Professional Documents

Culture Documents

2019 03 12 17 56 10 874 - 1552393570874 - XXXPS8275X - Itrv

2019 03 12 17 56 10 874 - 1552393570874 - XXXPS8275X - Itrv

Uploaded by

Dhananjay JaiswalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2019 03 12 17 56 10 874 - 1552393570874 - XXXPS8275X - Itrv

2019 03 12 17 56 10 874 - 1552393570874 - XXXPS8275X - Itrv

Uploaded by

Dhananjay JaiswalCopyright:

Available Formats

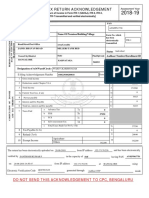

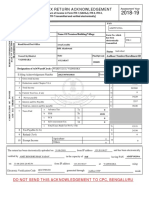

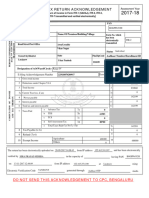

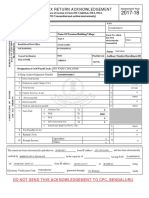

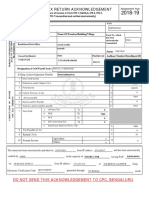

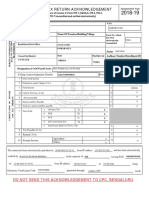

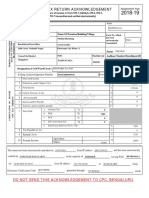

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

FORM

ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-2A, ITR-3,

ITR-4S (SUGAM), ITR-4, ITR-5, ITR-7 transmitted electronically without digital signature] . 2015.- 16.

(Please see Rule 12 of the Income-tax Rules, 1962)

Name PAN

RANJIT SAH

PERSONAL INFORMATION AND THE

BKKPS8275E

Form No. which

DATE OF ELECTRONIC

Flat/Door/Block No Name Of Premises/Building/Village

has been ITR-4S

TRANSMISSION

HOWRAHHAT HOWRAGHAT BAZAR

electronically

transmitted

Road/Street/Post Office Area/Locality

KARBIANGLONG HOWRAGHAT Individual

Status

Town/City/District State Pin Aadhaar Number

KARBIANGLONG

ASSAM 782481

Designation of AO (Ward / Circle) ITO W-2, NAGAON Original or Revised ORIGINAL

E-filing Acknowledgement Number 691002750250317 Date(DD-MM-YYYY) 25-03-2017

1 Gross Total Income 1 277460

2 Deductions under Chapter-VI-A 2 9610

3 Total Income 3 267850

COMPUTATION OF INCOME

a Current Year loss, if any 3a 0

4

AND TAX THEREON

4 Net Tax Payable 0

5 Interest Payable 5 0

6 Total Tax and Interest Payable 6 0

7 Taxes Paid

a Advance Tax 7a 0

b TDS 7b 0

c TCS 7c 0

d Self Assessment Tax 7d 0

e Total Taxes Paid (7a+7b+7c +7d) 7e 0

8 Tax Payable (6-7e) 8 0

9 Refund (7e-6) 9 0

10 Exempt Income Agriculture

10

Others 0

VERIFICATION

I, RANJIT SAH son/ daughter of BHARAT SAH , holding Permanent Account Number BKKPS8275E

solemnly declare to the best of my knowledge and belief, the information given in the return and the schedules thereto which have been transmitted

electronically by me vide acknowledgement number mentioned above is correct and complete and that the amount of total income and other particulars

shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to income-tax for

the previous year relevant to the assessment year 2015-16. I further declare that I am making this return in my capacity as

and I am also competent to make this return and verify it.

Sign here Date 25-03-2017 Place HOWRAGHAT

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

Identification No. of TRP Name of TRP Counter Signature of TRP

For Office Use Only

Receipt No Filed from IP address 59.93.188.68

Date

Seal and signature of BKKPS8275E446910027502503170417131AF9B889971787DF465A123FC78F5F0EDC

receiving official

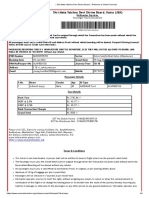

Please send the duly signed Form ITR-V to “Centralized Processing Centre, Income Tax Department, Bengaluru 560500”, by ORDINARY

POST OR SPEED POST ONLY, within 120 days from date of transmitting the data electronically. Form ITR-V shall not be received in any other

office of the Income-tax Department or in any other manner. The confirmation of receipt of this Form ITR-V at ITD-CPC will be sent to the e-mail

address hrishikesh_biswas@yahoo.in

You might also like

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .KumarNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Aadityaa PawarNo ratings yet

- Itr-V Alwpd7329j 2015-16 650346110080317Document1 pageItr-V Alwpd7329j 2015-16 650346110080317technoclickserviceNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)shalabhNo ratings yet

- Itr-V Ajqpy0100n 2017-18 775756550170517Document1 pageItr-V Ajqpy0100n 2017-18 775756550170517Raj RajNo ratings yet

