Professional Documents

Culture Documents

3 Models of Child Care PL Locked

3 Models of Child Care PL Locked

Uploaded by

tonnyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3 Models of Child Care PL Locked

3 Models of Child Care PL Locked

Uploaded by

tonnyCopyright:

Available Formats

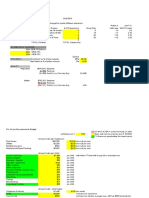

Child Care Center Example Profit & Loss

Replace only blue numbers with your variables

FTE = Full Time Equivalent # of Infants # of Toddlers # of Preschoolers

Total Average FTE Children Enrolled (with CCAP) 36 4 12 20

Number of children with CCAP enrollment 3 1 0 2

Hours of Operation/Day 9.5

Days of Operation/Year 240

CCAP= child care assistance program

Revenues Annual Infant Rate Toddler Rate Preschooler Rate

Parent paid tuition/fees 290,580 800 750 700

State/other subsidies (tuition) 23,820 735 682 625

# of Breakfasts: # of Lunch/Suppers: # of Snacks:

Number of Meals/Snacks 3 1 1 1

State/other subsidies (food) 26,166 5,948.64 17,470.08 2,748

Child Care Grant

Child Care Grant 13,932 Rate: $32.25 32.25 Only if # of CCAP is 1 or 5% of total

State/other subsidies/incentives (other) 0

Fundraising Income -

Total Revenues 354,501

Expenses Annual

# FTE employees including owner 5 Pay rate 1: Pay rate 2: Pay rate 3:

Hourly Rates 11.20 12.70 13.59

Number at each hourly rate 1 1 2

Total Wages 132,634 21,504.00 24,384.00 52,185.60

Holiday and Personal

Worker's Comp. at leave - # of days per

Benefits FICA at .0765: 3% yr:

Mandatory Benefits 14,949 10,738.35 4,211.12 14

Optional Benefits 38,716 7736.96

Total Labor 186,299

Rent 24,000

Electricity 1,800

Heating Oil 4,000 Note: Formulas for grants, food and supplies based on 90% attendance

Propane/Other -

Telephone/Internet/Fax 2,000

Janitorial & Premises Maintenance -

Snowplow/Grounds Maint 500

Other -

Total Occupancy 32,300

Cost per child per day:

Food/Formula 34,992 4.50 Per child

Diapers, Disposables 864 1.00 Per infant

Children's supplies (clay, workbooks, paper,

crayons, etc.) 13,824 2.00 Per Toddler and Preschooler

Cleaning & Paper Products 7,776 1.00 Per Child

Total Food & Consumables 57,456

Accounting Fees 800

Advertising & Promotion 2,500

Continuing Education 2,000

Dues & subscriptions 500

Event Costs (fundraising/other special events 1,000

Furniture, Fixtures & Equipment Expense (including

durable toys, mats, bedding, etc.) 5,000

Insurance (hazard & liability) 4,000

Legal & Other professional Fees 500

Licenses & Permits 500

Miscellaneous 1,000

Office Supplies 500

Other Professional Fees 500

Postage 500 This is an example of a for-profit child care center. There are fi

Repairs & Maintenance (equipment) 1,500

Travel & Entertainment 1,500

employees. The owner's income is figured at $18 per hour. The

Vehicle Expense 4,000 takes care of administration of the center. Employees and own

Total G&A Expense 26,300 receive 14 days of personal leave, health benefits and 3% of pa

retirement account. In addition to $34,560 annually at $18 per

Total Operating Expenses 302,355 owner realizes a small profit. If this center was also operated o

Earnings Before Taxes, Interest Depreciation &

owner's home, they would realize an additional savings of $32,3

Amortization 52,146 occupancy expenses. Monthly charges for each age of child co

raised to realize higher profits or pay higher wages.

