Professional Documents

Culture Documents

Gliol

Gliol

Uploaded by

CaballeroGiovanniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gliol

Gliol

Uploaded by

CaballeroGiovanniCopyright:

Available Formats

FOCUS ON SURFACTANTS

2018 [‘Focus on Surfactants’, Feb crackers. Pemex’s EO output in Mexico showcased natural fatty alcohol (C12-

2018]. The CPO export tax exemption hit 218,000 tonnes in 2017, a decrease 14) ethoxylate nonionic surfactants

period was originally to have been from 294,000 tonnes in 2016. Mar 2018 (SABIC SABICOL L2/L3/L7/L9);

three months to the beginning of Apr EO contract prices dropped from Feb synthetic alcohol (isodecyl and

but the Plantation Industries and 2018 after a fall in the feedstock isotridecyl alcohol) ethoxylates (SABIC

Commodities Ministry (MPIC) decided ethylene contract for Mar 2018. The SABICOL DA5/DA7/TA5/TA6/TA7/TA8/

to prolong it. Malaysian CPO exports Mar 2018 EO contract dropped month- TA9); castor oil ethoxylates (SABIC

were reported to have been vibrant in on-month by 1.40 cents/lb to 51.60- SABICOL EL30/40/55); and

Mar 2018 and were expected to remain 61.10 cents/lb free on board (FOB). EO polyethyleneglycols (SAPEG200/300/

strong in Apr. Imports from Africa and supply is anticipated to be narrower by 400/600).

the Middle East were also expected to the beginning of summer, influenced by

rise in Apr-May 2018 due to Hari Raya higher demand from the start of the Original Source: SABIC, 2018. Found on

SpecialChem Cosmetics and Personal Care

Puasa (Eid al-Fitr) in Jun 2018. In 1-10 peak downstream surfactants season Innovation and Solutions, 24 Apr 2018, (Website:

Apr 2018, exports improved by 25.6% and many EO/EG turnarounds. http://www.specialchem4cosmetics.com)

month-to-month to 449,007 tonnes. Furthermore, downstream EG demand

CPO exports in Mar 2018 jumped by is anticipated to witness a pick-up from

19.2% month-on-month and by 23.7% the PET market, which peaks during

year-on-year to 1.57 M tonnes. CPO

demand is projected to rise in the

Apr-Aug 2018. EO capacity in the USA

includes Shell Chemicals’ 715,000

ASSOCIATED

coming months. However, domestic

plantation stocks are still deemed

tonnes/y capacity in Geismar, LA; Dow

Chemical’s 700,000 tonnes/y capacity

PRODUCTS

‘underweight’ mainly due to a projected in Taft, LA; and Huntsman’s 580,000

weakness in prices amid anticipated tonnes/y capacity in Port Neches, TX. AkzoNobel Specialty Chemicals

oversupply in mid-2018. signs cooperation agreement with

Original Source: ICIS Chemical Business,

13-19 Apr 2018, 293 (14), 32 (Website: http:// Ineos Nitriles to expand chelates

Original Source: The Star, 11 & 13 Apr 2018,

(Website: http://thestar.com.my) ã Star www.icis.com) ã Reed Business Information production

Publications (M) Bhd 2018 Limited 2018.

AkzoNobel Specialty Chemicals and

Ineos Nitriles have signed a long-term

Ethylene oxide cooperation agreement that will allow

BASF lifts force majeure on US

AkzoNobel to expand its production of

US chemical profile: ethylene oxide purified EO products

biodegradable chelates, used in

The various uses of ethylene oxide BASF had imposed force majeure (FM) detergents and other industries, utilizing

(EO) are outlined; the production of on US purified ethylene oxide (EO)- one of Ineos Nitriles’ chemical products.

