Professional Documents

Culture Documents

Secretary Benson Discloses Personal Finances

Secretary Benson Discloses Personal Finances

Uploaded by

WDET 101.9 FMCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Secretary Benson Discloses Personal Finances

Secretary Benson Discloses Personal Finances

Uploaded by

WDET 101.9 FMCopyright:

Page 1 of_!

}_

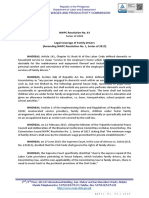

Form A

MICHIGAN DEPARTMENT OF STATE

2018 VOLUNTARY FINANCIAL DISCLOSURE STATEMENT

(Office Use Only)

Name: Joe e f¥i'\ 8e.JI\ son Daytime Telephone:

REPORT

TYPE [Z] 2018 Annual (Due: May 15, 2019)

PRELIMINARY INFORMATION -ANSWER EACH OF THESE QUESTIONS

Ame11dment

A. Did you, your spouse, or your dependent child:

a. Own any reportable asset that was worth more than $500 at the

end of the reporting period? Q!

b. Receive more than $500 in unearned income from any reportable

Yes [Zj No

F. Did you have any reportable agreement or arrangement with an

outside entity during the reporting period or in the current calendar

year up through the date of filing?

Yes

~ No

asset during the reportina oeriod?

B. Did you, your spouse, or your dependent child purchase, sell, or

exchange any securities or reportable real estate in a transaction

exceeding $500 during the reporting period?

Yes No

~

G. Did you, your spouse, or your dependent child receive any

reportable gift(s) totaling more than $500 in value from a single

source during the reporting oeriod?

Yes

No

~

C. Did you or your spouse have "earned" income (e.g., salaries,

honoraria, or pension/IRA distributions) of $500 or more during the

reporting period?

Yes [Xi No

H. Did you, your spouse, or your dependent child receive any

reportable travel or reimbursements for travel totaling more than

$500 in value from a single source during the reporting period?

Yes

No [¼]

D. Did you, your spouse, or your dependent child have any reportable

liability (more than $10,000) at any point during the reporting period?

YesD No [xJ I. Did any individual or organization mal<e a donation to charity in

lieu of paying you for a speech, appearance, or article during the

reporting period?

Yes No ~

E. Did you hold any reportable positions during the reporting period or in

the current calendar year up through the date of filing? Yes IZ] No

ATTACH THE CORRESPONDING SCHEDULE IF YOU ANSWER "YES"

SCHEDULE A - ASSETS & "UNEARNED INCOME"

I Name Jocelyn Ben.,s on I........2=......,_!L

BLOCK A BLOCK B BLOCKC BLOCKD BLOCK E

Assets and/or Income Sources Value of Asset Type of Income Amount of Income Transaction

Identify (a) each asset held for Investment or Indicate value of asset at close of the reporting period. If you use a Check all columns that apply. For accounts that For assets for which you checked "Tax-Deferred· In Block C, you Indicate if the

production of income and with a fair market value valuation method other than fair market value. please specify the method generate tax-deferred income (such as 401(k), IRA, or may check the .. None~ column. For all other assets indicate the asset had

exceeding $500 al the end of the reporting period, used. 529 accounts). you may check lhe "Tax-Deferred' category of income by checking the appropriate box below. purchases (P),

and (b) any other reportable asset or source of

If an asset was sold during the reporting period and is included only

column. Dividends, interest, and capital gains, Dividends, interest, and capital gains, even if reinvested, sales (S), or

income that generated more than S500 in "'unearned"

because it generated income, the value should be .. None. ft

even if reinvested, must be disclosed as income must be disclosed as income for assets held in taxable exchanges (E)

income during the year. for assets held in taxable accounts. Check "None• accounts. Check "NoneM ii no income was earned or exceeding $500

·column M is for assets held by your spouse or dependent child in which if the asset generated no income during the reporting generated. in the reporting

Provide complete names of stocks and mutual funds you have no interest period. period.

