Professional Documents

Culture Documents

Problem 1. ASHTA Company Has The Following Transactions

Problem 1. ASHTA Company Has The Following Transactions

Uploaded by

JhunCopyright:

Available Formats

You might also like

- Mastering Fundamental AnalysisDocument242 pagesMastering Fundamental Analysissairanga1997% (31)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- 162 001Document1 page162 001Christian Mark AbarquezNo ratings yet

- AuditingDocument13 pagesAuditingVenilyn Valencia75% (4)

- 2019 AudProb ARevenueCycleDocument8 pages2019 AudProb ARevenueCycleJhun0% (2)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Karkits CorporationDocument4 pagesKarkits Corporation김우림0% (3)

- CHAPTER 10 - Pre-Board Examinations-1Document35 pagesCHAPTER 10 - Pre-Board Examinations-1Mr.AccntngNo ratings yet

- AUDITING PROBLEMS TEST BANK 2 With AnswersDocument14 pagesAUDITING PROBLEMS TEST BANK 2 With AnswersKimberly Milante100% (4)

- Paper 1 Financial AccountingDocument10 pagesPaper 1 Financial AccountingTuryamureeba JuliusNo ratings yet

- Financial StatementsDocument6 pagesFinancial StatementsLuiNo ratings yet

- Santos, Donise Ronadel D. Section 9 Activity Module 9Document4 pagesSantos, Donise Ronadel D. Section 9 Activity Module 9Donise Ronadel SantosNo ratings yet

- 2018 - Audpra - LiabSHE 1Document1 page2018 - Audpra - LiabSHE 1JhunNo ratings yet

- Audit of LiabilitiesDocument5 pagesAudit of LiabilitiesMenacexgNo ratings yet

- AP QuizzerDocument9 pagesAP QuizzerAngel TumamaoNo ratings yet

- Audit of Liabilities Problem No. 1: Auditing ProblemsDocument8 pagesAudit of Liabilities Problem No. 1: Auditing ProblemsSailah DimakutaNo ratings yet

- AUDITING-Audit of LiabilitiesDocument9 pagesAUDITING-Audit of LiabilitiesJamhel MarquezNo ratings yet

- LiabilityDocument8 pagesLiabilityAce DesabilleNo ratings yet

- Liability SeatworkDocument8 pagesLiability SeatworkMary Ann B. GabucanNo ratings yet

- Auditing Problems Test Bank 2 Auditing Problems Test Bank 2Document16 pagesAuditing Problems Test Bank 2 Auditing Problems Test Bank 2xjammerNo ratings yet

- Home Work Dec 26 2018Document5 pagesHome Work Dec 26 2018shejaguarNo ratings yet

- Audit ProbDocument16 pagesAudit ProbJewel Mae Mercado100% (1)

- Date Description AmountDocument5 pagesDate Description AmountClaire BarbaNo ratings yet

- Applied Auditing Quiz #1 (Diagnostic Exam)Document7 pagesApplied Auditing Quiz #1 (Diagnostic Exam)ephraimNo ratings yet

- Comprehensive ProblemDocument2 pagesComprehensive ProblemCeline Floranza100% (1)

- Applied Auditing Quiz #1 (Diagnostic Exam)Document15 pagesApplied Auditing Quiz #1 (Diagnostic Exam)xjammerNo ratings yet

- FAR - Midterms and FinalsDocument14 pagesFAR - Midterms and FinalsShanley Vanna EscalonaNo ratings yet

- Audit Fot Liability Problem #2Document3 pagesAudit Fot Liability Problem #2Ma Teresa B. CerezoNo ratings yet

- Acctg336 - Opening CaseDocument6 pagesAcctg336 - Opening CaseSheila DominguezNo ratings yet

- Auditing Problems Test Bank 2Document10 pagesAuditing Problems Test Bank 2Ne BzNo ratings yet

- Auditing Problems Test Bank 2Document15 pagesAuditing Problems Test Bank 2Mark Jonah Bachao80% (5)

- Accounting For Warranties and PremiumsDocument8 pagesAccounting For Warranties and Premiumsalcazar rtuNo ratings yet

- Auditing 1 Final ExamDocument8 pagesAuditing 1 Final ExamEdemson NavalesNo ratings yet

