Professional Documents

Culture Documents

MENA Market Intelligence

MENA Market Intelligence

Uploaded by

Jawad Mahmood KhokharOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MENA Market Intelligence

MENA Market Intelligence

Uploaded by

Jawad Mahmood KhokharCopyright:

Available Formats

Kuwait Financial Centre “Markaz”

RESEARCH

MENA Market Intelligence

October 2010

Week ending 21st of October

Market Performance: Markets were mainly flat during this week

Research Highlights: which may indicate that markets are correlated however wide

Provide readers with weekly margins are noticed, Lebanon lost 9.1%WTD, while Egypt gained

updates on analyst 3.8% WTD. Turkey continues to dominate YTD returns by

recommendations from different advancing 32.8%, while at the other side of the spectrum Lebanon

investment houses collate views remains the worst performing market YTD.

on the state of MENA economy,

sector developments and fixed Equity Research: During the week we reviewed 11 equity

income news. research reports, out of which 10 were buy/overweight, 1 was

Neutral with no sell recommendation, this indicates that analyst risk

appetite have increased. During this week research coverage was

wider than usual (usually KSA and Egypt have the lion’s share of

coverage)

Fixed income Development: Spreads on Arabian Gulf Islamic

bonds widened by the most in five months this week as investors

Markaz Research is available sold sukuk with lower debt ratings to raise funds for new issuance

on Bloomberg from state-backed banks.

Type “MRKZ” <Go>

New Fund Launches: 3 Funds were introduced this week 2 were

based on Islamic shariah and one Plain vanilla Equity fund,

however, they all share one thing in common a “capital

appreciation” strategy.

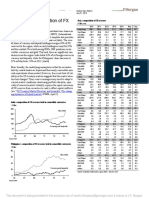

M.R. Raghu CFA, FRM Table 1: Market Performance

Head of Research

+965 2224 8280 Indicators M. Cap Last Chg weekly MTD YTD 2009

rmandagolathur@markaz.com MENA Markets (USD Bn) Close (%) % % % %

Saudi (TASI) 332 6303 -0.7 0.6% -1.4 2.95 27

Humoud Salah N Al Sabah Turkey ISE National 100 282 70167 0.7 1.8% 6.68 32.8 97

Assistant Analyst Kuwait SE WT.INDEX 129 483 0.9 0.0% 3.61 25.2 -5

+965 2224 8000 ext. 1206 Abu Dhabi (ADI)^ 80 2745 1.2 -1.2% 2.67 0.03 15

halsabah@markaz.com Qatar(QE Index) 79 7828 0.9 -1.3% 1.72 12.5 1

Morocco (CAI) 66 11999 0.8 0.0% 0.87 14.9 -5

Dubai (DFMGI) 55 1759 0.9 0.0% 4.45 -2.49 10

Egypt (Hermes) 55 640 0.8 3.8% 3.79 11.7 34

Jordan (Amman) 26 5112 0.4 0.0% 1.41 -7.4 -12

Oman(Muscat SM) 18 6534 0.5 0.0% 0.95 2.59 17

Kuwait Financial Centre Bahrain (BAX) 17 1474 0.1 0.0% 2.03 1.08 -19

S.A.K. “Markaz” Lebanon (BSE) 10 1404 0.1 -9.1% -2.4 -10.4 33

Source: The Daily Morning Brief “Markaz”

P.O. Box 23444, Safat 13095,

Kuwait

Tel: +965 2224 8000

Fax: +965 2242 5828

markaz.com

RESEARCH

October 2010

What Analysts are recommending

Market Price on

Date of Target Current

Market Currency Recommendation Recommendation House

Recommendation Price Price

Company day

Etisalat UAE AED Buy 20-Oct 11.6 22 11.7 CICR

Abu Dhabi Islamic Bank UAE AED Buy 20-Oct 3.18 3.65 3.2 Rasmala

Cairo Poultry Company Egypt EGP Buy 17-Oct 13.5 17.4 15.25 EFG Hermes

Qatar Navigation Qatar Qar Buy 20-Oct 81.9 103 82.8 EFG Hermes

Ma’aden KSA SAR Buy 19-Oct 21.8 25.1 21.6 Global

Union National Bank UAE AED Outperform 20-Oct 3.2 5.2 3.58 Credit Suisse

Kuwait Food Kuwait KWD Overweight 17-Oct 1.64 1.836 1.58 TAIB

AL-Othaim KSA SAR Overweight 18-Oct 72.8 87.4 70.5 NCB Capital

Qatar Electricity and water Qatar QAR Accumulate 20-Oct 115 131 114.5 NBK capital

The Commercial Bank of Qatar Qatar QAR Accumulate 19-Oct 86 92 83 NBK Capital

GB Auto EGYPT EGP Neutral 21-Oct 49 51.4 49.16 Credit Suisse

Kuwait Financial Centre “Markaz” 2

RESEARCH

October 2010

Equity Recommendation-Key points

Company House Recommendation Rationale

Etisalat CICR Buy Although, 9 month consolidated results were below

(UAE) consensus CICR issued a “Buy” recommendation with a

price target of AED 22 based on expansions in regional

and international markets, 9 months ending September

30 results shows 1.6% YoY decline, in revenues to AED

23.3Bn, EBIT declined 22% to AED 10.2Bn and Net

earnings declined 18% to AED5.6Bn.

