Professional Documents

Culture Documents

Module 22 Federal Securities Acts and Antitrust Law

Module 22 Federal Securities Acts and Antitrust Law

Uploaded by

El Sayed AbdelgawwadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 22 Federal Securities Acts and Antitrust Law

Module 22 Federal Securities Acts and Antitrust Law

Uploaded by

El Sayed AbdelgawwadCopyright:

Available Formats

MODULE 22 FEDERAL SECURITIES ACTS AND ANTITRUST LAW 101

(7) Even if exempt from registration under 1934 Act, still subject to antifraud provisions

(8) Extensive potential liability for insiders

(a) Must forego trading if one has such knowledge until public has information

1] Includes insiders and anyone with knowledge (e.g., accountant, attorney, engineer)

2] Illegal for person (tipper) to give inside information to another person (called tippee)

3] Tippee is liable if acts on inside information until information is known by public

a] Tipper is liable for illegal profits of tippee

12. Civil liability

a. Any person who intentionally (willfully) manipulates a security may be liable to the buyer

or

seller of that security if the buyer or seller is damaged

(1) Note that both buyers and sellers may recover under the 1934 Act

b. Any person who makes a misleading (or of course false) statement about any material fact in

any

, application, report, or document is liable to an injured purchaser or seller if s/he

(1) Relied on the statement, and

(2) Did not know it was false or misleading

(3) Privity of contract is not necessary

(4) However, the party sued can avoid liability if s/he can prove s/he

(a) Acted in good faith, and

(b) Had no knowledge that the statement(s) was (were) materially misleading or false

(c) SEC may collect liability funds for victims of securities fraud

l3. Criminal liability

a. Has been increased due to Sarbanes-Oxley Act

(1) Individuals in violation of Rule lOb-5 may be put in prison for up to twenty years and/or may

be fined for up to five million dollars

(a) May be put in prison for up to twenty-five years and/or fined for willful violation of 1934

Act

(2) Corporations or partnerships are subject to fines of up to twenty-five million dollars

b. Criminal liability can also be used for intentional false or misleading statements on material

facts

provided in applications, reports, or other documents under this Act

14. The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 prohibits discharge of any

debts incurred in violation of securities laws

a. This Act applies to parts of Modules 27 and 28 too, and is now effective and is therefore

testable

onCPAexam.

15. Both private parties and SEC now have civil remedies against violators of 1934 Act

a. Private parties may recover from those who violate rule lOb-5 as well as from others sharing

re-

sponsibility such as attorneys, accountants, corporations

(1) Private parties may also rescind contracts to purchase contacts when violations hurt them

b. SEC authorized to give awards to individuals that provide information leading to prosecution

of

insider-trading violators

16. Statute of limitations extended for securities fraud

17. Reporting requirements of insiders under 1934 Act

a. Must file statement with SEC

(1) Discloses amount of equity securities

(2) Time of statement disclosure

(a) When securities registered, or

(b) When registration statement becomes effective, or

(c) Within ten days of person attaining insider status

(3) Insider must report any changes in ownership within ten days

You might also like

- Isolutions Lifecycle Cost ToolDocument6 pagesIsolutions Lifecycle Cost Tooljaswal_anilNo ratings yet

- Sovereign's Guide For DummysDocument15 pagesSovereign's Guide For DummysNelson PaynterNo ratings yet

- Construction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerFrom EverandConstruction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerNo ratings yet

- Module 22 F Deral Sec Rities Cts and Antitrust La WDocument2 pagesModule 22 F Deral Sec Rities Cts and Antitrust La WHazem El SayedNo ratings yet

- S SR G A: Professional ResponsibilitiesDocument2 pagesS SR G A: Professional ResponsibilitiesZeyad El-sayedNo ratings yet

- Commodatum/Mutuum Principal Obligations of The Bailee in A Commodatum/MutuumDocument7 pagesCommodatum/Mutuum Principal Obligations of The Bailee in A Commodatum/MutuumSe'f BenitezNo ratings yet

