Professional Documents

Culture Documents

REVENUE MEMORANDUM CIRCULAR NO. 89 - 2007 Issued On December 18

REVENUE MEMORANDUM CIRCULAR NO. 89 - 2007 Issued On December 18

Uploaded by

Cliff Daquioag0 ratings0% found this document useful (0 votes)

15 views1 pageThe memorandum directs large taxpayers to comply with regulations requiring mandatory electronic filing of tax returns and electronic payment of taxes through the Electronic Filling and Payment System (EFPS). Based on existing revenue regulations, large taxpayers must electronically file returns and pay taxes through authorized EFPS banks, not revenue collection officers, beginning July 2002. Tax payments through revenue collection officers are only permitted if there are no authorized EFPS banks in the revenue district office where the taxpayer is registered. The memorandum reminds large taxpayers to pay taxes electronically through EFPS banks to avoid penalties for manual payment through revenue collection officers.

Original Description:

Original Title

37862rmc 89-2007.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe memorandum directs large taxpayers to comply with regulations requiring mandatory electronic filing of tax returns and electronic payment of taxes through the Electronic Filling and Payment System (EFPS). Based on existing revenue regulations, large taxpayers must electronically file returns and pay taxes through authorized EFPS banks, not revenue collection officers, beginning July 2002. Tax payments through revenue collection officers are only permitted if there are no authorized EFPS banks in the revenue district office where the taxpayer is registered. The memorandum reminds large taxpayers to pay taxes electronically through EFPS banks to avoid penalties for manual payment through revenue collection officers.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

15 views1 pageREVENUE MEMORANDUM CIRCULAR NO. 89 - 2007 Issued On December 18

REVENUE MEMORANDUM CIRCULAR NO. 89 - 2007 Issued On December 18

Uploaded by

Cliff DaquioagThe memorandum directs large taxpayers to comply with regulations requiring mandatory electronic filing of tax returns and electronic payment of taxes through the Electronic Filling and Payment System (EFPS). Based on existing revenue regulations, large taxpayers must electronically file returns and pay taxes through authorized EFPS banks, not revenue collection officers, beginning July 2002. Tax payments through revenue collection officers are only permitted if there are no authorized EFPS banks in the revenue district office where the taxpayer is registered. The memorandum reminds large taxpayers to pay taxes electronically through EFPS banks to avoid penalties for manual payment through revenue collection officers.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

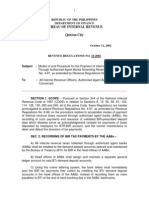

REVENUE MEMORANDUM CIRCULAR NO.

89-2007 issued on December 18,

2007 directs all large taxpayers to strictly comply with the Electronic Filling and

Payment System (EFPS) regulations relative to the mandatory electronic Filing (e-

Filing) of tax returns and electronic Payment (e-Payment) of taxes due thereon.

Based on the provisions of Section 3(a) and (b) of Revenue Regulations (RR)

No. 9-2007, as amended by RR Nos. 2-2002, 9-2002, 5-2004 and last amended by RR

No. 10-2007, beginning July 1, 2002, there would be no instances where large

taxpayers would have manually filed their tax returns nor paid their taxes manually

beginning August 1, 2002, unless the BIR system has been down during the deadline

date or the revised form has not been available in EFPS.

With respect to tax payments of large taxpayers, the same must be made only

through authorized EFPS Authorized Agent Banks (AABs) and not through Revenue

Collection Officers (RCOs) of the Bureau of Internal Revenue (BIR).

In practice, tax payments coursed through the RCOs of the BIR are only

allowed in instances where there are no AABs within the Revenue District Office

where the taxpayer is registered.

Thus, all large taxpayers are reminded to refrain from manually paying their

taxes through the RCOs and to strictly comply with the Regulations mandating them to

e-pay their taxes through their EFPS AABs. Otherwise, the penalty of 25% surcharge

for wrong venue, as provided for under Section 248 (a)(2) of the 1997 Tax Code, as

amended, shall be imposed.

You might also like

- Digest RR 5-2015Document1 pageDigest RR 5-2015Cristine100% (1)

- Revenue Regulations No. 9-2001Document6 pagesRevenue Regulations No. 9-2001Anonymous GMUQYq8No ratings yet

- 68120RR 1-2013 PDFDocument6 pages68120RR 1-2013 PDFandrew estimoNo ratings yet

- Advisory - Filing of ITR 2021Document2 pagesAdvisory - Filing of ITR 2021pelgonehNo ratings yet

- TAX2Document2 pagesTAX2Nicolyn Rae EscalanteNo ratings yet

- 68120RR 1-2013Document6 pages68120RR 1-2013Allan AlcantaraNo ratings yet

- Revenue Memorandum Circular No. 26-2018: Bureau of Internal RevenueDocument3 pagesRevenue Memorandum Circular No. 26-2018: Bureau of Internal RevenuePaul GeorgeNo ratings yet

- RMC No. 03-2006 (Guidelines On Attachments)Document2 pagesRMC No. 03-2006 (Guidelines On Attachments)Marco RvsNo ratings yet

