Professional Documents

Culture Documents

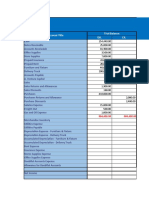

Presentation of Financial Statements: IFRS Is Similar But Differences May Relate To

Presentation of Financial Statements: IFRS Is Similar But Differences May Relate To

Uploaded by

Duaaaa0 ratings0% found this document useful (0 votes)

42 views11 pagesOriginal Title

IAS-REVIEWER.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

42 views11 pagesPresentation of Financial Statements: IFRS Is Similar But Differences May Relate To

Presentation of Financial Statements: IFRS Is Similar But Differences May Relate To

Uploaded by

DuaaaaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 11

CHAPTER 5 Onerous Contract

Current Liabilities o Unavoidable costs of meeting the obligation exceed

IAS 1, Presentation of Financial Statements: economic benefits to be realized.

Requires liabilities to be classified as current or o Recognize lower of cost of fulfillment or penalty from

noncurrent non-fulfillment.

Current: o If onerous from entity's own action--no recognition until

1. Expects to settle in its normal business cycle that action happens.

2. Holds primarily for the purpose of trading Restructuring

3. Expects to settle within 12 months of the balance o A program planned and controlled by management that

sheet date materially changes either scope of business or manner

4. Does not have the right to defer until 12 months after in which business is conducted.

the balance sheet date o Such as sale or termination of line of business, closure

IFRS is similar but differences may relate to: of location, change in management structure, material

o Refinanced short-term debt– only long-term if reorganization which changes nature and focus of

completed prior to balance sheet date vs. U.S. GAAP operations.

which allows long-term if an agreement has been o U.S. GAAP doesn’t allow restructuring provision until

reached prior to balance sheet date, even if not liability incurred, so may occur later than under IFRS.

completed by then. Contingent Assets

o Accounts payable on demand due to violation of o Probable asset arising from past events whose existence

debt covenants—must be current unless lender issues will be confirmed by occurrence or non-occurrence of

waiver of at least 12 months by balance sheet date. The future event.

waiver must be obtained, under U.S. GAAP, by annual o Don’t recognize—disclose when probable inflow of

report issuance date. economic benefits.

o Bank overdrafts—netted against cash if an integral part o Recognize as asset when virtually certain.

of cash management—otherwise current liabilities. U.S. o Earlier recognition of contingent asset and related gain

GAAP always treats as current liabilities. than U.S. GAAP, which generally requires realization

o Liabilities and assets of uncertain timing, amount, or before recognition.

existence. Proposed Amendments to IAS 37

o Onerous contracts and restructuring costs. o Criterion of “probable outflow of resources” for provision

o Examples of environmental costs and nuclear would be removed---i.e.—recognize as long as

decommissioning costs. reasonably measurable.

o “Best estimate” rule would be replaced with liability

Contingent Liabilities and Provisions measurement at what would be a rational expectation of

Contingent liability is either: payment to relieve present obligation---in many cases

o Possible obligation from past events to be confirmed by the present value of required resources.

presence or absence of future event OR IAS 19, Employee Benefits

o Present obligation not recognized because no probable o Covers all forms of employee compensation and benefits

outflow of resources or amount can’t be measured other than share-based compensation (e.g. stock

reliably options).

o Contingent liability is not recognized on balance sheet Four types:

while a provision is. 1. Short-term (compensated absences and bonuses).

o Provision is a liability of uncertain timing or amount: 2. Post-employment ( pensions, medical benefits, etc.).

o Present legal or constructive obligation resulting from 3. Other long-term benefits (deferred compensation and

past event (constructive—e.g. manufacturer announces disability).

will honor defunct retailer rebates). 4. Termination benefits (severance and early retirement).

o Probable (more likely than not) outflow of resources. IFRS 2, Share-based Payment

o Can be estimated reliably. o IASB and FASB worked closely on standards.

Types of Differences Between IFRS and U.S. GAAP o # of minor differences, but both standards

o U.S. GAAP doesn’t recognize constructive obligations— substantially similar

only legal. o IFRS 2 sets out measurement principles and specific

o For contingencies U.S. GAAP does not define probable, guidance for three types of transactions:

although research shows most accountants use 70%- o Equity-settled—entity receives goods or services in

90% probability. IAS 37 uses “more likely than not”, exchange for equity instruments (e.g. stock options).

which implies a threshold of just over 50%.

o Cash-settled—entity receives goods or services by o Both have deferred tax assets and liabilities re: timing

incurring liability to supplier based on price or value of differences and operating loss and tax credit carryovers.

shares or other equity instruments (e.g. share o March 2009 IASB exposure draft “Income Tax” intended

appreciation rights). to eliminate differences with U.S. GAAP.

o Choice of settlement of above two options. o Final standard replacing IAS 12 still not published as of

Equity-settled Spring 2011.

o Non-employees– if fair value of goods or services Tax Laws and Rates

can’t be determined—use fair value of the equity o Current and deferred taxes based on rates enacted or

instrument as of each date goods or services are substantively enacted (when future steps can’t change

received vs. U.S. GAAP where fair value of instrument outcome) by balance sheet date.

used and measured at earlier of commitment for o U.S. GAAP must use actually enacted rates.

performance or when performance completed. o To minimize double taxation some countries apply lower

o Employees—use fair value of instrument since fair rate to distributed profits vs. retained profits.

value of services not reliably measurable—value at date Recognition of Deferred Tax Asset

of grant—need to estimate # of options expected to o If future realization probable (undefined) vs. U.S. GAAP

vest multiplied by fair value to determine compensation where realization takes place if more likely than not --

expense over vesting period (offset is paid-in capital). -IAS 12 is more stringent if probability interpreted to

o If single vesting date (cliff vesting)—straight-line over mean greater than “more likely than not”.

service period. Disclosures

o If installments (graded vesting)—amortize each o IAS 12 requires extensive disclosures, including current

installment (tranche) over their vesting period. and deferred components of tax expense and

o U.S. GAAP re: graded vesting—choice of accelerated or relationship between hypothetical expense based on

straight-line recognition. statutory vs. effective tax rates using 2 approaches

o Modification of stock option plans—length or price may (statutory rate in home country or weighted average

change—recognize, at minimum, original compensation statutory rate between jurisdictions).

cost at grant date. IFRS vs. U.S. GAAP

o If fair value reduced---no change in compensation o IFRS can cause temporary differences not existing

deduction. under U.S. GAAP (e.g. revaluation model for p, p & e

o If fair value increased—increase compensation by the under IAS 16).

like amount. o Differences in impairment standards.

o U.S. GAAP—if modifications—fair value at modification Financial Statement Presentation

date determines compensation expense---no minimum o Under U.S. GAAP—deferred tax assets and liabilities

compensation as under IFRS. current or non-current based on underlying asset or

Cash-settled liability or, if for loss or credit carryforwards, timing of

o Stock appreciation rights—recognize liability for future expected realization.

cash outflow at fair value of appreciation rights using o IAS 1, Presentation of Financial Statements”—only

an option pricing model. noncurrent.

o Remeasure at each balance sheet date until settled. IAS 18, Revenue

o U.S. GAAP—certain cash-settled payments classified as o Single standard covering most revenues (sale of goods,

equity, whereas liability under IFRS. rendering of services, interest, royalties and dividends).

