Professional Documents

Culture Documents

Introduction To Depriciation

Introduction To Depriciation

Uploaded by

Ashish ChandraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction To Depriciation

Introduction To Depriciation

Uploaded by

Ashish ChandraCopyright:

Available Formats

10.

1 CONCEPT OF DEPRECIATION

Every firm acquires different types of assets for starting its operations and these assets can be

broadly classified into fixed and current assets. Fixed assets are generally used for a longer

period; these include machinery, plants and buildings. These assets are not meant for resale,

but this does not mean that their value will always remain the same. It means that fixed assets

lose their value over time. Therefore, a firm will distribute the cost of fixed assets over time in

the form of Depreciation.

According to the Institute of Chartered Accountants of India, “Depreciation is a measure of the

wearing out or other loss of value of a depreciable asset arising from use, time or obsolescence.

Depreciation is allocated so as to charge a fair proportion of the cost in each accounting period

during the expected useful life of an asset”.

Depreciation revolves around three important aspects of an asset:

Cost of the asset

Estimated life of the asset (no. of years)

Residual value of the asset

10.1.1 Features of Depreciation

The definition of depreciation given by the Institute of Chartered Accountants of India reveals

the distinguishing features of the term ‘Depreciation’. These features of depreciation are

described below:

i. Depreciation denotes Loss of value, which implies a fall in the value of assets.

ii. Depreciation is related to tangible fixed assets.

iii. The fall in the value of assets is due to the regular use of the asset in business

operations.

iv. Depreciation represents the gradual, continuous and permanent fall in the value. The

fall in the value is because of depletion and obsolescence.

v. Depreciation should be provided in each accounting year during the expected useful life

of the asset.

vi. Depreciation is a non-cash expense and represents the reduction in the value of an asset

due to wear and tear, age or obsolescence.

For the loss in the value of intangible assets, such as patents and copyrights, amortisation is

used.

10.1.2 Factors of Depreciation

Physical

Deterioration

Obsolescenc Depreciatio Inadequac

e n y

Depletion

Figure 10.1 Factors Causing Depreciation of Assets

There are mainly four factors that lead to the depreciation of fixed assets. (Figure 10.1) These

four factors are explained as follows:

i. Physical Deterioration - This occurs in two ways: (1) by the continuous and gradual use

of the asset that renders fixed assets useless. This is known as wear and tear of assets.

(2) Natural deterioration occurs through rust and rot. This happens mainly in the case of

metal assets, including vehicles and machinery.

ii. Obsolescence - This makes the asset out of date. By the passing of each day, new

technologies are being introduced in the market, making the old one obsolete. The

simplest example is replacement of typewriters by computers.

iii. Inadequacy - This is the incapability of a machine due to the increased capacity of a

firm. With an increase in size, firms expand their operations, which will further put

pressure on the productivity of an asset. If the asset cannot meet the existing demand

of a firm, it is considered as inadequate.

iv. Depletion - Mainly natural assets that include oil wells and mines get depleted with

time, due to the extraction of raw resources from them.

You might also like

- Cambridge IGCSE and O Level Accounting Workbook (June Baptista, Stimpson) (Z-Library)Document97 pagesCambridge IGCSE and O Level Accounting Workbook (June Baptista, Stimpson) (Z-Library)Asif Ali100% (5)

- WWA Market StructureDocument1 pageWWA Market StructureMus'ab Abdullahi BulaleNo ratings yet

- Accounting For DepreciationDocument16 pagesAccounting For DepreciationKrishna100% (2)

- Certificate of Agreement For Coverage of Student LoanDocument4 pagesCertificate of Agreement For Coverage of Student LoanJohn BaileyNo ratings yet

- Anti-Epal Memorandum - DILG Memorandum Circular - 2010-101Document1 pageAnti-Epal Memorandum - DILG Memorandum Circular - 2010-101Brylle Vincent LabuananNo ratings yet

- Accounting For Plant Assets FinalDocument17 pagesAccounting For Plant Assets FinalAbdii Dhufeera100% (2)

- DEPRECIATIONDocument3 pagesDEPRECIATIONUsirika Sai KumarNo ratings yet

- 320 Accountancy Eng Lesson14Document30 pages320 Accountancy Eng Lesson14Debdeep C.No ratings yet

