Professional Documents

Culture Documents

Lecture Exercise - Chapter 4

Lecture Exercise - Chapter 4

Uploaded by

Chuah Chong AnnCopyright:

Available Formats

You might also like

- Jane Lazar CGFR 8th Ed Solutions AfaDocument228 pagesJane Lazar CGFR 8th Ed Solutions Afasharmitraa100% (17)

- FAR 570 Test Mac July 2021 - QQDocument3 pagesFAR 570 Test Mac July 2021 - QQAthira Adriana Bt RemlanNo ratings yet

- Management Report On Tesla, Inc.Document7 pagesManagement Report On Tesla, Inc.Naveed IbrahimNo ratings yet

- Share & Business Valuation Case Study Question and SolutionDocument6 pagesShare & Business Valuation Case Study Question and SolutionSarannyaRajendraNo ratings yet

- Manual For Finance QuestionsDocument56 pagesManual For Finance QuestionssamiraZehra85% (13)

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- Complete SRS For CMSDocument26 pagesComplete SRS For CMSAtta Ur Rehman TariqNo ratings yet

- The Land Transportation OfficeDocument4 pagesThe Land Transportation OfficeMaùreen AbegailNo ratings yet

- SFM MTP 1 Nov 18 ADocument12 pagesSFM MTP 1 Nov 18 ASampath KumarNo ratings yet

- Additional Question Topic 3: So No Need To Add With Reb/f and Current Year ProfitDocument8 pagesAdditional Question Topic 3: So No Need To Add With Reb/f and Current Year ProfitMastura Abd HamidNo ratings yet

- Tutorial 4 Questions (Chapter 4)Document4 pagesTutorial 4 Questions (Chapter 4)jiayiwang0221No ratings yet

- BCM 4206 Corporate Finance PDFDocument4 pagesBCM 4206 Corporate Finance PDFSimon silaNo ratings yet

- Bazg521 Nov25 AnDocument2 pagesBazg521 Nov25 AnDheeraj RaiNo ratings yet

- F2Solution December 2017 ExamDocument8 pagesF2Solution December 2017 Examshafiqul alamNo ratings yet

- PST FM 2015 2023Document92 pagesPST FM 2015 2023PhilipNo ratings yet

- Tutorial 5 Jan 2022 Question OnlyDocument8 pagesTutorial 5 Jan 2022 Question OnlyMurali RasamahNo ratings yet

- Bfi 4301 Financial Management Paper 1Document10 pagesBfi 4301 Financial Management Paper 1Paul AtariNo ratings yet

- Final Exam 2020 CorrectionDocument4 pagesFinal Exam 2020 Correctionmonaatallah1No ratings yet

- Consolidation QuestionsDocument16 pagesConsolidation QuestionsUmmar FarooqNo ratings yet

- BBM 310Document4 pagesBBM 310Kimondo KingNo ratings yet

- OSA JUL23 S2 BCOM ACC Management Accounting and Finance 3B FINALDocument7 pagesOSA JUL23 S2 BCOM ACC Management Accounting and Finance 3B FINALAmithNo ratings yet

- Quiz in Investment AnswersDocument7 pagesQuiz in Investment AnswersElaine Fiona Villafuerte100% (1)

- Quiz in Investment AnswersDocument7 pagesQuiz in Investment AnswersLenny Ramos VillafuerteNo ratings yet

- Tutorial 3 Questions (Chapter 2)Document4 pagesTutorial 3 Questions (Chapter 2)jiayiwang0221No ratings yet

- IPO Note - Associated Oxygen LTDDocument5 pagesIPO Note - Associated Oxygen LTDturjoyNo ratings yet

- University of Mauritius: Faculty of Law and ManagementDocument9 pagesUniversity of Mauritius: Faculty of Law and ManagementMîñåk ŞhïïNo ratings yet

- Work Book M5 AFMDocument5 pagesWork Book M5 AFMNaimeesha MattaparthiNo ratings yet

- Test Paper: Chapter-1: Cost of CapitalDocument13 pagesTest Paper: Chapter-1: Cost of Capitalcofinab795No ratings yet