Choice-of-settlement o U.S. GAAP has no single standard—instead over 200

o Treat as cash-settled only if present obligation to different authoritative pronouncements, so difficult to

settle in cash— otherwise, treat as equity-settled. compare IAS 18 and U.S. GAAP .

o Remeasure at each balance sheet date until settled. o Revenue must be measured at fair value of

o If supplier can choose—entity has compound consideration received or receivable.

instrument with debt and equity components: o May need to split transaction into multiple elements

o Debt component measured at each balance sheet (e.g. sale of software and maintenance contract) or

date (recognize change in value in income). may need to combine multiple transactions into one for

o Equity component remains in equity and if supplier true economic substance.

chooses debt settlement in equity—transfer debt Sale of Goods—5 Criteria

piece to equity. o Transfer of significant risks and rewards to buyer (IAS

IAS 12, Income Taxes has various examples of how seller may retain risks).

o Similar approach with U.S. GAAP. o No effective control maintained or management

involvement.

o Can measure revenue reliably. o Contractual right to:

o Probable future economic benefits flow to seller. a) Receive cash or other financial asset

o Selling costs can be measured reliably. b) Exchange financial assets or financial liabilities under

Rendering of Service potentially favorable conditions

o Estimate reliably amount of revenue, costs incurred or to o An equity instrument of another entity

be incurred, and stage of completion (see IAS 11, o A contract that will or may be settled in the equity’s own

Construction Contracts, which can also apply to service equity instruments and is not classified as an equity

contracts). instrument of the entity

o Probable benefits will flow to enterprise. o Financial liability (e.g. payables, loans from other

o U.S. GAAP doesn’t allow percentage-of-completion for entities, bonds, etc.):

service contracts. o A contractual obligation to:

o If outcome can’t be measured reliably, only estimate a) Deliver cash or another financial asset

revenue to extent expenses are probably recoverable— b) Exchange financial assets or financial liabilities

otherwise, recognize only expense and not revenue. under potentially unfavorable conditions

Interest, Royalties and Dividends (if reliably o A contract that will or may be settled in the equity’s own

measurable) equity instruments.

o Interest recognized on effective yield basis. o Equity instrument—any contract that evidences a

o Royalties recognized on accrual basis based on relevant residual interest in the assets of an entity after

agreement. deducting all its liabilities.

o Dividends recognized when shareholder’s right to Compound Financial Instruments

receive payment is established. o Both a liability and equity element (e.g. convertible

Exchange of Goods or Services—no gain or loss if bond).

similar—if dissimilar—recognize fair value of what is o Split accounting required using with and without

received adjusted for cash paid or received method.

IASB-FASB Revenue Recognition Project Classification of Financial Assets and Liabilities

o Both boards working since 2002. o Financial asset:

o June 2010—joint Exposure Draft “Revenue from 1. Fair value through profit or loss (FVPL)

Contracts with Customers”. 2. Held-to-maturity investments

5 steps: 3. Loans and receivables

1. Identify the contract. 4. Available-for-sale financial assets

2. Identify separate performance obligations in the o Financial liabilities:

contract. 1. Fair value through profit or loss (FVPL)

3. Determine the transaction price. 2. Financial liabilities measured at amortized cost

4. Allocate the transaction price to the separate Measurement of Financial Instruments

performance obligations. o Initial—fair value (normally = amount paid or

5. Recognize the revenue allocated to each performance received).

obligation when the entity satisfies each performance o Subsequent—cost, amortized cost, or fair value.

obligation.

Financial Instruments CHAPTER 6

Three Standards China: Background

o IAS 32, Financial Instruments: Presentation. o World’s largest country with population of over 1.3

o IAS 39, Financial Instruments: Recognition and billion.

Measurement. o People’s Republic of China (PRC) established in 1949.

o IFRS 7, Financial Instruments: Disclosure. o Politically: Communist, one-party state.

Also—IFRS 9, Financial Instruments—issued in o Economically: Until the 1980s, all firms state-owned.

November 2009 to replace IAS 39—effective o Currently in transformation to socialist market economy.

November 2013 o World’s fourth largest economy and fastest growing

Definitions among large economies, and is largest recipient of FDI.

o IAS 32 says a financial instrument is any contract that o China

gives rise to both a financial asset of one entity and a o First securities regulations adopted in 1984.

financial liability or equity instrument of another entity. o Two major stock exchanges, Shanghai and Shenzhen

o Financial asset (e.g. cash, receivables, loans to others, established in 1

etc.): o 990 and 1991.

o Cash

o Government controls capital market via Chinese Security o Pre-operating expenses – deferred, then

Regulatory Commission (CSRC) similar to SEC. expensed when operations begin, whereas, under

o Domestic companies list four types of shares: A, B, C, H. IAS 38, expense immediately.

o Market characterized by speculation, high share o Business combinations – no specific rules,

turnover. whereas IAS 22 specifically discusses accounting for

o First securities regulations adopted in 1984. business combinations.

o Two major stock exchanges, Shanghai and Shenzhen

established in 1990 and 1991. Germany: Background

o Government controls capital market via Chinese Security European Union’s largest country, population 83

Regulatory Commission (CSRC) similar to SEC. million.

o Domestic companies list four types of shares: A, B, C, H. West Germany and East Germany established in

o Market characterized by speculation, high share 1949, were reunified in 1990.

turnover. Historically, banks have been primary source of

Accounting Profession finance via both loans and equity.

o In October 2007, the ICAEW (Institute of Chartered Since reunification, the economy has been

Accountants in England and Wales) and CICPA launched affected by internationalization.

a joint project for cooperation between the professional German companies increasingly listing on

bodies in the two countries. foreign exchanges, e.g., New York Stock

o Most domestic Chinese accounting firms are “hooked up” Exchange.

to a government-sponsoring body, although the Most common business forms are

government has encouraged independence. Aktiengesellschaft (AG) and Gesellschaft mit

o “Guanxi” or tight, close-knit networks, is common way of beschrankter Haftung (GMBH).

doing business, but may collide ethically for accountants AG are publicly traded/GMBH are non-publicly

Accounting Regulation traded.

o Government continues to act as accounting regulator. Historically had significant influence on

o Recent activity is focused on harmonizing variety of accounting systems in a number of other

domestic systems which vary by industry. countries.

o Committed to converging with IFRS, spurred by desired Japan’s commercial code is modeled on

membership in World Trade Organization (WTO). Germany’s.

o Audits of financial statements widely required. Accounting Profession

o Death penalty in an accounting fraud case suggests that Profession has traditionally been less influential

it is taken very seriously. than in U.S./U.K.

o Ministry of Finance (MoF) in similar role as FASB. Auditing is dominant part of profession and

o MoF has issued several pronouncements to achieve certified auditors title of Wirtschaftprufer (WP)

harmony. was created in 1931.