- MBA Chp-11 - DepreciationDocument30 pagesMBA Chp-11 - DepreciationNitish rajNo ratings yet

- Act 3Document15 pagesAct 3tashakhandelwal575No ratings yet

- Accounting (Depreciation)Document11 pagesAccounting (Depreciation)PowerPoint GoNo ratings yet

- Accounting andDocument10 pagesAccounting andPrachi GargNo ratings yet

- DepriciationDocument4 pagesDepriciationnehagupta4915No ratings yet

- CH 12Document19 pagesCH 12Vandana GuptaNo ratings yet

- 1, Aset TetapDocument45 pages1, Aset TetapM Syukrihady IrsyadNo ratings yet

- Accounting For Non - Current AssetsDocument10 pagesAccounting For Non - Current AssetsMichael BwireNo ratings yet

- DepreciationDocument6 pagesDepreciationujjawalr9027No ratings yet

- DepreciationDocument8 pagesDepreciationbhanu100% (1)

- 2014 Fundamental Chap 2Document19 pages2014 Fundamental Chap 2Yoom AkkaasNo ratings yet

- BBA II Chapter 3 Depreciation AccountingDocument28 pagesBBA II Chapter 3 Depreciation AccountingSiddharth Salgaonkar100% (1)

- Chapter 10 1Document63 pagesChapter 10 1HEM CHEANo ratings yet

- Module 5Document9 pagesModule 5amritsaikias4No ratings yet

- Accountancy - DepreciationDocument4 pagesAccountancy - DepreciationGedie RocamoraNo ratings yet

- 10.3.1 Physical DepreciationDocument13 pages10.3.1 Physical DepreciationlalNo ratings yet

- Chapter 11 - Depreciation and DepletionDocument46 pagesChapter 11 - Depreciation and DepletionDawn Rei DangkiwNo ratings yet

- Unit 5Document22 pagesUnit 5sumitbabu0210No ratings yet

- Unit 5 BBA SEM I DepreciationDocument24 pagesUnit 5 BBA SEM I DepreciationRaghuNo ratings yet

- Eco - Basic Concepts of MacroeconomicsDocument2 pagesEco - Basic Concepts of Macroeconomicspoorani2827No ratings yet

- Chapter 2-Plant Assets and Intangible AssetsDocument15 pagesChapter 2-Plant Assets and Intangible Assetsyared kebedeNo ratings yet

- Long-Lived Assets: Revsine/Collins/Johnson/Mittelstaedt: Chapter 10Document18 pagesLong-Lived Assets: Revsine/Collins/Johnson/Mittelstaedt: Chapter 10NileshAgarwalNo ratings yet

- CH 10Document56 pagesCH 10Tifany Natasia100% (1)

- Concept of DepreciationDocument2 pagesConcept of DepreciationpalvinderNo ratings yet

- CH 10 Plant Assets Natural ResourcesDocument59 pagesCH 10 Plant Assets Natural ResourcesJochebed BuriasNo ratings yet

- Class-Xi Depreciation: K S H I T I JDocument8 pagesClass-Xi Depreciation: K S H I T I Jsk23skNo ratings yet

- Preview of Chapter 10: Intermediate Accounting 17th Edition Kieso Weygandt WarfieldDocument24 pagesPreview of Chapter 10: Intermediate Accounting 17th Edition Kieso Weygandt WarfieldDavid Bradley BeckNo ratings yet

- Members of The Group: 01. Dimas Dirga Pratama 20.0102.0030 02. Denitto Giantoro 20.0102.0071Document19 pagesMembers of The Group: 01. Dimas Dirga Pratama 20.0102.0030 02. Denitto Giantoro 20.0102.0071Denitto GiantoroNo ratings yet

- Account Unit No. 3 Q. 1Document4 pagesAccount Unit No. 3 Q. 1Aniket ChandNo ratings yet

- Chapter 10 - Fixed Assets and Intangible AssetsDocument94 pagesChapter 10 - Fixed Assets and Intangible AssetsAsti RahmadaniaNo ratings yet

- Plant Assets, Natural Resources, and Intangibles: QuestionsDocument34 pagesPlant Assets, Natural Resources, and Intangibles: QuestionsKing Chan100% (2)

