Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

12 viewsModule 21 Professional Responsibilities

Module 21 Professional Responsibilities

Uploaded by

Zeyad El-sayedThe document discusses the responsibilities and functions of the Public Company Accounting Oversight Board (PCAOB). The PCAOB regulates accounting firms that audit public companies. It has five board members, oversees inspections of accounting firms, sets auditing standards, enforces compliance with professional standards and securities laws, and performs investigations. The PCAOB also has additional responsibilities like requiring preapproval of non-audit services by audit committees and disclosure of related fees.

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

You might also like

- All Bookish Knowledge Parts in ONE FILE - AADocument30 pagesAll Bookish Knowledge Parts in ONE FILE - AAtuitiontutoraNo ratings yet

- Dear Client:: Private and ConfidentialDocument3 pagesDear Client:: Private and ConfidentialJubert Ng100% (2)

- SAP Design Thinking QuestionsDocument5 pagesSAP Design Thinking QuestionsSiddharth SinhaNo ratings yet

- Solutions Manual: 1st EditionDocument21 pagesSolutions Manual: 1st EditionJunior Waqairasari100% (1)

- Executive Summary: School of Accountancy, Business and HospitalityDocument36 pagesExecutive Summary: School of Accountancy, Business and HospitalityArchie Lazaro100% (1)

- BangkoDocument2 pagesBangkojasteja100% (1)

- GovernanceDocument15 pagesGovernanceChristlyn Joy BaralNo ratings yet

- Auditors and Audit Committee 2022Document47 pagesAuditors and Audit Committee 2022Sherry LaiNo ratings yet

- P6 Audit New Suggested CA Inter May 18Document14 pagesP6 Audit New Suggested CA Inter May 18Rishabh jainNo ratings yet

- AUD 689 Advanced Auditing Topic 8 Group AuditDocument20 pagesAUD 689 Advanced Auditing Topic 8 Group AuditSyaza Syahirah Sa'imanNo ratings yet

- Audit and AssuranceDocument16 pagesAudit and AssuranceAmolaNo ratings yet

- Dec 2021Document16 pagesDec 2021DiyaNo ratings yet

- Paper - 6: Auditing and Assurance: © The Institute of Chartered Accountants of IndiaDocument14 pagesPaper - 6: Auditing and Assurance: © The Institute of Chartered Accountants of IndiaMuraliNo ratings yet

- Audit Dec 21 Suggested Answer @mission - CA - InterDocument19 pagesAudit Dec 21 Suggested Answer @mission - CA - Intersantosh pandeyNo ratings yet

- Auditing PaperDocument172 pagesAuditing PaperHimanshu SainiNo ratings yet

- Ques PPR Jan 2021Document14 pagesQues PPR Jan 2021ashwani7789No ratings yet

- Corporate Governance and Clause 49 of The Listing AgreementDocument2 pagesCorporate Governance and Clause 49 of The Listing AgreementHeta MunjyasaraNo ratings yet

- Sarbanes-Oxley Act: Compensation-This Provision Relates To Situations When An Issuer Restates ItsDocument6 pagesSarbanes-Oxley Act: Compensation-This Provision Relates To Situations When An Issuer Restates ItsAnonymous XBVhHGMqdNo ratings yet

- Scan 0090Document2 pagesScan 0090Zeyad El-sayedNo ratings yet

- Corporate Governance and FinanceDocument9 pagesCorporate Governance and FinancePratyasha DasguptaNo ratings yet

- 69779bos55738 p6Document16 pages69779bos55738 p6OPULENCENo ratings yet

- Schedule Iv (See Section 149 (8) ) Code For Independent DirectorsDocument8 pagesSchedule Iv (See Section 149 (8) ) Code For Independent DirectorssamarthNo ratings yet

- International Financial MarketsDocument2 pagesInternational Financial MarketsAsim RazaNo ratings yet

- AuditNew Suggested Ans CA Inter Jan 21Document14 pagesAuditNew Suggested Ans CA Inter Jan 21Priyansh KhatriNo ratings yet

- UGBS 2024 AUDIT AND ASSURANCE Tutorial questions set 2 PDDocument29 pagesUGBS 2024 AUDIT AND ASSURANCE Tutorial questions set 2 PDboadirudolf8No ratings yet

- Business & Finance Chapter-13 Corporate Governance: 1 Faker Ahmed Bulue FCADocument2 pagesBusiness & Finance Chapter-13 Corporate Governance: 1 Faker Ahmed Bulue FCAShahid MahmudNo ratings yet