- Toaz - Info Afar Reviewer PRDocument10 pagesToaz - Info Afar Reviewer PRLiliNo ratings yet

- NOTES PROBLEMS ACCTG-323-newDocument3 pagesNOTES PROBLEMS ACCTG-323-newJoyluxxiNo ratings yet

- 3b79070f9fdf9cd3f1dc5d6aeda6e1c3Document3 pages3b79070f9fdf9cd3f1dc5d6aeda6e1c3Vivian TamerayNo ratings yet

- Adjusting Entry ProblemsDocument5 pagesAdjusting Entry ProblemsRize Takatsuki100% (1)

- Review of The Accounting Process PDFDocument3 pagesReview of The Accounting Process PDFShiela Marie Sta AnaNo ratings yet

- Auditing Problem 12-18-21Document23 pagesAuditing Problem 12-18-21Joebelle JamosoNo ratings yet

- A. Cash and Cash EquivalentsDocument24 pagesA. Cash and Cash EquivalentskimkimNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting Entriesdatu puti33% (3)

- Practice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetDocument11 pagesPractice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetBenedict FajardoNo ratings yet

- Answer Quiz 1-Ol2Document15 pagesAnswer Quiz 1-Ol2Kristina KittyNo ratings yet

- ENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 2022Document9 pagesENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 202202Adibah Seila NafazaNo ratings yet

- Quiz ZDocument5 pagesQuiz ZShannen CalimagNo ratings yet

- Accounts Accounts Cash + Receivable + Supplies + Equipment Payable +Document4 pagesAccounts Accounts Cash + Receivable + Supplies + Equipment Payable +greysonNo ratings yet

- CHAPTER 8 Caselette Audit of LiabilitiesDocument32 pagesCHAPTER 8 Caselette Audit of LiabilitiesNavarro, April Rose P.No ratings yet

- Quiz - CashDocument1 pageQuiz - CashAna Mae HernandezNo ratings yet

- Accounting Level IV Coc: Project OneDocument5 pagesAccounting Level IV Coc: Project OneTewodros BekeleNo ratings yet

- Fragment M 11Document7 pagesFragment M 11sm munNo ratings yet

- Loans and Receivables Handout1Document3 pagesLoans and Receivables Handout1XXXXXXXXXXXXXXXXXXNo ratings yet

- Auditing ProblemsDocument6 pagesAuditing ProblemsMaurice AgbayaniNo ratings yet

- 02 Unit 1-Audit of Liabilities ExercisesDocument21 pages02 Unit 1-Audit of Liabilities Exerciseskara albueraNo ratings yet

- ReSA B43 AFAR Final PB Exam - Questions, Answers - SolutionsDocument25 pagesReSA B43 AFAR Final PB Exam - Questions, Answers - SolutionsElaine Joyce GarciaNo ratings yet

- Final Examination in Auditing Principles and Application 1Document8 pagesFinal Examination in Auditing Principles and Application 1Anie Martinez0% (1)

- Merchandising 2 Set ADocument2 pagesMerchandising 2 Set AGabrielle VizcarraNo ratings yet

- AP Liab 1stsetDocument9 pagesAP Liab 1stsetMaritessNo ratings yet

- BKNC3 - Activity 1 - Review ExamDocument3 pagesBKNC3 - Activity 1 - Review ExamDhel Cahilig0% (1)

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Auditing Revenue CycleDocument3 pagesAuditing Revenue CycleJhunNo ratings yet

- 2018 - Audpra - LiabSHE 1Document1 page2018 - Audpra - LiabSHE 1JhunNo ratings yet

- Beneath Your BeautifulDocument3 pagesBeneath Your BeautifulJhunNo ratings yet

- Audit Ethics CaseletsDocument4 pagesAudit Ethics CaseletsJhun33% (3)

- An Analytical Study of Employee Stock Option SchemeDocument10 pagesAn Analytical Study of Employee Stock Option SchemeIjcams PublicationNo ratings yet

- CP11 September22 EXAMDocument5 pagesCP11 September22 EXAMElroy PereiraNo ratings yet

- Accounting AssignmentDocument7 pagesAccounting AssignmentGui Xiang KhooNo ratings yet

