Professional Documents

Culture Documents

Section 291 Recapture: Taxes: T NSA T Onsinp Operty

Section 291 Recapture: Taxes: T NSA T Onsinp Operty

Uploaded by

El Sayed AbdelgawwadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Section 291 Recapture: Taxes: T NSA T Onsinp Operty

Section 291 Recapture: Taxes: T NSA T Onsinp Operty

Uploaded by

El Sayed AbdelgawwadCopyright:

Available Formats

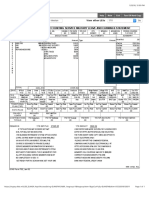

504 MODULE 34 TAXES: TRANSACTIONS IN PROPERTY

5. Section 291 Recapture

a. The ordinary income element on the disposition of Sec. 1250 property by corporations is

in-

creased by 20% of the additional amount that would have been ordinary income if the property

had instead

EXAMPLE:been Sec. 1245

Assuming property

the same facts as or Sec.

in the 1245

above recovery

example exceptproperty.'

that the building was sold by Corporation X,

the computation of gain would be

Total gain ($350,000 - $200,000) $150,000

Post-1969 additional depreciation recaptured as ordinary income . (30,000)*

Additional ordinary income-20% of $70,000 (the additional amount that

would have been ordinary income if the property were Sec. 1245 property) (]4.000)*

Remainder is Sec. 1231 gain $l.fJ.Q,QQQ

* All $44,000 ($30,000 + $14,000) of recapture is referred to as Sec. 1250 ordinary income.

p. • Summary of Gains and Losses on Business Property. The treatment of gains and losses (other than

personal casualty and theft) on property held for more than one year is summarized in the following

four steps (also enumerated on flowchart at end of this section):

a. Separate all recognized gains and losses into four

categories

(1) Ordinary gain and loss

(2) Sec. 1231 casualty and theft gains and losses

(3) Sec. 1231 gains and losses other than by casualty or theft

(4) Gains and losses on capital assets (other than by casualty or theft)

b. Any

NOTE: gain(3)(casualty

(2) and or other) classifications

are only "temporary on Sec. 1231 andproperty is treated

all gains and as ultimately

losses will ordinaryreceive

income to extent

ordinary of Sec.

or capi-

tal treatment.

c. 1245, 1250, and 291 depreciation recapture.

After depreciation recapture, any remaining Sec. 1231 casualty. and theft gains and losses on busi-

ness property are netted.

(1) If losses exceed gains-the losses and gains receive ordinary treatment

(2) If gains exceed losses-the net gain is combined with other Sec. 1231 gains and losses in d.

below

d. After recapture, any remaining Sec. 1231 gains and losses (other than by casualty or theft), are

combined with any net casualty or theft gain from c. above.

(l) Iflosses exceed gains-the losses and gains receive ordinary treatment

$

(2) If gains exceed losses-the net gain receives LTCG treatment (except ordinary income treat- (500)

ment to extent of nonrecaptured net Sec. 1231 losses for the five most recent tax years) (1,000

EXAMPLE: Taxpayer incurred the following transactions during the current taxable year: )

(2;000

Loss on condemnation of land used in business held fifteen months )

Loss on sale of machinery used in business held two months

Bad debt loss on loan made three years ago to friend

Gain from insurance reimbursement for tornado damage to business property held

ten years Sec. 1231 Other Capital 3,000

. Loss on sale of business equipment held three

Ordinary years

Sec. 1231 S-T (4,000)

Gain on sale. of land

$(1,000) heldfour years and used in business

Casualty $(2,000)* 5,000

-

treated as follows: Note$ that

The gains and losses would be$3,000 (500)the loss on machinery is ordinary because it was

not held more than one year. (4,000)

5,000

_ 3.000 $3.500

$!LQf2QJ $3500 $~

$3.500

* A nonbusiness bad debt is always treated as a STCL.