- Module 22 Federal Securities Acts and Antitrust LawDocument2 pagesModule 22 Federal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNo ratings yet

- Limitation Act, 1963Document35 pagesLimitation Act, 1963shalu23augNo ratings yet

- UtsaDocument3 pagesUtsaARYAN R NAIRNo ratings yet

- Module 21 Professional ResponsibilitiesDocument2 pagesModule 21 Professional ResponsibilitiesZeyad El-sayedNo ratings yet

- Module 21 Professional ResponsibilitiesDocument2 pagesModule 21 Professional ResponsibilitiesZeyad El-sayedNo ratings yet

- 4 Registered LandDocument26 pages4 Registered LandEdwin OlooNo ratings yet

- Part 1 - Propsectus 1. Laws Governing Fundraising by Public IssueDocument17 pagesPart 1 - Propsectus 1. Laws Governing Fundraising by Public IssueAnthea LeungNo ratings yet

- LTD Grp. 2 - IrelandDocument6 pagesLTD Grp. 2 - IrelandDarby MarNo ratings yet

- Business-Law DummyDocument7 pagesBusiness-Law DummySweta KumariNo ratings yet

- 51 43 The Limitation ActDocument31 pages51 43 The Limitation ActtonyvinayakNo ratings yet

- Limitation ActDocument19 pagesLimitation Actllb19019.bappyNo ratings yet

- 26 26 The Limitation Act 1963Document35 pages26 26 The Limitation Act 1963Pankaj KundraNo ratings yet

- The Limitation Act, 1908: (ACT NO. IX of 1908)Document14 pagesThe Limitation Act, 1908: (ACT NO. IX of 1908)aminur rahmanNo ratings yet

- Securities Review 101Document6 pagesSecurities Review 101Mike DogNo ratings yet

- SecuritiesRegulation Quinn Fall2004Document79 pagesSecuritiesRegulation Quinn Fall2004Erin JacksonNo ratings yet

- Quiz 3Document3 pagesQuiz 3Jane BaggyNo ratings yet

- Business Law 2nd SemDocument7 pagesBusiness Law 2nd SemRroshnee BiswalNo ratings yet

- Colorado Requirements For Full Disclosure of Real Estate ContaminationDocument20 pagesColorado Requirements For Full Disclosure of Real Estate ContaminationyelenickNo ratings yet

- AsdDocument5 pagesAsdKim TaehyungNo ratings yet

- Limitation Act 1963Document19 pagesLimitation Act 1963Natasha SharmaNo ratings yet

- Legal Aid and Legal AssistanceDocument13 pagesLegal Aid and Legal AssistanceUngapen KartikayNo ratings yet

- The Law of Limitation ActDocument27 pagesThe Law of Limitation Actclemence1987No ratings yet

- The Limitation Act 1963Document30 pagesThe Limitation Act 1963alkca_lawyerNo ratings yet

- Private Caveat 2017Document12 pagesPrivate Caveat 2017China WeiNo ratings yet

- Nda - Iocl DRDocument6 pagesNda - Iocl DRraghav joshiNo ratings yet

- Title 11 - Bankruptcy Chapter 3 - Case Administration Subchapter Iv - Administrative PowersDocument5 pagesTitle 11 - Bankruptcy Chapter 3 - Case Administration Subchapter Iv - Administrative PowersA. CampbellNo ratings yet

- Limitation ActDocument25 pagesLimitation Actmithun7No ratings yet

- B. Modifying Tort Law: Cowardice (Imposing Statutory Duties Is An Easy Way of Gaining Popularity With The PeopleDocument1 pageB. Modifying Tort Law: Cowardice (Imposing Statutory Duties Is An Easy Way of Gaining Popularity With The PeopleShalini AriyarathneNo ratings yet

- Right To Information Why?Document24 pagesRight To Information Why?shakthivelNo ratings yet