Accounting Principles and Practice Institut der Wirtschaftprufer similar to the

o Computation of taxable income is of primary importance. AICPA.

o Conservatism is criticized as a method by which owners Obtaining WP title is extremely rigorous.

can understate income and justify low wages. Wirtschaftpruferkammer (WPK) is a state-

o Lack of conservatism is still a major difference with sponsored group that oversees auditing

IFRS. profession.

o Lack of accounting infrastructure contributes to the Accounting Regulation

gap between accounting principles and practice. o Commercial code and tax laws are main sources of

o Accounting System for Business Enterprises (ASBE) accounting rules.

is followed by over 500,000 firms, including all listed o Traditionally has not used a system of independent

companies. institutional oversight.

Differences with IFRS o Stock exchange rules have less influence than in U.S.

o Property, plant, and equipment -- historical cost, o Prudence (conservatism) is fundamental--recognition of

whereas IAS 16 permits revaluations. revenues only when realized, losses when they appear

o Asset impairments – Chinese standards are silent, possible.

whereas IAS 36 requires impairment test and o Began change away from creditor orientation in 1960s

recognition of loss. towards shareholder orientation.

o As of 2009 the German Accounting Standards Board o Obtaining CPA title is extremely rigorous, as in Germany.

(GASB) worked on IASB projects relating to the financial o Low status within Japanese society vs. engineers and

crisis. scientists.

Accounting Principles and Practices o Collectivism leads to lack of trust of auditors.

o Historical cost attribute for measuring tangible assets is o Tax advising is a much larger, separate, profession.

strictly adhered to. Accounting Regulation

o Traditional focus on creditor protection is at odds with o Government influences accounting via Commercial Code,

the true and fair view concept. Corporate Income Tax Law and Securities and Exchange

o Importance of tax laws led to the reverse authoritative Law.

principle which requires expenses to be deducted from o Similar to Germany, strong creditor orientation and

accounting income if they are to be tax deductible. accounting rules closely tied to tax rules.

o Differences between accounting and tax income are o Big Bang financial reforms are leading to harmonization

minimal, thereby reducing need for deferred taxes. with international standards.

o In contrast to China, conservatism has been used to o These reforms included requirements for consolidation

resist labor’s wage demands. and fair value accounting for tradable securities.

o Standards allow for income smoothing, frequently o Business Accounting Principles issued by Ministry of

accomplished via early recognition of losses. Finance consist of 7 guidelines (the equivalent of a

o EU fourth directive requires true and fair view, but conceptual framework).

Germans have a unique interpretation of the concept. o In December 2009 Japan Financial Services Agency

o Commitment to globalization reflected in rule that allows (FSA) permitted domestic use of IFRS and established

public companies to use IFRS for consolidated framework for voluntary adoption of IFRS starting with

statements. fiscal years ending on or after March 31, 2010

o Main intention of German Accounting Law Modernization

Act is conformity with IFRS. Accounting Principles and Practices

o In August 2010 only about 10 German companies were o In contrast to U.S., net income is less a measure of

listed on the NYSE due to NYSE overregulation. performance and seen more as funds available for

Differences with IFRS dividends.

o Goodwill – deducted immediately against equity, o Since providers of financing tend to be close to the

whereas, under IFRS 3, accounted for as an indefinite firm, there has historically been little pressure for

life intangible asset. disclosure.

o Internally generated intangibles – not recognized, o Lack of disclosure is apparent in segment reporting.

whereas, under IAS 38, recognized as an asset under o 2007 Tokyo Agreement goal to eliminate all Japanese

some conditions. GAAP and IFRS differences by June 2011 (except major

o Leases – accounting uses tax rules, with capitalization new IFRS developed after 2011.

rare, whereas IAS 17 criteria result in more frequent Differences with IFRS

capitalization. o Revaluation of Land – allowed, but updating not

o Accounting for subsidiaries – allow exclusion of required, whereas, under IFRS 16, revaluations require

dissimilar subsidiaries, which are consolidated under IAS regular updating.

27. o Pre-operating costs – capitalization is allowed,

Japan: Background whereas, under IAS 38, expensed immediately.

o Population 127 million, world’s third largest economy. o Construction contracts – completed contract method

o Banks are primary source of finance via both loans and is allowed, whereas IAS 11 essentially requires

equity, and cross-corporate equity ownership is also percentage-of-completion.

common. o Provisions – allows for provisions prior to actual

o Keiretsu (and predecessor Zaibatsu) emphasize close obligation, whereas IAS 37 only allows for present

business ties and reflect cultural value of collectivism. obligations based on past transaction.

o 1990s recession led to an increase in Japanese firms’ Mexico: Background

attempts to obtain capital internationally. o History of significant inflation-- government control of

Accounting Profession business is partially blamed for this.

o Certified Public Accountants Law (1948) established the o Significant changes in 1990s, including privatization of

profession. state-owned firms and NAFTA.

o JICPA is one of the nine founding members of the IASC. o Historically, most businesses family-owned-- even the

o Profession is significantly less influential than in very large—prefer to raise capital via debt vs. equity—but

U.S./U.K. and is also much smaller in numbers than U.S. gradually changing.

o Mexico’s one stock exchange, the Bolsa Mexicana de Accounting Profession

Valores, is privately-owned. o World’s first association of professional accountants, The

o Represents one of the largest U.S. trading partners (75% Society of Accountants in Edinburgh, established in

of Mexico’s imports, more than 80% of her exports, and 1853.

60% of all FDI). o Six professional chartered bodies coordinated through

Accounting Profession Consultative Committee of Accountancy Bodies (CCAB).

o The Asociacion de Contadores Publicos, first professional o The profession developed in response to the needs of

accountant organization, established in 1917. industry and has influenced the development of

o This group was succeeded by the Mexican Institute of professions in a number of other countries.

Public Accountants (MIPA) in 1964. o Compared to the U.S. the certification requirements

o MIPA establishes accounting and auditing principles. focus more on work experience and less on university

o In order to practice public accounting in Mexico, one education.

needs a “professional diploma.” Accounting Regulation

o Contador Publico Certificado (CPC) is equivalent of U.S. o The Companies Act, accounting pronouncements, and

CPA and can have reciprocal privileges in U.S. and stock exchange rules comprise accounting regulation.