You might also like

- MyPay PDFDocument1 pageMyPay PDFPaul BeznerNo ratings yet

- Week 1 QuestionsDocument9 pagesWeek 1 Questionscrystal38844718No ratings yet

- Revsine FRA 8e Chap011 SMDocument64 pagesRevsine FRA 8e Chap011 SMseawoodsNo ratings yet

- CH 11Document21 pagesCH 11cushin200950% (8)

- Income and Changes in Retained Earnings: - Chapter 12Document49 pagesIncome and Changes in Retained Earnings: - Chapter 12Moqadus SeharNo ratings yet

- Uber Misc PDFDocument2 pagesUber Misc PDFWaleed A ElTahanNo ratings yet

- PDF W2Document1 pagePDF W2John LittlefairNo ratings yet

- Taxes: Nsacti Ns in E TY: D. Ain and Losse On Bu Pe TDocument1 pageTaxes: Nsacti Ns in E TY: D. Ain and Losse On Bu Pe TEl Sayed AbdelgawwadNo ratings yet

- D. Gains and Losses o Bus Ness Property: Taxes T Ansact Onsinp PE TYDocument1 pageD. Gains and Losses o Bus Ness Property: Taxes T Ansact Onsinp PE TYZeyad El-sayedNo ratings yet

- Solved Elizabeth Owns Equipment That Cost 500 000 and Has An AdjustedDocument1 pageSolved Elizabeth Owns Equipment That Cost 500 000 and Has An AdjustedAnbu jaromiaNo ratings yet

- Chapter 17Document8 pagesChapter 17张心怡No ratings yet

- Sec 1245 Property Personal Property,: MOD Le 34 Taxes Transacti NS N TDocument2 pagesSec 1245 Property Personal Property,: MOD Le 34 Taxes Transacti NS N TEl Sayed AbdelgawwadNo ratings yet

- Chapters 10 and 11 OutlineDocument11 pagesChapters 10 and 11 OutlineHamzah B ShakeelNo ratings yet

- I - " I. - T C L I I - .: 61. (B) The Requirement Is To Determine Mcewing CorDocument2 pagesI - " I. - T C L I I - .: 61. (B) The Requirement Is To Determine Mcewing CorZeyad El-sayedNo ratings yet

- Module 35 Taxes: Partnerships:: 'S CC G C C Se e I 7 .E., o Co - Es Y. S CDocument2 pagesModule 35 Taxes: Partnerships:: 'S CC G C C Se e I 7 .E., o Co - Es Y. S CEl Sayed AbdelgawwadNo ratings yet

- ACCTNG 5557 Ppt-Sanjida AfrinDocument5 pagesACCTNG 5557 Ppt-Sanjida AfrinSanjida DorothiNo ratings yet

- Module 34 Taxes: Transactions N E TY: I Prop RDocument2 pagesModule 34 Taxes: Transactions N E TY: I Prop REl Sayed AbdelgawwadNo ratings yet

- Module 33 Taxes: IndividualDocument1 pageModule 33 Taxes: IndividualZeyad El-sayedNo ratings yet

- 2018 Tax2A Test 2 Suggested Solution Question 3Document2 pages2018 Tax2A Test 2 Suggested Solution Question 3molemothekaNo ratings yet

- Taxes: Transactions in Property: S, ,,, - , S,, S F ADocument2 pagesTaxes: Transactions in Property: S, ,,, - , S,, S F AZeyad El-sayedNo ratings yet

- Chapter 10 - With NotesDocument47 pagesChapter 10 - With NotesJackNo ratings yet

- Capital GainDocument10 pagesCapital GainMakki BakhshNo ratings yet

- Rules, Required By: Intangible)Document5 pagesRules, Required By: Intangible)Iqra HayatNo ratings yet

- Unit-6C Insurance-ClaimsDocument49 pagesUnit-6C Insurance-Claimsadityaupreti2003No ratings yet

- UponDocument38 pagesUponfawamahsaNo ratings yet

- CGT SummaryDocument3 pagesCGT Summaryk.c sedibeNo ratings yet

- WFT Ch17 SolutionsDocument32 pagesWFT Ch17 Solutionshappybebe69No ratings yet

- Capital Gains Tax Lecture Summary 2020Document45 pagesCapital Gains Tax Lecture Summary 2020nsnhemachenaNo ratings yet

- Capital Gains Tax Lecture Summary 2020Document40 pagesCapital Gains Tax Lecture Summary 2020Tatenda RamsNo ratings yet

