Professional Documents

Culture Documents

SST Versus Solvency II - Comparison Analysis

SST Versus Solvency II - Comparison Analysis

Uploaded by

Xena WarriorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SST Versus Solvency II - Comparison Analysis

SST Versus Solvency II - Comparison Analysis

Uploaded by

Xena WarriorCopyright:

Available Formats

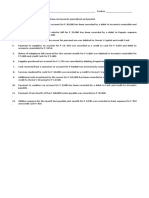

SST versus Solvency II - Comparison

analysis

Transcript of investor and analyst video presentation

Patrick Raaflaub, Group CRO

Zurich, 29 April 2016

The following transcript must be read in conjunction with (i) the presentation slides and related materials made available

by Swiss Re Ltd ("Swiss Re") on its website under http://www.swissre.com/investors/financial_information/ solely for

your information in connection with the presentation on SST versus Solvency II – Comparison analysis and (ii) with all

other publicly available information published by Swiss Re.

Cautionary note on forward-looking statements

Certain statements and illustrations contained herein are forward-looking. These statements (including as to plans,

objectives, targets, and trends) and illustrations provide current expectations of future events based on certain

assumptions and include any statement that does not directly relate to a historical fact or current fact.

Forward-looking statements typically are identified by words or phrases such as “anticipate”, “assume”, “believe”,

“continue”, “estimate”, “expect”, “foresee”, “intend”, “may increase”, “may fluctuate” and similar expressions, or by future

or conditional verbs such as “will”, “should”, “would” and “could”. These forward-looking statements involve known and

unknown risks, uncertainties and other factors, which may cause Swiss Re’s actual results of operations, financial

condition, solvency ratios, capital or liquidity positions, or prospects to be materially different from any future results of

operations, financial condition, solvency ratios, capital or liquidity positions, or prospects expressed or implied by such

statements or cause Swiss Re to not achieve its published targets. Such factors include, among others:

instability affecting the global financial system and developments related thereto;

deterioration in global economic conditions;

Swiss Re’s ability to maintain sufficient liquidity and access to capital markets, including sufficient liquidity to

cover potential recapture of reinsurance agreements, early calls of debt or debt-like arrangements and

collateral calls due to actual or perceived deterioration of Swiss Re’s financial strength or otherwise;

the effect of market conditions, including the global equity and credit markets, and the level and volatility of

equity prices, interest rates, credit spreads, currency values and other market indices, on Swiss Re’s investment

assets;

changes in Swiss Re’s investment result as a result of changes in its investment policy or the changed

composition of its investment assets, and the impact of the timing of any such changes relative to changes in

market conditions;

uncertainties in valuing credit default swaps and other credit-related instruments;

possible inability to realise amounts on sales of securities on Swiss Re’s balance sheet equivalent to their mark-

to-market values recorded for accounting purposes;

the outcome of tax audits, the ability to realise tax loss carryforwards and the ability to realise deferred tax

assets (including by reason of the mix of earnings in a jurisdiction or deemed change of control), which could

negatively impact future earnings;

the possibility that Swiss Re’s hedging arrangements may not be effective;

the lowering or loss of one of the financial strength or other ratings of one or more Swiss Re companies, and

developments adversely affecting Swiss Re’s ability to achieve improved ratings;

the cyclicality of the reinsurance industry;

Swiss Re SST versus Solvency II – Comparison analysis 1

uncertainties in estimating reserves;

uncertainties in estimating future claims for purposes of financial reporting, particularly with respect to large

natural catastrophes, as significant uncertainties may be involved in estimating losses from such events and

preliminary estimates may be subject to change as new information becomes available;

the frequency, severity and development of insured claim events;

acts of terrorism and acts of war;

mortality, morbidity and longevity experience;

policy renewal and lapse rates;

extraordinary events affecting Swiss Re’s clients and other counterparties, such as bankruptcies, liquidations

and other credit-related events;

current, pending and future legislation and regulation affecting Swiss Re or its ceding companies and the

interpretation of legislation or regulations;

legal actions or regulatory investigations or actions, including those in respect of industry requirements or

business conduct rules of general applicability;

changes in accounting standards;

significant investments, acquisitions or dispositions, and any delays, unexpected costs or other issues

experienced in connection with any such transactions;

changing levels of competition; and

operational factors, including the efficacy of risk management and other internal procedures in managing the

foregoing risks.