Abu Dhabi Rasmala Buy Abu Dhabi Islamic Bank Continues to post impressive

Islamic Bank numbers, higher spreads, better fees and commission

(UAE) and improving asset quality lead income to rise by more

than 30%. Furthermore ADIB surpassed Rasmala’s

estimates which lead Rasmala to reiterates its “Buy”

recommendation thus updating, price target to DHS

3.65

Cairo Poultry EFG Buy EFG Hermes estimates that Net profits will grow 17%

Company Hermes CAGR in the next 5 years. On the back of the increased

(Egypt) demand for frozen birds due to new regulation, this

regulation would help speed up the consolidation of a

fragmented market. In its initiation report EFG Hermes

issued a “ Buy” Recommendation with a price target of

EGP 17.4

Qatar EFG Buy EFG Hermes issued a “ Buy” recommendation with a

Navigation Hermes price target of QAR 103 the rationale behind this

(UAE) recommendation was 1) the company is trading at a

50% discount to its peers 2) QNAV is positively geared

to the local economy thus would benefit from, robust

growth levels.

Ma’aden Global Buy Core business expansion, which will transform Ma’aden

(KSA) from a plain vanilla mining company into a mining and

processing company. Furthermore Ma’aden is continually

expanding its product portfolio thus stabilizing revenue

streams and the commencement of the phosphate

project in the 4thQ would contribute to bottom line

growth. Global issued a “Buy” rating with a target price

of SAR25.1

Union Credit Outperform 3Q10 numbers are in, net income increased 28.4% YoY

National Suisse to AED 459mn. 26.8% above CS estimates. ROE

Bank increased to 19.6% the highest since 3rd quarter 2008.

(Qatar) Asset quality remains high NPl stood at 1.5%. Credit

Suisse reiterates its “Outperform” ratio with a price

target of AED 5.2 per share.

Kuwait Food Taib Overweight 1H10 numbers are in, Sales increased 10.7% YoY to

(Kuwait) KWD334.42, Net Profits doubled to KWD27.7, while cost

of sales increased 10.8% to KWD273.69. Taib sees a

12% upside potential from current prices thus reiterates

its Overweight recommendation

AL Othaim NCB Overweight 3rd quarter 2010 was positive and in line with NCB

(KSA) Capital capital’s estimates. However NCB believes that net

income growth levels is unsustainable due to a reversal

in provision taken for 2009 it project. Adjusted net

income increased 28% to SAR32mn, COGS decrease

which lead to 1.01% increase in gross margin to 7%.

Kuwait Financial Centre “Markaz” 3

RESEARCH

October 2010

NCB Capital maintains its “Overweight”

Recommendation with a price target of SAR 87.4.

QEWC NBK Accumulate Strong Q3 numbers in line with NBK capital’s estimates,

(Qatar) Capital Total revenue increased 27% to QAR 944mn, Electricity

remains the largest contributor to revenue

[55%].Operation levels were improving EBITDA

increased 17% YoY to QAR 555mn. Based on positive

results NBK Capital reiterated its “Accumulate”

recommendation with a price target of QAR 131.

GB Auto Credit Neutral After more than 101% YTD stock price gain, Credit

(Egypt) Suisse Suisse issued a “Neutral” recommendation with a price

target of 51.4 EGP mainly because the increased in

demand is priced in current price levels. Furthermore

Credit Suisse may turn bullish on GB Auto, if Iraq sales

numbers went up and the sustainable growth of GB’s in-

house financing number.

The NBK Accumulate Net profits increased 29% to QAR 508mn on the back of

Commercial Capital lower provisions, Operating income increased 1% a 7%

Bank of Qatar increase on NBK’s forecast. Furthermore total assets

(KSA) increased 5% in 3Q10, mainly due to increase in loans,

net loans increased by 4% to QAR 37.4bn. NBK Capital’s

recommendation was “Accumulate” with a price target

of QAR 92.

Kuwait Financial Centre “Markaz” 4

RESEARCH

October 2010

Fixed Income development1

Company Market View

Apicorp KSA Saudi Arabia-based Arab Petroleum Investments

Corp. (Apicorp) may issue more conventional or

Islamic bonds after successfully raising SAR2bn

($533mn) via its debut bond issue last week that

was three times oversubscribed, the lender's top

executive said.