- IPPTChap 010Document40 pagesIPPTChap 010Mo ZhuNo ratings yet

- ACC3004H Tax 2 April Test 2015 Suggested Solution Question 2Document3 pagesACC3004H Tax 2 April Test 2015 Suggested Solution Question 2Sibonelo MasukuNo ratings yet

- 5TH.B Provisions, Contingent Liabilities and Contingent AssetsDocument4 pages5TH.B Provisions, Contingent Liabilities and Contingent AssetsAnthony DyNo ratings yet

- Accounting Errata Sheet 2022 291121Document2 pagesAccounting Errata Sheet 2022 291121Saudi MindNo ratings yet

- Fa Far Sesi 2Document28 pagesFa Far Sesi 2hdyhNo ratings yet

- Exercise 1Document2 pagesExercise 1Dương HàNo ratings yet

- 1995Document17 pages1995Gelo MVNo ratings yet

- Module 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CDocument3 pagesModule 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CZeyad El-sayedNo ratings yet

- LAW320Document4 pagesLAW320katherine_vampireNo ratings yet

- It (Deductions B)Document18 pagesIt (Deductions B)Rein ConcepcionNo ratings yet

- Taxes: Transactions in Property: B.1 Capital AssetsDocument2 pagesTaxes: Transactions in Property: B.1 Capital AssetsZeyad El-sayedNo ratings yet

- 16.9.chapter 8+9 - Conso SoCI - Jun 11 - AnswerDocument3 pages16.9.chapter 8+9 - Conso SoCI - Jun 11 - AnswerPHUC TRAN TRIEU NGUYENNo ratings yet

- Instructions For Schedule D (Form 1120S) : Capital Gains and Losses and Built-In GainsDocument3 pagesInstructions For Schedule D (Form 1120S) : Capital Gains and Losses and Built-In GainsIRSNo ratings yet

- Insurance Claims For Loss of Stock and Loss of Profit: After Studying This Chapter, You Will Be Able ToDocument50 pagesInsurance Claims For Loss of Stock and Loss of Profit: After Studying This Chapter, You Will Be Able ToRiyaNo ratings yet

- Taxes: Transactions in Prope TYDocument3 pagesTaxes: Transactions in Prope TYEl Sayed AbdelgawwadNo ratings yet

- US Internal Revenue Service: I1040sd - 2000Document8 pagesUS Internal Revenue Service: I1040sd - 2000IRSNo ratings yet

- 2006 BIR - Ruling - DA 745 06 - 20180405 1159 SdfparDocument7 pages2006 BIR - Ruling - DA 745 06 - 20180405 1159 Sdfpar--No ratings yet

- Ias 36Document12 pagesIas 36MariaNo ratings yet

- Apply Your Knowledge: Case Study 1Document3 pagesApply Your Knowledge: Case Study 1Queen ValleNo ratings yet

- Cash FlowDocument4 pagesCash FlowAsim RizwanNo ratings yet

- Limited Liability Partnership (LLP)Document10 pagesLimited Liability Partnership (LLP)sejal ambetkarNo ratings yet

- F 982 SqaDocument1 pageF 982 Sqaeagle12No ratings yet

- US Internal Revenue Service: f1120sd - 1994Document2 pagesUS Internal Revenue Service: f1120sd - 1994IRSNo ratings yet

- F6zwe 2015 Dec ADocument8 pagesF6zwe 2015 Dec APhebieon MukwenhaNo ratings yet

- IAS 36 Practice Questions Solutions 08122022 104310amDocument4 pagesIAS 36 Practice Questions Solutions 08122022 104310amAdnan MaqboolNo ratings yet

- Insurance Claims For Loss of Stock and Loss of Profit 2 PDFDocument22 pagesInsurance Claims For Loss of Stock and Loss of Profit 2 PDFEswari Gk100% (1)

- Chapter 3 SolutibsDocument57 pagesChapter 3 SolutibsHarsh KhandelwalNo ratings yet

- Solved Corporation Q A Calendar Year Taxpayer Has Incurred The FollowingDocument1 pageSolved Corporation Q A Calendar Year Taxpayer Has Incurred The FollowingAnbu jaromiaNo ratings yet

- IAS 7 - Statement of Cash FlowsDocument21 pagesIAS 7 - Statement of Cash FlowsTD2 from Henry HarvinNo ratings yet