Canada based on passing certain exams. o Similar to the U.S., and unlike Germany and Japan, tax

Accounting Principles and Practices rules do not significantly influence financial reporting.

o Mexican GAAP heavily influenced by U.S. GAAP due to o Standard-setters have historically taken a principles-

NAFTA, geographical proximity, and comprehensiveness based approach using a statement of principles as a

of U.S. GAAP. conceptual framework.

o Despite international influences, Mexico’s Bulletin B-10 o Has not historically had a strong, SEC type agency, but

on inflation accounting shows how harmonized recent scandals have led to increased regulation.

accounting may not be appropriate for all circumstances. o The Financial Reporting Council (FRC) annual report for

o In November 2008 the Mexico Securities and Exchange 2008/2009-- key themes for 2009/2010 would be to

Commission announced that all companies listed on the influence:

Mexican Stock Exchange will be required to use IFRS in o Market participants to high standards of reporting and

2012 governance

o Bulletin B-10, Recognition of the Effects of Inflation, o Legislators and standard-setters to encourage

reflects a major difference to U.S. GAAP. proportionate and principles-based approach in

o Nonmonetary assets and liabilities to be restated for furtherance of the first goal

purchasing power changes of the peso. o International regulatory authorities to encourage

o Inventory can be restated using current replacement effective cooperation

costs. Accounting Principles and Practices

o Recognition in income (generally) of the gain or loss o A primary objective of accounting is to support an

from the net monetary position, asset or liability. effective capital market.

o In line with IAS 29, Mexico has given up on inflation o The true and fair view principle is paramount.

accounting recently, due to low rate of inflation o True and fair view override requires that companies not

Differences with IFRS comply with standards that would result in misleading

o Statement of cash flows – statement of changes in financial statements.

financial position required, whereas IAS 7 requires a o Professional judgment is essential additional component

statement of cash flows. to true and fair view.

o Inflation Accounting – requires inflation adjustments o Financial Reporting Review Panel 2010 annual report

regardless of inflation rate, whereas IAS 29 required says there has been continuous improvement in the

only for hyperinflationary countries. general quality of IFRS financial reporting.

o Negative Goodwill – recorded as a deferred credit and Differences with IFRS

amortized over a period of up to five years, whereas o Goodwill – amortization allowed, whereas IFRS 3

IFRS 3 requires immediate recognition of gain. prohibits amortization and requires an annual

United Kingdom: Background impairment test.

o Population of about 62 million, comprised of England, o Related party disclosures – requires disclosure of

Northern Ireland, Scotland, and Wales. related party names, whereas IAS 24 requires disclosure

o Among the five countries in this chapter, its financial by type, not name, of related party.

structure is closest to the U.S. o Revaluation gains/losses – generally not taken to

o 15,000 Private Limited Companies (PLCs) with about income statement, whereas IAS 40 requires gains and

2,500 of these listed on the London Stock Exchange. losses to affect net income.

o Import purchase – a company purchases from a

CHAPTER 7 foreign supplier and later pays in the supplier’s currency.

Foreign exchange rate o Foreign exchange risk – the chance that the exporter

o Purchase price of a foreign currency-- e.g., in February will receive less or that the importer will pay more than

2010 it cost about 0.08 U.S. dollars (eight cents) to anticipated as a result of a change in the exchange rate.

purchase one Mexican peso. Accounting – sale transaction

o From 1945 to 1973 countries had exchange rates fixed One transaction perspective

to the U.S. dollar. o Treats sale and collection as one transaction.

o U.S. dollar was fixed to gold at $35 per ounce. o Transaction is complete when foreign currency is

o Balance-of-payments deficits in the U.S. during the received and converted, and sale is measured at

1960s doomed this system, so, by March 1973 most converted amount.

currencies were allowed to float in value. o This approach is not allowed under IAS or U.S. GAAP.

Exchange Rate Mechanisms Two transaction perspective

o Independent float – currency value allowed to move o Treats sale and collection as two transactions

freely with little government intervention. o Sale is one transaction and collection is a second

o Pegged to another currency – currency value fixed transaction.

(pegged) in terms of a particular foreign currency (e.g., o Sale is based on current exchange rate.

U.S. dollar), and central bank intervenes to maintain the o If exchange rate changes, collection is for different

exchange rate. amount.

o European Monetary System (Euro) – twelve o Difference is considered foreign exchange gain or loss.

countries use a single currency, which floats against o Concepts are identical for purchase transaction.

other currencies such as the U.S. dollar.

Foreign Exchange Rates Transaction types, exposure type and gain or loss

o Exchange rates, to the U.S. dollar, are published in many – export sales

places on the internet and in newspapers. o Export sale asset exposure--if foreign currency

o Exchange rates are reflected both as US $ equivalent appreciates foreign exchange gain.

(direct quotes) and currency per US $ (indirect quotes). o Export sale asset exposure--if foreign currency

Spot rates and Forward rates depreciates foreign exchange loss.

o Spot rate – today’s price for purchasing or selling a o Import purchase liability exposure -- if foreign

foreign currency. currency appreciates foreign exchange loss.

o Forward rate – today’s price for purchasing or selling a o Import purchase liability exposure -- if foreign

foreign currency for some future date. currency depreciates foreign exchange gain.

o Premium -- when the forward rate is greater than the

spot rate for a particular day.

o Discount -- when the forward rate is less than the spot o Hedging -- protecting against losses from exchange rate

rate for a particular day. fluctuations. Companies often use foreign currency

Option contracts forward contracts and foreign currency options.

o Foreign currency option – gives the right, but not o Foreign currency forward contract – an agreement

the obligation, to trade foreign currency for some period. to buy or sell foreign currency at a future date.

o Put option – the option to sell the foreign currency. o Foreign currency option – the right to buy or sell

o Call option – the option to buy the foreign currency. foreign currency for a period of time.

o Strike price – the exchange rate at which currency will o Hedge accounting – an offsetting gain or loss from

be exchanged when option is exercised. the hedge is recognized in net income during the same

o Option premium – cost of purchasing the option, period as the gain or loss from the hedged item.

which is a function of the option’s intrinsic value and o Cash flow hedge – an accounting designation for

time value. hedges that offset variability in cash flows of hedged

o Intrinsic value – is the gain that could be made by items.

immediate exercise of the option. o Fair value hedge – an accounting designation for

o Time value – the value that derives from the fact that hedges that offset the variability in fair value of hedged

the currency value could increase during the remainder assets and liabilities.

of the option period.

Terminology CHAPTER 8

o Export sale – a company sells to a foreign customer Translating Foreign Currency Financial Statements

and later receives payment in the customer’s currency. – Conceptual Issues

o Foreign country operations usually prepare financial o Income statement items are translated at the exchange

statements using local currency as the monetary unit. rate in effect at the time of the transaction.

o These financial statements must be translated into home Current Rate Method

country currency. o Objective is to reflect that the parent’s entire investment

o These operations also typically use local GAAP. in a foreign subsidiary is exposed to exchange risk.

o Financial statements must be translated into home o All assets and liabilities are translated at the current

country GAAP. exchange rate.