These factors are not exhaustive. Swiss Re operates in a continually changing environment and new risks emerge

continually. Readers are cautioned not to place undue reliance on forward-looking statements. Swiss Re undertakes no

obligation to publicly revise or update any forward-looking statements, whether as a result of new information, future

events or otherwise.

In making this communication available, Swiss Re gives no advice and makes no recommendation to buy, sell or

otherwise deal in its shares, or in any other securities or investments whatsoever. The communication does not

constitute or form part of, and should not be construed as, an offer for sale or subscription of, or solicitation of any offer or

invitation to subscribe for, underwrite or otherwise acquire or dispose of any securities of Swiss Re and it does not

constitute an invitation or inducement to engage in investment activity under section 21 of the UK Financial Services

and Markets Act 2000. None of the Swiss Re securities have been, or will be, registered under the US Securities Act of

1933, as amended (the "Act"), and such securities may not be offered or sold in the United States except pursuant to an

exemption from, or in a transaction not subject to, the registration requirements of the Act and in compliance with state

securities laws. This communication is not intended to be a recommendation to buy, sell or hold securities and does not

constitute an invitation to effect any transaction with, or to make use of any services provided by, Swiss Re nor is it an

offer for the sale of, or the solicitation of an offer to buy, securities in any jurisdiction, including the United States. Any

such offer will only be made by means of a prospectus or offering memorandum, and in compliance with applicable

securities laws.

[Patrick Raaflaub]

Good day everyone! Thank you for watching this presentation on Swiss Re's Group

solvency under the Swiss Solvency Test and Solvency II. My name is Patrick Raaflaub, I am

Swiss Re's Group CRO.

Slide 2: SST and Solvency II are equivalent but not equal

As a Swiss insurance group, Swiss Re has been reporting its solvency under the SST since

2008. The SST became legally binding for all Swiss insurance companies in 2011. It was

also the first regime to gain full equivalence to Solvency II in 2015.

It is important to stress that equivalent does not mean equal. SST and Solvency II are

conceptually very similar. However, there are important differences between the two

Swiss Re SST versus Solvency II – Comparison analysis 2

methods. As a consequence, an SST ratio cannot be directly compared with a Solvency II

ratio.

In this presentation, I will show you how Swiss Re's Group SST ratio translates into a

comparable Solvency II ratio. Currently, the difference is about 90 percentage points.

This comparison is based on our interpretation of the EU Solvency II requirements as we

implemented it for our legal entities in Luxembourg. It was not externally reviewed and

was produced on a best effort basis using Swiss Re's SST calculation for 2016.

Slide 3: SST and Solvency II have many similarities but also important differences

SST and Solvency II share many similarities. For example, both frameworks are risk-based

and apply an economic balance sheet approach.

Under an "economic balance sheet approach", assets and liabilities are valued on a market

consistent basis in order to derive the available capital.

The approach is "risk-based" as we use our internal risk model to measure the required

capital.

If the available capital is greater than the required capital, the company holds regulatory

excess capital and has a solvency ratio above 100%.

Despite these similarities, SST and Solvency II differ in key aspects. These differences can

lead to a significant divergence of the solvency ratios. I would like to focus on the six

differences shown on this slide as they explain the main difference between our Group

SST ratio and the comparable Solvency II ratio.

There are also other differences, such as the deduction and aggregation method or long-

term guarantee measures to address cyclical volatility under the Solvency II framework. As

Swiss Re follows a strict economic view, we do not apply these adjustments in our

Solvency II assessment.

Slide 4: Swiss Re’s Group Solvency II ratio is significantly higher than our SST 2016

ratio

On this slide you can see the walk between our Group SST ratio and the comparable

Group Solvency II ratio.

Swiss Re SST versus Solvency II – Comparison analysis 3

When applying the six main differences, our Group SST ratio currently translates into a

Solvency II ratio of 312%. This is about 90 percentage points higher than the SST ratio.

Let me provide you with more details on each of these differences and how they impact

our Group Solvency II ratio.

Slide 5: Impact of capital cost recognition

The first difference between SST and Solvency II is the way run-off capital costs are

recognised.

Run-off capital costs compensate for the required capital during the run-off of the

liabilities. On the economic balance sheet, they form part of the liabilities. However, SST

requires run-off capital costs to be added to both available and required capital.

Not adding these costs increases the solvency ratio by about 38 percentage points.

Slide 6: Impact of risk measure

The second difference is well known.

Solvency II uses the 99.5% Value at Risk measure, also called VaR, which represents the

loss that will likely be exceeded only once in 200 years.

SST applies the 99% shortfall measure, also called tail VaR, which represents the average

of all annual losses that occur less than once in 100 years. This is represented by the blue

area below the curve in the graph.

For insurers, 99% tail VaR typically represents a higher loss than 99.5% VaR, as their

portfolios include significant exposure to rare but severe events like pandemics. For Swiss

Re's risk profile, the difference between the two measures is currently estimated to be

USD 2.4 billion.

Using VaR instead of tail VaR decreases the required capital. This leads to an increase in

our solvency ratio of about 42 percentage points.

Slide 7: Impact of modelling differences

The next difference relates to the fact that some risks are modelled differently under SST

and Solvency II.

Swiss Re SST versus Solvency II – Comparison analysis 4

An important aspect is the way we model run-off capital costs: under SST, they are based

on 99% tail VaR, while under Solvency II they are based on 99.5% VaR. In addition, SST

acknowledges diversification at group level, while Solvency II does not. As a result, SST

run-off capital costs are lower than under Solvency II. This impacts both available as well

as required capital.

Required capital is further impacted by operational risk, which is not explicitly modelled

under SST but is quantified under Solvency II.

With regard to credit risk, Swiss Re reflects sovereign risk in its internal model and is

therefore compliant with the latest EIOPA opinion.

Under Solvency II, credit spread risk can be significantly dampened where the regulator

allows application of the deduction and aggregation method or long-term guarantee

measures. However, we do not use these measures in our Group Solvency II assessment.

Currently, the modelling differences shown here decrease our solvency ratio by 10

percentage points.

Slide 8: Impact of valuation difference due to discounting

There are also a number of valuation differences. The largest impact results from the usage

of different yield curves.

Under SST, discounting can be based on own risk-free interest rates approved by FINMA.

Solvency II requires discounting to be based on credit adjusted LIBOR swap curves and

applies ultimate forward rates.

The main impact of this difference is on available capital, but it also affects required

capital. The direction and magnitude of the impact depends heavily on the shape of the

yield curves.

Swiss Re applies its own set of risk-free interest rates, which are approved by FINMA. They

are based on government bonds. We do not use ultimate forward rates and do not apply

any long-term guarantee measures.

Currently the Solvency II curves are lower. This results in less available and slightly higher

required capital.

It decreases the solvency ratio by 18 percentage points.

Swiss Re SST versus Solvency II – Comparison analysis 5

Slide 9: Impact of deferred taxes

Finally, SST and Solvency II differ in their treatment of taxes: SST is pre-tax, while Solvency

II is post-tax.

On the economic balance sheet, future profits are recognised as unrealised gains. The tax

debt that corresponds to such an unrealised gain is recognised as a deferred tax liability.

While not relevant for SST, deferred taxes form part of the liabilities on the Solvency II

balance sheet. This decreases available capital. At the same time, the loss absorbing

capacity of deferred taxes reduces the Solvency II required capital.

In most cases the solvency ratio increases from this change, even though the impact on

required capital is usually smaller than the impact on available capital.

Based on our calculations, the post-tax view increases our solvency ratio by about 37

percentage points.

Slide 10: Conclusion

I hope this presentation provided you with some clarity on the important differences

between the Swiss Solvency Test and Solvency II. Even though both frameworks apply

economic and risk-based solvency principles, the resulting ratios are not directly

comparable.

Swiss Re is very strongly capitalised under both SST and Solvency II.

When comparing public disclosures, it is important to bear in mind that an SST ratio

typically translates into a significantly higher Solvency II ratio.

Swiss Re has been actively engaged in SST and Solvency II discussions for many years.

We work closely with regulators and clients around the world to support the development

– and more importantly the convergence – of economic solvency regimes.

Thank you very much for watching this video!

Swiss Re SST versus Solvency II – Comparison analysis 6

Corporate calendar & contacts

Corporate calendar

29 July 2016 Second Quarter 2016 Results

3 November 2016 Third Quarter 2016 Results

2 December 2016 Investors' Day

23 February 2017 Annual results 2016

16 March 2017 Publication of Annual Report 2016 and EVM Report 2016

21 April 2017 153rd Annual General Meeting

4 May 2017 First Quarter 2017 Results

Investor Relations contacts

E-Mail Investor_Relations@swissre.com

Hotline +41 43 285 4444

Philippe Brahin +41 43 285 7212

Jutta Bopp +41 43 285 5877

Manfred Gasser +41 43 285 5516

Chris Menth +41 43 285 3878

Iunia Rauch-Chisacof +41 43 285 7844

Swiss Re SST versus Solvency II – Comparison analysis 7

You might also like

- SVP Cap Solutions Fund II & Banner Ridge Secondary Fund VDocument61 pagesSVP Cap Solutions Fund II & Banner Ridge Secondary Fund Vgeorgi.korovskiNo ratings yet

- Formula Sheet Foundations of FinanceDocument5 pagesFormula Sheet Foundations of Financeyukti100% (1)

- Bill HotelDocument54 pagesBill Hotelidhul bram sakti100% (1)

- Advance ITT Exam 1 Day Revision Notes Module Ii Unit 1 - Advanced Excel Chapter 1 - Working With XMLDocument23 pagesAdvance ITT Exam 1 Day Revision Notes Module Ii Unit 1 - Advanced Excel Chapter 1 - Working With XMLvanshika agarwal75% (4)

- E13.2 (LO 1) (Accounts and Notes Payable) The Following Are Selected 2022 Transactions ofDocument4 pagesE13.2 (LO 1) (Accounts and Notes Payable) The Following Are Selected 2022 Transactions ofChupa HesNo ratings yet

- Credit Suisse IBD Case CompetitionDocument4 pagesCredit Suisse IBD Case CompetitionSahit Chowdary GarapatiNo ratings yet

- F3 Sunday TestDocument15 pagesF3 Sunday TestAliRazaSattarNo ratings yet

- Chapter 23 Solutions Manual ExamDocument15 pagesChapter 23 Solutions Manual ExamMariance Romaulina Malau67% (3)

- Petty Cash ReportDocument1 pagePetty Cash ReportAziz Khan LodhiNo ratings yet

- Credit Suisse Group Takes Decisive Action To Pre-Emptively Strengthen Liquidity and Announces Public Tender Offers For Debt SecuDocument1 pageCredit Suisse Group Takes Decisive Action To Pre-Emptively Strengthen Liquidity and Announces Public Tender Offers For Debt SecuPrateek KumarNo ratings yet

- Id21 PresentationDocument108 pagesId21 PresentationHa DoanNo ratings yet

- Switzerland: The Worst Seems To Be Over For Swiss IndustryDocument5 pagesSwitzerland: The Worst Seems To Be Over For Swiss Industryangelos_siopisNo ratings yet

- Valuations DisclaimerDocument2 pagesValuations DisclaimerAyush VargheseNo ratings yet

- Credit Suisse Age Event Acceleration Xiv EtnsDocument2 pagesCredit Suisse Age Event Acceleration Xiv EtnsZerohedgeNo ratings yet