- I. Structure 1. Gross Income A. Determine GROSS INCOME: - Above The Line: Taken After Calculating Gross Income andDocument4 pagesI. Structure 1. Gross Income A. Determine GROSS INCOME: - Above The Line: Taken After Calculating Gross Income andIva K. TodorovaNo ratings yet

- Instructions For Schedule D (Form 1120S) : Capital Gains and Losses and Built-In GainsDocument3 pagesInstructions For Schedule D (Form 1120S) : Capital Gains and Losses and Built-In GainsIRSNo ratings yet

- IPCC Mock Test Taxation - Only Solution - 25.09.2018Document12 pagesIPCC Mock Test Taxation - Only Solution - 25.09.2018KaustubhNo ratings yet

- Se Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossDocument3 pagesSe Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossZeyad El-sayedNo ratings yet

- Module 22 Federal Securities Acts and Antitrust LawDocument2 pagesModule 22 Federal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNo ratings yet

- Scan 0015Document2 pagesScan 0015El Sayed AbdelgawwadNo ratings yet

- Federal Securities Acts and Antitrust LawDocument3 pagesFederal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNo ratings yet

- Ill LLQ J: ContractsDocument2 pagesIll LLQ J: ContractsEl Sayed AbdelgawwadNo ratings yet

- Agency: I. Formation of The Agency RelationshipDocument7 pagesAgency: I. Formation of The Agency RelationshipEl Sayed AbdelgawwadNo ratings yet

- M Dule 22 Federal Securities Acts and Antitrust LawDocument2 pagesM Dule 22 Federal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNo ratings yet

- Module 22 Federal Securities Acts and Antitrust LawDocument2 pagesModule 22 Federal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNo ratings yet

- P L N L U N N T MP: Sarbanes-Ox Eyactof2 2Document2 pagesP L N L U N N T MP: Sarbanes-Ox Eyactof2 2El Sayed AbdelgawwadNo ratings yet

- Scan 0014Document2 pagesScan 0014El Sayed AbdelgawwadNo ratings yet

- C Ayton Act of 1914: Module 22 Fe E A SE UDocument2 pagesC Ayton Act of 1914: Module 22 Fe E A SE UEl Sayed AbdelgawwadNo ratings yet

- Scan 0020Document2 pagesScan 0020El Sayed AbdelgawwadNo ratings yet

- Contracts: Over IDocument2 pagesContracts: Over IEl Sayed AbdelgawwadNo ratings yet

- Federal Securities Acts and Antitrust Law: C o C eDocument2 pagesFederal Securities Acts and Antitrust Law: C o C eEl Sayed AbdelgawwadNo ratings yet

- Scan 0021Document2 pagesScan 0021El Sayed AbdelgawwadNo ratings yet

- Cont A: R CTSDocument2 pagesCont A: R CTSEl Sayed AbdelgawwadNo ratings yet

- Cont Acts: G A A yDocument1 pageCont Acts: G A A yEl Sayed AbdelgawwadNo ratings yet

- Scan 0014Document2 pagesScan 0014El Sayed AbdelgawwadNo ratings yet

- Scan 0014Document2 pagesScan 0014El Sayed AbdelgawwadNo ratings yet

- Contracts: D Still Owes CTDocument2 pagesContracts: D Still Owes CTEl Sayed AbdelgawwadNo ratings yet

- Scan 0007Document2 pagesScan 0007El Sayed AbdelgawwadNo ratings yet

- S S S T I E: ContractsDocument2 pagesS S S T I E: ContractsEl Sayed AbdelgawwadNo ratings yet

- Scan 0003Document2 pagesScan 0003El Sayed AbdelgawwadNo ratings yet

- Module 26 Secured Transactions:: S G S C R eDocument2 pagesModule 26 Secured Transactions:: S G S C R eEl Sayed AbdelgawwadNo ratings yet

- Scan 0002Document2 pagesScan 0002El Sayed AbdelgawwadNo ratings yet

- J .T/DTD: Tjrrji?"Document1 pageJ .T/DTD: Tjrrji?"El Sayed AbdelgawwadNo ratings yet