Expense per Child 8,399

Revenue per Child 9,847

Up to 2 meals and 1 snack per day

or 1 meal and 2 snacks per day

Only if # of CCAP is 1 or 5% of total

CAP is 1 or 5% of total

Pay rate 4:

18.00

1

34,560.00

Health premium per mo. per Retirement

employee: percentage

450 3%

27,000 3,979.01

upplies based on 90% attendance

ofit child care center. There are five

ome is figured at $18 per hour. The owner

f the center. Employees and owner all

eave, health benefits and 3% of pay in a

on to $34,560 annually at $18 per hour, the

If this center was also operated out of the

alize an additional savings of $32,300 of the

ly charges for each age of child could be

or pay higher wages.

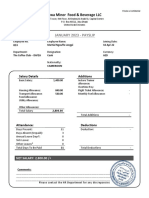

Child Care Group Home Example Profit & Loss

Replace only blue numbers with your variables

FTE = Full Time Equivalent # of Infants # of Toddlers # of Preschoolers

Total Average FTE Children

Enrolled (with CCAP) 12 0 12 0

Number of children with CCAP

enrollment 2 0 2 0

Hours of Operation/Day 9.5

Days of Operation/Year 240

CCAP= child care assistance

program

Toddler Preschooler

Revenues Annual Infant Rate Rate Rate

Parent paid tuition/fees 91,632 800 750 700

State/other subsidies (tuition) 16,368 735 682 625

# of Breakfasts: # of Lunch/ # of Snacks: Up to 2 meals and 1 snack per day

Number of Meals/Snacks 3 1 1 1 or 1 meal and 2 snacks per day

State/other subsidies (food) 9,461 2,255.04 6,125.76 1,080 Only if # of CCAP is 1 or 5% of total

Grant Rate:

Child Care Grant 4,644 $32.25 32.25 Only if # of CCAP is 1 or 5% of total

State/other subsidies/incentives

(other) 0

Fundraising Income -

Total Revenues 122,108

Expenses Annual

# FTE employees including owner 1 Pay rate 1: Pay rate 2: Pay rate 3: Pay rate 4:

Hourly Rates 11.20 12.70 13.59 18.00

Number at each hourly rate 0 1 0 0

Total Wages 24,384 - 24,384.00 - -

Holiday and Health

Worker's Personal leave premium per

Comp. at - # of days mo. per Retirement

Benefits FICA at .0765: 3% per yr: employee: percentage

Mandatory Benefits 2,748 1,974.19 774.19 14 450 3%

Optional Benefits 7,554 1422.4 5,400 731.52

Total Labor 34,686

Rent -

Electricity - Note: Formulas for grants, food and supplies

Heating Oil - based on 90% attendance

Propane/Other -

Telephone/Internet/Fax -

Maintenance -

Snowplow/Grounds Maint -

Other -

Total Occupancy -

Cost per child per day:

Food/Formula 12,312 4.75 Per child

Diapers, Disposables - 1.00 Per infant

Children's supplies (clay,

workbooks, paper, crayons, etc.) 5,184 2.00 Per Toddler and Preschooler

Cleaning & Paper Products 2,592 1.00 Per Child

Total Food & Consumables 20,088

Accounting Fees 800

Advertising & Promotion 500

Continuing Education 300

Dues & subscriptions 200

Event Costs (fundraising/other

special events -

Furniture, Fixtures & Equipment

Expense (including durable toys,

mats, bedding, etc.) 5,000

Insurance (hazard & liability) 1,800

Legal & Other professional Fees 500

This is an example of a for-profit child care

Licenses & Permits 500

Miscellaneous 1,000 group home. There is one employee. The

Office Supplies 200 owner's income is figured at $18 per hour. The

Other Professional Fees - owner takes care of administration of the center.

Postage 100 Employee and owner all receive 14 days of

(equipment) 500

Travel & Entertainment -

personal leave, health benefits and 3% of pay in

Vehicle Expense 3,000 a retirement account. In addition to $34,560

Total G&A Expense 14,400 annually at $18 per hour, the owner realizes a

small profit. This group home is operated out of

Total Operating Expenses 69,174 the owner's home, which saves occupancy

Earnings Before Taxes, Interest

expenses. Monthly charges for each age of

Depreciation & Amortization 52,933 child could be raised to realize higher profits or

pay higher wages.

