Professional Documents

Culture Documents

D Et R In: Rule 101,102 Ethics Rulings in Ependence and Integrity Hics Ul Gs

D Et R In: Rule 101,102 Ethics Rulings in Ependence and Integrity Hics Ul Gs

Uploaded by

Zeyad El-sayed0 ratings0% found this document useful (0 votes)

15 views3 pagesThis document discusses various scenarios related to professional responsibilities and independence for accountants. It provides 30 ethics rulings addressing situations that could potentially impair a CPA's independence, such as: serving in a management role for a client organization; exercising control over a client's budget; owning a material amount of a client's bonds or securities; having a loan with an uninsured balance from a client financial institution; or serving on the board of a client nonprofit organization. The rulings aim to help CPAs determine whether independence would be considered impaired in different professional circumstances.

Original Description:

df567kjgf

Original Title

Scan 0010

Copyright

© © All Rights Reserved

Available Formats

RTF, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses various scenarios related to professional responsibilities and independence for accountants. It provides 30 ethics rulings addressing situations that could potentially impair a CPA's independence, such as: serving in a management role for a client organization; exercising control over a client's budget; owning a material amount of a client's bonds or securities; having a loan with an uninsured balance from a client financial institution; or serving on the board of a client nonprofit organization. The rulings aim to help CPAs determine whether independence would be considered impaired in different professional circumstances.

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

Download as rtf, pdf, or txt

0 ratings0% found this document useful (0 votes)

15 views3 pagesD Et R In: Rule 101,102 Ethics Rulings in Ependence and Integrity Hics Ul Gs

D Et R In: Rule 101,102 Ethics Rulings in Ependence and Integrity Hics Ul Gs

Uploaded by

Zeyad El-sayedThis document discusses various scenarios related to professional responsibilities and independence for accountants. It provides 30 ethics rulings addressing situations that could potentially impair a CPA's independence, such as: serving in a management role for a client organization; exercising control over a client's budget; owning a material amount of a client's bonds or securities; having a loan with an uninsured balance from a client financial institution; or serving on the board of a client nonprofit organization. The rulings aim to help CPAs determine whether independence would be considered impaired in different professional circumstances.

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

Download as rtf, pdf, or txt

You are on page 1of 3

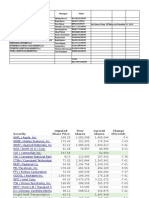

50 MODULE 21 PROFESSIONAL RESPONSIBIliTIES

the general assets of the insurance company.

Rule 101,102 Ethics Rulings

18. A university faculty member cannot be

Independence and Integrity Ethics Rulings independent

2. A member may join a trade association that is a to a student senate fund because the student senate is

client, without impairing independence, but may not a part of the university which is the member's em-

serve in a capacity of management. ployer.

3. Extensive accounting and consulting services, in-

cluding interpretation of statements, forecasts, etc.,

do not impair independence ..

4. Independence is impaired if the member cosigns

checks or purchase orders or exercises general su-

pervision over budgetary controls.

5. The independence Of an elected legislator (a

CPA)

in a local government is impaired with respect to

that governmental unit. .

6. Mere designation as executor or trustee, without

ac-

tual services in either capacity, does not impair in-

dependence, but actual service does.

7. If a member is a trustee of a

foundation,indepen-

dence is impaired.

8. Independence of a member serving as director or

of- .

ficer of a local United Way or similar organization

is not impaired with respect to a charity receiving

funds from that organization unless the organization

exercises managerial control over that charity.

9. Independence is impaired if a member serves on

the

board of a nonprofit social club if the board has ul-

timate responsibility for the affairs of the club.

10. The acquisition of equity or debt securities

as a con-

. dition for membership in a country club does not

normally impair independence; serving on the club's

governing board or taking part in its management

does impair independence.

11. Independence is impaired if a member serves on

a

. committee administering a client's deferred com-

pensation program.

12. Membership on governmental advisory

committees

does not impair independence with respect to that

governmental unit. .

13. A member serving as director of

an.enterprise would

not be independent with respect to the enterprise's

profit sharing and retirement trust.

14. A member's independence is impaired

when owning

bonds in a municipal authority.

15. A member's ownership of an apartment

in a co-op

apartment building would impair the member's and

the firm's independence.

16. A member serving with a client bank in a

cofiduci-

ary capacity, with respect to a trust, does not impair

independence with' respect to the bank or trust de-

partment (if the estate's or trust's assets were not

material).

17. Independence is not impaired when a

member's re-

tirement plan is invested and managed by an insur-

ance company in a separate account, not a part of

19. Independence is impaired when prior year fees for dependence; uninsured deposits do not impair inde-

professional services, whether billed or unbilled, pendence if the uninsured amounts are immaterial.

remain unpaid for more than one year prior to the 26. CPA Firm A is not independent of an entity

date of the report. audited

20. If a member audits an employee benefit plan, inde- by Firm B. CPA Firm B may only use Firm A per-

sonnel in a 'manner similar to internal auditors with-

pendence is impaired with respect to employer if a out impairing Firm B' s independence.

partner or professional employee of the firm had 27. A member (and the member's firm) are not inde-

significant influence over such employer, was in a pendent if the member serves on the advisory board

key position with the employer, or was associated of a client unless the advisory board (1) is truly ad-

with the employer as a promoter, underwriter, or visory, (2) has no authority to make or appear to

voting trustee. make management decisions, and (3) membership is

21. Independence with respect to a fund-raising founda- distinct with minimal, if any, common membership

with management and the board of directors.

tion is impaired if a member serves on the board of 28. A member must be independent to issue an audit

directors of the entity for whose benefit the founda- opinion or a review report, but need not be inde-

tion exists (unless position is purely honorary). pendent to issue a compilation report (such lack of

22. Member who is not in public practice may use CPA independence is disclosed).

designation in connection with financial statements 29. Membership in a credit union does not impair

and correspondence of member's employer. May audit

also use CP A designation on business cards if along independence if (1) the member qualifies as a credit

with employment title. Member may not imply in- union member on grounds other than by providing

dependence from employer. Member cannot state professional services, (2) the member does not exert

that transmittal is in conformity with GAAP. significant influence over the credit union, (3) the

23. If a client financial institution merely services member's loans (if any) from credit union are nor.-

a mal (see Interpretation 101-1), and (4) the condi-

member's loan, independence is not impaired. tions of ruling 70 have been met.

24. A member with a material limited partnership inter- 30. A member's investment in a limited partnership

est is not independent of other limited partnerships im-

that have the same general partner. pairs independence with respect to the limited part-

25. Maintaining state or federally insured deposits (e.g., nership; when the investment is material, indepen-

dence is impaired with respect to both the general

checking accounts, savings accounts, certificates of partner of the limited partnership and any subsidi-

deposit) in a financial institution does not impair in- aries of the limited partnership.

You might also like

- Investments in Associates FA AC OverviewDocument85 pagesInvestments in Associates FA AC OverviewHannah Shaira Clemente73% (11)

- 2017 12 31 Thirteen LLC Investment SummaryDocument437 pages2017 12 31 Thirteen LLC Investment SummaryLarryDCurtis100% (2)

- Corporate Governance in UgandaDocument42 pagesCorporate Governance in UgandaXavier Francis S. LutaloNo ratings yet

- Manual of Regulations For BanksDocument840 pagesManual of Regulations For Banksdyosangpinagpala100% (5)

- GEF Case 2Document6 pagesGEF Case 2gabrielaNo ratings yet

- O Ves S R e S o S Is S I e S, Sses, S Ts S, I - . S S A: Professional ResponsibilitiesDocument2 pagesO Ves S R e S o S Is S I e S, Sses, S Ts S, I - . S S A: Professional ResponsibilitiesZeyad El-sayedNo ratings yet

- 74713bos60485 Inter p1 cp10 U2Document24 pages74713bos60485 Inter p1 cp10 U2Gurusaran SNo ratings yet

- Loan Function of BanksDocument4 pagesLoan Function of BanksSherlyn Paran Paquit-SeldaNo ratings yet

- Scan 0009Document2 pagesScan 0009Zeyad El-sayedNo ratings yet

- LLC Operating AgreementDocument13 pagesLLC Operating AgreementSucreNo ratings yet

- Independent DirectorsDocument3 pagesIndependent DirectorsadityadesaiNo ratings yet

- CH 02 - Business, Trade - Commecer AkDocument17 pagesCH 02 - Business, Trade - Commecer AkArundhoti MukherjeeNo ratings yet

- Introduction To Independence and GIP - Jan 2011Document16 pagesIntroduction To Independence and GIP - Jan 2011Praveen MalineniNo ratings yet

- Professional EthicsDocument51 pagesProfessional EthicsFremaNo ratings yet

- Neral Features of Business Forms in Vietnam - ENT LawDocument5 pagesNeral Features of Business Forms in Vietnam - ENT LawPassionNo ratings yet

- Investment in AssociatesDocument47 pagesInvestment in AssociatesHimanshu GaurNo ratings yet

- 52465bos42065final p1 cp1 U5 PDFDocument14 pages52465bos42065final p1 cp1 U5 PDFRAHUL PRASADNo ratings yet

- Duties of DirectorsDocument3 pagesDuties of DirectorsfaracgehNo ratings yet

- Jan 162022 BRPD 01 eDocument7 pagesJan 162022 BRPD 01 epk ghoshNo ratings yet

- Module 8 PAS 27 & 28Document4 pagesModule 8 PAS 27 & 28Jan JanNo ratings yet

- As 18Document13 pagesAs 18Knowledge GuruNo ratings yet

- CH 02 - Business, Trade - Commecer AkDocument13 pagesCH 02 - Business, Trade - Commecer AkArundhoti MukherjeeNo ratings yet

- Code of Business Ethics Policy GuidelinesDocument8 pagesCode of Business Ethics Policy GuidelinesowenNo ratings yet

- The Duty of Loyalty From Directors, Partners and Senior Employees - Gaby Hardwicke SolicitorsDocument17 pagesThe Duty of Loyalty From Directors, Partners and Senior Employees - Gaby Hardwicke SolicitorsAndres RestrepoNo ratings yet

- Dwnload Full Principles of Auditing Other Assurance Services 19th Edition Whittington Solutions Manual PDFDocument36 pagesDwnload Full Principles of Auditing Other Assurance Services 19th Edition Whittington Solutions Manual PDFtobijayammev100% (10)

- Full Download Principles of Auditing Other Assurance Services 19th Edition Whittington Solutions ManualDocument36 pagesFull Download Principles of Auditing Other Assurance Services 19th Edition Whittington Solutions Manualjamesturnerzdc100% (34)

- Ac Standard - AS18Document8 pagesAc Standard - AS18api-3705877No ratings yet

- The Risks and Rewards of Multiple Lender FinancingsDocument5 pagesThe Risks and Rewards of Multiple Lender Financingsjude loh wai sengNo ratings yet

- CorpoRev - Jan 8 Part 3 - EmuyDocument4 pagesCorpoRev - Jan 8 Part 3 - EmuyHannah Keziah Dela CernaNo ratings yet

- Ugbs Accounting For Investment in Associate and Joint VentureDocument30 pagesUgbs Accounting For Investment in Associate and Joint VentureStudy GirlNo ratings yet

- Connected LendingDocument5 pagesConnected Lending22satendraNo ratings yet

- Presentation Slide PDFDocument10 pagesPresentation Slide PDFIsa BorodoNo ratings yet

- Watered StocksDocument10 pagesWatered StocksBruno GalwatNo ratings yet

- Single Borrowers LimitDocument10 pagesSingle Borrowers LimitCamille LamadoNo ratings yet

- Suitability of PersonsDocument20 pagesSuitability of Personsjaphethmm01No ratings yet

- New Operating AgreementDocument16 pagesNew Operating AgreementMichaelAllenCrainNo ratings yet

- Cbactg01 Chapter 5 ModuleDocument7 pagesCbactg01 Chapter 5 ModuleJohn DavisNo ratings yet

- Geeta Saar 107 Auditor Not To Render Certain ServicesDocument7 pagesGeeta Saar 107 Auditor Not To Render Certain Servicesvaibhavayush994No ratings yet

- Consolidated Financial Statements - 2. DefinitionsDocument3 pagesConsolidated Financial Statements - 2. DefinitionsshubhamNo ratings yet

- Review Questions: Click On The Questions To See AnswersDocument10 pagesReview Questions: Click On The Questions To See AnswersJinjer Ann LanticanNo ratings yet

- FAR.112 - INVESTMENT IN ASSOCIATES AND JOINT VENTURES With AnswerDocument6 pagesFAR.112 - INVESTMENT IN ASSOCIATES AND JOINT VENTURES With AnswerMaeNo ratings yet

- SECTION 185 of Companies ActDocument5 pagesSECTION 185 of Companies Actimmaestro.9999No ratings yet

- To Consolidated Financial Statements: Syllabus Guide Detailed OutcomesDocument51 pagesTo Consolidated Financial Statements: Syllabus Guide Detailed OutcomesDavid MorganNo ratings yet

- Users of Financial InformationDocument2 pagesUsers of Financial InformationmingmingpspspspsNo ratings yet

- Related Party Disclosures: International Accounting Standard 24Document5 pagesRelated Party Disclosures: International Accounting Standard 24FateNo ratings yet

- Directors Duties 24sept20Document2 pagesDirectors Duties 24sept20Visakh AntonyNo ratings yet

- Pas 28Document16 pagesPas 28abeladelmundosuarezNo ratings yet

- Module2 L1elec4Document15 pagesModule2 L1elec4Cheryvel GalleonNo ratings yet

- Duty of Care and Skill of Company DirectorsDocument7 pagesDuty of Care and Skill of Company Directorsarchit malhotra100% (2)

- Topic 9 - Corporate Finance and Capital ControlDocument7 pagesTopic 9 - Corporate Finance and Capital Controllebogang mkansiNo ratings yet

- LLC Operating AgreementDocument7 pagesLLC Operating AgreementEddi Jónsson100% (1)

- The State Bank of Vietnam Socialist Republic of Viet Nam Independence - Freedom - HappinessDocument17 pagesThe State Bank of Vietnam Socialist Republic of Viet Nam Independence - Freedom - HappinessFx121No ratings yet

- INDAS28 - Consolidation For Associates PDFDocument12 pagesINDAS28 - Consolidation For Associates PDFKedarNo ratings yet

- CH 22Document8 pagesCH 22laiveNo ratings yet

- PFRS 10Document13 pagesPFRS 10lovekath09No ratings yet

- Suntrust Banks, Inc. Corporate Governance GuidelinesDocument9 pagesSuntrust Banks, Inc. Corporate Governance GuidelinesPetruța MarianNo ratings yet

- Duties and Responsibilities of Independent DirectorDocument4 pagesDuties and Responsibilities of Independent DirectorsamNo ratings yet

- Pas 28Document4 pagesPas 28iyahvrezNo ratings yet

- Haroon Tabrez Haroon Tabrez Haroon Tabrez Haroon Tabrez: Paper P1Document49 pagesHaroon Tabrez Haroon Tabrez Haroon Tabrez Haroon Tabrez: Paper P1Mohsin ZafarNo ratings yet

- Debenture Trustee: What Is A Debenture?Document11 pagesDebenture Trustee: What Is A Debenture?Shalvin SharmaNo ratings yet

- Policy On Loans To Directors and Senior OffcialsDocument8 pagesPolicy On Loans To Directors and Senior OffcialssagarthegameNo ratings yet

- Fede Al Securities Acts: OvervieDocument2 pagesFede Al Securities Acts: OvervieZeyad El-sayedNo ratings yet

- Scan 0001Document2 pagesScan 0001Zeyad El-sayedNo ratings yet

- Deduct From Book Income: - B - T F Dul - .Document2 pagesDeduct From Book Income: - B - T F Dul - .Zeyad El-sayedNo ratings yet

- Scan 0001Document2 pagesScan 0001Zeyad El-sayedNo ratings yet

- Se Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossDocument3 pagesSe Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossZeyad El-sayedNo ratings yet

- Scan 0013Document2 pagesScan 0013Zeyad El-sayedNo ratings yet

- P N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEDocument3 pagesP N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEZeyad El-sayedNo ratings yet

- S Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateDocument3 pagesS Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- I y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateDocument2 pagesI y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Document2 pagesModule 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Zeyad El-sayedNo ratings yet

- Scan 0010Document3 pagesScan 0010Zeyad El-sayedNo ratings yet

- 80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateDocument2 pages80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZDocument2 pagesModule 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZZeyad El-sayedNo ratings yet

- B Nkruptcy: Discharge of A BankruptDocument2 pagesB Nkruptcy: Discharge of A BankruptZeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CDocument3 pagesModule 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CZeyad El-sayedNo ratings yet

- Module 21 Professional Responsibilities: Interpretation 101-2. A FirmDocument2 pagesModule 21 Professional Responsibilities: Interpretation 101-2. A FirmZeyad El-sayedNo ratings yet

- Scan 0012Document2 pagesScan 0012Zeyad El-sayedNo ratings yet

- Bankruptcy:: y y S e S Owed SDocument3 pagesBankruptcy:: y y S e S Owed SZeyad El-sayedNo ratings yet

- Revocation of Discharge: 2M Module27 BankruptcyDocument2 pagesRevocation of Discharge: 2M Module27 BankruptcyZeyad El-sayedNo ratings yet

- ET Section 10 01 Conce Tu LF Mework For A Cpa I e Ence StandardsDocument2 pagesET Section 10 01 Conce Tu LF Mework For A Cpa I e Ence StandardsZeyad El-sayedNo ratings yet

- Scan 0008Document2 pagesScan 0008Zeyad El-sayedNo ratings yet

- Scan 0010Document2 pagesScan 0010Zeyad El-sayedNo ratings yet

- Scan 0009Document2 pagesScan 0009Zeyad El-sayedNo ratings yet

- The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Document2 pagesThe Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Zeyad El-sayedNo ratings yet

- Scan 0018Document1 pageScan 0018Zeyad El-sayedNo ratings yet

- Professional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsDocument2 pagesProfessional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsZeyad El-sayedNo ratings yet

- Article I Responsibilities. Article Il-The Public InterestDocument2 pagesArticle I Responsibilities. Article Il-The Public InterestZeyad El-sayedNo ratings yet

- Scan 0006Document2 pagesScan 0006Zeyad El-sayedNo ratings yet

- Scan 0008Document2 pagesScan 0008Zeyad El-sayedNo ratings yet

- Scan 0008Document2 pagesScan 0008Zeyad El-sayedNo ratings yet

- Chapter 4 Choosing A Form of Business OwnershipDocument24 pagesChapter 4 Choosing A Form of Business OwnershipPete JoempraditwongNo ratings yet

- Company Law ProjectDocument21 pagesCompany Law ProjectNayanika Bhardwaj50% (2)

- Demerger and Tax On M&aDocument5 pagesDemerger and Tax On M&aChandan SinghNo ratings yet

- Salomon V Salomon - Case SummaryDocument4 pagesSalomon V Salomon - Case SummaryParag KabraNo ratings yet

- Companies Act FoundationDocument36 pagesCompanies Act FoundationrishikeshkallaNo ratings yet

- Public Enterprise in EthiopiaDocument14 pagesPublic Enterprise in EthiopiaAmbachew Motbaynor100% (22)

- All Satellites Receivable inDocument2 pagesAll Satellites Receivable inCE capital BuildersNo ratings yet

- Banking Laws Chapters 19 21Document40 pagesBanking Laws Chapters 19 21john uyNo ratings yet

- Anticipated Endowment AssuranceDocument1 pageAnticipated Endowment AssurancePankaj BeniwalNo ratings yet

- TataDocument8 pagesTataSherry SahaNo ratings yet

- Corporate, Removal of DirectorsDocument16 pagesCorporate, Removal of DirectorsRajatAgrawalNo ratings yet

- Group Reporting I: Concepts and Context: acquisition: hợp nhất merger: sáp nhập associate: liên kếtDocument31 pagesGroup Reporting I: Concepts and Context: acquisition: hợp nhất merger: sáp nhập associate: liên kếtPhạm Ngọc ÁnhNo ratings yet

- QB of Corporate Law & Practice ACE 302 - ACM 603 2018-19Document4 pagesQB of Corporate Law & Practice ACE 302 - ACM 603 2018-19isha NarwarNo ratings yet

- SECP FunctionsDocument13 pagesSECP FunctionsMehwish Murtaza0% (2)

- Bank RegisterDocument1 pageBank RegisterVivid SariNo ratings yet

- Partnership LiquidationDocument13 pagesPartnership LiquidationCjhay MarcosNo ratings yet

- Corporate-Personality EasyDocument4 pagesCorporate-Personality EasyNaim AhmedNo ratings yet

- Risk Management: Case Study On AIGDocument8 pagesRisk Management: Case Study On AIGPatrick ChauNo ratings yet

- What Is BootstrappingDocument3 pagesWhat Is BootstrappingCharu SharmaNo ratings yet

- Week 1 2 Introduction To Forward and Options LMSDocument24 pagesWeek 1 2 Introduction To Forward and Options LMSKastral KokNo ratings yet

- Assignment ON Ifrs1-First Time Adoption of IfrsDocument46 pagesAssignment ON Ifrs1-First Time Adoption of IfrsMohit BansalNo ratings yet

- CSXDocument130 pagesCSXmarcelluxNo ratings yet

- Role of SEBI As Regulator in Maintaining Corporate Governance Standards in IndiaDocument4 pagesRole of SEBI As Regulator in Maintaining Corporate Governance Standards in Indiasourav kumar rayNo ratings yet

- Corporate Finance Chapter 26Document83 pagesCorporate Finance Chapter 26billy930% (1)

- A Study of Open Interest in Nifty Future PDFDocument7 pagesA Study of Open Interest in Nifty Future PDFRaghuraman ThaiyarNo ratings yet

- GRI Year Book 2011Document16 pagesGRI Year Book 2011Global Real Estate InstituteNo ratings yet