(do not use only bcker symbols). ·column XII is for assets held by your spouse or dependent

If only a portion or

child in which you have no interest.

an asset was sold,

For all IRAs and other retirement plans (such as please indicate as

401(k) plans~ provide the value lor each asset held In !allows: (S (part)).

the account hat exceeds the reporting thresholds.

A B C D E F G H I J K L M I I Ill N V VI VII VIII IX X XI XI Leave this column

For bank and other cash accounts. totar the amount

blank lf there are

in all interest-bearing accounts. If the total is over

no transactions

$500, list every financial institution where there is

that exceeded

more than S500 in interest-bearing accounts.

$500.

For rental and other real property held for investment,

provide a complete address or description. e.g.,

"rental property," and a city and state.

For an ownership interest in a privately-held business

that is not publicly traded, stale the name of the

business, the nature of its activities, and its

geographic location in Block A.

Exclude: Your personal residence. including second

homes and vacation homes (unless there was rental

income during the reporting period): and any financial

interest In. or income derived from. a state

"~

E

~

retirement program, including the Thrift Savings Plan.

If you report a privately-traded fund that is an

!

!S

~

Excepted Investment Fund, please check the •EIF § 11 !

box.

If you so choose, you may indicate that an asset o § § ;;;

§

ti

::,

...

.

~

ts

j

§ g §8

0:

g ! <I> ;;;

t

income source is that of your spouse (SP) or

dependent child (DC), or jointly held with anyone

(JT), in the optional column on the far left. §

0

8 ~

g

0

~

! I

§

I 8

~ ij

8

iij §

J "'z

,_ <C i "'

0

z

w

0

~

E

i

0..

§

0

~ I;;,. 0

8.

:::: § J

q

For a detailed discussion of Schedule A

requirements, please refer to the instruction booklet.

.,

8

z

0

~

~

'!?

'I'

a

;;;

g

"t

g

~

;;,.

g g g

~

g

"'

g

~ l)l I

":'

!I ::l

8

~ !

&

i

0

0

3l

cl

w

z

0

z

"'

0

i5

Q

:,.

0

ffi I!!

~

"'

ll! ~ Ii:

"'

~

0

w

...

"'

w

w

u

X

w i !i

0

1'.

~€

~

<I>

8

z

0

!

§

~

i)!

§

~

~

IaIa! !!

:;:

:)i

'!?

'I'

::l

lil

"t

~

~

g ~ g

::;i 3l

8.

V,

P, S, S(part), or E

"'

SP, IEIF

DC, 1.§1'~~ Stoc~ .. -- --~ - _._L --·- ---·-

X

- - J - - f--- - - l - - -

I X

~1-.--

X

1--- ~

-·

S(pa,t)

JT

Examples.·! ISifflOl\ & s<1,.1ster I indefinite I I I I I

Royallles

X

I

Pa,tnershp

I jABC He<fge Fund X X

lncooie

X

DT ~;c.a..{ 13tUJ" )<. X IX

II

IJM tr-edit U,deii'\ X )( X

I( P/\lt1_ Ra~ ltC. X X X

IA/.C. /J '-103 (~) 'f X IX

Use additional sheets if more space is required.

C: ~ 0 UI

40~~ en

."' ~ (")

QI )>

"'"' :c

!g·

il m

!!!.

k:: Ill

C

:::, C

"' ~ c..

CD r

Q r- m

f g:

"' 0

::;; ... Cl

3

.,5" ;,;

)>

~ ~ 0

0 ~

nl ~ 3Cl) I

,:,

"' IJ)

)>

QI

:;: 0 en

C

;;;·

riCl)

en

nl m

.rJ --t

C "'

~ m en

p. '" None QI>

>

S1-$1.000 C

"" z

S1.001-$15,000 ()

m

)>

S15.001-$50,000

;;a

0

z

S50.001-$100.000 m < m

Ill C

S100,001-$250,000 .,, E' CD

Cl) r-

>< 0 -z

S250.001-S500,000 Q

2, Cl (")

)> ;;,:;

5500.001-S1 .000,000 CD 0

::c "'"'

1 :is:

S1,000,001-S5.000,000 -

~

S~000,001-$25.000,000 ~

S25.000,001-S50.000.000

"

Over S50.000.000 ~

Spouse/DC Assel over S1 ,000.000' ;:

NONE

z

Ill

DIVIDENDS 3

RENT

!1!.

