Professional Documents

Culture Documents

What Is Technical Analysis?: It's The Study of Market Action Primarily Through The Use of Charts

What Is Technical Analysis?: It's The Study of Market Action Primarily Through The Use of Charts

Uploaded by

neerajOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Is Technical Analysis?: It's The Study of Market Action Primarily Through The Use of Charts

What Is Technical Analysis?: It's The Study of Market Action Primarily Through The Use of Charts

Uploaded by

neerajCopyright:

Available Formats

INVESTMENT IN SHARES ❾

| Technical analysis |

What is Technical Analysis?

It's the study of market action primarily through the use of charts

A

S WE DISCUSSED in week five of However, Rom The pure

this series, there are two broad schools says that the two technical

of investment analysis: fundamental approaches do not analyst

and technical analysis. We have explored fun- invalidate each attempts to

damental analysis – finding the intrinsic value other and in fact bypass the

of a share through detailed investigation of are complemen- uncertainty of

the economy, industry and company itself – in tary. fundamental

analysis.

some detail in the past few weeks. Now we will The beauty of

Yonatan Rom

examine technical analysis: understand what it technical analysis

is, provide a few pointers on how to get started is that it uses only

and where to find more information. publicly available

Yonatan Rom, CEO of The Winning Edge share price infor-

and a technical analysis expert, describes tech- mation to iden-

nical analysis as: “The study of market action tify trends in share basic and R650 for the advanced.) There’s

primarily through the use of charts for the pur- prices and markets. These trends are then used also a free interactive basic technical analysis

pose of forecasting future price trends.” to make investment decisions. As a result, course available online for Online Share Trad-

Rom says that technical analysis differs technical analysis can be far more clinical than ing clients.

from fundamental analysis in two key ways. fundamental analysis and technical traders are Thirdly, there’s a charting tool available on

Firstly, technical analysts study market less likely to become too emotionally involved the website that uses ten years’ data.

action (that is price) whereas fundamental with their portfolio and so are more willing to For those who want to combine technical

analysts look at the factors affecting supply cut their losses rather than hanging on in the and fundamental analysis, Online Share Trad-

and demand. Secondly, technical analysts look hope that the fundamentals will, ultimately, ing has just introduced a new and exciting

at the effects of market movements whereas reassert themselves. investment tool called ShareMagic. ShareMag-

fundamental analysts look at the cause of mar- There are a number of books available on ic is a technical (charting) and fundamental

ket movements. “The pure technical analyst technical analysis for novices interested in pur- analysis package from ProfileData, the same

attempts to bypass the uncertainty of funda- suing this further. In addition, the process can company from which Online Share Trading

mental analysis and takes out the ambiguities be simplified – and its accuracy increased – by sources company profiles and research tools

of what factors are driving supply and demand. using technical analysis software. Standard’s for its website. Online Share Trading from the

It just looks at price action as simply as Online Share Trading customers can download Standard has negotiated a 50% discount for its

possible.” daily technical analysis data at discounted clients who will pay just R2 995,00 (including

The result, as Richard Seddon – head of prices through the website www.securities. VAT) for the software package. This is subject

Online Share Trading at the Standard – points co.za at R90 a month. to a 12-month download subscription. Online

out, is that technical analysis is useful in timing Online Share Trading also offers its cli- Share Trading clients also qualify for a dis-

the market when used with other confirming ents face-to-face basic and advanced courses count on the monthly download service fee and

data. on technical analysis for a low fee (R350 for pay just R134 a month (including VAT). ¤

The three key concepts of Technical Analysis

FOR TECHNICAL ANALYSTS, it’s irrel- market discounts everything”. Fundamental and market psychology, are all priced into the

evant whether a stock is expensive or cheap purists criticise technical analysis on the stock, removing the need to actually consider

relative to its fundamentals. The only thing grounds that it looks only at price movements these factors separately. This only leaves the

that matters, according to Investopedia.com, and completely ignores the fundamental driv- analysis of price movement, which technical

is “a security’s past trading data and what ers of profitability. However, as Investopedia. theory views as a product of the supply and

information this data can provide about where com notes: “Technical analysis assumes that, demand for a particular stock in the market.”

