Professional Documents

Culture Documents

Module 21 Professional Responsibilitles

Module 21 Professional Responsibilitles

Uploaded by

Zeyad El-sayed0 ratings0% found this document useful (0 votes)

10 views2 pagesAccountants can be held liable to third parties not in privity under certain conditions. The majority rule is that accountants are liable for negligence to "foreseen parties" - those the accountant knew would rely on financial statements for a specific transaction. Accountants are also liable for fraud or gross negligence to all parties. While the majority rule does not hold accountants liable to "foreseeable parties" - those an accountant could reasonably foresee relying on statements - some courts now do for negligence. The Securities Act of 1933 also provides for statutory liability of accountants to third parties for misstatements in registration statements.

Original Description:

4rtys21

Original Title

Scan 0024

Copyright

© © All Rights Reserved

Available Formats

RTF, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccountants can be held liable to third parties not in privity under certain conditions. The majority rule is that accountants are liable for negligence to "foreseen parties" - those the accountant knew would rely on financial statements for a specific transaction. Accountants are also liable for fraud or gross negligence to all parties. While the majority rule does not hold accountants liable to "foreseeable parties" - those an accountant could reasonably foresee relying on statements - some courts now do for negligence. The Securities Act of 1933 also provides for statutory liability of accountants to third parties for misstatements in registration statements.

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

Download as rtf, pdf, or txt

0 ratings0% found this document useful (0 votes)

10 views2 pagesModule 21 Professional Responsibilitles

Module 21 Professional Responsibilitles

Uploaded by

Zeyad El-sayedAccountants can be held liable to third parties not in privity under certain conditions. The majority rule is that accountants are liable for negligence to "foreseen parties" - those the accountant knew would rely on financial statements for a specific transaction. Accountants are also liable for fraud or gross negligence to all parties. While the majority rule does not hold accountants liable to "foreseeable parties" - those an accountant could reasonably foresee relying on statements - some courts now do for negligence. The Securities Act of 1933 also provides for statutory liability of accountants to third parties for misstatements in registration statements.

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

Download as rtf, pdf, or txt

You are on page 1of 2

64 MODULE 21 PROFESSIONAL RESPONSIBILITlES

2. Common Law Liability to Third Parties (Nonclients)

3. Client is in privity of contract with accountant based on contractual relationship

(1) In typical accountant-client relationship, there usually is no privity of contract between the ac-

countant and third parties

(2) Traditionally, accountants could use defense of no privity against suing third parties in con-

tract and negligence cases

(a) Ultramares decision is leading case in which accountants held liable only to parties for

whose primary benefit financial statements are intended

1] This generally means only client or third-party beneficiaries since these were in priv-

ity of contract with accountant

2] However, anyone (including third parties) who can prove fraud or constructive fraud

may recover

(b) This is a significant minority rule today

4. More recently, many courts have expanded liability to some third parties. The following

distinc-

tions should be understood:

(1) Foreseen party-third party who accountant knew would rely on financial statements, or

member of limited class that accountant knew would rely on financial statements, for

specified

transaction

(a) Majority rule is that accountant is liable to foreseen third parties for negligence

1] Rationale for not allowing liability to more third parties is that accountants should not

be exposed to liability in indeterminate amount to indeterminate class .

EXAMPLE: A CPA agrees to perform an auditfor ABC Client knowing that the financial

statements will be used to obtain a loan from XYZ Bank. Relying on the financial statements, XYZ

Bank loans ABC $100,000. ABC goes bankrupt. 1fXYZ can establish that the financial statements

were not fairly stated, thus causing the bank to give the loan, and ifnegligence can be established,

most courts will allow XYZ Bank to recover from the CPA.

EXAMPLE: Facts are the same as in the example above except that XYZ Bank was not specified.

Since the CPA knew that some bank would rely on these financial statements, the actual bank is a

foreseen party since it is a member of a limited class and most courts will allow for liability.

