Professional Documents

Culture Documents

Liaison Office: Steps To Be Taken To Open A Liaison Office

Liaison Office: Steps To Be Taken To Open A Liaison Office

Uploaded by

SwapnilCopyright:

Available Formats

You might also like

- Common Law MPC ChartDocument3 pagesCommon Law MPC Charttrong_it83% (6)

- Simplified Roberts Rules of OrderDocument41 pagesSimplified Roberts Rules of OrderAlfred Lacandula80% (5)

- Export Process in PakistanDocument14 pagesExport Process in Pakistanazeemtahir56625% (4)

- Bangladesh Exporter GuidelinesDocument27 pagesBangladesh Exporter GuidelinesBaki HakimNo ratings yet

- Liasion Offices in IndiaDocument3 pagesLiasion Offices in IndiaabhayNo ratings yet

- Exchange Control Declaration (GR) Form No.Document5 pagesExchange Control Declaration (GR) Form No.iqbal sNo ratings yet

- Export Incentives in IndiaDocument21 pagesExport Incentives in IndiaKarunakaran KrishnamenonNo ratings yet

- Statstics of Readynade Garments in Apparel IndustryDocument17 pagesStatstics of Readynade Garments in Apparel IndustryTanmay JagetiaNo ratings yet

- Export CreditDocument29 pagesExport CreditKaran SuriNo ratings yet

- Export Import UK Details Fundamental 9 Nov 14Document89 pagesExport Import UK Details Fundamental 9 Nov 14sa_mehediNo ratings yet

- Handicrafts Export Promotion Council Additional ExtraDocument27 pagesHandicrafts Export Promotion Council Additional ExtraManasa PriyaNo ratings yet

- SS Sourcing PVT LTDDocument3 pagesSS Sourcing PVT LTDsunilkumar_sajjaNo ratings yet

- Export Documentation For Garment HouseDocument88 pagesExport Documentation For Garment HouseRon Bhuyan0% (1)

- Global Business Opportunities - June 2021Document52 pagesGlobal Business Opportunities - June 2021VijaiNo ratings yet

- Parag Pro Final 22Document52 pagesParag Pro Final 22Tushar DivsNo ratings yet

- Section 195 and Form 15CBDocument53 pagesSection 195 and Form 15CBVALTIM09No ratings yet

- Appparel Export Merchandising (Fashion Buyer) - Mayoori MohanDocument10 pagesAppparel Export Merchandising (Fashion Buyer) - Mayoori MohanMAYOORI MOHANNo ratings yet

- India's Foreign Trade Policy - 29 August 2021Document17 pagesIndia's Foreign Trade Policy - 29 August 2021Akanksha GuptaNo ratings yet

- International Trade FinanceDocument156 pagesInternational Trade FinancekhaledawarsiNo ratings yet

- Boutique & Factory-ProposalDocument10 pagesBoutique & Factory-ProposalPradeep ChauhanNo ratings yet

- Knowledge Bank: Fedai RulesDocument10 pagesKnowledge Bank: Fedai RulesRohan Singh100% (1)

- Import & Export Documentations in International Trade - PPTX - Week - 3Document37 pagesImport & Export Documentations in International Trade - PPTX - Week - 3Kennedy HarrisNo ratings yet

- Presentation SAHIL POLDocument8 pagesPresentation SAHIL POLAtharva patoleNo ratings yet

- Export Import and CountertradeDocument32 pagesExport Import and Countertradeapi-246907195No ratings yet

- Import &am Export in IndiaDocument32 pagesImport &am Export in Indiaravips4uNo ratings yet

- AskariDocument31 pagesAskariShoaib QuddusNo ratings yet

- Bangladesh Importer Guidelines PDFDocument27 pagesBangladesh Importer Guidelines PDFMd Delowar Hossain MithuNo ratings yet

- Export Procedure PDFDocument2 pagesExport Procedure PDFMichaelNo ratings yet

- Export Import TanzaniaDocument16 pagesExport Import Tanzaniaahmenat2137No ratings yet

- Export Potentials of Small Scale IndustriesDocument29 pagesExport Potentials of Small Scale IndustriesTanveer Singh Rainu60% (10)

- Top 100-200 Clothing Brands For Men - Page (2 Out of 4) - Henleys, User Contributed Rankings - ShareRanksDocument9 pagesTop 100-200 Clothing Brands For Men - Page (2 Out of 4) - Henleys, User Contributed Rankings - ShareRanksArun Ann100% (1)