the security might move in future”. Technical at any given time, a stock’s price reflects eve- Secondly, technical analysis is based on

analysis is based on three key assumptions: rything that has or could affect the company the premise that prices move in trends. In a

the market discounts everything, share prices – including fundamental factors. Technical nutshell this means that once a trend in the

move in trends and that history repeats itself. analysts believe that the company’s funda- direction of a share price has been estab-

The first key assumption is that “the mentals, along with broader economic factors lished, the next move in share prices is more

31 AUGUST 2006 FINWEEK 1

INVESTMENT IN SHARES ❾

likely to be in the same direction as that trend The last key assumption upon which the ket stimuli over time. Technical analysis uses

rather than in a different direction. In other discipline of technical analysis is built is chart patterns to analyse market movements

words, if a share price is firmly established that history tends to repeat itself, especially and understand trends.

in a bull (or upward trend), the share price in share price movement. Investopedia.com Although many of these charts have been

is more likely to continue increasing rather says: “The repetitive nature of price move- used for more than 100 years, they are still

than decrease in the next trading period. Most ments is attributed to market psychology. believed to be relevant because they illustrate

technical trading strategies are based on this In other words, market participants tend to patterns in price movements that often repeat

assumption. provide a consistent reaction to similar mar- themselves.” ¤

First Steps in Technical Analysis: Charts

TECHNICAL ANALYSIS is the study of to seconds. The most frequently used time rithmic chart shows you the percentage move

market action (in prices), mainly using charts. scales are intraday, daily, weekly, monthly, in a share price, which is what investors are

In this article, we’ll discuss what charts are quarterly and annually. The shorter the time interested in.

and the different types of charts used by tech- frame, the more detailed the chart. Each data These two concepts are illustrated in

nical analysts. point can represent the closing price of the graph 2.

In simple terms, charts are the basic period or show the open, the high, the low From this basic discussion, let’s look at

building blocks of technical analysis. They and the close depending on the chart used. the four most common types of technical

can provide buy or sell signals to those who The second key thing to note is the price analysis charts and what they’re used for. The

know what they are looking for. scale on the right hand side of the chart. The chart types are: the line chart, the bar chart,

Technical analysis charts look exactly price scale moves from low prices to high the candlestick chart and the point and figure

the same as any other business-related chart. prices, but the catch is that it can be con- chart.

Investopedia.com says: “A chart is simply a structed using either a linear (or arithmetic) Investopedia.com says: “The most basic

graphical representation of a series of prices or logarithmic scale. of the four charts is the line chart (graph

over a set time frame. For example, a chart Investopedia.com notes: “If a price scale 3) because it represents only the closing

may show a stock’s price movement over is constructed using a linear scale, the space prices over a set period. The line is formed

a one-year period, where each point on the between each price point (10, 20, 30, 40) by connecting the closing prices over the

graph represents the closing price for each is separated by an equal amount. A price time frame. Line charts do not provide visual

day the stock is traded.” (See graph 1.) The move from 10 to 20 on a linear scale is the information of the trading range for the indi-

time scale runs at the bottom (or x-) axis, same distance on the chart as a move from vidual points such as the high, low and open-

while the share price is shown on the vertical 40 to 50. In other words, the price scale ing prices. However, the closing price is often

(or y-) axis. Graph 1 shows that this particular measures moves in absolute terms and does considered to be the most important price in

share price was R245 in October 2004 (point not show the effects of percentage change. stock data compared to the high and low for

1) and rose to R265 in June 2005. If a price scale is in logarithmic terms, then the day and this is why it’s the only value used

There are two key things to note when the distance between points will be equal in in line charts.”

you look at a chart: the time scale and the terms of percentage change. A price change The second type of chart is the bar

price scale. from 10 to 20 is a 100% increase in the price chart (graph 4). Investopedia.com says it’s an

According to Investopedia.com, the time while a move from 40 to 50 is only a 25% improvement “on the line chart as it adds sev-

scale refers to the range of dates at the bottom change, even though they are represented by eral more key pieces of information to each

4

of the chart, which can vary from decades the same distance on a linear scale.” A loga- data point. The chart is made up of a series of »

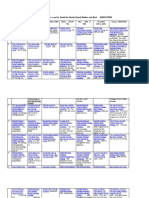

> GRAPH 1: Basic Share price chart > GRAPH 2: pricing sCales > GRAPH 3: line chart