- 2019 03 31 15 05 10 049 - 1554024910049 - XXXPJ4090X - Itrv PDFDocument1 page2019 03 31 15 05 10 049 - 1554024910049 - XXXPJ4090X - Itrv PDFShivshankar RNo ratings yet

- 2018 03 04 21 10 37 424 - 1520178037424 - XXXPS9207X - ItrvDocument1 page2018 03 04 21 10 37 424 - 1520178037424 - XXXPS9207X - Itrvrohit sNo ratings yet

- Meghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRVDocument1 pageMeghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRVYunusShaikhNo ratings yet

- 2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFDocument1 page2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFakshay guptaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageamitNo ratings yet

- Sukhjeet Singh 2018-19 (Itr) PDFDocument1 pageSukhjeet Singh 2018-19 (Itr) PDFAnonymous XgLFw9IcQNo ratings yet

- 102 1500880491102 XXXPP4297X ItrvDocument1 page102 1500880491102 XXXPP4297X Itrvramarao_pandNo ratings yet

- 2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFDocument1 page2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFAkshya BhoiNo ratings yet

- Ack FY 17-18-Ramesh BDocument1 pageAck FY 17-18-Ramesh BMurthy KarumuriNo ratings yet

- PDF 708541760280317Document1 pagePDF 708541760280317RISHI PARMARNo ratings yet

- 2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvDocument1 page2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvHARI KRISHAN PALNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagechinna rajaNo ratings yet

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementMadan ChaturvediNo ratings yet

- PDF 383187620040816Document1 pagePDF 383187620040816Ender gamerNo ratings yet

- 2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFDocument1 page2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFAnupam GauravNo ratings yet

- Ack VDocument1 pageAck VShantanu MetayNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageKishor VibhuteNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnil vaddiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSpartans Taekwondo academy Taekwondo loversNo ratings yet

- Itr-V Atipc3056f 2012-13 661170550180713Document1 pageItr-V Atipc3056f 2012-13 661170550180713Gst IndiaNo ratings yet

- Itr-V Bogpp6352h 2017-18 225020870280917Document1 pageItr-V Bogpp6352h 2017-18 225020870280917DEVIL RDXNo ratings yet

- Itr 2018-19 S B Mishra PDFDocument1 pageItr 2018-19 S B Mishra PDFJITENDRA DUBEBYNo ratings yet

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .Balkar BhullerNo ratings yet

- 2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - AcknowledgementDocument1 page2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - Acknowledgementanusha.veldandiNo ratings yet

- 2018 07 19 12 06 41 640 - 1531982201640 - XXXPS3223X - Acknowledgement PDFDocument1 page2018 07 19 12 06 41 640 - 1531982201640 - XXXPS3223X - Acknowledgement PDFHarshal A ShahNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSuraj Dev MahatoNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagehealth with wealthNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluruyogesh baghelNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSunil PeerojiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageBibhu Datta SenapatiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageRakesh MauryaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageRakesh MauryaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageRahul KashyapNo ratings yet

- Itr 19-20 PDFDocument1 pageItr 19-20 PDFAnonymous fM5CtB8Qm7No ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageGolu GuptaNo ratings yet

- 2019 07 17 12 05 41 184 - 1563345341184 - XXXPG9565X - ItrvDocument1 page2019 07 17 12 05 41 184 - 1563345341184 - XXXPG9565X - ItrvsantoshkumarNo ratings yet

- 2018 08 31 08 56 38 421 - 1535685998421 - XXXPR9465X - Acknowledgement PDFDocument1 page2018 08 31 08 56 38 421 - 1535685998421 - XXXPR9465X - Acknowledgement PDFVarun MgNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageCA Jitu DashNo ratings yet

- Letsgettin Fraud CompanyDocument1 pageLetsgettin Fraud CompanyAnonymous A3CiCzvNo ratings yet

- Soumyadeep Chanda Itr Ay 2018Document1 pageSoumyadeep Chanda Itr Ay 2018Cajonized Guy DeepNo ratings yet

- Ack F.y.2017-18Document1 pageAck F.y.2017-18NishantNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSanjeet SinghNo ratings yet

- 17 18 SaleemDocument1 page17 18 Saleembalaji xeroxNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAditya SharmaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnsar ValiNo ratings yet

- 2018 07 20 11 14 23 177 - 1532065463177 - XXXPC3536X - Acknowledgement PDFDocument1 page2018 07 20 11 14 23 177 - 1532065463177 - XXXPC3536X - Acknowledgement PDFGanesh DasaraNo ratings yet

- Maadhavan Chandhiran 16-Mar-2018 454072340Document1 pageMaadhavan Chandhiran 16-Mar-2018 454072340samaadhuNo ratings yet

- Bava Bro PDFDocument1 pageBava Bro PDFSomasundara ReddyNo ratings yet

- Edjpb0287g Itrv PDFDocument1 pageEdjpb0287g Itrv PDFArun BhatnagarNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageTaiyabaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAshwini oRNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBINAYAK CHAKRABORTYNo ratings yet

- 2018 07 28 13 20 32 119 - 1532764232120 - XXXPC9710X - Acknowledgement PDFDocument1 page2018 07 28 13 20 32 119 - 1532764232120 - XXXPC9710X - Acknowledgement PDFvscomputersNo ratings yet

