Professional Documents

Culture Documents

Module 40 Taxes: Gift and Estate: A ' - , (, ' S,, S, ' S - , - C S - .

Module 40 Taxes: Gift and Estate: A ' - , (, ' S,, S, ' S - , - C S - .

Uploaded by

Zeyad El-sayedOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 40 Taxes: Gift and Estate: A ' - , (, ' S,, S, ' S - , - C S - .

Module 40 Taxes: Gift and Estate: A ' - , (, ' S,, S, ' S - , - C S - .

Uploaded by

Zeyad El-sayedCopyright:

Available Formats

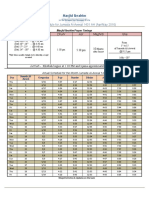

MODULE 40 TAXES: GIFT AND ESTATE 687

and federal estate taxes are not deductible in computing a poses, income in respect of a decedent will be included in

decedent's taxable estate. Note that although foreign death the decedent's gross estate at its fair market value on the

taxes are not deductible in computing a decedent's taxable appropriate valuation date. For income tax purposes, the

estate, a limited tax credit is allowed for foreign death taxes income tax basis of the decedent (zero) transfers over to the

in computing the net estate tax payable. estate or beneficiary who collects the fee. The recipient of

the income must classify it in the same manner (i.e., ordi-

19. (a) The requirement is to determine whether federal nary income) as would have the decedent. Thus, the ac-

estate tax returns must be filed for the estates of Eng and counting fee must be included in Ross' gross estate and must

Lew. For a decedent dying during 2009, a federal estate tax also be included in the estate's fiduciary income tax return

return (Form 706) must be filed if the decedent's gross estate

exceeds ($3,500,000). If a decedent made taxable lifetime

gifts such that the decedent's applicable transfer tax credit

was used to offset the gift tax, the ($3,500,000) exemption

amount must be reduced by the amount of taxable lifetime

gifts to determine whether a return is required to be filed.

Since Lew made no lifetime gifts and the value of

Lew's gross estate was only $2,800,000, no federal estate

tax return is required to be filed for Lew's estate. In Eng's

case, the ($3,500,000) exemption is reduced by Eng's

$100,000 of taxable lifetime gifts to $3,400,000. However,

since Eng's gross estate totaled only $2,600,000, no federal

estate tax return is required to be filed for Eng's estate.

20. (d) The requirement is to determine the correct

statement regarding the use of the alternate valuation date in

computing the federal estate tax. An executor of an estate

can elect to use the alternate valuation date (the date six

months after the decedent's death) to value the assets in-

cluded in a decedent's gross estate only if its use decreases

both the value of the gross estate and the amount of estate

tax liability. Answer (a) is incorrect because the alternate

valuation date cannot be used if its use increases the value of

the gross estate. Answer (b) is incorrect because the use of

the alternate valuation date is an irrevocable election. An-

swer (c) is incorrect because the alternate valuation date is

only used to value an estate's assets, not its liabilities.

21. (c) The requirement is to determine when the pro-

ceeds of life insurance payable to the estate's executor, as

the estate's representative, are includible in the decedent's

gross estate. The proceeds of life insurance on the dece-

dent's life are always included in the decedent's gross estate

if (1) they are receivable by the estate, (2) the decedent pos-

sessed any incident of ownership in the policy, or (3) they

are receivable by another (e.g., the estate's executor) for the

benefit of the estate.

22. (d) The requirement is to determine the proper in-

come and estate tax treatment of an accounting fee earned by

Ross before death, that was subsequently collected by the

executor of Ross' estate. Since Ross was a calendar-year,

cash-method taxpayer, the income would not be included on

Ross' final individual income tax return because payment

had not been received. Since the accounting fee would not

be included in Ross' final income tax return because of

Ross' cash method of accounting, the accounting fee would

be "income in respect of a decedent." For estate tax pur-

( (Form 706) must be filed and the tax paid within nine

F months of the decedent's death, unless an extension of time

or has been granted.

m

1 24. (c) The requirement is to determine the amount of

0 marital deduction that can be claimed in computing Alan's

4 taxable estate. In computing the taxable estate of a dece-

1) dent, an unlimited marital deduction is allowed for the por-

b tion of the decedent's estate that passes to the decedent's

e surviving spouse. Since $900,000 was bequeathed outright

c to Alan's widow, Alari's estate will receive a marital deduc-

a tion of $900,000.

