Professional Documents

Culture Documents

Employee Investment Details - Filled 2018-19

Employee Investment Details - Filled 2018-19

Uploaded by

RAVIOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Employee Investment Details - Filled 2018-19

Employee Investment Details - Filled 2018-19

Uploaded by

RAVICopyright:

Available Formats

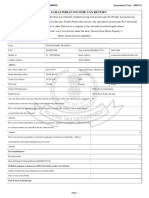

Employee Investment Details for Income Tax Purposes

To be filled by the Employee To be filled by the Accounts Department

Sign if

Date of Joining : 25th Sep 2015 Required Verification verified &

Testimonials Procedure

found ok

Tax Exemption

Sno. Description of Allowances Eligibility Actual Spent Amount Passed

Rental Receipts &

As per IT slab House Owner PAN

1 House Rent 1.00 No. (if requried)

2 Conveyance Nil Nil Nil

3 Medical 12.00 Medical Bills Medical Bills

4 Uniform ( As per Salary ) Nil Nil Nil

5 Child Education (INR 1200/Child) School Fee Rcpts No. of Children /

ages / Receipts

5 Hostel ( INR 3600/Child) Hostel Fee Rcpts

Leave Travel ( Block 2014-17) 1) leave on travel

All Tickets & dates? 2) Tckt &

6 Dates of Travel ( To be filled ) xx / xx / xxxx to xx /xx /xxxx Boarding Passes Boarding Pass 3)

Dependants

Last LTA availed ( Calendar Year )

Investment Under Section 80C

7a

b Total of INR Employee PF

of Premium Contribution

150000 for a) +

c Home Loan 12.00 2.00 ReceiptsPaid Verify for gap

between 1.5 L and

d Principal/ PF / PF contribution

LIC / PPF / NSC

e etc

Bank Interest Joint Name ? / Full

8 Housing loan interest ( Sec 24 ) 200,000 2.00 2.00 Statement Claim or shared

9 Contribution to NPS 50,000 -

10 Others (Please specify if any) Pension Statetment

Date Signature of Accounts Exec : Date

Signature of the employee :

1/29/2019 Signature of Accounts HOD : xx/xx/xxxx

You might also like

- Bir Form 2307Document3 pagesBir Form 2307Salve Dela Cruz100% (5)

- Commerce SS1 Third Term Lesson PlanDocument14 pagesCommerce SS1 Third Term Lesson PlanIvan ObaroNo ratings yet

- Tenderloin Housing Clinic Review 3-23-12Document6 pagesTenderloin Housing Clinic Review 3-23-12auweia10% (1)

- JD - Financial Analyst-XL Dynamics India Pvt. Ltd.Document2 pagesJD - Financial Analyst-XL Dynamics India Pvt. Ltd.shaileshbhoi100% (1)

- Home Loan: TCHFL HL MITC Version 17Document4 pagesHome Loan: TCHFL HL MITC Version 17Ali Khan AKNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument4 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internasmar corNo ratings yet

- Investment Declaration Form F.Y 2023-24Document4 pagesInvestment Declaration Form F.Y 2023-24Aditi Suryavanshi100% (2)

- 2307Document2 pages2307Bunny Sardina Pandongan0% (1)

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasAurora Pelagio VallejosNo ratings yet

- Final-Investment Declaration Form FY 19 - 20Document12 pagesFinal-Investment Declaration Form FY 19 - 20Bhupender RawatNo ratings yet

- Actual Investment Declaration For FY 2017-18: Section Nature of Deduction Maximum Amt Documents RequiredDocument6 pagesActual Investment Declaration For FY 2017-18: Section Nature of Deduction Maximum Amt Documents Requiredsandeepreddys091537No ratings yet

- 9Document2 pages9Le Lhiin CariñoNo ratings yet

- Income Tax Option Cum Declaration Form (2022 2023)Document4 pagesIncome Tax Option Cum Declaration Form (2022 2023)kkkNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internaskiezer agrudaNo ratings yet

- IT DeclarationDocument2 pagesIT Declarationummar farooqNo ratings yet

- Application Form For Mses: Bank of BarodaDocument4 pagesApplication Form For Mses: Bank of BarodaSuresh JainNo ratings yet

- Income Tax Declaration Form For The Financial Year 2006-07Document9 pagesIncome Tax Declaration Form For The Financial Year 2006-07Chalan B SNo ratings yet

- Itns 285Document2 pagesItns 285Anurag SharmaNo ratings yet

- 2307 Jan 2018 ENCS v3 SignedDocument2 pages2307 Jan 2018 ENCS v3 SignedStanleyMarkPardiñanLazagaNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 449048510080820 Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 449048510080820 Assessment Year: 2020-21రాకేష్ బాబు చట్టిNo ratings yet