- Board'S Report: Ministry of Corporate AffairsDocument8 pagesBoard'S Report: Ministry of Corporate Affairsaryan manjunathaNo ratings yet

- Sox ADocument2 pagesSox ARicha RekhiNo ratings yet

- Audit Tutorial 2Document10 pagesAudit Tutorial 2Chong Soon Kai100% (1)

- QCOM Master Audit Committee Charter (As Approved 5-16-23)Document7 pagesQCOM Master Audit Committee Charter (As Approved 5-16-23)rmaleem084No ratings yet

- Naresh Chandra Committee Report On Corporate Audit andDocument20 pagesNaresh Chandra Committee Report On Corporate Audit andHOD CommerceNo ratings yet

- BEC Final Review NotesDocument38 pagesBEC Final Review NotessheldonNo ratings yet

- Corporate Governance in The PhilippinesDocument3 pagesCorporate Governance in The PhilippinesGlenn Mae BagaresNo ratings yet

- Objective Question Chapter 1Document3 pagesObjective Question Chapter 1Rakesh DhungelNo ratings yet

- Format of Quarterly Compliance Report On Corporate GovernanceDocument4 pagesFormat of Quarterly Compliance Report On Corporate GovernanceSushant Yashwant PawarNo ratings yet

- Auditing Question Bank 1Document6 pagesAuditing Question Bank 1Shahadath HossenNo ratings yet

- Ceo and Cfo CertificationDocument6 pagesCeo and Cfo CertificationNeha GeorgeNo ratings yet

- Module 21 Professional ResponsibilitiesDocument3 pagesModule 21 Professional ResponsibilitiesZeyad El-sayedNo ratings yet

- 1 Pre EngagementDocument11 pages1 Pre EngagementVito CorleonNo ratings yet

- Scan 0006Document2 pagesScan 0006Zeyad El-sayedNo ratings yet

- Aguila, Paulo Timothy Cis c5Document3 pagesAguila, Paulo Timothy Cis c5Paulo Timothy AguilaNo ratings yet

- Audit & Assurance - December 2010Document12 pagesAudit & Assurance - December 2010S M Wadud TuhinNo ratings yet

- Chap2 Corporate Governance What Is A Well Governed Organization-CompressedDocument51 pagesChap2 Corporate Governance What Is A Well Governed Organization-CompressedJhesam CamachoNo ratings yet

- Corporate GovernanceDocument3 pagesCorporate GovernanceIzuku MidoriyaNo ratings yet

- Sox PDFDocument10 pagesSox PDFRajesh ChoudharyNo ratings yet

- Audit CommitteeDocument3 pagesAudit CommitteeFrances Marella CristobalNo ratings yet

- Code IdDocument4 pagesCode IdVipasha SanghaviNo ratings yet

- 2009 A-2 Class NotesDocument5 pages2009 A-2 Class Notescome2sayNo ratings yet

- F8 Notes Acca NotesDocument10 pagesF8 Notes Acca NotesSehaj Mago100% (1)

- Audit Committee Corporate GovernanceDocument36 pagesAudit Committee Corporate GovernanceVivek VermaNo ratings yet

- Gov ReviewerDocument7 pagesGov ReviewerAlyssa Grace LecarosNo ratings yet

- Corporate Governance: Indian Institute of Foreign TradeDocument14 pagesCorporate Governance: Indian Institute of Foreign TradeT_haque2No ratings yet

- Past Paper CAF 8 - ISA 210Document13 pagesPast Paper CAF 8 - ISA 210bilaladnan.120802No ratings yet

- Short Notes 16Document19 pagesShort Notes 16shresthanightingaleNo ratings yet

- D11 AudDocument2 pagesD11 AudNafees AhmedNo ratings yet

- Auditing&Assurance LL (Lesson2)Document13 pagesAuditing&Assurance LL (Lesson2)BRIAN KORIRNo ratings yet

- A Brief Overview of The Draft Corporate Governance Code For Listed Companies.Document2 pagesA Brief Overview of The Draft Corporate Governance Code For Listed Companies.Nana KwameNo ratings yet

- Bos 36238 P 6Document16 pagesBos 36238 P 6vinay parulekarNo ratings yet

- Novartis - Code For Independent Directors RDocument4 pagesNovartis - Code For Independent Directors RSaju XavierNo ratings yet

- Samples of Solution Manual For Modern Auditing Assurance Services and The Integrity of Financial Reporting 8th Edition by William C. BoyntonDocument22 pagesSamples of Solution Manual For Modern Auditing Assurance Services and The Integrity of Financial Reporting 8th Edition by William C. BoyntonLa Hanif Abdul JabarNo ratings yet

