Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

93 viewsPak and Afgan

Pak and Afgan

Uploaded by

anon-679522The landlocked Islamic State of Afghanistan is an extremely poor country. An estimated 4 million to 5 million of the population has been displaced. Natural catastrophes such as drought and earthquakes, have afflicted the country in the past few years.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Complete Final Project On Seven Star HotelDocument91 pagesComplete Final Project On Seven Star Hoteliqrayounas100% (4)

- Geology of RwandaDocument8 pagesGeology of RwandaEl PatrickNo ratings yet

- Review Report of Education Policies of Pakistan From 2011 To 2020Document7 pagesReview Report of Education Policies of Pakistan From 2011 To 2020Zalfa ChaudryNo ratings yet

- Supreme Court Decision Cantonment Employee Is Govt ServentDocument76 pagesSupreme Court Decision Cantonment Employee Is Govt Serventmlk ZahidNo ratings yet

- Fghanistan AND Akistan: by Travis Q. LydayDocument5 pagesFghanistan AND Akistan: by Travis Q. LydaySeema LalwaniNo ratings yet

- 2015 Mineral YearbookDocument8 pages2015 Mineral Yearbookahmad jamshid safiNo ratings yet

- Afghanistan's Mineral Resource Potential A Boon or BaneDocument24 pagesAfghanistan's Mineral Resource Potential A Boon or BaneKinza ZebNo ratings yet

- Case-Study4 Aral SeaDocument22 pagesCase-Study4 Aral SeaAndreea FarcasNo ratings yet

- HE Hilippines: by Travis Q. LydayDocument5 pagesHE Hilippines: by Travis Q. LydaybournetapsNo ratings yet

- Afghanistans Natural ResourcesDocument6 pagesAfghanistans Natural ResourcesShaieq FrotanNo ratings yet

- Multiple-11p-Factors Make Afghan CommunitiesDocument11 pagesMultiple-11p-Factors Make Afghan CommunitiesAzhar Ahmad NazriNo ratings yet

- Mining and Its Impacts On Environment and Health With Special Reference To Ballari District, Karnataka, IndiaDocument7 pagesMining and Its Impacts On Environment and Health With Special Reference To Ballari District, Karnataka, IndiaIJAERS JOURNALNo ratings yet

- Afghanistan'S Natural Resources: February 2019Document6 pagesAfghanistan'S Natural Resources: February 2019JakeNo ratings yet

- 1.1 Nsuta Manganese Deposit: Cote D' Ivoire Ghana TogoDocument5 pages1.1 Nsuta Manganese Deposit: Cote D' Ivoire Ghana TogoBobby WskNo ratings yet

- Ground Water Quality - NepalDocument4 pagesGround Water Quality - NepalNepali NepaliNo ratings yet

- The Mineral Industry of The Central African RepublicDocument2 pagesThe Mineral Industry of The Central African RepublichascoaateNo ratings yet

- ETH, DJI, ERI, & SOM (East Africa Mineral 2002Document9 pagesETH, DJI, ERI, & SOM (East Africa Mineral 2002SENAITNo ratings yet

- K501018494 PDFDocument11 pagesK501018494 PDFG. SASIDHARA KURUPNo ratings yet

- Ajol-File-Journals 406 Articles 256334 651bbf20338abDocument16 pagesAjol-File-Journals 406 Articles 256334 651bbf20338abMadam CashNo ratings yet

- 2.25 Afghanistan Energy by Nadeem MalikDocument19 pages2.25 Afghanistan Energy by Nadeem MalikihsanulhaqNo ratings yet

- 1 Introduction Final PDFDocument21 pages1 Introduction Final PDFRegina EfraimNo ratings yet

- Afgan TransportDocument45 pagesAfgan Transportuzseoul100% (1)

- The Geology, Mineral Resources of Sierra Leone and How The Resources Can Be Used To Develop The NationDocument8 pagesThe Geology, Mineral Resources of Sierra Leone and How The Resources Can Be Used To Develop The NationGitta kamaraNo ratings yet

- Mineral Resource Conflict JharkhandDocument20 pagesMineral Resource Conflict JharkhandSTANZIN SKALDANNo ratings yet

- 2013 - Vol III - Laterite 2013Document9 pages2013 - Vol III - Laterite 2013Zaheer AbbasNo ratings yet

- Potential Geologic in JordanDocument14 pagesPotential Geologic in JordanSteven TremolNo ratings yet

- Geochemical Aspects of Uranium in The Sumayar Valley, Northern Areas of PakistanDocument25 pagesGeochemical Aspects of Uranium in The Sumayar Valley, Northern Areas of PakistaniamalikNo ratings yet

- 6 AfghanistanDocument1 page6 Afghanistansaurabh9870panditNo ratings yet

- East Africa Mineral 2003Document10 pagesEast Africa Mineral 2003SENAITNo ratings yet

- 9angola Recursos NaturaisDocument8 pages9angola Recursos NaturaisElmiro CarvalhoNo ratings yet

- D, E, E, S: Jibouti Ritrea Thiopia AND OmaliaDocument8 pagesD, E, E, S: Jibouti Ritrea Thiopia AND Omalial90olki90000No ratings yet

- Distribution of Area Under Waterlogging & Salinity in PakistanDocument3 pagesDistribution of Area Under Waterlogging & Salinity in PakistanDopest KhanNo ratings yet

- 28 GhanaDocument4 pages28 GhanaIsaac AmankwaaNo ratings yet

- Hormuz Strait Dam Futuristic MacroprojectDocument14 pagesHormuz Strait Dam Futuristic MacroprojectMariabelen MalagaNo ratings yet

- 2017-2018 Minerals Yearbook: AfghanistanDocument6 pages2017-2018 Minerals Yearbook: Afghanistanahmad jamshid safiNo ratings yet

- Marine Resources in Pakistan: A Tentative InventoryDocument10 pagesMarine Resources in Pakistan: A Tentative InventorymishwiNo ratings yet

- Mineral Resources and Occurrances in Al-Jazira AreaDocument16 pagesMineral Resources and Occurrances in Al-Jazira AreaMuhanned AljeboryNo ratings yet

- References: Ectionstore/ - Public/37/005/37005818.Pdf+"Alginates"&Proxystylesheet InisDocument7 pagesReferences: Ectionstore/ - Public/37/005/37005818.Pdf+"Alginates"&Proxystylesheet InisCenaAnzuresNo ratings yet

- Geo Literature ReveiwDocument2 pagesGeo Literature ReveiwPari WishNo ratings yet

- The International Journal of Engineering and Science (The IJES)Document6 pagesThe International Journal of Engineering and Science (The IJES)theijesNo ratings yet

- Economics Project ReportDocument7 pagesEconomics Project ReportSnehal JoshiNo ratings yet

- Ibm - Gov.in - IMYB 2011 - Iron Ore PDFDocument35 pagesIbm - Gov.in - IMYB 2011 - Iron Ore PDFdrrcc0761No ratings yet

- The Effect of Waste Management of Oil Drilling and Gold Mining Extraction in The Yakutia Arctic (Russian)Document14 pagesThe Effect of Waste Management of Oil Drilling and Gold Mining Extraction in The Yakutia Arctic (Russian)AJHSSR JournalNo ratings yet

- Environmental Impact Assessment and The Controversy of The Mining Arc in VenezuelaDocument5 pagesEnvironmental Impact Assessment and The Controversy of The Mining Arc in VenezuelaErik RodriguezNo ratings yet

- SomaliaDocument4 pagesSomaliaengmahshmNo ratings yet

- Tajikistan Energy Opportunities: Ambassador Shirinov Discusses Energy IssuesDocument12 pagesTajikistan Energy Opportunities: Ambassador Shirinov Discusses Energy IssuesKeral PatelNo ratings yet