(b) Accountant liable for fraud, constructive fraud, or gross negligence to all parties whether

foreseen or not

(2) Distinguish foreseen party and foreseeable party

(a) Foreseeable party-any party that accountant could reasonably foresee would receive fi-

nancial statements and use them

1] Majority rule is that accountant not liable to merely foreseeable parties for

negligence

EXAMPLE: A CPA is informed that financial statements after being audited will be used to obtain a

loan from a bank. The audited financial statements are also shown to trade creditors and potential

investors. The bank is aforeseen third party but these other third parties are not actually foreseen

parties and generally cannot recover from the CPAfor ordinary negligence. They may qualify as

foreseeable third parties since creditors or investors are the types of parties whom an accountant

should reasonably foresee as users of the audited financial statements.

2] Some courts now hold that accountant is liable for negligence to parties that are

merely foreseeable.

5. Statutory Liability to Third Parties-Securities Act of 1933

6. General information on.the Securities Act of 1933

(1) Covers regulation of sales of securities registered under 1933 Act

(a) Requires registration of initial issuances of securities with

SEC

(b) Makes it unlawful for registration statement to contain untrue material fact or to omit ma-

terial fact

You might also like

- Explanation of SecuritizationDocument15 pagesExplanation of SecuritizationForeclosure Fraud100% (15)

- DepositsDocument10 pagesDepositsJeremy Kuizon Pacuan100% (1)

- REVOCATION OF MEMORANDUM OF AGREEMENT - Alegria TandocDocument3 pagesREVOCATION OF MEMORANDUM OF AGREEMENT - Alegria TandocMichael Cleofas Asuten100% (1)

- Chapter 05Document23 pagesChapter 05Hammam MustafaNo ratings yet

- 2.offer and Acceptance (Business Law) Chapter 2Document19 pages2.offer and Acceptance (Business Law) Chapter 2natsu lol100% (1)

- Auditors LiabilityDocument2 pagesAuditors Liabilitycessd3No ratings yet

- Explanation of SecuritizationDocument15 pagesExplanation of Securitizationchickie10No ratings yet

- Financial Rehabilitation and Insolvency Act of 2010Document29 pagesFinancial Rehabilitation and Insolvency Act of 2010ethelandicoNo ratings yet

- University of London La3002 OctoberDocument4 pagesUniversity of London La3002 OctoberJUNAID FAIZANNo ratings yet

- Accountants Legal Responsabilities GleimDocument14 pagesAccountants Legal Responsabilities GleimpfreteNo ratings yet

- Legal LiabilityDocument30 pagesLegal LiabilityAbdu MohammedNo ratings yet

- Module 21 P Fessional Responsi I ES: RO B LitiDocument2 pagesModule 21 P Fessional Responsi I ES: RO B LitiHazem El SayedNo ratings yet

- Module 21 Professional Responsibilities: P R P U T T N I N H D DN PDocument3 pagesModule 21 Professional Responsibilities: P R P U T T N I N H D DN PZeyad El-sayedNo ratings yet

- Legal LiabilityDocument30 pagesLegal LiabilityDiane PascualNo ratings yet

- Lesson 4 Auditors LiabilityDocument3 pagesLesson 4 Auditors Liabilitywambualucas74No ratings yet

- University of Jahangir Nagar Institute of Business AdministrationDocument6 pagesUniversity of Jahangir Nagar Institute of Business Administrationtabassum tasnim SinthyNo ratings yet

- Auditor's LiabilityDocument6 pagesAuditor's LiabilityHilda MuchunkuNo ratings yet

- Auditing SP 2008 CH 5 SolutionsDocument13 pagesAuditing SP 2008 CH 5 SolutionsManal ElkhoshkhanyNo ratings yet

- Chapter 4Document4 pagesChapter 4viechocNo ratings yet

- Solution Manual For Auditing and Assurance Services Arens Elder Beasley 15th EditionDocument15 pagesSolution Manual For Auditing and Assurance Services Arens Elder Beasley 15th EditionMeredithFleminggztay100% (90)

- Module 21 Professional Responsibilities:, A e y - S, e o o e - , - e T IsDocument2 pagesModule 21 Professional Responsibilities:, A e y - S, e o o e - , - e T IsZeyad El-sayedNo ratings yet

- 4.6. Phar-MorDocument4 pages4.6. Phar-Morviethoangvn100% (1)

- Sol19 Sebagian2Document7 pagesSol19 Sebagian2nanda rafsanjaniNo ratings yet

- Ch05.pdf Audit SolutionDocument14 pagesCh05.pdf Audit SolutionChristianto TanerNo ratings yet