- Corporate Governance Final MCQ BookDocument77 pagesCorporate Governance Final MCQ BookFidas RoyNo ratings yet

- L2 A Well Governed OrganizationDocument21 pagesL2 A Well Governed OrganizationBSAc 1A - DAYAG, KAYETTE B.No ratings yet

- Scan 0013Document2 pagesScan 0013Zeyad El-sayedNo ratings yet

- Scan 0001Document2 pagesScan 0001Zeyad El-sayedNo ratings yet

- Fede Al Securities Acts: OvervieDocument2 pagesFede Al Securities Acts: OvervieZeyad El-sayedNo ratings yet

- P N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEDocument3 pagesP N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEZeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Document2 pagesModule 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Zeyad El-sayedNo ratings yet

- Scan 0001Document2 pagesScan 0001Zeyad El-sayedNo ratings yet

- Scan 0012Document2 pagesScan 0012Zeyad El-sayedNo ratings yet

- S Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateDocument3 pagesS Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- Se Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossDocument3 pagesSe Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossZeyad El-sayedNo ratings yet

- I y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateDocument2 pagesI y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- Revocation of Discharge: 2M Module27 BankruptcyDocument2 pagesRevocation of Discharge: 2M Module27 BankruptcyZeyad El-sayedNo ratings yet

- 80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateDocument2 pages80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- Scan 0018Document1 pageScan 0018Zeyad El-sayedNo ratings yet

- Scan 0010Document3 pagesScan 0010Zeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZDocument2 pagesModule 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZZeyad El-sayedNo ratings yet

- B Nkruptcy: Discharge of A BankruptDocument2 pagesB Nkruptcy: Discharge of A BankruptZeyad El-sayedNo ratings yet

- The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Document2 pagesThe Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Zeyad El-sayedNo ratings yet

- Deduct From Book Income: - B - T F Dul - .Document2 pagesDeduct From Book Income: - B - T F Dul - .Zeyad El-sayedNo ratings yet

- Scan 0010Document2 pagesScan 0010Zeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CDocument3 pagesModule 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CZeyad El-sayedNo ratings yet

- Bankruptcy:: y y S e S Owed SDocument3 pagesBankruptcy:: y y S e S Owed SZeyad El-sayedNo ratings yet

- Professional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsDocument2 pagesProfessional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsZeyad El-sayedNo ratings yet

- Article I Responsibilities. Article Il-The Public InterestDocument2 pagesArticle I Responsibilities. Article Il-The Public InterestZeyad El-sayedNo ratings yet

- Module 21 Professional Responsibilities: Interpretation 101-2. A FirmDocument2 pagesModule 21 Professional Responsibilities: Interpretation 101-2. A FirmZeyad El-sayedNo ratings yet

- ET Section 10 01 Conce Tu LF Mework For A Cpa I e Ence StandardsDocument2 pagesET Section 10 01 Conce Tu LF Mework For A Cpa I e Ence StandardsZeyad El-sayedNo ratings yet

- Scan 0006Document2 pagesScan 0006Zeyad El-sayedNo ratings yet

- Scan 0009Document2 pagesScan 0009Zeyad El-sayedNo ratings yet

- Scan 0008Document2 pagesScan 0008Zeyad El-sayedNo ratings yet

- Scan 0008Document2 pagesScan 0008Zeyad El-sayedNo ratings yet

- Scan 0008Document2 pagesScan 0008Zeyad El-sayedNo ratings yet

- Mongolia's Trade AnalysisDocument3 pagesMongolia's Trade AnalysisSeren TsekiNo ratings yet

- Labour Equipment & MaterialDocument33 pagesLabour Equipment & MaterialSaurabh Kumar SharmaNo ratings yet

- This Report Is Dedicated To My Parents & Teachers For Their Love, Affection and GuidanceDocument47 pagesThis Report Is Dedicated To My Parents & Teachers For Their Love, Affection and Guidance037-061No ratings yet

- Cigarettes in PeruDocument20 pagesCigarettes in PeruMiguel DaneriNo ratings yet

- f2p9g - Egac Cab AgreementDocument4 pagesf2p9g - Egac Cab AgreementAles esaamNo ratings yet

- Chapter - 11 Lumpsum - MCQDocument3 pagesChapter - 11 Lumpsum - MCQNRKNo ratings yet

- 12 Questions For Management and NonDocument9 pages12 Questions For Management and NonalkazumNo ratings yet