- Cerro Lindo Site Visit Presentation VF PDFDocument41 pagesCerro Lindo Site Visit Presentation VF PDFEdinssonRamosNo ratings yet

- Credit Suisse StrategyDocument69 pagesCredit Suisse StrategyJoel YesuratnamNo ratings yet

- Sunrise Shareholder Information DocumentDocument455 pagesSunrise Shareholder Information DocumentCalimeroNo ratings yet

- 2023feb22 LBG Annual Report PublishedDocument2 pages2023feb22 LBG Annual Report PublishedLouise SinghNo ratings yet

- Building The First Truly Global Brewer: Legal DisclaimerDocument50 pagesBuilding The First Truly Global Brewer: Legal DisclaimerKritie SethNo ratings yet

- SCB Strategic Review 2015 PDFDocument49 pagesSCB Strategic Review 2015 PDFamirentezamNo ratings yet

- Trading Strateg: April 2022 Pension Fund Rebalancing EstimatesDocument2 pagesTrading Strateg: April 2022 Pension Fund Rebalancing EstimatessirdquantsNo ratings yet

- 2020 LB q1 Ims Pillar 3 DisclosuresDocument7 pages2020 LB q1 Ims Pillar 3 DisclosuressaxobobNo ratings yet

- Q1 2023 Mid Quarter Update VFINAL3 030823Document30 pagesQ1 2023 Mid Quarter Update VFINAL3 030823S CNo ratings yet

- Cappuccino Notes: An Investment Offering A Enhanced Exposure To A Portfolio of Underlying AssetsDocument3 pagesCappuccino Notes: An Investment Offering A Enhanced Exposure To A Portfolio of Underlying AssetsLameuneNo ratings yet

- Invitation To Acquire Shares in Linc AB (Publ)Document186 pagesInvitation To Acquire Shares in Linc AB (Publ)ssylwia.cieslikNo ratings yet

- A Train Hs1 Lender Presentation 21st July 2021Document32 pagesA Train Hs1 Lender Presentation 21st July 2021Badrul Hisham ShafieNo ratings yet

- A Train Hs1 Lender Presentation 21st July 2021Document32 pagesA Train Hs1 Lender Presentation 21st July 2021Badrul Hisham ShafieNo ratings yet

- BUD ABI AB-InBev SABMiller Presentation Analyst Call 30 August 2016Document36 pagesBUD ABI AB-InBev SABMiller Presentation Analyst Call 30 August 2016Ala BasterNo ratings yet

- CIO Note Feb 6 2018Document2 pagesCIO Note Feb 6 2018Anonymous 2LowCnVdfNo ratings yet

- Residential Mortgages Detailed ExplanationsDocument29 pagesResidential Mortgages Detailed ExplanationsRoakhNo ratings yet

- Leader in AI-Driven Storage Solutions: December 2020Document48 pagesLeader in AI-Driven Storage Solutions: December 2020rojNo ratings yet

- Hulsey PresentationDocument67 pagesHulsey PresentationRupaliVajpayeeNo ratings yet

- Global Money Dispatch: Credit Suisse EconomicsDocument3 pagesGlobal Money Dispatch: Credit Suisse EconomicsbrineshrimpNo ratings yet

- Company Presentation Directed Private Placement of NOK 100 - 150 MillionDocument24 pagesCompany Presentation Directed Private Placement of NOK 100 - 150 MillionAfiq KhidhirNo ratings yet

- Centennial Resource Development Investor PresentationDocument52 pagesCentennial Resource Development Investor PresentationshortmycdsNo ratings yet

- Campofrio Food Group: Annex To Bond Report For The Twelve Month Period Ended 31 December 2014Document32 pagesCampofrio Food Group: Annex To Bond Report For The Twelve Month Period Ended 31 December 2014janet aybarNo ratings yet

- Aviva 2012 Full Year Results PresentationDocument32 pagesAviva 2012 Full Year Results PresentationAviva GroupNo ratings yet