- DRAFT RR-Implementing EOPT - For Public ConsultationDocument4 pagesDRAFT RR-Implementing EOPT - For Public ConsultationGennelyn OdulioNo ratings yet

- "Section 3. - COVERAGE.-xxx XXX XXXDocument2 pages"Section 3. - COVERAGE.-xxx XXX XXXnaldsdomingoNo ratings yet

- UntitledDocument3 pagesUntitledAkshat MehariaNo ratings yet

- Tax AmnestyDocument38 pagesTax AmnestyElsha dela penaNo ratings yet

- SOP For ScrutinyDocument5 pagesSOP For Scrutinyacgstdiv4No ratings yet

- RMC 37-2019Document1 pageRMC 37-2019Lhance BabacNo ratings yet

- 02-2004 Vat Philippine Port Authority PpaDocument3 pages02-2004 Vat Philippine Port Authority Ppaapi-247793055No ratings yet

- Monthly Percentage Tax ReturnDocument3 pagesMonthly Percentage Tax ReturnAu B ReyNo ratings yet

- RMC No. 73-2018Document3 pagesRMC No. 73-2018Madi KomoaNo ratings yet

- RMO No. 5-2002Document13 pagesRMO No. 5-2002lantern san juanNo ratings yet

- Circular Refund 147-1.5 Times RefundDocument5 pagesCircular Refund 147-1.5 Times Refundbanerjeeankita13No ratings yet

- Statutory Updates For Nov-21 ExamsDocument50 pagesStatutory Updates For Nov-21 ExamsShodasakshari VidyaNo ratings yet

- RR 3-02Document6 pagesRR 3-02matinikkiNo ratings yet

- Circular No.59Document6 pagesCircular No.59Hr legaladviserNo ratings yet

- RMC No 32-2018 PDFDocument4 pagesRMC No 32-2018 PDFzooeyNo ratings yet

- 02-2003 Staggered Filing of ReturnDocument4 pages02-2003 Staggered Filing of Returnapi-247793055No ratings yet

- Tot RR On It and WT RR 4 2024Document25 pagesTot RR On It and WT RR 4 2024floravielcasternoboplazoNo ratings yet

- By Rowena Altura: Volume 9 No.12Document6 pagesBy Rowena Altura: Volume 9 No.12arnelmapzNo ratings yet

- Bureau of Internal Revenue Quezon CityDocument6 pagesBureau of Internal Revenue Quezon CityPeggy SalazarNo ratings yet

- Service Tax Changes Process Amounting To Manufacture or Production of Goods Excluding Alcoholic Beverages For Human ConsumptionDocument5 pagesService Tax Changes Process Amounting To Manufacture or Production of Goods Excluding Alcoholic Beverages For Human ConsumptionYesBroker InNo ratings yet

- RMC 88-2018Document1 pageRMC 88-2018KevinPesaseNo ratings yet

- Draft Payment RulesDocument5 pagesDraft Payment RulesLillyLalithaNo ratings yet

- GST Circular PDFDocument11 pagesGST Circular PDFNavnera divisionNo ratings yet

- Version 5.0 (PASS5) : November 12, 2008Document5 pagesVersion 5.0 (PASS5) : November 12, 2008Otis MelbournNo ratings yet

- REVENUE MEMORANDUM CIRCULAR NO. 4-2018 Issued On January 11, 2018 ProvidesDocument1 pageREVENUE MEMORANDUM CIRCULAR NO. 4-2018 Issued On January 11, 2018 ProvidesAnonymous c19rbKRNo ratings yet

- Payment of Tax: (SECTION 49 To 53A)Document36 pagesPayment of Tax: (SECTION 49 To 53A)Mehak KaushikkNo ratings yet

- RMC 3-2018 (DST)Document2 pagesRMC 3-2018 (DST)sanNo ratings yet

- CA Inter Payment of GST Notes @mission - CA - InterDocument36 pagesCA Inter Payment of GST Notes @mission - CA - InterKush BafnaNo ratings yet

- RR No. 02-2006Document10 pagesRR No. 02-2006odessaNo ratings yet

- Bir Regulations No. 14-2003Document12 pagesBir Regulations No. 14-2003Haryeth CamsolNo ratings yet

- No Interest Under GST On Delayed Filing.....Document6 pagesNo Interest Under GST On Delayed Filing.....qt9m2bqvzkNo ratings yet

- Circular CGST 197Document5 pagesCircular CGST 197Jaipur-B Gr-2No ratings yet

- Tax UpdatesDocument79 pagesTax UpdatesFreijiah SonNo ratings yet

- Professional Programme (New Syllabus) Supplement FOR Advanced Tax LawDocument5 pagesProfessional Programme (New Syllabus) Supplement FOR Advanced Tax Lawmanjunath rNo ratings yet

- REVENUE MEMORANDUM CIRCULAR NO. 14-2015 Issued On April 6, 2015 PrescribesDocument1 pageREVENUE MEMORANDUM CIRCULAR NO. 14-2015 Issued On April 6, 2015 PrescribesGdares YakitNo ratings yet

