Professional Documents

Culture Documents

Pascual Vs Cir Digest

Pascual Vs Cir Digest

Uploaded by

erlaine_franciscoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pascual Vs Cir Digest

Pascual Vs Cir Digest

Uploaded by

erlaine_franciscoCopyright:

Available Formats

Pascual vs.

Commissioner of Internal Revenue

L-78133. 18 October 1988

FACTS:

Petitioners sold 2 parcels of land in 1968 to Marenir Development Corp, and 3 parcels to

Reyes and Samson on 1970. They realized a net profit of P165,224.70 in 1968 and P60,000 in

1970. The corresponding capital gains taxes were paid by petitioners in 1973 and 1974 by

availing of the tax amnesties granted in the said years. Commissioner, however, wrote a letter

demanding the payment of P107,101.70, alleging that it was a deficiency in the corporate income

taxes for years 1968 and 1970. On defense, petitioners claim that they have already availed of a

tax amnesty. Commissioner contends that on the years in question, petitioners as co-owners in

the real estate transactions formed an unregistered joint venture which is taxable as a

corporation, and that the partnership was subject to a corporate income tax as distinguished from

the profits derived from partnership by them, which was subject to individual tax. Responded

further argued that the tax amnesty did not cover the tax liability of the unregistered partnership.

Issue:

Whether or not petitioners formed an unregistered partnership which is subject to

corporate income tax.

Ruling:

No. In the present case, here is no evidence that the petitioners agreed to contribute

money, property or industry to a common fund and that they intended to divide the profits among

themselves. The respondent just assumed these conditions to be present on the basis of the fact

that petitioners purchased certain parcels of land and become co-owners thereof. The frequency

of transactions they performed does not manifest the character of habituality peculiar to business

transactions for the purpose of gain.

In this case, there is no adequate basis to support the proposition that there exists a

partnership. The two isolated transactions whereby they purchased properties and sold the same a

few years thereafter did not thereby make them partners. They shared in the gross profits as co-

owners and paid their capital gains taxes on their net profits and availed of the tax amnesty

thereby. Under the circumstances, they cannot be considered to have formed an unregistered

partnership which is thereby liable for corporate income tax, as the respondent commissioner

proposes.

You might also like

- US Vs ClarinDocument1 pageUS Vs ClarinEmelie Marie DiezNo ratings yet

- Manila Mandarin Hotels Vs Commissioner of Internal Revenue DIGESTDocument1 pageManila Mandarin Hotels Vs Commissioner of Internal Revenue DIGESTerlaine_franciscoNo ratings yet

- Pascual vs. CIR Case DigestDocument5 pagesPascual vs. CIR Case DigestGuiller C. MagsumbolNo ratings yet

- Pascual V Cir DigestDocument1 pagePascual V Cir DigestDani Lynne100% (4)

- Partnership Case DigestsDocument15 pagesPartnership Case DigestsButch MaatNo ratings yet

- Universal Mills Vs Universal TextileDocument4 pagesUniversal Mills Vs Universal TextileRose Ann VeloriaNo ratings yet

- CASE Digest - PartnershipDocument7 pagesCASE Digest - Partnershipboybilis50% (4)

- International Express Travel and Tour Services Inc V CADocument1 pageInternational Express Travel and Tour Services Inc V CAMarioneMaeThiamNo ratings yet

- Domingo vs. CarlitosDocument4 pagesDomingo vs. CarlitosMp CasNo ratings yet

- I4 Estanislao v. CADocument1 pageI4 Estanislao v. CAMlaNo ratings yet

- 232 Tan Tiong Bio Vs CIRDocument1 page232 Tan Tiong Bio Vs CIRjoyceNo ratings yet

- Partnership (Case Digests)Document17 pagesPartnership (Case Digests)Lou Ann AncaoNo ratings yet

- Bache vs. Ruiz DigestDocument3 pagesBache vs. Ruiz DigestJay EmNo ratings yet

- Cases in Partnership (Unfinished)Document14 pagesCases in Partnership (Unfinished)Faye Cience BoholNo ratings yet

- Partnership - Case Digests 1Document34 pagesPartnership - Case Digests 1Carlo Talatala100% (1)

- CIR Vs Norton and Harrison CompanyDocument1 pageCIR Vs Norton and Harrison CompanymarvinNo ratings yet

- Week 1 DigestDocument15 pagesWeek 1 DigestTinn ApNo ratings yet

- Partnership-Saludo Vs PNB Case DigestDocument3 pagesPartnership-Saludo Vs PNB Case DigestDesiree Jane Espa Tubaon100% (1)