- Lakme West Bengal (India) Beauty Adviser - 1 Year (2018 - 2019)Document2 pagesLakme West Bengal (India) Beauty Adviser - 1 Year (2018 - 2019)Majid AliNo ratings yet

- Future Generali Brochure PDFDocument19 pagesFuture Generali Brochure PDFSangeeta LakhoteNo ratings yet

- Sugar Plugin For Excel 6.1.0Document6 pagesSugar Plugin For Excel 6.1.0chicagogroovesNo ratings yet

- Group D7: Giridaran - Moksh - Mithila - Revant - Rhythym - SwapnilDocument6 pagesGroup D7: Giridaran - Moksh - Mithila - Revant - Rhythym - Swapnilrev1202No ratings yet

- DHL Parcel Uk: International Label AdviceDocument7 pagesDHL Parcel Uk: International Label AdviceCarol ManirakizaNo ratings yet

- Wholesale Fba Brands Sheet 12345Document18 pagesWholesale Fba Brands Sheet 12345you forNo ratings yet

- AmazonDocument1 pageAmazonAnkit SoniNo ratings yet

- Katalog YSADocument37 pagesKatalog YSAEko Santoso Soedibdjo50% (2)

- Final Exam 4Document4 pagesFinal Exam 4HealthyYOU100% (1)

- Resume Emma HansonDocument1 pageResume Emma Hansonapi-341634449No ratings yet

- JLL DXBQ12013Document0 pagesJLL DXBQ12013Olena StanislavovnaNo ratings yet

- Cameron - Project ManagerDocument3 pagesCameron - Project ManagerThaw Zin OoNo ratings yet

- Rondell Data Corporation - FinalDocument32 pagesRondell Data Corporation - FinalVineet Chauhan100% (1)

- Axiata Iar-Full ReportDocument103 pagesAxiata Iar-Full ReportAnonymous vCRo3mj7MNNo ratings yet

- Senior Policy Compliance Technical Writer in Dallas TX Resume Candace TateDocument3 pagesSenior Policy Compliance Technical Writer in Dallas TX Resume Candace TateCandaceTateNo ratings yet

- SD Questions About Pricing ConditionDocument9 pagesSD Questions About Pricing ConditionAniruddha Chakraborty100% (1)

- Basic Concepts of QualityDocument6 pagesBasic Concepts of QualityAnju Gaurav DrallNo ratings yet

- Process Costing - Actg RVWDocument2 pagesProcess Costing - Actg RVWJenyl Mae NobleNo ratings yet

Module 21 Professional Responsibilities

Module 21 Professional Responsibilities

Uploaded by

Zeyad El-sayed0 ratings0% found this document useful (0 votes)

12 views2 pagesThe document discusses the responsibilities and functions of the Public Company Accounting Oversight Board (PCAOB). The PCAOB regulates accounting firms that audit public companies. It has five board members, oversees inspections of accounting firms, sets auditing standards, enforces compliance with professional standards and securities laws, and performs investigations. The PCAOB also has additional responsibilities like requiring preapproval of non-audit services by audit committees and disclosure of related fees.

Original Description:

jht568sda

Original Title

Scan 0031

Copyright

© © All Rights Reserved

Available Formats

RTF, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the responsibilities and functions of the Public Company Accounting Oversight Board (PCAOB). The PCAOB regulates accounting firms that audit public companies. It has five board members, oversees inspections of accounting firms, sets auditing standards, enforces compliance with professional standards and securities laws, and performs investigations. The PCAOB also has additional responsibilities like requiring preapproval of non-audit services by audit committees and disclosure of related fees.

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

Download as rtf, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views2 pagesModule 21 Professional Responsibilities

Module 21 Professional Responsibilities

Uploaded by

Zeyad El-sayedThe document discusses the responsibilities and functions of the Public Company Accounting Oversight Board (PCAOB). The PCAOB regulates accounting firms that audit public companies. It has five board members, oversees inspections of accounting firms, sets auditing standards, enforces compliance with professional standards and securities laws, and performs investigations. The PCAOB also has additional responsibilities like requiring preapproval of non-audit services by audit committees and disclosure of related fees.