- 2307 Jan 2018 ENCS v3.1Document90 pages2307 Jan 2018 ENCS v3.1Lex AmarieNo ratings yet

- Bir Form 2307Document2 pagesBir Form 2307Geraldine BacoNo ratings yet

- Show Int. Rate: Tax Saving and Misc Earning DeclarationDocument1 pageShow Int. Rate: Tax Saving and Misc Earning DeclarationAK TRIPATHINo ratings yet

- 1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityDocument3 pages1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityReese QuinesNo ratings yet

- TR 46 For Web Final7Document2 pagesTR 46 For Web Final7Anonymous DbmKEDxNo ratings yet

- Employees' Provident Fund and Misc, Provisions Act, 1952 Employees' Pension Scheme (Paragraph 20 (4) )Document1 pageEmployees' Provident Fund and Misc, Provisions Act, 1952 Employees' Pension Scheme (Paragraph 20 (4) )Chauhan NihilNo ratings yet

- Employees' Pension Scheme (Prargraph 20 (4) ) The Employees' Provident Funds & Misc. Provision Act, 1952Document2 pagesEmployees' Pension Scheme (Prargraph 20 (4) ) The Employees' Provident Funds & Misc. Provision Act, 1952savita17julyNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument3 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasRonaldo CatindigNo ratings yet

- 2307Document3 pages2307JUCONS ConstructionNo ratings yet

- 2307 LessorDocument3 pages2307 LessorPaul EspinosaNo ratings yet

- 2307 Jan 2018 ENCS v3Document2 pages2307 Jan 2018 ENCS v3JunnetteTevesPujidaNo ratings yet

- 2307 - Rent My CarDocument10 pages2307 - Rent My CarSoeletraNo ratings yet

- GH DepotDocument12 pagesGH DepotNormelita S. Dela CruzNo ratings yet

- Í ( ) - È5Â Esquillo Nielââââââââ Â ÇF! (56 Î Mr. Niel EsquilloDocument3 pagesÍ ( ) - È5Â Esquillo Nielââââââââ Â ÇF! (56 Î Mr. Niel Esquillogthmc2023No ratings yet

- 2307 FORM - WITHHOLDING 2021 - VanDocument46 pages2307 FORM - WITHHOLDING 2021 - VanHraid MundNo ratings yet

- 2307Document2 pages2307Nephy Bersales Taberara67% (3)

- Prefill: Date of AGMDocument110 pagesPrefill: Date of AGMVinay DattaNo ratings yet

- 2307 Jan 2018 ENCS v3Document2 pages2307 Jan 2018 ENCS v3Analyn DomingoNo ratings yet

- Final Itr PDFDocument8 pagesFinal Itr PDFharish1000No ratings yet

- 2307 Jan 2018 ENCS v3Document2 pages2307 Jan 2018 ENCS v3Mark Patrics Comentan VerderaNo ratings yet

- Dimensional Service Corporation 2307Document3 pagesDimensional Service Corporation 2307Randy RosasNo ratings yet

- BIR Form 2307Document3 pagesBIR Form 2307Jocere LopezNo ratings yet

- Sample 2307Document4 pagesSample 2307kaysNo ratings yet

- Tax Computation 2023-24Document6 pagesTax Computation 2023-24aarthir88No ratings yet

- Aziz Sir LPCDocument2 pagesAziz Sir LPCঅনি চৌধুরীNo ratings yet

- 2018 07 26 08 12 24 532 - 1926212275 - PDFDocument6 pages2018 07 26 08 12 24 532 - 1926212275 - PDFRAKESHNo ratings yet

- Challan 280Document2 pagesChallan 280Rahul SinglaNo ratings yet

- Form 2307Document18 pagesForm 2307Charlie Juliet Charlie HensonNo ratings yet

- Draft: Veridian at Emerald Isle 11B 1502 549.82Document1 pageDraft: Veridian at Emerald Isle 11B 1502 549.82sachinNo ratings yet

- Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document5 pagesFill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"May Joy DepalomaNo ratings yet

- Income Tax Challan - 280Document1 pageIncome Tax Challan - 280Subrata SarkarNo ratings yet

- Case Study - DeepakDocument3 pagesCase Study - Deepakamanbhardwaj5No ratings yet

- Certificate of Creditable Tax Withheld at Source: Cauayan Petron Service Center / Ferdinand GalopeDocument3 pagesCertificate of Creditable Tax Withheld at Source: Cauayan Petron Service Center / Ferdinand GalopeAnnalyn Gonzales ModeloNo ratings yet

- PC Square2307Document3 pagesPC Square2307SirManny ReyesNo ratings yet

- BIR Form 0605 - Annual Registration FeeDocument2 pagesBIR Form 0605 - Annual Registration FeeRonn Robby Rosales100% (3)