- Presentation of ECGC, KolkataDocument30 pagesPresentation of ECGC, Kolkatabharti ashhplayNo ratings yet

- Mid MCDocument47 pagesMid MCPhuong PhamNo ratings yet

- J Gate Members DetailsDocument8 pagesJ Gate Members DetailstextiledeepakNo ratings yet

- Importers in Delhi From ChinaDocument8 pagesImporters in Delhi From ChinaBhavvyam BhatnagarNo ratings yet

- Textile Times Volume 12Document40 pagesTextile Times Volume 12mohammed_ismail69No ratings yet

- Proforma Invoice GarmentDocument4 pagesProforma Invoice GarmentMehedi HasanNo ratings yet

- IBAGuideLine PDFDocument7 pagesIBAGuideLine PDFPramod NandakumarNo ratings yet

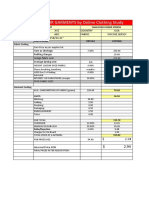

- COST SHEET FOR GARMENTS by Online Clothing StudyDocument3 pagesCOST SHEET FOR GARMENTS by Online Clothing StudyNilesh JariwalaNo ratings yet

- FEMA Compliance and Recent Policies On FDI - CA Manoj ShahDocument58 pagesFEMA Compliance and Recent Policies On FDI - CA Manoj ShahAbhinay KumarNo ratings yet

- Export Import Data Bank IndiaDocument1 pageExport Import Data Bank Indiapravin963No ratings yet

- Flow ChartDocument6 pagesFlow ChartNavukkarasu Jaganathan100% (1)

- Fair Directory 02-2016Document96 pagesFair Directory 02-2016NJ enterpriseNo ratings yet

- Magam Exports PVT LimitedDocument28 pagesMagam Exports PVT LimitedMrunal ShirsatNo ratings yet

- Export Promoting InstitutesDocument21 pagesExport Promoting InstitutesVikaskundu28100% (1)

- Bill DiscountingDocument43 pagesBill DiscountingVamshi Palavajala100% (1)

- LC Copy - Ef-004 2021 - Vikohasan - 6X40'FT - 3hochiminh 3haiphongDocument4 pagesLC Copy - Ef-004 2021 - Vikohasan - 6X40'FT - 3hochiminh 3haiphongKhaerul FazriNo ratings yet

- User Manual Oracle Banking Digital Experience Corporate Trade FinanceDocument213 pagesUser Manual Oracle Banking Digital Experience Corporate Trade FinanceTarik AljaroushiNo ratings yet

- Republic of Korea: IndiaDocument56 pagesRepublic of Korea: IndiaAashhna KumarNo ratings yet

- Ima Icici AccontsDocument79 pagesIma Icici AccontsKaran PanchalNo ratings yet

- International Trade FinanceDocument33 pagesInternational Trade Financemesba_17No ratings yet

- Export Requirements - UAEDocument20 pagesExport Requirements - UAEParthMairNo ratings yet

- Export Tutorial: - Researching MarketsDocument12 pagesExport Tutorial: - Researching MarketssadafshariqueNo ratings yet

- Role of An Intermediatry - Buying HouseDocument15 pagesRole of An Intermediatry - Buying HouseGarima DhimanNo ratings yet

- Lifestyle International PVT Ltd-Max Retail Division: 1 Dhruv Singh 10 PGDM 035Document23 pagesLifestyle International PVT Ltd-Max Retail Division: 1 Dhruv Singh 10 PGDM 035Kshatriy'as ThigalaNo ratings yet

- Role of DirectorsDocument25 pagesRole of DirectorsAshish JindalNo ratings yet

- Arag Apparel: Quality Apparel For EveryoneDocument19 pagesArag Apparel: Quality Apparel For Everyonemustafe omerNo ratings yet

- MICR CodeDocument635 pagesMICR Codemother21020% (1)

- Related Press Release: A.P. (DIR Series) Circular No. 56 Dated June 28, 2010Document8 pagesRelated Press Release: A.P. (DIR Series) Circular No. 56 Dated June 28, 2010Moin LadhaNo ratings yet

- Renewal of Regular Contractor's License (SOLE - PROP) - 11192018 (Repaired)Document25 pagesRenewal of Regular Contractor's License (SOLE - PROP) - 11192018 (Repaired)Justine Jay AlderiteNo ratings yet