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

Download as rtf, pdf, or txt

You are on page 1of 2

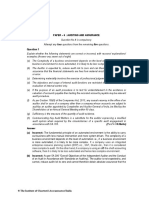

MODULE 21 PROFESSIONAL RESPONSIBIliTIES 71

2. Consists of five members

(1) Two members must be or have been CPAs

(2) Three members cannot be or cannot have been Cl'As

(3) None of Board members may receive payor profits from CPA firms

3. Board regulates firms that audit SEC registrants, not accounting firms of private companies

4. Main functions of Board are to

(1) Register and conduct inspections of public accounting firms

(a) This replaces peer reviews

(2) Set standards on auditing, quality control, independence, or preparation of audit reports

(a) May adopt standards of existing professional groups or new groups

(b) Accounting firm must have second partner review and approve each audit report

(c) Accounting firm must report on examination of internal control structure along with de-

scription of material weaknesses

(3) May regulate nonaudit services CPA firms perform for clients

(4) Enforce compliance with professional standards, securities laws relating to accountants and

audits

(5) Perform investigations and disciplinary proceedings on registered public accounting firms

(6) May perform any other duties needed to promote high professional standards and to improve

auditing quality

(7) Material services must receive preapproval by audit committee, and fees for those services

must be disclosed to investors

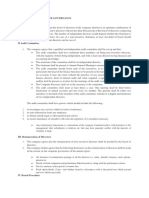

5. Additional new responsibilities and provisions recently added

6. Company must disclose whether it has adopted code of ethics for company's principal

executive

officer, principal accounting officer, principal financial officer or controller

(1) Company may have separate codes of ethics for different officers or may have broad code of

ethics covering all officers and directors

(2) Company is not required to adopt code of ethics but if it has not, it must disclose the reasons

why

7. Company officials found liable for fraud cannot use bankruptcy law to discharge that liability

8. Attorneys practicing before SEC representing public companies must report evidence of

material

violations by the company or its officers, directors, or agents of securities laws or breach of fidu-

ciary duties

(1) Report must be made to chief legal officer or chief executive officer'

(a) If they do not respond appropriately, then report of evidence must be made "up the ladder"

to audit committee of board of directors, another committee of independent

directors, or

finally to board of directors

9. SEC adopted new rules requiring more events to be reported on Form 8-K and shortening

filing

deadlines for most reportable events to four business days after the events

(1) If company becomes directly or contingently liable for material obligation arising from an off-

balance-sheet arrangement, it must describe this including its material terms and nature of

ar-

rangement

10. Company must disclose several items if a director has resigned or refused to stand for

reelection

because of disagreement with company's practices, operations or policies, or if director has been

removed for cause

(1) Company must disclose such items as circumstances regarding disagreement with company

11. If new executive officer is appointed, company must disclose information such as his or her

name,

the position, and description of any material terms of employment agreement between company

and officer

You might also like

- All Bookish Knowledge Parts in ONE FILE - AADocument30 pagesAll Bookish Knowledge Parts in ONE FILE - AAtuitiontutoraNo ratings yet

- Dear Client:: Private and ConfidentialDocument3 pagesDear Client:: Private and ConfidentialJubert Ng100% (2)

- SAP Design Thinking QuestionsDocument5 pagesSAP Design Thinking QuestionsSiddharth SinhaNo ratings yet

- Solutions Manual: 1st EditionDocument21 pagesSolutions Manual: 1st EditionJunior Waqairasari100% (1)

- Executive Summary: School of Accountancy, Business and HospitalityDocument36 pagesExecutive Summary: School of Accountancy, Business and HospitalityArchie Lazaro100% (1)

- BangkoDocument2 pagesBangkojasteja100% (1)

- GovernanceDocument15 pagesGovernanceChristlyn Joy BaralNo ratings yet

- Auditors and Audit Committee 2022Document47 pagesAuditors and Audit Committee 2022Sherry LaiNo ratings yet

- P6 Audit New Suggested CA Inter May 18Document14 pagesP6 Audit New Suggested CA Inter May 18Rishabh jainNo ratings yet

- AUD 689 Advanced Auditing Topic 8 Group AuditDocument20 pagesAUD 689 Advanced Auditing Topic 8 Group AuditSyaza Syahirah Sa'imanNo ratings yet

- Audit and AssuranceDocument16 pagesAudit and AssuranceAmolaNo ratings yet

- Dec 2021Document16 pagesDec 2021DiyaNo ratings yet

- Paper - 6: Auditing and Assurance: © The Institute of Chartered Accountants of IndiaDocument14 pagesPaper - 6: Auditing and Assurance: © The Institute of Chartered Accountants of IndiaMuraliNo ratings yet

- Audit Dec 21 Suggested Answer @mission - CA - InterDocument19 pagesAudit Dec 21 Suggested Answer @mission - CA - Intersantosh pandeyNo ratings yet

