Professional Documents

Culture Documents

Municipality Notes RRE Comm PP MV: FY 2019 Rhode Island Tax Rates by Class of Property

Municipality Notes RRE Comm PP MV: FY 2019 Rhode Island Tax Rates by Class of Property

Uploaded by

Anonymous twcKq4Original Description:

Original Title

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Municipality Notes RRE Comm PP MV: FY 2019 Rhode Island Tax Rates by Class of Property

Municipality Notes RRE Comm PP MV: FY 2019 Rhode Island Tax Rates by Class of Property

Uploaded by

Anonymous twcKq4Copyright:

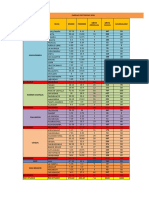

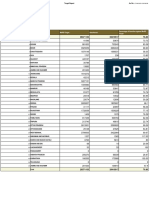

FY 2019 Rhode Island Tax Rates by Class of Property

Assessment Date December 31, 2017

Tax Roll Year 2018

MUNICIPALITY NOTES RRE COMM PP MV

BARRINGTON 2 $19.50 $19.50 $19.50 $42.00

BRISTOL 15.38 15.38 15.38 17.35

BURRILLVILLE 18.20 18.20 18.20 40.00

CENTRAL FALLS 8 26.31 39.67 73.11 48.65

CHARLESTOWN 9.64 9.64 9.64 13.08

COVENTRY 7 21.61 26.05 21.61 18.75

CRANSTON 2 20.29 30.44 30.44 42.44

CUMBERLAND 15.42 15.42 29.96 19.87

EAST GREENWICH 2 23.00 23.00 23.00 22.88

EAST PROVIDENCE 1, 8 22.88 25.33 56.51 37.10

EXETER 2 15.39 15.39 15.39 32.59

FOSTER 2 22.84 22.84 31.42 36.95

GLOCESTER 20.00 24.00 40.00 24.37

HOPKINTON 20.07 20.07 20.07 21.18

JAMESTOWN 8.85 8.85 8.85 14.42

JOHNSTON 8 27.49 27.49 59.71 41.46

LINCOLN 8 22.35 27.30 35.13 30.66

LITTLE COMPTON 5.96 5.96 11.92 13.90

MIDDLETOWN 2 13.75 18.20 13.75 16.05

NARRAGANSETT 2 9.95 13.93 13.93 16.46

NEW SHOREHAM 5.95 5.95 5.95 9.75

NEWPORT 2 9.99 14.98 14.98 23.45

NORTH KINGSTOWN 19.09 19.09 19.09 22.04

NORTH PROVIDENCE 8 26.14 32.88 68.11 41.95

NORTH SMITHFIELD 7 17.24 19.13 42.99 37.62

PAWTUCKET 2 20.13 33.21 52.09 50.00

PORTSMOUTH 6 15.97 15.97 15.97 22.50

PROVIDENCE 9 18.80 36.70 55.80 50.00

RICHMOND 6 21.36 21.36 21.36 22.64

SCITUATE 6, 7 19.39 23.27 41.24 30.20

SMITHFIELD 17.56 18.40 60.74 39.00

SOUTH KINGSTOWN 15.68 15.68 15.68 18.71

TIVERTON 2 16.39 16.39 16.39 19.14

WARREN 18.86 18.86 18.86 26.00

WARWICK 20.80 31.19 41.59 34.60

WEST GREENWICH 3, 8 23.70 23.70 35.57 19.02

WEST WARWICK 4 27.18 33.18 43.16 28.47

WESTERLY 11.88 11.88 11.88 29.67

WOONSOCKET 2, 8 24.08 36.19 46.58 46.58

Source: Division of Municipal Finance Represents tax rate per thousand dollars of assessed value.

CLASSES:

RRE = Residential Real Estate COMM = Commercial Real Estate PP = Personal Property MV = Motor Vehicles

NOTES:

1) Rates support fiscal year 2018 for East Providence.

2) Municipality had a revaluation or statistical update effective 12/31/17.

3) Vacant land taxed at $16.89 per thousand of assessed value.