Sukuk All Spreads on Arabian Gulf Islamic bonds widened by

the most in five months this week as investors sold

sukuk with lower debt ratings to raise funds for new

issuance from state-backed banks. The difference

between average yields over the London interbank

offered rate widened 41bps to 481bps, the biggest

increase since the week ended May 21, according to

the HSBC/NASDAQ Dubai GCC US Dollar Sukuk

Index, which tracks 19 corporate and sovereign

bonds. The spread on global Islamic debt rose

23bps to 377bps, the HSBC/NASDAQ US Dollar

Sukuk Index shows

Emirates UAE Emirates Aluminium (Emal), a joint venture

Aluminium between Abu Dhabi's Mubadala Development Co.

and Dubai Aluminum Co., plans to sell more than

$1bn of bonds and secure about $700mn of export

credit financing in 2011 to finance the expansion of

its smelter, the company's CEO said

Doha Bank Qatar Doha Bank will go on a global roadshow early next

year ahead of a planned $500mn, five-year bond

issue, the lender's CEO said. Raghavan

Seetharaman, Doha Bank's CEO, said that the

company would meet investors in Asia, Europe and

the US--including in Hong Kong, New York and

London--either in January or February to market

the bond. "It looks like it, yes," he said. "We have

good experience in these markets

Islamic KSA Saudi-based Islamic Development Bank has

Development launched a $500mn, five-year sukuk offering at

Bank 40bps over mid-swaps, one of the banks running

the sale said. Pricing is at the tight end of guidance

set Tuesday at 40-50bps over mid-swaps. The

issuer is rated AAA by all three major credit rating

agencies.

Dubai Electricity UAE Fitch has assigned Dubai Electricity and Water

and Water Authority's (DEWA) $500mn and $1.5bn notes a

Company senior unsecured rating of 'BBB-'. The $500mn

DEWA notes are due in 2016 and bear a coupon of

6.375% while the $1.5bn notes are due in 2020 and

bear a coupon of 7.375%

A number of sources which include Bloomberg, Zawya, and daily newspapers were utilized in the creation of the fixed income section

which is mainly from Markaz GCC daily report

Kuwait Financial Centre “Markaz” 5

RESEARCH

October 2010

Qatar telecom Qatar Qatar Telecom may raise a further $1.25bn from a

dual-tranche bond issue, a week after issuing bonds

worth $1.5bn. Qtel's planned $500mn six-year

tranche is priced at 100.15, a slight discount to the

current trading price of the six-year bond issued

last week. "The fresh raising is an extension to the

previous six-year bond issue with similar terms and

maturity date," a banker said. In addition, Qtel

plans to raise $500mn to $750mn in a new 15-year

tranche, priced at 262.5-267.5 basis points over 10-

year treasuries

Bank Of Bahrain Bahrain Bahrain-based Bank of Bahrain and Kuwait plans to

and Kuwait issue a five-year benchmark, USD bond as early as

this week, a person familiar with the deal said

Tuesday. "The book runners for BBK's bond sale,

slated for this week, are Citi, Deutsche Bank and

HSBC," the banker said.

Dubai UAE Dubai’s finance department denied asking lenders

for a $500mn loan as part of an arrangement to sell

a sovereign bond, al-Bayan newspaper reported

today. The Financial Times reported yesterday that

the emirate asked lenders seeking to manage its

recent sovereign bond sale to offer the government

a $500mn loan over 3 years at 300bps over the

LIBOR

Kuwait Financial Centre “Markaz” 6

RESEARCH

October 2010

New Fund Launches

Fund Name Type Geo focus Details

AL Hayah Fund Open- Egypt AL Hayah fund is a “Capital Appreciation “fund that invests in

Ended Islamic equity and to lesser extent fixed income offering, the

Equity fund invests in Egypt and is managed by Al Watani Bank of

Egypt.

Al Haya Fund fee structure: Admin Fees of 0.6% per annum

paid monthly, Management fees of 0.6 per annum paid

monthly, performance fee 10% (over 10% Hurdle rate) and

0.1% per annum paid monthly custodian fee. the fund is in

its initial subscription phase and is open to all investors .

Invest AD- Open- Iraq Iraq Opportunity fund is a “Capital” Appreciation fund with a

Iraq Ended fixed geographical location; the fund aims to grow investor’s

opportunity capital by investing in the Iraqi stock market. The fund is

Fund Equity administrated by Apex Fund Services Dubai and is domiciled

in the Cayman Island, the fund is open to all investors except

U.S nationals.

Iraq Opportunity Fund, Fee Structure: Admin fee 0.12% per

Annum, Subscription fee 3% of value, redemptions are

executed once a month with a 1% fee, Performance fee is

20% and the management charge 0.8% management fee

per annum.

