Professional Documents

Culture Documents

Financial Forecasting and FCF Valuation

Financial Forecasting and FCF Valuation

Uploaded by

biswanathOriginal Description:

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Financial Forecasting and FCF Valuation

Financial Forecasting and FCF Valuation

Uploaded by

biswanathCopyright:

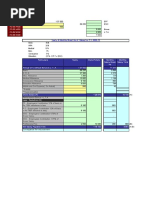

Problem on Financial Forecasting and Free Cash Flow Method of Valuation

Kaplan Ltd. has the following actual financial statements as on 31 st March 2017:

INCOME STATEMENT Rs-million

Revenues 5,000

Raw Materials 3,000

Employee cost 450

Overheads 600

Depreciation 100

COGS 4,150

Interest 50

EBT 800

Tax @ 30% 240

EAT 560

Dividend -

BALANCE SHEET

Fixed assets 1,000

Current assets 750

Total assets 1,750

Equity share capital 135

Reserves & surplus 560

8% debenture 625

Current liability 430

Total liabilities 1,750

The debenture is repayable in 5 equal instalments from 2017-18.

While forecasting the financial statements from 2018 to 2014 you can consider the

following:

1. The cost structure can remain the same.

2. The revenue growth Y0Y would be 5%, but in years 2020 and 2023, there would be

3% rise in the selling price.

3. The company follows SLM for depreciation calculation but due to increasing

additional capacity, the depreciation will be Rs. 120 million in year 2020 and Rs.150

million in the year 2022.

4. The company would be in 30% tax bracket throughout.

5. After the forecast period, a stable growth rate of 3% is considered to be realistic.

You might also like

- Practice Question On Group AccountsDocument12 pagesPractice Question On Group Accountsemerald75% (4)

- HE 2 Questions - Updated-1Document6 pagesHE 2 Questions - Updated-1halelz69No ratings yet

- Seminar 09 Calculating NCInt Simple Example ColourDocument2 pagesSeminar 09 Calculating NCInt Simple Example Colour金鑫No ratings yet

- Afar Quiz 5 Probs Subsequent To Acqui DateDocument13 pagesAfar Quiz 5 Probs Subsequent To Acqui DatejajajaredredNo ratings yet

- Analisis Kinerja KeuanganDocument5 pagesAnalisis Kinerja KeuanganAngga SetiaNo ratings yet

- Spring 2024 - ACC501 - 1Document3 pagesSpring 2024 - ACC501 - 1freebutterfly121No ratings yet

- Chapter 5-Financial Planning and ForecastingDocument20 pagesChapter 5-Financial Planning and ForecastingMOHAMAD SAFWAN BIN FAUZI STUDENTNo ratings yet

- Praktikum Ke-1 Chapter 3: Financial Statement and Ratio AnalysisDocument3 pagesPraktikum Ke-1 Chapter 3: Financial Statement and Ratio AnalysisTaram 1003No ratings yet

- Planning and ForecastingDocument16 pagesPlanning and ForecastingAinun Nisa NNo ratings yet

- Transaction AssignmentDocument2 pagesTransaction AssignmentAbdullah - Al - Safoan 211-15-14629No ratings yet

- Ias 28 Associates Tutorial QuestionsDocument17 pagesIas 28 Associates Tutorial QuestionsAnesu Nathan ChiwaridzoNo ratings yet

- Case Study 3: Alok Industries: Business ValuationDocument6 pagesCase Study 3: Alok Industries: Business Valuationsairad1999No ratings yet

- WEEK 6-7 ULO A, B, C Answer KeyDocument4 pagesWEEK 6-7 ULO A, B, C Answer Keyzee abadilla100% (1)

- Cashflow QuestionDocument2 pagesCashflow QuestionMick MingleNo ratings yet

- Akuntansi 2Document5 pagesAkuntansi 22310102052.refatNo ratings yet

- Quikchex 2019 Tax Comparison PDFDocument5 pagesQuikchex 2019 Tax Comparison PDFGMFL MumbaiNo ratings yet

- ALABANG PLUMBING IntroDocument1 pageALABANG PLUMBING IntroIsa NgNo ratings yet

- 2016-2017 2017-2018 2018-2019 All Values in INR ThousandsDocument18 pages2016-2017 2017-2018 2018-2019 All Values in INR ThousandsSomlina MukherjeeNo ratings yet

- CR Questions 60+Document102 pagesCR Questions 60+George NicholsonNo ratings yet

- Assets 2005 2004: Ques2. Prepare A Cash Flow Statement As Per As-3Document4 pagesAssets 2005 2004: Ques2. Prepare A Cash Flow Statement As Per As-3Harsh GuptaNo ratings yet

- TUGAS AKUNTANSI DASAR PERTEMUAN 5 RICO ANANTA RANEX SAPUTRA NewDocument8 pagesTUGAS AKUNTANSI DASAR PERTEMUAN 5 RICO ANANTA RANEX SAPUTRA Newrico anantaNo ratings yet

- Practice Exercise - Cobble Hill Part 3 Cash Flow - BlankDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Blank155- Salsabila GadingNo ratings yet

