Professional Documents

Culture Documents

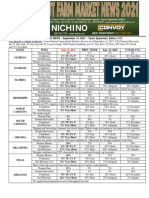

Cotton Marketing News

Cotton Marketing News

Uploaded by

Brittany EtheridgeCopyright:

You might also like

- Dominant Firm Competitive Fringe SolutionDocument2 pagesDominant Firm Competitive Fringe SolutionJéssica Dutra100% (1)

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument2 pagesCotton Marketing NewsMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument2 pagesCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Rev CM N 06282019Document1 pageRev CM N 06282019Brittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Newsletter July 2019Document7 pagesNewsletter July 2019Brittany EtheridgeNo ratings yet

- Cotton Payments Update-FINAL-0311Document6 pagesCotton Payments Update-FINAL-0311Brittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- CQ Perspectives Mar 2011Document4 pagesCQ Perspectives Mar 2011Crop QuestNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Doane Ag Insights WeeklyDocument7 pagesDoane Ag Insights WeeklydoaneadvisoryNo ratings yet

- Prairie Farmer, Vol. 56: No. 12, March 22, 1884 A Weekly Journal for the Farm, Orchard and FiresideFrom EverandPrairie Farmer, Vol. 56: No. 12, March 22, 1884 A Weekly Journal for the Farm, Orchard and FiresideNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- AgricultureDocument21 pagesAgriculturekrmanu2804No ratings yet

- USGC Market Perspectives ReportDocument14 pagesUSGC Market Perspectives Reportajdcavalcante78No ratings yet

- CQ Perspectives Jan 2005Document4 pagesCQ Perspectives Jan 2005Crop QuestNo ratings yet

- PEANUT MARKETING NEWS - August 17, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - August 17, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Mushrooms Get Popular: Conserving Soil Increases YieldsDocument8 pagesMushrooms Get Popular: Conserving Soil Increases YieldsMwape Martin WakamaiNo ratings yet

- In 1983 The Reagan Administration Introduced A New Agricultural ProgramDocument1 pageIn 1983 The Reagan Administration Introduced A New Agricultural Programtrilocksp SinghNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Corn Fact Book 2010Document28 pagesCorn Fact Book 2010National Corn Growers AssociationNo ratings yet

- Economics of Ginger Root Production in Hawaii: Cooperative Extension ServiceDocument7 pagesEconomics of Ginger Root Production in Hawaii: Cooperative Extension ServiceAlexNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- South America To Dominate SoybeansDocument2 pagesSouth America To Dominate SoybeansSamyakNo ratings yet

- Sec 5.3 MC Three Applications of Supply, Demand, and ElasticityDocument9 pagesSec 5.3 MC Three Applications of Supply, Demand, and ElasticityLại Nguyễn Hoàng Phương VyNo ratings yet

- American Economic Association The American Economic ReviewDocument8 pagesAmerican Economic Association The American Economic ReviewBajram MorinaNo ratings yet

- Hemp FarmsDocument4 pagesHemp FarmsLogan CampbellNo ratings yet

- Crop Production and Management Farm ReportDocument4 pagesCrop Production and Management Farm Reportapi-252447938No ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- 121020-Ecowrap 20201012Document5 pages121020-Ecowrap 20201012DEVA NAIKNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- ID Analisis Komparatif Tingkat Pendapatan Petani Sayuran Di Kabupaten Tanah Datar KDocument17 pagesID Analisis Komparatif Tingkat Pendapatan Petani Sayuran Di Kabupaten Tanah Datar KNanangKuswantoNo ratings yet

- Overview of Agricultural MarketingDocument61 pagesOverview of Agricultural MarketingGedionNo ratings yet

- Shelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Document1 pageShelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Brittany EtheridgeNo ratings yet

- MONSANTO, THE LEADING Producer of Genetically Modified Plant SeedDocument3 pagesMONSANTO, THE LEADING Producer of Genetically Modified Plant Seeddestiny710No ratings yet

- Focus On Ag: August 26, 2019 2019 Crop Yields Remain A Big QuestionDocument2 pagesFocus On Ag: August 26, 2019 2019 Crop Yields Remain A Big QuestionFluenceMediaNo ratings yet

- Corporate Farming Vis-A-Vis Contract Farming in India: A Critical PerspectiveDocument12 pagesCorporate Farming Vis-A-Vis Contract Farming in India: A Critical PerspectiveastuteNo ratings yet

- PEANUT MARKETING NEWS - May 29, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 29, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Focus On Ag (4-02-18)Document2 pagesFocus On Ag (4-02-18)FluenceMediaNo ratings yet

- Productivity.: Are Nignet Governiue Foodgrain) Coopera Salmon. EqualsDocument1 pageProductivity.: Are Nignet Governiue Foodgrain) Coopera Salmon. Equalsdon504No ratings yet

- Plant Growth Regulators - PGR - MarketDocument15 pagesPlant Growth Regulators - PGR - MarketAgricultureNo ratings yet