MAC Ethical Open- Tunis Mac Ethical fund is a “Capital appreciation fund” mainly

FCP Ended targeting Islamic Complaint Equity and to a lesser extent

invest in cash and cash equivalents. The fund will invest in

Equity the Tunisian Stock Market and will be domiciled in Tunisia.

The Ethical Fund is open to all investors and is managed by

MAC SA.

The fee structure of this fund includes but not limited to;

Management fees 1% paid quarterly, 15% performance fee

above 10% ”Hurdle rate”, custodian fees 0.1% paid

Quarterly and Redemption fee structure is as follows less

than 1 year 3% Fees, between 1-2 2% fee and between 2-3

years 1% fee shares are redeemable weekly.

Kuwait Financial Centre “Markaz” 7

RESEARCH

October 2010

Markaz Research Offerings

Strategic Research Periodic Research Sector Research

The Golden Portfolio (Sept-10) Infrastructure

The New Regulations on Kuwait Investment Sector (Jun-10) Daily

Persistence in Performance (Jun-10) Markaz Daily Morning Brief GCC Power

Kuwait Capital Market Law (Mar-10) Markaz Kuwait Watch GCC Ports

What to expect in 2010 (Jan-10) Daily Fixed Income Update GCC Water

GCC Banks - Done with Provisions? (Jan-10) GCC Airports

What is left for 2009? (Sept-09) Weekly GCC Roads & Railways

Kuwait Investment Sector (Jun-09) GCC ICT

Missing The Rally (Jun-09) KSE Market Weekly Review

Shelter in a Storm (Mar-09) MENA Market intelligence Real Estate – Market Outlook

Diworsification: The GCC Oil Stranglehold (Jan-09) International Market Update

This Too Shall Pass ( Jan-09) Real Estate Market Commentary Dubai Real Estate - Trends and Outlook(Apr-10)

Fishing in Troubled Waters(Dec-08) Egypt Real Estate - Trends and Outlook(Feb-10)

Down and Out: Saudi Stock Outlook (Oct-08) Monthly Kuwait Real Estate Outlook(Dec-09)

Mr. GCC Market-Manic Depressive (Sept-08) Abu Dhabi Residential (Nov-09)

Global Investment Themes (June-08) Mena Mergers & Acquisitions Office Investment in KSA (Jul-09)

To Yield or Not To Yield (May-08) Option Market Activity Saudi Arabia – Residential Real Estate Outlook (Jun-09)

Banking Sweet spots (Apr-08) GCC Quants Saudi Arabia (Sep-08)

The “Vicious Square” Monetary Policy options for Kuwait (Feb-08) Market Review Abu Dhabi (July-08)

China and India: Too Much Too Fast (Oct-07) GCC Corporate Earnings Algeria (Mar-08)

A Potential USD 140b Industry: Review of Asset Management Jordan (Mar-08)

Industry in Kuwait (Sep-07) Quarterly Kuwait (Feb-08)

A Gulf Emerging Portfolio: And Why Not? (Jun-07) GCC Equity Funds Lebanon (Dec-07)

To Leap or To Lag: Choices before GCC Regulators (Apr-07) Thought Speaks Qatar (Sep-07)

Derivatives Market in GCC (Mar-07) Equity Research Statistics Saudi Arabia (Jul-07)

Managing GCC Volatility (Feb-07) U.S.A. (May-07)

GCC for Fundamentalists (Dec-06) Syria (Apr-07)

GCC Leverage Risk (Nov-06)

Real Estate Strategic Research

GCC Distressed Real Estate Opportunities (Sep-09)

GCC Real Estate Financing (Sept-09)

Real Estate Earnings -2009 (May-09)

Supply Adjustments Are we done? (Apr-09)

Dubai Real Estate Meltdown (Feb-09)

Kuwait Financial Centre “Markaz” 8

RESEARCH

October 2010

Company Research

Saudi Arabia UAE Qatar Oman

Samba Financial Group (Aug-10) Kuwait

Jabal Omar Development (Jul-10)

Union National Bank (Sept-10) Qatar Gas Transport Co. (Sept-10) Shell Oman Marketing (Apr-10)

Arabian Cement Co (Jul-10) (For Internal Use Only) FGB (Aug-10) QISB (Sept-10) Galfar Engineering & Cont. (Nov-08)

Yanbu Cement Co. (Jun-10) Qurain Petrochem. Ind. (Aug-10) Etisalat (Aug-10) Masraf Al-Rayan (Jun-10) Oman Telecommunications (Sept-08)

Saudi Telecom Co. (Jun-10) Wataniya (Jul-10) Dubai Financial Market (Sept-09) Commercial Bank of Qatar (Mar-10) Bank Muscat(Sept-08)