u

se 25. (b) The requirement is to determine Edwin' s basis

th for the stock inherited from Lynri's estate. A special rule

e applies if a decedent (Lynn) acquires appreciated property as

fe a gift within one year of death, and this property passes to

e the donor (Edwin) or donor's spouse. Then the donor's

w (Edwin' s) basis is the basis of the property in the hands of

as the decedent (Lynn) before death. Since Lynn had received

c the stock as a gift, Lynn's basis before death ($5,000) be-

ol comes the basis of the stock to Edwin.

le

ct n. Generation-Skipping Tax

e

d 26. (c) The requirement is to determine the correct

b statement regarding the generation-skipping transfer tax.

y

th The generation-skipping transfer tax is imposed as a separate

e tax in addition to the federal gift and estate taxes, and is

e designed to prevent an individual from escaping an entire

x generation of gift and estate taxes by transferring property to

e a person that is two or more generations below that of the

c transferor. The tax is imposeq at the highest tax rate (45%

ut for 2008) under the transfer tax rate schedule.

or

Ill. Income Taxation of Estates and Trusts

of 27. (c) The requirement is to determine the amount of

R the estate's $10,000 distribution that must be included in

o gross income by Crane's widow. The maximum amount

ss that is taxable to beneficiaries is limited to the estate's dis-

' tributable net income (DNI). Since distributions to multiple

es beneficiaries exceed DNI, the estate's $12,000 of DNI must

ta be prorated to distributions to determine the portion of each

te distribution that must be included in gross income. Since

. distributions to the widow and daughter totaled $15,000, the

portion of the $10,000 distribution that must be included in

23. the widow's gross income equals ($10,000/$15,000) x

(c) $12,000 = $8,000.

Th

e 28. (a) The requirement is to determine the estate's

req distributable net income (DNI). An estate's DNI generally

uir is its taxable income before the income distribution deduc-

em tion, increased by its personal exemption, any net capital

ent loss deduction, and tax-exempt interest (reduced by related

is nondeductible expenses), and decreased by any net capital

to gains allocable to corpus. Here, the estate's DNI is the

det $20,000 of taxable interest reduced by the $5,000 of admin-

er istrative expenses attributable to taxable income, or $15,000.

mi

ne 29. (b) The requirement is to determine the due date for

wit the Fiduciary Income Tax Return (Form 1041) for the es-

hin

ho

w

ma

ny

mo

nth

s

aft

er

the

dat

e

of

Al

an'

s

de

ath

his

fed

era

l

est

ate

tax

ret

urn

sh

oul

d

be

file

d.

Th

e

fed

era

l

est

ate

tax

ret

urn

You might also like

- Chap 06Document30 pagesChap 06Tim JamesNo ratings yet

- OutlineDocument71 pagesOutlineMaxwell NdunguNo ratings yet

- ACC 430 Chapter 17Document13 pagesACC 430 Chapter 17vikkiNo ratings yet

- Module 40 Taxes: Gift and Estate: 11. Generation-Skipping TaxDocument2 pagesModule 40 Taxes: Gift and Estate: 11. Generation-Skipping TaxZeyad El-sayedNo ratings yet

- Taxes: Gift and Estate: S A Dard DeductioDocument2 pagesTaxes: Gift and Estate: S A Dard DeductioZeyad El-sayedNo ratings yet

- Module 40 Taxes: Gift and Estate: Standard Dedu Tion For A Trust or An Estate in The FiduciaryDocument2 pagesModule 40 Taxes: Gift and Estate: Standard Dedu Tion For A Trust or An Estate in The FiduciaryZeyad El-sayedNo ratings yet

- Scan 0004Document2 pagesScan 0004Zeyad El-sayedNo ratings yet

- Module 40 T Xes: Gift D Est TE: A AN ADocument2 pagesModule 40 T Xes: Gift D Est TE: A AN AZeyad El-sayedNo ratings yet

- Module 33 Taxes: IndividualDocument2 pagesModule 33 Taxes: IndividualAnonymous JqimV1ENo ratings yet