- Auditing PaperDocument172 pagesAuditing PaperHimanshu SainiNo ratings yet

- Ques PPR Jan 2021Document14 pagesQues PPR Jan 2021ashwani7789No ratings yet

- Corporate Governance and Clause 49 of The Listing AgreementDocument2 pagesCorporate Governance and Clause 49 of The Listing AgreementHeta MunjyasaraNo ratings yet

- Sarbanes-Oxley Act: Compensation-This Provision Relates To Situations When An Issuer Restates ItsDocument6 pagesSarbanes-Oxley Act: Compensation-This Provision Relates To Situations When An Issuer Restates ItsAnonymous XBVhHGMqdNo ratings yet

- Scan 0090Document2 pagesScan 0090Zeyad El-sayedNo ratings yet

- Corporate Governance and FinanceDocument9 pagesCorporate Governance and FinancePratyasha DasguptaNo ratings yet

- 69779bos55738 p6Document16 pages69779bos55738 p6OPULENCENo ratings yet

- Schedule Iv (See Section 149 (8) ) Code For Independent DirectorsDocument8 pagesSchedule Iv (See Section 149 (8) ) Code For Independent DirectorssamarthNo ratings yet

- International Financial MarketsDocument2 pagesInternational Financial MarketsAsim RazaNo ratings yet

- AuditNew Suggested Ans CA Inter Jan 21Document14 pagesAuditNew Suggested Ans CA Inter Jan 21Priyansh KhatriNo ratings yet

- UGBS 2024 AUDIT AND ASSURANCE Tutorial questions set 2 PDDocument29 pagesUGBS 2024 AUDIT AND ASSURANCE Tutorial questions set 2 PDboadirudolf8No ratings yet

- Business & Finance Chapter-13 Corporate Governance: 1 Faker Ahmed Bulue FCADocument2 pagesBusiness & Finance Chapter-13 Corporate Governance: 1 Faker Ahmed Bulue FCAShahid MahmudNo ratings yet

- Board'S Report: Ministry of Corporate AffairsDocument8 pagesBoard'S Report: Ministry of Corporate Affairsaryan manjunathaNo ratings yet

- Sox ADocument2 pagesSox ARicha RekhiNo ratings yet

- Audit Tutorial 2Document10 pagesAudit Tutorial 2Chong Soon Kai100% (1)

- QCOM Master Audit Committee Charter (As Approved 5-16-23)Document7 pagesQCOM Master Audit Committee Charter (As Approved 5-16-23)rmaleem084No ratings yet

- Naresh Chandra Committee Report On Corporate Audit andDocument20 pagesNaresh Chandra Committee Report On Corporate Audit andHOD CommerceNo ratings yet

- BEC Final Review NotesDocument38 pagesBEC Final Review NotessheldonNo ratings yet

- Corporate Governance in The PhilippinesDocument3 pagesCorporate Governance in The PhilippinesGlenn Mae BagaresNo ratings yet

- Objective Question Chapter 1Document3 pagesObjective Question Chapter 1Rakesh DhungelNo ratings yet

- Format of Quarterly Compliance Report On Corporate GovernanceDocument4 pagesFormat of Quarterly Compliance Report On Corporate GovernanceSushant Yashwant PawarNo ratings yet

- Auditing Question Bank 1Document6 pagesAuditing Question Bank 1Shahadath HossenNo ratings yet

- Ceo and Cfo CertificationDocument6 pagesCeo and Cfo CertificationNeha GeorgeNo ratings yet

- Module 21 Professional ResponsibilitiesDocument3 pagesModule 21 Professional ResponsibilitiesZeyad El-sayedNo ratings yet

- 1 Pre EngagementDocument11 pages1 Pre EngagementVito CorleonNo ratings yet

- Scan 0006Document2 pagesScan 0006Zeyad El-sayedNo ratings yet

- Aguila, Paulo Timothy Cis c5Document3 pagesAguila, Paulo Timothy Cis c5Paulo Timothy AguilaNo ratings yet

- Audit & Assurance - December 2010Document12 pagesAudit & Assurance - December 2010S M Wadud TuhinNo ratings yet

- Chap2 Corporate Governance What Is A Well Governed Organization-CompressedDocument51 pagesChap2 Corporate Governance What Is A Well Governed Organization-CompressedJhesam CamachoNo ratings yet

- Corporate GovernanceDocument3 pagesCorporate GovernanceIzuku MidoriyaNo ratings yet