- Experimental Investigation On Solar Absorption Refrigeration System in Malaysia PDFDocument5 pagesExperimental Investigation On Solar Absorption Refrigeration System in Malaysia PDFRana Abdul RehmanNo ratings yet

- Financial Institution Failure Prediction Using Adaptive Neuro-Fuzzy Inference Systems: Evidence From The East Asian Economic CrisisDocument2 pagesFinancial Institution Failure Prediction Using Adaptive Neuro-Fuzzy Inference Systems: Evidence From The East Asian Economic CrisisHannan KüçükNo ratings yet

- BJ S C, USA: Doug LehrDocument12 pagesBJ S C, USA: Doug LehrBalkis FatihaNo ratings yet

- Tyco Pre Action LimitsDocument13 pagesTyco Pre Action LimitsGrbayern Munchen100% (2)

- Check Manual: ES SeriesDocument42 pagesCheck Manual: ES SeriesArturo CalderonNo ratings yet

- Technical Data Sheet Street Light - 120W: Description: Product Code VH04120010401Document1 pageTechnical Data Sheet Street Light - 120W: Description: Product Code VH04120010401Martin Takudzwa Chakadona100% (1)

- Women Security Assistance System With GPS Tracking and Messaging SystemDocument4 pagesWomen Security Assistance System With GPS Tracking and Messaging Systemhamed razaNo ratings yet

- W005F.... W10F: 1.5 A 50 V To 1000 VDocument4 pagesW005F.... W10F: 1.5 A 50 V To 1000 VBraulio Manuel Trejo PerezNo ratings yet

- EprDocument8 pagesEprcyrimathewNo ratings yet

- Melon Growing Tips PDFDocument1 pageMelon Growing Tips PDFTaahirah Ben ZinatNo ratings yet

- Introduction To LinguisticsDocument4 pagesIntroduction To LinguisticsRomnick Fernando CoboNo ratings yet

- FS 1 Activity 3Document6 pagesFS 1 Activity 3Nilda EStradaNo ratings yet

- Eurocode 1 ComparisonDocument10 pagesEurocode 1 ComparisontbaysakNo ratings yet

- BSR 231 Grouping Assignment FinaleDocument149 pagesBSR 231 Grouping Assignment FinaleMUHAMMAD FARIS IQBAL BIN RIDUANNo ratings yet

- Bos 50633Document2 pagesBos 50633Krishna SharmaNo ratings yet

- Table Tennis ActivityDocument2 pagesTable Tennis ActivityCristopher JhanrieNo ratings yet

- ECGBiometricsMACS13 Sumair v5 ResearchGateDocument7 pagesECGBiometricsMACS13 Sumair v5 ResearchGatearlikaNo ratings yet

- Cuprins: State of The Art LivingDocument15 pagesCuprins: State of The Art LivingBogdan IonițăNo ratings yet

- Chattel MortgageDocument2 pagesChattel MortgageSugar ReeNo ratings yet

- Cerro de PascoDocument2 pagesCerro de PascoevelynNo ratings yet

- One Week Online FDP, 21-27 March 2021 - REVISEDDocument9 pagesOne Week Online FDP, 21-27 March 2021 - REVISEDKanhaNo ratings yet

- Travel Motivations and State of DevelopmentDocument6 pagesTravel Motivations and State of Developmentphuong anh phamNo ratings yet

- Necromancer Bone Spear Build With Masquerade (Patch 2.6.10 Season 22) - Diablo 3 - Icy Veins 3Document1 pageNecromancer Bone Spear Build With Masquerade (Patch 2.6.10 Season 22) - Diablo 3 - Icy Veins 3filipNo ratings yet

- Lembar Permintaan Obat Unit UgdDocument3 pagesLembar Permintaan Obat Unit Ugdpuskesmas anyarNo ratings yet

- Buckling and Ultimate Strength Assessment For Offshore Structures APRIL 2004Document5 pagesBuckling and Ultimate Strength Assessment For Offshore Structures APRIL 2004Flávio RodriguesNo ratings yet

- Emergency ProceduresDocument19 pagesEmergency ProceduresMilos Kalember100% (1)

- Shri Mata Vaishno Devi Shrine Board - Welcome To Online ServicesDocument4 pagesShri Mata Vaishno Devi Shrine Board - Welcome To Online Servicesphool baghNo ratings yet

- R&D Outline ProjectDocument3 pagesR&D Outline ProjectDeepak KumarNo ratings yet

- (Number) (Case Title) Docket No. - Date - Topic - Ponente - Digest Maker Petitioner: Respondents: Case Doctrine: FactsDocument72 pages(Number) (Case Title) Docket No. - Date - Topic - Ponente - Digest Maker Petitioner: Respondents: Case Doctrine: FactsJohn Rey FerarenNo ratings yet

- Co Nte NT KN Ow Led Ge An D Ped Ag Og yDocument30 pagesCo Nte NT KN Ow Led Ge An D Ped Ag Og yLeizel Sayan-labiangNo ratings yet