- Mint Delhi 01-02-2024 240201 083443Document18 pagesMint Delhi 01-02-2024 240201 083443PRINCE SHARMANo ratings yet

- FINANCIAL POSITION June302017Document10 pagesFINANCIAL POSITION June302017Reginald ValenciaNo ratings yet

- Quotation - 179337.pdf - PDF UNION CHEMICALSDocument3 pagesQuotation - 179337.pdf - PDF UNION CHEMICALSW GangenathNo ratings yet

- Pengaruh Kinerja Keuangan Dan Ekonomi Makro Terhadap Harga Saham Perusahaan Manufaktur Yang Terdaftar Dibursa Efek IndoneisaDocument25 pagesPengaruh Kinerja Keuangan Dan Ekonomi Makro Terhadap Harga Saham Perusahaan Manufaktur Yang Terdaftar Dibursa Efek IndoneisaOptimis SelaluNo ratings yet

- Business Finance Module 1Document10 pagesBusiness Finance Module 1Adoree RamosNo ratings yet

- HL Basic Savings A - C 042022Document2 pagesHL Basic Savings A - C 042022Taufiq AriffinNo ratings yet

- New Central Bank Act ReviewerDocument10 pagesNew Central Bank Act ReviewernoorlawNo ratings yet

- Covering LetterDocument2 pagesCovering LetterAishwary SinhaNo ratings yet

- ABC Analysis CA FinalDocument8 pagesABC Analysis CA FinalvenkatprashanthNo ratings yet

- Organization and Management Quarter 2.1Document38 pagesOrganization and Management Quarter 2.1Ehlvie PreciosoNo ratings yet

- More Thought Square Foot: Enlivening WorkspacesDocument173 pagesMore Thought Square Foot: Enlivening WorkspacesRaviraj Tiruke100% (1)

- CV - Rejaul Karim - 03.10.2023Document5 pagesCV - Rejaul Karim - 03.10.2023Md Byzed AhmedNo ratings yet

- Channel Trading StrategyDocument51 pagesChannel Trading StrategyVijay86% (7)

- Modules and TasksDocument2 pagesModules and TasksRITESH NANDANNo ratings yet

- Snowflake Sec Form s1Document848 pagesSnowflake Sec Form s1anoopiit2012No ratings yet

- Discussion Questions: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument7 pagesDiscussion Questions: Manila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- Practice Problems CH 12Document3 pagesPractice Problems CH 12Samira PereziqNo ratings yet

- AAT Skillcheck ResultsDocument9 pagesAAT Skillcheck ResultsCiprian IchimNo ratings yet

- List of Lease Instruments With Isin No. - Ewyc-Wfc-2012Document12 pagesList of Lease Instruments With Isin No. - Ewyc-Wfc-2012Wajid100% (1)

- Mba Project AxiesDocument55 pagesMba Project Axiespavan kumarNo ratings yet

- Derivatives Jan 11Document5 pagesDerivatives Jan 11Matthew FlemingNo ratings yet

- Articulate English May-2023Document88 pagesArticulate English May-2023Rani KumariNo ratings yet

- Sunil Jain ResumeDocument4 pagesSunil Jain Resumesunilmalpura5768100% (5)

- Internet Banking Sample ProposalDocument6 pagesInternet Banking Sample Proposalprem09080% (1)

- FRRB 2Document220 pagesFRRB 2gauravmandu100% (2)

Problem 1. ASHTA Company Has The Following Transactions

Problem 1. ASHTA Company Has The Following Transactions

Uploaded by

JhunOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem 1. ASHTA Company Has The Following Transactions

Problem 1. ASHTA Company Has The Following Transactions

Uploaded by

JhunCopyright:

Available Formats

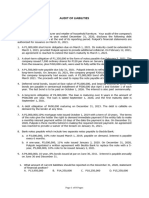

Problem 1. ASHTA Company has the following transactions.

Feb 2 The company purchased goods from Happy Corp. for P150,000 subject to cash discount

germs of 2/10, n/30. The company records purchases and accounts payable at net amounts

after cash discounts. The invoice was paid on February 25.