- Taxation Law Bar Questions & Answers: Submitted By: BALUYUT, Maria Corazon de Leon, Dino GADOR, Ken Reyes SUCGANG, JustinDocument8 pagesTaxation Law Bar Questions & Answers: Submitted By: BALUYUT, Maria Corazon de Leon, Dino GADOR, Ken Reyes SUCGANG, JustinKen Reyes GadorNo ratings yet

- Vi K. Credit For The E E Yandthed Sab Ed: M Ule Taxes: Ind Vi UalDocument3 pagesVi K. Credit For The E E Yandthed Sab Ed: M Ule Taxes: Ind Vi UalZeyad El-sayedNo ratings yet

- Jessa B. Regalario Ms. Tabernilla V-Bsa F. Schedule and Computation of The Tax Estate Tax Imposed On Net EstateDocument8 pagesJessa B. Regalario Ms. Tabernilla V-Bsa F. Schedule and Computation of The Tax Estate Tax Imposed On Net EstatejessaNo ratings yet

- Maryland Mortgage Program - Recapture TaxDocument12 pagesMaryland Mortgage Program - Recapture TaxNishika JGNo ratings yet

- Allowable Deductions SEC. 86. Computation of Net Estate. - For The Purpose of The Tax Imposed in ThisDocument5 pagesAllowable Deductions SEC. 86. Computation of Net Estate. - For The Purpose of The Tax Imposed in ThisJenny Rose Castro FernandezNo ratings yet

- Module 33 Taxes: IndividualDocument2 pagesModule 33 Taxes: IndividualAnonymous JqimV1ENo ratings yet

- SolutionsDocument16 pagesSolutionsapi-3817072100% (2)

- Taxes: Corporate: Sec. S OcDocument2 pagesTaxes: Corporate: Sec. S OcAnonymous JqimV1ENo ratings yet

- Preweek TaxationDocument13 pagesPreweek TaxationigorotknightNo ratings yet

- Freuler v. Helvering, 291 U.S. 35 (1934)Document12 pagesFreuler v. Helvering, 291 U.S. 35 (1934)Scribd Government DocsNo ratings yet

- Taxation of Estates and TrustsDocument42 pagesTaxation of Estates and TrustsAngelica Joyce DyNo ratings yet

- CPAR Tax On Estates and Trusts (Batch 92) - HandoutDocument10 pagesCPAR Tax On Estates and Trusts (Batch 92) - HandoutNikkoNo ratings yet

- Taxes: Individual: T D - B U H U N T BL U T P 7Document1 pageTaxes: Individual: T D - B U H U N T BL U T P 7Zeyad El-sayedNo ratings yet

- BusTax - Chapter 3 MODULEDocument8 pagesBusTax - Chapter 3 MODULETimon CarandangNo ratings yet

- Pre-Week Batch 90 (TAX)Document12 pagesPre-Week Batch 90 (TAX)Elaine Joyce GarciaNo ratings yet

- CPAR Taxation PreweekDocument38 pagesCPAR Taxation PreweekAndrei Nicole RiveraNo ratings yet

- CPAR Tax On Estates and Trusts Batch 91 HandoutDocument10 pagesCPAR Tax On Estates and Trusts Batch 91 HandoutJohnallenson DacosinNo ratings yet

- 0 Taxes: Gift A D EstateDocument1 page0 Taxes: Gift A D EstateZeyad El-sayedNo ratings yet

- Scan 0049Document2 pagesScan 0049Anonymous JqimV1ENo ratings yet

- Module 33 Taxes: Individual: I.O. Credit For Adoption ExpensesDocument2 pagesModule 33 Taxes: Individual: I.O. Credit For Adoption ExpensesZeyad El-sayedNo ratings yet

- Chapter 9 Estate Tax DeductionsDocument7 pagesChapter 9 Estate Tax DeductionsEthel Joy Tolentino GamboaNo ratings yet

- Procedure in Computing Vanishing DeductionDocument5 pagesProcedure in Computing Vanishing DeductionDon Tiansay100% (5)

- Tax 02-Lesson 05 - Estate Tax Credit, Distributable Estate, and Estate Tax ReturnsDocument31 pagesTax 02-Lesson 05 - Estate Tax Credit, Distributable Estate, and Estate Tax ReturnsMama MiyaNo ratings yet