- Paper - 2: Strategic Financial Management Questions Merger and AcquisitionsDocument27 pagesPaper - 2: Strategic Financial Management Questions Merger and AcquisitionsObaid RehmanNo ratings yet

- A. Information Is Costless and Widely Available To Market Participants at Approximately The Same TimeDocument14 pagesA. Information Is Costless and Widely Available To Market Participants at Approximately The Same TimeSHER LYN LOWNo ratings yet

- Accf3114 1Document12 pagesAccf3114 1Krishna 11No ratings yet

- MTP 1 Nov 18 QDocument6 pagesMTP 1 Nov 18 QSampath KumarNo ratings yet

- Revisionary Test Paper - Final - Syllabus 2012 - Dec2013: Group - IV Paper 17 - Strategic Performance Management Section - ADocument71 pagesRevisionary Test Paper - Final - Syllabus 2012 - Dec2013: Group - IV Paper 17 - Strategic Performance Management Section - ANagendra KrishnamurthyNo ratings yet

- Paper - 2: Strategic Financial Management Questions Future ContractDocument24 pagesPaper - 2: Strategic Financial Management Questions Future ContractRaul KarkyNo ratings yet

- Assignment Answer Sheet: Name: Subject: Assignment IiDocument6 pagesAssignment Answer Sheet: Name: Subject: Assignment IiAravindh ArulNo ratings yet

- FR-342.AFR (AL-I) Solution CMA January-2023 Exam.Document7 pagesFR-342.AFR (AL-I) Solution CMA January-2023 Exam.practice78222No ratings yet

- Sir Saud Tariq: 13 Important Revision Questions On Each TopicDocument29 pagesSir Saud Tariq: 13 Important Revision Questions On Each TopicShehrozST100% (1)

- Tutorial 7 PC & MONOPOLYDocument3 pagesTutorial 7 PC & MONOPOLYCHZE CHZI CHUAHNo ratings yet

- Management Accounitng - 104 (I)Document4 pagesManagement Accounitng - 104 (I)Rudraksh PareyNo ratings yet

- Exercises - Mergers and AcquisitionsDocument1 pageExercises - Mergers and AcquisitionsHune VerryNo ratings yet

- BACC1 Group Work-Fafa and BlewuDocument3 pagesBACC1 Group Work-Fafa and Blewuisaacbediako82No ratings yet

- McomDocument302 pagesMcommostfaNo ratings yet

- Problems On Marginal CostingDocument7 pagesProblems On Marginal Costingrathanreddy2002No ratings yet

- Exercise Final SECTION B 2019Document5 pagesExercise Final SECTION B 2019Arman ShahNo ratings yet

- Accounting BasicDocument2 pagesAccounting Basicinsanulf9No ratings yet

- FM+ECO M.Test EM Question 26.02.2023Document6 pagesFM+ECO M.Test EM Question 26.02.2023harish jangidNo ratings yet

- Financial Plan / Strategy / Analysis: 1.1 Project Implementation Cost ScheduleDocument11 pagesFinancial Plan / Strategy / Analysis: 1.1 Project Implementation Cost ScheduleNadrahNo ratings yet

- FAR 410 Topic 3: EquityDocument4 pagesFAR 410 Topic 3: EquityAmzarNo ratings yet

- Sept 2014 - 230716 - 233727Document22 pagesSept 2014 - 230716 - 233727mohddanialhanaffimustaffiNo ratings yet

- Acquisition & Mergers ValuationDocument18 pagesAcquisition & Mergers ValuationAqeel HanjraNo ratings yet

- Chapter 18 20Document11 pagesChapter 18 20jessa mae zerdaNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential 1 AC/FEB 2022/FAR320Document7 pagesUniversiti Teknologi Mara Final Examination: Confidential 1 AC/FEB 2022/FAR3202021202082No ratings yet

- Project 5 McCormick Workbook 2188Document13 pagesProject 5 McCormick Workbook 2188Vin JohnNo ratings yet

- 01 Leverages FTDocument7 pages01 Leverages FT1038 Kareena SoodNo ratings yet

- 202-Financial ManagementDocument5 pages202-Financial ManagementRAHUL GHOSALENo ratings yet

