Professional Documents

Culture Documents

Assessment Process With Government and Taxpayers Remedies

Assessment Process With Government and Taxpayers Remedies

Uploaded by

mina villamor0 ratings0% found this document useful (0 votes)

18 views1 pageAssesment Procedure of the BIR

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAssesment Procedure of the BIR

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

18 views1 pageAssessment Process With Government and Taxpayers Remedies

Assessment Process With Government and Taxpayers Remedies

Uploaded by

mina villamorAssesment Procedure of the BIR

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

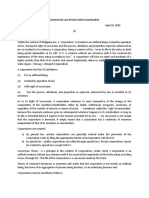

Assessment Process with Government and Taxpayers Remedies

Government will:

1. issue Letter of Authority

2. conduct Tax Audit/ Investigation by the Revenue Officer (RO)

3. issue PAN, except as those provided under SEC228 of the NIRC, if there is sufficient basis to

assess deficiency tax

Taxpayer may:

1. pay amount

2. ignore the PAN

3. file a reply to the PAN within 15 days

Government will:

1. dismiss assessment if reply is meritorious

2. issue FLD/FAN if Taxpayer is in default or unable to refute findings in PAN

Taxpayer may:

1. pay the FAN/FLD

2. fail to file a protest, hence assessment becomes final

3. protest the FAN within 30 days from receipt of assessment

If request for reconsideration, documents must be submitted within 60 days from filing of protest

Government may:

1. dismiss assessment if decision is in favor of the taxpayer

2. deny protest by duly authorized representative (FDDA)

3. deny protest by CIR (FDDA)

4. inaction by CIR or authorized representative within 180 days

Taxpayer may:

1. if denied by representative, file administrative appeal to CIR or appeal to the CTA within 30 days

2. if denied by CIR, file a Motion for Reconsideration with CIR or appeal to the CTA within 30 days

3. if inaction by CIR or after the expiration of the 180 day period, appeal to the CTA within 30 days

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- A Feminist Reading of Simone de Beauvior The Woman DestroyedDocument7 pagesA Feminist Reading of Simone de Beauvior The Woman Destroyedmina villamorNo ratings yet

- Commercial Law Review Set 3Document10 pagesCommercial Law Review Set 3mina villamorNo ratings yet

- Challenging Use of Cases of PronounsDocument2 pagesChallenging Use of Cases of Pronounsmina villamorNo ratings yet

- Afro Asian Literature ReviewerDocument31 pagesAfro Asian Literature Reviewermina villamorNo ratings yet

- Romina E. Villamor Study Guide 1 AnswersDocument3 pagesRomina E. Villamor Study Guide 1 Answersmina villamorNo ratings yet

- Sample Afro-Asian ExamDocument4 pagesSample Afro-Asian Exammina villamorNo ratings yet

- Commercial Law Review Set 2Document13 pagesCommercial Law Review Set 2mina villamorNo ratings yet

- Cultural DiversityDocument4 pagesCultural Diversitymina villamor100% (1)

- Dream VariationsDocument2 pagesDream Variationsmina villamorNo ratings yet

- Rescissible ContractsDocument19 pagesRescissible Contractsmina villamorNo ratings yet

- Election Law Q and ADocument7 pagesElection Law Q and Amina villamorNo ratings yet

- Doctrine of Limited LiabilityDocument6 pagesDoctrine of Limited Liabilitymina villamorNo ratings yet

- Intro To Creation StoriesDocument14 pagesIntro To Creation Storiesmina villamorNo ratings yet

- Mayer Steel Pipe Corp. vs. CA Case Digest: Dole Philippines, Inc. V Maritime Company of The PhilippinesDocument17 pagesMayer Steel Pipe Corp. vs. CA Case Digest: Dole Philippines, Inc. V Maritime Company of The Philippinesmina villamorNo ratings yet

- Feb. 18 GospelDocument1 pageFeb. 18 Gospelmina villamorNo ratings yet

- Final Exam in Elt 102Document1 pageFinal Exam in Elt 102mina villamorNo ratings yet

- Electronic Evidence Cases (As Listed in TheDocument11 pagesElectronic Evidence Cases (As Listed in Themina villamorNo ratings yet

- 2018 Sona HighlightsDocument2 pages2018 Sona Highlightsmina villamorNo ratings yet

- Midterm Exam in Eng 105Document1 pageMidterm Exam in Eng 105mina villamorNo ratings yet

- University of Sto. Tomas - Legazpi College of Law Review On Taxtion Quiz # 2Document1 pageUniversity of Sto. Tomas - Legazpi College of Law Review On Taxtion Quiz # 2mina villamorNo ratings yet

- HestiaDocument6 pagesHestiamina villamorNo ratings yet

- STATIONERYDocument1 pageSTATIONERYmina villamorNo ratings yet