INTEREST -t

'<

't:I

Cl) CD

CAPITAL GAINS r- ~

0 0

BUNDTRUST Cl

~

:::,

= ;,::

g Cl

TAX-DEFERRED ~

l>< 3Cl) ~

Olller Type of Income

~

(Specify: e.g.. Partnership Income or Fann Income)

w

None -

S1-S200

= ~·

R S201-S1,000

-

a

~

S1.001-S2.500 < )>

$2,501-S5,000 < 3

0

C CD

S5.001-S15,000 ;S a 0r-

o Cl

S15,001-$50.000 ~

,_ - --- --· •·- ,.._ , __ --- .,:::,=;,;0

S50.001-$100,000 0

~

3Cl) "C

S100.001-$1,000.000 Ill

x IC

S1.000.001-S5,000 .000 X

Over $5.000,000 !$

Spouse/DC Assel ,,111 Income over S1,000,000' 1;! 0

I~...

:v -t

!" iil CD

:::, r- --{)

~

. 0

"'Ill Cl

~ ~ ;;,:;

!l c>" m

:::,

m

SCHEDULE B - TRANSACTIONS N/A I

Namec .:J"'Me( y11 8 e.,AS On IPage_£ of __i__

Report any purchase. sale, or exchange transactions that exceeded $500 in tl1e T pe of Transaction Date Amount of Transaction

reporting perod of any security or real property held by you. your spouse. or your

dependent ehifd for Investment or the production of income. Include transactions that

resuhed in a capita I loss. Provide a brief description of an exchange transaction. A B C D E F G H I J K

Exclude transactions between ~ou, your spouse. or dependent children, or lhe

purchase or sale of your personal residence. unless it generated rental Income. If only

j (MOIDNYR)or

:;;;

a portion of an asset is sold, please choose "partial sale~ as the type or transaction.

... auane,1y,

ci

Capital Gains: If a sales transadion resulted in a capital gain in excess of $500,_ check

the "'capital gains" box. unless it was an asset in a tax-deferred account and disclose

; ! g,

~~

ii

Monlhly, or Bi•

weekly, ii

81)pllcabkl

.:.§ §§ §§ 88 §§ .:.§

80

~g ;:;§

°-§

~~

88

I

i

g~

§'-'

~}

the capital gain income on Scheoule A.

1"- j ~

IE I ii

o.:l

8. .,;

;;; z;; ~~ ~~

8ii!

~~ !~ ~~

§§

;;;~

§.;

:ll1Jl

~g

1)l~

~

0

~ 8.

o!e

• Column K is for assets solely held by your spouse or dependent child.

SP, DC. JT Asset

SP f•ample

I Mega Co,p. Slod< X X 319117 X

Use additional sheets if more space is required.

SCHEDULE C - EARNED INCOME

I Page£ of _!j_

List the source, type, and amount of earned income from any source (other than the filer's current employment by the state of Michigan) totaling $500 or more during the reporting period. For a spouse, list

the source and amount of any honoraria; list only the source for other spouse earned income exceeding $500. See examples below.

EXCLUDE: Military pay (such as National Guard or Reserve pay), state of Michigan retirement programs, and benefits received under the Social Security Act.

Source (include date of receipt for honoraria) Type Amount

Keene State Aooroved Teachina Fee $6.000

State of Marvland Leaislat1ve Pension s,s.ooo

Examples: Civil War Roundtable (Oct. 2) Spouse Speech $1.000

Ontario County Board of Education Spouse Salary NIA

f<oss .Irt I +-,a+, Ve.- II'\ Soo,f-s

,

5 CL( (UI'- V !I 3CJ(). 000

VJa..vne S+-tL+e_ Lll') ~ v e.ts1f-\t Sa,__/nrV

' ~-

7tJ, 00CJ

I

I

(!,'+u of- l) e-+v-() (

I

+- I

Sp ()LP<~- Su lav-V

I

ff

I b'5iOtJO

Use additional sheets if more space is required.