4) Real Property taxed at four different rates: $39.20 (apartments 6+ units); $33.18 (combination, commercial I, commercial

II, industrial, commercial condo, comm./ind. vacant land, comm. buildings on leased land, utilities and rails, other vacant

land); $39.20 (two to five family); $27.18 (one family residence, estates, farms, seasonal/beach property, residential vacant

land, residential buildings on leased land, residential condo, time shared condo, farm/forest/open space, mobile homes,

two-family owner occupied properties)

5) New Shoreham's Real Property is assessed at 80% of Fair Market Value at the time of revaluation/update. Real

Property in all other municipalities is assessed at 100%.

6) Motor vehicles in Portsmouth, Richmond & Scituate are assessed at 70%, 80%, & 95%, respectively, of the retail value

per local ordinance. Motor vehicles are assessed at 100% in all other municipalities, before any adjustments.

7) Rates rounded to two decimals

8) Denotes homestead exemption available

9) Providence rate shown is for owner occupied residential property; non-owner occupied rate is $31.96

You might also like

- Content and Contextual Analysis-Speech of Corazon Aquino (Moreno, Keilse)Document8 pagesContent and Contextual Analysis-Speech of Corazon Aquino (Moreno, Keilse)Keilse100% (9)

- Aboriginal and Culturally Responsive Pedagogies Assignment 1Document8 pagesAboriginal and Culturally Responsive Pedagogies Assignment 1api-332411347No ratings yet

- Roofing Materials 1Document53 pagesRoofing Materials 1Jason Pana50% (2)

- Women and Infants SuitDocument16 pagesWomen and Infants SuitAnonymous twcKq4No ratings yet

- The Relationships Among Sea-Food Restaurant Service Quality Perceived Value Customer Satisfaction and Behavioral IntentionsDocument5 pagesThe Relationships Among Sea-Food Restaurant Service Quality Perceived Value Customer Satisfaction and Behavioral IntentionsashisbhuniyaNo ratings yet

- Flexible Instruction Delivery Plan TemplateDocument2 pagesFlexible Instruction Delivery Plan TemplateAisa Edza100% (5)

- Rekap KS 1Document30 pagesRekap KS 1Estu PamungkasNo ratings yet

- Annual Program 2017 Divisi F3+++Document436 pagesAnnual Program 2017 Divisi F3+++taufik purnomoNo ratings yet

- PPFF 2020Document44 pagesPPFF 2020Jenny Matilde Collave GonzálezNo ratings yet

- Nr. CRT Produs Bucăți Pret BucatăDocument2 pagesNr. CRT Produs Bucăți Pret BucatăPaul MarginasNo ratings yet

- Input Data Sheet For E-Class Record: Region Division School Name School Id School YearDocument33 pagesInput Data Sheet For E-Class Record: Region Division School Name School Id School YearMAGDALINA COPITANo ratings yet

- Parte Mensuales. 2022Document46 pagesParte Mensuales. 2022Grevil AvelarNo ratings yet

- PlannerDocument3 pagesPlannersubaash libraNo ratings yet

- ESTADUAL 2010 - ResultadosDocument19 pagesESTADUAL 2010 - ResultadososwaldovbNo ratings yet

- Best Sector Times 65Document1 pageBest Sector Times 65ShaitanNo ratings yet

- 29 October EfficiencyDocument25 pages29 October EfficiencymonowaraNo ratings yet

- BSN1H Art AppDocument5 pagesBSN1H Art AppDianne Medel GumawidNo ratings yet

- Roofing Materials 1Document53 pagesRoofing Materials 1Melvin QuidongNo ratings yet

- Scotch SNR TT Gs Alp Sum Results DivisionDocument2 pagesScotch SNR TT Gs Alp Sum Results DivisionLei ZhangNo ratings yet

- Metrado Muro de ContencionDocument6 pagesMetrado Muro de ContencionMaríaElenaMendozaNo ratings yet

- Chart Title: X Y Volumen de MercanciaDocument2 pagesChart Title: X Y Volumen de Mercanciabrayan chaparroNo ratings yet

- Evaluasi Program Gizi 2022Document14 pagesEvaluasi Program Gizi 2022Verawaty DamaNo ratings yet

- Group1 Data-Draft (EditedDocument27 pagesGroup1 Data-Draft (EditedBon Harold DumasNo ratings yet

- Rata Incidenta Covid 19 17 10 2021Document2 pagesRata Incidenta Covid 19 17 10 2021jeanina lupuNo ratings yet

- Total Number of Collection 2023Document16 pagesTotal Number of Collection 2023CarlNo ratings yet