- A. The Constitution and The Income Tax: Federal Income Tax Professor Morrison Fall 2003 CHAPTER 1: IntroductionDocument67 pagesA. The Constitution and The Income Tax: Federal Income Tax Professor Morrison Fall 2003 CHAPTER 1: IntroductioncjleopNo ratings yet

- BT 211 Module 05 1Document12 pagesBT 211 Module 05 1Franz PampolinaNo ratings yet

- Lecture Notes Estates and TrustDocument3 pagesLecture Notes Estates and TrustNneka VillacortaNo ratings yet

- Resident Citizen, Non-Resident Citizen, and Resident Alien DecedentsDocument6 pagesResident Citizen, Non-Resident Citizen, and Resident Alien DecedentsSophia Angelica Marie MarasiganNo ratings yet

- Donor's TaxDocument6 pagesDonor's TaxMoises A. Almendares100% (1)

- Taxes: Gift and Estate: y - , e e e - C, ,,, C ' - Y, - o o O,, e ' 'Document3 pagesTaxes: Gift and Estate: y - , e e e - C, ,,, C ' - Y, - o o O,, e ' 'El-Sayed MohammedNo ratings yet

- FAQ About NY's CE Tax CreditDocument6 pagesFAQ About NY's CE Tax CreditHenrietta JordanNo ratings yet

- CPAR Tax On Estates and Trusts (Batch 90) - HandoutDocument10 pagesCPAR Tax On Estates and Trusts (Batch 90) - HandoutAljur SalamedaNo ratings yet

- CIR v. LednickyDocument2 pagesCIR v. LednickyBananaNo ratings yet

- 7 Taxation For Estates and Trusts CompressDocument6 pages7 Taxation For Estates and Trusts CompressGiella MagnayeNo ratings yet

- AICPA - CPA Reg 2017Document12 pagesAICPA - CPA Reg 2017Gene'sNo ratings yet

- I. J. Marshall and Claribel Marshall v. Commissioner of Internal Revenue, Flora H. Miller v. Commissioner of Internal Revenue, 510 F.2d 259, 10th Cir. (1975)Document8 pagesI. J. Marshall and Claribel Marshall v. Commissioner of Internal Revenue, Flora H. Miller v. Commissioner of Internal Revenue, 510 F.2d 259, 10th Cir. (1975)Scribd Government DocsNo ratings yet

- Connecticut Resident Income Tax InformationDocument11 pagesConnecticut Resident Income Tax InformationShraddhanand MoreNo ratings yet

- Dwnload Full Pearsons Federal Taxation 2019 Individuals 32nd Edition Rupert Test Bank PDFDocument20 pagesDwnload Full Pearsons Federal Taxation 2019 Individuals 32nd Edition Rupert Test Bank PDFsportfulscenefulzb3nh100% (16)

- Scan 0060Document2 pagesScan 0060Zeyad El-sayedNo ratings yet

- S I Ssa: Module 33 Taxes: IndividualDocument1 pageS I Ssa: Module 33 Taxes: IndividualZeyad El-sayedNo ratings yet

- United States Court of Appeals Second Circuit.: Nos. 148-150, Dockets 29926-29928Document9 pagesUnited States Court of Appeals Second Circuit.: Nos. 148-150, Dockets 29926-29928Scribd Government DocsNo ratings yet

- Chapter c14Document27 pagesChapter c14DrellyNo ratings yet

- Module 36 Taxes: CorporateDocument1 pageModule 36 Taxes: CorporateAnonymous JqimV1ENo ratings yet

- EstateDocument10 pagesEstateGelyn CruzNo ratings yet

- Fundamentals of Taxation 2019 12th Edition Schisler Test BankDocument17 pagesFundamentals of Taxation 2019 12th Edition Schisler Test BankJaredStantonpqcrj100% (11)

- Bmidterm - Estate TrustsDocument43 pagesBmidterm - Estate TrustsRexell DepalacNo ratings yet

- Classification of Deductible Expenses Section 212 Expenses:: Have AGI LimitationsDocument6 pagesClassification of Deductible Expenses Section 212 Expenses:: Have AGI Limitations张心怡No ratings yet

- CH 06Document31 pagesCH 06cushin200975% (4)