- Sox PDFDocument10 pagesSox PDFRajesh ChoudharyNo ratings yet

- Audit CommitteeDocument3 pagesAudit CommitteeFrances Marella CristobalNo ratings yet

- Code IdDocument4 pagesCode IdVipasha SanghaviNo ratings yet

- 2009 A-2 Class NotesDocument5 pages2009 A-2 Class Notescome2sayNo ratings yet

- F8 Notes Acca NotesDocument10 pagesF8 Notes Acca NotesSehaj Mago100% (1)

- Audit Committee Corporate GovernanceDocument36 pagesAudit Committee Corporate GovernanceVivek VermaNo ratings yet

- Gov ReviewerDocument7 pagesGov ReviewerAlyssa Grace LecarosNo ratings yet

- Corporate Governance: Indian Institute of Foreign TradeDocument14 pagesCorporate Governance: Indian Institute of Foreign TradeT_haque2No ratings yet

- Past Paper CAF 8 - ISA 210Document13 pagesPast Paper CAF 8 - ISA 210bilaladnan.120802No ratings yet

- Short Notes 16Document19 pagesShort Notes 16shresthanightingaleNo ratings yet

- D11 AudDocument2 pagesD11 AudNafees AhmedNo ratings yet

- Auditing&Assurance LL (Lesson2)Document13 pagesAuditing&Assurance LL (Lesson2)BRIAN KORIRNo ratings yet

- A Brief Overview of The Draft Corporate Governance Code For Listed Companies.Document2 pagesA Brief Overview of The Draft Corporate Governance Code For Listed Companies.Nana KwameNo ratings yet

- Bos 36238 P 6Document16 pagesBos 36238 P 6vinay parulekarNo ratings yet

- Novartis - Code For Independent Directors RDocument4 pagesNovartis - Code For Independent Directors RSaju XavierNo ratings yet

- Samples of Solution Manual For Modern Auditing Assurance Services and The Integrity of Financial Reporting 8th Edition by William C. BoyntonDocument22 pagesSamples of Solution Manual For Modern Auditing Assurance Services and The Integrity of Financial Reporting 8th Edition by William C. BoyntonLa Hanif Abdul JabarNo ratings yet

- Corporate Governance Final MCQ BookDocument77 pagesCorporate Governance Final MCQ BookFidas RoyNo ratings yet

- L2 A Well Governed OrganizationDocument21 pagesL2 A Well Governed OrganizationBSAc 1A - DAYAG, KAYETTE B.No ratings yet

- Scan 0013Document2 pagesScan 0013Zeyad El-sayedNo ratings yet

- Scan 0001Document2 pagesScan 0001Zeyad El-sayedNo ratings yet

- Fede Al Securities Acts: OvervieDocument2 pagesFede Al Securities Acts: OvervieZeyad El-sayedNo ratings yet

- P N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEDocument3 pagesP N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEZeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Document2 pagesModule 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Zeyad El-sayedNo ratings yet

- Scan 0001Document2 pagesScan 0001Zeyad El-sayedNo ratings yet

- Scan 0012Document2 pagesScan 0012Zeyad El-sayedNo ratings yet

- S Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateDocument3 pagesS Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- Se Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossDocument3 pagesSe Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossZeyad El-sayedNo ratings yet

- I y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateDocument2 pagesI y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- Revocation of Discharge: 2M Module27 BankruptcyDocument2 pagesRevocation of Discharge: 2M Module27 BankruptcyZeyad El-sayedNo ratings yet

- 80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateDocument2 pages80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- Scan 0018Document1 pageScan 0018Zeyad El-sayedNo ratings yet

- Scan 0010Document3 pagesScan 0010Zeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZDocument2 pagesModule 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZZeyad El-sayedNo ratings yet

- B Nkruptcy: Discharge of A BankruptDocument2 pagesB Nkruptcy: Discharge of A BankruptZeyad El-sayedNo ratings yet

- The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Document2 pagesThe Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Zeyad El-sayedNo ratings yet

- Deduct From Book Income: - B - T F Dul - .Document2 pagesDeduct From Book Income: - B - T F Dul - .Zeyad El-sayedNo ratings yet

- Scan 0010Document2 pagesScan 0010Zeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CDocument3 pagesModule 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CZeyad El-sayedNo ratings yet

- Bankruptcy:: y y S e S Owed SDocument3 pagesBankruptcy:: y y S e S Owed SZeyad El-sayedNo ratings yet

- Professional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsDocument2 pagesProfessional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsZeyad El-sayedNo ratings yet