Expense per Child 5,765

Revenue per Child 10,176

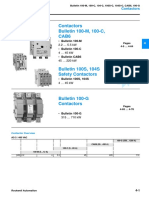

Child Care Home Example Profit and Loss

Replace only blue numbers with your variables

FTE = Full Time Equivalent # of Infants # of Toddlers # of Preschoolers

CCAP) 8 0 4 4

Number of children with CCAP enrollment 2 0 0 2

Hours of Operation/Day 9.5

Days of Operation/Year 240

CCAP= child care assistance program

Revenues Annual Infant Rate Toddler Rate Preschooler Rate

Parent paid tuition/fees 57,000 800 750 750

State/other subsidies (tuition) 15,000 735 682 625

# of Breakfasts: # of Lunch/Supp# of Snacks: Up to 2 meals and 1 snack per day

Number of Meals/Snacks 3 1 1 1 or 1 meal and 2 snacks per day

State/other subsidies (food) 6,800 1,684.80 4,285.44 829 Only if # of CCAP is 1 or 5% of total

Child Care

Grant Rate:

Child Care Grant 3,096 $32.25 32.25 Only if # of CCAP is 1 or 5% of total

State/other subsidies/incentives (other) 0

Fundraising Income -

Total Revenues 81,899

Expenses Annual

# FTE employees including owner - Pay rate 1: Pay rate 2: Pay rate 3: Pay rate 4:

Hourly Rates 11.20 12.70 13.59 18.00

Number at each hourly rate 0 0 0 0

Total Wages - - - - -

Health

Holiday and premium per

Worker's Personal leave - mo. per Retirement

Benefits FICA at .0765: Comp. at 3% # of days per yr: employee: percentage

Mandatory Benefits - - - 14 450 3%

Optional Benefits - 0 - -

Total Labor -

Rent -

Electricity - Note: Formulas for grants, food and

Heating Oil - supplies based on 90% attendence

Propane/Other -

Telephone/Internet/Fax -

Janitorial & Premises Maintenance -

Snowplow/Grounds Maint -

Other -

Total Occupancy -

Cost per child per day:

Food/Formula 8,208 4.75 Per child

Diapers, Disposeables - 1.00 Per infant

Children's supplies (clay, workbooks, paper,

crayons, etc.) 3,456 2.00 Per Toddler and Preschooler

Cleaning & Paper Products 1,728 1.00 Per Child

Total Food & Consumables 13,392

Accounting Fees 500

Advertising & Promotion -

Continuing Education -

Dues & subscriptions -

Event Costs (fundraising/other special events -

Furniture, Fixtures & Equipment Expense

(including durable toys, mats, bedding, etc.) 3,000

Insurance (hazard & liability) 1,800

Legal & Other professional Fees 500

Licenses & Permits 500

Miscellaneous 500

Office Supplies 200 This is an example of a for-profit child care home.

Other Professional Fees - There are no employees. The owner's income is

Postage 100 figured at $18 per hour for 10 hours 5 days a week.

Repairs & Maintenance (equipment) 500

The owner takes care of all administration and children.

Travel & Entertainment -

Vehicle Expense 3,000 Owner receives 14 days of personal leave, health

Total G&A Expense 10,600 benefits and 3% of pay in a retirement account. In

addition to $43,200 annually, the owner realizes a very

Total Operating Expenses 23,992 small profit. This child care home is operated out of the

Earnings Before Taxes, Interest

owner's home, which saves occupancy expenses.

Depreciation & Amortization 57,907 Monthly charges for each age of child could be raised

to realize higher profits or pay additional expenses.