- Canadian Income Taxation 2016 2017 19th Edition Buckwold Test BankDocument25 pagesCanadian Income Taxation 2016 2017 19th Edition Buckwold Test BankMatthewWhitetwks100% (66)

- Acct 557Document5 pagesAcct 557kihumbae100% (5)

- Scan 0013Document2 pagesScan 0013Zeyad El-sayedNo ratings yet

- Scan 0001Document2 pagesScan 0001Zeyad El-sayedNo ratings yet

- Fede Al Securities Acts: OvervieDocument2 pagesFede Al Securities Acts: OvervieZeyad El-sayedNo ratings yet

- P N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEDocument3 pagesP N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEZeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Document2 pagesModule 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Zeyad El-sayedNo ratings yet

- Scan 0001Document2 pagesScan 0001Zeyad El-sayedNo ratings yet

- Scan 0012Document2 pagesScan 0012Zeyad El-sayedNo ratings yet

- S Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateDocument3 pagesS Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- Se Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossDocument3 pagesSe Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossZeyad El-sayedNo ratings yet

- I y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateDocument2 pagesI y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- Revocation of Discharge: 2M Module27 BankruptcyDocument2 pagesRevocation of Discharge: 2M Module27 BankruptcyZeyad El-sayedNo ratings yet

- 80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateDocument2 pages80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- Scan 0018Document1 pageScan 0018Zeyad El-sayedNo ratings yet

- Scan 0010Document3 pagesScan 0010Zeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZDocument2 pagesModule 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZZeyad El-sayedNo ratings yet

- B Nkruptcy: Discharge of A BankruptDocument2 pagesB Nkruptcy: Discharge of A BankruptZeyad El-sayedNo ratings yet

- The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Document2 pagesThe Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Zeyad El-sayedNo ratings yet

- Deduct From Book Income: - B - T F Dul - .Document2 pagesDeduct From Book Income: - B - T F Dul - .Zeyad El-sayedNo ratings yet

- Scan 0010Document2 pagesScan 0010Zeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CDocument3 pagesModule 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CZeyad El-sayedNo ratings yet

- Bankruptcy:: y y S e S Owed SDocument3 pagesBankruptcy:: y y S e S Owed SZeyad El-sayedNo ratings yet

- Professional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsDocument2 pagesProfessional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsZeyad El-sayedNo ratings yet

- Article I Responsibilities. Article Il-The Public InterestDocument2 pagesArticle I Responsibilities. Article Il-The Public InterestZeyad El-sayedNo ratings yet

- Module 21 Professional Responsibilities: Interpretation 101-2. A FirmDocument2 pagesModule 21 Professional Responsibilities: Interpretation 101-2. A FirmZeyad El-sayedNo ratings yet

- ET Section 10 01 Conce Tu LF Mework For A Cpa I e Ence StandardsDocument2 pagesET Section 10 01 Conce Tu LF Mework For A Cpa I e Ence StandardsZeyad El-sayedNo ratings yet

- Scan 0006Document2 pagesScan 0006Zeyad El-sayedNo ratings yet

- Scan 0009Document2 pagesScan 0009Zeyad El-sayedNo ratings yet

- Scan 0008Document2 pagesScan 0008Zeyad El-sayedNo ratings yet

- Scan 0008Document2 pagesScan 0008Zeyad El-sayedNo ratings yet

- Scan 0008Document2 pagesScan 0008Zeyad El-sayedNo ratings yet

- Annual Report Library Management System 2020-2021Document144 pagesAnnual Report Library Management System 2020-2021ARUNAVA SAMANTANo ratings yet

- Re-Imagining Crotonville:: Epicentre of Ge'S LeadershipDocument7 pagesRe-Imagining Crotonville:: Epicentre of Ge'S LeadershipShalini SarkarNo ratings yet

- Case Digest - Carpio VS Sulu Resources Development CorporationDocument3 pagesCase Digest - Carpio VS Sulu Resources Development Corporationfred rhyan llausasNo ratings yet

- Sri Lanka ArchitectureDocument35 pagesSri Lanka ArchitectureNescie Marie Sudario BautistaNo ratings yet

- Outline For Internship PresentationDocument2 pagesOutline For Internship PresentationThe Card ManNo ratings yet