- 1882-1889 Whitman WA Precinct Level Election ResultsDocument66 pages1882-1889 Whitman WA Precinct Level Election ResultsJohn MNo ratings yet

- SoDocument45 pagesSokaldera RifaiNo ratings yet

- 2019 14 Ita f1 q0 Timing Qualifyingsessionbestsectortimes v01Document1 page2019 14 Ita f1 q0 Timing Qualifyingsessionbestsectortimes v01frehanyaqNo ratings yet

- Proyecto Teoria Estruc. 2 (2-19-0847)Document11 pagesProyecto Teoria Estruc. 2 (2-19-0847)Raylin NoseNo ratings yet

- Rata Incidenta Covid 19 15 10 2021Document2 pagesRata Incidenta Covid 19 15 10 2021jeanina lupuNo ratings yet

- Class Record: Region Division School Name School Id School YearDocument5 pagesClass Record: Region Division School Name School Id School YearUnissNo ratings yet

- Eastern Mines - MAGARENG: Truck Registration DetailsDocument6 pagesEastern Mines - MAGARENG: Truck Registration DetailsManuel AndréNo ratings yet

- BGR (CustomReport) 3Document8 pagesBGR (CustomReport) 3bluegrassrivalsNo ratings yet

- Analiza PronosticDocument8 pagesAnaliza PronosticAdrian RoscaNo ratings yet

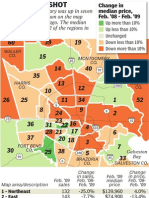

- Sales AreasDocument1 pageSales AreasHouston Chronicle100% (1)

- 2019 10 GBR f1 r0 Timing Racebestsectortimes v01Document1 page2019 10 GBR f1 r0 Timing Racebestsectortimes v01andresNo ratings yet

- 1ST Year-Summer-Coaching-AllotmentDocument1 page1ST Year-Summer-Coaching-AllotmentthealkpNo ratings yet

- Rata Incidenta Covid 19 19 10Document2 pagesRata Incidenta Covid 19 19 10jeanina lupuNo ratings yet

- Conteo Original 6 08Document8 pagesConteo Original 6 08Dennis Raúl Cáceres LaricoNo ratings yet

- Fare Calculator Grab Uber MyCar NuccarDocument4 pagesFare Calculator Grab Uber MyCar NuccarKim Ben NajibNo ratings yet

- Manga Rec T15Document7 pagesManga Rec T15Douglas SandyNo ratings yet

- Anatomical Properties-Mr. FrankDocument16 pagesAnatomical Properties-Mr. FrankJoshuaNo ratings yet

- Xii-Nm (A) - RT-03 - 06-05-24Document2 pagesXii-Nm (A) - RT-03 - 06-05-24Satwant KaurNo ratings yet

- OmegaDocument6 pagesOmegaSUMIT JAINNo ratings yet

- Data Statistik Tal Barat r2Document74 pagesData Statistik Tal Barat r2RendiNo ratings yet

- Resultado GeralDocument1 pageResultado GeraloswaldovbNo ratings yet

- Promkes - Data Kegiatan Pemberdayaan Masyarakat 2019Document19 pagesPromkes - Data Kegiatan Pemberdayaan Masyarakat 2019Tyas HapsariNo ratings yet

- Cakupan Vaksinasi Dosis 2 KPCPEN - 24 April 2022 Pukul 08.00 WIBDocument1 pageCakupan Vaksinasi Dosis 2 KPCPEN - 24 April 2022 Pukul 08.00 WIBCece CeriaCeriaCelalauNo ratings yet

- Overdose Response in BC Communities in 2020Document3 pagesOverdose Response in BC Communities in 2020Ashley WadhwaniNo ratings yet

- ROL Agulhas NK-HKDocument7 pagesROL Agulhas NK-HKSprol ImperialNo ratings yet

- HomeCumulativeDataRpt Centre 3Document1 pageHomeCumulativeDataRpt Centre 3Suman DhaliNo ratings yet

- Table 8 Offenses Known To Law Enforcement by State by City 2013Document294 pagesTable 8 Offenses Known To Law Enforcement by State by City 2013Adam BuchananNo ratings yet

- Nouveau Feuille de Calcul Microsoft ExcelDocument8 pagesNouveau Feuille de Calcul Microsoft ExcelAta Ben messaoudNo ratings yet