- GR L-24332 Rallos Vs Felix Go ChanDocument1 pageGR L-24332 Rallos Vs Felix Go Chanlucky javellanaNo ratings yet

- 06 Philex Mining vs. CIRDocument1 page06 Philex Mining vs. CIRJoshua Erik Madria100% (1)

- Benito VS SecDocument2 pagesBenito VS Secjojo50166No ratings yet

- Sulo NG Bayan Vs Araneta DigestDocument1 pageSulo NG Bayan Vs Araneta DigestSimeon SuanNo ratings yet

- Agency DigestDocument22 pagesAgency DigestJhollina33% (3)

- Week Three Case DigestDocument4 pagesWeek Three Case DigestdondzNo ratings yet

- Idos vs. CADocument3 pagesIdos vs. CAGia DimayugaNo ratings yet

- O-Q Part 1 DIGESTDocument12 pagesO-Q Part 1 DIGESTLaw CoNo ratings yet

- Taxation Cases DigestDocument11 pagesTaxation Cases Digestenzoaleno100% (2)

- Josefina Realubit Vs ProsencioDocument4 pagesJosefina Realubit Vs ProsencioMarvin A Gamboa100% (2)

- Agency - Modes of Extinguishment of Agency - Barba, Daylinda C.Document1 pageAgency - Modes of Extinguishment of Agency - Barba, Daylinda C.gongsilogNo ratings yet

- Wesleyan University V FacultyDocument3 pagesWesleyan University V FacultyCharlie Brown100% (1)

- Tax Case Digests For 27 JanDocument7 pagesTax Case Digests For 27 JanJermaeDelosSantosNo ratings yet

- Orporate Overnance Nformation IghtsDocument6 pagesOrporate Overnance Nformation IghtsdoraemoanNo ratings yet

- Valentin Guijarno vs. CIR (Caguete)Document2 pagesValentin Guijarno vs. CIR (Caguete)Francis MasiglatNo ratings yet

- Fernando V Franco G.R. No. L-27786Document3 pagesFernando V Franco G.R. No. L-27786Therese ElleNo ratings yet

- Campus Rueda & Co. vs. Pacific Commercial & Co., 44 Phil. 916Document1 pageCampus Rueda & Co. vs. Pacific Commercial & Co., 44 Phil. 916JulioNo ratings yet

- Saludo Vs PNB Case DigestDocument3 pagesSaludo Vs PNB Case DigestNovi Mari Noble0% (1)

- Spouses Alfredo and Susana Ong Philippine Commercial International BankDocument29 pagesSpouses Alfredo and Susana Ong Philippine Commercial International BankGenevieve BermudoNo ratings yet

- Lung Center vs. Quezon City (SUMMARY)Document3 pagesLung Center vs. Quezon City (SUMMARY)ian clark MarinduqueNo ratings yet

- Corporation Digested Cases 1-18Document29 pagesCorporation Digested Cases 1-18Roli Sitjar ArangoteNo ratings yet

- #16 Indian Chamber of Commerce PhilsDocument2 pages#16 Indian Chamber of Commerce PhilsJü BëNo ratings yet

- Tocao Vs CADocument1 pageTocao Vs CAJustin Loredo50% (2)

- Munasque vs. CADocument2 pagesMunasque vs. CAKelsey Olivar MendozaNo ratings yet

- Tocao VS CaDocument2 pagesTocao VS Camitsudayo_No ratings yet

- Cayetano v. LeonidasDocument4 pagesCayetano v. LeonidasKikoy IlaganNo ratings yet

- 7 Heirs of Jose Lim Vs Juliet LimDocument1 page7 Heirs of Jose Lim Vs Juliet LimNova MarasiganNo ratings yet

- Martinez vs. Ong Pong, 14 Phil. 726Document4 pagesMartinez vs. Ong Pong, 14 Phil. 726Lorjyll Shyne Luberanes TomarongNo ratings yet

- Leung vs. IacDocument1 pageLeung vs. IacFranzMordenoNo ratings yet

- Litton Vs Hill & Ceron Et AlDocument2 pagesLitton Vs Hill & Ceron Et Alchisel_159No ratings yet

- Fletcher Sec. 20Document3 pagesFletcher Sec. 20Yngel Lumampao Ugdamin-DignadiceNo ratings yet