- Master Questions, Advance Level Questions and Additional Questions-Chapter 4Document18 pagesMaster Questions, Advance Level Questions and Additional Questions-Chapter 4manmeet0001No ratings yet

- UKAF4034-ACR-Tutorial 4-Q BasicConsoDocument7 pagesUKAF4034-ACR-Tutorial 4-Q BasicConsotan JiayeeNo ratings yet

- Mock Test Q2 PDFDocument5 pagesMock Test Q2 PDFManasa SureshNo ratings yet

- Accounts Paper Answer 24.06.2020Document17 pagesAccounts Paper Answer 24.06.2020Prathmesh JambhulkarNo ratings yet

- FINANCIAL MANAGEMENT October 20172016 PatternSemester IIDocument4 pagesFINANCIAL MANAGEMENT October 20172016 PatternSemester IISwati DafaneNo ratings yet

- Question No 1: A-Gross PayDocument6 pagesQuestion No 1: A-Gross PayArmaghan Ali MalikNo ratings yet

- The Valuation of Digital Intangibles: Technology, Marketing and InternetFrom EverandThe Valuation of Digital Intangibles: Technology, Marketing and InternetNo ratings yet

- WEEK 13 Financial ControlDocument13 pagesWEEK 13 Financial ControlChuah Chong AnnNo ratings yet

- Lesson 2: Relevant Costs For Decision MakingDocument41 pagesLesson 2: Relevant Costs For Decision MakingChuah Chong AnnNo ratings yet

- Management Accounting: Information That Creates ValueDocument101 pagesManagement Accounting: Information That Creates ValueChuah Chong Ann100% (1)

- Topic 4 (Responding To Primary Stakeholders) : Stockholder Rights and Corporate GovernanceDocument27 pagesTopic 4 (Responding To Primary Stakeholders) : Stockholder Rights and Corporate GovernanceChuah Chong AnnNo ratings yet

- Worksheet For Funding Retirement NeedsDocument6 pagesWorksheet For Funding Retirement NeedsChuah Chong AnnNo ratings yet

- Barriers in Implementing Performance Measurement SystemsDocument1 pageBarriers in Implementing Performance Measurement SystemsChuah Chong AnnNo ratings yet

- Tutorial 9 Jan 2019 AnswersDocument9 pagesTutorial 9 Jan 2019 AnswersChuah Chong AnnNo ratings yet

- Part I: Government Election: April 2017Document4 pagesPart I: Government Election: April 2017Chuah Chong AnnNo ratings yet

- Lecture 11 - Audit in Public SectorDocument56 pagesLecture 11 - Audit in Public SectorChuah Chong Ann100% (2)

- Tutorial 7 Answer Q1 2 3Document12 pagesTutorial 7 Answer Q1 2 3Chuah Chong AnnNo ratings yet

- PFP Group Assignment - 17032019Document38 pagesPFP Group Assignment - 17032019Chuah Chong AnnNo ratings yet

- MUET July 2013 WritingDocument19 pagesMUET July 2013 WritingChuah Chong Ann67% (3)

- Lecture 6 - Performance Management in Public SectorDocument4 pagesLecture 6 - Performance Management in Public SectorChuah Chong AnnNo ratings yet

- Jazz Improvisation Lesson Plan 2 17 17Document2 pagesJazz Improvisation Lesson Plan 2 17 17api-310967404No ratings yet

- 2011 Equipment Flyer 05272011updatedDocument24 pages2011 Equipment Flyer 05272011updatedChecho BuenaventuraNo ratings yet

- HanumanstaleDocument449 pagesHanumanstaleBhaskar Gundu100% (2)

- Grade 10 - English Literature - The Little Match Girl - 2021-22Document4 pagesGrade 10 - English Literature - The Little Match Girl - 2021-22Bhavya SomaiyaNo ratings yet

- Science5 Q4 Module5 Week5 18pDocument18 pagesScience5 Q4 Module5 Week5 18praymondcapeNo ratings yet

- Test 1 Rectification and Subsidiary Books 21.05.2019Document2 pagesTest 1 Rectification and Subsidiary Books 21.05.2019bhumikaaNo ratings yet