ethylene glycols (EG) accounts for containing products due to an The move will strengthen AkzoNobel

around 75% of EO consumption while unexpected equipment problem, leading Specialty Chemicals’ leadership

the production of surfactants such as to the closure of its EO plant at position in the chelates business,

alkylphenol ethoxylates and detergent Geismar, LA, USA. However, at the supporting customer growth as well as

alcohol ethoxylates is the second- beginning of Apr the company lifted the improving both companies’

largest sector. The narrow EO supply in FM after successfully re-establishing sustainability profiles. AkzoNobel

the USA is attributed to production operations in all affected facilities. Specialty Chemicals will invest in

issues in 1Q 2018 and the production facilities at Ineos’s site at

Original Source: ICIS Chemical Business, 6-12 Cologne, Germany. Ineos Nitriles is the

commencement of the peak season in Apr 2018, 293 (13), 6 (Website: http://www.

the downstream PET and surfactants world’s largest producer of acrylonitrile,

icis.com) ã Reed Business Information

segments. The expected pick-up in Limited 2018 a key chemical building block used in

demand from the downstream many industries. With this partnership,

segments will run from Apr 2018 to Aug AkzoNobel Specialty Chemicals will be

2018. Furthermore, demand was able to expand its chelates production

healthy during the winter season as the in Europe. Construction of the new

weather boosted the downstream EG SURFACTANTS facilities at Cologne will start in late

market. In the USA, Sasol’s $11 bn 2018 and completion is due in 2020.

Lake Charles Chemicals Project Ineos will operate these new plants.

SABIC presented product portfolio

(LCCP) [‘Focus on Surfactants’, May at IESD, Shanghai Original source: Ineos, 20 Apr 2018 (Website:

2017 & Feb 2015] is 81% complete and http://www.ineos.com) ã Ineos 2018

is set to commence its initial units in 2H SABIC presented its full fluids product

2018. LCCP houses a 1.5 M tonnes/y portfolio at IESD, China’s International

ethane cracker and six downstream Exhibition for Surfactants and Lonza presents PreservationPlus at

plants. The EO/EG line will have a Detergents, in Shanghai, 24-26 Apr in-cosmetics Global 2018

capacity of 250,000 tonnes/y of 2018. SABIC Specialties provides high-

monoethylene glycol (MEG) and value, technologically advanced At in-cosmetics Global 2018, which

300,000 tonnes/y of crude EO and chemical derivatives for use in a wide took place on 17-19 Apr 2018 in

related higher glycols. Cracker capacity range of applications. These products Amsterdam, the Netherlands, Lonza

in the USA is anticipated to grow by find their way into industrial uses such Consumer Product Ingredients unveiled

35% by 2019, with additional cracker as speciality lubricants, crop protection, PreservationPlus, a new approach to

projects and expansions of current and oil & gas applications. SABIC ensuring preservative efficacy optimized

June 2018 3

You might also like

- Petrochemical IndustryDocument12 pagesPetrochemical IndustryamirlngNo ratings yet

- Extra Lecture - Ethylene ProductionDocument5 pagesExtra Lecture - Ethylene ProductionLe Anh QuânNo ratings yet

- Akzo CaseDocument2 pagesAkzo CaseSindhu SinghNo ratings yet

- Spiral Dynamics Integral 1Document3 pagesSpiral Dynamics Integral 1Wangshosan100% (2)

- Acetic Acid: US Chemical ProfileDocument1 pageAcetic Acid: US Chemical ProfileJESSICA PAOLA TORO VASCONo ratings yet

- Linear Alkylbenzene in Asia 2017Document1 pageLinear Alkylbenzene in Asia 2017محمد عليNo ratings yet

- Acetic Acid: Us Chemical ProfileDocument1 pageAcetic Acid: Us Chemical ProfileJESSICA PAOLA TORO VASCONo ratings yet

- New Methanol Synthesis Catalyst From TopsoeDocument2 pagesNew Methanol Synthesis Catalyst From TopsoesatishchemengNo ratings yet

- RAW Materials: Focus ON SurfactantsDocument2 pagesRAW Materials: Focus ON SurfactantsBasmalh MorsiNo ratings yet

- MARKET OUTLOOK - Europe and Asia Polymer OutlookDocument6 pagesMARKET OUTLOOK - Europe and Asia Polymer OutlookRead ArticlesNo ratings yet