- An Overview of Mineral Resources Development in Nigeria: Problems and ProspectsDocument9 pagesAn Overview of Mineral Resources Development in Nigeria: Problems and Prospectswilolud672080% (5)

- Ilocos Mining Situation - WengkidoodledooDocument42 pagesIlocos Mining Situation - WengkidoodledooSheila Laoagan-De VeraNo ratings yet

- Minerals in Afghanistan The Potential For GoldDocument7 pagesMinerals in Afghanistan The Potential For GoldArslan ArshadNo ratings yet

- The Geology Mineral Resources of Sierra Leone andDocument9 pagesThe Geology Mineral Resources of Sierra Leone andjamesNo ratings yet

- Natural Resources of Bangladesh MineralDocument9 pagesNatural Resources of Bangladesh Mineraljaz hoodNo ratings yet

- PNAAZ114Document16 pagesPNAAZ114ibrahim khanNo ratings yet

- Surface Water IRAQDocument5 pagesSurface Water IRAQfadhilkjNo ratings yet

- Genesis of The Sinkholes at Al-Najaf Governorate, South IraqDocument14 pagesGenesis of The Sinkholes at Al-Najaf Governorate, South IraqMohammad MohammadNo ratings yet

- Cambodia Management WaterDocument8 pagesCambodia Management WaterronaldoNo ratings yet

- Myb3 2017 18 KazakhstanDocument17 pagesMyb3 2017 18 Kazakhstan498104054No ratings yet

- Anthaniel SeminarDocument58 pagesAnthaniel SeminarUchechukwu FortuneNo ratings yet

- Groundwater Depletion and Its Impact On Environmet in Kathmandu ValleyDocument21 pagesGroundwater Depletion and Its Impact On Environmet in Kathmandu ValleyAnonymous nwPK1ZHNo ratings yet

- Article 3 HighlightDocument11 pagesArticle 3 Highlighthassan sardarNo ratings yet

- Energy Resources in Afghanistan and Measures To ImDocument12 pagesEnergy Resources in Afghanistan and Measures To Imsinamohammadali88No ratings yet

- Rural Development Policies in Sub-Saharan Africa and Cooperation with the European Union : United Republic of TanzaniaFrom EverandRural Development Policies in Sub-Saharan Africa and Cooperation with the European Union : United Republic of TanzaniaNo ratings yet

- Greater Mekong Subregion Atlas of the Environment: 2nd EditionFrom EverandGreater Mekong Subregion Atlas of the Environment: 2nd EditionNo ratings yet

- SWOT AnalysisDocument3 pagesSWOT AnalysisKHURAM AHMER0% (1)

- Pakistan India Strategic RivalryDocument10 pagesPakistan India Strategic RivalryParisa UjjanNo ratings yet

- Colonial Paradigm of Indian HistoryDocument92 pagesColonial Paradigm of Indian HistoryKosla Vepa78% (9)

- Economic Analysis of Fish Farming in Punjab, PakistanDocument13 pagesEconomic Analysis of Fish Farming in Punjab, PakistanDr-Umar Ijaz AhmedNo ratings yet

- 1St Merit List of 1St Prof. DVM Degree Program 2020. (Corrigendum)Document2 pages1St Merit List of 1St Prof. DVM Degree Program 2020. (Corrigendum)RizwanNo ratings yet

- Language Movement and The Beginning of Bangladeshi NationalismDocument46 pagesLanguage Movement and The Beginning of Bangladeshi Nationalismabdullah islamNo ratings yet

- Pak Studies 1000 Most Repeated MCQsDocument138 pagesPak Studies 1000 Most Repeated MCQshradmn wapdaNo ratings yet

- Analysis 269 2014Document10 pagesAnalysis 269 2014Syeda FatimaNo ratings yet

- Company Profile (Danish Enterprises & Construction) - NewDocument9 pagesCompany Profile (Danish Enterprises & Construction) - Newgra8leoNo ratings yet

- Twenty Years of TheNewsDocument71 pagesTwenty Years of TheNewsArif KhanNo ratings yet

- Yetmgeta Abdella 2018Document11 pagesYetmgeta Abdella 2018Shafici CqadirNo ratings yet

- Interim Constitution of 1972Document4 pagesInterim Constitution of 1972muhammad shoaib jamilNo ratings yet

- Overpopulation ITS CAUSES AND EFFECTSDocument7 pagesOverpopulation ITS CAUSES AND EFFECTSAsif Khan ShinwariNo ratings yet

- Thesis Proposals For ICTDocument19 pagesThesis Proposals For ICTHassan Magan67% (3)

- New SheetDocument13 pagesNew Sheetparamount laceNo ratings yet

- Pakistan Current Affairs MCQsDocument3 pagesPakistan Current Affairs MCQsImran Hayat0% (1)

- Literacy Rate in PakistanDocument16 pagesLiteracy Rate in PakistanMuhammad saqibNo ratings yet

- Denizens of Alien Worlds A Survey of Students and Teachers at Pakistan's Urdu and English Language-Medium Schools, and MadrassasDocument21 pagesDenizens of Alien Worlds A Survey of Students and Teachers at Pakistan's Urdu and English Language-Medium Schools, and MadrassasUsman AhmadNo ratings yet

- Agriculture Problems in Pakistan and Their SolutionsDocument6 pagesAgriculture Problems in Pakistan and Their SolutionsSalam Zeeshan67% (3)

- 302-Influence of Allied CultureDocument10 pages302-Influence of Allied CultureZubair Latif100% (1)

- PTS Imc 2023 PBDocument24 pagesPTS Imc 2023 PBhinasadia26juneNo ratings yet

- Definition of Foreign PolicyDocument3 pagesDefinition of Foreign PolicyAliza IshraNo ratings yet

- Gazzette MBBS 2nd Year A 2012 - 0Document25 pagesGazzette MBBS 2nd Year A 2012 - 0shahrukhziaNo ratings yet

- Indian Afghanishtan 3Document40 pagesIndian Afghanishtan 3Aadhya ChhabraNo ratings yet

- Media Ethics - Country Paper On PakistanDocument27 pagesMedia Ethics - Country Paper On PakistanhadmediaNo ratings yet

- Pakistan Studies TOP MCQSDocument53 pagesPakistan Studies TOP MCQSbilalturi100% (1)

- AJAZ ALI KHAN Secy Coal & Energy Dept. Sindh Govt., Thar CoalDocument19 pagesAJAZ ALI KHAN Secy Coal & Energy Dept. Sindh Govt., Thar CoalHasnain GoharNo ratings yet

Pak and Afgan

Pak and Afgan

Uploaded by

anon-6795220 ratings0% found this document useful (0 votes)

93 views7 pagesThe landlocked Islamic State of Afghanistan is an extremely poor country. An estimated 4 million to 5 million of the population has been displaced. Natural catastrophes such as drought and earthquakes, have afflicted the country in the past few years.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe landlocked Islamic State of Afghanistan is an extremely poor country. An estimated 4 million to 5 million of the population has been displaced. Natural catastrophes such as drought and earthquakes, have afflicted the country in the past few years.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

93 views7 pagesPak and Afgan

Pak and Afgan

Uploaded by

anon-679522The landlocked Islamic State of Afghanistan is an extremely poor country. An estimated 4 million to 5 million of the population has been displaced. Natural catastrophes such as drought and earthquakes, have afflicted the country in the past few years.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 7