- Overview of Legal Liability of CpaDocument15 pagesOverview of Legal Liability of CpaPankaj KhannaNo ratings yet

- Auditors - Liability ClassDocument6 pagesAuditors - Liability Classsala chaweneNo ratings yet

- Chapter 7 Audit & AssuranceDocument30 pagesChapter 7 Audit & AssuranceKhairul Fahmi0% (2)

- Week2 Auditor's LiabilityDocument28 pagesWeek2 Auditor's LiabilityNasrulhaqim Nazri100% (1)

- CHAPTER 13 - Current LiabilitiesDocument3 pagesCHAPTER 13 - Current LiabilitiesKajal ChaudharyNo ratings yet

- AUD689 Tutorial Question Legal LiabilityDocument5 pagesAUD689 Tutorial Question Legal LiabilityJebatNo ratings yet

- Scan 0002Document2 pagesScan 0002El Sayed AbdelgawwadNo ratings yet

- Review Questions: Chapter 04 - Legal Liability of CpasDocument14 pagesReview Questions: Chapter 04 - Legal Liability of CpasJima KromahNo ratings yet

- The Auditor's Legal LiabilityDocument32 pagesThe Auditor's Legal LiabilityLaiba KanwalNo ratings yet

- Cac4203 The Auditor & Liability Under The LawDocument14 pagesCac4203 The Auditor & Liability Under The Lawkelvin mkweshaNo ratings yet

- Master of Business Administration - MBA Semester IIIDocument8 pagesMaster of Business Administration - MBA Semester IIIkamalkantshuklaNo ratings yet

- Legal LiabilityDocument9 pagesLegal LiabilityviolettaNo ratings yet

- Ch03 Maintaining Professional Responsibility Regulation and Legal LiabilityDocument4 pagesCh03 Maintaining Professional Responsibility Regulation and Legal Liabilitymichaelanunag26No ratings yet

- Module 21 Professional ResponsibilitiesDocument2 pagesModule 21 Professional ResponsibilitiesZeyad El-sayedNo ratings yet

- Module 3 Topic 2 Rights, Duties & Obligations of BankDocument4 pagesModule 3 Topic 2 Rights, Duties & Obligations of Banksarthak chaturvediNo ratings yet

- The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Document2 pagesThe Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Zeyad El-sayedNo ratings yet

- Debentures and ChargesDocument4 pagesDebentures and Chargesrobertkarabo.jNo ratings yet

- Bank SecrecyDocument4 pagesBank SecrecyDave A ValcarcelNo ratings yet

- Regulattion and Legal Liability by KonrathDocument15 pagesRegulattion and Legal Liability by KonrathDominic Earl AblanqueNo ratings yet

- Chapter 08 AnsDocument7 pagesChapter 08 AnsDave Manalo50% (2)

- Kibabii University Name: Wasike RoseDocument9 pagesKibabii University Name: Wasike RoseDONALDNo ratings yet

- Questions and Answers:: A Banker Customer CanDocument14 pagesQuestions and Answers:: A Banker Customer CanKhaleda AkhterNo ratings yet

- Regulattion and Legal Liability by KonrathDocument15 pagesRegulattion and Legal Liability by KonrathDominic Earl AblanqueNo ratings yet

- Lecture Two - Legal Liability and Ethics, Independance, Corporate GovernanceDocument42 pagesLecture Two - Legal Liability and Ethics, Independance, Corporate GovernancePranto KarmokarNo ratings yet

- Legal Concepts Related To Auditor's LiabilityDocument6 pagesLegal Concepts Related To Auditor's LiabilityFerial FerniawanNo ratings yet

- Special LawsDocument5 pagesSpecial LawsMarian's PreloveNo ratings yet

- Multiple-Choice QuestionsDocument20 pagesMultiple-Choice QuestionsnicoleNo ratings yet

- Chapter 08 Auditor's Legal LiabilityDocument20 pagesChapter 08 Auditor's Legal LiabilityRichard de LeonNo ratings yet

- Legal LiabilityDocument32 pagesLegal Liabilitynurhoneyz100% (1)