- Ocwen 10-QDocument88 pagesOcwen 10-QForeclosure FraudNo ratings yet

- Bac 2015033010 Q 20150030Document252 pagesBac 2015033010 Q 20150030pcsriNo ratings yet

- Offering Memorandum ConfidentialDocument404 pagesOffering Memorandum ConfidentialOscar GarroNo ratings yet

- Next Edge Private Lending Presentation v1Document16 pagesNext Edge Private Lending Presentation v1dpbasicNo ratings yet

- NPI Hotel OverviewDocument6 pagesNPI Hotel OverviewxusorcimNo ratings yet

- Guidance Note On Derivative AccountingDocument9 pagesGuidance Note On Derivative AccountingHimanshu AggarwalNo ratings yet

- Zurich Confirms Outstanding Financial StrengthDocument2 pagesZurich Confirms Outstanding Financial StrengthAshutos MohantyNo ratings yet

- Recommended Merger Between Saudi British Bank and Alawwal BankDocument28 pagesRecommended Merger Between Saudi British Bank and Alawwal BankTarek DomiatyNo ratings yet

- 2020 LBG q1 Ims Pillar 3 DisclosuresDocument8 pages2020 LBG q1 Ims Pillar 3 DisclosuressaxobobNo ratings yet

- Lendify - Investor Presentation - 16 Jan 2018 PDFDocument58 pagesLendify - Investor Presentation - 16 Jan 2018 PDFDeepakNo ratings yet

- KKR Global Private Equity Overview - EMEADocument24 pagesKKR Global Private Equity Overview - EMEARavi Chaurasia100% (1)

- Global Macro Commentary July 14Document2 pagesGlobal Macro Commentary July 14dpbasicNo ratings yet

- Global Money Dispatch: Credit Suisse EconomicsDocument2 pagesGlobal Money Dispatch: Credit Suisse EconomicsSean KeenanNo ratings yet

- FVRR Company Presentation Feb 2024Document49 pagesFVRR Company Presentation Feb 2024steven.tranNo ratings yet

- CWK Company OverviewDocument30 pagesCWK Company OverviewrichsantiagoNo ratings yet

- Kash Investor PresentationDocument20 pagesKash Investor PresentationPhilip GardinerNo ratings yet

- er20130130BullPhatDragon PDFDocument2 pageser20130130BullPhatDragon PDFBelinda WinkelmanNo ratings yet

- Hyatt Q4-2014-Form-10-K - v001 - w9z3mbDocument912 pagesHyatt Q4-2014-Form-10-K - v001 - w9z3mbMaha MansoorNo ratings yet

- q3 2022 Presentation VFDocument32 pagesq3 2022 Presentation VFMiguel SuárezNo ratings yet

- Royal Bank of Canada First Quarter Results Conference Call Friday, February 21, 2020Document10 pagesRoyal Bank of Canada First Quarter Results Conference Call Friday, February 21, 2020ntNo ratings yet

- Nearly Over The Worst - 28112011Document2 pagesNearly Over The Worst - 28112011Philip MorrishNo ratings yet

- 2024 Q 1 SpeechDocument8 pages2024 Q 1 SpeechGDoingThings YTNo ratings yet

- Höegh Investor Presentation HLNG Investor Presentation IPODocument48 pagesHöegh Investor Presentation HLNG Investor Presentation IPOEnrique Hernandez DelgadoNo ratings yet

- Asia Ig Credit Trading : Singapore Telecommunications Limited ("SingtelDocument4 pagesAsia Ig Credit Trading : Singapore Telecommunications Limited ("Singtelkn0qNo ratings yet

- Afe Investor Presentation For The Quarter Ended 31 March 2019Document30 pagesAfe Investor Presentation For The Quarter Ended 31 March 2019Tarek DomiatyNo ratings yet

- Primary and Secondary MarketDocument57 pagesPrimary and Secondary MarketRahul Shakya100% (1)

- UBS & CS Merger PresentationDocument12 pagesUBS & CS Merger PresentationBilly LeeNo ratings yet