THE MINERAL INDUSTRIES OF

AFGHANISTAN AND PAKISTAN

By Travis Q. Lyday

AFGHANISTAN resources include barite, coal, chromite, lead, salt, sulfur, talc,

and zinc, as well as natural gas and petroleum. Some of these

The landlocked Islamic State of Afghanistan is an extremely resources have been exploited, and others have not because the

poor country with rugged terrain and a seasonally harsh climate. country generally lacks the infrastructure to use them and the

It encompasses approximately 652,000 square kilometers (km2). country has limited resources under production (Afghanistan

For almost one-quarter of a century, the country has endured Online, undated a§; MBendi Information Services, undated§).

extreme political upheaval, civil strife, and outright war A small copper deposit is located at Ainak, which may have the

(Afghanistan Online, undated a§1). Most of the major capability to be mined at a rate of 5,000 metric tons per year of

administrative, agricultural, communication, education, ore (CountryWatch, 2000§). Cement produced from indigenous

government, heavy- and small-scale industries, social services, sources also was provided to local markets in minor quantities.

and transportation systems have been seriously damaged or The main fossil fuel resources in Afghanistan were coal, natural

utterly destroyed. An estimated 4 million to 5 million of the gas, and as-yet untapped petroleum (Afghanistan Online,

population of 26 million has been displaced within and outside undated a§). The country also produced hydroelectric power

the country. Additionally, natural catastrophes such as drought (CountryWatch, 2000§).

and earthquakes, have afflicted the country in the past few years The economy was essentially agricultural, which included

(Afghanistan Online, undated b§; BBC News, 2002§). subsistence farming and livestock raising. Before the war that

From the mid-1990s until late 2001, the Taliban (originally a removed the Taliban regime, Afghanistan’s gross domestic

group of Islamic scholars derived from the Pashtun ethnic product was estimated to be $6.9 billion with per capita income

majority community) controlled about 90% of the country. of about $300. The bulk of national production consisted of

Because of the Taliban’s extreme version of Islam , they were agricultural and forestry products (53%) followed by light

opposed by an alliance of factions drawn mainly from industry (28%), trade (8%), construction (6%), and other (5%)

Afghanistan’s minorities based in the north called the Northern (Asian Development Bank, 2002§).

Alliance. Additionally, the Taliban was recognized as the Afghanistan’s economy has additional potential because of its

legitimate Government by only Pakistan, Saudi Arabia, and strategic geographic position as a transit route for Central Asian

United Arab Emirates (BBC News, 2002§; U.S. Department of hydrocarbons to the Arabian Sea. The feasibility of using the

State, 2002§). country’s geographic location as a transit route was

Following about 2 months of pressure from U.S. air power demonstrated in the late 1990s when Unocal Corp. of the United

and ground forces that ended in the collapse of the ruling States led the multinational Central Asia Gas Pipeline

Taliban, Afghan factions under United Nations sponsorship and consortium in evaluating construction of a pipeline from

that were opposed to the Taliban agreed on a political process to Turkmenistan through western Afghanistan to natural gas

restore stability and governance to the country. At yearend, the markets in Pakistan (Unocal Corp., 2002§).

Interim Authority was attempting the establishment of For more than 30 years, the wars and violence in Afghanistan

Government ministries and necessary social services that would have inflicted severe physical and socioeconomic effects on the

lead to a restructuring of Government to be apportioned toward country’s environment and its people and have intensified the

a balance of the different ethnic groups (U.S. Department of country’s environmental problems. The more-crucial ones, in

State, 2002§). addition to such natural hazards as drought, earthquakes, and

The country has economic potential owing to natural flooding, are deforestation, desertification, soil erosion, and

resources that range from exotic minerals, such as lapis lazuli water pollution. Regulation and protection jurisdiction of the

and other fine gems for which Afghanistan has been an environment was within the Ministry of Agriculture and the

important source for many centuries, to more-standard ore Ministry of Water and Power, but the Taliban had suspended the

deposits, such as copper, gold, and iron ore (Geotimes, 2002; activities of both organizations in 1996; fledgling interim

Shroder, 1983). The precious and semiprecious stone deposits Ministries were being organized near yearend (CountryWatch,

are numerous. Some of the main gemstones that have been 2000§).

produced are aquamarine, emerald, kunzite, lapis lazuli, ruby, The transport system in Afghanistan was in poor condition

and tourmaline (Colored Stone, 2001§). Additional mineral with almost 80% of the highways and roads unpaved. Owing to

the rugged terrain in the country, the only operational rail

network, which was about 25 kilometers (km) long, joined

1

References that include a section twist (§) are found in the Internet References

Afghanistan with Turkmenistan and Uzbekistan (MBendi

Cited section. Information Services, undated§).

THE MINERAL INDUSTRIES OF AFGHANISTAN AND PAKISTAN—2001 2.1

References Cited substantiated the potential of the metals copper, gold, iron ore,

lead, platinum, silver, and zinc and of the quarry products

Geotimes, 2002, Afghanistan—Geology in a troubled land: Geotimes, v. 47, no. multicolored granite, marble, and other dimension stones

2, February, p. 17.

Shroder, J.F., Jr., 1983, The U.S.S.R. and Afghanistan mineral resources, in (Mining Magazine, 2001; Pakistan Ministry of Finance, 2002§).

Agnew, A.F., ed., International minerals—A national perspective (AAAS In January, the Pakistani Government approved a package of

Selected Symposium 90): Boulder, Colorado, Westview Press Inc., offshore exploration and development incentives. The

p. 115-153. incentives would apply to new and existing leases for 5 years.

Under the changes, exploration periods were increased to 5

Internet References Cited

years from 3 years, two optional renewals of 2 years each, and a

Afghanistan Online, [undated] a, Economy—Basics of the Afghan economy, maximum retention of 10 years allowed on a case-by-case basis.

accessed September 16, 2002, at URL http://www.afghan-web.com/ The import duties and taxes for exploration equipment would be

economy/basics2.html. waived. After the first commercial discovery, the duties would

Afghanistan Online, [undated] b, Economy—The state of the Afghan economy,

be 3%.

accessed September 16, 2002, at URL http://www.afghan-web.com/

economy/econstate.html. In addition, corporate income tax would be reduced from 50%

Asian Development Bank, 2002, Economic performance, Afghanistan, accessed to 40%. Investors would recover the costs of exploration and

August 27, 2002, at URL http://www.adb.org/Documents/Reports/ development projects, up to 85%, and thereafter share revenues

Annual_Report/2001/afg.asp. with the Government. A sliding scale royalty was to be

BBC News, 2002 (July 7), Afghanistan, Country Profile, accessed September

16, 2002, at URL http://news.bbc.co.uk/1/hi/world/south_asia/ introduced with a payment holiday of 4 years; a flat 12.5%

country_profiles/1162668.stm. royalty applied previously.

Colored Stone, 2001, Afghan gem supply down, market OK, accessed Pakistan’s offshore area is divided into 3 zones. The shallow

September 18, at URL http://www.colored-stone.com/stories/nov01/ designation applies to areas in less than 200 meters (m) of water,

afghan.cfm.

CountryWatch, 2000, Afghanistan, accessed November 14, 2001, at URL

the deep designation to areas in 200 to 1,000 m of water, and the

http://www.countrywatch.com. ultradeep designation to areas in more than 1,000 m of water.