- Products: Focus ONDocument1 pageProducts: Focus ONadssaNo ratings yet

- Brazil Lagos Industria Quimica NanoparticulateDocument1 pageBrazil Lagos Industria Quimica NanoparticulateChe LoNo ratings yet

- V49N044Document4 pagesV49N044Nitin RawatNo ratings yet

- Global Ethylene Capacity Poised For Major Expansion - Oil & Gas JournalDocument9 pagesGlobal Ethylene Capacity Poised For Major Expansion - Oil & Gas JournalcarlosapemNo ratings yet

- EthanolDocument2 pagesEthanolsanjayshah99No ratings yet

- Acrylic Acid - 2004Document1 pageAcrylic Acid - 2004martinsclabsasNo ratings yet

- SurfactantDocument1 pageSurfactantToni TanNo ratings yet

- Thel Top Ten Chemical Companies 2014Document6 pagesThel Top Ten Chemical Companies 2014haiqalNo ratings yet

- Acrolein-Market SurveyDocument4 pagesAcrolein-Market SurveyChristopher NicholsNo ratings yet

- Polyurethane ManufacturerDocument4 pagesPolyurethane ManufacturerPratibha GuptaNo ratings yet

- J Focat 2019 09 010Document1 pageJ Focat 2019 09 010Toni TanNo ratings yet

- Reporte de Tendencias PPDocument1 pageReporte de Tendencias PPErick CamachoNo ratings yet

- Monoethanolamine: Production Plant: ArticleDocument11 pagesMonoethanolamine: Production Plant: ArticleRahmanNo ratings yet

- Indeks Harga CEPCI 2010Document2 pagesIndeks Harga CEPCI 2010juang_ariandoNo ratings yet

- Market SurveyDocument3 pagesMarket SurveyNurbaity IsmailNo ratings yet

- Petrochemicals Growing Pains For US Ethylene: Chemical WeekDocument7 pagesPetrochemicals Growing Pains For US Ethylene: Chemical WeekPaolo ScafettaNo ratings yet

- Resumo Alargado - Estudo Da ProducaoDocument10 pagesResumo Alargado - Estudo Da ProducaoAlbert SosnowskiNo ratings yet

- Building C1 Value Chains in Partnership Mode: Point of ViewDocument2 pagesBuilding C1 Value Chains in Partnership Mode: Point of Viewsumit6singhNo ratings yet

- Prospects of The Petrochemical Industry in NigeriaDocument14 pagesProspects of The Petrochemical Industry in NigeriaOdinaka BlessedNo ratings yet

- EthanolDocument2 pagesEthanolJulissa SantisNo ratings yet

- ... Amid Further Round of Tio Price Increases Columbian Opens Brazilian Carbon Black Plant, Outlines Further InvestmentsDocument2 pages... Amid Further Round of Tio Price Increases Columbian Opens Brazilian Carbon Black Plant, Outlines Further InvestmentsGavoutha BisnisNo ratings yet

- Luthero Winter - BrasilDocument13 pagesLuthero Winter - BrasilYlm PtanaNo ratings yet

- Petrochemicals From Oil Sands: Petroleum SocietyDocument8 pagesPetrochemicals From Oil Sands: Petroleum SocietyEleonora LetorNo ratings yet

- Acetic AcidDocument8 pagesAcetic AcidMohammedRahimNo ratings yet

- Haldor Topsoe A-S - Promoting Medium-Temperature CO Shift Catalysts PDFDocument1 pageHaldor Topsoe A-S - Promoting Medium-Temperature CO Shift Catalysts PDFzorro21072107No ratings yet

- Focus On Surfactants ArticleDocument8 pagesFocus On Surfactants ArticleAngieNo ratings yet

- CMAI Techology Newsletter022011Document2 pagesCMAI Techology Newsletter022011hendri_tayNo ratings yet

- A Catalytic Cracking Process For Ethylene and Propylene From Paraffin StreamsDocument13 pagesA Catalytic Cracking Process For Ethylene and Propylene From Paraffin StreamsMukthiyar SadhullahNo ratings yet

