Professional Documents

Culture Documents

REVENUE REGULATIONS NO. 10-2002 Issued On July 18, 2002 Imposes A Ceiling

REVENUE REGULATIONS NO. 10-2002 Issued On July 18, 2002 Imposes A Ceiling

Uploaded by

Cliff Daquioag0 ratings0% found this document useful (0 votes)

78 views1 pageRevenue Regulations No. 10-2002 places a ceiling on entertainment, amusement and recreation expenses that can be claimed as deductions by individuals engaged in business, taxable estates and trusts, individuals engaged in a profession, domestic corporations, resident foreign corporations, and general professional partnerships. The ceiling is 0.50% of net sales for taxpayers engaged in goods/property sales and 1% of net revenue for taxpayers engaged in service/professional sales. Expenses are subject to verification and must comply with substantiation requirements to be deductible under the ceiling. Non-deductible amounts will be disallowed and penalties may apply.

Original Description:

Original Title

RR_10-2002.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRevenue Regulations No. 10-2002 places a ceiling on entertainment, amusement and recreation expenses that can be claimed as deductions by individuals engaged in business, taxable estates and trusts, individuals engaged in a profession, domestic corporations, resident foreign corporations, and general professional partnerships. The ceiling is 0.50% of net sales for taxpayers engaged in goods/property sales and 1% of net revenue for taxpayers engaged in service/professional sales. Expenses are subject to verification and must comply with substantiation requirements to be deductible under the ceiling. Non-deductible amounts will be disallowed and penalties may apply.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

78 views1 pageREVENUE REGULATIONS NO. 10-2002 Issued On July 18, 2002 Imposes A Ceiling

REVENUE REGULATIONS NO. 10-2002 Issued On July 18, 2002 Imposes A Ceiling

Uploaded by

Cliff DaquioagRevenue Regulations No. 10-2002 places a ceiling on entertainment, amusement and recreation expenses that can be claimed as deductions by individuals engaged in business, taxable estates and trusts, individuals engaged in a profession, domestic corporations, resident foreign corporations, and general professional partnerships. The ceiling is 0.50% of net sales for taxpayers engaged in goods/property sales and 1% of net revenue for taxpayers engaged in service/professional sales. Expenses are subject to verification and must comply with substantiation requirements to be deductible under the ceiling. Non-deductible amounts will be disallowed and penalties may apply.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

REVENUE REGULATIONS NO.

10-2002 issued on July 18, 2002 imposes a ceiling

on the amount of entertainment, amusement and recreational expenses claimed by the

following taxpayers: 1) individuals engaged in business, including taxable estates and

trusts; 2) individuals engaged in practice of profession; 3) domestic corporations; 4)

resident foreign corporations; and 5) general professional partnerships, including its

members.

The term “entertainment, amusement and recreation expenses” includes

representation expenses and/or depreciation or rental expense relating to entertainment

facilities, as described in the Regulations.

The following expenses are not considered entertainment, amusement and

recreational expenses: 1) expenses treated as compensation or fringe benefits for services

rendered under an employer-employee relationship; 2) expenses for charitable or fund-

raising events; 3) expenses for bonafide business meeting of stockholders, partners or

directors; 4) expenses for attending or sponsoring an employee to a business league or

professional organization meeting; 5) expenses for events organized for promotion,

marketing and advertising; and 6) other expenses of similar nature.

The requisites for the deductibility of said expenses, subject to the ceiling

prescribed, are specified in the Regulations.

There shall be allowed a deduction from gross income an amount equivalent to

the actual entertainment, amusement and recreation expense paid or incurred within the

taxable year by the taxpayer, but in no case shall such deduction exceed 0.50 % of net

sales for taxpayers engaged in sale of goods or properties; or 1% of net revenue for

taxpayers engaged in sale of services, including exercise of profession and use or lease of

properties.

If a taxpayer derives income from both sale of goods/properties and services, the

allowable entertainment, amusement and recreation expense shall in all cases be

determined based on an apportionment formula, taking into consideration the percentage

of the net sales/net revenue to the total net sales/net revenue, but which in no case shall

exceed the maximum percentage ceiling provided in the Regulations.