MBendi Information Services, [undated], Afghanistan, Country Profile, accessed In June, the Government amended its petroleum policy for

September 19, 2002, at URL http://www.mbendi.co.za/land/as/af/ p0005.htm. onshore exploration. To increase the pace of onshore

UNOCAL Corp., 2002 (December 10), Unocal statement on withdrawal from

exploration, a 10-year plan that would gradually increase

the proposed Central Asia Gas (CentGas) pipeline project, accessed

September 19, 2002, at URL http://www.unocal.com/uclnews/98news/ activity to 100 wells drilled per year was created. Similar to the

centgas.htm. offshore incentive package, the income tax rate was lowered to a

U.S. Department of State, 2002a, Afghanistan, Background Note, accessed uniform 40% from 50% to 55%; the initial terms of exploration

August 23, 2002, at URL http://www.state.gov/r/pa/ei/bgn/5380.htm. licenses were increased to 5 years from 3 years, renewals of 2

U.S. Department of State, 2002b, Afghanistan, Background Note, accessed

August 23, 2002, at URL http://www.state.gov/r/pa/ei/bgn/5380.htm. years each versus the previous 3-year renewals, and three

extensions of 1 year each. Additionally, an open- access system

Major Sources of Information would be followed for pipeline infrastructure development. For

tie-in pipelines constructed by a producer, buyer, or a third

Ministry of Mines and Industries, Kabul, Afghanistan party, separate transmission tariffs would be allowed. A 5-year

Ministry of Water and Electricity, Kabul, Afghanistan retention of significant gas discoveries would be allowed. For

marginal properties, the Government withdrew the $500,000

PAKISTAN production bonus requirement (Oil & Gas Journal, 2001b).

The Government also approved a production-sharing

The Islamic Republic of Pakistan is in South Asia in the agreement (PSA) that was a model for future agreements. It

northwestern corner of the Indian subcontinent. It borders India approved a policy to allow current (2001) holders of concessions

to the east, China to the northeast, Afghanistan to the north and to opt to convert to a PSA. To convert, the company must have

west, and Iran to the southwest. The Arabian Sea along the completed its work obligations for the initial term of the

south forms a 1,046-km coastline. Its total area of 803,940 km2 exploration license and must execute the PSA within 90 days of

is slightly less than twice the size of California (U.S. Central Government approval (Oil & Gas Journal, 2001a).

Intelligence Agency, 2001§; Islamic Republic of Pakistan, In March, the Pakistani Government established a commission

undated§). to investigate ways in which the country’s cement and other

Primarily owing to severe drought in the agricultural sector, industrial fuel users could be converted to coal rather than

the growth of Pakistan’s gross domestic product (GDP) declined continuing to rely on more-expensive imported oil and gas. The

to a rate of 2.6% in fiscal year 2001 (July 1-June 30) from a aim was to reduce Pakistan’s dependance on imported energy;

growth rate of 3.9% in 2000. Pakistan’s GDP was expected to this could save an estimated $22 million per year in foreign

increase by 3% in fiscal year 2002 (Asian Development Bank, exchange and provide an incentive for developing the country’s

2002). domestic coal resources (Mining Journal, 2001a).

Mining and quarrying products, which included petroleum In early June, the Government approved $15.7 million in

and natural gas, played a minor role in the economy of Pakistan; development aid for the minerals sector and required the

they accounted for only 0.5% of the GDP (Country Briefings, provincial governments to implement it within 30 days. The

2002§). The country produces a variety of minerals; the more- decision followed intense lobbying by the minerals sector,

important of which include barite, chromite, coal, dolomite, which told the Central Government that the provincial

limestone, magnesite, natural gas, gypsum, petroleum, salt, and authorities were resisting implementation of the 1995 minerals

sulfur. Additionally, recent regional geological surveys have policy primarily owing to lack of funding. The bulk of the funds

2.2 U.S. GEOLOGICAL SURVEY MINERALS YEARBOOK—2001

was assigned to the Geological Survey of Pakistan to complete a domestic production capacity. Despite the development of the

geologic mapping survey of the entire country at a scale of necessary infrastructure to transport and distribute its gas and

1:50,000 within 5 years. Also included in the funding was an petroleum adequately, net imports were projected to increase

initiative for the Provincial governments to establish mine substantially, at about 7% per year, in coming years, which may

departments at their Provincial level (Mining Journal, 2001c). present burdens. The country had about 7,400 km of

On November 30, the Governments of China and Pakistan transmission pipeline (U.S. Energy Information Administration,

signed a $350 million contract for reviving the development of 2002§; Pakistan Ministry of Petroleum and Natural Resources,

the Saindak copper-gold project in Balochistan Province, it had undated§).

been shut down in early 1996 owing to the lack of working In 2001, most of the foreign-owned oil exploration and

capital. The contract was awarded on a lease basis to the China production companies active in Pakistan were small

Metallurgical Construction Corp. (MCC) for a period of 10 independents. The most prominent were two United Kingdom-

years. The Balochistani Provincial government was to receive a based companies—Lasmo Oil Plc, which was acquired by

royalty of $700,000 per year. MCC initially would invest $39 Italy’s Eni in 2001, and BP Pakistan Exploration and Production

million as working capital to make the project viable. The Inc. (a subsidiary of BP Plc) (BP Plc, 2002§; Eni, 2002§).

project was scheduled to start production by December 2002. Pakistan’s producers were centered on the Potwar Plateau in

During the 6-month initial production period of operation in Punjab and Sindh Provinces (Iran Daily, 2001).

1995-96, Saindak produced more than 1,500— metric tons (t) of A 30,000-barrel-per-day (bbl/d) oil refinery was under

blister copper that contained about 10 kilograms (kg) of gold construction by Bosicor Pakistan Ltd. near Karachi, Balochistan

and 200 kg of silver. Once in full production, Saindak was Province. The $50 million refinery will produce almost all types

scheduled to produce 45,000 t/yr of copper, which would offset of petroleum products from crude oil supplied by France’s

the 30,000 t/yr of copper imports, 1.5 t/yr of gold, and 2.8 t/yr of TotalFinalElf from Qatar. The products will be purchased by

silver (Pakistan & Gulf Economist, 2002b; Dawn, 2001§). Pakistan State Oil Co. Ltd. A refurbished unit previously owned

Pakistan Steel was Pakistan’s only integrated steel plant. It by a U.S. petroleum company was being used in the construction

was located near Port Muhammad Bin Qasim, which is 25 km of the refinery (Pakistan & Gulf Economist, 2002a; U.S. Energy

east of Karachi, and had a capacity of 1.1 million metric tons per Information Administration, 2002§).

year (Mt/yr). It was constructed with technical assistance from In February, the Pak-Arab Refinery Co. Ltd. (Parco)

the Soviet Union. The coking coal, iron ore, and manganese for commissioned its greenfield Mid-Country Refinery (MCR)

the plant were imported. It produced billets, coke, galvanized complex at Mahmood Kot, Punjab Province. The $886 million

sheets, hot- and cold-rolled coils and sheets, and pig iron. complex consisted of 11 main process units and treatment and

In 2001, Pakistan had 24 cement plants that had a total recovery units along with a full complement of residential

installed capacity of 16.3 Mt/yr. Of these, 20 plants that had a housing. There also were numerous offsite/utilities units and

total of 14.4 Mt/yr of capacity were in the private sector, and the other permanent facilities, which included 46 crude oil;

remaining 4 plants that had a total of 1.9 Mt/yr capacity were in intermediate feeds stock; and other finished products storage

the public sector (Pakistan Ministry of Finance, 2002§). tanks. The refinery had a throughput capacity of 100,000 bbl/d

Early in the year, producers of high-quality marble in Sindh that consisted of light Arabian crude from Saudi Arabia and

Province were forced to stop their operations owing to increases crude from Abu Dhabi. Parco was a joint venture among the

in freight cost, abnormal utility charges, and load shedding by countries of Austria, Abu Dhabi, and Pakistan; the Government

the Karachi Electric Supply Corp., which together led to high of Pakistan held a 60% interest, and Abu Dhabi Petroleum

production costs and unacceptable delays to export Investment and OMV of Austria held the remaining 40%

consignments. Some leading producers claimed that Pakistani interest (Parco Ltd., 2001a§, b§).

