) City of Tacloban) S.SDocument1 pageJoint Affidavit of Cohabitation: Republic of The Philippines) City of Tacloban) S.SFrancis Louie Allera HumawidNo ratings yet

- Confirmation of Deed of Absolute Sale: AcknowledgmentDocument2 pagesConfirmation of Deed of Absolute Sale: AcknowledgmentFrancis Louie Allera HumawidNo ratings yet

- Petition To Cancel Statutory LienDocument2 pagesPetition To Cancel Statutory LienFrancis Louie Allera HumawidNo ratings yet

- Notice of Adverse Claim: The Register of DeedsDocument2 pagesNotice of Adverse Claim: The Register of DeedsFrancis Louie Allera HumawidNo ratings yet

- Affidavit of Admission of Paternity: Republic of The Philippines) City of Tacloban) S.SDocument1 pageAffidavit of Admission of Paternity: Republic of The Philippines) City of Tacloban) S.SFrancis Louie Allera HumawidNo ratings yet

- Affidavit of Support and Guaranty: Republic of The Philippines) City of Tacloban) SsDocument2 pagesAffidavit of Support and Guaranty: Republic of The Philippines) City of Tacloban) SsFrancis Louie Allera HumawidNo ratings yet

- Unlawful Detainer - SOLAJESDocument8 pagesUnlawful Detainer - SOLAJESFrancis Louie Allera HumawidNo ratings yet

- BEFORE ME, A Notary Public For and in The (Province/City/Municipality) ofDocument1 pageBEFORE ME, A Notary Public For and in The (Province/City/Municipality) ofFrancis Louie Allera HumawidNo ratings yet

- Petition For Certiorari: Court of AppealsDocument5 pagesPetition For Certiorari: Court of AppealsFrancis Louie Allera HumawidNo ratings yet

- Summer Tax Final ExaminationsDocument14 pagesSummer Tax Final ExaminationsFrancis Louie Allera HumawidNo ratings yet

- Humawid Prelims 2020 Civil Law Review IDocument7 pagesHumawid Prelims 2020 Civil Law Review IFrancis Louie Allera HumawidNo ratings yet

- Petition To Sell in Extrajudicial Foreclosure: Page 1 of 3Document3 pagesPetition To Sell in Extrajudicial Foreclosure: Page 1 of 3Francis Louie Allera HumawidNo ratings yet

- Republic of The Philippines) City of Tacloban) SsDocument1 pageRepublic of The Philippines) City of Tacloban) SsFrancis Louie Allera HumawidNo ratings yet

- Complaint: Page 1 of 3Document3 pagesComplaint: Page 1 of 3Francis Louie Allera HumawidNo ratings yet

- Complaint: Regional Trial Court Branch 13Document7 pagesComplaint: Regional Trial Court Branch 13Francis Louie Allera HumawidNo ratings yet

- Forcible Entry SemanesDocument4 pagesForcible Entry SemanesFrancis Louie Allera HumawidNo ratings yet

- CONTEMPT - AfableDocument6 pagesCONTEMPT - AfableFrancis Louie Allera HumawidNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsRajNo ratings yet

- Reynolds - Surety Performance Bond Claims 1Document34 pagesReynolds - Surety Performance Bond Claims 1Konan Snowden100% (5)

- Aditya Birla Health Insurance Co. LimitedDocument5 pagesAditya Birla Health Insurance Co. LimitedAbdul HafeelNo ratings yet

- S1386 SCAs SingletonDocument3 pagesS1386 SCAs SingletonICNJNo ratings yet

- Sar 7 Eligibility Status ReportDocument2 pagesSar 7 Eligibility Status ReportNathan Ryan SlatenNo ratings yet

- January To May 2022 Complete CA EnglishDocument641 pagesJanuary To May 2022 Complete CA EnglishShekhar SahNo ratings yet

- Assignment 29 Indemnity Bond: Principal ObligeeDocument4 pagesAssignment 29 Indemnity Bond: Principal ObligeeAksa Rasool100% (1)

- Enriquez vs. Sun Life Insurance of Canada (G.R. No. 15895, Nov. 29, 1920)Document1 pageEnriquez vs. Sun Life Insurance of Canada (G.R. No. 15895, Nov. 29, 1920)Thoughts and More Thoughts100% (1)

- Immidiate Annuity Options Business Line June 25, 2023Document1 pageImmidiate Annuity Options Business Line June 25, 2023Madhupam KrishnaNo ratings yet

- A - Supreme Court - S Interpretation of ArbitrationDocument4 pagesA - Supreme Court - S Interpretation of ArbitrationNitish GuptaNo ratings yet

- INS3124Document2 pagesINS3124hugomalespinNo ratings yet

- Calix Docs Hillsboro PDFDocument159 pagesCalix Docs Hillsboro PDFFuck YourBullshitMandatoryAccountNo ratings yet

- Pasani Loan Terms & Condition For Baloyi Wisani CydrickDocument6 pagesPasani Loan Terms & Condition For Baloyi Wisani CydrickClint AnthonyNo ratings yet

- Guidelines For Submission of Investment (India) 2020-21Document6 pagesGuidelines For Submission of Investment (India) 2020-21sriharshamysuruNo ratings yet

- TTMF Mortgage Application PDFDocument4 pagesTTMF Mortgage Application PDFLorenzo BurnleyNo ratings yet

- Module12 Gross EstateDocument12 pagesModule12 Gross EstateKenNo ratings yet

- Hoosegow V Chubb National Insurance CompanyDocument32 pagesHoosegow V Chubb National Insurance CompanyTHROnline100% (1)

- Domingo O. Ignacio - 3251892000309Document10 pagesDomingo O. Ignacio - 3251892000309Roberto IgnacioNo ratings yet

- Curriculum Development GuideDocument6 pagesCurriculum Development GuideHafiz FathNo ratings yet

- Your Special Blend: Rewarding Our PartnersDocument13 pagesYour Special Blend: Rewarding Our PartnersNiklaus MichaelsonNo ratings yet

- Insurance TermsDocument11 pagesInsurance TermsRenu SyamNo ratings yet

- (Financial Accounting & Reporting 2) : Lecture AidDocument18 pages(Financial Accounting & Reporting 2) : Lecture AidMay Grethel Joy PeranteNo ratings yet

- Underwriters and Brokers (Submitted)Document17 pagesUnderwriters and Brokers (Submitted)dollu mehtaNo ratings yet

- Guardian - STD & LTD Plan Summary 2022Document4 pagesGuardian - STD & LTD Plan Summary 2022Jessi ChallagullaNo ratings yet

- InvoiceDocument12 pagesInvoiceKenny XNo ratings yet

- LV Xpress Inc-CoiDocument1 pageLV Xpress Inc-CoiDinesh KumarNo ratings yet

- April 1st Script - Fronter Cheat SheetDocument3 pagesApril 1st Script - Fronter Cheat SheetJuanNo ratings yet

- Guidelines To The Diagnostic Centre For Lic Pre-Insurance Medical CheckupDocument3 pagesGuidelines To The Diagnostic Centre For Lic Pre-Insurance Medical CheckupAmita SaigalNo ratings yet

- F6mys 2012 Dec ADocument7 pagesF6mys 2012 Dec AMohd IrfanNo ratings yet

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument2 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationTontadarya PolytechnicNo ratings yet