Professional Documents

Culture Documents

Claiming Tax Back When You Have Stopped Working

Claiming Tax Back When You Have Stopped Working

Uploaded by

Dave Benson IIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Claiming Tax Back When You Have Stopped Working

Claiming Tax Back When You Have Stopped Working

Uploaded by

Dave Benson IICopyright:

Available Formats

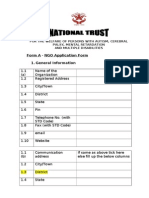

Claiming tax back when you have

stopped working

Please use these if you write or call, it will help to avoid delay.

Tax reference

National Insurance number

Issued by

About this form

We have received your application for repayment of Income Tax. Please answer the questions below and j the box

that applies. You may not need to complete all of this form to receive your repayment.

1 Are you unemployed not claiming Jobseeker’s

Yes No

Allowance, taxable Incapacity Benefit (IB) or taxable

Employment and Support Allowance (ESA) and expect If yes, hand your parts 2 and 3 of form P45 to your new

to be back at work within four weeks? employer, who will make any repayment due to you.

2 Are you claiming Jobseeker’s Allowance, taxable IB or

Yes No

taxable ESA?

If yes, you will get your repayment after 5 April from:

• your HM Revenue & Customs (HMRC) office if you are

claiming taxable IB, or

• from the Benefit Office if you are claiming Jobseeker’s

Allowance or ESA, or

• when your claim ends if this is earlier.

If you have ticked ‘Yes' to either of these questions you do not need to complete and return this form.

If you have ticked ‘No' go to question 3.

3 Are you unemployed not claiming Jobseeker’s

Allowance, taxable IB or taxable ESA and you Yes No

expect to be unemployed for four weeks or more?

4 Have you retired permanently and are not claiming

Jobseeker’s Allowance, taxable IB, taxable ESA? Yes No

5 Are you not claiming Jobseeker’s Allowance, taxable IB

or taxable ESA and do not expect to claim or go back Yes No

to work (including part-time or casual employment)

before the start of the new tax year on 6 April?

6 Are you employed, in receipt of a pension and/or

Yes No

occupational pension?

If you have answered ‘Yes' to any of the questions 3 to 6, complete the rest of this form and return it with

your P45 (parts 2 and 3).

P50 Page 1 HMRC 08/09

Claim for repayment Address

Fill in this form if:

• you are not claiming one of the taxable benefits listed

below, and

• you have been unemployed for four weeks, or you have

retired permanently, or you do not expect to claim one of

the taxable benefits listed below or go back to work before Postcode

the start of the new tax year on 6 April.

Taxable benefits are: Date of birth DD MM YYYYY

• Jobseeker’s Allowance

• Taxable IB (Incapacity Benefit payable during the first

28 weeks of your incapacity is not taxable). IB payable I certify that since leaving my employment with

after the first 28 weeks of your incapacity is taxable. enter name of last employer

• Employment and Support Allowance (ESA).

• Carer’s Allowance.

Please j at least one of the following boxes:

Your earnings since leaving the employer named

• I have been unemployed, and have claimed one of

in the declaration the taxable benefits listed, and I am not in receipt of a

Type of earnings j one box only continuing Occupational/Works Pension.

• I have been unemployed and have not claimed one

Part-time Casual Self-employed of the taxable benefits listed, and I am not in receipt

Amount of earnings of a pension.

• I have retired permanently and have claimed one of

£ • 0 0

the taxable benefits listed, and I am not in receipt

If you paid Income Tax on these earnings, please attach: of a pension.

• a letter giving the name and address of the employer or • I have retired permanently and have not claimed

contractor, and one of the taxable benefits listed, and I am not

• the certificate of tax deducted (parts 2 and 3 of form P45). in receipt of a pension.

Your pension details • I do not expect to go back to work (including part-time

or casual employment) before the start of the new tax

Amount of pension received per week

year on 6 April, and I am not in receipt of a pension.

£ • 0 0 If you have claimed, enter the name of the Benefit Office

where you claimed.

Date my pension started DD MM YYYY

Amount of lump sum received from either a private Signature

pension/annuity commutation or state pension deferral

£ • 0 0

Amount of tax paid Date DD MM YYYY

£ • 0 0

Please send either your P45 (parts 2 and 3) from your

pension/annuity payer, or notification from Department of What to do next

Work and Pensions, in addition to any P45 (parts 2 and 3) Send your completed form to the address on the front of this form

issued by an employer. with your P45 (parts 2 and 3).

Declaration How you’ll get your repayment

Your HMRC office will send any repayment due to you by post, with

You may be prosecuted for making false statements.

a new form P45 (parts 1A, 2 and 3), if necessary.

Surname

Repayments of Income Tax are made by payable order crossed

‘Account Payee only’ which have to be paid into a bank or building

society. If you want the payable order to be sent direct to your bank

First names or building society please give their name and address and your

account number in a separate letter. If you do not have a bank or

building society account please give the name and address of

someone who does, so we can make the payable order out to them.

Page 2

You might also like

- TFN Declaration Form PDFDocument6 pagesTFN Declaration Form PDFrsdommetiNo ratings yet

- CV CruzDocument2 pagesCV CruzJoseph David100% (2)

- Sc2 Self Certification FormDocument2 pagesSc2 Self Certification FormdiannehoosonNo ratings yet

- General Payroll, Employment and DeductionsDocument6 pagesGeneral Payroll, Employment and DeductionsJosh LeBlancNo ratings yet

- Pioneer Review, May 16, 2013Document18 pagesPioneer Review, May 16, 2013surfnewmediaNo ratings yet

- CUI vs. CUI Case DigestDocument3 pagesCUI vs. CUI Case Digestcryzia0% (1)

- Starter - ChecklistDocument3 pagesStarter - ChecklistHamtha NoordeenNo ratings yet

- Claim For Repayment of Tax When You Have Stopped Working: Your Income Since Leaving Your Last EmploymentDocument2 pagesClaim For Repayment of Tax When You Have Stopped Working: Your Income Since Leaving Your Last EmploymentbvkettNo ratings yet

- P 50Document2 pagesP 50Emily DeerNo ratings yet

- Starter Checklist - HMRCDocument4 pagesStarter Checklist - HMRChope petersNo ratings yet

- Flexibly Accessed Pension Lump Sum: Repayment Claim (Tax Year 2021 To 2022)Document9 pagesFlexibly Accessed Pension Lump Sum: Repayment Claim (Tax Year 2021 To 2022)ErmintrudeNo ratings yet

- Paid Parental Leave (PPL) ApplicationDocument8 pagesPaid Parental Leave (PPL) ApplicationConan McClellandNo ratings yet

- Claiming Back Tax Paid On A Lump Sum: What To Do Now If The Form Is Filled in by Someone ElseDocument9 pagesClaiming Back Tax Paid On A Lump Sum: What To Do Now If The Form Is Filled in by Someone ElseErmintrudeNo ratings yet

- SSP1 FormDocument8 pagesSSP1 FormLIBRANo ratings yet

- Statutory Sick Pay and An Employee's Claim For Benefit: If You Are An EmployerDocument6 pagesStatutory Sick Pay and An Employee's Claim For Benefit: If You Are An EmployerpatrikosNo ratings yet

- Paid Parental Leave Application For An EmployeeDocument6 pagesPaid Parental Leave Application For An EmployeeVictor DaneNo ratings yet

- During Your Base Period? Were You Unable To WorkDocument1 pageDuring Your Base Period? Were You Unable To WorkKen SuNo ratings yet

- Starter - Checklist Mehdi RaghaiDocument3 pagesStarter - Checklist Mehdi RaghaijamesNo ratings yet

- Aon Starter ChecklistDocument3 pagesAon Starter ChecklistHugo TillNo ratings yet

- WireWheel Short Term DisabilityDocument7 pagesWireWheel Short Term DisabilitySteve MooreNo ratings yet

- Jobseeker's Allowance: Help While You Look For WorkDocument24 pagesJobseeker's Allowance: Help While You Look For Worklearningcurveasia3076No ratings yet

- Instructions To Supply Tax File and Superannuation Details OnlineDocument7 pagesInstructions To Supply Tax File and Superannuation Details OnlineMahesh DrallNo ratings yet

- Jobseekers Notification - 03 - 05 - 23 PDFDocument4 pagesJobseekers Notification - 03 - 05 - 23 PDFPalombella BellaNo ratings yet

- 2023 - 2024 Starter - Checklist - Dimitrios KosmidisDocument3 pages2023 - 2024 Starter - Checklist - Dimitrios KosmidismoomisNo ratings yet

- Statutory Sick Pay (SSP) : Employee's Statement of Sickness: About This FormDocument3 pagesStatutory Sick Pay (SSP) : Employee's Statement of Sickness: About This FormAbdul TaibiNo ratings yet

- ASK Italian NEST FW Letter 1 NewDocument2 pagesASK Italian NEST FW Letter 1 NewGiovanni CanisiNo ratings yet

- Starter Checklist About This Form:: Last Name or Family Name First Name (S)Document4 pagesStarter Checklist About This Form:: Last Name or Family Name First Name (S)Anca IroaiaNo ratings yet

- Schedule Se (Form 1040)Document2 pagesSchedule Se (Form 1040)Vita Volunteers WebmasterNo ratings yet

- Tax Impact of Job LossDocument7 pagesTax Impact of Job LossbullyrayNo ratings yet

- Beckley Motorsports Park: Application For EmploymentDocument4 pagesBeckley Motorsports Park: Application For EmploymentNRG WEB DESIGNS100% (1)

- Statutory Sick Pay Claim Form ssp1Document6 pagesStatutory Sick Pay Claim Form ssp1k.a.smithniNo ratings yet

- Aus TFN DeclarationDocument6 pagesAus TFN DeclarationjessepurcelltamihanaNo ratings yet

- Ssp1 InteractiveDocument5 pagesSsp1 InteractiveAdam KruzynskiNo ratings yet

- E MailerDocument2 pagesE MailerElina CiuneleNo ratings yet

- TFN Declaration FormDocument6 pagesTFN Declaration FormMaiko KimberlyNo ratings yet

- TFN Declaration Form N3092Document6 pagesTFN Declaration Form N3092mct5s8wdrkNo ratings yet

- 21-08ClaimsandBenefits 2Document6 pages21-08ClaimsandBenefits 2wcandace408No ratings yet

- Credit Assessment of Housing Loans in Australia: Data Compiled by Dr. D. Sreenivasa CharyDocument45 pagesCredit Assessment of Housing Loans in Australia: Data Compiled by Dr. D. Sreenivasa Charysaumya tiwariNo ratings yet

- Payroll Tax Declaration ENGDocument2 pagesPayroll Tax Declaration ENGЕвгений БодякинNo ratings yet

- TFN Declaration Form N3092Document6 pagesTFN Declaration Form N3092Randhawa SukhmanNo ratings yet

- Payroll Setup ChecklistDocument4 pagesPayroll Setup ChecklistcaliechNo ratings yet

- Tax Unit 4 (Tax On Individual)Document116 pagesTax Unit 4 (Tax On Individual)Shivam PalNo ratings yet

- Payroll ChecklistDocument1 pagePayroll ChecklistDummy accountNo ratings yet

- VOG29A Bank Details FormDocument1 pageVOG29A Bank Details Formjoeashenhurst84No ratings yet

- National Insurance UK How-ToDocument5 pagesNational Insurance UK How-ToÁdám T. BogárNo ratings yet

- NSESAF1 - New Style Employment and Supprt Allowance PDFDocument23 pagesNSESAF1 - New Style Employment and Supprt Allowance PDFEllie JeanNo ratings yet

- 21-08 Claims and BenefitsDocument6 pages21-08 Claims and BenefitsLamarNo ratings yet

- Strats TFN Declaration FormDocument6 pagesStrats TFN Declaration Formysw2vvr9m5No ratings yet

- CIBenefitsRightsInformation BILLIECASEBIER-727202007224240Document15 pagesCIBenefitsRightsInformation BILLIECASEBIER-727202007224240BILLIE CASEBIERNo ratings yet

- TFN Declaration FormDocument6 pagesTFN Declaration FormTim DunnNo ratings yet

- Jobkeeper Employee Nomination Notice: Section ADocument2 pagesJobkeeper Employee Nomination Notice: Section AAnonymous H8viqHlM3wNo ratings yet

- WWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enDocument17 pagesWWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enLeslie BrownNo ratings yet

- Alliance Trust Full Sipp Handbook 2011Document14 pagesAlliance Trust Full Sipp Handbook 2011rohit1000No ratings yet

- Ci Benefits Rights InformationDocument15 pagesCi Benefits Rights InformationBladimir LoraNo ratings yet

- Tax File Number Declaration - RuviniDocument6 pagesTax File Number Declaration - RuviniruviniogodapolaNo ratings yet

- Form p50Document2 pagesForm p50Carlos ResendeNo ratings yet

- Tax File Number DeclarationDocument7 pagesTax File Number DeclarationJessie YuNo ratings yet

- About This Form: Starter ChecklistDocument2 pagesAbout This Form: Starter ChecklistcallejerocelesteNo ratings yet

- Jobseekers Notification - 18!04!23Document4 pagesJobseekers Notification - 18!04!23Renee McGuinnessNo ratings yet

- 2014 Personal ChecklistDocument3 pages2014 Personal ChecklistjeyaNo ratings yet

- How To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreFrom EverandHow To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreNo ratings yet

- Building Contruction Workers Regulation of Employment and Working Conditions Act 1996Document14 pagesBuilding Contruction Workers Regulation of Employment and Working Conditions Act 1996omarmhusainNo ratings yet

- Organizational Behavior in WalmartDocument4 pagesOrganizational Behavior in WalmartMutisya JeffreyNo ratings yet

- Human RelationsDocument59 pagesHuman Relationsgadhi147100% (1)

- CASE STUDY-External RecruitmentDocument4 pagesCASE STUDY-External RecruitmentashdetorresNo ratings yet

- VA DRC Supply Chain Officer Myintkyina 1post 090920 PDFDocument2 pagesVA DRC Supply Chain Officer Myintkyina 1post 090920 PDFsaw thomasNo ratings yet

- Chapter 8 Day To Day Concern 1Document25 pagesChapter 8 Day To Day Concern 1Umair HashmiNo ratings yet

- Form - A (NGO Proforma)Document8 pagesForm - A (NGO Proforma)Ashwani Singh ChauhanNo ratings yet

- Motivational Methods and ProgramDocument2 pagesMotivational Methods and ProgramCamae Snyder GangcuangcoNo ratings yet

- Japanese Management SystemsDocument24 pagesJapanese Management SystemsPalwinder KaurNo ratings yet

- Chapter 1 - Overview of Industrial Relations: WWW - Edutap.co - inDocument12 pagesChapter 1 - Overview of Industrial Relations: WWW - Edutap.co - inDabbler VirtuosoNo ratings yet

- Hbo CHP 7Document11 pagesHbo CHP 7Raraj100% (1)

- 12 Chapter3goodDocument44 pages12 Chapter3goodAkbar JanNo ratings yet

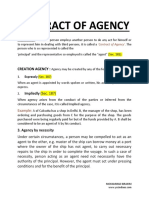

- Contract of AgencyDocument8 pagesContract of Agencyjerry zaidiNo ratings yet

- MLT Web SitesDocument3 pagesMLT Web SitesNavarro CollegeNo ratings yet

- Barcelonia, Rica Cristine CAS-06-601E REFLECTION: Chapter 2 - Research Methods in Industrial/Organizational PsychologyDocument5 pagesBarcelonia, Rica Cristine CAS-06-601E REFLECTION: Chapter 2 - Research Methods in Industrial/Organizational PsychologyRica Cristine BarceloniaNo ratings yet

- Berman Enterprises Inc., Standard Tank Cleaning Corp., and General Marine Transport Corp. v. Local 333, United Marine Division, International Longshoremen's Association, Marine Towing and Transportation Employers' Association, McAllister Brothers, Inc., Diesel Vessel Operators, Inc., Spentonbush Transport Service, Inc., Morania Oil Tanker Corporation, Bouchard Transportation Company, Inc., Moran Towing & Transportation Company, Inc., Poling Transportation Corporation, Eklof Marine Corporation, Red Star Marine Services, Inc., Reinauer Transportation Companies, Inc., and Turecamo Coastal & Harbor Towing Corporation, 644 F.2d 930, 2d Cir. (1981)Document13 pagesBerman Enterprises Inc., Standard Tank Cleaning Corp., and General Marine Transport Corp. v. Local 333, United Marine Division, International Longshoremen's Association, Marine Towing and Transportation Employers' Association, McAllister Brothers, Inc., Diesel Vessel Operators, Inc., Spentonbush Transport Service, Inc., Morania Oil Tanker Corporation, Bouchard Transportation Company, Inc., Moran Towing & Transportation Company, Inc., Poling Transportation Corporation, Eklof Marine Corporation, Red Star Marine Services, Inc., Reinauer Transportation Companies, Inc., and Turecamo Coastal & Harbor Towing Corporation, 644 F.2d 930, 2d Cir. (1981)Scribd Government DocsNo ratings yet

- Lessons For Undercover' BossesDocument2 pagesLessons For Undercover' BossesResheta Ahmed Smrity100% (2)

- Practice of Etiquette Through Suffocation - A Critical Study On Manual Scavengers in India and A Way ForwardDocument13 pagesPractice of Etiquette Through Suffocation - A Critical Study On Manual Scavengers in India and A Way ForwardsriramNo ratings yet

- Industrial Maids Service LTD Ims Is A Corporation Based inDocument1 pageIndustrial Maids Service LTD Ims Is A Corporation Based inMiroslav GegoskiNo ratings yet

- Corporate Deck - Zimyo - 2023Document19 pagesCorporate Deck - Zimyo - 2023devikaNo ratings yet

- Comm 222 Final Review NotesDocument86 pagesComm 222 Final Review NotesNoah Abdeen100% (1)

- PRACTICAL ASSIGNMENT Data AnalysisDocument19 pagesPRACTICAL ASSIGNMENT Data AnalysisNYANDA BENJAMINNo ratings yet

- Principles of ManagementDocument16 pagesPrinciples of ManagementSumit ChakrabortyNo ratings yet

- Management Accounting 21.1.11 QuestionsDocument5 pagesManagement Accounting 21.1.11 QuestionsAmeya TalankiNo ratings yet

- BA5 PREmid 2022Document2 pagesBA5 PREmid 2022Glecy Mae Carredo Delgado IINo ratings yet

- The Effects of Automation and Artificial Intelligence On Employment and ReskillingDocument5 pagesThe Effects of Automation and Artificial Intelligence On Employment and Reskillingabhijitpaul1544No ratings yet

- KoKo Manual PDFDocument27 pagesKoKo Manual PDFmfanariNo ratings yet