marble was no longer competitive in world markets and that In October, the Asian Development Bank announced that it

foreign buyers of high-quality marble were turning to China, would provide a $1 million technical assistance grant to

Egypt, and India for their supplies (Industrial Minerals, 2001). restructure Pakistan’s natural gas sector to make it more efficient

Pakistan has vast untapped coal deposits, which according to and attractive for investments from the private sector. The

some estimates, may be adequate for up to 100 years. Sindh Pakistani Government approved its own funding of $1.5 million

Province alone has sufficient coal resources to meet national in corresponding support. Heretofore, the public sector had been

requirements for decades. The Sindh Coal Authority (SCA) was unable to improve its infrastructure because of underfunding,

planning to build a 450-megawatt integrated powerplant to meet and, therefore, natural gas discoveries have remained

anticipated demand by 2005; it would burn coal supplied from undeveloped, thus keeping the country heavily reliant on imports.

the Province’s Dadu District. The SCA also delineated a 50- The Ministry of Petroleum and Natural Resources was to

km2 area for leasing to private parties. The Government implement the program (Asian Development Bank, 2001).

launched a bankable feasibility study of the substantial Thar coal Pakistan’s natural gas producers included the State-owned

resources in Sindh Province’s Tharparkar Desert with plans to producers Pakistan Petroleum Ltd. and Oil and Gas

develop the coal through international competitive bidding Development Corp., as well as the foreign companies Atlantic

(Asian Mining Journal, 2001; Mining Journal, 2001b). Richfield of the United States, BHP Billiton Plc of Australia,

Because Pakistan consumed more than 5 times its domestic Lasmo Oil, and OMV areas (Iran Daily, 2001). These were

production, it continued to depend on imported oil and natural operating the following gasfields: Adhi Field, Punjab Province;

gas in 2001. Although the country will probably never attain Shikarpur Field, Sindh Province; Kandhkot Field, Sindh

self-sufficiency in oil and gas, the Government encouraged Province; and Sui Field, Balochistan Province (Pakistan

private firms, which included foreign owned, to develop Petroleum Ltd., 2002).

THE MINERAL INDUSTRIES OF AFGHANISTAN AND PAKISTAN—2001 2.3

The transportation infrastructure of Pakistan was moderately Pakistan & Gulf Economist, 2002b, Industry and economy—The revival of

developed. Of the 247,811 km of roads, 141,252 km was paved, Saindak project: Pakistan & Gulf Economist, v. 21, no. 11, March 18, p. 29.

Pakistan Petroleum Ltd., 2002: Progress [a monthly publication of Pakistan

which included 339 km of expressways, and 106,559 km was Petroleum Ltd.], v. 49, no. 7, February, p. 8.

unpaved. Pakistant has no inland waterways. The public sector

railway system consisted of 7,718 km of broad gauge (1.676 m Internet References Cited

track, 293 km of which was electrified and 1,037 km of which

was double track, and 445 km of narrow gauge (1.000- m) track. BP Plc, 2002, Pakistan, In Your Area, accessed at URL http://www.bp.com/

in_your_area/ transition_page.asp?language=1&id=55.

Of the 117 airports, 82 had permanent-surface runways. Country Briefings, 2002 (August 12), Pakistan, accessed at URL

International shipping ports included Karachi and Port www.countrybriefings.com.

Muhammad bin Qasim. The merchant marine fleet of 17 ships Dawn, 2001 (December 1), Saindak deal signed, accessed at URL

included 1 petroleum tanker. Pipelines included 4,044 km for http://www.dawn.com/2001/12/01/top14/htm/.

Eni, 2002, Pakistan, Eni Around the World, accessed at URL

natural gas, 250 km for crude oil, and 885 km for petroleum http://216.239.39.120/translate_c?hl=en&u=http://www.eni.it.

products (U.S. Central Intelligence Agency, 2001§). Islamic Republic of Pakistan, undated, Introducing Pakistan, Country Profile,

accessed September 20, 2002, at URL http://www.pak.gov.pk/public/

References Cited country.html.

Pakistan Ministry of Finance, 2002, Manufacturing, mining, and investment

Asian Development Bank, 2001, Reforming Pakistan’s gas sector: Manila, policies, Economic Survey, 2001-02, accessed September 24, 2002, at URL

Philippines, Asian Development Bank press release, October 15, 1 p. http://www.finance.gov.pk.

Asian Development Bank, 2002, Pakistan to show modest economic growth in Pakistan Ministry of Petroleum and Natural Resources, [undated], Introduction,

2002: Manila, Philippines, Asian Development Bank press release, April 9, accessed October 2, at URL http://www.mpnr.gov.pk/intro.html.

2 p. Parco Ltd., 2001a, About Parco [undated], accessed at URL

Asian Mining Journal, 2001, Pakistan’s energy priority: Asian Mining Journal, http://www.parco.com.pk/parco/about_parco.html.

August-October, p. 33. Parco Ltd., 2001b (March), Parco Mid-Country Refinery, accessed at URL

Industrial Minerals, 2001, Mineral notes—Pakistani marble crisis: Industrial http://www.parco.com.pk/parco/midcountryrefinery.html.

Minerals, no. 401, February, p.73. U.S. Central Intelligence Agency, 2001, Pakistan, World Factbook 2001,

Iran Daily, 2001, Economic features—Energy in Pakistan: Tehran, Iran, Iran accessed September 24, at URL http://www.cia.gov/cia/publications/

Daily, April 14, p. 5. factbook/geos/pk.html.

Mining Journal, 2001a, Industry in action—Pakistan aims to cut energy costs: U.S. Energy Information Administration, 2002 (March), Pakistan Country

Mining Journal, v. 336, no. 8625, March 16, p. 202. Analysis Brief, accessed September 23, at URL http://www.eia.doe.gov/

Mining Journal, 2001b, Industry in action—Pakistan urged to use more coal: emeu/cabs/pakistan2.html.

Mining Journal, v. 336, no. 8631, April 23, p. 315.

Mining Journal, 2001c, Mining week—Pakistani Government pushes minerals Major Sources of Information

sector: Mining Journal, v. 336, no. 8638, p. 436.

Mining Magazine, 2001, Pakistani Government pushes minerals sector: Mining

Ministry of Petroleum and Natural Resources

Magazine, v. 185, no. 1, July, p.41.

Oil & Gas Journal, 2001a, Exploration & development—Pakistan sweetens 3d Floor, A Block, Pak Secretariat

terms of new, old offshore licenses: Oil & Gas Journal, v. 99, no. 7, February Islamabad, Pakistan

12, p. 42. Telephone: +92 51 9208223

Oil & Gas Journal, 2001b, Quick takes: Oil & Gas Journal, v. 99, no. 22, May Fax: +92 51 9205437

28, p. 8.

Pakistan & Gulf Economist, 2002a, Finance and markets—Another refinery to

start production: Pakistan & Gulf Economist, v. 21, no. 12, March 25, p. 17.