- Scan 0002Document2 pagesScan 0002El Sayed AbdelgawwadNo ratings yet

- Module 26 Secured Transactions:: o C, G eDocument2 pagesModule 26 Secured Transactions:: o C, G eEl Sayed AbdelgawwadNo ratings yet

- Secured Transactions: FreezerDocument2 pagesSecured Transactions: FreezerEl Sayed AbdelgawwadNo ratings yet

- Priorities: Secu Ed TransactionsDocument2 pagesPriorities: Secu Ed TransactionsEl Sayed AbdelgawwadNo ratings yet

- Fi V Y, A (A A y I R S (B) A R S Si: Secured TransactionsDocument2 pagesFi V Y, A (A A y I R S (B) A R S Si: Secured TransactionsEl Sayed AbdelgawwadNo ratings yet

- I 1040Document161 pagesI 1040ricola1982No ratings yet

- Quiz Chapter 3 SolutionDocument4 pagesQuiz Chapter 3 SolutionAde MumboNo ratings yet

- The Rules On Recovery of Tax Erroneously or Illegally Collected Can Be Found Under Section 229 of The Tax CodeDocument2 pagesThe Rules On Recovery of Tax Erroneously or Illegally Collected Can Be Found Under Section 229 of The Tax CodeFrancisJosefTomotorgoGoingo100% (1)

- REQUERIMIENTODocument110 pagesREQUERIMIENTOJulian Leonardo Mahecha SuescunNo ratings yet

- p4491 PDFDocument384 pagesp4491 PDFcatalin cretuNo ratings yet

- Interactive Form W-9 Form From EchoSign - Com Electronic SignatureDocument1 pageInteractive Form W-9 Form From EchoSign - Com Electronic SignatureEchoSign95% (19)

- Section 125 Cafeteria Plans OverviewDocument10 pagesSection 125 Cafeteria Plans OverviewmarkNo ratings yet

- 30 Day DiaryDocument2 pages30 Day Diaryapi-3711938No ratings yet

- Complete Return President Obama 2012 PDFDocument38 pagesComplete Return President Obama 2012 PDFTyler DeiesoNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument1 pageRequest For Taxpayer Identification Number and CertificationIsmail; HossainNo ratings yet

- Capital Gains and Losses: Schedule D (Form 1040) 12Document2 pagesCapital Gains and Losses: Schedule D (Form 1040) 12tinpenaNo ratings yet

- US Internal Revenue Service: I1040gi - 2006Document87 pagesUS Internal Revenue Service: I1040gi - 2006IRS100% (1)

- OID Tax Diagram 3Document2 pagesOID Tax Diagram 3ricetech100% (14)

- Qap FormatDocument8 pagesQap FormatPau Line EscosioNo ratings yet

- 19 Al RichardsDocument12 pages19 Al RichardsRiriNo ratings yet

- IRS Response LetterDocument3 pagesIRS Response Letternoname6100% (1)

- US Internal Revenue Service: I1040 - 1995Document84 pagesUS Internal Revenue Service: I1040 - 1995IRS67% (3)

- UnknownDocument4 pagesUnknownnayla marie santiago cuadradoNo ratings yet

- Guide: Tax ReturnDocument84 pagesGuide: Tax ReturnLars Renteria SilvaNo ratings yet

- Short Form Request For Individual Tax Return TranscriptDocument2 pagesShort Form Request For Individual Tax Return TranscriptAmber CarterNo ratings yet

- FDR New Deal: A. Relief MeasuresDocument3 pagesFDR New Deal: A. Relief MeasureswaqarNo ratings yet

- Information For The Press - Press Office - SSADocument4 pagesInformation For The Press - Press Office - SSATony DiazNo ratings yet

- Additional District Inspector of Schools (Se) Asansol Sub Division. Pay Slip Government of West BengalDocument1 pageAdditional District Inspector of Schools (Se) Asansol Sub Division. Pay Slip Government of West BengalABHIJIT HAZRANo ratings yet

- $5-10 Million Texas PPP LoansDocument30 pages$5-10 Million Texas PPP LoansMary Claire PattonNo ratings yet

- 2011-2179 Federal Register KINGPINDocument2 pages2011-2179 Federal Register KINGPINGebran KaramNo ratings yet

- IRS TaxpatriotDocument34 pagesIRS TaxpatriotZerohedge100% (1)