Primary conceptual issues o Stockholders’ equity accounts are translated at historical

o Each financial statement item must be translated using exchange rates.

the appropriate exchange rate. o Income statement items are translated at the exchange

o Choices include the current exchange rate, average rate in effect at the time of the transaction.

exchange rate, and the historical exchange rate. Translation methods illustrated – Summary

o Current exchange rate is as of the balance sheet date, Current Rate Method

while historical exchange rate is as of the date of the o All assets and liabilities translated at current rate.

transaction. o This results in net asset exposure.

o The resulting translation adjustment can be recognized o Net asset exposure and devaluing foreign currency

in current income or included in an equity account on results in translation loss.

the balance sheet. o Translation adjustment included in equity.

Balance Sheet Exposure Temporal Method

o Assets and liabilities translated at the current exchange o Primarily monetary assets and liabilities translated at

rate are exposed to risk of a translation adjustment. current rate.

o When foreign currency appreciates, a net asset exposure o This results in net liability exposure.

results in a positive translation adjustment. o Net liability exposure and devaluing foreign currency

o When foreign currency appreciates, a net liability result in translation gain.

exposure results in a negative translation adjustment. o Translation gain included in current income.

o Assets and liabilities translated at the historical exchange U.S. GAAP

rate are not exposed to a translation adjustment. o FASB ASC 830, Foreign Currency Matters( formerly SFAS

Translation Methods 52, Foreign Currency Translation) is the relevant

o Current/Noncurrent Method accounting standard.

o Current assets and liabilities are translated at the current o Requires identification of functional currency.

exchange rate. o Functional currency is the primary currency of the

o Noncurrent assets and liabilities and stockholders’ equity foreign subsidiary’s operating environment.

accounts are translated at historical exchange rates. o The standard includes a list of indicators as guidance for

o There is no theoretical basis for this method. the foreign currency decision.

o Method is seldom used in any countries and is not o When functional currency is U.S. Dollar, temporal

allowed by U.S. GAAP or IFRS. method is required.

Monetary/Nonmonetary Method o When functional currency is foreign currency, current

o Monetary assets and liabilities are translated at the rate method is required.

current exchange rate. IFRS

o Nonmonetary assets and liabilities and stockholders’ o IAS 21, The Effects of Changes in Foreign Exchange

equity accounts are translated at historical exchange Rates is the relevant accounting standard.

rates. o Uses the functional currency approach developed by the

o The translation adjustment measures the net foreign FASB.

exchange gain or loss on current assets and liabilities as o The standard includes a list, similar to the FASB list, of

if these items were carried on the parent’s books. indicators as guidance for the foreign currency decision.

Temporal Method o The standard’s requirements pertaining to

o Objective is to translate financial statements as if the hyperinflationary economies are substantially different

subsidiary had been using the parent’s currency. from U.S. GAAP.

o Items carried on subsidiary’s books at historical cost, Highly Inflationary Economies – U.S. GAAP

including all stockholders’equity items, are translated at o U.S. GAAP defines such economies as those with

historical exchange rates. cumulative 100% inflation over a period of three years

o Items carried on subsidiary’s books at current value are (with compounding—average of 26% per year for three

translated at current exchange rates. years in a row).

o Temporal method required—translation gains/losses o Net income represents the amount of dividends that

reported in income can be paid out while still maintaining the company’s

Hyperinflationary Economies – IFRS capital balance.

o IAS 21 and 29 use the term hyperinflationary economies. o Historical cost net income maintains a nominal, not

o IAS 21 is not as specific in defining hyperinflationary adjusted for inflation, amount of contributed capital.

economies as is U.S. GAAP, but does suggest that a o General purchasing power net income maintains the

cumulative three-year rate approaching or exceeding purchasing power of contributed capital.

100% is evidence. o Current cost net income maintains the productive

o IAS 21 requires restatement of the foreign financial capacity of physical capital.

statements for inflation per IAS 29, Financial Reporting in General Purchasing Power (GPP) Accounting

Hyperinflationary Economies. o Updates historical cost accounting for changes in the

o IAS 21 then requires the use of the current exchange general purchasing power of the monetary unit.

rate to translate the restated financial statements, o Also referred to as General Price-Level-Adjusted

including all balance sheet accounts as well as all Historical Cost Accounting (GPLAHC).

income statement o Nonmonetary assets and liabilities, stockholders’ equity

o Companies that have foreign subsidiaries with highly and income statement items are restated using the

integrated operations use the temporal method. General Price Index (GPI).

o The temporal method requires translation gains and o Requires purchasing power gains and losses to be

losses to be recognized in income. included in net income.

o Losses negatively affect earnings, and both gains and Current Cost (CC) Accounting

losses increase earnings volatility. o Updates historical cost of assets to the current cost to

o t accounts. replace those assets.

o IAS approach is substantially different from U.S. GAAP. o Also referred to as Current Replacement Cost

o These gains and losses result from the combination of Accounting (CRC).

balance sheet exposure and exchange rate fluctuations. o Nonmonetary assets are restated to current

o Companies can also hedge to offset the effects of the replacement costs and expense items are based on

translation adjustment to equity under the current rate these restated costs.

method. o Holding gains and losses are included in equity.

o Companies can hedge against gains and losses by using United States and United Kingdom

foreign currency forward contracts, options, and o SFAS 33, Financial Reporting and Changing Prices

borrowings. briefly required large U.S. companies to provide GPP

CHAPTER 9 and CC accounting disclosures.

Inflation Accounting – Conceptual Issues o This information is now optional (SFAS 89) and few

Impact of inflation on financial statements companies provide it.

o Understated asset values. o In the U.K., SSAP 16 required current cost information,

o Overstated income and overpayment of taxes. but this was later rescinded.

o Demands for higher dividends. o Both countries have experienced low rates of inflation

o Differing impacts across companies resulting in lack of since the 1980s, which is why the inflation accounting

comparability. requirements were lifted.

Impact of inflation on financial statements Latin America

o Historical cost ignores purchasing power gains and o Latin America has a long history of significant inflation.

losses. o Brazil, Chile, and Mexico have developed sophisticated

o Purchasing power losses result from holding monetary inflation accounting standards over time.

assets, such as cash and accounts receivable. o Like the U.S. and U.K., Brazil has abandoned inflation

o Purchasing power gains result from holding monetary accounting.

liabilities, such as accounts payable. o Mexico’s Bulletin B-10, Recognition of the Effects of

o The two most common approaches to inflation Inflation in Financial Information, is a well-known

accounting are general purchasing power accounting example.

and current cost accounting. Mexico – Bulletin B-10

Net Income and Capital Maintenance o Required restatement of nonmonetary assets and

o Historical cost, general purchasing power and current liabilities using the central bank’s general price level

cost accounting all flow from different concepts of index.

capital maintenance. o An exception was the option to use replacement cost for

inventory and related cost of goods sold.

o Another exception was imported machinery and o IAS 27, Consolidated and Separate Financial

equipment. Statements, uses the effective control definition.

o This exception allowed a combination of country of Group Accounting – Full Consolidation

origin price index and the exchange rate between o Full consolidation involves aggregation of 100 percent

Mexico and country of origin. of the subsidiary’s financial statement elements.