- FBT Form 1603Document2 pagesFBT Form 1603Cb SingsonNo ratings yet

- 2307 Jan 2018 ENCS v3Document4 pages2307 Jan 2018 ENCS v3Jasmin Sheryl Fortin-CastroNo ratings yet

- IT Declaration Form 2019-20Document1 pageIT Declaration Form 2019-20KarunaNo ratings yet

- 2307 WestmontDocument2 pages2307 WestmontMarie Francisco100% (1)

- BIR Form 2307Document2 pagesBIR Form 2307Angelique MasupilNo ratings yet

- 968 Glass & Aluminum Co.Document10 pages968 Glass & Aluminum Co.Ben Carlo RamosNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Comp-XM Basix Guide PDFDocument6 pagesComp-XM Basix Guide PDFJai PhookanNo ratings yet

- High Probability Trading StrategiesDocument3 pagesHigh Probability Trading Strategiesnfappa50% (2)

- Lecture 09 - Dual-Listed Company ArbitrageDocument32 pagesLecture 09 - Dual-Listed Company ArbitrageecondocsNo ratings yet

- AF121 Week 4 - Fraud Ethics NewDocument18 pagesAF121 Week 4 - Fraud Ethics NewChand DivneshNo ratings yet

- Ii Puc AccountsDocument3 pagesIi Puc AccountsShekarKrishnappaNo ratings yet

- Kelompok 7 Anggota: 1.aditiya Bayu Setiaji 2. Nurica Rizky KhasanahDocument2 pagesKelompok 7 Anggota: 1.aditiya Bayu Setiaji 2. Nurica Rizky KhasanahPenatik KisahNo ratings yet

- Axis Bank - FE - East India - Online Auction - 05th-January-2019Document18 pagesAxis Bank - FE - East India - Online Auction - 05th-January-2019Biju PerinkottilNo ratings yet

- Financing CycleDocument4 pagesFinancing CycleYzah CariagaNo ratings yet

- 16732-Article Text-63840-4-10-20220429Document20 pages16732-Article Text-63840-4-10-20220429Biniyam YitbarekNo ratings yet

- Fabm Notes Lesson 005 008Document13 pagesFabm Notes Lesson 005 008KyyNo ratings yet

- April 2023 Coventry University London: 4008AFE Examination The Economic Environment of BusinessDocument7 pagesApril 2023 Coventry University London: 4008AFE Examination The Economic Environment of BusinessSalai SivagnanamNo ratings yet

- Financial ManagementDocument40 pagesFinancial ManagementDennis Esik MaligayaNo ratings yet

- Screenshot 20240131-145706 ChromeDocument2 pagesScreenshot 20240131-145706 ChromeNagaraj VukkadapuNo ratings yet

- Project Management For Special EventsDocument6 pagesProject Management For Special EventsKeith ParkerNo ratings yet

- Confronting Ethical Dilemmas in The WorkplaceDocument5 pagesConfronting Ethical Dilemmas in The WorkplaceCristian Cucos CucosNo ratings yet

- 2018 BNP Paribas Integrated ReportDocument56 pages2018 BNP Paribas Integrated ReportKotha Anil Reddy (PGDM 18-20)No ratings yet

- Statement For Customer #1046913: NTN# - ATTN:Naveed NazarDocument3 pagesStatement For Customer #1046913: NTN# - ATTN:Naveed NazarHamza NajamNo ratings yet

- Chapter Six: Managerial Economics, 8e William F. Samuelson Stephen G. MarksDocument25 pagesChapter Six: Managerial Economics, 8e William F. Samuelson Stephen G. MarksAli EmadNo ratings yet

- Test 3Document7 pagesTest 3info view0% (1)

- CT5 PXS 11Document88 pagesCT5 PXS 11Yash Tiwari0% (1)

- Department of Labor: 96 19484Document5 pagesDepartment of Labor: 96 19484USA_DepartmentOfLaborNo ratings yet

- Extra Reading For Further Comprehension: Net Present Value (NPV)Document27 pagesExtra Reading For Further Comprehension: Net Present Value (NPV)widedbenmoussaNo ratings yet

- Module 12 MACC423 Eugene A RuanoDocument14 pagesModule 12 MACC423 Eugene A RuanoCatherine LeroNo ratings yet

- NBFC List - IndiaDocument152 pagesNBFC List - IndiambkfunnNo ratings yet

- Introduction To: Forex TradingDocument22 pagesIntroduction To: Forex TradingLESVIN SUGUMARANNo ratings yet

- 2001 Excerpt Gao-02-111 ML Efforts in The Securities IndustryDocument3 pages2001 Excerpt Gao-02-111 ML Efforts in The Securities IndustrytofumasterNo ratings yet

- 1-2 - Assignment - Current and Contingent LiabilitiesDocument6 pages1-2 - Assignment - Current and Contingent LiabilitiesOliviane Theodora Wenno0% (1)