2.4 U.S. GEOLOGICAL SURVEY MINERALS YEARBOOK—2001

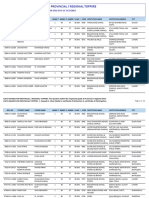

TABLE 1

AFGHANISTAN AND PAKISTAN: ESTIMATED PRODUCTION OF MINERAL COMMODITIES 1/ 2/

(Metric tons unless otherwise specified)

Country and commodity 1997 1998 1999 2000 2001

AFGHANISTAN 3/

Barite 2,000 2,000 2,000 2,000 2,000

Cement, hydraulic 116,000 116,000 120,000 120,000 120,000

Coal, bituminous 185,000 190,000 190,000 r/ 190,000 r/ 185,000

Copper, mine output, Cu content 5,000 5,000 5,000 5,000 5,000

Gas, natural:

Gross million cubic meters 2,700 2,600 3,000 3,000 3,000

Marketed do. 2,300 2,200 2,500 2,500 2,500

Gypsum 3,000 3,000 3,000 3,000 3,000

Natural gas liquids thousand 42-gallon barrels 40 40 45 45 45

Nitrogen, N content of ammonia 5,000 5,000 5,000 5,000 5,000

Salt, rock 13,000 13,000 13,000 13,000 13,000

PAKISTAN

Metals:

Aluminum, bauxite, gross weight 4,934 4,954 11,216 8,668 9,000

Chromite ore:

Gross weight 23,763 8,885 16,279 26,844 26,000

Cr2O3 content 10,693 3,998 7,325 12,080 12,000

Iron and steel:

Pig iron e/ thousand tons 1,400 1,500 1,500 1,500 1,500

Steel, crude do. 479 494 500 e/ 500 e/ 500

Lead, refined, secondary e/ 2,000 2,000 2,000 2,000 2,000

Industrial minerals:

Abrasives, natural, emery e/ 150 150 150 120 4/ 150

Barite 23,390 20,657 20,505 21,234 25,000

Cement, hydraulic thousand tons 9,001 8,901 9,600 r/ e/ 9,900 r/ e/ 9,900

Chalk 5,350 4,357 6,283 7,711 7,700

Clays:

Bentonite 16,450 14,196 15,349 27,700 28,000

Fire clay 111,145 66,672 152,379 143,643 145,000

Fuller's earth 12,307 14,659 15,565 15,288 15,000

Kaolin (china clay) 66,235 70,777 64,692 49,574 50,000

Other e/ 200,000 200,000 200,000 200,000 200,000

Feldspar 25,169 31,191 29,235 43,186 45,000

Fluorspar 1,050 1,000 e/ 220 997 1,000

Gypsum, crude 464,942 243,978 244,538 377,000 380,000

Magnesite, crude 4,057 3,157 2,175 4,192 4,200

Nitrogen, N content of ammonia 1,548,600 1,797,200 1,998,900 1,884,300 1,966,100 4/

Phosphate rock: e/

Gross weight 11,045 5/ 11,000 11,500 11,000 11,000

P2O5 content 1,880 1,870 1,950 2,000 2,000

Pigments, mineral, natural, ocher 2,600 e/ 3,180 3,200 e/ 4,747 4,800

Salt:

Rock thousand tons 1,042 1,038 1,019 1,313 1,500

Marine do. 19 15 16 20 20

Total do. 1,061 1,053 1,035 1,333 1,520

Sand: e/

Bajir and common 170,000 175,000 175,000 212,120 4/ 215,000

Glass 165,000 122,000 4/ 130,000 162,000 4/ 165,000

Sodium compounds, n.e.s.:

Caustic soda 263,300 216,000 220,000 e/ 220,000 e/ 220,000

Soda ash, manufactured e/ 220,000 220,000 230,000 230,000 230,000

Stone:

Aragonite and marble 314,309 354,818 391,754 582,000 585,000

Dolomite 176,096 99,741 188,573 287,962 290,000

Limestone thousand tons 9,016 8,749 9,437 9,884 9,900

Other (as "ordinary stone") e/ do. 10 15 18 20 20

Strontium minerals, celestite 3,000 e/ 598 634 1,918 2,000

Sulfur:

Native e/ 150 150 150 150 200

Byproduct, all sources 22,002 18,988 21,166 20,189 21,000

Total 22,152 19,138 21,316 20,339 21,200

Talc and related materials, soapstone 45,414 48,927 67,670 54,365 55,000

See footnotes at end of table.

TABLE 1--Continued

AFGHANISTAN AND PAKISTAN: ESTIMATED PRODUCTION OF MINERAL COMMODITIES 1/ 2/

(Metric tons unless otherwise specified)

Country and commodity 1997 1998 1999 2000 2001

PAKISTAN--Continued 3/

Mineral fuels and related material:

Coal, all grades thousand tons 4,700 r/ 3,164 3,461 3,116 3,500

Coke e/ do. 720 850 4/ 900 900 900

Gas, natural:

Gross production million cubic meters 16,992 20,224 8,876 24,222 25,000

Marketed production (sales) e/ do. 14,700 17,500 7,700 20,900 21,000

Natural gas liquids e/ thousand 42-gallon barrels 1,080 1,080 564 4/ 600 600

Petroleum:

Crude do. 21,900 16,885 19,986 20,450 22,000

Refinery products e/

Gasoline thousand 42-gallon barrels 8,800 8,900 8,589 4/ 8,500 8,700

Jet fuel do. 4,600 4,700 5,255 4/ 5,500 5,700

Kerosene do. 4,000 3,707 4/ 2,714 4/ 2,700 3,000

Distillate fuel oil do. 13,000 13,500 14,000 14,000 15,000

Residual fuel oil do. 13,500 13,419 4/ 13,500 13,500 15,000

Lubricants do. 1,400 1,400 1,500 1,500 2,000

Other do. 5,100 5,000 5,000 5,000 7,000

Total do. 50,400 50,600 50,600 50,700 56,400

e/ Estimated; estimated data are rounded to no more than three significant digits; may not add to totals shown. r/ Revised.

1/ Table includes data available through September 30, 2002.

1/ Table includes data available through October 8, 2002.

3/ In addition to the commodities listed, asbestos, lapis lazuli, uranium, and a variety of crude construction materials (clays, stone, and sand and gravel) presumably

are produced, but available information is inadequate to make reliable estimates of output levels.

4/ Reported figure.

TABLE 2

PAKISTAN: STRUCTURE OF THE MINERAL INDUSTRY IN 2001

Commodity Location of main facilities Comment

Barite Balochistan Development Authority Khuzdar, Sukkar District.

Do. Bolan Mining Enterprises do.

Do. Razvi Mining Ltd. Abbottabad, Kohistan, and Swat Districts.

Bauxite Black Mountain Minerals Manshera, Rawalpindi District.

Do. Punjab Mineral Development Corp. Khushab, Rawalpindi District.

Celestite Industrial Mineral Enterprises Dera Ghazi Khan, Thano Bula, and Kalu Khuhar Mines, northeast of Karachi.

Cement Associated Cement Co. Ltd. Wah, Rawalpindi District.

Do. do. Rohri, Sukkur District.

Do. Attock Cement (Pak) Ltd. Hub Chowki, near Karachi.

Do. Chakwal Cement Co. Ltd. Lahore.

Do. Cherat Cement Co. Ltd. Karachi.

Do. Dandot Cement Co. Ltd. Lahore.

Do. D.G. Khan Cement Co. Ltd. do.

Do. Fecto Cement Co. Ltd. Karachi.

Do. Gharibwhal Cement Ltd. Jhelom, Rawalpindi District.

Do. Javedan Cement Ltd. Near Karachi.

Do. Lucky Cement Ltd. Karachi.

Do. Maple Leaf Cement Factory Ltd. Lahore.

Do. Mustehkam Cement Ltd. Hattar, Abbottabad District.

Do. Zeal-Pak Cement Factory Ltd. Hyderabad.

Chromite Numerous small companies Mines mainly in the Hindubagh area north of Quetta.

Coal, bituminous Government of Pakistan West and south of Rawalpindi along Salt Range and east and south of Quetta.

Do. Pakistani Water and Power Development Authority do.

Fluorspar Balochistan Development Authority Dilband Ridge, Kolat District.

Gas, natural Sui Northern Gas Pipelines Ltd. Northeast of Sukkur District.

Do. do. East of Sukkur District.