- Renewal of Regular Contractor's License (SOLE - PROP) - PNEDocument24 pagesRenewal of Regular Contractor's License (SOLE - PROP) - PNERodjun QuiolasNo ratings yet

- Workbook - 3rd SemDocument94 pagesWorkbook - 3rd SemKandu SahibNo ratings yet

- July 25, 2016 RA 9165 Direct Assault & GODDocument2 pagesJuly 25, 2016 RA 9165 Direct Assault & GODpolNo ratings yet

- Kho v. Makalintal (1999) : Topic: Validity of Search WarrantDocument2 pagesKho v. Makalintal (1999) : Topic: Validity of Search WarrantdelayinggratificationNo ratings yet

- Ax Reminder: When To Apply 10% or 15% EWT For Professional FeesDocument2 pagesAx Reminder: When To Apply 10% or 15% EWT For Professional FeesRegs AccexNo ratings yet

- Partha Moulik-Offer LetterDocument3 pagesPartha Moulik-Offer LetterparthaNo ratings yet

- Compel Discovery - Stong MoveDocument3 pagesCompel Discovery - Stong MovePublic Knowledge100% (3)

- 19 Patula vs. PeopleDocument2 pages19 Patula vs. PeopleNivNo ratings yet

- 1.code of Commerce+Special Laws (Final)Document26 pages1.code of Commerce+Special Laws (Final)Melvin BanzonNo ratings yet

- In The Line of Fire A Memoir Pervez MusharrafDocument4 pagesIn The Line of Fire A Memoir Pervez Musharrafhussymian06No ratings yet

- Chapter 4Document27 pagesChapter 4kimiskyperNo ratings yet

- Bill Drafting Manual Kentucky General AssemblyDocument205 pagesBill Drafting Manual Kentucky General AssemblyTayyib ShahNo ratings yet

- SOSIOLOGI HUKUM EDIT 2013 November 1Document72 pagesSOSIOLOGI HUKUM EDIT 2013 November 1Riko Kurnia PutraNo ratings yet

- Compendium of Tax Laws in PakistanDocument3 pagesCompendium of Tax Laws in PakistanMalick Sajid Ali IlladiiNo ratings yet

- Guidelines For Striking Off - Appendix 1Document2 pagesGuidelines For Striking Off - Appendix 1Siti Nur Fatihah ZamuriNo ratings yet

- State OrganisationDocument13 pagesState OrganisationSahrul IrawanNo ratings yet

- Sample Script For PTA Officer ElectionsDocument2 pagesSample Script For PTA Officer ElectionsAllexa De GuzmanNo ratings yet

- BVI ActDocument110 pagesBVI ActW.t. LamNo ratings yet

- Finance (Allowances) Department: G.O.No.47, DATED: 20 February, 2014Document3 pagesFinance (Allowances) Department: G.O.No.47, DATED: 20 February, 2014Papu KuttyNo ratings yet

- Order in The Matter of Vaibhav Pariwar India Projects LimitedDocument19 pagesOrder in The Matter of Vaibhav Pariwar India Projects LimitedShyam SunderNo ratings yet

- Group Gratuity Schemes: BY: Manjusha Arora Ankur GargDocument15 pagesGroup Gratuity Schemes: BY: Manjusha Arora Ankur GargManjusha AroraNo ratings yet

- Intosai-P: Principles of Transparency and AccountabilityDocument11 pagesIntosai-P: Principles of Transparency and AccountabilityishtiaqNo ratings yet

- James Johnson v. K Mart Corporation, 273 F.3d 1035, 11th Cir. (2001)Document47 pagesJames Johnson v. K Mart Corporation, 273 F.3d 1035, 11th Cir. (2001)Scribd Government DocsNo ratings yet

- Affidavit of Truth Actual and Constructive Noticejeffrey Thomas Maehr Id 000000000Document148 pagesAffidavit of Truth Actual and Constructive Noticejeffrey Thomas Maehr Id 000000000thenjhomebuyer100% (2)

- What Are Man's Truths Ultimately Merely His Irrefutable Errors - NietzscheDocument5 pagesWhat Are Man's Truths Ultimately Merely His Irrefutable Errors - NietzscheThavam RatnaNo ratings yet

- Foreclosure Case Wins Misc 48 PagesDocument46 pagesForeclosure Case Wins Misc 48 Pagestraderash1020100% (4)