- 1922 Benton WA Prcinct VoteDocument2 pages1922 Benton WA Prcinct VoteJohn MNo ratings yet

- Net WinDocument4 pagesNet WinAbdel RodriguezNo ratings yet

- English 10 Proficiency Level 2022-2023Document2 pagesEnglish 10 Proficiency Level 2022-2023Ehdz B Visperas-TarangcoNo ratings yet

- Passage Plan BLANK FORM 1Document8 pagesPassage Plan BLANK FORM 1Aljhon VelasquezNo ratings yet

- Municipio Tipo de Superficie Adoq. Asf. C.H. Emp. Rev. T.TDocument4 pagesMunicipio Tipo de Superficie Adoq. Asf. C.H. Emp. Rev. T.TErnesto Pablo RiveraNo ratings yet

- Blotter (Capital Market) - 1Document35 pagesBlotter (Capital Market) - 1Arif Hasan KhanNo ratings yet

- Data Harian Agustus 2018Document96 pagesData Harian Agustus 2018Budi SusantoNo ratings yet

- Elevasi AirDocument9 pagesElevasi AirRahma idahNo ratings yet

- Nifty PE PB Dividend Yield ChartDocument12 pagesNifty PE PB Dividend Yield ChartJayaprakash MuthuvatNo ratings yet

- Warwick School Committee AgendaDocument3 pagesWarwick School Committee AgendaAnonymous twcKq4No ratings yet

- Complaint - Pullman and LynchDocument21 pagesComplaint - Pullman and LynchAnonymous twcKq4No ratings yet

- Committo Arrest Report - TPDDocument4 pagesCommitto Arrest Report - TPDAnonymous twcKq4No ratings yet

- 2019 - H 5171 SUBSTITUTE B: in General Assembly January Session, A.D. 2019Document5 pages2019 - H 5171 SUBSTITUTE B: in General Assembly January Session, A.D. 2019Anonymous twcKq4No ratings yet

- Angel Joel LucianoDocument1 pageAngel Joel LucianoAnonymous twcKq4No ratings yet

- PPSD Report MediaDocument93 pagesPPSD Report MediaAnonymous twcKq4No ratings yet

- Jose Luis GervacioDocument1 pageJose Luis GervacioAnonymous twcKq4No ratings yet

- Academic Honors Proposal 4-16-19Document7 pagesAcademic Honors Proposal 4-16-19Anonymous twcKq4No ratings yet

- Final Oca Child Fatality Review Panel Report03232017Document56 pagesFinal Oca Child Fatality Review Panel Report03232017Anonymous twcKq4No ratings yet

- Attleboro Chief Conflict of Interest DisclosureDocument2 pagesAttleboro Chief Conflict of Interest DisclosureAnonymous twcKq4No ratings yet

- 911 LetterDocument2 pages911 LetterAnonymous twcKq4No ratings yet

- 5.23.19 Michael Ella FlyerDocument1 page5.23.19 Michael Ella FlyerAnonymous twcKq4No ratings yet

- 2019 - S 0152 SUBSTITUTE A: in General Assembly January Session, A.D. 2019Document13 pages2019 - S 0152 SUBSTITUTE A: in General Assembly January Session, A.D. 2019Anonymous twcKq4No ratings yet

- Managing Pain After Dental SurgeryDocument1 pageManaging Pain After Dental SurgeryAnonymous twcKq4No ratings yet

- RIDE Letter East Greenwich Field Trip PolicyDocument3 pagesRIDE Letter East Greenwich Field Trip PolicyAnonymous twcKq4No ratings yet

- 2-14-18 Lily's Hot Stone Massage IncDocument3 pages2-14-18 Lily's Hot Stone Massage IncAnonymous twcKq4No ratings yet

- United States District Court For The District of Rhode IslandDocument4 pagesUnited States District Court For The District of Rhode IslandAnonymous twcKq4No ratings yet

- Brown University Community Letter 04-09-19Document3 pagesBrown University Community Letter 04-09-19Anonymous twcKq4No ratings yet

- FY2019 SFO Governors Budget Articles PDFDocument74 pagesFY2019 SFO Governors Budget Articles PDFAnonymous twcKq4No ratings yet

- In General Assembly January Session, A.D. 2019Document2 pagesIn General Assembly January Session, A.D. 2019Anonymous twcKq4No ratings yet