SCHEDULE D - LIABILITIES

B-U\SQQ I Page_~ot_3_

I

Report liabilities of over $10,000 owed to any one creditor at any time during the reporting period by you, your spouse or your dependent child. Mark the highest amount owed during the reporting

period. Exclude: Any mortgage on your personal residence (unless you rent it out); loans secured by automobiles, household furniture, or appliances; liabilities of a business in which you own an interest

(unless you are personally liable); and liabilities owed to you by a spouse or the child, parent, or sibling of you or your spouse. Report a revolving charge account (i.e., credit card) only if the balance

at the close of the reporting period exceeded $500. 'Column K is for liabilities held solely by your spouse or dependent child.

Amount of Liability

A B C 0 E F G H I J K

Date

SP,

DC.JT Creditor

Liability

Type of Liability 0

~

Incurred 0 0 :0

0 o.~

ci 0 _J

MONR ,0 .:.o 0 ciu

,0 ~o ~o

.g '

~o

00

~o

00

00

00

0

ci

00

.:.o

00

~o

00

~o

00

00

00

00

00

0 q

00

00

cici

0

00

-0

.

00

00 ,,.

IO

,,.:3j:::,

o · ·o

00

Olli

00

i.n-o· .o

00

ciO

0IO

00

IO0

Oo

0 .

00

00 0_.,,

00

.

00

.no :;; ~ 0

., C.

U> U> ~"' .,.,,.

II)~ ~N N IO IO~

U> IF)

~IO ION ,,.,,.

NlO >

0 ej~

""" U> U>

IF)U, (l)tl) (l)!J)

Example Firsl Bank of Wilmington, DE S/15 Mortgage on Renlal Properly, Dover. DE X

Non,o

SCHEDULE E - POSITIONS

Report all positions, compensated or uncompensated, held during the current or prior calendar year as an officer, director, trustee of an or9anization, partner, proprietor, representative, employee, or

consultant of any corporation, firm, partnership, or other business enterprise, nonprofit organization, labor organization, or educational or other institution other than the state of Michigan. Exclude:

Positions held in an relioious, social, fraternal, or political entities (such as political arties and campaion oroanizations : and oositions sole! of an honorarv nature.

Position Name of Organization

Use additional sheets if more space is required.

SCHEDULE F - AGREEMENTS

I....-2., cz

Identify the date. parties to. and general terms of any agreement or arrangement that you have with respect to: future employment; a leave of absence during the period of government service:

continuation or deferral of payments by a former or current employer other than the state of Michigan; or continuing participation in an employee welfare or benefit plan maintained by a former employer.

Date Parties to Agreement Terms of Agreement

Jo 10 Wa__~ ,, e.... St-afe.- Ll.r\ ~ v rs i-J- ,1 £) T"1"ji\LL,d Fa..c.u.J+, 1 - flt\ tl ct.id Lea.ue. b,,, ~ i'Vlti i J.11'1 ~o lC/

I

I I u ~

SCHEDULE G - GIFTS

Report the source (by name), a brief description, and the value of all gifts totaling more than $500 received by you, your spouse, or your dependent child from any source during the year. Exclude: Gifts

from relatives. gifts of personal hospitality from an individual, local meals. and gifts to a spouse or dependent child that are totally independent of his or her relationship to you. Gifts with a value of $50 or

less need not be added towards the $500 disclosure threshold.

Source Description Value

Example: I Mr. Joseph Smith, Arlington. VA SilverPla1ter{prior delermination of personal friendship received from the Committee on Elhics) 550

Non ,f7__,

Use additional sheets if more space is required.

SCHEDULE H-TRAVEL PAYMENTS and REIMBURSEMENTS

I...._E_ i of

Identify the source and list travel itinerary, dates and nature of expenses provided for travel and travel-related expenses by you, your spouse, or your dependent child during the reporting period.