The claimed expense shall be subject to verification and audit for purposes of

determining its deductibility as well as compliance with the substantiation requirements,

as provided in the Regulations. If after verification, a taxpayer is found to have shifted

the amount of the entertainment, amusement and recreation expense to any other expense

in order to avoid being subjected to the prescribed ceiling, the amount shifted shall be

disallowed in its totality, without prejudice to such penalties as may be imposed by the

Tax Code of 1997.

The ceiling provided on the Regulations shall apply only to entertainment,

amusement and recreation expenses paid or incurred beginning September 1, 2002,

regardless of the taxpayer’s accounting period.

You might also like

- PayslipDocument1 pagePayslipmallikarjunamargam100% (3)

- Allowable Deductions (Prediscussion File)Document54 pagesAllowable Deductions (Prediscussion File)Chantal Pascual67% (3)

- Preferential TaxationDocument9 pagesPreferential TaxationAnna Mae Sanchez100% (3)

- Ampongan Chap 1Document2 pagesAmpongan Chap 1iamjan_101No ratings yet

- Financing and Prob CompDocument31 pagesFinancing and Prob CompRyan Joseph MagtibayNo ratings yet

- FTP FTP - Bir.gov - PH Webadmin1 PDF 2294rr10 02Document5 pagesFTP FTP - Bir.gov - PH Webadmin1 PDF 2294rr10 02Marj Fulgueras-GoNo ratings yet

- RR 10-02Document5 pagesRR 10-02matinikkiNo ratings yet

- RR 10-02Document2 pagesRR 10-02saintkarri100% (1)

- Module 5 Deductions From Gross IncomeDocument3 pagesModule 5 Deductions From Gross Incomekaswabelife16No ratings yet

- Deductions, Are The Amounts, Which The Law Allows To Be Deducted From Gross Income inDocument22 pagesDeductions, Are The Amounts, Which The Law Allows To Be Deducted From Gross Income inJamilenePandanNo ratings yet

- Deductions From Gross IncomeDocument3 pagesDeductions From Gross IncomeJohnmer AvelinoNo ratings yet

- Dfinal - Allow DeductionsDocument76 pagesDfinal - Allow DeductionsRexell DepalacNo ratings yet

- Les On Deductibility of Expenses.04.04.08Document3 pagesLes On Deductibility of Expenses.04.04.08Christine BobisNo ratings yet

- Deductions From Gross IncomeDocument12 pagesDeductions From Gross IncomevsplanciaNo ratings yet

- Revenue Regulations No 5-2017Document7 pagesRevenue Regulations No 5-2017Joy Cae ManinangNo ratings yet

- Income Tax - MidtermDocument9 pagesIncome Tax - MidtermThe Second OneNo ratings yet

- Philippines: A.1. Corporate Income TaxDocument6 pagesPhilippines: A.1. Corporate Income TaxIts meh SushiNo ratings yet

- DeductionsDocument6 pagesDeductionsjerome rodejoNo ratings yet

- RR No. 11-2018Document90 pagesRR No. 11-2018Leticia TaclasNo ratings yet

- PWDDocument5 pagesPWDMarinel FelipeNo ratings yet

- Deductions From Gross Income Lesson 13Document72 pagesDeductions From Gross Income Lesson 13Mikaela SamonteNo ratings yet

- Business Tax Laws (Phils)Document15 pagesBusiness Tax Laws (Phils)Jean TanNo ratings yet

- HK IRD Tax GuideDocument34 pagesHK IRD Tax GuideAlex LimNo ratings yet

- Revenue Regulations No. 3-98Document14 pagesRevenue Regulations No. 3-98Angela Magbanua100% (1)

- Allowable Deductions For Individuals and Corporations Engaged in Business / Individuals in The Exercise of ProfessionDocument28 pagesAllowable Deductions For Individuals and Corporations Engaged in Business / Individuals in The Exercise of ProfessionAlyssa Camille DiñoNo ratings yet