- Article I Responsibilities. Article Il-The Public InterestDocument2 pagesArticle I Responsibilities. Article Il-The Public InterestZeyad El-sayedNo ratings yet

- Module 21 Professional Responsibilities: Interpretation 101-2. A FirmDocument2 pagesModule 21 Professional Responsibilities: Interpretation 101-2. A FirmZeyad El-sayedNo ratings yet

- ET Section 10 01 Conce Tu LF Mework For A Cpa I e Ence StandardsDocument2 pagesET Section 10 01 Conce Tu LF Mework For A Cpa I e Ence StandardsZeyad El-sayedNo ratings yet

- Scan 0006Document2 pagesScan 0006Zeyad El-sayedNo ratings yet

- Scan 0009Document2 pagesScan 0009Zeyad El-sayedNo ratings yet

- Scan 0008Document2 pagesScan 0008Zeyad El-sayedNo ratings yet

- Scan 0008Document2 pagesScan 0008Zeyad El-sayedNo ratings yet

- Scan 0008Document2 pagesScan 0008Zeyad El-sayedNo ratings yet

- Mongolia's Trade AnalysisDocument3 pagesMongolia's Trade AnalysisSeren TsekiNo ratings yet

- Labour Equipment & MaterialDocument33 pagesLabour Equipment & MaterialSaurabh Kumar SharmaNo ratings yet

- This Report Is Dedicated To My Parents & Teachers For Their Love, Affection and GuidanceDocument47 pagesThis Report Is Dedicated To My Parents & Teachers For Their Love, Affection and Guidance037-061No ratings yet

- Cigarettes in PeruDocument20 pagesCigarettes in PeruMiguel DaneriNo ratings yet

- f2p9g - Egac Cab AgreementDocument4 pagesf2p9g - Egac Cab AgreementAles esaamNo ratings yet

- Chapter - 11 Lumpsum - MCQDocument3 pagesChapter - 11 Lumpsum - MCQNRKNo ratings yet

- 12 Questions For Management and NonDocument9 pages12 Questions For Management and NonalkazumNo ratings yet

- Lakme West Bengal (India) Beauty Adviser - 1 Year (2018 - 2019)Document2 pagesLakme West Bengal (India) Beauty Adviser - 1 Year (2018 - 2019)Majid AliNo ratings yet

- Future Generali Brochure PDFDocument19 pagesFuture Generali Brochure PDFSangeeta LakhoteNo ratings yet

- Sugar Plugin For Excel 6.1.0Document6 pagesSugar Plugin For Excel 6.1.0chicagogroovesNo ratings yet

- Group D7: Giridaran - Moksh - Mithila - Revant - Rhythym - SwapnilDocument6 pagesGroup D7: Giridaran - Moksh - Mithila - Revant - Rhythym - Swapnilrev1202No ratings yet

- DHL Parcel Uk: International Label AdviceDocument7 pagesDHL Parcel Uk: International Label AdviceCarol ManirakizaNo ratings yet

- Wholesale Fba Brands Sheet 12345Document18 pagesWholesale Fba Brands Sheet 12345you forNo ratings yet

- AmazonDocument1 pageAmazonAnkit SoniNo ratings yet

- Katalog YSADocument37 pagesKatalog YSAEko Santoso Soedibdjo50% (2)

- Final Exam 4Document4 pagesFinal Exam 4HealthyYOU100% (1)

- Resume Emma HansonDocument1 pageResume Emma Hansonapi-341634449No ratings yet

- JLL DXBQ12013Document0 pagesJLL DXBQ12013Olena StanislavovnaNo ratings yet

- Cameron - Project ManagerDocument3 pagesCameron - Project ManagerThaw Zin OoNo ratings yet

- Rondell Data Corporation - FinalDocument32 pagesRondell Data Corporation - FinalVineet Chauhan100% (1)

- Axiata Iar-Full ReportDocument103 pagesAxiata Iar-Full ReportAnonymous vCRo3mj7MNNo ratings yet

- Senior Policy Compliance Technical Writer in Dallas TX Resume Candace TateDocument3 pagesSenior Policy Compliance Technical Writer in Dallas TX Resume Candace TateCandaceTateNo ratings yet

- SD Questions About Pricing ConditionDocument9 pagesSD Questions About Pricing ConditionAniruddha Chakraborty100% (1)

- Basic Concepts of QualityDocument6 pagesBasic Concepts of QualityAnju Gaurav DrallNo ratings yet

- Process Costing - Actg RVWDocument2 pagesProcess Costing - Actg RVWJenyl Mae NobleNo ratings yet