Emaar Economic City (Jun-10) Boubyan Bank (June-10) ADCB (Jun-09) Oman cement (Sept-08)

Qassim Cement Company (Jun-10)

Qatar Telecom (Jun-09)

Savola Group (May-10)

Agility (June-10) DP World (Jun-09) Industries Qatar (Apr-09) Raysut Cement Company (Aug-08)

Alinma Bank (May-10) Gulf Bank of Kuwait (May -10) NBAD (Feb-09) Qatar National Bank (Feb-09) National Bank of Oman (Aug-08)

Jarir Marketing (May-10) National Bank of Kuwait (Mar-10) Sorouh Real Estate (Feb-09) United Development Co. (Feb-09) OIB (July-08)

Bank Al Bilad (May-10) Al Deera Holding (Aug-09) Aldar Properties (Feb-09) Qatar Fuel Co. (Dec-08) Jordan

Bank Al Jazira (Apr-10)

Kuwait Finance House (Apr-09) Gulf Cement Company (Jan-09) Qatar Shipping Co (Dec-08)

Makkah Construction (Apr-10)

Saudi Cement Company(Apr-10) Kuwait Financial Centre (Dec-08) Abu Dhabi National Hotels (Dec-08) Barwa Real Estate Co. (Nov-08) Arab Bank (Sept-08)

Southern Province Cement Co(Mar-10) Commercial Bank of Kuwait (Oct-08) Dubai Investments (Dec-08) Qatar Int’l Islamic bank (Nov-08) Cairo Amman Bank (Oct-08)

Saudi Electricity Company(Feb-10) National Industries Group (Sept-08) Arabtec Holding (Dec-08) Qatar Insurance Co. (Nov-08)

Saudi Arabian Mining Co(Feb-10) Zain (Sept-08)

Yamama Saudi Cement (Feb-10)

Air Arabia ( Nov-08) Doha Bank (Aug-08) Morocco

Etihad Etisalat (Feb-10) Global Investment House (Sept-08) Union Properties (Nov-08) QEWC (July-08) Maroc Telecom (Mar-10)

Al Marai Company (Dec-09) Kipco (Sept-08) Dubai Islamic bank (Oct-08)

Bahrain Egypt

Arab National Bank (Oct-09) The Investment Dar (Sept-08) Emaar Properties (July-08)

SAFCO (Oct-09) Burgan Bank (Sept-08) Dana Gas (July-08) Batelco (Aug-10)

Al Rajhi Bank (Aug-09) Al Salam Bank (Aug-10) Sidi Kerir Petrochemicals (Jul-10)

Automated Systems Co (Aug-08)

Riyad Bank (Jul-09)

Gulf Finance House (Oct-08) Egypt Kuwait Holding (Mar-10)

Sabic (Mar-09) Al Safat Investment Co (July-08)

Esterad Inv. Company (Aug-08) Commercial Int’l Bank (Oct-08)

Saudi Investment Bank (Jan-09)

Kingdom Holding Co (Dec-08) Bahrain Islamic Bank (Aug-08) Orascom Telecom (Sep-08)

Saudi Kayan Petro Co. (Aug-08) Ithmaar Bank (July-08) Mobinil (Sep-08)

Banque Saudi Fransi (Jun-08) Tameer (July-08) Telecom Egypt (Aug-08)

EFG-Hermes (Jun-08)

Markaz Research Offerings

Markaz Research is available on: Bloomberg Type “MRKZ” <GO>,

Thomson Financial, Reuters Knowledge, Zawya Investor & Noozz.

To obtain a print copy, kindly contact:

Kuwait Financial Centre “Markaz”

Media and Communications Department

Tel: +965 2224 8000 Ext. 1814

Fax: +965 2249 8740

Postal Address: P.O. Box 23444, Safat, 13095, State of Kuwait

Email: info@markaz.com

markaz.com/research

Kuwait Financial Centre “Markaz” 9

RESEARCH

October 2010

Kuwait Financial Centre “Markaz” 10

RESEARCH

October 2010

Disclaimer

This report has been prepared and issued by Kuwait Financial Centre S.A.K (Markaz), which is

regulated by the Central Bank of Kuwait. The report is intended to be circulated for general

information only and should not to be construed as an offer to buy or sell or a solicitation of an offer

to buy or sell any financial instruments or to participate in any particular trading strategy in any

jurisdiction.

The information and statistical data herein have been obtained from sources we believe to be

reliable but no representation or warranty, expressed or implied, is made that such information and

data is accurate or complete, and therefore should not be relied upon as such. Opinions, estimates

and projections in this report constitute the current judgment of the author as of the date of this

report. They do not necessarily reflect the opinion of Markaz and are subject to change without

notice. Markaz has no obligation to update, modify or amend this report or to otherwise notify a

reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or

estimate set forth herein, changes or subsequently becomes inaccurate, or if research on the

subject company is withdrawn.