- (Phase III - Case 2) Ediga Anamma v. State of APDocument11 pages(Phase III - Case 2) Ediga Anamma v. State of APvaibhav4yadav-4No ratings yet

- Nomination Remuneration PolicyDocument9 pagesNomination Remuneration PolicyUniinfo Telecom Services Ltd.No ratings yet

- Full Legal Complaint Filed by Mark Mullins Against The Town of RichlandsDocument19 pagesFull Legal Complaint Filed by Mark Mullins Against The Town of RichlandsJeff WilliamsonNo ratings yet

- Case 015 - Maccay V NobelaDocument6 pagesCase 015 - Maccay V NobeladirtylipopipsNo ratings yet

Liaison Office: Steps To Be Taken To Open A Liaison Office

Liaison Office: Steps To Be Taken To Open A Liaison Office

Uploaded by

SwapnilOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Liaison Office: Steps To Be Taken To Open A Liaison Office

Liaison Office: Steps To Be Taken To Open A Liaison Office

Uploaded by

SwapnilCopyright:

Available Formats

Liaison office

Liaison office is a place of business to act as a channel of communication between the

Principal place of business or Head office by whatever name called and entities in India but

which does not undertake any commercial/ trading/ industrial activity, directly or indirectly,

and maintains itself out of inward remittances received from abroad through normal banking

channel.

Steps to be taken to open a liaison office:

Step-1: Designate a Bank & branch where your account will be opened (post approval) who

will be an Authorized Dealer Category I Bank (AD Bank) for your liaison office in India.

Step-2: File an application in FNC form Annex B with all necessary documents to the Reserve

Bank of India (RBI) through the AD Bank. The list of necessary documents is as follows:

1. Certificate of Incorporation/ Registration or Memorandum & Articles of Association

attested by Indian Embassy/ Notary Public in the country of Registration (English

version).

2. Latest audited balance sheet of the applicant entity.

3. Certificate from CA in India about satisfaction or otherwise of the additional criteria*

by the parent company.

4. A KYC of the parent company in a prescribed format from their bankers.

5. Profile of the applicant.

6. Nature & location of activities & sources of funds.

7. Information about directors, shareholders & key managerial personnel

*The following additional criteria are also considered by RBI while sanctioning Liaison

office of a foreign entity:

a) A profit-making track record during the immediately preceding three financial

years in the home country.

b) Net worth [total of paid-up capital and free reserves, less intangible assets as

per the latest Audited Balance Sheet or Account Statement certified by a

Certified Public Accountant or any Registered Accounts Practitioner by

whatever name] not less than USD 50,000 or its equivalent.

Applicants who do not satisfy the eligibility criteria and are subsidiaries of other companies

can submit a Letter of Comfort from their parent company as per Annex-A, subject to the

condition that parent company satisfies the eligibility criteria as prescribed above.

Step-3: Obtain approval of RBI after which a UIN [Unique Identification Number] will be

provided to you. **

** Permission to setup these offices are initially granted for a period of 3 years and this may

be extended from time to time by an AD Category I Bank.

Step-4: Apply to ROC to obtain a “Certificate of Establishment of Place of Business in India”.

Step-5: Apply for registration for PAN with Income Tax Authority.

Step-6: Apply for registration for TAN with Income Tax Authority.

Step-7: Open account with Bank and to obtain account number.

Activities that a liaison office can undertake in India:

i. Representing in India the parent company/ group companies

ii. Promoting export/ import from/ to India

iii. Promoting technical/ financial collaborations between parent/ group companies in

India

iv. Acting as a communication channel between the parent company and Indian

companies.

Application for Undertaking Additional Activities or Additional liaison offices in India:

Requests for undertaking activities in addition to what has been permitted initially by the RBI

may be submitted through the designated AD Category I bank to RBI, justifying the need with

comments of the designated AD Category I bank.

Requests for establishing additional Liaison offices may be submitted though fresh FNC form,

duly signed by the authorized signatory of the foreign entity in the home country to RBI.

However, the documents mentioned in the form FNC need not be resubmitted, if there are

no changes to the documents already submitted earlier.

i. If the number of offices exceeds 4 (i.e. one LO in each zone), the applicant has

to justify the need for additional office/s.

ii. The applicant may identify one of its Offices in India as the Nodal Office, which

will coordinate the activities of all Offices in India.