- Accounting Charts - Quick Referencer by ICAIDocument22 pagesAccounting Charts - Quick Referencer by ICAIQuestion Bank100% (1)

- ch2: Accounting Cycle For SGBDocument23 pagesch2: Accounting Cycle For SGBmathewosNo ratings yet

- A Case Study On DepreciationDocument15 pagesA Case Study On Depreciationtashakhandelwal575No ratings yet

- Fundamental II Chapter 2Document13 pagesFundamental II Chapter 2jaabirm78No ratings yet

- Acquisition of PP&E Acquisition of PP&EDocument20 pagesAcquisition of PP&E Acquisition of PP&EbereniceNo ratings yet

- 200101231005-Rupesh Nathe CIA4 (Accrued Depreciation)Document14 pages200101231005-Rupesh Nathe CIA4 (Accrued Depreciation)Rupesh NatheNo ratings yet

- Chapter 7 DepreciationDocument50 pagesChapter 7 Depreciationpriyam.200409No ratings yet

- Unit 4Document21 pagesUnit 4yebegashet100% (1)

- M 2Document22 pagesM 2r79sivaNo ratings yet

- Study Note 1.2, Page 12 32Document21 pagesStudy Note 1.2, Page 12 32s4sahithNo ratings yet

- Plant Assets Natural Resources and Intangible AsDocument59 pagesPlant Assets Natural Resources and Intangible AsxunaidNo ratings yet

- Afm Unit-6Document21 pagesAfm Unit-6Moon LoverNo ratings yet

- DepreciationDocument8 pagesDepreciationanjalikapoorNo ratings yet

- Dep of FADocument81 pagesDep of FAgoel76vishalNo ratings yet

- DepreciationDocument10 pagesDepreciationsoumibasuNo ratings yet

- 10 PpeDocument53 pages10 PpeSalsa Byla100% (1)

- Concept and Accounting of Depreciation: Learning OutcomesDocument35 pagesConcept and Accounting of Depreciation: Learning OutcomesShristiNo ratings yet

- Accounting For Intangible AssetsDocument47 pagesAccounting For Intangible AssetsMarriel Fate CullanoNo ratings yet

- DocumentsDocument36 pagesDocumentsPositive thinkingNo ratings yet

- Unit 3 FA-IIDocument19 pagesUnit 3 FA-IIBlack boxNo ratings yet

- CH 5 Depreciation and AmortisationDocument50 pagesCH 5 Depreciation and AmortisationdeepakNo ratings yet

- Intermediate AccountingDocument66 pagesIntermediate AccountingTiến NguyễnNo ratings yet

- Topic: Depreciation: Subtopic: Causes of Depreciation ObjectivesDocument3 pagesTopic: Depreciation: Subtopic: Causes of Depreciation ObjectivesFungaiNo ratings yet

- Irregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryFrom EverandIrregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryNo ratings yet

- Balances of Different Ledger Accounts Amount (RS)Document2 pagesBalances of Different Ledger Accounts Amount (RS)Ashish ChandraNo ratings yet

- Format of The Statement of Cash FlowsDocument3 pagesFormat of The Statement of Cash FlowsAshish ChandraNo ratings yet

- Consumer Service Innovation of FlipkartDocument4 pagesConsumer Service Innovation of FlipkartAshish ChandraNo ratings yet

- Résumé Writing: Goals, Tips, and JustificationsDocument34 pagesRésumé Writing: Goals, Tips, and JustificationsAshish ChandraNo ratings yet

- Imc Team 4 ReportDocument6 pagesImc Team 4 ReportAshish ChandraNo ratings yet

- Sip Report HDFC Bank (Digitization)Document65 pagesSip Report HDFC Bank (Digitization)Ashish Chandra100% (1)

- Study of Challenges Faced by Small Companies in Adopting Social Media MarketingDocument7 pagesStudy of Challenges Faced by Small Companies in Adopting Social Media MarketingAshish ChandraNo ratings yet

- Analyzing Consumer Behaviour in Context of New Product LaunchDocument41 pagesAnalyzing Consumer Behaviour in Context of New Product LaunchAshish ChandraNo ratings yet