o Based on inflation being held to under 5% for several o When the subsidiary is not 100 percent owned, the

consecutive years, Bulletin B-10 was abandoned late in non-owned portion is presented in a separate item

2007. called minority interest.

o Companies no longer are required to use inflation o Full consolidation is accomplished using one of two

accounting. methods-- purchase method or pooling of interests

Netherlands – Replacement Cost Accounting method.

o Prior to the required use of IFRS in 2005, Dutch o IFRS 3, issued in 2004, allows the use of the purchase

companies could use replacement cost accounting. method only.

o In 2003 and 2004 only Heineken used this approach. o Pooling of interests is no longer acceptable under IFRS,

o Heineken presented inventories and fixed assets at or in the U.S., Canada, Brazil or Mexico.

replacement cost. Full Consolidation – Purchase Method

o Cost of sales and depreciation were also based on o When one company purchases a majority of the voting

replacement costs. shares of another company, the purchased assets and

o The entry accompanying the asset revaluation was liabilities are stated at fair value.

reported in stockholders’ equity. o The excess of the purchase price over the fair value of

International Financial Reporting Standards the net assets is goodwill.

o IAS 15, Information Reflecting the Effects of Changing o IFRS 3, Business Combinations, measures the minority

Prices was issued in 1981. interest as the minority percentage multiplied by the

o This standard has been withdrawn due to lack of fair value of the purchased net assets.

support. Full Consolidation – Goodwill

o The relevant standard now is IAS 29, Financial o Significant variation exists internationally in accounting

Reporting in Hyperinflationary Economies. for goodwill.

IAS 29 is required for some companies located in

o o U.S., IFRS, and most other countries require goodwill

environments experiencing very high levels of to be capitalized as an asset.

inflation. o Some countries require amortization over a period of

o IAS 29 includes guidelines for determining the up to 40 years.

environments where it must be used. o U.S., Canada, and IFRS do not require amortization but

o Nonmonetary assets and liabilities and stockholders’ do require an annual impairment test.

equity are restated using a general price index. o Japan allows the option of immediate expensing of

o Income statement items are restated using a general goodwill.

price index from the time of the transaction. Group Accounting – Equity Method

o Purchasing power gains and losses are included in net o When companies do not control, but have significant

income. influence over an investee, the equity method is used.

Background and conceptual issues o Twenty percent ownership is often used as the

o Business combinations are the primary mechanism threshold for significant influence.

used by MNEs for expansion. o The equity method is sometimes referred to as one-line

o Sometimes the acquiree ceases to exist. consolidation.

o In other cases, the acquiree remains a separate legal o Some differences exist between countries regarding

entity as a subsidiary of the acquirer (parent). standards

o Accounting for the parent and one or more subsidiaries o pertaining to the equity method.

is often called group accounting. Group Accounting – Other

Group Accounting – Determination of control o As stated previously, the pooling of interests method is

o Control provides the basis for whether a parent and a no longer permitted by IFRS and in many countries.

subsidiary should be accounted for as a group. o Pooling of interests was historically a popular method

o Legal control through majority ownership or legal because it allowed for lower expense recognition

contract is often used to determine control. compared to the purchase method.

o Effective control can be achieved without majority o The proportionate consolidation method is allowed

ownership. under IAS 31, Financial Reporting of Interests in Joint

Ventures, but is prohibited by U.S. GAAP. The equity 2. Its operating results are regularly reviewed for

method is used instead. performance and resource allocation.

o The IASB issued an exposure draft in late 2007, ED 9, 3. Discrete financial information is available for it.

Joint Arrangements, that proposes using the equity IFRS 8, Operating Segments – Significance

method only in joint ventures, in an effort to converge Tests to Justify Disclosure

with U.S. GAAP. The transitional arrangements have not Must meet any of the following tests:

yet been finalized. o Revenue test—segment revenue (external and

Group Accounting – Further Convergence of U.S. intersegment) represents 10% or more of

GAAP and IFRS combined internal and external revenue.

o In January 2008 IFRS 3 was revised. In addition, an o Profit or loss test—segment profit or loss is

amended version of IAS 27, Consolidated and Separate 10% or more of the higher of the combined

Financial Statements was issued, both of which become reported profit of profitable segments or the

effective July 1, 2009, with earlier adoption permitted. combined loss of all segments reporting a loss.

o In December 2007 FASB issued SFAS 141 (R), Business o Asset test—segment assets are 10% or more

Combinations and SFAS 160, Noncontrolling Interests in of the combined assets of all operating

Consolidated Financial Statements. segments.

o The major change in IFRS has the acquirer remeasuring o Notwithstanding the tests above, segments must

its investment in the acquiree at its fair value at the be disclosed if less than 75% of total company

date of control, with any gain or loss recognized in net sales are to outsiders

income. U.S. GAAP

o This replaces the step treatment, which measured the Only three substantive differences exist between

fair value at each step of achieving control. IFRS 8 and U.S. GAAP:

o The major change in U.S. GAAP includes requiring the U.S. GAAP does not require disclosure of segment

use of the acquisition method for business combinations liabilities.

and classifying noncontrolling interests as equity. IFRS 8 explicitly includes intangibles in the definition of

Segment Reporting long-lived assets for geographic area disclosures.

Background When a company has a matrix form of organization, IFRS

o MNEs typically have multiple types of businesses 8 allows operating segments to be based on either

located around the world. products or services or geographic areas. U.S. GAAP

o Consolidated financial statements aggregate this only allows the products or services basis.

information.

o Different types of business activity and location involve Disclosures

different growth prospects and risks. o General information about the operating segment (how

o Financial statement users desire information to be identified and products and services).

disaggregated in order to facilitate its usefulness. o Segment profit or loss and the following line items:

o Beginning in the 1960s, standard setters began to a. Revenues from external customers

require disclosures by segment. b. Intersegment revenues

o Segments are defined both by line-of-business and c. Interest revenue and expense

geographic area. d. Depreciation, depletion and amortization

o The AICPA and Association of Investment e. Other significant noncash items in segment profit or

Management and Research (AIMR) recommend loss

segment reporting consistent with how a business is f. Unusual items (e.g. discontinued operations and

managed. extraordinary items)

o A significant point of resistance to segment reporting g. Income tax expense or benefit

is concerns about competitive disadvantage. h. Total segment assets (and liabilities for IFRS).