- Limitation Act 1963Document36 pagesLimitation Act 1963Rajbir kaurNo ratings yet

- Unit VDocument16 pagesUnit VBala KrishnanNo ratings yet

- The Limitation ActDocument27 pagesThe Limitation ActLakshyaNo ratings yet

- Fede Al Securities Acts: OvervieDocument2 pagesFede Al Securities Acts: OvervieZeyad El-sayedNo ratings yet

- Credit Transaction in A NutshellDocument4 pagesCredit Transaction in A NutshellJulius John Ramos TamayaoNo ratings yet

- Case StudiesDocument9 pagesCase Studiesshashank jakkaNo ratings yet

- Chattel MortgageDocument7 pagesChattel MortgageAya BeltranNo ratings yet

- Module 10 BAREBUSX Credit TransactionsDocument60 pagesModule 10 BAREBUSX Credit TransactionsJennalyn DamasoNo ratings yet

- Obtaining Property by Deception: Actus ReusDocument5 pagesObtaining Property by Deception: Actus ReusninnikNo ratings yet

- Credit Transactions Final ReviewerDocument5 pagesCredit Transactions Final ReviewerJumen Gamaru Tamayo100% (1)

- Mortgages Worksheet 2021-2022Document12 pagesMortgages Worksheet 2021-2022JensenNo ratings yet

- International Trusts Act 1984Document25 pagesInternational Trusts Act 1984DocuReaderNo ratings yet

- Fischman v. Raytheon Mfg. Co., 188 F.2d 783, 2d Cir. (1951)Document14 pagesFischman v. Raytheon Mfg. Co., 188 F.2d 783, 2d Cir. (1951)Scribd Government DocsNo ratings yet

- Unit 3Document23 pagesUnit 3sanjiv dasNo ratings yet

- Rule 130 Testimonial EvidenceDocument8 pagesRule 130 Testimonial EvidenceGenevieve PenetranteNo ratings yet

- SecuritiesRegulation Quinn Spring2003Document95 pagesSecuritiesRegulation Quinn Spring2003Erin JacksonNo ratings yet

- Group 2 Insolvency Presentation-1Document13 pagesGroup 2 Insolvency Presentation-1TumisangNo ratings yet

- PROPERTY ReviewerDocument8 pagesPROPERTY ReviewerMonica Bolado-AsuncionNo ratings yet

- Limitation Act 1963Document22 pagesLimitation Act 1963Malla Reddy AVNo ratings yet

- Right To Information ACT 2005: Good GovernanceDocument21 pagesRight To Information ACT 2005: Good GovernanceAmansinghaman00No ratings yet

- Obligation Not To Transfer DepositDocument3 pagesObligation Not To Transfer DepositJirah Lou-Anne SacliwanNo ratings yet

- 5 6316439597127565363Document13 pages5 6316439597127565363KhayceePadillaNo ratings yet

- Federal False Claims Act - Title 31 - Qui Tam Whistleblower's Guide To The False Claims ActDocument13 pagesFederal False Claims Act - Title 31 - Qui Tam Whistleblower's Guide To The False Claims Actrainmaker31310% (1)

- Module 22 Federal Securities Acts and Antitrust LawDocument2 pagesModule 22 Federal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNo ratings yet

- M Dule 22 Federal Securities Acts and Antitrust LawDocument2 pagesM Dule 22 Federal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNo ratings yet

- Agency: I. Formation of The Agency RelationshipDocument7 pagesAgency: I. Formation of The Agency RelationshipEl Sayed AbdelgawwadNo ratings yet

- C Ayton Act of 1914: Module 22 Fe E A SE UDocument2 pagesC Ayton Act of 1914: Module 22 Fe E A SE UEl Sayed AbdelgawwadNo ratings yet

- Scan 0015Document2 pagesScan 0015El Sayed AbdelgawwadNo ratings yet

- P L N L U N N T MP: Sarbanes-Ox Eyactof2 2Document2 pagesP L N L U N N T MP: Sarbanes-Ox Eyactof2 2El Sayed AbdelgawwadNo ratings yet