This report does not have regard to the specific investment objectives, financial situation and the

particular needs of any specific person who may receive this report. Investors are urged to seek

financial advice regarding the appropriateness of investing in any securities or investment strategies

discussed or recommended in this report and to understand that statements regarding future

prospects may not be realized. Investors should note that income from such securities, if any, may

fluctuate and that each security’s price or value may rise or fall. Investors should be able and willing

to accept a total or partial loss of their investment. Accordingly, investors may receive back less than

originally invested. Past performance is historical and is not necessarily indicative of future

performance.

Kuwait Financial Centre S.A.K (Markaz) does and seeks to do business, including investment banking

deals, with companies covered in its research reports. As a result, investors should be aware that

the firm may have a conflict of interest that could affect the objectivity of this report.

You might also like

- NVDXT ParametersDocument5 pagesNVDXT ParametersStephen Blommestein50% (2)

- Cruz V Valero and Luzon Sugar CompanyDocument2 pagesCruz V Valero and Luzon Sugar CompanyPatricia Gonzaga0% (1)

- Motherson Sumi Systems LTD Excel FinalDocument30 pagesMotherson Sumi Systems LTD Excel Finalwritik sahaNo ratings yet

- Morning Star Report 20171119125636Document2 pagesMorning Star Report 20171119125636wesamNo ratings yet

- QNBFS Daily Market Report - Sept 17Document5 pagesQNBFS Daily Market Report - Sept 17QNBGroupNo ratings yet

- JS Income FundDocument9 pagesJS Income Fundcoolbouy85No ratings yet

- DMR Eng 3Document9 pagesDMR Eng 3faheemmpNo ratings yet

- Trade Performance and Fund Flow Week Ended 9 February 2024-258Document5 pagesTrade Performance and Fund Flow Week Ended 9 February 2024-258Shabandi MnNo ratings yet

- QFR 03-March 2022 LDocument70 pagesQFR 03-March 2022 LNapolean DynamiteNo ratings yet

- Screenshot 2022-07-24 at 9.04.59 PMDocument46 pagesScreenshot 2022-07-24 at 9.04.59 PMieda1718No ratings yet

- A Potential USD 140 BN Industry: Kuwait Financial Centre S.A.K "Markaz"Document19 pagesA Potential USD 140 BN Industry: Kuwait Financial Centre S.A.K "Markaz"Adama KoneNo ratings yet

- KazakhstanDocument13 pagesKazakhstanЛяззат НуртайNo ratings yet

- Muthoot Finance LTD.: Business OverviewDocument5 pagesMuthoot Finance LTD.: Business OverviewAvinash ThakurNo ratings yet

- Markets Ranking - Markets Adspend by Quarter Y2007Document2 pagesMarkets Ranking - Markets Adspend by Quarter Y2007Misk CommunicationNo ratings yet

- August ETF ReportDocument5 pagesAugust ETF ReportzoetechocNo ratings yet

- Mutual FundDocument8 pagesMutual FundMayur khambhatiNo ratings yet

- GCC Markets Monthly Report - June-2023Document10 pagesGCC Markets Monthly Report - June-2023Nirmal MenonNo ratings yet

- PSX Quote 31-08-2022Document42 pagesPSX Quote 31-08-2022wasayrazaNo ratings yet

- Indian Commodities Market: March 14, 2007Document40 pagesIndian Commodities Market: March 14, 2007parishkaaNo ratings yet

- Investor Digest: Equity Research - 20 March 2024Document5 pagesInvestor Digest: Equity Research - 20 March 2024brian butarNo ratings yet

- Market Update 26th February 2018Document1 pageMarket Update 26th February 2018Anonymous iFZbkNwNo ratings yet

- Market Technical Reading - Stronger Technical Bull Run Underway! - 15/09/2010Document6 pagesMarket Technical Reading - Stronger Technical Bull Run Underway! - 15/09/2010Rhb InvestNo ratings yet

- Mutual Fund Report Feb-20Document39 pagesMutual Fund Report Feb-20muddasir1980No ratings yet

- Cy 22 Return OpenDocument20 pagesCy 22 Return Openhamadashraf.swhccNo ratings yet

- Taj Hotels Balance Sheet ComparisonDocument3 pagesTaj Hotels Balance Sheet ComparisonjaykumariyerNo ratings yet

- QFR (PRS) March 2022Document20 pagesQFR (PRS) March 2022Napolean DynamiteNo ratings yet

- Commodity Exchanges - Prospects and Emerging Opportunities in IndiaDocument53 pagesCommodity Exchanges - Prospects and Emerging Opportunities in Indianb1920No ratings yet