- FY2019 SFO Governors Budget Articles PDFDocument74 pagesFY2019 SFO Governors Budget Articles PDFAnonymous twcKq4No ratings yet

- D-18-39 Interstate NavigationDocument23 pagesD-18-39 Interstate NavigationAnonymous twcKq4No ratings yet

- Contemporary Philippine Arts From The RegionsDocument31 pagesContemporary Philippine Arts From The RegionsLuisa Phamela SingianNo ratings yet

- Broderick Hanyard: ObjectiveDocument4 pagesBroderick Hanyard: ObjectiveBroderick HanyardNo ratings yet

- Industrial Tour Report On (Four H Apparels LTD) : University of ChittagongDocument34 pagesIndustrial Tour Report On (Four H Apparels LTD) : University of ChittagongMandal SouvikNo ratings yet

- Gabriela Thomas - ResumeDocument6 pagesGabriela Thomas - Resumeapi-534188015No ratings yet

- How Would You Like To Capture Your Past Memories? - Why Do People Write Diary? - Can You Name A Famous Book Which Is Actually ADocument8 pagesHow Would You Like To Capture Your Past Memories? - Why Do People Write Diary? - Can You Name A Famous Book Which Is Actually AAashi GuptaNo ratings yet

- DANCE FORMS MapehDocument25 pagesDANCE FORMS MapehQuelonio Kate0% (1)

- China Japan Korea: of The Floating World". It Is TheDocument3 pagesChina Japan Korea: of The Floating World". It Is TheJaimeCrispinoNo ratings yet

- Member Biography Sheet: Business InformationDocument6 pagesMember Biography Sheet: Business InformationAsyraf DaudNo ratings yet

- Assignment On Prerogative MercyDocument17 pagesAssignment On Prerogative MercyMasudur Rahman RanaNo ratings yet

- Anti Corruption Notes.Document60 pagesAnti Corruption Notes.PrernaNo ratings yet

- The Problem and Literature Review Background of The StudyDocument60 pagesThe Problem and Literature Review Background of The StudyDandyNo ratings yet

- Rule 126, Search and SeizureDocument40 pagesRule 126, Search and SeizureErnie PadernillaNo ratings yet

- Auditing Theory: C. Both I and IIDocument8 pagesAuditing Theory: C. Both I and IIKIM RAGANo ratings yet

- Meaning and Scope of GovernanceDocument13 pagesMeaning and Scope of GovernanceDen Marc BalubalNo ratings yet

- India TourismDocument3 pagesIndia TourismPrakash ShekhawatNo ratings yet

- In India, Many Are Death Due To The Virus A New Guidelines For Disposal of DeadDocument2 pagesIn India, Many Are Death Due To The Virus A New Guidelines For Disposal of DeadCrisyl LipawenNo ratings yet

- Literature Reviews: 1) AttractivenessDocument14 pagesLiterature Reviews: 1) AttractivenessMubarra ShabirNo ratings yet

- Supreme Court of India Page 1 of 23Document24 pagesSupreme Court of India Page 1 of 23simmi guptaNo ratings yet

- Same-Sex Marriage As A Religious Right Essay 3 Final DraftDocument6 pagesSame-Sex Marriage As A Religious Right Essay 3 Final Draftapi-582891715No ratings yet

- With Sample On Activities of TBL PDFDocument145 pagesWith Sample On Activities of TBL PDFHaya MonaNo ratings yet

- Columbia's Teachers College Report About Muslim Students in NYC Public SchoolsDocument18 pagesColumbia's Teachers College Report About Muslim Students in NYC Public SchoolsmeligyxxiNo ratings yet

- 4SW1 01 Que 20190526Document16 pages4SW1 01 Que 20190526nabeelNo ratings yet

- Overview of Green Business Practices Within The Bangladeshi RMG Industry: Competitiveness and Sustainable Development PerspectiveDocument14 pagesOverview of Green Business Practices Within The Bangladeshi RMG Industry: Competitiveness and Sustainable Development PerspectiveHosney Jahan SraboniNo ratings yet

- PolittnessDocument8 pagesPolittnessLarassNo ratings yet

- Proposed Class Action by RCMP MembersDocument29 pagesProposed Class Action by RCMP MembersChronicle HeraldNo ratings yet

- B767 and A330 Fuel Cons Report June 26Document7 pagesB767 and A330 Fuel Cons Report June 26Tanker War Blog100% (4)