275 50 1315

Point #2 45 Linear (Arithmetic) Price Scale

Logarithmic (Log) Price Scale

35

1300

255

25

30

Point #1 1285

235

Notice how the scale is 1270

215 15

not evenly spaced. The

Notice how the scale

distance between $10

and $20 is the same as

10

increases by $5 and is

equally spaced.

the distance beween 1255

195 $20 and $40

5 1245

2004 2005 Aug Nov 05 Apr Aug Nov 05 Apr 2006 Feb Mar Apr May

Source: Investopedia.com Source: Investopedia.com Source: Investopedia.com

2 FINWEEK 31 AUGUST 2006

INVESTMENT IN SHARES ❾

2 vertical lines that represent each data point. value over that period. When this is the case, colours to explain what has happened during

« A vertical line represents the high and low the dash on the right (close) is lower than the the trading period.”

for the trading period, along with the closing dash on the left (open).” Candlestick charts use different colours

price. The close and open are represented on Thirdly, technical analysts commonly use depending on whether a share price increased

the vertical line by a horizontal dash. The the candlestick chart (graph 5). Investopedia. or fell in a trading day.

opening price on a bar chart is illustrated by com says, it “is similar to a bar chart, but The last commonly used chart is the point

the dash that’s located on the left side of the it differs in the way that it’s visually con- and figure chart (graph 6). According to

vertical bar. Conversely, the close is repre- structed. Similar to the bar chart, the candle- Investopedia.com: “This type of chart reflects

sented by the dash on the right. Generally, stick also has a thin vertical line showing the price movements and is not as concerned

if the left dash (open) is lower than the right period’s trading range. The difference comes about time and volume in the formulation of

dash (close) then the bar will be shaded black, in the formation of a wide bar on the vertical the points. The point and figure chart removes

representing an up period for the stock, which line, which illustrates the difference between the noise, or insignificant price movements,

means it’s gained value. A bar that’s coloured the open and close. And, like other charts, in the stock, which can distort traders’ views

red signals that the stock has gone down in Candlesticks also rely heavily on the use of of the price trends.” ¤

> GRAPH 4: A BAR CHART > CHART 5: CANDELSTICK CHART > GRAPH 6: point and figure chart

1320

1315 1300

1305 1250

1300

1290

1200

1285

1275 1150

1270

1260 1100

1245

1245

2006 Feb Mar Apr May 2006 Feb Mar Apr May 04 05 06 05

Source: Investopedia.com Source: Investopedia.com Source: Investopedia.com

The Advantages of Technical Analysis

ALTHOUGH TECHNICAL ANALYSIS can to any trading medium or time horizon. Techni- The last key advantage of technical analysis

appear to be incredibly complicated and not cal analysis can be used on any financial secu- over fundamental analysis is that investors can

for the “fundamental investment purist”, it does rity with a trading history, including shares, unit look at any market instead of just focusing on

have some advantages over fundamental invest- trusts, commodities, foreign exchange, fixed a narrow range of investment instruments as

ment analysis. income securities or futures. fundamental analysts do, which can be very

Yonatan Rom, CEO of The Winning Edge, In addition, technical traders can change time-consuming.

says that technical analysis has three key advan- their investment horizon to whatever they want Technical analysis is an important tool in

tages over fundamental analysis. as you get daily, weekly, monthly or intraday the investor’s arsenal and is increasingly used by

The first key advantage of technical analy- charts that can go from minute-to-minute or both professional and personal investors to aid in

sis, according to Rom, is that it can be adapted 30-minute charts. making and timing investment decisions. ¤

>

QUIZ

EACH WEEK we’ll publish three ques- each week’s questions. 1. What is technical analysis?

tions related to the week’s content. At To take part in the draw just 2. What are the three key concepts of

the end of the 12 weeks Online Share answer the following questions and technical analysis?

Trading will give R10 000 worth of submit your answers either online to 3. What are the building blocks of

Satrix shares in an online account to SBquizz@finweek.co.za or by fax to technical analysis? ¤

the reader who has correctly answered (011) 884-0851.

Online Share Trading is operated by Standard Financial Markets (Pty) Ltd. Reg. No. 1972/008305/07. An authorised user of the JSE Limited and a member of the Standard Bank Group.