Expense per Child 2,999

Revenue per Child 10,237

You might also like

- Home Health Care Services Business Plan Sample - Financial PlanDocument11 pagesHome Health Care Services Business Plan Sample - Financial Plangauravj180% (1)

- Chapter 10-Compensation Income: True or FalseDocument15 pagesChapter 10-Compensation Income: True or FalseJarren Basilan57% (7)

- Payroll Canadian 1st Edition Dryden Test BankDocument38 pagesPayroll Canadian 1st Edition Dryden Test Bankriaozgas3023100% (17)

- 8.3 Life and Work - BudgetDocument4 pages8.3 Life and Work - BudgetSam TannyNo ratings yet

- Scenario ADocument10 pagesScenario ADandyNo ratings yet

- Business Mathematics: Topic: Salaries and Wages Taxable and Nontaxable BenefitsDocument6 pagesBusiness Mathematics: Topic: Salaries and Wages Taxable and Nontaxable BenefitsAj Gomez100% (1)

- Fringe Benefits and Fringe Benefit Tax ExercisesDocument3 pagesFringe Benefits and Fringe Benefit Tax Exercisesaj lopezNo ratings yet

- Grow Management Consultants Pty LTD Profit and Loss Statement July 17 To June 18Document2 pagesGrow Management Consultants Pty LTD Profit and Loss Statement July 17 To June 18Hussnain ShahNo ratings yet

- Goal 5-Part 1 BDocument3 pagesGoal 5-Part 1 Bapi-665608272No ratings yet

- ISAP Capital Budget Capital ISAPDocument1 pageISAP Capital Budget Capital ISAPKevinOhlandtNo ratings yet

- PaySlip DEC BDocument1 pagePaySlip DEC BSRIKANTHNo ratings yet

- Generic Cost Model: CentersDocument20 pagesGeneric Cost Model: Centershamed anwerNo ratings yet

- Annual Food Service Department Budget Report FOR FISCAL YEAR 2020-2021Document9 pagesAnnual Food Service Department Budget Report FOR FISCAL YEAR 2020-2021api-536652711No ratings yet

- Sample Budget For Abundant Blessings Children'S Academy: OperationsDocument4 pagesSample Budget For Abundant Blessings Children'S Academy: Operationsapi-605495878No ratings yet

- 4 6048443301533583445Document3 pages4 6048443301533583445Beka AsraNo ratings yet

- Managing Personal Finances WiselyDocument39 pagesManaging Personal Finances WiselyYong Chun WahNo ratings yet

- 2015 Garage EquipementDocument35 pages2015 Garage EquipementSolomon WaldemariamNo ratings yet

- Get Award Letter Report AsyncDocument4 pagesGet Award Letter Report AsyncJanelle GarrisonNo ratings yet

- 2024 - 0213 TST BOCES Budget PresentationDocument11 pages2024 - 0213 TST BOCES Budget PresentationShadeNo ratings yet

- Financial Feasibility SampleDocument66 pagesFinancial Feasibility SampleKimmyNo ratings yet

- Ch.4 Book Exercise + AnswerDocument7 pagesCh.4 Book Exercise + Answertomsuen63No ratings yet

- Fafsa4caster Cost of College Worksheet Noah Vasquez 1Document3 pagesFafsa4caster Cost of College Worksheet Noah Vasquez 1api-608871465No ratings yet

- 2.08 Why BudgetDocument5 pages2.08 Why BudgetJakeFromStateFarmNo ratings yet

- CDF 547 AnnualbudgetDocument2 pagesCDF 547 Annualbudgetapi-506629613No ratings yet

- Laon 1,000.00 SSS Loan - sss/Phic/HDMF 318.75 Others Recent Cash Out 3,500.00 Recent Cash OutDocument86 pagesLaon 1,000.00 SSS Loan - sss/Phic/HDMF 318.75 Others Recent Cash Out 3,500.00 Recent Cash Outherky napiNo ratings yet

- Staffing Selection Form - 2.2020Document2 pagesStaffing Selection Form - 2.2020eric.risner0% (1)

- Payroll Canadian 1St Edition Dryden Test Bank Full Chapter PDFDocument37 pagesPayroll Canadian 1St Edition Dryden Test Bank Full Chapter PDFhebexuyenod8q100% (7)