Reporting requirements for liaison offices:

i. LO has to file Annual Activity Certificate [AAC] as per Annex D from CAs, at the

end of March 31, along with the audited Balance Sheet on or before September

30 of that year. In case the annual accounts of the LO are finalized with

reference to a date other than March 31, the AAC along with the audited

Balance sheet may be submitted within six months from the due date of the

Balance Sheet to the designated AD Category I bank, and a copy to the

Directorate General of Income Tax, New Delhi along with the audited financial

statements.

ii. Applicants from Bangladesh, Sri Lanka, Afghanistan, Iran, China, Hong Kong,

Macau or Pakistan desirous of opening a LO in India shall have to register with

the state police authorities.

Closure of liaison offices:

At the time of winding up of LO the company has to approach the designated AD Category I

bank with the following documents:

i. Copy of RBI’s permission/ approval from sectoral regulator(s) for establishing

LO.

ii. Auditor’s certificate

a. Indicating the manner in which the remittable amount has been arrived

at and supported by a statement of assets & liabilities of the applicant,

and indicating the manner of disposal of assets;

b. Confirming that all liabilities in India including arrears of gratuity and

other benefits to employees etc. of the office have been either fully

met or adequately provided for; and

c. Confirming that no income accruing from sources outside India

(including proceeds of exports) has remained un-repatriated to India

iii. Confirmation from the applicant/ parent company that no legal proceedings in

any court in India are pending and there is no legal impediment to the

remittance.

iv. A report from ROC regarding compliances with the provisions of Companies

Act, 2013, in case of winding up of the office in India.

v. Any other document specified by the RBI while granting approval.

List of Notifications:

Notification No. FEMA 22(R)/2016-RB dated March 31, 2016

Master Direction No. 18 dated January 1, 2016

AP DIR Series Circular No.69 dated May 12, 2016

Notification No. FEMA 22/2000-RB dated May 3, 2000

LIST OF NOTIFICATIONS/CIRCULARS CONSOLIDATED IN THIS MASTER DIRECTION

(Notification No. FEMA 22/2000-RB dated May 3, 2000)

Sl. Notification/ Circular No./ Press

Date

No Release

1. Notification no. FEMA 22/2000-RB May 03, 2000

2. Notification No FEMA 13/2000-RB May 03, 2000

3. Notification No FEMA 21/2000-RB May 03, 2000

4. Notification no. FEMA 95/2003-RB July 02, 2003

5. Notification no. FEMA 102/2003-RB Oct. 03, 2003

6. Notification no. FEMA 134/2005-RB May 07, 2005

7. Notification no. FEMA 161/2005-RB Sept 18, 2007

8. Notification no. FEMA 198/2009-RB Sept. 24, 2009

9. Notification no. FEMA 204/2009-RB April 05, 2010

10. A.P. (DIR series) Circular No. 3 July 06, 2002

11. A.P. (DIR series) Circular No. 37 Nov. 15, 2003

12. A.P. (DIR series) Circular No. 58 Jan. 16, 2004

13. A.P. (DIR series) Circular No. 39 April 25, 2005

14. A.P. (DIR series) Circular No. 44 May 17, 2005

15. A.P. (DIR series) Circular No. 02 July 31, 2008

December 30,

16. A.P. (DIR series) Circular No. 23

2009

December 30,

17. A.P. (DIR series) Circular No. 24

2009

18. A.P. (DIR series) Circular No. 06 August 09, 2010

19. A.P. (DIR series) Circular No. 02 July 15, 2011

20. A.P. (DIR series) Circular No. 76 February 9, 2012

21. A.P. (DIR series) Circular No. 88 March 1, 2012

September 17,

22. A.P. (DIR series) Circular No. 31

2012

September 25,

23. A.P.(DIR series) Circular No. 35

2012

November 26,

24. A.P. (DIR series) Circular No. 55

2012

25. A.P. (DIR series) Circular No. 93 January 15, 2014

26. A.P. (DIR series) Circular No. 142 June 12, 2014

27. Press release 2013-14/2440 June 17, 2014

You might also like

- Common Law MPC ChartDocument3 pagesCommon Law MPC Charttrong_it83% (6)

- Simplified Roberts Rules of OrderDocument41 pagesSimplified Roberts Rules of OrderAlfred Lacandula80% (5)

- Export Process in PakistanDocument14 pagesExport Process in Pakistanazeemtahir56625% (4)