COPY: Kirsty Laschinger ADVERTISING: Shaun Besarab

4 FINWEEK 31 AUGUST 2006

You might also like

- Mastering Fundamental AnalysisDocument242 pagesMastering Fundamental Analysissairanga1997% (31)

- 10 2022Document64 pages10 2022Ahm FerdousNo ratings yet

- A simple approach to technical analysis of financial markets: How to construct and interpret technical analysis charts to improve your online trading activityFrom EverandA simple approach to technical analysis of financial markets: How to construct and interpret technical analysis charts to improve your online trading activityRating: 3 out of 5 stars3/5 (1)

- Technical Analysis of StockDocument77 pagesTechnical Analysis of StockBhavesh RogheliyaNo ratings yet

- Technical Analysis: Learn To Analyse The Market Structure And Price Action And Use Them To Make Money With Tactical Trading StrategiesFrom EverandTechnical Analysis: Learn To Analyse The Market Structure And Price Action And Use Them To Make Money With Tactical Trading StrategiesRating: 4 out of 5 stars4/5 (40)

- Entry and Exit Point For Intraday TradingDocument4 pagesEntry and Exit Point For Intraday TradingSANTIKIRI PONo ratings yet

- CMT BookDocument45 pagesCMT Bookprem sagar50% (2)

- Top Trading TipsDocument55 pagesTop Trading TipsRadhika TrisyahdanaNo ratings yet

- Technical Analysis of Stocks Commodities 2018 No 08Document64 pagesTechnical Analysis of Stocks Commodities 2018 No 08s9298100% (2)

- Nihar - TECHNICAL ANALYSISDocument56 pagesNihar - TECHNICAL ANALYSISNihar SavaliyaNo ratings yet

- Technical AnalysisDocument65 pagesTechnical Analysisaurorashiva1No ratings yet

- Cory Janssen Chad Langager Casey Murphy: Fundamental Analysis Technical AnalysisDocument43 pagesCory Janssen Chad Langager Casey Murphy: Fundamental Analysis Technical AnalysisRahul ChaudharyNo ratings yet

- Complete Final NanduDocument76 pagesComplete Final Nandupandukrish0143No ratings yet

- Energy Trading (Unit 04)Document54 pagesEnergy Trading (Unit 04)rathneshkumar100% (1)

- Technical Analysis by MetastockDocument47 pagesTechnical Analysis by MetastockRoulette Taurosso100% (1)

- Technical AnalysisDocument94 pagesTechnical AnalysisPranav Vira100% (1)

- Technical Analysis SynopsisDocument15 pagesTechnical Analysis Synopsisfinance24100% (1)

- Technical AnalysisDocument31 pagesTechnical AnalysismubinNo ratings yet

- Tech AnsisDocument40 pagesTech AnsisnitinvasuNo ratings yet

- Tech AnalysisDocument29 pagesTech AnalysisNirmala RaniNo ratings yet

- Project Report Submitted For The Partial Fulfillment of TheDocument42 pagesProject Report Submitted For The Partial Fulfillment of Thedhiraj singhNo ratings yet

- Questionnaire Stock MarketDocument18 pagesQuestionnaire Stock Marketprateek gangwaniNo ratings yet

- Role of Technical Analysis As A Tool For Trading DecisionsDocument43 pagesRole of Technical Analysis As A Tool For Trading Decisionsgauravw008100% (1)

- Fundamental Analysis Technical Analysis: 1. The Market Discounts EverythingDocument13 pagesFundamental Analysis Technical Analysis: 1. The Market Discounts EverythingMuhammad SaidNo ratings yet

- Varshini EquityresearchusingtechnicalanalysisDocument10 pagesVarshini EquityresearchusingtechnicalanalysisNeeraj KumarNo ratings yet

- Project Report Submitted For The Partial Fulfillment of TheDocument42 pagesProject Report Submitted For The Partial Fulfillment of TheVignesh HollaNo ratings yet

- Earnings Expenses Assets Liabilities: The DifferencesDocument15 pagesEarnings Expenses Assets Liabilities: The DifferencesAnshita GargNo ratings yet

- Fundamental Analysis Covering EICDocument15 pagesFundamental Analysis Covering EICsatinderpalkaurNo ratings yet

- Role of Technical Analysis As A Tool For Trading DecisionsDocument43 pagesRole of Technical Analysis As A Tool For Trading DecisionsDeepak Shrivastava100% (1)