April 1 The company purchased a truck for P120,000 from Broom Motors Corp., paying P12,000 in

cash and signing a one-year, 12% note for the balance of the purchase price.

May 1 The company borrowed P240,000 from Manila Bank by signing a P276,000 noninterest-

bearing note due one year form May 1

Aug 1 The company’s board of directors declared a P900,000 cash dividend that was payable on

September 10 to shareholders of record on August 31.

Requirements:

1. Prepare all journal entries necessary to record the transactions described about.

2. Assume that ASHTA’s financial statement ends on December 31 and that no adjusting entries

relative to the transactions above been recorded. Prepare any adjusting journal entries concerning

interest that are necessary to present fair financial statements at December 31.

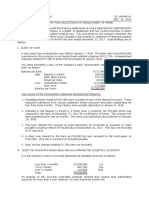

Problem 2. In conjunction with your firm’s examination of the financial statements of BATUR as of

December 31, 2017, you obtained the information from the company’s voucher register shown in the

work paper below.

No Date Ref Description Amount Charged

1 12.18 200 Supplies, shipped FOB destination P 15,000 Supplies

12.15.17; received 12.17.17

2 12.18 203 Auto insurance, 12.15.17 - 12.15.18 22,000 Prepaid Ins

3 12.21 209 Repairs services; received 12.20.17 19,000 Repairs

4 12.26 212 Merchandise, shipped FOB shipping 123,000 Inventory

point, 12.20.17; received 12.24.17

5 12.21 210 Payroll, 12.07.17 – 12.21.17 (12 days) 69,000 Salaries

6 12.21 234 Subscription to magazine for 2018 5,000 Subs. Exp

7 12.28 236 Utilities for December 2017 24,000 Utilities Exp

8 12.28 241 Merchandise, shipped FOB 111,500 Inventory

destination, 12.24.17; received 1.2.18

9 12.28 242 Merchandise, shipped FOB 84,000 Inventory

destination, 12.24.17; received 1.2.18

10 1.2 1 Legal services; received 12.28.17 46,000 Legal Exp

11 1.2 2 Medical services for employees for 25,000 Medical Exp

December 2017

12 1.5 3 Merchandise shipped FOB shipping 55,000 Inventory

point, 12.29.17 received 1.4.18

13 1.10 4 Payroll 12.21.17-1.5.13 (12 days total, 72,000 Salaries

4 days in January 2018)

14 1.10 6 Merchandise, shipped FOB shipping 64,000 Inventory

point 1.2.18 received 1.6.18

15 1.12 8 Merchandise, shipped FOB 38,000 Inventory

destination 1.3.18 received 1.10.18

16 1.13 9 Maintenance services received 1.9.18 9,000 Repairs

17 1.14 10 Interest on bank loan, 10.10.17- 30,000 Interest Exp

1.10.18

18 1.15 11 Manufacturing equipment, installed 254,000 Machinery &

12.29.17 Equip

19 1.15 12 Dividend declared 1.15.18 160,000 Div Payable

Accrued liabilities as of December 31, 2017 were as follows:

Accrued payroll P 48,000

Accrued interest payable 26,666

Dividends payable 160,000

The accrued payroll and accrued interest payable were reversed effective 1.1.8.

Requirements:

Review the data given above and prepare journal entries to adjust the accounts on December 31, 2017.

Assume that the company follows FOB terms for recording inventory purchases.

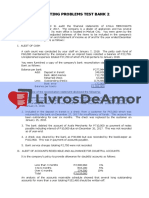

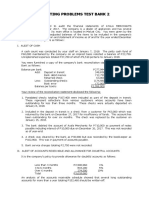

Problem 3. The shareholder’s equity section of RAIN Company’s statement of financial position as of

December 31, 2016 is as follows:

Ordinary share capital (P5 par, 250,000 shares

Authorized, 17,500 issued and outstandingP 687,500

Share premium 275,000

Total Paid-in Capital P962,500

Unappropriated retained earnings P 667,500

Appropriated retained earnings 250,000

Total retained earnings 917,500

Total shareholders’ equity P 1,880,000

Rain had the following equity transactions in 2017:

Jan 15 Completed the building renovation for which P250,000 of retained earnings had been

restricted. Paid the contractor P242,500 all of which is capitalized.