- Bangladesh Exporter GuidelinesDocument27 pagesBangladesh Exporter GuidelinesBaki HakimNo ratings yet

- Liasion Offices in IndiaDocument3 pagesLiasion Offices in IndiaabhayNo ratings yet

- Exchange Control Declaration (GR) Form No.Document5 pagesExchange Control Declaration (GR) Form No.iqbal sNo ratings yet

- Export Incentives in IndiaDocument21 pagesExport Incentives in IndiaKarunakaran KrishnamenonNo ratings yet

- Statstics of Readynade Garments in Apparel IndustryDocument17 pagesStatstics of Readynade Garments in Apparel IndustryTanmay JagetiaNo ratings yet

- Export CreditDocument29 pagesExport CreditKaran SuriNo ratings yet

- Export Import UK Details Fundamental 9 Nov 14Document89 pagesExport Import UK Details Fundamental 9 Nov 14sa_mehediNo ratings yet

- Handicrafts Export Promotion Council Additional ExtraDocument27 pagesHandicrafts Export Promotion Council Additional ExtraManasa PriyaNo ratings yet

- SS Sourcing PVT LTDDocument3 pagesSS Sourcing PVT LTDsunilkumar_sajjaNo ratings yet

- Export Documentation For Garment HouseDocument88 pagesExport Documentation For Garment HouseRon Bhuyan0% (1)

- Global Business Opportunities - June 2021Document52 pagesGlobal Business Opportunities - June 2021VijaiNo ratings yet

- Parag Pro Final 22Document52 pagesParag Pro Final 22Tushar DivsNo ratings yet

- Section 195 and Form 15CBDocument53 pagesSection 195 and Form 15CBVALTIM09No ratings yet

- Appparel Export Merchandising (Fashion Buyer) - Mayoori MohanDocument10 pagesAppparel Export Merchandising (Fashion Buyer) - Mayoori MohanMAYOORI MOHANNo ratings yet

- India's Foreign Trade Policy - 29 August 2021Document17 pagesIndia's Foreign Trade Policy - 29 August 2021Akanksha GuptaNo ratings yet

- International Trade FinanceDocument156 pagesInternational Trade FinancekhaledawarsiNo ratings yet

- Boutique & Factory-ProposalDocument10 pagesBoutique & Factory-ProposalPradeep ChauhanNo ratings yet

- Knowledge Bank: Fedai RulesDocument10 pagesKnowledge Bank: Fedai RulesRohan Singh100% (1)

- Import & Export Documentations in International Trade - PPTX - Week - 3Document37 pagesImport & Export Documentations in International Trade - PPTX - Week - 3Kennedy HarrisNo ratings yet

- Presentation SAHIL POLDocument8 pagesPresentation SAHIL POLAtharva patoleNo ratings yet

- Export Import and CountertradeDocument32 pagesExport Import and Countertradeapi-246907195No ratings yet

- Import &am Export in IndiaDocument32 pagesImport &am Export in Indiaravips4uNo ratings yet

- AskariDocument31 pagesAskariShoaib QuddusNo ratings yet

- Bangladesh Importer Guidelines PDFDocument27 pagesBangladesh Importer Guidelines PDFMd Delowar Hossain MithuNo ratings yet

- Export Procedure PDFDocument2 pagesExport Procedure PDFMichaelNo ratings yet

- Export Import TanzaniaDocument16 pagesExport Import Tanzaniaahmenat2137No ratings yet

- Export Potentials of Small Scale IndustriesDocument29 pagesExport Potentials of Small Scale IndustriesTanveer Singh Rainu60% (10)

- Top 100-200 Clothing Brands For Men - Page (2 Out of 4) - Henleys, User Contributed Rankings - ShareRanksDocument9 pagesTop 100-200 Clothing Brands For Men - Page (2 Out of 4) - Henleys, User Contributed Rankings - ShareRanksArun Ann100% (1)

- Presentation of ECGC, KolkataDocument30 pagesPresentation of ECGC, Kolkatabharti ashhplayNo ratings yet

- Mid MCDocument47 pagesMid MCPhuong PhamNo ratings yet

- J Gate Members DetailsDocument8 pagesJ Gate Members DetailstextiledeepakNo ratings yet

- Importers in Delhi From ChinaDocument8 pagesImporters in Delhi From ChinaBhavvyam BhatnagarNo ratings yet

