Professional Documents

Culture Documents

Marketing Strategies of The LIC of India

Marketing Strategies of The LIC of India

Uploaded by

Nihal SinghCopyright:

Available Formats

You might also like

- CHAKRA FOR SEX - Harnessing The Sexual EnergyDocument36 pagesCHAKRA FOR SEX - Harnessing The Sexual EnergyDamir67% (3)

- 06 Chapter 1 MARKETING STRATEGIES IN LIFE INSURANCE BUSINESSDocument61 pages06 Chapter 1 MARKETING STRATEGIES IN LIFE INSURANCE BUSINESSrahulhaldankarNo ratings yet

- UGC NET - Marketing ManagementDocument85 pagesUGC NET - Marketing ManagementKasiraman Ramanujam100% (1)

- James DiagramsDocument73 pagesJames DiagramsgabrielNo ratings yet

- Brigada Eskwela Regional Kick-Off Program FINAL PDFDocument2 pagesBrigada Eskwela Regional Kick-Off Program FINAL PDFmsantos2870% (10)

- Marketing Strategies-2738 PDFDocument4 pagesMarketing Strategies-2738 PDFrajuNo ratings yet

- MINOR PROJECT On InsuranceDocument53 pagesMINOR PROJECT On InsurancedivyaNo ratings yet

- 1.1) Explain The Various Elements of The Marketing ProcessDocument14 pages1.1) Explain The Various Elements of The Marketing ProcessKasim MalikNo ratings yet

- Marketing Strategy of LicDocument58 pagesMarketing Strategy of Licsoniharshvardhan214No ratings yet

- 1:-Introduction 1.1: - Importance of The TopicDocument62 pages1:-Introduction 1.1: - Importance of The TopicRICHA mehtaNo ratings yet

- Marketing Strategies in Life Insurance Business: Chapter - IiDocument40 pagesMarketing Strategies in Life Insurance Business: Chapter - IiChayanika KashyapNo ratings yet

- Marketing Management ofDocument17 pagesMarketing Management ofprince goyalNo ratings yet

- Project Report On Marketing Techinques of Ing Vysya Life InsuranceDocument9 pagesProject Report On Marketing Techinques of Ing Vysya Life Insurancemujeebul_siddiquiNo ratings yet

- Rough MKTNG Insrnce PRCT FinalDocument68 pagesRough MKTNG Insrnce PRCT Finalmrchavan143No ratings yet

- Contemporary Issues in Marketing of Life PDFDocument15 pagesContemporary Issues in Marketing of Life PDFSameer GaikwadNo ratings yet

- Final ProjectDocument14 pagesFinal Projectkiru_makhija100% (1)

- LIC ReportDocument65 pagesLIC ReportAtish PandaNo ratings yet

- Report On STDP Analysis HDFC Life (Harsh Gulabani)Document7 pagesReport On STDP Analysis HDFC Life (Harsh Gulabani)Harsh GulabaniNo ratings yet

- 7 PsDocument5 pages7 PsatulbhushanNo ratings yet

- Insurance Marketing India 03Document19 pagesInsurance Marketing India 03mehedi hasanNo ratings yet

- Icici Prudential Final DraftDocument21 pagesIcici Prudential Final DraftDavid JohnNo ratings yet

- 10 Chapter 6Document62 pages10 Chapter 6Satya Prakash ChinnaraNo ratings yet

- Indian Insurance SectorDocument18 pagesIndian Insurance SectorSaket KumarNo ratings yet

- SM Unit 3Document9 pagesSM Unit 3KANNAN MNo ratings yet

- Marketing of InsuranceDocument22 pagesMarketing of InsuranceshrenikNo ratings yet

- Marketing of Insurance FinalDocument44 pagesMarketing of Insurance Finalshrenik100% (1)

- Research PaperDocument10 pagesResearch PaperrahulNo ratings yet

- 7 P's of Services MarketingDocument169 pages7 P's of Services MarketingZulejha IsmihanNo ratings yet

- Fundamentals of Modern Marketing: Marketing Management Iii Sem Bba 2021Document28 pagesFundamentals of Modern Marketing: Marketing Management Iii Sem Bba 2021MANN JAINNo ratings yet

- Turnaround ManagementDocument8 pagesTurnaround ManagementaimyNo ratings yet

- P6Document6 pagesP6pardeshikanchan07No ratings yet

- TOPIC 1 Role of MarketingDocument69 pagesTOPIC 1 Role of MarketingArif Sofi100% (1)

- Bharti AXA General Insurance Is A Joint Venture Between BhartiDocument34 pagesBharti AXA General Insurance Is A Joint Venture Between BhartiNavpreet SinghNo ratings yet

- Himalayan College of Management Marketing Management MGMT 5212Document11 pagesHimalayan College of Management Marketing Management MGMT 5212iam arpanNo ratings yet

- Chapter-1 Introduction - Role of Advertising in InsuranceDocument57 pagesChapter-1 Introduction - Role of Advertising in InsuranceManasvi Darshan Tolia100% (2)

- Introduction To Marketing: by Jojo Joy NDocument111 pagesIntroduction To Marketing: by Jojo Joy NVivinNo ratings yet

- HimanshuDocument3 pagesHimanshukamal panchalNo ratings yet

- Suggestion and ConclusionDocument4 pagesSuggestion and ConclusionSidhantha Jain100% (1)

- Distribution ChannelsDocument28 pagesDistribution ChannelsAbhinav G PandeyNo ratings yet

- Shubham KumarDocument3 pagesShubham Kumarkamal panchalNo ratings yet

- Dawud MarcetingDocument51 pagesDawud Marcetingshambel misgieNo ratings yet

- Abstract and Introduction For InterimDocument54 pagesAbstract and Introduction For InterimPriti SivasubramanianNo ratings yet

- MaricoDocument78 pagesMaricoShyam Maari67% (3)

- 7ps of International Marketing With Ref To Domestic & International MarketsDocument15 pages7ps of International Marketing With Ref To Domestic & International MarketsSimrat Singh Arora0% (2)

- Marketing MixDocument6 pagesMarketing MixHimanshu PaliwalNo ratings yet

- A Study On Marketing Strategies and Sales Development Methiods in Amul Ltd.Document34 pagesA Study On Marketing Strategies and Sales Development Methiods in Amul Ltd.Shailesh AsampallyNo ratings yet

- Marketing of Insurance Services PDFDocument19 pagesMarketing of Insurance Services PDFRajeshsharmapurangNo ratings yet

- Marketing Mix Insurance SectorDocument4 pagesMarketing Mix Insurance SectorSantosh Pradhan100% (1)

- Nature, Scope & Marketing of Banking and Insurance ServicesDocument17 pagesNature, Scope & Marketing of Banking and Insurance ServicesAmit PrakashNo ratings yet

- Task 1 - ReferênciasDocument4 pagesTask 1 - ReferênciasAlan Toledo100% (1)

- Explore Measurements To Advance The Service Quality of Janashakthi Insurance Life Claims DepartmentDocument24 pagesExplore Measurements To Advance The Service Quality of Janashakthi Insurance Life Claims DepartmentNuwan KumarasingheNo ratings yet

- Report On Customer Relationship ManagementDocument19 pagesReport On Customer Relationship ManagementjerthNo ratings yet

- Sip Project Proposal 21029Document6 pagesSip Project Proposal 21029Priyanka MoreNo ratings yet

- Marketing 7 P's of InsuranceDocument169 pagesMarketing 7 P's of InsuranceVinit Poojary75% (4)

- INSPLOREDocument17 pagesINSPLOREGarima PandeyNo ratings yet

- Reliance: A Project Report ON Marketing Mix and Insurance Awareness in Retail SectorDocument61 pagesReliance: A Project Report ON Marketing Mix and Insurance Awareness in Retail SectorSuhas IngaleNo ratings yet

- Insurance Marketing India 01Document12 pagesInsurance Marketing India 01mehedi hasanNo ratings yet

- Marketing Mastery: Strategies for Building and Sustaining a Strong Customer BaseFrom EverandMarketing Mastery: Strategies for Building and Sustaining a Strong Customer BaseNo ratings yet