IFRS 8, Operating Segments : i. Expenditures for additions to long-lived assets (U.S.

o Substantially converges IFRS with U.S. GAAP. GAAP) and noncurrent assets (IFRS 8).

o Adopts the management approach to segment j. Information about products and services.

reporting. k. Information about major customers (if 10% or more

o Management disaggregates components to make of total entity revenue).

operating decisions. l. Information about geographic areas.

o An operating segment is an enterprise component if:

1. It earns revenues and incurs expenses.

You might also like

- Schedule M GuidanceDocument194 pagesSchedule M GuidanceAbhishek JaiswalNo ratings yet

- Intermediate Accounting Volume 2 Canadian 11th Edition Kieso Test BankDocument53 pagesIntermediate Accounting Volume 2 Canadian 11th Edition Kieso Test BankJenniferMartinezbisoa100% (19)

- Problems: Set C: InstructionsDocument2 pagesProblems: Set C: InstructionsRabie HarounNo ratings yet

- Statement of Financial PerformanceDocument3 pagesStatement of Financial PerformanceJudith DurensNo ratings yet

- Ias 37 Provisions Contingent Liabilities and Contingent Assets SummaryDocument5 pagesIas 37 Provisions Contingent Liabilities and Contingent Assets SummaryChristian Dela Pena67% (3)

- FA MBA Quarter I SNU Course Outline 2020Document7 pagesFA MBA Quarter I SNU Course Outline 2020Kartikey BharadwajNo ratings yet

- Accounting ProjectDocument135 pagesAccounting ProjectMylene SalvadorNo ratings yet

- Genre in The Discourse Community of Finance Sean NesslDocument2 pagesGenre in The Discourse Community of Finance Sean Nesslsnessl94100% (1)

- SS&C GlobeOp - FA ModuleDocument34 pagesSS&C GlobeOp - FA ModuleAnil Dube100% (1)

- CVP AnalysisDocument5 pagesCVP AnalysisDianne BausaNo ratings yet

- Chapter 13 Theory Notes: LO1: Understanding LiabilitiesDocument8 pagesChapter 13 Theory Notes: LO1: Understanding LiabilitiesOmar MetwaliNo ratings yet

- INTACT2-Handout No. 5v2 PDFDocument8 pagesINTACT2-Handout No. 5v2 PDFCharlyn Jewel OlaesNo ratings yet

- Chapter 5 in Class NoteDocument6 pagesChapter 5 in Class NoteAn TrịnhNo ratings yet

- Ias 37Document6 pagesIas 37Tope JohnNo ratings yet

- Doupnik 6e Chap005 PPT Accessible GM OutputDocument56 pagesDoupnik 6e Chap005 PPT Accessible GM Outputhasan jabrNo ratings yet

- Liabilities NotesDocument15 pagesLiabilities NotesFarah PatelNo ratings yet

- Chapter 8 - Current Liabilities and The Time Value of MoneyDocument4 pagesChapter 8 - Current Liabilities and The Time Value of MoneyAlice LiddellNo ratings yet

- Provisions Ias 37 QnsDocument46 pagesProvisions Ias 37 Qnschalojunior16No ratings yet

- Accounting For Provisions and Contingent LiabilitiesDocument8 pagesAccounting For Provisions and Contingent LiabilitiesHenry Lister100% (1)

- Module 13 PAS 37Document6 pagesModule 13 PAS 37Jan JanNo ratings yet

- ULOa. Liabilities - 0Document8 pagesULOa. Liabilities - 0pam pamNo ratings yet

- L03-Ias 37Document48 pagesL03-Ias 37Mohamed IyaanNo ratings yet

- Accounting IVDocument75 pagesAccounting IVsiphosibanyoni261No ratings yet

- Week6-Lecture 13 NotesDocument42 pagesWeek6-Lecture 13 Noteskk23212No ratings yet

- IAS 37 - Provisions Contingent Assets and LiabilitiesDocument25 pagesIAS 37 - Provisions Contingent Assets and Liabilitiesfarukh.kitchlewNo ratings yet

- IAS 37 - SummaryDocument5 pagesIAS 37 - Summarysitoulamanish100No ratings yet

- ACTGIA2 - CH01 2 3 4 - Liabilities Etc.Document44 pagesACTGIA2 - CH01 2 3 4 - Liabilities Etc.chingNo ratings yet

- MFRS137 - Prov, CL & CADocument14 pagesMFRS137 - Prov, CL & CAAkai GunnerNo ratings yet

- TA09 - Provision and ContingencyDocument7 pagesTA09 - Provision and Contingencyy8p8qdqqw7No ratings yet

- LiabilitiesDocument3 pagesLiabilitiesClyn CFNo ratings yet

- p1 Corp Reporting Cpa Article 2017 Accounting For Provisions and ContingenciesDocument6 pagesp1 Corp Reporting Cpa Article 2017 Accounting For Provisions and ContingencieskimNo ratings yet

- Ias 37 Provision and Contingencies-2Document9 pagesIas 37 Provision and Contingencies-2Darren PeñaredondoNo ratings yet

- Ms. Sharon A. Bactat Prof. Suerte R. Dy: Sabactat@mmsu - Edu.ph Srdy@mmsu - Edu.phDocument26 pagesMs. Sharon A. Bactat Prof. Suerte R. Dy: Sabactat@mmsu - Edu.ph Srdy@mmsu - Edu.phCrisangel de LeonNo ratings yet

- FARAP - Liabilities - Part 1Document26 pagesFARAP - Liabilities - Part 1vanNo ratings yet

- ULOa. Liabilities - 1Document47 pagesULOa. Liabilities - 1pam pamNo ratings yet

- ModuleACC 309 Current LiabilitiesDocument8 pagesModuleACC 309 Current LiabilitiesEdward Glenn BaguiNo ratings yet

- Chapter 1 - Current Liabilities, Provisions and ContingenciesDocument13 pagesChapter 1 - Current Liabilities, Provisions and ContingenciesAbraham ChinNo ratings yet

- Module 1Document7 pagesModule 1Alextrasza LouiseNo ratings yet

- Ia 2 - ReviewerDocument3 pagesIa 2 - ReviewerCenelyn PajarillaNo ratings yet

- ACC 211 Discussion - Provisions, Contingent Liability and Decommissioning LiabilityDocument5 pagesACC 211 Discussion - Provisions, Contingent Liability and Decommissioning LiabilitySayadi AdiihNo ratings yet

- Accounting For ProvisionsDocument2 pagesAccounting For ProvisionsAldrin CalimlimNo ratings yet

- Chapter 11 IAS 37Document30 pagesChapter 11 IAS 37Rumbidzai MapanzureNo ratings yet

- 1d 5 Learning Module Week 5 Financial AccountingDocument11 pages1d 5 Learning Module Week 5 Financial AccountingLJNo ratings yet

- IAS 37 Provisions, Contingent Liabilities and Contingent AssetsDocument7 pagesIAS 37 Provisions, Contingent Liabilities and Contingent AssetsMd Mahmudul HassanNo ratings yet

- Questions: Liabilities, and Equity. These ElementsDocument38 pagesQuestions: Liabilities, and Equity. These ElementssiaaswanNo ratings yet

- Summary Notes LiabilitiesDocument2 pagesSummary Notes LiabilitiesCRISANGELNo ratings yet

- Module 4Document56 pagesModule 4Jiane SanicoNo ratings yet

- Learning Material 1Document7 pagesLearning Material 1salduaerossjacobNo ratings yet