- Equity Research Using Technical Analysis: July 2019Document10 pagesEquity Research Using Technical Analysis: July 2019Siva RajNo ratings yet

- Notes On Technical AnalysisDocument40 pagesNotes On Technical Analysissandip sinha100% (1)

- Technical AnalysisDocument18 pagesTechnical AnalysisMayank GuptaNo ratings yet

- Chapter 1Document7 pagesChapter 1ashi ashiNo ratings yet

- Investment Assignment (Yitagesu Wondachew)Document9 pagesInvestment Assignment (Yitagesu Wondachew)yitNo ratings yet

- 1 Technical AnalysisDocument12 pages1 Technical Analysismonik shahNo ratings yet

- Effectiveness of Technical Analysis in Banking Sector of Equity MarketDocument9 pagesEffectiveness of Technical Analysis in Banking Sector of Equity MarketSriranga G HNo ratings yet

- What Is Technical Analysis?: Intrinsic Value PatternsDocument21 pagesWhat Is Technical Analysis?: Intrinsic Value PatternsAna Gabrielle Montenegro CascoNo ratings yet

- Comparative Analysis Between The Fundamental and Technical Analysis 2016 PDFDocument6 pagesComparative Analysis Between The Fundamental and Technical Analysis 2016 PDFYoh Sandriano Naru HitangNo ratings yet

- Technical Analysis: IntroductionDocument51 pagesTechnical Analysis: IntroductionAbhishek Lenka100% (1)

- Technical Analysis: The Basic AssumptionsDocument30 pagesTechnical Analysis: The Basic AssumptionsDevdutt RainaNo ratings yet

- Adobe Scan 18-Sept-2023Document22 pagesAdobe Scan 18-Sept-2023Harshita GuptaNo ratings yet

- Technic AnalysisDocument66 pagesTechnic AnalysisqrweqtweqtqNo ratings yet

- A Study On Technical Analysis of Select Listed Companies in Bse With Referene To KarvyDocument12 pagesA Study On Technical Analysis of Select Listed Companies in Bse With Referene To KarvyRaj KumarNo ratings yet

- Machine Learning Algorithms For Stock Market PredictionDocument7 pagesMachine Learning Algorithms For Stock Market PredictionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- IapmDocument3 pagesIapmmanishaNo ratings yet

- Final Synopsis (Monika)Document4 pagesFinal Synopsis (Monika)Monika GhoshNo ratings yet

- Technical Analysis: IntroductionDocument41 pagesTechnical Analysis: IntroductionACeNo ratings yet

- Technical AnalysisDocument46 pagesTechnical AnalysisAnam Tawhid100% (1)

- Balaji ProjectDocument72 pagesBalaji ProjectDeepak RanjanNo ratings yet

- Technical Analysis of Selected Auto Shares Listed On Indian Stock ExchangeDocument9 pagesTechnical Analysis of Selected Auto Shares Listed On Indian Stock ExchangeRajesh SadhwaniNo ratings yet

- Optimized Indicators of Technical Analysis On TheDocument10 pagesOptimized Indicators of Technical Analysis On Themohdlareb75No ratings yet

- Fta BajajDocument10 pagesFta BajajKhaisarKhaisarNo ratings yet

- Technical Analysis: Dr.D.S.PrasadDocument152 pagesTechnical Analysis: Dr.D.S.PrasadDrKunal Karade100% (1)

- Investment Analysis 8Document6 pagesInvestment Analysis 8Mujtaba AhmadNo ratings yet

- NOV161462 (1) Refernce 5Document6 pagesNOV161462 (1) Refernce 5Aani RashNo ratings yet

- UNIT 5 - Technical Analysis in InvestmentDocument22 pagesUNIT 5 - Technical Analysis in InvestmentmoltenadNo ratings yet

- Chapter 2Document11 pagesChapter 2Temporary MailNo ratings yet

- Abhishek Rai DissertationDocument120 pagesAbhishek Rai DissertationAnurag MohantyNo ratings yet

- Unit 8 Technical Analysis: ObjectivesDocument13 pagesUnit 8 Technical Analysis: Objectivesveggi expressNo ratings yet

- SAPM - Technical Analysis Unit 3Document14 pagesSAPM - Technical Analysis Unit 3Priya KNo ratings yet