Petroleum, crude Occidental Petroleum Co. Ltd. Dhurnal Oilfield, west of Islamabad.

Do. Oil and Gas Development Corp. (Government of Pakistan) Tando Alam Oilfield, east of Karachi.

Do. Pakistan Oil Fields Ltd. Morgah Oilfield, Rawalpindi District.

Do. Union Texas Kheskeli Oilfield, southeast of Karachi.

Do. do. Laghari Oilfield, southwest of Karachi.

Petroleum, refined Attock Refinery Ltd. Rawalpindi District.

Do. National Refinery Ltd. Korangi, Karachi District.

Do. Pakistan Refinery Ltd. Karachi District.

Phosphate rock Sarhad Development Authority Kakul Mine, Hazara area north of Islamabad.

Salt, marine Numerous small companies Along the Arabian Sea Coast, near Karachi District.

Salt, rock Government of Pakistan Kalabagh, Khewra, and Warcha Mines, southern escarpment of Salt Range,

Rawalpindi District.

Steel, crude Karachi Rolling Mills Ltd. Karachi District.

Do. Newshera Engineering Co. Ltd. Lahore District.

Do. Pakistan Steel Mills Corp. Ltd. Karachi District.

Do. Special Steels of Pakistan do.

Talc Black Mountain Minerals and others Near Afghanistan border extending from Parachinar east across Peshawar

District to Sherwan.

You might also like

- Complete Final Project On Seven Star HotelDocument91 pagesComplete Final Project On Seven Star Hoteliqrayounas100% (4)

- Geology of RwandaDocument8 pagesGeology of RwandaEl PatrickNo ratings yet

- Review Report of Education Policies of Pakistan From 2011 To 2020Document7 pagesReview Report of Education Policies of Pakistan From 2011 To 2020Zalfa ChaudryNo ratings yet

- Supreme Court Decision Cantonment Employee Is Govt ServentDocument76 pagesSupreme Court Decision Cantonment Employee Is Govt Serventmlk ZahidNo ratings yet

- Fghanistan AND Akistan: by Travis Q. LydayDocument5 pagesFghanistan AND Akistan: by Travis Q. LydaySeema LalwaniNo ratings yet

- 2015 Mineral YearbookDocument8 pages2015 Mineral Yearbookahmad jamshid safiNo ratings yet

- Afghanistan's Mineral Resource Potential A Boon or BaneDocument24 pagesAfghanistan's Mineral Resource Potential A Boon or BaneKinza ZebNo ratings yet

- Case-Study4 Aral SeaDocument22 pagesCase-Study4 Aral SeaAndreea FarcasNo ratings yet

- HE Hilippines: by Travis Q. LydayDocument5 pagesHE Hilippines: by Travis Q. LydaybournetapsNo ratings yet

- Afghanistans Natural ResourcesDocument6 pagesAfghanistans Natural ResourcesShaieq FrotanNo ratings yet

- Multiple-11p-Factors Make Afghan CommunitiesDocument11 pagesMultiple-11p-Factors Make Afghan CommunitiesAzhar Ahmad NazriNo ratings yet

- Mining and Its Impacts On Environment and Health With Special Reference To Ballari District, Karnataka, IndiaDocument7 pagesMining and Its Impacts On Environment and Health With Special Reference To Ballari District, Karnataka, IndiaIJAERS JOURNALNo ratings yet

- Afghanistan'S Natural Resources: February 2019Document6 pagesAfghanistan'S Natural Resources: February 2019JakeNo ratings yet

- 1.1 Nsuta Manganese Deposit: Cote D' Ivoire Ghana TogoDocument5 pages1.1 Nsuta Manganese Deposit: Cote D' Ivoire Ghana TogoBobby WskNo ratings yet

- Ground Water Quality - NepalDocument4 pagesGround Water Quality - NepalNepali NepaliNo ratings yet

- The Mineral Industry of The Central African RepublicDocument2 pagesThe Mineral Industry of The Central African RepublichascoaateNo ratings yet

- ETH, DJI, ERI, & SOM (East Africa Mineral 2002Document9 pagesETH, DJI, ERI, & SOM (East Africa Mineral 2002SENAITNo ratings yet

- K501018494 PDFDocument11 pagesK501018494 PDFG. SASIDHARA KURUPNo ratings yet

- Ajol-File-Journals 406 Articles 256334 651bbf20338abDocument16 pagesAjol-File-Journals 406 Articles 256334 651bbf20338abMadam CashNo ratings yet

- 2.25 Afghanistan Energy by Nadeem MalikDocument19 pages2.25 Afghanistan Energy by Nadeem MalikihsanulhaqNo ratings yet

- 1 Introduction Final PDFDocument21 pages1 Introduction Final PDFRegina EfraimNo ratings yet

- Afgan TransportDocument45 pagesAfgan Transportuzseoul100% (1)

- The Geology, Mineral Resources of Sierra Leone and How The Resources Can Be Used To Develop The NationDocument8 pagesThe Geology, Mineral Resources of Sierra Leone and How The Resources Can Be Used To Develop The NationGitta kamaraNo ratings yet

- Mineral Resource Conflict JharkhandDocument20 pagesMineral Resource Conflict JharkhandSTANZIN SKALDANNo ratings yet

- 2013 - Vol III - Laterite 2013Document9 pages2013 - Vol III - Laterite 2013Zaheer AbbasNo ratings yet

- Potential Geologic in JordanDocument14 pagesPotential Geologic in JordanSteven TremolNo ratings yet

- Geochemical Aspects of Uranium in The Sumayar Valley, Northern Areas of PakistanDocument25 pagesGeochemical Aspects of Uranium in The Sumayar Valley, Northern Areas of PakistaniamalikNo ratings yet

- 6 AfghanistanDocument1 page6 Afghanistansaurabh9870panditNo ratings yet

- East Africa Mineral 2003Document10 pagesEast Africa Mineral 2003SENAITNo ratings yet

- 9angola Recursos NaturaisDocument8 pages9angola Recursos NaturaisElmiro CarvalhoNo ratings yet

- D, E, E, S: Jibouti Ritrea Thiopia AND OmaliaDocument8 pagesD, E, E, S: Jibouti Ritrea Thiopia AND Omalial90olki90000No ratings yet

- Distribution of Area Under Waterlogging & Salinity in PakistanDocument3 pagesDistribution of Area Under Waterlogging & Salinity in PakistanDopest KhanNo ratings yet

- 28 GhanaDocument4 pages28 GhanaIsaac AmankwaaNo ratings yet

- Hormuz Strait Dam Futuristic MacroprojectDocument14 pagesHormuz Strait Dam Futuristic MacroprojectMariabelen MalagaNo ratings yet

- 2017-2018 Minerals Yearbook: AfghanistanDocument6 pages2017-2018 Minerals Yearbook: Afghanistanahmad jamshid safiNo ratings yet

- Marine Resources in Pakistan: A Tentative InventoryDocument10 pagesMarine Resources in Pakistan: A Tentative InventorymishwiNo ratings yet

- Mineral Resources and Occurrances in Al-Jazira AreaDocument16 pagesMineral Resources and Occurrances in Al-Jazira AreaMuhanned AljeboryNo ratings yet

- References: Ectionstore/ - Public/37/005/37005818.Pdf+"Alginates"&Proxystylesheet InisDocument7 pagesReferences: Ectionstore/ - Public/37/005/37005818.Pdf+"Alginates"&Proxystylesheet InisCenaAnzuresNo ratings yet

- Geo Literature ReveiwDocument2 pagesGeo Literature ReveiwPari WishNo ratings yet

- The International Journal of Engineering and Science (The IJES)Document6 pagesThe International Journal of Engineering and Science (The IJES)theijesNo ratings yet