- Accounting Principles Canadian Volume II 7th Edition Weygandt Test BankDocument86 pagesAccounting Principles Canadian Volume II 7th Edition Weygandt Test BankJosephWilliamsostmdNo ratings yet

- CFAS Module 8Document42 pagesCFAS Module 8Eu NiceNo ratings yet

- Presentation On Contingent Assets and LiabilitiesDocument24 pagesPresentation On Contingent Assets and Liabilitiesअतुल सिंहNo ratings yet

- Accounting2 Notes P2 (Cabilto)Document22 pagesAccounting2 Notes P2 (Cabilto)Lovely Jane Raut CabiltoNo ratings yet

- Liability and ProvisionDocument45 pagesLiability and ProvisionDenise RoqueNo ratings yet

- Pas 37Document24 pagesPas 37rena chavez100% (1)

- Nishat Mills LimitedDocument7 pagesNishat Mills LimitedRamsha ZahidNo ratings yet

- Module 11 Current Liabilities Provisions and ContingenciesDocument14 pagesModule 11 Current Liabilities Provisions and ContingenciesZyril RamosNo ratings yet

- Provision Contingency Liabilities and CoDocument16 pagesProvision Contingency Liabilities and CoPipz G. Castro100% (1)

- Midterms PAS 8-10-24Document12 pagesMidterms PAS 8-10-24Ed ViggayanNo ratings yet

- Pas 36: Impairment of Assets: ObjectiveDocument6 pagesPas 36: Impairment of Assets: ObjectiveLEIGHANNE ZYRIL SANTOSNo ratings yet

- Current Liabilities - RecognitionDocument8 pagesCurrent Liabilities - Recognitionuser anonymousNo ratings yet

- CHAPTER 13 - Current LiabilitiesDocument3 pagesCHAPTER 13 - Current LiabilitiesKajal ChaudharyNo ratings yet

- Module 1 Current Liabilities Provisions and ContingenciesDocument14 pagesModule 1 Current Liabilities Provisions and ContingenciesFujoshi BeeNo ratings yet

- Chapter 26Document8 pagesChapter 26Mae Ciarie YangcoNo ratings yet

- Warranty Obligation and ExpectsDocument18 pagesWarranty Obligation and ExpectsFlorentina O. OpanioNo ratings yet

- Pas 32, Pas 12 & Pas 33Document7 pagesPas 32, Pas 12 & Pas 33Olive Jean TiuNo ratings yet

- MGT 224Document12 pagesMGT 224Nikita DavidsonNo ratings yet

- UKAYDocument3 pagesUKAYQueenie AlgireNo ratings yet

- Vegetable SpaghettiDocument1 pageVegetable SpaghettiQueenie AlgireNo ratings yet

- SK Officials: "Mamamayang Nagkaka-Isa Tungo Sa Ika-Uunlad NG Barangay"Document1 pageSK Officials: "Mamamayang Nagkaka-Isa Tungo Sa Ika-Uunlad NG Barangay"Queenie AlgireNo ratings yet

- IWD Briefing Document enDocument3 pagesIWD Briefing Document enQueenie AlgireNo ratings yet

- How To Write Macros in ExcelDocument14 pagesHow To Write Macros in ExcelQueenie AlgireNo ratings yet

- 6 Overview of Management AccountingDocument15 pages6 Overview of Management AccountingQueenie AlgireNo ratings yet

- Wk2 1Document43 pagesWk2 1Queenie AlgireNo ratings yet

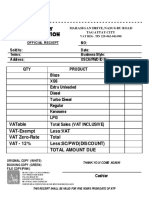

- NO: Sold To: Date: Terms: Business Style: Address: Osca/Pwd Id NoDocument6 pagesNO: Sold To: Date: Terms: Business Style: Address: Osca/Pwd Id NoQueenie AlgireNo ratings yet

- 1 HistoryDocument20 pages1 HistoryQueenie AlgireNo ratings yet

- Would You Be Willing To Give Up Everything For Your Friends?Document8 pagesWould You Be Willing To Give Up Everything For Your Friends?Queenie AlgireNo ratings yet

- Module 1Document5 pagesModule 1Its Nico & SandyNo ratings yet

- CH06Document26 pagesCH06Will TrầnNo ratings yet

- British American TobaccoDocument30 pagesBritish American TobaccoFahim YusufNo ratings yet

- Chapter 7 - Forecasting Financial StatementsDocument23 pagesChapter 7 - Forecasting Financial Statementsamanthi gunarathna95No ratings yet

- Chapter 9Document7 pagesChapter 9jeanNo ratings yet

- Fundamental Analysis PresentationDocument28 pagesFundamental Analysis Presentation354Prakriti SharmaNo ratings yet

- Rapid FPA Suite Financial Statement Training June 2023Document11 pagesRapid FPA Suite Financial Statement Training June 2023Jayabharath SNo ratings yet

- Financial Statements Analysis - StudentsDocument63 pagesFinancial Statements Analysis - StudentsThanh TienNo ratings yet

- Ch08 SM FA7eDocument52 pagesCh08 SM FA7e007020100% (2)

- SAP TcodesDocument47 pagesSAP Tcodesdushyant mudgalNo ratings yet

- Long Quiz. Strategy & The Master Budget Organizational Innovations - TQM & JIT - Attempt ReviewDocument30 pagesLong Quiz. Strategy & The Master Budget Organizational Innovations - TQM & JIT - Attempt ReviewCalix SuraoNo ratings yet

- Quiz-Answers CBDocument5 pagesQuiz-Answers CBniczNo ratings yet

- Business Description: St. Anthony's College San Jose, Antique, 5700Document29 pagesBusiness Description: St. Anthony's College San Jose, Antique, 5700Niña VirayoNo ratings yet

- FS Analysis TBPDocument5 pagesFS Analysis TBPAnonymous OswH2ea5L9No ratings yet

- BusMath Q1 Mod6Document20 pagesBusMath Q1 Mod6Romeo CorporalNo ratings yet

- ToyotaDocument4 pagesToyotaعبدالرحمن منصورNo ratings yet

- Chapter 10 Exercises Acc101Document6 pagesChapter 10 Exercises Acc101Nguyen Thi Van Anh (K17 HL)No ratings yet

- MCOM Sem 1 FA Project On Consolidated Financial StatementDocument27 pagesMCOM Sem 1 FA Project On Consolidated Financial StatementAnand Singh100% (5)

- Welcome Aboard 3 Year Bsa!!Document61 pagesWelcome Aboard 3 Year Bsa!!Riza Mae AlceNo ratings yet

- CHAPTER 8-Revenue Recognition: Construction Contracts Multiple ChoiceDocument12 pagesCHAPTER 8-Revenue Recognition: Construction Contracts Multiple ChoiceShane TorrieNo ratings yet

- IA2 ProvisionDocument21 pagesIA2 ProvisionMitchie Faustino100% (1)

- SUBMITTALS (ADMIN 2 Pasapayroll)Document6 pagesSUBMITTALS (ADMIN 2 Pasapayroll)mnmusorNo ratings yet