- Unit1. Economic EnvironmentDocument50 pagesUnit1. Economic EnvironmentAkshat YadavNo ratings yet

- FN 202 Chapter 4Document38 pagesFN 202 Chapter 4BablooNo ratings yet

- Chap 17Document26 pagesChap 17api-2409004560% (1)

- The Contribution of Abu Yusufs Thought Islamic EcDocument18 pagesThe Contribution of Abu Yusufs Thought Islamic EcArs TaeNo ratings yet

- mg2CURRICULUM VITAEDocument4 pagesmg2CURRICULUM VITAELovely Rose Dungan TiongsonNo ratings yet

- Hip Hop EvolutionDocument9 pagesHip Hop Evolutionapi-317111281No ratings yet

- BS en Iso 11203-2009Document14 pagesBS en Iso 11203-2009Valentina CoroiNo ratings yet

- CIV PRO DigestDocument54 pagesCIV PRO DigestbcarNo ratings yet

- Credit To Andrew Kroeze and Cole Gordon For This FrameworkDocument8 pagesCredit To Andrew Kroeze and Cole Gordon For This FrameworkAsdgf FdsgfNo ratings yet

- Rights and Duties of The Partners in Indian Partnership Act 1932Document11 pagesRights and Duties of The Partners in Indian Partnership Act 1932Ayushman PandaNo ratings yet

- Borrowing Cost & Gov Grants-QUIZDocument3 pagesBorrowing Cost & Gov Grants-QUIZDanah EstilloreNo ratings yet

- Eia Report of Expansion of Thermal Power Plant: Tamnar, Tehsil Gharghoda, Dist Raigarh (Chhattisgarh)Document16 pagesEia Report of Expansion of Thermal Power Plant: Tamnar, Tehsil Gharghoda, Dist Raigarh (Chhattisgarh)Agila R RamamoorthyNo ratings yet

- (123doc) - De-Kiem-Tra-Hoc-Ky-Ii-Mon-Tieng-Anh-Lop-6-Truong-Thcs-Phan-Chu-Trinh-Dien-Khanh-Khanh-Hoa PDFDocument3 pages(123doc) - De-Kiem-Tra-Hoc-Ky-Ii-Mon-Tieng-Anh-Lop-6-Truong-Thcs-Phan-Chu-Trinh-Dien-Khanh-Khanh-Hoa PDFDo Thi LanNo ratings yet

- Jumada Al-Awwal 1431 AH Prayer ScheduleDocument2 pagesJumada Al-Awwal 1431 AH Prayer SchedulemasjidibrahimNo ratings yet

- Revista Paradores Otoño 2011Document85 pagesRevista Paradores Otoño 2011filustroNo ratings yet

- Collective Bargaining Assignment Final - EditedDocument17 pagesCollective Bargaining Assignment Final - EditedEzatullah HamnawaNo ratings yet

- Garmin GTX 330 ManualDocument6 pagesGarmin GTX 330 Manualdannyells_danielsNo ratings yet

- HDFC Bank LimitedDocument5 pagesHDFC Bank LimitedRaushan MehrotraNo ratings yet

- Fostiima Business School Application ProcessDocument10 pagesFostiima Business School Application ProcessShashank KumarNo ratings yet

- 07 Social Science Civics Key Notes Ch08 Market Around UsDocument1 page07 Social Science Civics Key Notes Ch08 Market Around Uspoojasukhija1980No ratings yet

- GS Form No. 8 - Gaming Terminal Expansion-Reduction Notification FormDocument2 pagesGS Form No. 8 - Gaming Terminal Expansion-Reduction Notification FormJP De La PeñaNo ratings yet

- Lecture 2 - Cost AssignmentDocument10 pagesLecture 2 - Cost AssignmentJaquin0% (1)

- Publishing and Disseminating Dalit Literature: Joshil K. AbrahamDocument8 pagesPublishing and Disseminating Dalit Literature: Joshil K. AbrahamkalyaneeNo ratings yet

- Rethinking Frank ViolaDocument28 pagesRethinking Frank ViolaNuno Philippus LupusNo ratings yet

- France S Approach To The Indo Pacific RegionDocument4 pagesFrance S Approach To The Indo Pacific RegionDievca ToussaintNo ratings yet