- Republic VS Cocofed PDFDocument4 pagesRepublic VS Cocofed PDFRhev Xandra AcuñaNo ratings yet

- Delpher Traders vs. IacDocument3 pagesDelpher Traders vs. IacKent A. AlonzoNo ratings yet

- Heirs of Tan Eng Kee v. CADocument2 pagesHeirs of Tan Eng Kee v. CAGia Dimayuga100% (1)

- Cases To Remember in Corporation LawDocument45 pagesCases To Remember in Corporation LawRessie June PedranoNo ratings yet

- Mitsubishi Corp. v. CIR JUne 5, 2017-DigestDocument6 pagesMitsubishi Corp. v. CIR JUne 5, 2017-DigestRandy Sioson100% (1)

- 27 International Express Travel v. CA (De Leon)Document2 pages27 International Express Travel v. CA (De Leon)ASGarcia24No ratings yet

- Moran JR Vs CADocument1 pageMoran JR Vs CAracrabe96No ratings yet

- #6 Evangelista & Co. vs. Abad SantosDocument1 page#6 Evangelista & Co. vs. Abad SantosEm Asiddao-DeonaNo ratings yet

- 7.) Pascual and Dragon V CIRDocument2 pages7.) Pascual and Dragon V CIRRusty SeymourNo ratings yet

- Pascual and Dragon Vs CirDocument2 pagesPascual and Dragon Vs CirJo Vic Cata BonaNo ratings yet

- Pascual Vs Cir Tax2Document3 pagesPascual Vs Cir Tax2Rodel Cadorniga Jr.No ratings yet

- Pascual v. Commissioner GR. No. 78133 October 18, 1988 Doctrine: Distinction Between Co-Ownership and An Unregistered Partnership or JointDocument2 pagesPascual v. Commissioner GR. No. 78133 October 18, 1988 Doctrine: Distinction Between Co-Ownership and An Unregistered Partnership or JointBrylle Garnet DanielNo ratings yet

- Client Attorney RelationshipDocument2 pagesClient Attorney Relationshiperlaine_franciscoNo ratings yet

- Terminating Attorney-Client RelationshipDocument3 pagesTerminating Attorney-Client Relationshiperlaine_francisco50% (2)

- Attorney Client RelationshipDocument2 pagesAttorney Client Relationshiperlaine_franciscoNo ratings yet

- Solicitation of Legal Services Definition of TermsDocument8 pagesSolicitation of Legal Services Definition of Termserlaine_franciscoNo ratings yet

- Attorney's Fees PALEDocument5 pagesAttorney's Fees PALEerlaine_franciscoNo ratings yet

- Dynamic Builders Vs PresbiteroDocument33 pagesDynamic Builders Vs Presbiteroerlaine_franciscoNo ratings yet

- PALE - Part I PRACTICE OF LAWDocument5 pagesPALE - Part I PRACTICE OF LAWerlaine_franciscoNo ratings yet

- Pagcor Vs Bir DigestDocument1 pagePagcor Vs Bir Digesterlaine_francisco50% (2)

- Confidentiality PALE Lawyer-ClientDocument5 pagesConfidentiality PALE Lawyer-Clienterlaine_franciscoNo ratings yet

- Editha Salindong Agayan vs. Kital Philippines Corp., Et Al.Document14 pagesEditha Salindong Agayan vs. Kital Philippines Corp., Et Al.erlaine_franciscoNo ratings yet

- Mercado vs. CADocument8 pagesMercado vs. CAerlaine_franciscoNo ratings yet

- PatentDocument8 pagesPatenterlaine_franciscoNo ratings yet

- Sales Case Digest Compilation 2015 PDFDocument134 pagesSales Case Digest Compilation 2015 PDFObin Tambasacan BaggayanNo ratings yet

- PALE Syllabus and CLASS POLICIES AMDocument2 pagesPALE Syllabus and CLASS POLICIES AMerlaine_franciscoNo ratings yet

- Jica Study PDFDocument363 pagesJica Study PDFerlaine_franciscoNo ratings yet

- Amigo vs. TevesDocument6 pagesAmigo vs. Teveserlaine_franciscoNo ratings yet

- US vs. KieneDocument2 pagesUS vs. Kieneerlaine_franciscoNo ratings yet

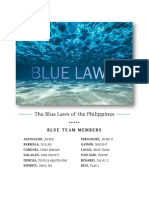

- BLUE LAWS - Written Report PDFDocument70 pagesBLUE LAWS - Written Report PDFerlaine_francisco100% (2)