- 33 Dheeraj Trilokchandani - Technical Analysis of Indian Stock MarketDocument64 pages33 Dheeraj Trilokchandani - Technical Analysis of Indian Stock Marketrahulsogani123100% (1)

- Vinod PJCT NEWDocument90 pagesVinod PJCT NEWmanojNo ratings yet

- Technical Analysis and Fundamental Analysis Are The Two Main Schools of Thought in The FinancialDocument2 pagesTechnical Analysis and Fundamental Analysis Are The Two Main Schools of Thought in The Financialdurgesh dhumalNo ratings yet

- Use of Vectors in Financial Graphs: by Dr Abdul Rahim WongFrom EverandUse of Vectors in Financial Graphs: by Dr Abdul Rahim WongNo ratings yet

- The Strategic Technical Analysis of the Financial Markets: An All-Inclusive Guide to Trading Methods and ApplicationsFrom EverandThe Strategic Technical Analysis of the Financial Markets: An All-Inclusive Guide to Trading Methods and ApplicationsNo ratings yet

- SD211 Part1 MerchantVessels PDFDocument34 pagesSD211 Part1 MerchantVessels PDFneerajNo ratings yet

- Wah Shan 1Document2 pagesWah Shan 1neerajNo ratings yet

- A Perfect Event Every Time... : Excellent Learning Facilities TransportationDocument2 pagesA Perfect Event Every Time... : Excellent Learning Facilities TransportationneerajNo ratings yet

- Msin 1320 Anx 2Document5 pagesMsin 1320 Anx 2neerajNo ratings yet

- Petrolpages PDFDocument4 pagesPetrolpages PDFneerajNo ratings yet

- Eam ElegraphDocument8 pagesEam ElegraphneerajNo ratings yet

- India Citizens CharterDocument18 pagesIndia Citizens CharterneerajNo ratings yet

- Maritime LawDocument12 pagesMaritime Lawneeraj100% (1)

- JAN FEB MAR APR MAY JUN July AUG Sept OCT NOV DEC Course NameDocument2 pagesJAN FEB MAR APR MAY JUN July AUG Sept OCT NOV DEC Course NameneerajNo ratings yet

- North Signals Issue 112 June 2018 OnlineDocument11 pagesNorth Signals Issue 112 June 2018 OnlineneerajNo ratings yet

- Rice CargoDocument16 pagesRice CargoneerajNo ratings yet

- Yantez RivverDocument15 pagesYantez RivverneerajNo ratings yet

- Kelvin Compass DeflectorDocument3 pagesKelvin Compass Deflectorneeraj0% (1)

- West P&i Rule Book 2018Document204 pagesWest P&i Rule Book 2018neerajNo ratings yet

- Magnetic Compass Error Calculation 2Document1 pageMagnetic Compass Error Calculation 2neerajNo ratings yet

- Parametric RollingDocument7 pagesParametric RollingneerajNo ratings yet

- Table 3-1. Troubleshooting Guidelines: Perform All Troubleshooting in An Area Free of Combustible GasesDocument1 pageTable 3-1. Troubleshooting Guidelines: Perform All Troubleshooting in An Area Free of Combustible GasesneerajNo ratings yet

- Stability Criteria For Grain Cargo: Home Port Chief Mate Chief Mater-Oral English Lessons My Books Master Class - 1Document6 pagesStability Criteria For Grain Cargo: Home Port Chief Mate Chief Mater-Oral English Lessons My Books Master Class - 1neerajNo ratings yet

- Battery Replacement: Chapter 3, MaintenanceDocument1 pageBattery Replacement: Chapter 3, MaintenanceneerajNo ratings yet

- Figure 3-4. Flashback Arrester Locations: Chapter 3, MaintenanceDocument1 pageFigure 3-4. Flashback Arrester Locations: Chapter 3, MaintenanceneerajNo ratings yet

- Chapter 3, Maintenance: Figure 3-3. Location of Parts in Filament WellsDocument1 pageChapter 3, Maintenance: Figure 3-3. Location of Parts in Filament WellsneerajNo ratings yet

- Section 3 MaintenanceDocument1 pageSection 3 MaintenanceneerajNo ratings yet

- Flashback Arrester Replacement: WarningDocument1 pageFlashback Arrester Replacement: WarningneerajNo ratings yet