- The Effects of New Technology On Parents Child Relationship in Dina, JhelumDocument4 pagesThe Effects of New Technology On Parents Child Relationship in Dina, JhelumThe Explorer IslamabadNo ratings yet

- HNNE Term Proforma Front Sheet 2008 With InstructionsDocument4 pagesHNNE Term Proforma Front Sheet 2008 With InstructionsMaribel MuevecelaNo ratings yet

- Passion in EntrepreneurshipDocument12 pagesPassion in EntrepreneurshipCharisse WooNo ratings yet

- Mathematics V: 3 Periodical ExamDocument3 pagesMathematics V: 3 Periodical ExamTrace de GuzmanNo ratings yet

- Immuno and InfectiousDocument17 pagesImmuno and Infectiousgreen_archerNo ratings yet

- Litw - Phase 1 - Structural Steel Fabrication BoqDocument1 pageLitw - Phase 1 - Structural Steel Fabrication BoqLakshmi ManjunathNo ratings yet

- Finnchain References 2017Document6 pagesFinnchain References 2017CarlosSanchezSanchezNo ratings yet

- Sample Bar Exam QuestionsDocument3 pagesSample Bar Exam QuestionsslydogchuckNo ratings yet

- Phimosis N ParaphimosisDocument14 pagesPhimosis N ParaphimosisDhella 'gungeyha' RangkutyNo ratings yet

- Aik CH 5Document10 pagesAik CH 5rizky unsNo ratings yet

- VATRA Tractor Fault Codes DTC & TroubleshootingDocument73 pagesVATRA Tractor Fault Codes DTC & TroubleshootingFernando KrothNo ratings yet

- Hitachi Global Vs CIRDocument5 pagesHitachi Global Vs CIRAnonymous vAVKlB1No ratings yet

- Y Aquasilvi CultureDocument14 pagesY Aquasilvi CultureCeejey EscabarteNo ratings yet

- Least LEARNED COMPETENCIESDocument2 pagesLeast LEARNED COMPETENCIESAnne Cerna ElgaNo ratings yet

- Action Report - TamilNadu - Shallots, PerambalurDocument6 pagesAction Report - TamilNadu - Shallots, PerambalurKajal YadavNo ratings yet

- Finance Batch 2022-24Document20 pagesFinance Batch 2022-24LAKHAN TRIVEDINo ratings yet

- Conformity (Majority Influence)Document11 pagesConformity (Majority Influence)Camille FernandezNo ratings yet

- Assignment On Fundamentals of PartnershipDocument8 pagesAssignment On Fundamentals of Partnershipsainimanish170gmailc100% (1)

- Business PlanDocument25 pagesBusiness PlanJay PatelNo ratings yet

- Resume SeetaRamDocument2 pagesResume SeetaRamdasarinaveenNo ratings yet

- Ramanuja Srivaishnavism VisistaadvaitaDocument32 pagesRamanuja Srivaishnavism VisistaadvaitarajNo ratings yet

Lecture Exercise - Chapter 4

Lecture Exercise - Chapter 4

Uploaded by

Chuah Chong AnnOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lecture Exercise - Chapter 4

Lecture Exercise - Chapter 4

Uploaded by

Chuah Chong AnnCopyright:

Available Formats

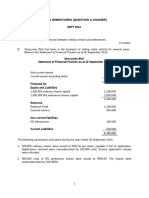

LECTURE EXERCISE – CHAPTER 4

Endo Berhad currently has 4 million shares issued and outstanding, valued at RM2.00

each, and the company has annual earnings equal to 20% of the market value of the

shares. A two for five rights issue is proposed at an issue price of RM1.65 each.

If the market continues to value the shares on a price/earnings ratio of 5, what would

be the value per share if the new funds are expected to earn, as a percentage of the

money raised:

(i) 15%,

(ii) 20%, and

(iii) 25%.

(iv) How would these values from (i), (ii) and (iii) compare with the theoretical ex-

rights price? Explain the differences.