- Cont A: R CTSDocument2 pagesCont A: R CTSEl Sayed AbdelgawwadNo ratings yet

- Federal Securities Acts and Antitrust Law: C o C eDocument2 pagesFederal Securities Acts and Antitrust Law: C o C eEl Sayed AbdelgawwadNo ratings yet

- Federal Securities Acts and Antitrust LawDocument3 pagesFederal Securities Acts and Antitrust LawEl Sayed AbdelgawwadNo ratings yet

- Scan 0021Document2 pagesScan 0021El Sayed AbdelgawwadNo ratings yet

- Ill LLQ J: ContractsDocument2 pagesIll LLQ J: ContractsEl Sayed AbdelgawwadNo ratings yet

- Scan 0020Document2 pagesScan 0020El Sayed AbdelgawwadNo ratings yet

- J .T/DTD: Tjrrji?"Document1 pageJ .T/DTD: Tjrrji?"El Sayed AbdelgawwadNo ratings yet

- Scan 0014Document2 pagesScan 0014El Sayed AbdelgawwadNo ratings yet

- Scan 0014Document2 pagesScan 0014El Sayed AbdelgawwadNo ratings yet

- Cont Acts: G A A yDocument1 pageCont Acts: G A A yEl Sayed AbdelgawwadNo ratings yet

- Scan 0002Document2 pagesScan 0002El Sayed AbdelgawwadNo ratings yet

- Scan 0014Document2 pagesScan 0014El Sayed AbdelgawwadNo ratings yet

- Scan 0003Document2 pagesScan 0003El Sayed AbdelgawwadNo ratings yet

- S S S T I E: ContractsDocument2 pagesS S S T I E: ContractsEl Sayed AbdelgawwadNo ratings yet

- Contracts: D Still Owes CTDocument2 pagesContracts: D Still Owes CTEl Sayed AbdelgawwadNo ratings yet

- Contracts: Over IDocument2 pagesContracts: Over IEl Sayed AbdelgawwadNo ratings yet

- Scan 0007Document2 pagesScan 0007El Sayed AbdelgawwadNo ratings yet

- Module 26 Secured Transactions:: S G S C R eDocument2 pagesModule 26 Secured Transactions:: S G S C R eEl Sayed AbdelgawwadNo ratings yet

- Scan 0002Document2 pagesScan 0002El Sayed AbdelgawwadNo ratings yet

- Module 26 Secured Transactions:: o C, G eDocument2 pagesModule 26 Secured Transactions:: o C, G eEl Sayed AbdelgawwadNo ratings yet

- Secured Transactions: FreezerDocument2 pagesSecured Transactions: FreezerEl Sayed AbdelgawwadNo ratings yet

- Scan 0007Document1 pageScan 0007El Sayed AbdelgawwadNo ratings yet

- Fi V Y, A (A A y I R S (B) A R S Si: Secured TransactionsDocument2 pagesFi V Y, A (A A y I R S (B) A R S Si: Secured TransactionsEl Sayed AbdelgawwadNo ratings yet

- Priorities: Secu Ed TransactionsDocument2 pagesPriorities: Secu Ed TransactionsEl Sayed AbdelgawwadNo ratings yet

- UN Salary ScaleDocument8 pagesUN Salary Scalemaconny20No ratings yet

- Topic 02 Accounting Statements and Cash FlowDocument23 pagesTopic 02 Accounting Statements and Cash FlowVictorNo ratings yet

- Bibliography Books: Behaviour", Tata Mcgraw Hill Publishing Company Limited, New DelhiDocument9 pagesBibliography Books: Behaviour", Tata Mcgraw Hill Publishing Company Limited, New DelhiHarsha SekaranNo ratings yet

- Quiz#2 - Accounting and FinanceDocument11 pagesQuiz#2 - Accounting and Financew.nursejatiNo ratings yet