- BIR How To Compute Fringe Benefit Tax REL PARTYDocument69 pagesBIR How To Compute Fringe Benefit Tax REL PARTYRyoNo ratings yet

- Basic Income Taxation of Corporations in PhilippinesDocument7 pagesBasic Income Taxation of Corporations in PhilippinesMae Katherine Grande Lumbria100% (1)

- Business Tax Laws in The PhilippinesDocument12 pagesBusiness Tax Laws in The PhilippinesEthel Joi Manalac MendozaNo ratings yet

- B - Individual Taxation: PhilippinesDocument4 pagesB - Individual Taxation: PhilippinesJasper Allen B. Barrientos100% (1)

- PPTXDocument140 pagesPPTXGuinevereNo ratings yet

- 2018-Train ActDocument65 pages2018-Train ActAnthonette ManagaytayNo ratings yet

- Income and Withholding TaxesDocument67 pagesIncome and Withholding TaxesPo EllaNo ratings yet

- Revenue Regulation NoDocument38 pagesRevenue Regulation NolalararafafaNo ratings yet

- Income Tax - 3-28-12 Ganer FinalDocument85 pagesIncome Tax - 3-28-12 Ganer Finaljeromie163No ratings yet

- General Tax Liabilities of Domestic CorpsDocument5 pagesGeneral Tax Liabilities of Domestic CorpsCora EleazarNo ratings yet

- Taxation: DATE: November 10,2018 Presented By: Mr. Florante P. de Leon, Mba, CBDocument35 pagesTaxation: DATE: November 10,2018 Presented By: Mr. Florante P. de Leon, Mba, CBFlorante De LeonNo ratings yet

- Tax Midterm ReviewerDocument18 pagesTax Midterm ReviewerAyessa GayamoNo ratings yet

- RMC 102-2017 HighlightsDocument3 pagesRMC 102-2017 HighlightsmmeeeowwNo ratings yet

- Revenue Regulations No 3-98Document9 pagesRevenue Regulations No 3-98Anonymous MikI28PkJcNo ratings yet

- Taxation - Allowable Business DeductionsDocument51 pagesTaxation - Allowable Business DeductionsHannah OrosNo ratings yet

- DeductionsDocument7 pagesDeductionsConcerned CitizenNo ratings yet

- tAX LESSON B .Document10 pagestAX LESSON B .intramuramazingNo ratings yet

- Tax 1 ReviewerDocument7 pagesTax 1 ReviewerRaymond SangalangNo ratings yet

- RR 03-98Document5 pagesRR 03-98Ayvee BlanchNo ratings yet

- TAXATION Ver 2Document3 pagesTAXATION Ver 2coleenllb_usaNo ratings yet

- Taxes On Personal IncomeDocument13 pagesTaxes On Personal IncomeEthel Joi Manalac MendozaNo ratings yet

- Answer Key Tax 3rd ExamDocument17 pagesAnswer Key Tax 3rd ExamCharlotte GallegoNo ratings yet

- National TaxesDocument106 pagesNational TaxesJeeNo ratings yet

- Allowable Deductions NotesDocument5 pagesAllowable Deductions NotesPaula Mae DacanayNo ratings yet

- Sec C Business Income TaxDocument18 pagesSec C Business Income TaxfelekeayuNo ratings yet

- 8531 1uniDocument18 pages8531 1uniMs AimaNo ratings yet

- Lesson 5 - Exclusions and Deductions of Income TaxationDocument34 pagesLesson 5 - Exclusions and Deductions of Income TaxationKhu AbenesNo ratings yet

- Bantillo, Cheska Kate M. Cid, Manuel Lionel MDocument47 pagesBantillo, Cheska Kate M. Cid, Manuel Lionel MCHESKAKATE BANTILLO100% (1)

- Contribut Ions To Pension and TrustsDocument3 pagesContribut Ions To Pension and TrustsMiracle GraceNo ratings yet

- Preferential TaxationDocument10 pagesPreferential TaxationAlex OngNo ratings yet

- RMC 30-2008.PDF - Life and Non-Life InsuranceDocument5 pagesRMC 30-2008.PDF - Life and Non-Life InsuranceAbaNo ratings yet