SUGGESTED ANSWER

Step 1: Find the theoretical ex-rights price

Five existing shares at cum-rights price @

RM2.00/share RM10.00

Two new shares at issue price of RM1.65/share RM 3.30

Seven shares will have a theoretical value of RM13.30

Theoretical ex-rights price RM13.30/7 RM1.90 per share

Step 2: Find total earnings after rights issue

Existing earnings 20% 4,000,000 RM2 RM 1,600,000

New funds raised from 4,000,000 (2/5) RM1.65

RM2,640,000

rights issue

Earnings as a % of Additional earnings on Existing Total earnings

new funds raised new funds raised earnings after rights issue

RM RM RM

(i) 15% 396,000 1,600,000 1,996,000

(ii) 20% 528,000 1,600,000 2,128,000

(iii) 25% 660,000 1,600,000 2,260,000

Step 3: Find total market value of equity and market price per share after rights issue, given a

P/E ratio of 5

Total earnings after rights Total market value of equity Market price per share after

issue after rights issue rights issue

RM RM RM

(i) 1,996,000 9,980,000 1.78

(ii) 2,128,000 10,640,000 1.90

(iii) 2,260,000 11,300,000 2.02

If the additional funds from rights issue raised are expected to earn the same rate

as existing funds, the actual market price per share will be equal to the

theoretical ex-rights price per share.

If the additional funds from rights issue raised are expected to earn a higher rate

than existing funds, the actual market price per share will be above the

theoretical ex-rights price per share.

If the additional funds from rights issue raised are expected to earn a lower rate

than existing funds, the actual market price per share will be below the

theoretical ex-rights price per share

You might also like

- Jane Lazar CGFR 8th Ed Solutions AfaDocument228 pagesJane Lazar CGFR 8th Ed Solutions Afasharmitraa100% (17)

- FAR 570 Test Mac July 2021 - QQDocument3 pagesFAR 570 Test Mac July 2021 - QQAthira Adriana Bt RemlanNo ratings yet

- Management Report On Tesla, Inc.Document7 pagesManagement Report On Tesla, Inc.Naveed IbrahimNo ratings yet

- Share & Business Valuation Case Study Question and SolutionDocument6 pagesShare & Business Valuation Case Study Question and SolutionSarannyaRajendraNo ratings yet

- Manual For Finance QuestionsDocument56 pagesManual For Finance QuestionssamiraZehra85% (13)

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- Complete SRS For CMSDocument26 pagesComplete SRS For CMSAtta Ur Rehman TariqNo ratings yet

- The Land Transportation OfficeDocument4 pagesThe Land Transportation OfficeMaùreen AbegailNo ratings yet

- SFM MTP 1 Nov 18 ADocument12 pagesSFM MTP 1 Nov 18 ASampath KumarNo ratings yet

- Additional Question Topic 3: So No Need To Add With Reb/f and Current Year ProfitDocument8 pagesAdditional Question Topic 3: So No Need To Add With Reb/f and Current Year ProfitMastura Abd HamidNo ratings yet

- Tutorial 4 Questions (Chapter 4)Document4 pagesTutorial 4 Questions (Chapter 4)jiayiwang0221No ratings yet

- BCM 4206 Corporate Finance PDFDocument4 pagesBCM 4206 Corporate Finance PDFSimon silaNo ratings yet

- Bazg521 Nov25 AnDocument2 pagesBazg521 Nov25 AnDheeraj RaiNo ratings yet

- F2Solution December 2017 ExamDocument8 pagesF2Solution December 2017 Examshafiqul alamNo ratings yet

- PST FM 2015 2023Document92 pagesPST FM 2015 2023PhilipNo ratings yet

- Tutorial 5 Jan 2022 Question OnlyDocument8 pagesTutorial 5 Jan 2022 Question OnlyMurali RasamahNo ratings yet

- Bfi 4301 Financial Management Paper 1Document10 pagesBfi 4301 Financial Management Paper 1Paul AtariNo ratings yet

- Final Exam 2020 CorrectionDocument4 pagesFinal Exam 2020 Correctionmonaatallah1No ratings yet

- Consolidation QuestionsDocument16 pagesConsolidation QuestionsUmmar FarooqNo ratings yet

- BBM 310Document4 pagesBBM 310Kimondo KingNo ratings yet

- OSA JUL23 S2 BCOM ACC Management Accounting and Finance 3B FINALDocument7 pagesOSA JUL23 S2 BCOM ACC Management Accounting and Finance 3B FINALAmithNo ratings yet