Mar 3 Issued 50,000 additional ordinary shares for P8 per share.

May 18 Declared a dividend of P1,50 per share to be paid on July 31, 2017 to shareholders of record

on June 30, 2017.

June 19 Approved additional building renovation to be funded internally. The estimated cost of the

project is P200,000 and retained earnings are to be restricted for that amount.

July 31 Paid the dividend.

Dec 31 Declared a property dividend to be paid on January 10, 2018, to shareholders of record on

Jan 5, 2018. The dividend is to consist of equipment with a carrying value of P150,000. The

equipment’s fair value at December 31, 2017 is P157,500.

Dec 31 Reported P442,500 of net income on December 31, 2017 income statement.

Requirements: What is the balance of the following account at December 31, 2017?

1. Ordinary Share Capital

2. Share Premium

3. Unappropriated Retained Earnings

4. Shareholder’s Equity

You might also like

- Mastering Fundamental AnalysisDocument242 pagesMastering Fundamental Analysissairanga1997% (31)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- 162 001Document1 page162 001Christian Mark AbarquezNo ratings yet

- AuditingDocument13 pagesAuditingVenilyn Valencia75% (4)

- 2019 AudProb ARevenueCycleDocument8 pages2019 AudProb ARevenueCycleJhun0% (2)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Karkits CorporationDocument4 pagesKarkits Corporation김우림0% (3)

- CHAPTER 10 - Pre-Board Examinations-1Document35 pagesCHAPTER 10 - Pre-Board Examinations-1Mr.AccntngNo ratings yet

- AUDITING PROBLEMS TEST BANK 2 With AnswersDocument14 pagesAUDITING PROBLEMS TEST BANK 2 With AnswersKimberly Milante100% (4)

- Paper 1 Financial AccountingDocument10 pagesPaper 1 Financial AccountingTuryamureeba JuliusNo ratings yet

- Financial StatementsDocument6 pagesFinancial StatementsLuiNo ratings yet

- Santos, Donise Ronadel D. Section 9 Activity Module 9Document4 pagesSantos, Donise Ronadel D. Section 9 Activity Module 9Donise Ronadel SantosNo ratings yet

- 2018 - Audpra - LiabSHE 1Document1 page2018 - Audpra - LiabSHE 1JhunNo ratings yet

- Audit of LiabilitiesDocument5 pagesAudit of LiabilitiesMenacexgNo ratings yet

- AP QuizzerDocument9 pagesAP QuizzerAngel TumamaoNo ratings yet

- Audit of Liabilities Problem No. 1: Auditing ProblemsDocument8 pagesAudit of Liabilities Problem No. 1: Auditing ProblemsSailah DimakutaNo ratings yet

- AUDITING-Audit of LiabilitiesDocument9 pagesAUDITING-Audit of LiabilitiesJamhel MarquezNo ratings yet

- LiabilityDocument8 pagesLiabilityAce DesabilleNo ratings yet

- Liability SeatworkDocument8 pagesLiability SeatworkMary Ann B. GabucanNo ratings yet

- Auditing Problems Test Bank 2 Auditing Problems Test Bank 2Document16 pagesAuditing Problems Test Bank 2 Auditing Problems Test Bank 2xjammerNo ratings yet

- Home Work Dec 26 2018Document5 pagesHome Work Dec 26 2018shejaguarNo ratings yet

- Audit ProbDocument16 pagesAudit ProbJewel Mae Mercado100% (1)

- Date Description AmountDocument5 pagesDate Description AmountClaire BarbaNo ratings yet

- Applied Auditing Quiz #1 (Diagnostic Exam)Document7 pagesApplied Auditing Quiz #1 (Diagnostic Exam)ephraimNo ratings yet

- Comprehensive ProblemDocument2 pagesComprehensive ProblemCeline Floranza100% (1)

- Applied Auditing Quiz #1 (Diagnostic Exam)Document15 pagesApplied Auditing Quiz #1 (Diagnostic Exam)xjammerNo ratings yet

- FAR - Midterms and FinalsDocument14 pagesFAR - Midterms and FinalsShanley Vanna EscalonaNo ratings yet

- Audit Fot Liability Problem #2Document3 pagesAudit Fot Liability Problem #2Ma Teresa B. CerezoNo ratings yet

- Acctg336 - Opening CaseDocument6 pagesAcctg336 - Opening CaseSheila DominguezNo ratings yet

- Auditing Problems Test Bank 2Document10 pagesAuditing Problems Test Bank 2Ne BzNo ratings yet

- Auditing Problems Test Bank 2Document15 pagesAuditing Problems Test Bank 2Mark Jonah Bachao80% (5)

- Accounting For Warranties and PremiumsDocument8 pagesAccounting For Warranties and Premiumsalcazar rtuNo ratings yet

- Auditing 1 Final ExamDocument8 pagesAuditing 1 Final ExamEdemson NavalesNo ratings yet

- Toaz - Info Afar Reviewer PRDocument10 pagesToaz - Info Afar Reviewer PRLiliNo ratings yet

- NOTES PROBLEMS ACCTG-323-newDocument3 pagesNOTES PROBLEMS ACCTG-323-newJoyluxxiNo ratings yet

- 3b79070f9fdf9cd3f1dc5d6aeda6e1c3Document3 pages3b79070f9fdf9cd3f1dc5d6aeda6e1c3Vivian TamerayNo ratings yet

- Adjusting Entry ProblemsDocument5 pagesAdjusting Entry ProblemsRize Takatsuki100% (1)

- Review of The Accounting Process PDFDocument3 pagesReview of The Accounting Process PDFShiela Marie Sta AnaNo ratings yet

- Auditing Problem 12-18-21Document23 pagesAuditing Problem 12-18-21Joebelle JamosoNo ratings yet

- A. Cash and Cash EquivalentsDocument24 pagesA. Cash and Cash EquivalentskimkimNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting Entriesdatu puti33% (3)

- Practice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetDocument11 pagesPractice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetBenedict FajardoNo ratings yet

- Answer Quiz 1-Ol2Document15 pagesAnswer Quiz 1-Ol2Kristina KittyNo ratings yet

- ENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 2022Document9 pagesENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 202202Adibah Seila NafazaNo ratings yet

- Quiz ZDocument5 pagesQuiz ZShannen CalimagNo ratings yet

- Accounts Accounts Cash + Receivable + Supplies + Equipment Payable +Document4 pagesAccounts Accounts Cash + Receivable + Supplies + Equipment Payable +greysonNo ratings yet

- CHAPTER 8 Caselette Audit of LiabilitiesDocument32 pagesCHAPTER 8 Caselette Audit of LiabilitiesNavarro, April Rose P.No ratings yet

- Quiz - CashDocument1 pageQuiz - CashAna Mae HernandezNo ratings yet

- Accounting Level IV Coc: Project OneDocument5 pagesAccounting Level IV Coc: Project OneTewodros BekeleNo ratings yet

- Fragment M 11Document7 pagesFragment M 11sm munNo ratings yet

- Loans and Receivables Handout1Document3 pagesLoans and Receivables Handout1XXXXXXXXXXXXXXXXXXNo ratings yet

- Auditing ProblemsDocument6 pagesAuditing ProblemsMaurice AgbayaniNo ratings yet

- 02 Unit 1-Audit of Liabilities ExercisesDocument21 pages02 Unit 1-Audit of Liabilities Exerciseskara albueraNo ratings yet

- ReSA B43 AFAR Final PB Exam - Questions, Answers - SolutionsDocument25 pagesReSA B43 AFAR Final PB Exam - Questions, Answers - SolutionsElaine Joyce GarciaNo ratings yet

- Final Examination in Auditing Principles and Application 1Document8 pagesFinal Examination in Auditing Principles and Application 1Anie Martinez0% (1)

- Merchandising 2 Set ADocument2 pagesMerchandising 2 Set AGabrielle VizcarraNo ratings yet

- AP Liab 1stsetDocument9 pagesAP Liab 1stsetMaritessNo ratings yet

- BKNC3 - Activity 1 - Review ExamDocument3 pagesBKNC3 - Activity 1 - Review ExamDhel Cahilig0% (1)

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Auditing Revenue CycleDocument3 pagesAuditing Revenue CycleJhunNo ratings yet