- Markets and Commodity Figures: 04 July 2017Document4 pagesMarkets and Commodity Figures: 04 July 2017Tiso Blackstar GroupNo ratings yet

- Market Technical Reading - Next Resistance Only at 1,524.69! - 14/09/2010Document6 pagesMarket Technical Reading - Next Resistance Only at 1,524.69! - 14/09/2010Rhb InvestNo ratings yet

- Markets and Commodity Figures: 05 July 2017Document4 pagesMarkets and Commodity Figures: 05 July 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: 06 July 2017Document4 pagesMarkets and Commodity Figures: 06 July 2017Tiso Blackstar GroupNo ratings yet

- WFE Annual Statistics Guide 2015Document296 pagesWFE Annual Statistics Guide 2015smitajNo ratings yet

- Markets and Commodity Figures: 12 March 2017Document4 pagesMarkets and Commodity Figures: 12 March 2017Tiso Blackstar GroupNo ratings yet

- Kenanga Today - 230322 (Kenanga)Document5 pagesKenanga Today - 230322 (Kenanga)hl lowNo ratings yet

- Market Technical Reading: Muted Trading Sentiment Expected - 09/09/2010Document6 pagesMarket Technical Reading: Muted Trading Sentiment Expected - 09/09/2010Rhb InvestNo ratings yet

- Markets and Commodity Figures: 24 July 2017Document4 pagesMarkets and Commodity Figures: 24 July 2017Tiso Blackstar GroupNo ratings yet

- Africa Investor - April 24 2017Document4 pagesAfrica Investor - April 24 2017Tiso Blackstar GroupNo ratings yet

- AfricaInvestor - March 6 2017Document4 pagesAfricaInvestor - March 6 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: 16 July 2017Document4 pagesMarkets and Commodity Figures: 16 July 2017Tiso Blackstar GroupNo ratings yet

- 20th July, 2020Document8 pages20th July, 2020samuel debebeNo ratings yet

- Markets and Commodity Figures: 03 July 2017Document4 pagesMarkets and Commodity Figures: 03 July 2017Tiso Blackstar GroupNo ratings yet

- Africa Investor - July 25 2017Document4 pagesAfrica Investor - July 25 2017Tiso Blackstar GroupNo ratings yet

- Africa InvestorDocument4 pagesAfrica InvestorTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: 07 March 2017Document4 pagesMarkets and Commodity Figures: 07 March 2017Tiso Blackstar GroupNo ratings yet

- Derivatives in GCCDocument32 pagesDerivatives in GCCmacocean0% (1)

- AfricaInvestor - March 13 2017Document4 pagesAfricaInvestor - March 13 2017Tiso Blackstar GroupNo ratings yet

- AfricaInvestor - September 11 2017Document4 pagesAfricaInvestor - September 11 2017Tiso Blackstar GroupNo ratings yet

- Earn - World November 2023Document7 pagesEarn - World November 2023isaacngoma2000No ratings yet

- Mutual Fund: MARCH, 2020Document60 pagesMutual Fund: MARCH, 2020RAJ STUDY WIZARDNo ratings yet

- Market Technical Reading - A Penetration of The 10-Day SMA Is Crucial To Trading Sentiment... - 30/09/2010Document6 pagesMarket Technical Reading - A Penetration of The 10-Day SMA Is Crucial To Trading Sentiment... - 30/09/2010Rhb InvestNo ratings yet

- Asia: Composition of FX ReservesDocument2 pagesAsia: Composition of FX ReservesmuhjaerNo ratings yet

- Property Sector Update: IFRIC 15 Deferred To 2012 - 01/09/2010Document2 pagesProperty Sector Update: IFRIC 15 Deferred To 2012 - 01/09/2010Rhb InvestNo ratings yet

- Markets and Commodity FiguresDocument4 pagesMarkets and Commodity FiguresTiso Blackstar GroupNo ratings yet

- SamplemarketresearchDocument21 pagesSamplemarketresearchBig4 AdsNo ratings yet

- Macro Presentation: Jazira CapitalDocument8 pagesMacro Presentation: Jazira CapitalMohamed FahmyNo ratings yet

- Markets and Commodity FiguresDocument4 pagesMarkets and Commodity FiguresTiso Blackstar GroupNo ratings yet

- Public Shariah MFR August 2021Document47 pagesPublic Shariah MFR August 2021UmmiNo ratings yet

- Markets and Commodity FiguresDocument4 pagesMarkets and Commodity FiguresTiso Blackstar GroupNo ratings yet

- सार - Last Note by Mr. Prashant JainDocument12 pagesसार - Last Note by Mr. Prashant JaindhavalNo ratings yet

- AfricaInvestor - April 11 2017Document4 pagesAfricaInvestor - April 11 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity FiguresDocument4 pagesMarkets and Commodity FiguresTiso Blackstar GroupNo ratings yet