- Digital Marketing Decoded: A Comprehensive Guide to 2024 Strategies and TacticsFrom EverandDigital Marketing Decoded: A Comprehensive Guide to 2024 Strategies and TacticsNo ratings yet

- Dance Like A ManDocument4 pagesDance Like A ManShubhadip aichNo ratings yet

- Bowthorpe News May 2017Document36 pagesBowthorpe News May 2017Anonymous AySEIwycNo ratings yet

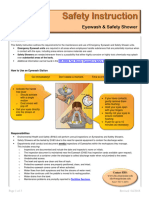

- Eyewash and Safety Shower SiDocument3 pagesEyewash and Safety Shower SiAli EsmaeilbeygiNo ratings yet

- Experimental and CFD Resistance Calculation of A Small Fast CatamaranDocument7 pagesExperimental and CFD Resistance Calculation of A Small Fast CatamaranChandra SibaraniNo ratings yet

- Mathematics: Quarter 3 - Module 5: Independent & Dependent EventsDocument19 pagesMathematics: Quarter 3 - Module 5: Independent & Dependent EventsAlexis Jon NaingueNo ratings yet

- Chapter 2: Decision MakingDocument16 pagesChapter 2: Decision Makingafzal_aNo ratings yet

- Create BAPI TutorialDocument28 pagesCreate BAPI TutorialRoberto Trejos GonzalezNo ratings yet

- Importance of Assessment of Intelligence in Clinical PsychologyDocument1 pageImportance of Assessment of Intelligence in Clinical PsychologyKimberly AlcantaraNo ratings yet

- Detail of Common Toilet: Section Elevation C - C' Section Elevation D - D'Document1 pageDetail of Common Toilet: Section Elevation C - C' Section Elevation D - D'RichaNo ratings yet

- Tle Ap-Swine Q3 - WK3 - V4Document7 pagesTle Ap-Swine Q3 - WK3 - V4Maria Rose Tariga Aquino100% (1)

- Oops (Object Oriented Programming Structure)Document10 pagesOops (Object Oriented Programming Structure)MANOJ SNo ratings yet

- Article 2013 Legume Perspectives 1-45-46Document53 pagesArticle 2013 Legume Perspectives 1-45-46kondwanigift0101No ratings yet

- Schwarze Schlichte Salesfolder enDocument6 pagesSchwarze Schlichte Salesfolder en姚晓卫No ratings yet

- Services Provided by Merchant BanksDocument4 pagesServices Provided by Merchant BanksParul PrasadNo ratings yet

- 2010 Complete Algop Primary ResultsDocument206 pages2010 Complete Algop Primary ResultsCatherine SnowNo ratings yet

- Form LRA 42Document3 pagesForm LRA 42Godfrey ochieng modiNo ratings yet

- Boreal Forests Canadian Shield Tundra Arctic Canadian Rockies Coast Mountains Prairies Great Lakes St. Lawrence RiverDocument2 pagesBoreal Forests Canadian Shield Tundra Arctic Canadian Rockies Coast Mountains Prairies Great Lakes St. Lawrence Riversaikiran100No ratings yet

- Pediatric OrthopaedicDocument66 pagesPediatric OrthopaedicDhito RodriguezNo ratings yet

- Space Planning Guidelines: Edition 2Document29 pagesSpace Planning Guidelines: Edition 2Nur Nabilah SyazwaniNo ratings yet

- Amazon Goes To HollywoodDocument27 pagesAmazon Goes To Hollywoodvalentina cahya aldamaNo ratings yet

- Weight Tracking Chartv2 365days WeeklyDocument20 pagesWeight Tracking Chartv2 365days WeeklyozgegizemNo ratings yet

- Annotated BibliographyDocument7 pagesAnnotated Bibliographyapi-340711045No ratings yet

- Persons With Disabilities: Key PointsDocument8 pagesPersons With Disabilities: Key PointsShane ArroyoNo ratings yet

- Final Management Project On Geo TVDocument35 pagesFinal Management Project On Geo TVAli Malik100% (1)

- Annex VI - Final Narrative ReportDocument4 pagesAnnex VI - Final Narrative ReporttijanagruNo ratings yet

- Final English Presentation - FiskDocument8 pagesFinal English Presentation - FiskMary FreakyNo ratings yet

- Kakhisong Church A2-ModelDocument1 pageKakhisong Church A2-ModelanzaniNo ratings yet

Marketing Strategies of The LIC of India

Marketing Strategies of The LIC of India

Uploaded by

Nihal SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Marketing Strategies of The LIC of India

Marketing Strategies of The LIC of India

Uploaded by

Nihal SinghCopyright:

Available Formats

Chapter III

Marketing Strategies of the

LIC of India

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

CHAPTER III

MARKETING STRATEGIES OF THE LIC OF INDIA

3.1 INTRODUCTION

“Effective marketing strategies are vital for the survival and growth of companies

in the rapidly changing business environment of the 21st century1”. “The success or failure in

today‟s competitive market is depending on the marketing strategies that they could adopt

with all effectiveness2”, Life Insurance is no exception to this rule. The problem is still

more serious with the Life Insurance sector as they have to promote strategies to sell

more products.

The entry of foreign players brings enormous pressure on the profitable, efficient

and socially responsible public Insurance companies of India. Private players have now

created vast opportunity for the specific category of professionals and the demand for

qualified, skilled, expertise knowledge actuaries have suddenly increased. Foreign and

private Insurance players are ready to capture the market by providing the products and

services at cheaper rates and also offering unbundled innovative products (Pension

market, annuity market etc.,) with a variety of benefits leading to cut throat competition

in the existing India Insurance organization. (LIC and GIC).

It is observed that 80 percent of LIC‟s business is processed by 20 percent of its

ill- trained agent force, whereas the foreign players, with the domestic partner‟s strong

brand value, can test the unconventional distribution channels like brokers, the internet,

the banking distribution system, etc. It is also observed that the public sector insurances

concentrate on sale of policies without concentrating much on the service needs of their

policyholders. As a result many of the individuals remain under insured3.

1

The Institute of Certified Risk and Insurance Managers, “Insurance Marketing”, ICFAI University Press,

Hyderabad, 2002.

2

Sharma, R. D., Gurjeet Kaur, “Marketing Effectiveness in Banking”, Anmol Publications PVT LTD.,

New Delhi, 2003.

3

Rajesham and Rajende, “Changing Scenario of Indian Insurance Sector”, Indian Journal of Marketing,

Vol. 36, No. 7, July, 2006, pp. 9-15.

61

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

The LIC of India has to compete with foreign and private players by adopting

effective marketing strategies. The term strategy is used in business to describe how an

organization is going to achieve its objectives and mission. Marketing strategies provide

concepts and processes for gaining competitive advantages by delivering superior customer

value. A successful organization requires to develop competitive marketing strategies.

Marketing strategy implies development of an action plan to achieve the marketing

objectives. Marketing strategies involve skill and concerted effort on the part of the

management to evolve tools and techniques, which are understood and accepted

throughout the organization in furtherance of the marketing cause. It has been observed

that most profitable businesses have well thought out and well executed strategies.

Whereas the least profitable businesses have no explicit strategy, a poorly conceived

strategy, or a strategy that the organization cannot successfully execute.

According to Granroos, marketing strategy in the case of services may consist of

1. Traditional External Marketing 2. Internal marketing 3. Interactive marketing.

Traditional external marketing consists of the usual four „Ps‟ viz., Products, Price, Place

and Promotion of marketing mix. Internal marketing implies that the service firm must

effectively train and motivate its customer friendly employees as well as all the supporting

service personnel to work as a team to provide customer satisfaction. Interactive marketing

emphasizes that the perceived services quality is highly dependent on the quality of buyer

seller interaction. It describes the skill of employees in handling customer contact and

covers delivery of the product in a most satisfying manner.

Design an initial marketing strategy for introducing the product into the market,

the marketing strategy statement consists of three parts: a) the first part describes the

target market; the planned product positioning; the sales, market shares; and the profit

goals for the first few years, b) the second part outlines the product‟s planned price,

distribution and marketing budget for the first year and c) the third part describes the

planned long run sales, profit goals and marketing mix strategy.

Marketing strategy is the set of controllable variables and their levels that the life

insurance companies use to influence the target market. It means any variable under the

control of the life insurance companies that can influence the level of customer response

62

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

in a marketing mix variable. A seven factor classification has been given to support this

concept namely product, price, promotion and place (four P‟s). The study takes into

account three more „Ps‟ namely people, process and physical evidence besides the traditional

4 „Ps‟ as there is a vital component in the marketing mix of life Insurance companies.

In the backdrop of the above concept this chapter attempts to review the marketing

strategies adopted by the LIC of India based on seven „Ps‟ which are explained below.

3.2 PRODUCT STRATEGY

A Company‟s primary objective is to develop products that satisfy the customer‟s

needs. The company‟s existence is in trouble if it does not deliver need satisfying product

/ service. The concept of product extends the applicability of marketing principles to

insurance marketing. “A product is anything that can be offered to a market for attention,

acquisition, use or consumption that might satisfy a want or need. It includes physical

objects, services, persons, places, organizations and ideas.” Philip Kotler describes insurance

products as unsought (consumer) goods. “These are consumer goods that the consumer

does not know about or knows about but does not normally think of buying.”

In the service industry (including insurance), products are generally intangible in

nature. So service differentiation plays a key role in the successful marketing of services.

Without the quality of service being recognized and sought by customers, it is difficult to

sell a product either to a new customer or to an existing one. In the present competitive

environment, this service differentiation assumes greater significance. After the opening

up of the life insurance to the private sector, the LIC of India have been putting in more

efforts to continuously innovative products offered and the quality of service rendered are

going to dominate the market.

In insurance marketing, the differences between products and services have to be

considered before chalking out the strategies. Services are quite different from product,

where it is any act or performance that one party can offer to another that is essentially

intangible and does not result in the ownership of anything. In insurance marketing

products may or may not be tied to a physical product. Banking, medical and professional

services, health care, private education, transportation, insurance are a few examples of

service industries. There are certain characteristics of services such as intangibility,

inseparability, variability, and perishability that pose special challenges for marketers.

63

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

Based on the product characteristics, marketers have classified products on the

basis of durability, tangibility and usage (industrial or consumer). Each product type will

have an appropriate marketing mix strategy. The LIC of India, over a period of 55 years,

introduced several innovative products. A few of them are traditional products that have

been continued from pre-nationalization days. Life Insurance Corporation of India‟s

product mix includes whole life policies, endowment policies, term insurance plans, money

back policies, children policies, joint life policy, women policy, plans for handicapped

dependents, pension plans, unit linked insurance plans, health plan & health protection

plus and micro insurance.

In a competitive market, there is a greater need to provide insurance products that

meet the needs of our customers. The LIC of India therefore offers a wide variety of

products, which fulfills the needs of different segments of the society1. They are as follows:

3.2.1 Whole Life Policies

The risk is covered for the entire life of the policyholders. That is why, they are

known as whole life policies. The policy money and bonus are payable only to the

nominee or the beneficiary upon the death of the policyholder. These policies can be

issued either on profit basis or non- profit basis.

i. Whole Life Policy - Premiums are payable for a period of 40 years or up to the

age 80 of the life assured whichever is higher. Insurance money is payable on

death, whenever that occurs. Once the policy owner reaches the age of 80

(provided at least 40 years premium has been paid), the policy will be treated as

matured and insurance money will be paid to the life assured.

ii. Whole Life Policy - Limited payment is a variation of the Pure Whole Life

policy except that premiums are payable for a limited period at the choice of the

insured.

iii. The Whole Life Policy- Single Premium This is the best form of life assurance

for family provision since it enables the Life Assured to pay the premium during

the ordinarily vigorous and most productive years of life, relieving him from the

1

www.licindia.in/individual_plans.htm

64

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

necessity of making payments later in life when they might become a burden.

With Profits Single Premium policies do not cease to participate in profits after

completion of the period for which premium has been paid ,but continue to share

in the periodical Bonus Distribution until the death of the Life Assured.

iv. Jeevan Tarang is a whole of life plan which provides for annual survival benefit

at a rate of 5½ % of the Sum Assured after the chosen Accumulation Period.

The vested bonuses in a lump sum are payable on survival at the end of the

Accumulation Period or on earlier death. Further, the Sum Assured, along with

Loyalty Additions, if any, is payable on survival to the age of 100 years or on

earlier death.

3.2.2 Endowment Policies

Endowment policies cover the risk for a specified period at the end of which, the

sum assured is paid back to the policyholder, along with the entire bonus accumulated

during the term of the policy.

i. Endowment Assurances Policy – the face value of the policy will be paid either on

death of the insured during the period of insurance or on maturity if the insured

survives up to the end of the term.

ii. The Endowment Assurance Policy-Limited Payment - Just as in the case of limited

payment whole life polices, here, too, the payment of premium can be limited either

to a single payment or to a term shorter than the policy. The endowment is, however,

payable only at the end of the policy term, or on death of the policyholder if it takes

place earlier. If payment of the premiums ceases after at least three years' premiums

have been paid, a free paid-up Policy for an amount bearing the same proportion to

the sum assured as the number of premiums actually paid bears to the number

stipulated for in the policy, will be automatically secured provided the reduced sum

assured, exclusive of any attached bonus, is not less than `250. Such reduced paid-up

Policy will not be entitled to participate in the profits declared thereafter, but such

Bonus as has already been declared on the Policy will remain attached hereto.

65

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

iii. Jeevan Mitra (Double/Triple Cover Endowment Plan) - This is an Endowment

Assurance plan that provides greater financial protection against death throughout the

term of plan. It pays the maturity amount on survival to the end of the policy term.

Premiums are payable yearly, half-yearly, quarterly, monthly or through Salary deductions,

as opted by you, throughout the term of the policy or earlier death. This is a with-profit plan

and participates in the profits of the Corporation‟s life insurance business. It gets a share of

the profits in the form of bonuses. Simple Reversionary Bonuses are declared per thousand

Sum Assured annually at the end of each financial year. Once declared, they form part of

the guaranteed benefits of the plan. A Final (Additional) Bonus may also be payable

provided a policy has run for certain minimum period.

iv. Jeevan Anand This plan is a combination of Endowment Assurance and Whole Life

plans. It provides financial protection against death throughout the lifetime of the life

assured with the provision of payment of a lump sum at the end of the selected term in

case of his survival. Premiums are payable yearly, half-yearly, quarterly, monthly or

through salary deductions as opted by insurer throughout the selected term of the policy

or till earlier death. This is a with-profit plan and participates in the profits of the

Corporation‟s life insurance business. It gets a share of the profits in the form of bonuses.

v. New Jana Raksha Plan– This is an Endowment plan suitable for people in rural

areas. After payment of atleast two years‟ premiums, risk is covered for the next

3 years even if premiums are not paid. Agriculturists who depend on the vagaries of

nature find this policy very attractive.

vi. Jeevan Amrit - Some people, particularly the younger ones, want to have high cover

at a low cost. Further, many of them do not want commitment to pay premiums for a

longer duration. LIC's Jeevan Amrit is most suitable for such persons. Under this plan

premium payment is limited to 3 or 4 or 5 years and the premium payable during the

first year is higher than the premiums payable in subsequent years.

vii. Jeevan Vaibhav (Single Premium Endowment Assurance Plan) is a close-ended

single premium endowment assurance plan which offers guaranteed Loyalty

Addition, if any, payable on maturity or on death.

66

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

viii. Jeevan Shree I This plan offer many convenient premium paying terms. It provides

financial protection against death throughout the term of plan with the payment of

maturity amount on survival to the end of the policy term. The policy participates in

the profits of the Corporation‟s life insurance business from the 6th year onwards. It will

get a share of the profits in the form of bonus. Simple Reversionary Bonus will be

declared per thousand Basic Sum Assured annually at the end of each financial year.

Once the bonus is declared, it will form part of the guaranteed benefits of the plan.

ix. Jeevan Prumuk This is an Endowment Assurance plan offering the choice of three

premium paying terms. It provides financial protection against death throughout the

term of the plan with the payment of maturity amount on survival to the end of the

policy term. Premiums are payable yearly, half-yearly, quarterly or monthly, as opted by

the insurer. The policy provides for the Guaranteed Additions at the rate of ` 50/- per

thousand Sum Assured for each completed year for first five years of the policy.

The Guaranteed Additions are payable along with the Sum Assured at the time of claim.

3.2.3 Term Insurance Plans

In the case of term life insurance contract, the sum assured is payable only in the

event of death during the term. In the case of survival, the contract comes to an end at the

end of the term. There is no refund of premium. These policies are non-participating.

Since only death risk is covered, the premium is low and the contract is simple.

i. The Two Year Temporary Assurance policy is designed for the insuring public

who requires risk cover for a maximum of two years. Under the Two Year

Temporary Assurance policy a single premium is required to be paid at the outset of

the policy to cover the entire period of term. The proposer is required to pay the

medical examination fee. The proof of age must also accompany the proposal.

The policy issued will be only under the 'Without Profits' plan. The policy is not

entitled to any surrender value. No loan will be granted against the Two Year

Temporary Assurance policy.

ii. Convertible term insurance – This is a term insurance plan for a period of 5 or 7

years. The policy owner has the option of converting it into a limited payment

whole Life Insurance or an Endowment Assurance at the end of the term.

67

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

iii. Anmol Jeevan -I is the cheapest pure life risk plan. Plan is allowed to Physically

Handicapped Persons (Group A) with standard extra rates. The basic sum assured

under this plan will be the basis for medical examination and sum under

consideration (S.U.C).

iv. Amulya Jeevan – I: In case of unfortunate death of the Life Assured during the

term of the policy, Sum Assured is payable, provided the policy is kept in force.

In this policy maturity is nil. The policy shall not acquire any paid-up value. If the

Policy has lapsed, it may be revived during the life time of the Life Assured, but

within a period of 5 years from the date of first unpaid premium and before the date

of maturity, on submission of proof of continued insurability to the satisfaction of

the Corporation and the payment of all the arrears of premium together with interest

at such rate as may be fixed by the Corporation from time to time compounding

half-yearly.

3.2.4 Money Back Policies

In money back policies, the policyholder gets periodic payments during the term

of the policy and a lumpsum amount on surviving its term or in the event of death. Without

any deduction for the amounts paid till date. These type of polices are very popular.

i. The Money Back Policy-20 Years Unlike ordinary endowment insurance plans where

the survival benefits are payable only at the end of the endowment period, this

scheme provides for periodic payments of partial survival benefits as follows during

the term of the policy, of course so long as the policyholder is alive. In the case of a

20-year Money-Back Policy, 20% of the sum assured becomes payable each after

5, 10, 15 years, and the balance of 40% plus the accrued bonus become payable at

the end of 20th year.

ii. The Money Back Policy-25 Years For a Money-Back Policy of 25 years, 15% of the

sum assured becomes payable each after 5, 10, 15 and 20 years, and the balance 40%

Plus the accrued bonus become payable at the end of 25th year. An important feature of

this type of policies is that in the event of death at any time within the policy term, the

death claim comprises full sum assured without deducting any of the survival benefit

already paid. Similarly, the bonus is also calculated on the full sum assured.

68

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

iii. Jeevan Surabhi plan (15 years, 20 years and 25 years) is similar to other money

back plans. However main differences in regular money back plans and Jeevan

Surabhi are as under Maturity term is more than premium paying term. Early and

higher rate of survival benefit payment. Risk cover increases every five years.

The actual term and the premium paying term for these plans are as under.

Plan no. Policy Term Premium Paying Term

106 15 years 12 years

107 20 years 15 years

108 25 years 18 years

Full sum assured is paid back as survival benefit by the end of premium paying

term. However, the risk cover and additional risk cover continue and the policy

participates in profits till the end of policy term. Accident Benefit is restricted to the

premium paying period and to the overall limit of `5 lakhs on a single life.

iv. Bima Bachat is a money-back policy which offers financial security and assurance

to the policyholder and his family. Bima Bachat requires the policyholder to pay

only one premium. The amount paid for the premium depends on the duration of the

policy taken and sum assured.

3.2.5 Children Policies

The LIC of India has several policies for children – Jeevan Anurag, Children

Deferred Assurance Plans, Assurance Plan, Jeevan Kishore, Jeevan chhaya, Komal

Jeevan, Child Career Plan & Child Future Plan to protect the interest of children.

(i) Jeevan Anurag is with profits plan specifically designed to take care of the

educational needs of children. The plan can be taken by a parent on his or her own

life. Benefits under the plan are payable at pre-specified durations irrespective of

whether the Life Assured survives to the end of the policy term or dies during the

term of the policy. In addition, this plan also provides for an immediate payment of

basic sum assured amount on death of the life assured during the term of the policy.

69

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

(ii) Children's Deferred Endowment Assurance Plan (Vesting At 18 and 21) - This is an

Endowment Assurance plan designed to enable a parent or a legal guardian or any

near relative of the child (called proposer) to provide insurance cover on the life of

the child (called life assured). The plan has two stages, one covering the period from

the date of commencement of policy to the Deferred Date (called deferment period)

and the other covering the period from the Deferred Date to the date of maturity.

The insurance cover on the child‟s life starts from the Deferred Date and is available

during the latter period. The Deferred Date in case of Plan No 41 is the policy

anniversary date coinciding with or next following the date on which the child

completes 21 years of age. In case of Plan No. 50 it is the policy anniversary date

coinciding with or next following the 18th birthday of the child.

(iii) Jeevan Kishore: This policy is issued with profit, but bonus for waiting period will

vest immediately on the policy anniversary from which risk is covered or at the end

of 5 years from commencement of the policy whichever is later, provided the policy

is in force. No medical examination is necessary. This policy issued to the children

age group of one to twelve years.

(iv) Marriage Endowment or Education Annuity Plan – This is an Endowment

Assurance policy. If death occurs during the period of insurance no immediate

payment is made. Payment in lump sum (in case of marriage Endowment) and in

half-yearly installments over a period of 5 years (for Education Annuity) from date of

maturity only. Several benefits are available on maturity.

(v) Jeevan Chhaya: It is a plan where financial protection is given against death during

the term of the plan. It is an Endowment Assurance plan. Besides this benefit one-

fourth of Sum Assured is payable at the end of each of last four years of policy term

irrespective if the life assured dies or survives the duration of the policy.

(vi) Komal Jeevan: Under this children‟s plan, the payment of premium ceases on policy

anniversary immediately after the child attains 18 years of age. Risk under this plan

will commence either after 2 years from the date commencement of the policy or

from the policy anniversary immediately following the completion of 7 years of age,

whichever is later. The close relations such as grandparents, elder brothers or sisters,

uncles both from paternal or maternal side can gift „single premium policy‟ for love

70

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

and affection this plan. In such cases also, the policies will be proposed by father,

mother or legal guardian.

(vii) Child Career and Child Future Plans: These two plans are designed to meet

educational and other needs of growing child & also provide risk cover on the life of

the child not only during the policy term but also during the extended term. Policy

term is equal to maturity age minus age at entry. Policy can be taken for any

maturity age between 23& 27 years.

(viii) Jeevan Ankur - LIC‟s Jeevan Ankur is a conventional with profits plan, specially

designed to meet the educational and other needs of your child. If you are the parent

of a child aged upto 17 years, LIC‟s Jeevan Ankur is the most suitable insurance

plan for you which ensures that your responsibilities are met whether you survive or

not and without depending on anyone else. The risk cover under this plan will be on

your life as a parent and the named child shall be the nominee under the plan.

The policy term shall be based on the age at maturity of the child.

3.2.6 Joint Life Policy

Jeevan Saathi is a joint life assurance for husband and wife. During the period of

insurance, upon the death of one partner, the insurer pays the face value of the policy but

subsequently risk coverage continues on the survivor till the date of maturity. Premiums

payable from the date of death of first life are waived. On maturity or on the death of

second life, if earlier, face value of the policy is paid. Jeevan Saritha is also a joint life

assurance for husband and wife but provides benefit of joint life and last survivorship

annuity also apart from lump sum payment on death or maturity.

3.2.7 Women Policy

Jeevan Bharati – 1 is exclusively for women encouraging them to save for

SAFETY & SECURITY. This is like a money Back plan with 15 & 20 years term where

20% of the sum assured is paid at the end of every 5 years and on maturity, the balance

sum assured will be paid along with Reversionary Bonus & Final Additional Bonus if

any. Apart from the above, this plan offers following 3 optional Riders by payment of

additional premium, 1. Accident Benefit Rider, 2. Critical illness Rider & 3. Congenital

Disability Benefit Rider

71

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

3.2.8 Plans for Handicapped Dependents

Currently two plans are available to purchase for handicapped dependent. They are:

1. Jeevan Adhar : The benefits under the plan are for the handicapped dependant

which are partly in lump sum and partly in the form of an annuity.

2. Jeevan Vishwas : Is an Endowment Assurance plan designed for the benefit of

handicapped dependents.

3.2.9 Pension Plans

Pension plans are individual plans that gaze into your future and foresee financial

stability during your old age. These policies are most suited for senior citizens and those

planning a secure future so that you never give up on the best things in life.

Jeevan Akshay - VI : It is an Immediate Annuity plan, which can be purchased

by paying a lump sum amount. The plan provides for annuity payments of a stated

amount throughout the life time of the annuitant. Various options are available for the

type and mode of payment of annuities. Premium is to be paid in a lump sum. Minimum

purchase price: `100,000/- for all distribution channels except online. `150,000/- for on

line sale. No medical examination is required under the plan. No maximum limits for

purchase price, annuity etc. Minimum allowed age at entry is 30 years (completed) and

Maximum allowed age at entry is 85 years (completed). Age proof necessary.

3.2.10 Unit Linked Insurance Plans

Unit linked plans are combination of an investment fund (like mutual fund) and

an insurance policy. Unit linked plans offer a long-term investment option where return is

linked to the market performance but at the same time there is no compromise on

protection. Premiums received from the customers are utilized for purchasing units at the

prevailing prices. The daily unit price is calculated on the basis of the market value of

underlying assets (bonds, equities, government securities, etc.). Premiums paid by the

customer, less the charges like management/administrative expenses, are utilized for

purchasing units at the prevailing unit price of the day. Premiums are invested on the

basis of predetermined option of the customers.

72

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

Endowment plus which offers investment cum insurance cover during the term

of the policy. You can choose the level of insurance cover within the limits, which will

depend on the mode and level of premium you agree to pay. You have a choice of

investing your premiums in one of the four types of investment funds available.

Premiums paid after deduction of allocation charge will purchase units of the Fund type

chosen. The Unit Fund is subject to various charges and value of units may increase or

decrease, depending on the Net Asset Value (NAV).

3.2.11 Health Plan

Unit linked health insurance plan is a combination of Health Insurance and

investment with an objective of income and growth with low risk. Health is a major

concern on everybody‟s mind these days. With sky rocketing medical expenses, the

possibility of any illness leading to hospitalization or surgery is a constant source of

anxiety unless the family has actively provided for funds to meet such an eventuality.

Most families rarely provide for healthcare, and even if they do, it is grossly inadequate.

Given this scenario, LIC has launched two plans health plus and health protection plus.

1. Health Protection Plus, a unique long term health insurance plan that can combine

health insurance covers for the entire family (husband, wife and the children)

Hospital Cash Benefit (HCB) and Major Surgical Benefit (MSB) along with a ULIP

component (investment in the form of Units) that is specifically designed to meet

Domiciliary Treatment Benefit (DTB) / Out Patient Department (OPD) expenses for

the insured members1.

2. Jeevan Arogya – A unique non-linked Health Insurance plan which provides health

insurance cover against certain specified health risks and provides you with timely

support in case of medical emergencies and helps you and your family remain

financially independent in difficult times.

3.2.12 Micro Insurance

Still a vast majority of people in rural and urban areas remained uninsured

particularly those who are in lower income states and cannot afford insurance at normal

1

Wings Ready Reckoner, 24th Edition, Wings publications, Bangalore, 2011.

73

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

price. In order to cover a large section of uninsured, particularly among the vulnerable

sections of society, a new product ranged at a cheaper price was required to be launched

and that ideal product was „micro insurance‟.

1. Jeevan Madhur - It is a simple savings related life insurance plan where you may

pay premiums regularly at weekly, fortnightly, monthly, quarterly, half-yearly or

yearly intervals over the term of the policy.

2. Jeevan Mangal – It is a term assurance plan with return of premiums on maturity, where

you may pay the premiums either in lump sum or regularly at Yearly, Half Yearly,

Quarterly, Monthly, fortnightly or weekly intervals over the term of the policy.

3. Jeevan Deep - It is a simple savings related life insurance plan with Guaranteed

Additions where you may pay premiums either in lumpsum or regularly at monthly,

quarterly, half-yearly or yearly intervals over the term of the policy.

3.2.13 Bima Account - I

“LIC‟s Bima Account – I” is a simple non-linked plan under which you can be covered

without undergoing any medical examination subject to certain conditions. This plan offers you

everything you think of an insurance plan should provide Simplicity, Liquidity, Guaranteed

minimum return, No medical examination, Transparent charges and Risk cover.

3.2.14 Bima Account - II

“LIC‟s Bima Account - II” is a simple non-linked plan which offers you everything

you think of an insurance plan should provide Simplicity, Liquidity, Guaranteed

minimum return, Transparent charges and Risk cover.

In product strategy, it includes minimum age at entry, maximum age at entry,

maximum maturity age, minimum sum assured, maximum sum assured, sum assured in

multiplies, actual sum assured, minimum term, maximum term, mode rebate, risk coverage,

duplicate policy bond, tax benefits, dating back, policy loan facility, premium waiver

benefits, details of assignment, nomination facility, revival facility, surrender value of

policy, survival benefits, maturity benefits, claim settlement, variety of policies and

attractive schemes, term rider benefits, critical illness benefit raider, key-man insurance

and option to switch between funds were considered for this study.

74

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

3.3 PRICE STRATEGY

Price is the mean of setting the exchange value between two parties. Price, in

marketing mix terms, covers all aspects of pricing such as discount pricing, extended

credit, list price, and payment period (Woodruffe, 19951). Kandampully (2002)2 describes

―Pricing in service organizations is less influenced by cost, but more by customer„s

perceptions of quality, satisfaction, and value. The actual pricing of a service is thus often

determined by matching the customer„s perception of value. With this pricing method,

pricing is considered as a marketing mix variable, thereby considered together with the

other marketing mix variables before a marketing program is put together (Nagle and

Holden, 20023). Zeithaml and Bitner (2003)4 defines three basic marketing price strategies

which service companies can attend, the strategies are competition–based, cost–based,

and demand–based pricing strategies. Pricing in life insurance is somewhat complex as

compared to the pricing strategies of other financial products. The price (premium) for a

life insurance product is determined by expected claim costs, investment income,

administrative costs, and fair profit loading (Harrington and Niehaus, 2004 5). The claims

cost is based on the mortality rate realized on different age groups. The Actuary on

considerations that depend on the experience of the insurer in the past and his assessment

of the trends in the future decides the premium rates. Pricing in today„s insurance

business environment requires actuaries to be knowledgeable in an ever-expanding group

of issues because of the nature of diversified products. In case of life insurance, there is

limited scope to use price as a strategic weapon.

In pricing strategy, Premium charged, mode of premium payment, grace period

available to pay premium (extra days allowed for remitting premium), interest for

delayed payment of premium, rebate/discount on premium for annual and half yearly

1

Woodruffe, H. Services Marketing, 1st Edition, Pitman Publishing, London, 1995.

2

Kandampully, J. Services Management: The New Paradigm in Hospitality, Pearson Education, New

Delhi, 2002.

3

Nagle, T. T. and Holden, R. K. The Strategy and Tactics of Pricing, 3rd Edition, Pearson education, Inc.,

Upper Saddle River, New Jersey, 2002.

4

Zeithaml, V. A. and Bitner, M. J. Services Marketing: Integrating Customer Focus across the Firm, 3rd

Edition, McGraw–Hill, New York, 2003.

5

Harrington, S. E. and Niehaus, G. R. Risk Management and Insurance, Tata McGraw–Hill Publishing

Company Limited, New Delhi, 2004.

75

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

payment, single premium plan (received by insurer in a lump sum), rate of interest

charged on policy loan, additional premium payment for benefit of premium wavier and

term rider and way of premium payment were considered for this study.

3.4 PROMOTION STRATEGY

The „promotional mix‟ is a term used to describe the set of tools that a business

can use to communicate effectively the benefits of its products or services to its

customers. Market communication performs three basic roles in marketing–to inform, to

persuade, and to remind. Traditional promotion employs a variety of methods–including

advertising, sales promotion, public relation, and personal selling–to attract the attention

of existing and potential customers, and to inform them of the products, services, and

special offers made available by the firm (Peattie, and Peattie, 19941). Each of the

categories of promotion mix has now become familiar in many areas of services marketing.

In case of life insurance services, promotion is done through a mix of advertising, personal

selling, and sales promotion. Promotion communicates with the potential market so as to

persuade the prospective customers to try a new insurance product (Periasamy, 2005 2).

Online advertising is one marketing tool that is worth the money. As the Internet takes on

more power and influence all of the time, having a web presence will put an insurance

company on the cyber map and get it noticed. Block line advertising in trade journals,

industry publications and periodicals is the way to go. Television ads and print ads are

excellent forms of insurance marketing. All life insurance companies have started using

PR tools to make better image about them in the minds of general public. Personal selling

is extremely labour intensive but is the best form as far as insurance is concerned, dealing

with one customer at a time.

In promotion strategy, effectiveness of advertisement (TV, Radio, Newspaper,

etc), personal canvassing of development officers and agents, periodical agents and

policyholders meet, intimation of new policies through various correspondence (premium

Intimation letter, loan intimation letter, intimation of maturity of policy), reminders

1

Peattie, S. and Peattie, K. J., Promoting Financial Services with glittering Prizes, The International

Journal of Bank Marketing, Vol. 12, No. 6, 1994, pp. 19–29.

2

Periasamy, P., Principle and Practice of Insurance, 1st Edition, Himalaya Publishing House, Mumbai, 2005.

76

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

(premium intimation letter), educating policyholders who visit the LIC branch offices

(regarding products, premium payments, savings, income, investment etc.,) agent‟s

approach to policyholders (more professional approach, quickly handles queries, good

communication skills, solving problems) promotion of number of insured under

bancassurance were considered for the study.

3.5 PLACE OR PHYSICAL DISTRIBUTION STRATEGY

Place is another important element of marketing mix. Place refers to the location

where the product or service is available to the customer, including distribution channels.

Place contributes an important factor in the marketing of services (Bitner, 1990 1). In case

of life insurance, it is a combination of decisions regarding channels of distribution.

The emerging new opportunity for life insurance companies towards integration of the

financial services industry is bancassurance (Aggarwal, 20042). Bancassurance prospects

in India are really bright because huge banking infrastructure across urban, semi–urban

and rural India (Neelamegam and Veni, 20083) and life insurers are using this channel

(Shukla, 20064). New distributors like stockbrokers, financial planners, general agents,

and financial institutions etc. involve lower distribution costs, variable as opposed to

fixed expenses, lower front–end commission costs, and the opportunity of selling the

products in conjunction with other investment–related products (Chandler, 19945).

Strategy of worksite marketing is more useful in case of marketing of pension and health

plans. The widespread diffusion of the Internet has created an explosion in the growth of

electronic channels, including direct channels (that is, individual company web sites),

electronic markets, or electronic intermediaries over which multiple buyers and sellers do

1

Bitner, M. J., ―Evaluating Service Encounters: The Effects of Physical Surroundings and Employee

Responses, Journal of Marketing Research, Vol. 54, No. 2, 1990, pp. 69–82.

2

Aggarwal, V., ―Bancassurance: Concept, Framework and Implementation, The Journal of Insurance

Institute of India, Vol. 30, July–December, 2004, pp. 34–51.

3

Neelamegam, R. and Veni, K.P., ―Bancassurance–An Emerging Concept in India, The Journal of

Insurance Institute of India, Vol.34, January–June, 2008, pp. 49–54.

4

Shukla, A. K., ―Effect of Liberalisation on Indian Insurance Market–An Overview, The Journal of

Insurance Institute of India, Vol. 32, Jan.–June, 2006, pp. 10–12.

5

Chandler, M. L., ―Distribution Channels must adapt to Survive, Best„s Review (Life/Health), Vol. 94,

No. 9, 1994, pp. 54–56.

77

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

business (Malone, Yates, and Benjamin, 19871), and other cybermediaries (Sarkar,

Butler, and Steinfield, 19952). However, consumers have not shown a marked preference

for purchasing insurance product via the Internet (Trembly, 20013). The traditional

system of ―agents is the dominating one in India and this will continue to be a major

distribution channel for insurers, since this system has core roots in rural sector.

To study the place strategy, direct marketing, individual agents, insurance brokers,

bancassurance (corporate agents banks), other corporate agents, e-insurance/net marketing

were considered for the study.

3.6 PEOPLE STRATEGY

People, process, and physical evidence are the three ―Ps, which are especially

applicable to services marketing mix (Booms and Bitner, 19814). These three elements

are highly interrelated with each other. People are the main critical resource in any

organization, particularly service organization. Because of the simultaneity of production

and consumption in services, the service staff occupies the key position in influencing

customer„s perceptions of service quality. Woodruffe (1995) solely uses service personnel in

the ―People part of the services marketing mix. Recruiting the right staff and training

them appropriately in the delivery of their service is essential, if the service provider

wants to obtain a form of competitive advantage. Life insurance companies have to give

more attention in training and development their employees and agents. Building strong

relationship with their agents as well as the customers will help in meeting customer‟s

needs and serving them efficiently. Satisfaction depends on the nature of interaction

between customers and the people representing insurance companies. Training the

employees and agents to introduce new products and use of information technology for

efficiency both at staff and agent level are the key areas to look into.

1

Malone, T. W., Yates, J. and Benjamin, R. I., ―Electronic Markets and Electronic Hierarchies,

Communications of the ACM, Volume 30, No. 6, 1987, pp. 484–97.

2

Sarkar, M. B., Butler, B. and Steinfield, C., ―Intermediaries and Cybermediaries: A Continuing Role for

Mediating Players in the Electronic Marketplace, Journal of Computer Mediated Communication, Vol.1,

No.3, 1995, pp.1–14.

3

Trembly, A. C., ―Why the Insurance Industry has failed in the Online Distribution Channel, National

Underwriter (Property/Casualty/ Employee Benefits), Vol. 105, No. 37, 2001, pp. 19–21.

4

Booms, B. H. and Bitner, M. J. ―Marketing Strategies and Organization Structures for Service Firms, in

Donnelly, J. H. and George, W. R., (Eds), Marketing of services, American Marketing Association,

Chicago, 1981, pp. 47–51.

78

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

To study the people strategy, more frequent interaction by agent, development

officer, LIC officials to know policyholders needs, wants, ideas and complaints,

uninterrupted service is being provided at all counters of the branch office during working

hours, answering queries of policyholders over telephone/mobile phones by agents

regarding with policies, knowledge of branch employees and officials about the insurance

products, services and details of policyholder profile, development of utmost good faith

between the LIC of India and policyholders by employees, officials, agents, development

officer, etc., servicing time in branch office for premium payment, helpfulness of branch

manager/officials to the policyholders while facing any problem in surrendering, claim

settlement, maturity etc., customer friendliness of the employees, officials, development

officer, etc., were considered for the study.

3.7 PROCESS STRATEGY

A process is the method and sequence of actions in the service performance.

Unlike goods, services are processes. Services are the end results of deeds, acts,

performances, and activities performed by the firm„s employees alone or in conjunction

with various equipments, machinery, facilities, and so on. In assessing process, customers

evaluate whether the service follows a production–line approach or whether the process is

a customized one in which the customer is given personalized attention (Bowen and

Lawler, 19921). Shostack (19842) points out that since services are intangible and

therefore described in words by people, companies have to be really clear in defining the

service process. The risks of relying on words alone in describing services are the

oversimplification of the service, incompleteness of the description, subjectivity of

different readers and the biased interpretation of the words used to describe the service

(Shostack, 19873). This process involved in life insurance industry should be customer

friendly. The speed and accuracy of payment is of vital important. The process

methodology of life insurers should be such that it provides total ease and convenience to

1

Bowen, D.E. and Lawler, E.E., ―The Empowerment of Service Workers: What, Why, How and When,

Sloan Management Review, Vol. 33, No. 3, 1992, pp.31–39.

2

Shostack, L., ―Designing Services That Deliver, Harvard Business Review, Vol. 62, No. 1,

1984, pp. 133–139.

3

Shostack, L., ―Service Positioning through Structural Change, Journal of Marketing, Vol. 51,

No. 1, 1987, pp. 34–43.

79

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

the customers. Badly designed and poor processes lead to slow and inefficient delivery

and make it difficult for insurance employees and agents to do their job well.

Consequently it will result in low productivity and service failures.

In process strategy (Procedural aspect is called as Process Strategy), time taken

for taking policy, getting policy document, revival, getting loan, claim settlement and

surrender of policy, more information about various products and services in branch

office, essential services offered for the first time without discomforting the customer,

effectiveness of grievance redressal mechanism, improvement of quality of service of

LIC through different distribution channels to policyholders, premium paid certificate for

claiming tax benefits and customer-contact employees (insurance surveyors, loss assessors,

insurance advisors, agents and brokers) interact with customer during the service delivery

were considered for the study.

3.8 PHYSICAL EVIDENCE STRATEGY

The physical evidence is defined as the environment in which the service is

delivered and where the service provider and the customers interact, and any tangible

commodities that facilitate performance or communicate the service. According to

Zeithaml and Bitner (20031), to evaluate services before its purchase and to assess their

satisfaction with the service after it is bought, customers tend to rely on tangible cues, or

physical evidence. The appearance of building, landscaping, interior furnishing, equipments,

printed materials, and other visible cues all provide tangible evidence of a firm„s service

quality. This sort of physical evidence provides excellent opportunities for a service firm

to send clear and consistent marketing messages regarding the firm„s purpose the

intended market segment, and the nature of the service (Bitner, 1992 2 and 19963). In case

of insurance business, apart from office environment, materials such as brochures, policy

documents, and periodic statements are the tangibles, which will influence the customers.

Insurance companies and intermediaries need to manage all these physical evidences

1

Zeithaml, V. A. and Bitner, M. J., Services Marketing: Integrating Customer Focus across the Firm, 3rd

Edition, McGraw–Hill, New York, 2003.

2

Bitner, M. J., - Servicescapes: The Impact of Physical Surroundings on Customers and Employees,

Journal of Marketing, Vol. 56, No. 2, 1992, pp. 57–71.

3

Bitner, M. J., Services Marketing, McGraw Hill, New York, 1996.

80

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

carefully as they can have a profound impact on the impression of the customers.

Although all insurance companies provide similar essential service, the differences that

do exist are the physical evidence.

In physical evidence strategy (it brings tangibility to the invisible service and

helps customers to understand what they are buying and why they should buy it), exterior

facility (buildings, exterior design, parking, surrounding environment, signage,

landscape) in the LIC of India, interior facility (interior decor (or) design, layout, signage,

equipment, lifts, ventilation, proper seating, sidewalks for every movements , etc.,) in the

LIC of India, location of the LIC of India branches, appearance of personnel (agents,

officials and employees of the LIC of India), details of policy document, physical

attributes (brand name, logos, consistent standards, the LIC diaries, calendars, magazines),

insurance agent for the first time relies on tangible clues such as information brochures,

agents behavior, identity proof etc., service standards, guarantees and testimonials by

company‟s experts were considered for the study.

3.9 CONCLUSION

In this chapter an attempt has been made to bring out the marketing strategies of

the LIC of India with the mixture of the seven „P‟s namely Product, Price, Promotion,

Place, People, Process and Physical Evidence. Marketing strategy implies development

of an action plan to achieve the marketing objectives. Marketing strategy is a composite

of Insurance services, widely known as marketing mix, suitable to the people of India and

capable of meeting institutional objectives in the light of fast changes in the requirements

of life insurance policyholders of different socio-economic profile. Thus it is concluded

that the strategy of the insurance companies needs to be regularly monitored and

reviewed to keep the life insurance effective and viable.

81

Please purchase PDF Split-Merge on www.verypdf.com to remove this watermark.

You might also like

- CHAKRA FOR SEX - Harnessing The Sexual EnergyDocument36 pagesCHAKRA FOR SEX - Harnessing The Sexual EnergyDamir67% (3)

- 06 Chapter 1 MARKETING STRATEGIES IN LIFE INSURANCE BUSINESSDocument61 pages06 Chapter 1 MARKETING STRATEGIES IN LIFE INSURANCE BUSINESSrahulhaldankarNo ratings yet

- UGC NET - Marketing ManagementDocument85 pagesUGC NET - Marketing ManagementKasiraman Ramanujam100% (1)

- James DiagramsDocument73 pagesJames DiagramsgabrielNo ratings yet

- Brigada Eskwela Regional Kick-Off Program FINAL PDFDocument2 pagesBrigada Eskwela Regional Kick-Off Program FINAL PDFmsantos2870% (10)

- Marketing Strategies-2738 PDFDocument4 pagesMarketing Strategies-2738 PDFrajuNo ratings yet

- MINOR PROJECT On InsuranceDocument53 pagesMINOR PROJECT On InsurancedivyaNo ratings yet

- 1.1) Explain The Various Elements of The Marketing ProcessDocument14 pages1.1) Explain The Various Elements of The Marketing ProcessKasim MalikNo ratings yet

- Marketing Strategy of LicDocument58 pagesMarketing Strategy of Licsoniharshvardhan214No ratings yet

- 1:-Introduction 1.1: - Importance of The TopicDocument62 pages1:-Introduction 1.1: - Importance of The TopicRICHA mehtaNo ratings yet

- Marketing Strategies in Life Insurance Business: Chapter - IiDocument40 pagesMarketing Strategies in Life Insurance Business: Chapter - IiChayanika KashyapNo ratings yet

- Marketing Management ofDocument17 pagesMarketing Management ofprince goyalNo ratings yet

- Project Report On Marketing Techinques of Ing Vysya Life InsuranceDocument9 pagesProject Report On Marketing Techinques of Ing Vysya Life Insurancemujeebul_siddiquiNo ratings yet

- Rough MKTNG Insrnce PRCT FinalDocument68 pagesRough MKTNG Insrnce PRCT Finalmrchavan143No ratings yet

- Contemporary Issues in Marketing of Life PDFDocument15 pagesContemporary Issues in Marketing of Life PDFSameer GaikwadNo ratings yet

- Final ProjectDocument14 pagesFinal Projectkiru_makhija100% (1)

- LIC ReportDocument65 pagesLIC ReportAtish PandaNo ratings yet

- Report On STDP Analysis HDFC Life (Harsh Gulabani)Document7 pagesReport On STDP Analysis HDFC Life (Harsh Gulabani)Harsh GulabaniNo ratings yet

- 7 PsDocument5 pages7 PsatulbhushanNo ratings yet

- Insurance Marketing India 03Document19 pagesInsurance Marketing India 03mehedi hasanNo ratings yet

- Icici Prudential Final DraftDocument21 pagesIcici Prudential Final DraftDavid JohnNo ratings yet

- 10 Chapter 6Document62 pages10 Chapter 6Satya Prakash ChinnaraNo ratings yet

- Indian Insurance SectorDocument18 pagesIndian Insurance SectorSaket KumarNo ratings yet

- SM Unit 3Document9 pagesSM Unit 3KANNAN MNo ratings yet

- Marketing of InsuranceDocument22 pagesMarketing of InsuranceshrenikNo ratings yet

- Marketing of Insurance FinalDocument44 pagesMarketing of Insurance Finalshrenik100% (1)

- Research PaperDocument10 pagesResearch PaperrahulNo ratings yet

- 7 P's of Services MarketingDocument169 pages7 P's of Services MarketingZulejha IsmihanNo ratings yet

- Fundamentals of Modern Marketing: Marketing Management Iii Sem Bba 2021Document28 pagesFundamentals of Modern Marketing: Marketing Management Iii Sem Bba 2021MANN JAINNo ratings yet