- Chapter 3, Maintenance: Figure 3-1. TC Filament LocationDocument1 pageChapter 3, Maintenance: Figure 3-1. TC Filament LocationneerajNo ratings yet

- Chapter 3, Maintenance: Figure 3-2. Cotton Filter ReplacementDocument1 pageChapter 3, Maintenance: Figure 3-2. Cotton Filter ReplacementneerajNo ratings yet

- RFLR Artificial Intelligence in Asset ManagementDocument100 pagesRFLR Artificial Intelligence in Asset ManagementJason MilesNo ratings yet

- Foreign Exchange 101: Presented By: Jervin S. de Celis, CSR, CFMPDocument99 pagesForeign Exchange 101: Presented By: Jervin S. de Celis, CSR, CFMParthur the greatNo ratings yet

- The HANDBOOK of Trading Strategies. Strategies For Navigating and Profiting - CONTENTSDocument12 pagesThe HANDBOOK of Trading Strategies. Strategies For Navigating and Profiting - CONTENTSmerlinakisNo ratings yet

- BBMF2023 Tutorial Group 3 Power Root BerhadDocument35 pagesBBMF2023 Tutorial Group 3 Power Root BerhadKar EngNo ratings yet

- Trade Like A Pro With Japanese Candlesticks EbookDocument78 pagesTrade Like A Pro With Japanese Candlesticks EbookL M50% (2)

- A Study On Fundamental Analysis of Top IT Companies in India+Document13 pagesA Study On Fundamental Analysis of Top IT Companies in India+Muttavva mudenagudiNo ratings yet

- Dps Security Analysis and Portfolio ManagementDocument96 pagesDps Security Analysis and Portfolio ManagementDipali ManjuchaNo ratings yet

- D Ifta Journal 04Document44 pagesD Ifta Journal 04fredNo ratings yet

- Classical Charting & Technical AnalysisDocument17 pagesClassical Charting & Technical AnalysiszerdnaNo ratings yet

- Post Graduate Diploma BrochureDocument36 pagesPost Graduate Diploma BrochureAtanu SamataNo ratings yet

- BrochureDocument5 pagesBrochurePartibanKumarNo ratings yet

- 6 The Academy of Forex Table For Could Be Good Good Better and Best INDICATORSDocument56 pages6 The Academy of Forex Table For Could Be Good Good Better and Best INDICATORSPaulinus OnyejeluNo ratings yet

- File 29Document4 pagesFile 29Krishna C NNo ratings yet

- MGT521 Security Analysis and Portfolio Management 11567::sukhwinder Kaur 4.0 1.0 0.0 5.0 Courses With Numerical and Conceptual FocusDocument12 pagesMGT521 Security Analysis and Portfolio Management 11567::sukhwinder Kaur 4.0 1.0 0.0 5.0 Courses With Numerical and Conceptual FocusAmit KumarNo ratings yet

- Crypto Trading ProDocument3 pagesCrypto Trading ProM SerhatNo ratings yet

- Support and Resistance White Paper PDFDocument17 pagesSupport and Resistance White Paper PDFshermanNo ratings yet

- Certified Financial Technician (CFTe) - IFTADocument4 pagesCertified Financial Technician (CFTe) - IFTAAnopa KachereNo ratings yet

- Conference: 2021 International VirtualDocument5 pagesConference: 2021 International Virtualusama zedanNo ratings yet

- Improving Stock Trend Prediction Using LSTM Neural Network Trained On A Complex Trading StrategyDocument13 pagesImproving Stock Trend Prediction Using LSTM Neural Network Trained On A Complex Trading StrategyIJRASETPublicationsNo ratings yet

- Mbaproject - Kotak Sec PDFDocument63 pagesMbaproject - Kotak Sec PDFNAWAZ SHAIKHNo ratings yet

- Supreme IQ OptionDocument2 pagesSupreme IQ OptionIndigo GraficosNo ratings yet

- Trading The Gartley 222Document14 pagesTrading The Gartley 222Joao PereiraNo ratings yet

- BWB3068-IBF4 - Alternative InvestmentsDocument3 pagesBWB3068-IBF4 - Alternative InvestmentsHetty SamosirNo ratings yet

- Chapter - 1Document111 pagesChapter - 1Niranjan Phuyal100% (1)