- Allowable DeductionDocument33 pagesAllowable DeductionJobell CaballeroNo ratings yet

- 39621RMC 30-2008 (Full) PDFDocument5 pages39621RMC 30-2008 (Full) PDFCliff DaquioagNo ratings yet

- Improperly Accumulated Earnings TaxDocument2 pagesImproperly Accumulated Earnings TaxGo-RiNo ratings yet

- Fringe BenefitsDocument5 pagesFringe BenefitsJune Romeo ObiasNo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Basics About Sales, Use, and Other Transactional Taxes: Overview of Transactional Taxes for Consideration When Striving Toward the Maximization of Tax Compliance and Minimization of Tax Costs.From EverandBasics About Sales, Use, and Other Transactional Taxes: Overview of Transactional Taxes for Consideration When Striving Toward the Maximization of Tax Compliance and Minimization of Tax Costs.No ratings yet

- Ra, XG TR-FZ: Stejgo+.R@F, EDocument1 pageRa, XG TR-FZ: Stejgo+.R@F, ECliff DaquioagNo ratings yet

- Gluratior: Srruilltdtdc?!Flffilr DepartmedDocument2 pagesGluratior: Srruilltdtdc?!Flffilr DepartmedCliff DaquioagNo ratings yet

- @urdior: DepartmatDocument3 pages@urdior: DepartmatCliff DaquioagNo ratings yet

- RMO No.11-2018Document2 pagesRMO No.11-2018Cliff DaquioagNo ratings yet

- Prilipin.r Department: GtutationDocument4 pagesPrilipin.r Department: GtutationCliff DaquioagNo ratings yet

- JDMC, DA 2023 DOST-SEI Undergraduate Scholarship Program 0334 - October 28, 2022Document1 pageJDMC, DA 2023 DOST-SEI Undergraduate Scholarship Program 0334 - October 28, 2022Cliff DaquioagNo ratings yet

- #.Ciq Of: Revenue The CollectionDocument6 pages#.Ciq Of: Revenue The CollectionCliff DaquioagNo ratings yet

- RAO No. 2-2018Document16 pagesRAO No. 2-2018Cliff DaquioagNo ratings yet

- Subject: Bureau RevenueDocument1 pageSubject: Bureau RevenueCliff DaquioagNo ratings yet

- RMO No. 14-2020 Re OSH v1Document14 pagesRMO No. 14-2020 Re OSH v1Cliff DaquioagNo ratings yet

- RMO No.16-2018Document1 pageRMO No.16-2018Cliff DaquioagNo ratings yet

- RE ED P : MemorandumDocument5 pagesRE ED P : MemorandumCliff DaquioagNo ratings yet

- RMO - NO. 6-2018 - DigestDocument1 pageRMO - NO. 6-2018 - DigestCliff DaquioagNo ratings yet

- RMO No. 15-2020Document6 pagesRMO No. 15-2020Cliff DaquioagNo ratings yet

- RMO - NO. 9-2018 - DigestDocument5 pagesRMO - NO. 9-2018 - DigestCliff DaquioagNo ratings yet

- Revenue Memorandum Order No. 25-2020Document1 pageRevenue Memorandum Order No. 25-2020Cliff DaquioagNo ratings yet

- RMO No. 18-2020Document19 pagesRMO No. 18-2020Cliff DaquioagNo ratings yet

- Memorandum Orderno. E'o of To: Revenue ForDocument1 pageMemorandum Orderno. E'o of To: Revenue ForCliff DaquioagNo ratings yet

- Zojd: A Key Cy Revenue EmployeesDocument1 pageZojd: A Key Cy Revenue EmployeesCliff DaquioagNo ratings yet

- L (.Il Julylg,: or For The in To ofDocument7 pagesL (.Il Julylg,: or For The in To ofCliff DaquioagNo ratings yet

- Memorai (Dim No.: JUL 22, Ecodps DlvlslonDocument7 pagesMemorai (Dim No.: JUL 22, Ecodps DlvlslonCliff DaquioagNo ratings yet