- Quiz in Investment AnswersDocument7 pagesQuiz in Investment AnswersElaine Fiona Villafuerte100% (1)

- Quiz in Investment AnswersDocument7 pagesQuiz in Investment AnswersLenny Ramos VillafuerteNo ratings yet

- Tutorial 3 Questions (Chapter 2)Document4 pagesTutorial 3 Questions (Chapter 2)jiayiwang0221No ratings yet

- IPO Note - Associated Oxygen LTDDocument5 pagesIPO Note - Associated Oxygen LTDturjoyNo ratings yet

- University of Mauritius: Faculty of Law and ManagementDocument9 pagesUniversity of Mauritius: Faculty of Law and ManagementMîñåk ŞhïïNo ratings yet

- Work Book M5 AFMDocument5 pagesWork Book M5 AFMNaimeesha MattaparthiNo ratings yet

- Test Paper: Chapter-1: Cost of CapitalDocument13 pagesTest Paper: Chapter-1: Cost of Capitalcofinab795No ratings yet

- Paper - 2: Strategic Financial Management Questions Merger and AcquisitionsDocument27 pagesPaper - 2: Strategic Financial Management Questions Merger and AcquisitionsObaid RehmanNo ratings yet

- A. Information Is Costless and Widely Available To Market Participants at Approximately The Same TimeDocument14 pagesA. Information Is Costless and Widely Available To Market Participants at Approximately The Same TimeSHER LYN LOWNo ratings yet

- Accf3114 1Document12 pagesAccf3114 1Krishna 11No ratings yet

- MTP 1 Nov 18 QDocument6 pagesMTP 1 Nov 18 QSampath KumarNo ratings yet

- Revisionary Test Paper - Final - Syllabus 2012 - Dec2013: Group - IV Paper 17 - Strategic Performance Management Section - ADocument71 pagesRevisionary Test Paper - Final - Syllabus 2012 - Dec2013: Group - IV Paper 17 - Strategic Performance Management Section - ANagendra KrishnamurthyNo ratings yet

- Paper - 2: Strategic Financial Management Questions Future ContractDocument24 pagesPaper - 2: Strategic Financial Management Questions Future ContractRaul KarkyNo ratings yet

- Assignment Answer Sheet: Name: Subject: Assignment IiDocument6 pagesAssignment Answer Sheet: Name: Subject: Assignment IiAravindh ArulNo ratings yet

- FR-342.AFR (AL-I) Solution CMA January-2023 Exam.Document7 pagesFR-342.AFR (AL-I) Solution CMA January-2023 Exam.practice78222No ratings yet

- Sir Saud Tariq: 13 Important Revision Questions On Each TopicDocument29 pagesSir Saud Tariq: 13 Important Revision Questions On Each TopicShehrozST100% (1)

- Tutorial 7 PC & MONOPOLYDocument3 pagesTutorial 7 PC & MONOPOLYCHZE CHZI CHUAHNo ratings yet

- Management Accounitng - 104 (I)Document4 pagesManagement Accounitng - 104 (I)Rudraksh PareyNo ratings yet

- Exercises - Mergers and AcquisitionsDocument1 pageExercises - Mergers and AcquisitionsHune VerryNo ratings yet

- BACC1 Group Work-Fafa and BlewuDocument3 pagesBACC1 Group Work-Fafa and Blewuisaacbediako82No ratings yet

- McomDocument302 pagesMcommostfaNo ratings yet

- Problems On Marginal CostingDocument7 pagesProblems On Marginal Costingrathanreddy2002No ratings yet

- Exercise Final SECTION B 2019Document5 pagesExercise Final SECTION B 2019Arman ShahNo ratings yet

- Accounting BasicDocument2 pagesAccounting Basicinsanulf9No ratings yet

- FM+ECO M.Test EM Question 26.02.2023Document6 pagesFM+ECO M.Test EM Question 26.02.2023harish jangidNo ratings yet

- Financial Plan / Strategy / Analysis: 1.1 Project Implementation Cost ScheduleDocument11 pagesFinancial Plan / Strategy / Analysis: 1.1 Project Implementation Cost ScheduleNadrahNo ratings yet