- Financial Analysis ProblemDocument16 pagesFinancial Analysis ProblemShreyashi DasNo ratings yet

- Chapter 3 Adjusting The AccountsDocument28 pagesChapter 3 Adjusting The AccountsfuriousTaherNo ratings yet

- 5 Golden Rules For Penny Stocks PDFDocument5 pages5 Golden Rules For Penny Stocks PDFmu jiNo ratings yet

- Roadshow Beiersdorf / Société Générale: Paris, June 11th, 2009Document17 pagesRoadshow Beiersdorf / Société Générale: Paris, June 11th, 2009Gc DmNo ratings yet

- Advanced Property ValuationDocument8 pagesAdvanced Property ValuationAssignmentLab.comNo ratings yet

- Shrinking To Grow: Evolving Trends in Corporate Spin-OffsDocument12 pagesShrinking To Grow: Evolving Trends in Corporate Spin-OffsmdorneanuNo ratings yet

- Ias 20 Accounting For Government Grants and Disclosure of Government AssistanceDocument10 pagesIas 20 Accounting For Government Grants and Disclosure of Government AssistancegoodluckboasNo ratings yet

- Housing and Human SettlementDocument23 pagesHousing and Human SettlementYuuki Rito100% (2)

- Week 7 - Lesson 6 Notes ReceivableDocument17 pagesWeek 7 - Lesson 6 Notes ReceivablefrostNo ratings yet

- Invoice: Num. DDT: 821588 Of: 16-05-2019 Villa Tunari 621533Document2 pagesInvoice: Num. DDT: 821588 Of: 16-05-2019 Villa Tunari 621533Oscar MolinaNo ratings yet

- FINA4050 Class 6 Financial Modeling Basics PDFDocument26 pagesFINA4050 Class 6 Financial Modeling Basics PDFJai PaulNo ratings yet

- Discovery Fund April 23Document1 pageDiscovery Fund April 23Satyajeet AnandNo ratings yet

- The Value of EquityDocument42 pagesThe Value of EquitySYAHIER AZFAR BIN HAIRUL AZDI / UPMNo ratings yet

- QAISERDocument3 pagesQAISERsohailNo ratings yet

- Bridge Course in EconomicsDocument17 pagesBridge Course in EconomicsProfessor Tarun DasNo ratings yet

- Self-Managed Super: Factsheet June 2013Document2 pagesSelf-Managed Super: Factsheet June 2013RomeoNo ratings yet

- Customer SegmentationDocument6 pagesCustomer SegmentationwkdilaNo ratings yet

- Chapter 1 MFDocument11 pagesChapter 1 MFmanisha manuNo ratings yet

- Rich Da-WPS OfficeDocument10 pagesRich Da-WPS OfficeJerecel Gapi VigoNo ratings yet

- Transaction Confirmation Report en GB f79637Document1 pageTransaction Confirmation Report en GB f79637sam5083mzkNo ratings yet

- EoI RFQ For Development of Visakhapatnam Metro Rail ProjectDocument91 pagesEoI RFQ For Development of Visakhapatnam Metro Rail Projectkmmanoj1968No ratings yet

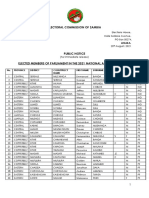

- Electoral Commission of Zambia: Elections House, Haile Selassie Avenue, PO Box 50274, 20 August, 2021Document4 pagesElectoral Commission of Zambia: Elections House, Haile Selassie Avenue, PO Box 50274, 20 August, 2021joseph katongoNo ratings yet

- Agoda Confirmed Booking at JDL ResidencesDocument1 pageAgoda Confirmed Booking at JDL ResidenceslyraNo ratings yet

- One Nation Under Wal-MartDocument6 pagesOne Nation Under Wal-Martgamecock1No ratings yet

- Balance of Payments Textbook NotesDocument4 pagesBalance of Payments Textbook Notesalina lorenaNo ratings yet