- Lecture 2 Answer1 1564205815261Document18 pagesLecture 2 Answer1 1564205815261Trinesh BhargavaNo ratings yet

- Latihan Lab 4 - Consolidated Financial StatementDocument9 pagesLatihan Lab 4 - Consolidated Financial StatementRijal PirmansyahNo ratings yet

- GAP Interest Rate Change in Interest Income in Relation With Change in Interest ExpenseDocument5 pagesGAP Interest Rate Change in Interest Income in Relation With Change in Interest ExpenseTACN-4TC-19ACN Nguyen Thu HienNo ratings yet

- Anandam Case AnalysisDocument5 pagesAnandam Case AnalysisVini ShethNo ratings yet

- ExamDocument4 pagesExammohammad maabrehNo ratings yet

- Cash Flow Assignment 1Document9 pagesCash Flow Assignment 1Ramakrishna J RNo ratings yet

- Lecture Week 7Document54 pagesLecture Week 7Muhammad HusseinNo ratings yet

- Fundamentals of Financial Management Concise 8E: Eugene F. Brigham & Joel F. HoustonDocument17 pagesFundamentals of Financial Management Concise 8E: Eugene F. Brigham & Joel F. Houstondas413No ratings yet

- Trial BalaneDocument2 pagesTrial BalaneBang BangNo ratings yet

- Himel LTD: Total AssetsDocument37 pagesHimel LTD: Total AssetsAbdulAhadNo ratings yet

- Perniagaan Jared Akaun Perdagangan Dan Untung Rugi Bagi Tahun Berakhir 30 April 2016Document2 pagesPerniagaan Jared Akaun Perdagangan Dan Untung Rugi Bagi Tahun Berakhir 30 April 2016weiqiNo ratings yet

- Illustration Ratio AnalysisDocument6 pagesIllustration Ratio AnalysisMUINDI MUASYA KENNEDY D190/18836/2020No ratings yet

- Q8 Motswala LimitedDocument2 pagesQ8 Motswala Limitedamosmalusi5No ratings yet

- CTC Salary CalculatorDocument1 pageCTC Salary CalculatorsavideshwalNo ratings yet

- Acc Topic 6 PDFDocument7 pagesAcc Topic 6 PDFBM10622P Nur Alyaa Nadhirah Bt Mohd RosliNo ratings yet

- Ratios ExercisesDocument3 pagesRatios ExercisesQuân HoàngNo ratings yet

- Solution Key To Problem Set 2Document6 pagesSolution Key To Problem Set 2Ayush RaiNo ratings yet

- Accounting 1Document2 pagesAccounting 1thu thienNo ratings yet

- Mcgraw-Hill/Irwin Corporate Finance, 7/E: © 2005 The Mcgraw-Hill Companies, Inc. All Rights ReservedDocument26 pagesMcgraw-Hill/Irwin Corporate Finance, 7/E: © 2005 The Mcgraw-Hill Companies, Inc. All Rights ReservedMohammad Ilham FawwazNo ratings yet

- WorkshitDocument12 pagesWorkshitLukman ArimartaNo ratings yet

- ABCDDocument4 pagesABCDYaseen Nazir MallaNo ratings yet

- 3.BACC III 2016 End - Docx ModeratedDocument7 pages3.BACC III 2016 End - Docx ModeratedsmlingwaNo ratings yet

- Tax Rs.000: Cfap 1: A A F RDocument1 pageTax Rs.000: Cfap 1: A A F R.No ratings yet

- FMDocument17 pagesFMRaghav Agarwal100% (3)

- Introduction To Consolidated Financial Statements: - Definitions - AssociatesDocument26 pagesIntroduction To Consolidated Financial Statements: - Definitions - AssociatesK58 Nguyễn Hương GiangNo ratings yet

- Accounting AssignmentDocument2 pagesAccounting Assignmentjannatulnisha78No ratings yet

- A. Hercules Poirot, P.I., Sa Worksheet For The Quarter Ended March 31, 2017 Account Titles Trial Balance Adjustmnets Adjusted Trial BalanceDocument5 pagesA. Hercules Poirot, P.I., Sa Worksheet For The Quarter Ended March 31, 2017 Account Titles Trial Balance Adjustmnets Adjusted Trial BalancevaldaNo ratings yet

- Cash Flow Statement - HODocument7 pagesCash Flow Statement - HOAditi VermaNo ratings yet

- Ratio AnlysDocument5 pagesRatio AnlysVi PhuongNo ratings yet

- Consolidation Q30Document5 pagesConsolidation Q30johny SahaNo ratings yet

- Mid Term FIN 514Document4 pagesMid Term FIN 514Showkatul IslamNo ratings yet

- 5 Cash Flow Practical - QuestionDocument2 pages5 Cash Flow Practical - QuestionSunny GoyalNo ratings yet

- Cash FlowsDocument12 pagesCash FlowsEjaz AhmadNo ratings yet

- Eva ProblemsDocument10 pagesEva ProblemsROSHNY DAVIS100% (1)

- ms4 2017 IIDocument4 pagesms4 2017 IIsachin gehlawatNo ratings yet