- FAR 410 Topic 3: EquityDocument4 pagesFAR 410 Topic 3: EquityAmzarNo ratings yet

- Sept 2014 - 230716 - 233727Document22 pagesSept 2014 - 230716 - 233727mohddanialhanaffimustaffiNo ratings yet

- Acquisition & Mergers ValuationDocument18 pagesAcquisition & Mergers ValuationAqeel HanjraNo ratings yet

- Chapter 18 20Document11 pagesChapter 18 20jessa mae zerdaNo ratings yet

- Universiti Teknologi Mara Final Examination: Confidential 1 AC/FEB 2022/FAR320Document7 pagesUniversiti Teknologi Mara Final Examination: Confidential 1 AC/FEB 2022/FAR3202021202082No ratings yet

- Project 5 McCormick Workbook 2188Document13 pagesProject 5 McCormick Workbook 2188Vin JohnNo ratings yet

- 01 Leverages FTDocument7 pages01 Leverages FT1038 Kareena SoodNo ratings yet

- 202-Financial ManagementDocument5 pages202-Financial ManagementRAHUL GHOSALENo ratings yet

- Master Questions, Advance Level Questions and Additional Questions-Chapter 4Document18 pagesMaster Questions, Advance Level Questions and Additional Questions-Chapter 4manmeet0001No ratings yet

- UKAF4034-ACR-Tutorial 4-Q BasicConsoDocument7 pagesUKAF4034-ACR-Tutorial 4-Q BasicConsotan JiayeeNo ratings yet

- Mock Test Q2 PDFDocument5 pagesMock Test Q2 PDFManasa SureshNo ratings yet

- Accounts Paper Answer 24.06.2020Document17 pagesAccounts Paper Answer 24.06.2020Prathmesh JambhulkarNo ratings yet

- FINANCIAL MANAGEMENT October 20172016 PatternSemester IIDocument4 pagesFINANCIAL MANAGEMENT October 20172016 PatternSemester IISwati DafaneNo ratings yet

- Question No 1: A-Gross PayDocument6 pagesQuestion No 1: A-Gross PayArmaghan Ali MalikNo ratings yet

- The Valuation of Digital Intangibles: Technology, Marketing and InternetFrom EverandThe Valuation of Digital Intangibles: Technology, Marketing and InternetNo ratings yet

- WEEK 13 Financial ControlDocument13 pagesWEEK 13 Financial ControlChuah Chong AnnNo ratings yet

- Lesson 2: Relevant Costs For Decision MakingDocument41 pagesLesson 2: Relevant Costs For Decision MakingChuah Chong AnnNo ratings yet

- Management Accounting: Information That Creates ValueDocument101 pagesManagement Accounting: Information That Creates ValueChuah Chong Ann100% (1)

- Topic 4 (Responding To Primary Stakeholders) : Stockholder Rights and Corporate GovernanceDocument27 pagesTopic 4 (Responding To Primary Stakeholders) : Stockholder Rights and Corporate GovernanceChuah Chong AnnNo ratings yet

- Worksheet For Funding Retirement NeedsDocument6 pagesWorksheet For Funding Retirement NeedsChuah Chong AnnNo ratings yet

- Barriers in Implementing Performance Measurement SystemsDocument1 pageBarriers in Implementing Performance Measurement SystemsChuah Chong AnnNo ratings yet

- Tutorial 9 Jan 2019 AnswersDocument9 pagesTutorial 9 Jan 2019 AnswersChuah Chong AnnNo ratings yet

- Part I: Government Election: April 2017Document4 pagesPart I: Government Election: April 2017Chuah Chong AnnNo ratings yet

- Lecture 11 - Audit in Public SectorDocument56 pagesLecture 11 - Audit in Public SectorChuah Chong Ann100% (2)

- Tutorial 7 Answer Q1 2 3Document12 pagesTutorial 7 Answer Q1 2 3Chuah Chong AnnNo ratings yet

- PFP Group Assignment - 17032019Document38 pagesPFP Group Assignment - 17032019Chuah Chong AnnNo ratings yet