- Taxation Reviewer On VATDocument10 pagesTaxation Reviewer On VATlchieSNo ratings yet

- Important GST Compliances As On April 1, 2021Document3 pagesImportant GST Compliances As On April 1, 2021Mohammed suhail.sNo ratings yet

- GST Update130 PDFDocument3 pagesGST Update130 PDFTharun RajNo ratings yet

- Tax Advisory BIR Form Shall Be Used For VAT PDFDocument1 pageTax Advisory BIR Form Shall Be Used For VAT PDFAndrew Benedict PardilloNo ratings yet

- GST Updates-45th Council MeetingDocument5 pagesGST Updates-45th Council Meetinghimesh amibrokerNo ratings yet

- Withholding Taxes: Carlo P. Divedor 19 October 2017Document20 pagesWithholding Taxes: Carlo P. Divedor 19 October 2017Melanie Grace Ulgasan LuceroNo ratings yet

- Circular No.45Document5 pagesCircular No.45Hr legaladviserNo ratings yet

- REVENUE MEMORANDUM CIRCULAR NO. 2-2018 Issued On January 8, 2018 ProvidesDocument2 pagesREVENUE MEMORANDUM CIRCULAR NO. 2-2018 Issued On January 8, 2018 ProvidesAnonymous HQymOK61No ratings yet

- Page 1 of 8Document8 pagesPage 1 of 8Faiqa HamidNo ratings yet

- Revenue Regulations No. 12-2002Document5 pagesRevenue Regulations No. 12-2002Sy HimNo ratings yet

- 80 2021 TT-BTC M 502560Document69 pages80 2021 TT-BTC M 502560XUnNo ratings yet

- FAQsonTDS 230221 120909Document8 pagesFAQsonTDS 230221 120909Bharath UGNo ratings yet

- 29133rmo 10-2006Document15 pages29133rmo 10-2006Denzel Edward CariagaNo ratings yet

- Electronic Liability LedgerDocument4 pagesElectronic Liability LedgerDark EmpireNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Gluratior: Srruilltdtdc?!Flffilr DepartmedDocument2 pagesGluratior: Srruilltdtdc?!Flffilr DepartmedCliff DaquioagNo ratings yet

- @urdior: DepartmatDocument3 pages@urdior: DepartmatCliff DaquioagNo ratings yet

- RMO No.16-2018Document1 pageRMO No.16-2018Cliff DaquioagNo ratings yet

- JDMC, DA 2023 DOST-SEI Undergraduate Scholarship Program 0334 - October 28, 2022Document1 pageJDMC, DA 2023 DOST-SEI Undergraduate Scholarship Program 0334 - October 28, 2022Cliff DaquioagNo ratings yet

- Prilipin.r Department: GtutationDocument4 pagesPrilipin.r Department: GtutationCliff DaquioagNo ratings yet

- RAO No. 2-2018Document16 pagesRAO No. 2-2018Cliff DaquioagNo ratings yet

- Subject: Bureau RevenueDocument1 pageSubject: Bureau RevenueCliff DaquioagNo ratings yet

- RMO No. 15-2020Document6 pagesRMO No. 15-2020Cliff DaquioagNo ratings yet

- RMO No.11-2018Document2 pagesRMO No.11-2018Cliff DaquioagNo ratings yet

- Ra, XG TR-FZ: Stejgo+.R@F, EDocument1 pageRa, XG TR-FZ: Stejgo+.R@F, ECliff DaquioagNo ratings yet

- RE ED P : MemorandumDocument5 pagesRE ED P : MemorandumCliff DaquioagNo ratings yet

- #.Ciq Of: Revenue The CollectionDocument6 pages#.Ciq Of: Revenue The CollectionCliff DaquioagNo ratings yet

- RMO - NO. 9-2018 - DigestDocument5 pagesRMO - NO. 9-2018 - DigestCliff DaquioagNo ratings yet

- RMO - NO. 6-2018 - DigestDocument1 pageRMO - NO. 6-2018 - DigestCliff DaquioagNo ratings yet

- Zojd: A Key Cy Revenue EmployeesDocument1 pageZojd: A Key Cy Revenue EmployeesCliff DaquioagNo ratings yet

- RMO No. 18-2020Document19 pagesRMO No. 18-2020Cliff DaquioagNo ratings yet

- Memorandum Orderno. E'o of To: Revenue ForDocument1 pageMemorandum Orderno. E'o of To: Revenue ForCliff DaquioagNo ratings yet

- RMO No. 14-2020 Re OSH v1Document14 pagesRMO No. 14-2020 Re OSH v1Cliff DaquioagNo ratings yet

- Memorai (Dim No.: JUL 22, Ecodps DlvlslonDocument7 pagesMemorai (Dim No.: JUL 22, Ecodps DlvlslonCliff DaquioagNo ratings yet

- Revenue Memorandum Order No. 25-2020Document1 pageRevenue Memorandum Order No. 25-2020Cliff DaquioagNo ratings yet

- L (.Il Julylg,: or For The in To ofDocument7 pagesL (.Il Julylg,: or For The in To ofCliff DaquioagNo ratings yet