- Turnaround ManagementDocument8 pagesTurnaround ManagementaimyNo ratings yet

- P6Document6 pagesP6pardeshikanchan07No ratings yet

- TOPIC 1 Role of MarketingDocument69 pagesTOPIC 1 Role of MarketingArif Sofi100% (1)

- Bharti AXA General Insurance Is A Joint Venture Between BhartiDocument34 pagesBharti AXA General Insurance Is A Joint Venture Between BhartiNavpreet SinghNo ratings yet

- Himalayan College of Management Marketing Management MGMT 5212Document11 pagesHimalayan College of Management Marketing Management MGMT 5212iam arpanNo ratings yet

- Chapter-1 Introduction - Role of Advertising in InsuranceDocument57 pagesChapter-1 Introduction - Role of Advertising in InsuranceManasvi Darshan Tolia100% (2)

- Introduction To Marketing: by Jojo Joy NDocument111 pagesIntroduction To Marketing: by Jojo Joy NVivinNo ratings yet

- HimanshuDocument3 pagesHimanshukamal panchalNo ratings yet

- Suggestion and ConclusionDocument4 pagesSuggestion and ConclusionSidhantha Jain100% (1)

- Distribution ChannelsDocument28 pagesDistribution ChannelsAbhinav G PandeyNo ratings yet

- Shubham KumarDocument3 pagesShubham Kumarkamal panchalNo ratings yet

- Dawud MarcetingDocument51 pagesDawud Marcetingshambel misgieNo ratings yet

- Abstract and Introduction For InterimDocument54 pagesAbstract and Introduction For InterimPriti SivasubramanianNo ratings yet

- MaricoDocument78 pagesMaricoShyam Maari67% (3)

- 7ps of International Marketing With Ref To Domestic & International MarketsDocument15 pages7ps of International Marketing With Ref To Domestic & International MarketsSimrat Singh Arora0% (2)

- Marketing MixDocument6 pagesMarketing MixHimanshu PaliwalNo ratings yet

- A Study On Marketing Strategies and Sales Development Methiods in Amul Ltd.Document34 pagesA Study On Marketing Strategies and Sales Development Methiods in Amul Ltd.Shailesh AsampallyNo ratings yet

- Marketing of Insurance Services PDFDocument19 pagesMarketing of Insurance Services PDFRajeshsharmapurangNo ratings yet

- Marketing Mix Insurance SectorDocument4 pagesMarketing Mix Insurance SectorSantosh Pradhan100% (1)

- Nature, Scope & Marketing of Banking and Insurance ServicesDocument17 pagesNature, Scope & Marketing of Banking and Insurance ServicesAmit PrakashNo ratings yet

- Task 1 - ReferênciasDocument4 pagesTask 1 - ReferênciasAlan Toledo100% (1)

- Explore Measurements To Advance The Service Quality of Janashakthi Insurance Life Claims DepartmentDocument24 pagesExplore Measurements To Advance The Service Quality of Janashakthi Insurance Life Claims DepartmentNuwan KumarasingheNo ratings yet

- Report On Customer Relationship ManagementDocument19 pagesReport On Customer Relationship ManagementjerthNo ratings yet

- Sip Project Proposal 21029Document6 pagesSip Project Proposal 21029Priyanka MoreNo ratings yet

- Marketing 7 P's of InsuranceDocument169 pagesMarketing 7 P's of InsuranceVinit Poojary75% (4)

- INSPLOREDocument17 pagesINSPLOREGarima PandeyNo ratings yet

- Reliance: A Project Report ON Marketing Mix and Insurance Awareness in Retail SectorDocument61 pagesReliance: A Project Report ON Marketing Mix and Insurance Awareness in Retail SectorSuhas IngaleNo ratings yet

- Insurance Marketing India 01Document12 pagesInsurance Marketing India 01mehedi hasanNo ratings yet

- Marketing Mastery: Strategies for Building and Sustaining a Strong Customer BaseFrom EverandMarketing Mastery: Strategies for Building and Sustaining a Strong Customer BaseNo ratings yet

- Digital Marketing Decoded: A Comprehensive Guide to 2024 Strategies and TacticsFrom EverandDigital Marketing Decoded: A Comprehensive Guide to 2024 Strategies and TacticsNo ratings yet

- Dance Like A ManDocument4 pagesDance Like A ManShubhadip aichNo ratings yet

- Bowthorpe News May 2017Document36 pagesBowthorpe News May 2017Anonymous AySEIwycNo ratings yet

- Eyewash and Safety Shower SiDocument3 pagesEyewash and Safety Shower SiAli EsmaeilbeygiNo ratings yet

- Experimental and CFD Resistance Calculation of A Small Fast CatamaranDocument7 pagesExperimental and CFD Resistance Calculation of A Small Fast CatamaranChandra SibaraniNo ratings yet

- Mathematics: Quarter 3 - Module 5: Independent & Dependent EventsDocument19 pagesMathematics: Quarter 3 - Module 5: Independent & Dependent EventsAlexis Jon NaingueNo ratings yet

- Chapter 2: Decision MakingDocument16 pagesChapter 2: Decision Makingafzal_aNo ratings yet

- Create BAPI TutorialDocument28 pagesCreate BAPI TutorialRoberto Trejos GonzalezNo ratings yet

- Importance of Assessment of Intelligence in Clinical PsychologyDocument1 pageImportance of Assessment of Intelligence in Clinical PsychologyKimberly AlcantaraNo ratings yet

- Detail of Common Toilet: Section Elevation C - C' Section Elevation D - D'Document1 pageDetail of Common Toilet: Section Elevation C - C' Section Elevation D - D'RichaNo ratings yet

- Tle Ap-Swine Q3 - WK3 - V4Document7 pagesTle Ap-Swine Q3 - WK3 - V4Maria Rose Tariga Aquino100% (1)

- Oops (Object Oriented Programming Structure)Document10 pagesOops (Object Oriented Programming Structure)MANOJ SNo ratings yet

- Article 2013 Legume Perspectives 1-45-46Document53 pagesArticle 2013 Legume Perspectives 1-45-46kondwanigift0101No ratings yet

- Schwarze Schlichte Salesfolder enDocument6 pagesSchwarze Schlichte Salesfolder en姚晓卫No ratings yet

- Services Provided by Merchant BanksDocument4 pagesServices Provided by Merchant BanksParul PrasadNo ratings yet

- 2010 Complete Algop Primary ResultsDocument206 pages2010 Complete Algop Primary ResultsCatherine SnowNo ratings yet

- Form LRA 42Document3 pagesForm LRA 42Godfrey ochieng modiNo ratings yet

- Boreal Forests Canadian Shield Tundra Arctic Canadian Rockies Coast Mountains Prairies Great Lakes St. Lawrence RiverDocument2 pagesBoreal Forests Canadian Shield Tundra Arctic Canadian Rockies Coast Mountains Prairies Great Lakes St. Lawrence Riversaikiran100No ratings yet

- Pediatric OrthopaedicDocument66 pagesPediatric OrthopaedicDhito RodriguezNo ratings yet

- Space Planning Guidelines: Edition 2Document29 pagesSpace Planning Guidelines: Edition 2Nur Nabilah SyazwaniNo ratings yet

- Amazon Goes To HollywoodDocument27 pagesAmazon Goes To Hollywoodvalentina cahya aldamaNo ratings yet

- Weight Tracking Chartv2 365days WeeklyDocument20 pagesWeight Tracking Chartv2 365days WeeklyozgegizemNo ratings yet

- Annotated BibliographyDocument7 pagesAnnotated Bibliographyapi-340711045No ratings yet

- Persons With Disabilities: Key PointsDocument8 pagesPersons With Disabilities: Key PointsShane ArroyoNo ratings yet

- Final Management Project On Geo TVDocument35 pagesFinal Management Project On Geo TVAli Malik100% (1)

- Annex VI - Final Narrative ReportDocument4 pagesAnnex VI - Final Narrative ReporttijanagruNo ratings yet

- Final English Presentation - FiskDocument8 pagesFinal English Presentation - FiskMary FreakyNo ratings yet

- Kakhisong Church A2-ModelDocument1 pageKakhisong Church A2-ModelanzaniNo ratings yet