- 2018 - Audpra - LiabSHE 1Document1 page2018 - Audpra - LiabSHE 1JhunNo ratings yet

- Beneath Your BeautifulDocument3 pagesBeneath Your BeautifulJhunNo ratings yet

- Audit Ethics CaseletsDocument4 pagesAudit Ethics CaseletsJhun33% (3)

- An Analytical Study of Employee Stock Option SchemeDocument10 pagesAn Analytical Study of Employee Stock Option SchemeIjcams PublicationNo ratings yet

- CP11 September22 EXAMDocument5 pagesCP11 September22 EXAMElroy PereiraNo ratings yet

- Accounting AssignmentDocument7 pagesAccounting AssignmentGui Xiang KhooNo ratings yet

- Mint Delhi 01-02-2024 240201 083443Document18 pagesMint Delhi 01-02-2024 240201 083443PRINCE SHARMANo ratings yet

- FINANCIAL POSITION June302017Document10 pagesFINANCIAL POSITION June302017Reginald ValenciaNo ratings yet

- Quotation - 179337.pdf - PDF UNION CHEMICALSDocument3 pagesQuotation - 179337.pdf - PDF UNION CHEMICALSW GangenathNo ratings yet

- Pengaruh Kinerja Keuangan Dan Ekonomi Makro Terhadap Harga Saham Perusahaan Manufaktur Yang Terdaftar Dibursa Efek IndoneisaDocument25 pagesPengaruh Kinerja Keuangan Dan Ekonomi Makro Terhadap Harga Saham Perusahaan Manufaktur Yang Terdaftar Dibursa Efek IndoneisaOptimis SelaluNo ratings yet

- Business Finance Module 1Document10 pagesBusiness Finance Module 1Adoree RamosNo ratings yet

- HL Basic Savings A - C 042022Document2 pagesHL Basic Savings A - C 042022Taufiq AriffinNo ratings yet

- New Central Bank Act ReviewerDocument10 pagesNew Central Bank Act ReviewernoorlawNo ratings yet

- Covering LetterDocument2 pagesCovering LetterAishwary SinhaNo ratings yet

- ABC Analysis CA FinalDocument8 pagesABC Analysis CA FinalvenkatprashanthNo ratings yet

- Organization and Management Quarter 2.1Document38 pagesOrganization and Management Quarter 2.1Ehlvie PreciosoNo ratings yet

- More Thought Square Foot: Enlivening WorkspacesDocument173 pagesMore Thought Square Foot: Enlivening WorkspacesRaviraj Tiruke100% (1)

- CV - Rejaul Karim - 03.10.2023Document5 pagesCV - Rejaul Karim - 03.10.2023Md Byzed AhmedNo ratings yet

- Channel Trading StrategyDocument51 pagesChannel Trading StrategyVijay86% (7)

- Modules and TasksDocument2 pagesModules and TasksRITESH NANDANNo ratings yet

- Snowflake Sec Form s1Document848 pagesSnowflake Sec Form s1anoopiit2012No ratings yet

- Discussion Questions: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument7 pagesDiscussion Questions: Manila Cavite Laguna Cebu Cagayan de Oro DavaoMae Angiela TansecoNo ratings yet

- Practice Problems CH 12Document3 pagesPractice Problems CH 12Samira PereziqNo ratings yet

- AAT Skillcheck ResultsDocument9 pagesAAT Skillcheck ResultsCiprian IchimNo ratings yet

- List of Lease Instruments With Isin No. - Ewyc-Wfc-2012Document12 pagesList of Lease Instruments With Isin No. - Ewyc-Wfc-2012Wajid100% (1)

- Mba Project AxiesDocument55 pagesMba Project Axiespavan kumarNo ratings yet

- Derivatives Jan 11Document5 pagesDerivatives Jan 11Matthew FlemingNo ratings yet

- Articulate English May-2023Document88 pagesArticulate English May-2023Rani KumariNo ratings yet

- Sunil Jain ResumeDocument4 pagesSunil Jain Resumesunilmalpura5768100% (5)

- Internet Banking Sample ProposalDocument6 pagesInternet Banking Sample Proposalprem09080% (1)

- FRRB 2Document220 pagesFRRB 2gauravmandu100% (2)