- Minibond Series 35Document58 pagesMinibond Series 35Ben JoneNo ratings yet

- The Ultimate Guide to US Financial Regulations: A Primer for Lawyers and Business ProfessionalsFrom EverandThe Ultimate Guide to US Financial Regulations: A Primer for Lawyers and Business ProfessionalsNo ratings yet

- The Insider's Guide to Securities Law: Navigating the Intricacies of Public and Private OfferingsFrom EverandThe Insider's Guide to Securities Law: Navigating the Intricacies of Public and Private OfferingsRating: 5 out of 5 stars5/5 (1)

- Household Yearly Budget Template ExcelDocument3 pagesHousehold Yearly Budget Template ExcelianachieviciNo ratings yet

- Agricultural and Commodity Marketing PresentationDocument22 pagesAgricultural and Commodity Marketing PresentationBikila MitikuNo ratings yet

- ReadingDocument205 pagesReadingHiền ThuNo ratings yet

- SBI SIP Registration FormDocument3 pagesSBI SIP Registration FormPrakash JoshiNo ratings yet

- Correcting EntriesDocument2 pagesCorrecting EntriesCriziel Ann LealNo ratings yet

- Examiner's Report: FA/FFA Financial Accounting Key Themes From Examiner Reports 2015 - 2018Document8 pagesExaminer's Report: FA/FFA Financial Accounting Key Themes From Examiner Reports 2015 - 2018Grace EtwaruNo ratings yet

- Government of Andhra Pradesh: (APTC Form-47)Document2 pagesGovernment of Andhra Pradesh: (APTC Form-47)Y.rajuNo ratings yet

- On The Effectiveness of Multi-Token Economies: Sean Kang Kideok Cho, Kyle ParkDocument5 pagesOn The Effectiveness of Multi-Token Economies: Sean Kang Kideok Cho, Kyle ParkmarpernasNo ratings yet

- Chapter Two Financial Analysis and Planning Part One-Financial Analysis 2.1Document17 pagesChapter Two Financial Analysis and Planning Part One-Financial Analysis 2.1TIZITAW MASRESHA100% (2)

- Past Paper Analysis Ratios Cfap and CafDocument1 pagePast Paper Analysis Ratios Cfap and CafANo ratings yet

- Formerly FSN E-Commerce Ventures Private Limited'Document3 pagesFormerly FSN E-Commerce Ventures Private Limited'Chandresh SinghNo ratings yet

- Secrecy in Bank Deposits - FinalDocument32 pagesSecrecy in Bank Deposits - FinalDeb BieNo ratings yet

- Taxation-IT For IndividualsDocument7 pagesTaxation-IT For IndividualsEmperiumNo ratings yet

- 4 Petty Cash FundDocument13 pages4 Petty Cash FundAlyssa Barbara D. Badidles100% (1)

- Financial IntermediariesDocument87 pagesFinancial IntermediariesKanika Sharma100% (1)

- Gam Quiz - Definition of TermsDocument11 pagesGam Quiz - Definition of TermsChristine Nathalie BalmesNo ratings yet

- Chapter 1 Simple Interest and Simple DiscountDocument38 pagesChapter 1 Simple Interest and Simple DiscountAbe Miguel BullecerNo ratings yet

- Prymary Teacher's GPF Account Slip For W.BDocument4 pagesPrymary Teacher's GPF Account Slip For W.BPranab Banerjee86% (7)

- Company Law RTP Compilation Question BankDocument40 pagesCompany Law RTP Compilation Question BankNoorul Zaman KhanNo ratings yet

- Double Taxation Avoidance AgreementsDocument3 pagesDouble Taxation Avoidance AgreementsPrabjot SinghNo ratings yet

- Mindtree Company PROJECTDocument16 pagesMindtree Company PROJECTSanjay KuriyaNo ratings yet

- FMWC Stage 7 Question BreakdownDocument3 pagesFMWC Stage 7 Question BreakdownBuat ApaNo ratings yet

- Acc301 Ca 2Document9 pagesAcc301 Ca 2Kathuria AmanNo ratings yet