- Mono Ethylene GlycolDocument8 pagesMono Ethylene GlycolBavitha YadavNo ratings yet

- Focus ON: Statistics/ Reviews MarketsDocument1 pageFocus ON: Statistics/ Reviews MarketsToni TanNo ratings yet

- Eurochem Eyes Russian Gas Producer Severneft-Urengoy: Top Stories More NewsDocument13 pagesEurochem Eyes Russian Gas Producer Severneft-Urengoy: Top Stories More Newsmispic99No ratings yet

- Oleochemicals 2011Document3 pagesOleochemicals 2011Doris de GuzmanNo ratings yet

- AkzoNobel Company Presentation - 2017Document29 pagesAkzoNobel Company Presentation - 2017Rounak JindalNo ratings yet

- Alberta - Canada's Petrochemical LeaderDocument2 pagesAlberta - Canada's Petrochemical Leaderingbarragan87No ratings yet

- The Company: Apache CorporationDocument5 pagesThe Company: Apache CorporationAlexanderNo ratings yet

- World's 10 Largest Petrochemicals CompaniesDocument7 pagesWorld's 10 Largest Petrochemicals CompaniesHassan NimirNo ratings yet

- Roger LeeDocument16 pagesRoger LeeAMANo ratings yet

- 2009 Report On Ethanol Market Concentration IDocument17 pages2009 Report On Ethanol Market Concentration IChristopher LuedtkeNo ratings yet

- MASS Balances With Page NumbersDocument31 pagesMASS Balances With Page NumbersTanavi RanaNo ratings yet

- Focus ON: Associated ProductsDocument1 pageFocus ON: Associated ProductswanNo ratings yet

- Ethanol Production in Brazil A Bridge Between Science and IndustryDocument13 pagesEthanol Production in Brazil A Bridge Between Science and IndustryJose ZuritaNo ratings yet

- DocumentDocument17 pagesDocumentPfunzo NevhusengaNo ratings yet

- StyreneDocument3 pagesStyreneelainejournalistNo ratings yet

- United Carbon Plans Californian Carbon Black Plant 2002Document1 pageUnited Carbon Plans Californian Carbon Black Plant 2002Gavoutha BisnisNo ratings yet

- Butyl AcrylateDocument3 pagesButyl AcrylateoencisomNo ratings yet

- Acrylic Acid in EuropeDocument9 pagesAcrylic Acid in EuropePınar BadesevNo ratings yet

- Paint Industry Analysis of 2013Document15 pagesPaint Industry Analysis of 2013Shashi KumarNo ratings yet

- 2023 - Mixed Xylene Market Size, Share, Growth & Forecast, 2035Document3 pages2023 - Mixed Xylene Market Size, Share, Growth & Forecast, 2035sufiyan ahmedNo ratings yet

- Reaching Zero with Renewables: Biojet FuelsFrom EverandReaching Zero with Renewables: Biojet FuelsNo ratings yet

- Solar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitFrom EverandSolar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitNo ratings yet

- Ethylene Oxide Is A Chemical Used To Make Ethylene GlycolDocument11 pagesEthylene Oxide Is A Chemical Used To Make Ethylene GlycolCaballeroGiovanniNo ratings yet

- Hex HepDocument3 pagesHex HepCaballeroGiovanniNo ratings yet

- Secuencia 2Document1 pageSecuencia 2CaballeroGiovanniNo ratings yet

- Temperatur AsDocument8 pagesTemperatur AsCaballeroGiovanniNo ratings yet

- Production: Industrial RoutesDocument6 pagesProduction: Industrial RoutesCaballeroGiovanniNo ratings yet

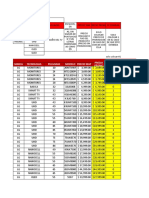

- Frasco Acetona Agua V1previo (ML) V2previo (ML) Mpic+sol (G) T (°C) Vpic (ML)Document20 pagesFrasco Acetona Agua V1previo (ML) V2previo (ML) Mpic+sol (G) T (°C) Vpic (ML)CaballeroGiovanniNo ratings yet