- Study of Challenges Faced by Small Companies in Adopting Social Media MarketingDocument7 pagesStudy of Challenges Faced by Small Companies in Adopting Social Media MarketingAshish ChandraNo ratings yet

- Study of Challenges Faced by Small Companies in Adopting Social Media MarketingDocument7 pagesStudy of Challenges Faced by Small Companies in Adopting Social Media MarketingAshish ChandraNo ratings yet

- Philippines - (Complainant: United States) : Taxes On Distilled SpiritsDocument20 pagesPhilippines - (Complainant: United States) : Taxes On Distilled SpiritsMa Gabriellen Quijada-TabuñagNo ratings yet

- Investment DecisionsDocument11 pagesInvestment DecisionsNJUGUNA IANNo ratings yet

- Roles of RBI As Banker To GovernmentDocument6 pagesRoles of RBI As Banker To GovernmentRishav KumarNo ratings yet

- 9 & 10corporations - Final Tax, Capital Gains Tax, IAET and BPRT (Module 9 & 10) IllustrationsDocument4 pages9 & 10corporations - Final Tax, Capital Gains Tax, IAET and BPRT (Module 9 & 10) IllustrationsRyan CartaNo ratings yet

- CV Morten JosefsenDocument3 pagesCV Morten JosefsenMorten Josefsen100% (1)

- Pre Authorized Payment ApplicationDocument4 pagesPre Authorized Payment ApplicationStephanie MathersNo ratings yet

- DBA 5005 Strategic Investment and Financing DecisionsDocument263 pagesDBA 5005 Strategic Investment and Financing DecisionsShrividhyaNo ratings yet

- Cases For LeadershipDocument5 pagesCases For LeadershipAminouYaouNo ratings yet

- Test Report Advance SoufianeDocument1 pageTest Report Advance SoufianeSami SAMOUKNo ratings yet

- Qatar BanksDocument44 pagesQatar BanksShaik InayathNo ratings yet

- Review The Corporate Level Strategies The Organization CurrentlyDocument6 pagesReview The Corporate Level Strategies The Organization CurrentlyIndika JayaweeraNo ratings yet

- 中国经济中长期发展和转型 国际视角的思考与建议Document116 pages中国经济中长期发展和转型 国际视角的思考与建议penweiNo ratings yet

- Mike Wileman - LinkedInDocument2 pagesMike Wileman - LinkedInDonna SteenkampNo ratings yet

- SAR-MAR-210422-1227PM - RR - 034-COPY 1.editedDocument12 pagesSAR-MAR-210422-1227PM - RR - 034-COPY 1.editedJishnu ChaudhuriNo ratings yet

- Gaurav Newalkar New Edited by GGDocument36 pagesGaurav Newalkar New Edited by GGMurli SavitaNo ratings yet

- Food & Bev Snapshot PDFDocument6 pagesFood & Bev Snapshot PDFfiqxedNo ratings yet

- PURA - Hardworking Human - 2020Document32 pagesPURA - Hardworking Human - 2020Ganesh Deshmukh100% (1)

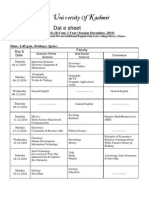

- Ni Versity of Ashmir: Dat e SheetDocument4 pagesNi Versity of Ashmir: Dat e SheetMukesh BishtNo ratings yet

- MBA Full Time (Core & Sectoral Program) Syllabus PDFDocument273 pagesMBA Full Time (Core & Sectoral Program) Syllabus PDF'Rohan NikamNo ratings yet

- Balance of PaymentDocument40 pagesBalance of PaymentgirishNo ratings yet

- TomatoproductdsDocument8 pagesTomatoproductdsrahuldtcNo ratings yet

- Bagnas v. CADocument1 pageBagnas v. CAMowanNo ratings yet

- Admission Form Dav ThermalDocument2 pagesAdmission Form Dav ThermalPardeep MalikNo ratings yet

- SalesA5GST 1Document6 pagesSalesA5GST 1Chintan B BhayaniNo ratings yet

- Financial Management: Topic: Risk & ReturnDocument4 pagesFinancial Management: Topic: Risk & ReturnIris FenelleNo ratings yet

- Jesus Redeems - Online PortalDocument1 pageJesus Redeems - Online PortalAnanthiNo ratings yet