Indicate whether a family member accompanied the traveler at the sponsor's expense. Disclosure is required regardless of whether the expenses were paid directly by the sponsor or were paid by you

and reimbursed by the sponsor. Exclude travel provided to a spouse or dependent child that is totally independent of his or her relationship to you.

Family Member

Lodging? Food?

Source Date(s) City of Departure-Destination-City of Return Included? (YIN)

(YIN) (YIN)

Govemment of Cl1ina {MECEA) y y N

Aug. 6-11 DC-Be,j1ng, China-DC

Example.s·

Habilat lor Humanity (c/,arity hin<lra,ser) y

Mar. 3-4 DC-Bosl0<1-DC y y

N()'(\ e- NIA I

Use additional sheets if more space is required.

SCHEDULE I-PAYMENTS MADE TO CHARITY IN

LIEU OF HONORARIA

I Name -To (!e_/ \I 0 ,....-1-_.,L I

List the source, activity (i.e., speech, appearance, or article), date, and amount of any payment made by the sponsor of an event to a charitable organization in lieu of paying an honorarium to you. A

separate list of charities receiving such payments must be filed directly with the Michigan Department of State.

Source Activity Date Amount

I Association of American Associations, WashinQton, DC Soeech Feb,2,2018 $2,000

Examples:

I XYZ Maaazine Article Aug. 13, 2018 $500

NOf\P~

Use additional sheets if more space is required.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5824)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Test Bank For Managerial Economics and Strategy 3rd Edition by PerloffDocument10 pagesTest Bank For Managerial Economics and Strategy 3rd Edition by PerloffDominic Glaze100% (40)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Detroit Food Metrics ReportDocument42 pagesDetroit Food Metrics ReportWDET 101.9 FM100% (6)

- Gretchen Whitmer DJC Interview TranscriptDocument15 pagesGretchen Whitmer DJC Interview TranscriptWDET 101.9 FMNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Corporate Social ResponsibilitDocument10 pagesCorporate Social ResponsibilitIrma Poldi SchweiniMiroNo ratings yet

- Greens RecipeDocument2 pagesGreens RecipeWDET 101.9 FMNo ratings yet

- PFAS in Drinking WaterDocument2 pagesPFAS in Drinking WaterWDET 101.9 FMNo ratings yet

- Residential Road Program Introduction 2019Document6 pagesResidential Road Program Introduction 2019WDET 101.9 FMNo ratings yet

- IRS Tax Reform Basics For Individuals 2018Document14 pagesIRS Tax Reform Basics For Individuals 2018WDET 101.9 FMNo ratings yet

- Detroit Census MapDocument1 pageDetroit Census MapWDET 101.9 FMNo ratings yet

- Infographic - Michigan School Finance at The Crossroads: A Quarter Century of State ControlDocument1 pageInfographic - Michigan School Finance at The Crossroads: A Quarter Century of State ControlWDET 101.9 FMNo ratings yet

- GST 4.26.2018Document44 pagesGST 4.26.2018WDET 101.9 FMNo ratings yet

- WDET's Preschool BallotDocument1 pageWDET's Preschool BallotWDET 101.9 FMNo ratings yet

- Black GarlicDocument2 pagesBlack GarlicWDET 101.9 FMNo ratings yet

- HUD False ClaimsDocument3 pagesHUD False ClaimsWDET 101.9 FMNo ratings yet

- MDEQ PFAS Contaminated SitesDocument1 pageMDEQ PFAS Contaminated SitesWDET 101.9 FMNo ratings yet

- Boil Water Advisory FAQDocument5 pagesBoil Water Advisory FAQWDET 101.9 FMNo ratings yet

- Combined Detroit Audit Exec Summary 551188 7Document27 pagesCombined Detroit Audit Exec Summary 551188 7WDET 101.9 FMNo ratings yet

- HDFC BankDocument8 pagesHDFC BankKRIZMAL TRADING SOLUTIONS PVT LTDNo ratings yet