- Textile Times Volume 12Document40 pagesTextile Times Volume 12mohammed_ismail69No ratings yet

- Proforma Invoice GarmentDocument4 pagesProforma Invoice GarmentMehedi HasanNo ratings yet

- IBAGuideLine PDFDocument7 pagesIBAGuideLine PDFPramod NandakumarNo ratings yet

- COST SHEET FOR GARMENTS by Online Clothing StudyDocument3 pagesCOST SHEET FOR GARMENTS by Online Clothing StudyNilesh JariwalaNo ratings yet

- FEMA Compliance and Recent Policies On FDI - CA Manoj ShahDocument58 pagesFEMA Compliance and Recent Policies On FDI - CA Manoj ShahAbhinay KumarNo ratings yet

- Export Import Data Bank IndiaDocument1 pageExport Import Data Bank Indiapravin963No ratings yet

- Flow ChartDocument6 pagesFlow ChartNavukkarasu Jaganathan100% (1)

- Fair Directory 02-2016Document96 pagesFair Directory 02-2016NJ enterpriseNo ratings yet

- Magam Exports PVT LimitedDocument28 pagesMagam Exports PVT LimitedMrunal ShirsatNo ratings yet

- Export Promoting InstitutesDocument21 pagesExport Promoting InstitutesVikaskundu28100% (1)

- Bill DiscountingDocument43 pagesBill DiscountingVamshi Palavajala100% (1)

- LC Copy - Ef-004 2021 - Vikohasan - 6X40'FT - 3hochiminh 3haiphongDocument4 pagesLC Copy - Ef-004 2021 - Vikohasan - 6X40'FT - 3hochiminh 3haiphongKhaerul FazriNo ratings yet

- User Manual Oracle Banking Digital Experience Corporate Trade FinanceDocument213 pagesUser Manual Oracle Banking Digital Experience Corporate Trade FinanceTarik AljaroushiNo ratings yet

- Republic of Korea: IndiaDocument56 pagesRepublic of Korea: IndiaAashhna KumarNo ratings yet

- Ima Icici AccontsDocument79 pagesIma Icici AccontsKaran PanchalNo ratings yet

- International Trade FinanceDocument33 pagesInternational Trade Financemesba_17No ratings yet

- Export Requirements - UAEDocument20 pagesExport Requirements - UAEParthMairNo ratings yet

- Export Tutorial: - Researching MarketsDocument12 pagesExport Tutorial: - Researching MarketssadafshariqueNo ratings yet

- Role of An Intermediatry - Buying HouseDocument15 pagesRole of An Intermediatry - Buying HouseGarima DhimanNo ratings yet

- Lifestyle International PVT Ltd-Max Retail Division: 1 Dhruv Singh 10 PGDM 035Document23 pagesLifestyle International PVT Ltd-Max Retail Division: 1 Dhruv Singh 10 PGDM 035Kshatriy'as ThigalaNo ratings yet

- Role of DirectorsDocument25 pagesRole of DirectorsAshish JindalNo ratings yet

- Arag Apparel: Quality Apparel For EveryoneDocument19 pagesArag Apparel: Quality Apparel For Everyonemustafe omerNo ratings yet

- MICR CodeDocument635 pagesMICR Codemother21020% (1)

- Related Press Release: A.P. (DIR Series) Circular No. 56 Dated June 28, 2010Document8 pagesRelated Press Release: A.P. (DIR Series) Circular No. 56 Dated June 28, 2010Moin LadhaNo ratings yet

- Renewal of Regular Contractor's License (SOLE - PROP) - 11192018 (Repaired)Document25 pagesRenewal of Regular Contractor's License (SOLE - PROP) - 11192018 (Repaired)Justine Jay AlderiteNo ratings yet

- Renewal of Regular Contractor's License (SOLE - PROP) - PNEDocument24 pagesRenewal of Regular Contractor's License (SOLE - PROP) - PNERodjun QuiolasNo ratings yet

- Workbook - 3rd SemDocument94 pagesWorkbook - 3rd SemKandu SahibNo ratings yet

- July 25, 2016 RA 9165 Direct Assault & GODDocument2 pagesJuly 25, 2016 RA 9165 Direct Assault & GODpolNo ratings yet

- Kho v. Makalintal (1999) : Topic: Validity of Search WarrantDocument2 pagesKho v. Makalintal (1999) : Topic: Validity of Search WarrantdelayinggratificationNo ratings yet