- Kibabii University: Name: Wasike Rose Reg No: BCO/0525/19Document10 pagesKibabii University: Name: Wasike Rose Reg No: BCO/0525/19DONALDNo ratings yet

- Intermediate Accounting Stice 18th Edition Solutions ManualDocument45 pagesIntermediate Accounting Stice 18th Edition Solutions ManualJames CarsonNo ratings yet

- U Pu Io: M Dule 1 P Fessional Responsibilit ESDocument2 pagesU Pu Io: M Dule 1 P Fessional Responsibilit ESZeyad El-sayedNo ratings yet

- Chapter 5 Final PDFDocument20 pagesChapter 5 Final PDFBebang NaronNo ratings yet

- Auditing: Chapter 5 Lecture NotesDocument12 pagesAuditing: Chapter 5 Lecture NotesKayla Shelton100% (1)

- Students Manuals Iqs Law c08Document26 pagesStudents Manuals Iqs Law c08haninadiaNo ratings yet

- Off Balance Sheet FinancingDocument25 pagesOff Balance Sheet FinancingAhsan MEHMOODNo ratings yet

- 2015 19-August Part-3 MemorandumDocument4 pages2015 19-August Part-3 Memorandumgrateful mabundaNo ratings yet

- Scan 0001Document2 pagesScan 0001Zeyad El-sayedNo ratings yet

- Fede Al Securities Acts: OvervieDocument2 pagesFede Al Securities Acts: OvervieZeyad El-sayedNo ratings yet

- Scan 0013Document2 pagesScan 0013Zeyad El-sayedNo ratings yet

- Scan 0001Document2 pagesScan 0001Zeyad El-sayedNo ratings yet

- S Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateDocument3 pagesS Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- P N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEDocument3 pagesP N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEZeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Document2 pagesModule 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Zeyad El-sayedNo ratings yet

- Se Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossDocument3 pagesSe Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossZeyad El-sayedNo ratings yet

- I y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateDocument2 pagesI y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- Scan 0010Document3 pagesScan 0010Zeyad El-sayedNo ratings yet

- Deduct From Book Income: - B - T F Dul - .Document2 pagesDeduct From Book Income: - B - T F Dul - .Zeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZDocument2 pagesModule 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZZeyad El-sayedNo ratings yet

- 80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateDocument2 pages80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- Module 21 Professional Responsibilities: Interpretation 101-2. A FirmDocument2 pagesModule 21 Professional Responsibilities: Interpretation 101-2. A FirmZeyad El-sayedNo ratings yet

- Scan 0012Document2 pagesScan 0012Zeyad El-sayedNo ratings yet

- Bankruptcy:: y y S e S Owed SDocument3 pagesBankruptcy:: y y S e S Owed SZeyad El-sayedNo ratings yet

- B Nkruptcy: Discharge of A BankruptDocument2 pagesB Nkruptcy: Discharge of A BankruptZeyad El-sayedNo ratings yet

- Scan 0018Document1 pageScan 0018Zeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CDocument3 pagesModule 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CZeyad El-sayedNo ratings yet

- Revocation of Discharge: 2M Module27 BankruptcyDocument2 pagesRevocation of Discharge: 2M Module27 BankruptcyZeyad El-sayedNo ratings yet

- ET Section 10 01 Conce Tu LF Mework For A Cpa I e Ence StandardsDocument2 pagesET Section 10 01 Conce Tu LF Mework For A Cpa I e Ence StandardsZeyad El-sayedNo ratings yet

- Article I Responsibilities. Article Il-The Public InterestDocument2 pagesArticle I Responsibilities. Article Il-The Public InterestZeyad El-sayedNo ratings yet

- Professional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsDocument2 pagesProfessional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsZeyad El-sayedNo ratings yet

- Scan 0010Document2 pagesScan 0010Zeyad El-sayedNo ratings yet

- The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Document2 pagesThe Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Zeyad El-sayedNo ratings yet

- Scan 0008Document2 pagesScan 0008Zeyad El-sayedNo ratings yet

- Scan 0006Document2 pagesScan 0006Zeyad El-sayedNo ratings yet

- Scan 0009Document2 pagesScan 0009Zeyad El-sayedNo ratings yet

- Scan 0008Document2 pagesScan 0008Zeyad El-sayedNo ratings yet

- Scan 0008Document2 pagesScan 0008Zeyad El-sayedNo ratings yet

- Lease Agreement Myrna BanoDocument3 pagesLease Agreement Myrna BanoMon Anthony MolobocoNo ratings yet