- FHP H0225594Document2 pagesFHP H0225594Raghavendra KamathNo ratings yet

- Ufc 3-701-09 Dod Facilities Pricing Guide, Fy2009 (15 September 2009)Document45 pagesUfc 3-701-09 Dod Facilities Pricing Guide, Fy2009 (15 September 2009)Bob VinesNo ratings yet

- Most Important Oneliners Questions and Answers January 2024Document16 pagesMost Important Oneliners Questions and Answers January 2024Devraj kundaraNo ratings yet

- 1.4 Partnership Template Answer SheetDocument14 pages1.4 Partnership Template Answer SheetCherry May PajutiningNo ratings yet

- Chapter 3 National Income. Where It Comes From and Where It GoesDocument11 pagesChapter 3 National Income. Where It Comes From and Where It GoesJoana Marie CalderonNo ratings yet

- Uniform Format of Accounts For Central Automnomous Bodies PDFDocument46 pagesUniform Format of Accounts For Central Automnomous Bodies PDFsgirishri4044No ratings yet

- History of Taxation and Tax ManagementDocument8 pagesHistory of Taxation and Tax ManagementchitraNo ratings yet

- Journal of Corporate Finance: Andrea MC Namara, Pierluigi Murro, Sheila O'DonohoeDocument17 pagesJournal of Corporate Finance: Andrea MC Namara, Pierluigi Murro, Sheila O'DonohoeChung HeiNo ratings yet

- Sample Partnership DeedDocument4 pagesSample Partnership DeedShahzad Faisal0% (1)

- 03-Nature & Attributes of Corporations PDFDocument50 pages03-Nature & Attributes of Corporations PDFzahreenamolinaNo ratings yet

- A Comprehensive Review of Bangladesh Cement Industry - August 2019 PDFDocument29 pagesA Comprehensive Review of Bangladesh Cement Industry - August 2019 PDFMahmudul Hasan SajibNo ratings yet

- Biscuit IndustryDocument98 pagesBiscuit IndustryEr Prakash Basak67% (3)

- PWC Zambia Transfer Pricing AlertDocument2 pagesPWC Zambia Transfer Pricing AlertGeorge ChitwaNo ratings yet

- U.S. v. Kelley SteinerDocument3 pagesU.S. v. Kelley SteinerKOMU NewsNo ratings yet

- Tax Administration Self Assessment Regulations NigeriaDocument3 pagesTax Administration Self Assessment Regulations NigeriaMark allenNo ratings yet

- Vat & Sales Tax Act, 1990Document16 pagesVat & Sales Tax Act, 1990Muhammad AfzalNo ratings yet

- Si Ap 130Document4 pagesSi Ap 130Aman AhlawatNo ratings yet

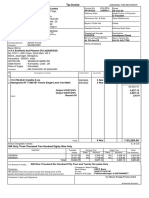

- (Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocument1 page(Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountMukul Pratap SinghNo ratings yet

- Effects of InflationDocument3 pagesEffects of InflationonenumbNo ratings yet

- Case DigestsDocument124 pagesCase DigestsIan ConcepcionNo ratings yet

- Title Iv Import Clearance and Formalities Goods DeclarationDocument42 pagesTitle Iv Import Clearance and Formalities Goods Declarationdennilyn recaldeNo ratings yet

- Agreement Between Syrian Arab Republic andDocument15 pagesAgreement Between Syrian Arab Republic andOECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- Building Plan Approval Procedure (Walton) PDFDocument2 pagesBuilding Plan Approval Procedure (Walton) PDFalirazaNo ratings yet

- Income Tax On Estates and Trusts: A. Taxability of EstatesDocument4 pagesIncome Tax On Estates and Trusts: A. Taxability of EstatesKevin OnaroNo ratings yet

- 7 TanzaniaDocument29 pages7 TanzaniaDoris Acheng OditNo ratings yet

- Search and Seizure: Income Tax ActDocument16 pagesSearch and Seizure: Income Tax ActFathima KaramaNo ratings yet

- D PattaDocument2 pagesD PattaDinesh NaiduNo ratings yet