- Career Choices: EntrepreneurDocument3 pagesCareer Choices: EntrepreneurJapette SobrevegaNo ratings yet

- Profit and Loss 2017-18Document2 pagesProfit and Loss 2017-18NoiresNo ratings yet

- 2021 Sweet Express Benefit GuideDocument20 pages2021 Sweet Express Benefit GuideCameron WolfNo ratings yet

- Home Budget ProjectDocument14 pagesHome Budget ProjectMurugan S100% (1)

- Monetisation ExerciseDocument3 pagesMonetisation ExerciseMariam Fatima BurhanNo ratings yet

- StartUPBUDGETDocument12 pagesStartUPBUDGETAYUSHI KULTHIANo ratings yet

- WEEK 5 - FNSACC507A - Management Accounting - WORKED EXAMPLES - Labour CostingDocument5 pagesWEEK 5 - FNSACC507A - Management Accounting - WORKED EXAMPLES - Labour Costingcharlotte FijerNo ratings yet

- Mighty Digits - 3 Statement Model TemplateDocument31 pagesMighty Digits - 3 Statement Model TemplateHilyah AuliaNo ratings yet

- Campussaver FinancialsDocument5 pagesCampussaver Financialsapi-707643099No ratings yet

- Cost of Employment CalculatorDocument3 pagesCost of Employment CalculatorMurooj MiroNo ratings yet

- Strategic Financial PlanningDocument17 pagesStrategic Financial Planningyogeshmata100% (1)

- Financial Survival GuideDocument24 pagesFinancial Survival GuideAlan LuckstedtNo ratings yet

- Wa0031.Document1 pageWa0031.ngouffo longpi martialNo ratings yet

- 2010 MercyAnnual ReportDocument3 pages2010 MercyAnnual ReportKristen Clark WelchNo ratings yet

- GROUP8 Module 5 ASSIGNMENT 1 COMPENSATION AND BENEFITSDocument12 pagesGROUP8 Module 5 ASSIGNMENT 1 COMPENSATION AND BENEFITSHannah RodriguezNo ratings yet

- Mixed Income Earner ITR PreparationDocument2 pagesMixed Income Earner ITR PreparationTony Rose Arzaga100% (1)

- Coffee Shop Business Plan - Financial PL PDFDocument18 pagesCoffee Shop Business Plan - Financial PL PDFSamenNo ratings yet

- Finals Quiz No. 1 W AnswerDocument4 pagesFinals Quiz No. 1 W AnswerLouris DanielNo ratings yet

- Business & Tax LawsDocument19 pagesBusiness & Tax Lawsparivesh_kmr100% (1)

- Security Agencies QuotationDocument4 pagesSecurity Agencies Quotationsl424129No ratings yet

- Tax Rev Prelim ExaminationDocument91 pagesTax Rev Prelim ExaminationshanksNo ratings yet

- Financial Statement and Ratio Analysis PowerpointDocument86 pagesFinancial Statement and Ratio Analysis PowerpointRadhi MajmudarNo ratings yet

- RAB Driver Harbun 2020 5 Personnel ApprovedDocument1 pageRAB Driver Harbun 2020 5 Personnel Approvedbimo anggoroNo ratings yet

- FlexiDeclaration 2224Document1 pageFlexiDeclaration 2224Tirumalesha DadigeNo ratings yet

- HF Assignment 3-1 Pt. 1Document5 pagesHF Assignment 3-1 Pt. 1RippleNo ratings yet

- Visual Optics Pty LTDDocument16 pagesVisual Optics Pty LTDPranjal KhatriNo ratings yet

- Data TablesDocument78 pagesData Tablesdale naughtonNo ratings yet

- 4.0 Financial Plan Lulwa - SolvedDocument14 pages4.0 Financial Plan Lulwa - SolvedTabish HyderNo ratings yet

- Yajuvendra ThakurDocument6 pagesYajuvendra ThakurthakuryaNo ratings yet

- Key Account Associates 2010Document1 pageKey Account Associates 2010Wenz Escayde LagboNo ratings yet