- C1 General ProvisionsDocument8 pagesC1 General ProvisionsBianca JampilNo ratings yet

- Sps. Villaluz v. LBP, G.R. No. 192602, January 18, 2017 (1347, 1461, and 1462)Document2 pagesSps. Villaluz v. LBP, G.R. No. 192602, January 18, 2017 (1347, 1461, and 1462)Nino Kim AyubanNo ratings yet

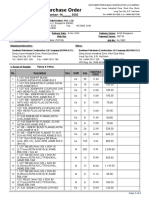

- Purchase Order: Number: 14 - SOODocument4 pagesPurchase Order: Number: 14 - SOOLê Đức ThiệnNo ratings yet

- Santich v. VCG Holding Corp.: Contract Enforcement and Arbitration OpinionDocument10 pagesSantich v. VCG Holding Corp.: Contract Enforcement and Arbitration OpinionMichael_Lee_RobertsNo ratings yet

- Palay Inc Vs ClaveDocument2 pagesPalay Inc Vs ClaveDarla GreyNo ratings yet

- SOGA Assignment 2Document22 pagesSOGA Assignment 2mitanshuraval98No ratings yet

- Ratanlal & Dhirajlal - The Law of Torts (26th Edition) - 1 PDFDocument232 pagesRatanlal & Dhirajlal - The Law of Torts (26th Edition) - 1 PDFgautam sanjay100% (1)

- BL2Document2 pagesBL2imsana minatozakiNo ratings yet

- Chattel Mortgage Real (Estate) MortgageDocument1 pageChattel Mortgage Real (Estate) MortgageAlexis NievesNo ratings yet

- Ateneo Central Bar Operations 2007 Civil LawDocument21 pagesAteneo Central Bar Operations 2007 Civil LawJeshuah GenttelNo ratings yet

- Corp ReviewerDocument12 pagesCorp ReviewerFerl Rama100% (1)

- Joo Contracts (F08)Document57 pagesJoo Contracts (F08)Ryan SanchezNo ratings yet

- 2.1 Offer: INDIAN CONTRACT ACT 1872: OFFER Business RegulationsDocument3 pages2.1 Offer: INDIAN CONTRACT ACT 1872: OFFER Business Regulationskarthik karthikNo ratings yet

- Rent AgreementDocument4 pagesRent AgreementAnil KumarNo ratings yet

- Villa Vs Garcia BosqueDocument2 pagesVilla Vs Garcia BosqueJohn Michael VidaNo ratings yet

- 80 Supercars V FLoresDocument6 pages80 Supercars V FLoresHana Danische ElliotNo ratings yet

- Moa and AoaDocument6 pagesMoa and AoaYash BansalNo ratings yet

- Laws 03 00181 PDFDocument27 pagesLaws 03 00181 PDFRodrigo AlcocerNo ratings yet

- REIWA Application For TenancyDocument10 pagesREIWA Application For TenancyTapan RajyaguruNo ratings yet

- A Contract May Be Created in The Following Ways: Orally:: BCC 302-Business LawDocument6 pagesA Contract May Be Created in The Following Ways: Orally:: BCC 302-Business LawParakh SinghNo ratings yet

- (Labor 2 - Atty. Nolasco) : G.R. No. 196539 Perez, J. Digest By: IntiaDocument2 pages(Labor 2 - Atty. Nolasco) : G.R. No. 196539 Perez, J. Digest By: IntiaRaymund CallejaNo ratings yet

- Sienes vs. EsparciaDocument1 pageSienes vs. EsparciasamontedianneNo ratings yet

- Hold Harmless Agreement TemplateDocument4 pagesHold Harmless Agreement TemplatedrixNo ratings yet

- State-Owned Vehicles Passenger Waiver of LiabilityDocument1 pageState-Owned Vehicles Passenger Waiver of LiabilityJacob GiffenNo ratings yet

- Porter v. Wertz: What Are The Facts of This Case?Document17 pagesPorter v. Wertz: What Are The Facts of This Case?Missy MeyerNo ratings yet