- MUET July 2013 WritingDocument19 pagesMUET July 2013 WritingChuah Chong Ann67% (3)

- Lecture 6 - Performance Management in Public SectorDocument4 pagesLecture 6 - Performance Management in Public SectorChuah Chong AnnNo ratings yet

- Jazz Improvisation Lesson Plan 2 17 17Document2 pagesJazz Improvisation Lesson Plan 2 17 17api-310967404No ratings yet

- 2011 Equipment Flyer 05272011updatedDocument24 pages2011 Equipment Flyer 05272011updatedChecho BuenaventuraNo ratings yet

- HanumanstaleDocument449 pagesHanumanstaleBhaskar Gundu100% (2)

- Grade 10 - English Literature - The Little Match Girl - 2021-22Document4 pagesGrade 10 - English Literature - The Little Match Girl - 2021-22Bhavya SomaiyaNo ratings yet

- Science5 Q4 Module5 Week5 18pDocument18 pagesScience5 Q4 Module5 Week5 18praymondcapeNo ratings yet

- Test 1 Rectification and Subsidiary Books 21.05.2019Document2 pagesTest 1 Rectification and Subsidiary Books 21.05.2019bhumikaaNo ratings yet

- The Effects of New Technology On Parents Child Relationship in Dina, JhelumDocument4 pagesThe Effects of New Technology On Parents Child Relationship in Dina, JhelumThe Explorer IslamabadNo ratings yet

- HNNE Term Proforma Front Sheet 2008 With InstructionsDocument4 pagesHNNE Term Proforma Front Sheet 2008 With InstructionsMaribel MuevecelaNo ratings yet

- Passion in EntrepreneurshipDocument12 pagesPassion in EntrepreneurshipCharisse WooNo ratings yet

- Mathematics V: 3 Periodical ExamDocument3 pagesMathematics V: 3 Periodical ExamTrace de GuzmanNo ratings yet

- Immuno and InfectiousDocument17 pagesImmuno and Infectiousgreen_archerNo ratings yet

- Litw - Phase 1 - Structural Steel Fabrication BoqDocument1 pageLitw - Phase 1 - Structural Steel Fabrication BoqLakshmi ManjunathNo ratings yet

- Finnchain References 2017Document6 pagesFinnchain References 2017CarlosSanchezSanchezNo ratings yet

- Sample Bar Exam QuestionsDocument3 pagesSample Bar Exam QuestionsslydogchuckNo ratings yet

- Phimosis N ParaphimosisDocument14 pagesPhimosis N ParaphimosisDhella 'gungeyha' RangkutyNo ratings yet

- Aik CH 5Document10 pagesAik CH 5rizky unsNo ratings yet

- VATRA Tractor Fault Codes DTC & TroubleshootingDocument73 pagesVATRA Tractor Fault Codes DTC & TroubleshootingFernando KrothNo ratings yet

- Hitachi Global Vs CIRDocument5 pagesHitachi Global Vs CIRAnonymous vAVKlB1No ratings yet

- Y Aquasilvi CultureDocument14 pagesY Aquasilvi CultureCeejey EscabarteNo ratings yet

- Least LEARNED COMPETENCIESDocument2 pagesLeast LEARNED COMPETENCIESAnne Cerna ElgaNo ratings yet

- Action Report - TamilNadu - Shallots, PerambalurDocument6 pagesAction Report - TamilNadu - Shallots, PerambalurKajal YadavNo ratings yet

- Finance Batch 2022-24Document20 pagesFinance Batch 2022-24LAKHAN TRIVEDINo ratings yet

- Conformity (Majority Influence)Document11 pagesConformity (Majority Influence)Camille FernandezNo ratings yet

- Assignment On Fundamentals of PartnershipDocument8 pagesAssignment On Fundamentals of Partnershipsainimanish170gmailc100% (1)

- Business PlanDocument25 pagesBusiness PlanJay PatelNo ratings yet

- Resume SeetaRamDocument2 pagesResume SeetaRamdasarinaveenNo ratings yet

- Ramanuja Srivaishnavism VisistaadvaitaDocument32 pagesRamanuja Srivaishnavism VisistaadvaitarajNo ratings yet