- Securitization and Structured Finance Post Credit Crunch: A Best Practice Deal Lifecycle GuideFrom EverandSecuritization and Structured Finance Post Credit Crunch: A Best Practice Deal Lifecycle GuideNo ratings yet

- Securities Operations: A Guide to Trade and Position ManagementFrom EverandSecurities Operations: A Guide to Trade and Position ManagementRating: 4 out of 5 stars4/5 (3)

- Saros Electronics LM317 Adjustable Voltage RegulatorDocument13 pagesSaros Electronics LM317 Adjustable Voltage RegulatorReneNo ratings yet

- Bài Tập Thì Hiện Tại Tiếp DiễnDocument9 pagesBài Tập Thì Hiện Tại Tiếp DiễnHÀ PHAN HOÀNG NGUYỆTNo ratings yet

- Nagothane Manufacturing Division Summer Internship ReportDocument5 pagesNagothane Manufacturing Division Summer Internship ReportMrudu PadteNo ratings yet

- Surface Treatments and CoatingsDocument4 pagesSurface Treatments and Coatingsmightym85No ratings yet

- HP 211B Manual PDFDocument61 pagesHP 211B Manual PDFDirson Volmir WilligNo ratings yet

- Conectores FsiDocument80 pagesConectores Fsijovares2099No ratings yet

- The PTP Telecom Profiles For Frequency, Phase and Time SynchronizationDocument30 pagesThe PTP Telecom Profiles For Frequency, Phase and Time Synchronizationalmel_09No ratings yet

- TP-20 For Protective RelaysDocument20 pagesTP-20 For Protective RelayssathiyaseelanNo ratings yet

- EN - Summer - 2013 - V-2012-08-17 - 1Document17 pagesEN - Summer - 2013 - V-2012-08-17 - 1chaudharyv100% (1)

- A Complete Manual On Ornamental Fish Culture: January 2013Document222 pagesA Complete Manual On Ornamental Fish Culture: January 2013Carlos MorenoNo ratings yet

- General Suggestion For SSCDocument6 pagesGeneral Suggestion For SSCJahirulNo ratings yet

- Case Digest: Assoc of Small Landowners vs. Sec. of Agrarian ReformDocument2 pagesCase Digest: Assoc of Small Landowners vs. Sec. of Agrarian ReformMaria Anna M Legaspi100% (3)

- Test Bank For Stationen 3rd EditionDocument20 pagesTest Bank For Stationen 3rd Editionattabaldigitulejp7tl100% (37)

- Perceived Consequences of Adoption of Mentha Cultivation in Central Uttar PradeshDocument8 pagesPerceived Consequences of Adoption of Mentha Cultivation in Central Uttar PradeshImpact JournalsNo ratings yet

- Derivatives - Practice QuestionsDocument4 pagesDerivatives - Practice QuestionsAdil AnwarNo ratings yet

- Lecture Note 3: Mechanism Design: - Games With Incomplete InformationDocument128 pagesLecture Note 3: Mechanism Design: - Games With Incomplete InformationABRAHAM GEORGENo ratings yet

- Pengenalan Safety N Health PDFDocument48 pagesPengenalan Safety N Health PDFwsuzana0% (1)

- M3-Social Media Text AnalyticsDocument19 pagesM3-Social Media Text AnalyticsKHAN SANA PARVEENNo ratings yet

- Strategy and Competitive Advantage Chapter 6Document7 pagesStrategy and Competitive Advantage Chapter 6Drishtee DevianeeNo ratings yet

- Worksheet There Was There Were 82860 20190907 20160905 120402Document4 pagesWorksheet There Was There Were 82860 20190907 20160905 120402Taty Angelita Vergara GonzalezNo ratings yet

- RR-0479-02 Novel Coronavirus (2019-nCoV) Real Time RT-PCR Kit-20200227 PDFDocument1 pageRR-0479-02 Novel Coronavirus (2019-nCoV) Real Time RT-PCR Kit-20200227 PDFwijaya adidarmaNo ratings yet

- Molnupiravir LOA 03232022Document12 pagesMolnupiravir LOA 03232022ivethNo ratings yet

- Manual KYK 30000Document20 pagesManual KYK 30000Benny ScorpyoNo ratings yet

- DHC Order - Section 59 Claim AmendmentsDocument35 pagesDHC Order - Section 59 Claim AmendmentsM VridhiNo ratings yet

- Laws4112 (2014) Exam Notes (Uq)Document132 pagesLaws4112 (2014) Exam Notes (Uq)tc_bassNo ratings yet

- Reboiler Case StudyDocument6 pagesReboiler Case StudyamlhrdsNo ratings yet

- Week 1 Shs Organic AgriDocument2 pagesWeek 1 Shs Organic Agrijessica coronel100% (2)