- Economics Project ReportDocument7 pagesEconomics Project ReportSnehal JoshiNo ratings yet

- Ibm - Gov.in - IMYB 2011 - Iron Ore PDFDocument35 pagesIbm - Gov.in - IMYB 2011 - Iron Ore PDFdrrcc0761No ratings yet

- The Effect of Waste Management of Oil Drilling and Gold Mining Extraction in The Yakutia Arctic (Russian)Document14 pagesThe Effect of Waste Management of Oil Drilling and Gold Mining Extraction in The Yakutia Arctic (Russian)AJHSSR JournalNo ratings yet

- Environmental Impact Assessment and The Controversy of The Mining Arc in VenezuelaDocument5 pagesEnvironmental Impact Assessment and The Controversy of The Mining Arc in VenezuelaErik RodriguezNo ratings yet

- SomaliaDocument4 pagesSomaliaengmahshmNo ratings yet

- Tajikistan Energy Opportunities: Ambassador Shirinov Discusses Energy IssuesDocument12 pagesTajikistan Energy Opportunities: Ambassador Shirinov Discusses Energy IssuesKeral PatelNo ratings yet

- An Overview of Mineral Resources Development in Nigeria: Problems and ProspectsDocument9 pagesAn Overview of Mineral Resources Development in Nigeria: Problems and Prospectswilolud672080% (5)

- Ilocos Mining Situation - WengkidoodledooDocument42 pagesIlocos Mining Situation - WengkidoodledooSheila Laoagan-De VeraNo ratings yet

- Minerals in Afghanistan The Potential For GoldDocument7 pagesMinerals in Afghanistan The Potential For GoldArslan ArshadNo ratings yet

- The Geology Mineral Resources of Sierra Leone andDocument9 pagesThe Geology Mineral Resources of Sierra Leone andjamesNo ratings yet

- Natural Resources of Bangladesh MineralDocument9 pagesNatural Resources of Bangladesh Mineraljaz hoodNo ratings yet

- PNAAZ114Document16 pagesPNAAZ114ibrahim khanNo ratings yet

- Surface Water IRAQDocument5 pagesSurface Water IRAQfadhilkjNo ratings yet

- Genesis of The Sinkholes at Al-Najaf Governorate, South IraqDocument14 pagesGenesis of The Sinkholes at Al-Najaf Governorate, South IraqMohammad MohammadNo ratings yet

- Cambodia Management WaterDocument8 pagesCambodia Management WaterronaldoNo ratings yet

- Myb3 2017 18 KazakhstanDocument17 pagesMyb3 2017 18 Kazakhstan498104054No ratings yet

- Anthaniel SeminarDocument58 pagesAnthaniel SeminarUchechukwu FortuneNo ratings yet

- Groundwater Depletion and Its Impact On Environmet in Kathmandu ValleyDocument21 pagesGroundwater Depletion and Its Impact On Environmet in Kathmandu ValleyAnonymous nwPK1ZHNo ratings yet

- Article 3 HighlightDocument11 pagesArticle 3 Highlighthassan sardarNo ratings yet

- Energy Resources in Afghanistan and Measures To ImDocument12 pagesEnergy Resources in Afghanistan and Measures To Imsinamohammadali88No ratings yet

- Rural Development Policies in Sub-Saharan Africa and Cooperation with the European Union : United Republic of TanzaniaFrom EverandRural Development Policies in Sub-Saharan Africa and Cooperation with the European Union : United Republic of TanzaniaNo ratings yet

- Greater Mekong Subregion Atlas of the Environment: 2nd EditionFrom EverandGreater Mekong Subregion Atlas of the Environment: 2nd EditionNo ratings yet

- SWOT AnalysisDocument3 pagesSWOT AnalysisKHURAM AHMER0% (1)

- Pakistan India Strategic RivalryDocument10 pagesPakistan India Strategic RivalryParisa UjjanNo ratings yet

- Colonial Paradigm of Indian HistoryDocument92 pagesColonial Paradigm of Indian HistoryKosla Vepa78% (9)

- Economic Analysis of Fish Farming in Punjab, PakistanDocument13 pagesEconomic Analysis of Fish Farming in Punjab, PakistanDr-Umar Ijaz AhmedNo ratings yet

- 1St Merit List of 1St Prof. DVM Degree Program 2020. (Corrigendum)Document2 pages1St Merit List of 1St Prof. DVM Degree Program 2020. (Corrigendum)RizwanNo ratings yet

- Language Movement and The Beginning of Bangladeshi NationalismDocument46 pagesLanguage Movement and The Beginning of Bangladeshi Nationalismabdullah islamNo ratings yet

- Pak Studies 1000 Most Repeated MCQsDocument138 pagesPak Studies 1000 Most Repeated MCQshradmn wapdaNo ratings yet

- Analysis 269 2014Document10 pagesAnalysis 269 2014Syeda FatimaNo ratings yet

- Company Profile (Danish Enterprises & Construction) - NewDocument9 pagesCompany Profile (Danish Enterprises & Construction) - Newgra8leoNo ratings yet

- Twenty Years of TheNewsDocument71 pagesTwenty Years of TheNewsArif KhanNo ratings yet

- Yetmgeta Abdella 2018Document11 pagesYetmgeta Abdella 2018Shafici CqadirNo ratings yet

- Interim Constitution of 1972Document4 pagesInterim Constitution of 1972muhammad shoaib jamilNo ratings yet

- Overpopulation ITS CAUSES AND EFFECTSDocument7 pagesOverpopulation ITS CAUSES AND EFFECTSAsif Khan ShinwariNo ratings yet

- Thesis Proposals For ICTDocument19 pagesThesis Proposals For ICTHassan Magan67% (3)

- New SheetDocument13 pagesNew Sheetparamount laceNo ratings yet

- Pakistan Current Affairs MCQsDocument3 pagesPakistan Current Affairs MCQsImran Hayat0% (1)

- Literacy Rate in PakistanDocument16 pagesLiteracy Rate in PakistanMuhammad saqibNo ratings yet

- Denizens of Alien Worlds A Survey of Students and Teachers at Pakistan's Urdu and English Language-Medium Schools, and MadrassasDocument21 pagesDenizens of Alien Worlds A Survey of Students and Teachers at Pakistan's Urdu and English Language-Medium Schools, and MadrassasUsman AhmadNo ratings yet

- Agriculture Problems in Pakistan and Their SolutionsDocument6 pagesAgriculture Problems in Pakistan and Their SolutionsSalam Zeeshan67% (3)

- 302-Influence of Allied CultureDocument10 pages302-Influence of Allied CultureZubair Latif100% (1)

- PTS Imc 2023 PBDocument24 pagesPTS Imc 2023 PBhinasadia26juneNo ratings yet

- Definition of Foreign PolicyDocument3 pagesDefinition of Foreign PolicyAliza IshraNo ratings yet

- Gazzette MBBS 2nd Year A 2012 - 0Document25 pagesGazzette MBBS 2nd Year A 2012 - 0shahrukhziaNo ratings yet

- Indian Afghanishtan 3Document40 pagesIndian Afghanishtan 3Aadhya ChhabraNo ratings yet

- Media Ethics - Country Paper On PakistanDocument27 pagesMedia Ethics - Country Paper On PakistanhadmediaNo ratings yet

- Pakistan Studies TOP MCQSDocument53 pagesPakistan Studies TOP MCQSbilalturi100% (1)

- AJAZ ALI KHAN Secy Coal & Energy Dept. Sindh Govt., Thar CoalDocument19 pagesAJAZ ALI KHAN Secy Coal & Energy Dept. Sindh Govt., Thar CoalHasnain GoharNo ratings yet