- Ax Reminder: When To Apply 10% or 15% EWT For Professional FeesDocument2 pagesAx Reminder: When To Apply 10% or 15% EWT For Professional FeesRegs AccexNo ratings yet

- Partha Moulik-Offer LetterDocument3 pagesPartha Moulik-Offer LetterparthaNo ratings yet

- Compel Discovery - Stong MoveDocument3 pagesCompel Discovery - Stong MovePublic Knowledge100% (3)

- 19 Patula vs. PeopleDocument2 pages19 Patula vs. PeopleNivNo ratings yet

- 1.code of Commerce+Special Laws (Final)Document26 pages1.code of Commerce+Special Laws (Final)Melvin BanzonNo ratings yet

- In The Line of Fire A Memoir Pervez MusharrafDocument4 pagesIn The Line of Fire A Memoir Pervez Musharrafhussymian06No ratings yet

- Chapter 4Document27 pagesChapter 4kimiskyperNo ratings yet

- Bill Drafting Manual Kentucky General AssemblyDocument205 pagesBill Drafting Manual Kentucky General AssemblyTayyib ShahNo ratings yet

- SOSIOLOGI HUKUM EDIT 2013 November 1Document72 pagesSOSIOLOGI HUKUM EDIT 2013 November 1Riko Kurnia PutraNo ratings yet

- Compendium of Tax Laws in PakistanDocument3 pagesCompendium of Tax Laws in PakistanMalick Sajid Ali IlladiiNo ratings yet

- Guidelines For Striking Off - Appendix 1Document2 pagesGuidelines For Striking Off - Appendix 1Siti Nur Fatihah ZamuriNo ratings yet

- State OrganisationDocument13 pagesState OrganisationSahrul IrawanNo ratings yet

- Sample Script For PTA Officer ElectionsDocument2 pagesSample Script For PTA Officer ElectionsAllexa De GuzmanNo ratings yet

- BVI ActDocument110 pagesBVI ActW.t. LamNo ratings yet

- Finance (Allowances) Department: G.O.No.47, DATED: 20 February, 2014Document3 pagesFinance (Allowances) Department: G.O.No.47, DATED: 20 February, 2014Papu KuttyNo ratings yet

- Order in The Matter of Vaibhav Pariwar India Projects LimitedDocument19 pagesOrder in The Matter of Vaibhav Pariwar India Projects LimitedShyam SunderNo ratings yet

- Group Gratuity Schemes: BY: Manjusha Arora Ankur GargDocument15 pagesGroup Gratuity Schemes: BY: Manjusha Arora Ankur GargManjusha AroraNo ratings yet

- Intosai-P: Principles of Transparency and AccountabilityDocument11 pagesIntosai-P: Principles of Transparency and AccountabilityishtiaqNo ratings yet

- James Johnson v. K Mart Corporation, 273 F.3d 1035, 11th Cir. (2001)Document47 pagesJames Johnson v. K Mart Corporation, 273 F.3d 1035, 11th Cir. (2001)Scribd Government DocsNo ratings yet

- Affidavit of Truth Actual and Constructive Noticejeffrey Thomas Maehr Id 000000000Document148 pagesAffidavit of Truth Actual and Constructive Noticejeffrey Thomas Maehr Id 000000000thenjhomebuyer100% (2)

- What Are Man's Truths Ultimately Merely His Irrefutable Errors - NietzscheDocument5 pagesWhat Are Man's Truths Ultimately Merely His Irrefutable Errors - NietzscheThavam RatnaNo ratings yet

- Foreclosure Case Wins Misc 48 PagesDocument46 pagesForeclosure Case Wins Misc 48 Pagestraderash1020100% (4)

- (Phase III - Case 2) Ediga Anamma v. State of APDocument11 pages(Phase III - Case 2) Ediga Anamma v. State of APvaibhav4yadav-4No ratings yet

- Nomination Remuneration PolicyDocument9 pagesNomination Remuneration PolicyUniinfo Telecom Services Ltd.No ratings yet

- Full Legal Complaint Filed by Mark Mullins Against The Town of RichlandsDocument19 pagesFull Legal Complaint Filed by Mark Mullins Against The Town of RichlandsJeff WilliamsonNo ratings yet

- Case 015 - Maccay V NobelaDocument6 pagesCase 015 - Maccay V NobeladirtylipopipsNo ratings yet