- Brunswick SuppliesDocument41 pagesBrunswick SuppliesNathan Bukoski100% (2)

- Preparation of Salt (Worksheet)Document11 pagesPreparation of Salt (Worksheet)terencechen1225No ratings yet

- AVO Analysis Guide PDFDocument89 pagesAVO Analysis Guide PDFceciliaNo ratings yet

- Lapidary Works of Art, Gemstones, Minerals and Natural HistoryDocument132 pagesLapidary Works of Art, Gemstones, Minerals and Natural HistoryWalterNo ratings yet

- Illusory SuperiorityDocument16 pagesIllusory Superiorityyzydrbabh5No ratings yet

- P1662/D8.0, March 2016 - IEEE Draft Recommended Practice For Design and Application of Power Electronics in Electrical Power SystemsDocument63 pagesP1662/D8.0, March 2016 - IEEE Draft Recommended Practice For Design and Application of Power Electronics in Electrical Power SystemsHgoglezNo ratings yet

- User Manual: Ac750 Wifi RouterDocument138 pagesUser Manual: Ac750 Wifi RouterKevin KimNo ratings yet

- Spohn Performance, Inc.: Part# D94-02-TB-DS - Adjustable Front Track BarDocument5 pagesSpohn Performance, Inc.: Part# D94-02-TB-DS - Adjustable Front Track BarJameson PowersNo ratings yet

- Evo Brochure PDFDocument21 pagesEvo Brochure PDFsatyaNo ratings yet

- Ord2021082419220163Document1 pageOrd2021082419220163bujjishaikNo ratings yet

- BCC - 1,2 H SPLN 41-4Document1 pageBCC - 1,2 H SPLN 41-4TPNo ratings yet

- San Andres Cop Pel 981Document21 pagesSan Andres Cop Pel 981RubenNo ratings yet

- Procedures For Meat Export From Rwanda-1Document6 pagesProcedures For Meat Export From Rwanda-1Eddy Mula DieudoneNo ratings yet

- IndonesiaDocument113 pagesIndonesiaLibrary100% (4)

- Bentonite PropertiesDocument8 pagesBentonite PropertiesJulie SpencerNo ratings yet

- What Is A Chest X-Ray (Chest Radiography) ?Document5 pagesWhat Is A Chest X-Ray (Chest Radiography) ?shravaniNo ratings yet

- Engine Training Manual - D114 SeriesDocument86 pagesEngine Training Manual - D114 SeriesMuhammad Imran Aftab83% (6)

- International Coatings MaintenanceDocument19 pagesInternational Coatings Maintenanceluckystrike9008100% (2)

- Chemical EnergerticsDocument24 pagesChemical EnergerticsAnotidaishe ChakanetsaNo ratings yet

- Contribution of Plato in Political ThoughtDocument18 pagesContribution of Plato in Political ThoughtKOTUB UDDIN AHMED100% (2)

- Reis & Helfman 2023 Fishes, Biodiversity ofDocument29 pagesReis & Helfman 2023 Fishes, Biodiversity ofhomonota7330No ratings yet

- Excise TaxDocument4 pagesExcise TaxCalvin Cempron100% (1)

- Printmaking Unit Plan - Amy Robertson Revised By: Deanna Plested GradeDocument47 pagesPrintmaking Unit Plan - Amy Robertson Revised By: Deanna Plested Gradeapi-264279988No ratings yet

- FeasibDocument57 pagesFeasibCPAREVIEWNo ratings yet

- Burn Case StudyDocument9 pagesBurn Case Studydakota100% (2)

- 1a209 Manual PDFDocument2 pages1a209 Manual PDFbayu edityaNo ratings yet

- Exp#05 M.inshal Fa18 Bme 022Document5 pagesExp#05 M.inshal Fa18 Bme 022Muhammad inshalNo ratings yet

- AKVA Group Cage Farming Aquaculture 2014 2015Document78 pagesAKVA Group Cage Farming Aquaculture 2014 2015norisnorisNo ratings yet

- Seminar Report On Smart Note TakerDocument22 pagesSeminar Report On Smart Note TakerSritejNo ratings yet