- XH-IAS 40 Investment Properties - SV-Out-of-class practice-EN NewDocument6 pagesXH-IAS 40 Investment Properties - SV-Out-of-class practice-EN NewHà Mai VõNo ratings yet

- Bookkeeping and Accounting CycleDocument9 pagesBookkeeping and Accounting CycleIhda Rachmatina Season IINo ratings yet

- Blue Finance Instruments Development Guideline BappenasDocument36 pagesBlue Finance Instruments Development Guideline BappenasDota ImamNo ratings yet

- Chapter Two: Planning FunctionDocument16 pagesChapter Two: Planning FunctionAsaye TesfaNo ratings yet

- Guide To Developing Skatepark FacilitiesDocument17 pagesGuide To Developing Skatepark FacilitiesLucianaNo ratings yet

- TED Speech - Chip ConleyDocument6 pagesTED Speech - Chip Conleyjunohcu310No ratings yet

- Adnan ThesisDocument51 pagesAdnan ThesisMohammad Naveed Hashmi100% (1)

- Economics of Poultry Broiler Farming: Techno Economic ParametersDocument2 pagesEconomics of Poultry Broiler Farming: Techno Economic ParametersBrijesh SrivastavaNo ratings yet

- CHAPTER 8-Revenue Recognition: Construction Contracts Multiple ChoiceDocument5 pagesCHAPTER 8-Revenue Recognition: Construction Contracts Multiple ChoiceJyasmine Aura V. AgustinNo ratings yet

- 2 Strategic Management Shan Foods Private LimitedDocument43 pages2 Strategic Management Shan Foods Private LimitedB'smah AhmedNo ratings yet

- CQF January 2017 M5L6 BlankDocument2 pagesCQF January 2017 M5L6 BlankNasim AkhtarNo ratings yet

- Informal Urbanism Dan Layout PerumahanDocument46 pagesInformal Urbanism Dan Layout Perumahanalfariz haidarNo ratings yet

- Acct Statement XX1708 26082022Document4 pagesAcct Statement XX1708 26082022Firoz KhanNo ratings yet

- NWPC Resolution No. 03 Series of 2020 Re Legal Coverage of Family DriversDocument2 pagesNWPC Resolution No. 03 Series of 2020 Re Legal Coverage of Family DriversDOLE Region 6No ratings yet

- Advanced Financial Accounting 10th Edition Christensen Cottrell Baker Solutions Chapter 15Document56 pagesAdvanced Financial Accounting 10th Edition Christensen Cottrell Baker Solutions Chapter 15renyNo ratings yet

- Faris Zulfiqar ResumeDocument1 pageFaris Zulfiqar ResumeAmit PathakNo ratings yet

- Business Studies Worksheet Test PDFDocument5 pagesBusiness Studies Worksheet Test PDFAhmad naveed100% (1)

- BAP11 A T2 2021 Individual AssignmentDocument7 pagesBAP11 A T2 2021 Individual AssignmentsadiaNo ratings yet

- DHL Glo DGF Gogreen Solutions BrochureDocument8 pagesDHL Glo DGF Gogreen Solutions Brochurehappiest1100% (1)

- Resume - Aditya WDocument3 pagesResume - Aditya WadityaNo ratings yet

- Credit Card DetailsDocument5 pagesCredit Card DetailsSyed Farid AliNo ratings yet

- Activity Based Costing ExamplesDocument23 pagesActivity Based Costing ExamplesPinkal PatelNo ratings yet

- Balance Sheet ITCDocument2 pagesBalance Sheet ITCProsenjit RoyNo ratings yet

- List of Headers Associated With PEOn DLTDocument8,197 pagesList of Headers Associated With PEOn DLTLokesh Ranjan KrishNo ratings yet

- PeTri CBO AttachementDocument19 pagesPeTri CBO AttachementPeTri ApTi100% (3)

- KhiyarsDocument3 pagesKhiyarsnadeemuzairNo ratings yet

- Supply Chain OperationsDocument17 pagesSupply Chain OperationsAsfand375yar KhanNo ratings yet