- CompensationDocument1 pageCompensationDandyNo ratings yet

- Labour CostDocument16 pagesLabour CostThanousha AbrahamsNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- RecursionDocument9 pagesRecursionMada BaskoroNo ratings yet

- Ex Lecture1Document2 pagesEx Lecture1AlNo ratings yet

- Background of Money Market in BangladeshDocument5 pagesBackground of Money Market in Bangladeshanamikabhoumik100% (1)

- Abita Brand GuideDocument7 pagesAbita Brand GuideGabriel Bedini de JesusNo ratings yet

- Brochure Fisher Fieldvue Dvc2000 Digital Valve Controllers en 124728Document4 pagesBrochure Fisher Fieldvue Dvc2000 Digital Valve Controllers en 124728Kaushal ParmarNo ratings yet

- Chem Project VDocument18 pagesChem Project Vmjvarun2006No ratings yet

- Unit 3 - Promotion - 27 Aug - ShareDocument38 pagesUnit 3 - Promotion - 27 Aug - SharebansaltulikaNo ratings yet

- FonaDocument36 pagesFonaiyadNo ratings yet

- Abroad Work Experience On ResumeDocument5 pagesAbroad Work Experience On Resumeafmrdrpsbbxuag100% (1)

- Athletics Throwing EventsDocument8 pagesAthletics Throwing EventsJehan PugosaNo ratings yet

- QuestionsDocument3 pagesQuestionsLayla RamirezNo ratings yet

- History of UniverseDocument1 pageHistory of UniversemajdaNo ratings yet

- Maya, Aztec, and Inca Civilizations PDFDocument116 pagesMaya, Aztec, and Inca Civilizations PDFGabriel Medina100% (2)

- 26 32LC2R-TJDocument45 pages26 32LC2R-TJJens Enoch-LarsenNo ratings yet

- Performance Task in MarketingDocument5 pagesPerformance Task in MarketingClarisse Marie GolosinoNo ratings yet

- Allison Taylor Dissertation Heinrich SchliemannDocument6 pagesAllison Taylor Dissertation Heinrich SchliemannPaperWritingServiceSuperiorpapersSpringfield100% (1)

- L 0606279Document179 pagesL 0606279Jeff ImmerNo ratings yet

- Reflective Paper - SoundDocument3 pagesReflective Paper - Soundkashan HaiderNo ratings yet

- Project On Sales Promotion ParagDocument66 pagesProject On Sales Promotion ParagavnishNo ratings yet

- TesisDocument78 pagesTesisWidya SariNo ratings yet

- Lecture 5 PDFDocument8 pagesLecture 5 PDFMuhammad Hamza EjazNo ratings yet

- Jargeous - Product - Catalog Ver 1220 Compressed PDFDocument16 pagesJargeous - Product - Catalog Ver 1220 Compressed PDFFirdaus YahyaNo ratings yet

- Digital Communications Project ReportDocument14 pagesDigital Communications Project ReportSonal Pinto0% (1)

- Marketing Management Project: Submitted byDocument41 pagesMarketing Management Project: Submitted byrpotnisNo ratings yet

- 20220725Document39 pages20220725Zenon CondoriNo ratings yet

- Verkstadshandbok Senda DRD Pro Al-Frame ElDocument78 pagesVerkstadshandbok Senda DRD Pro Al-Frame ElGeoffrey PearmainNo ratings yet

- BIG ASS FAN Element CustomerDocument10 pagesBIG ASS FAN Element CustomerJesus David Muñoz RoblesNo ratings yet

- Employee Background Verification SystemDocument5 pagesEmployee Background Verification SystemPayal ChauhanNo ratings yet

- Neverwhere by Neil Gaiman - Teacher Study GuideDocument3 pagesNeverwhere by Neil Gaiman - Teacher Study GuideHarperAcademic33% (3)

- Smallware InventoryDocument7 pagesSmallware Inventoryye min aungNo ratings yet