- Hampton Roads Americas Alliance MarketBeat Retail Q12018Document2 pagesHampton Roads Americas Alliance MarketBeat Retail Q12018Anonymous Feglbx5No ratings yet

- U.S Corn Preciso MaízDocument7 pagesU.S Corn Preciso MaízAnonymous TApDKFNo ratings yet

- Focus On Ag: Written by Kent Thiesse Farm Management Analyst and Vice President, Minnstar BankDocument2 pagesFocus On Ag: Written by Kent Thiesse Farm Management Analyst and Vice President, Minnstar BankFluenceMediaNo ratings yet

- Micro Final 4Document8 pagesMicro Final 4Muhammad Moavia Ramzan FAST NU LHRNo ratings yet

- FDI in Retail: Some Unanswered Questions: Mahazareen DasturDocument8 pagesFDI in Retail: Some Unanswered Questions: Mahazareen DasturShweta SrivastavaNo ratings yet

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Document2 pagesHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5No ratings yet

- National Posted Price Shelled MKT Price Market Loan Weekly PricesDocument1 pageNational Posted Price Shelled MKT Price Market Loan Weekly PricesBrittany EtheridgeNo ratings yet

- Lecture Note 3 Market EquilibriumDocument6 pagesLecture Note 3 Market EquilibriumManish PandeyNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Said Jeremy Mayes, General Manager For American Peanut Growers IngredientsDocument1 pageSaid Jeremy Mayes, General Manager For American Peanut Growers IngredientsBrittany EtheridgeNo ratings yet

- October 24, 2021Document1 pageOctober 24, 2021Brittany Etheridge100% (1)

- U.S. PEANUT EXPORTS - TOP 10 - From USDA/Foreign Agricultural Service (American Peanut Council)Document1 pageU.S. PEANUT EXPORTS - TOP 10 - From USDA/Foreign Agricultural Service (American Peanut Council)Brittany EtheridgeNo ratings yet

- October 17, 2021Document1 pageOctober 17, 2021Brittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument2 pagesCotton Marketing NewsBrittany EtheridgeNo ratings yet

- October 10, 2021Document1 pageOctober 10, 2021Brittany EtheridgeNo ratings yet

- Sept. 12, 2021Document1 pageSept. 12, 2021Brittany EtheridgeNo ratings yet

- 1,000 Acres Pounds/Acre TonsDocument1 page1,000 Acres Pounds/Acre TonsBrittany EtheridgeNo ratings yet

- Sept. 26, 2021Document1 pageSept. 26, 2021Brittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last WeekDocument1 pageShelled MKT Price Weekly Prices: Same As Last WeekBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- World Agricultural Supply and Demand EstimatesDocument40 pagesWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeNo ratings yet

- Sept. 19, 2021Document1 pageSept. 19, 2021Brittany EtheridgeNo ratings yet

- Dairy Market Report - September 2021Document5 pagesDairy Market Report - September 2021Brittany EtheridgeNo ratings yet

- 2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingDocument1 page2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingBrittany EtheridgeNo ratings yet

- October 3, 2021Document1 pageOctober 3, 2021Brittany EtheridgeNo ratings yet

- YieldDocument1 pageYieldBrittany EtheridgeNo ratings yet

- NicholasDocument1 pageNicholasBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbBrittany EtheridgeNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 11.8 % Down - 16.1%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 11.8 % Down - 16.1%Brittany EtheridgeNo ratings yet

- World Agricultural Supply and Demand EstimatesDocument40 pagesWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeNo ratings yet

- FPAC Honeybee Brochure August2021Document4 pagesFPAC Honeybee Brochure August2021Brittany EtheridgeNo ratings yet

- August 29, 2021Document1 pageAugust 29, 2021Brittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.6ct/lbDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.6ct/lbBrittany EtheridgeNo ratings yet

- August 22, 2021Document1 pageAugust 22, 2021Brittany EtheridgeNo ratings yet

- Sept. 5, 2021Document1 pageSept. 5, 2021Brittany EtheridgeNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 10.8 % Down - 15.0%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 10.8 % Down - 15.0%Brittany EtheridgeNo ratings yet

- AGECON-502 Macro Economics and PolicyDocument5 pagesAGECON-502 Macro Economics and PolicyAishwarya JillellaNo ratings yet

- 1311 Remuneration Structures Study en 0Document187 pages1311 Remuneration Structures Study en 0Andrei SavvaNo ratings yet

- Question 1: Score 0/1: Your Response Correct ResponseDocument50 pagesQuestion 1: Score 0/1: Your Response Correct ResponseAtarinta Dyah PitalokaNo ratings yet

- Multiple Choice Questions 1 in The Bottom Up Approach To CostDocument2 pagesMultiple Choice Questions 1 in The Bottom Up Approach To Costtrilocksp SinghNo ratings yet

- Presented by Zonaira SarfrazDocument19 pagesPresented by Zonaira SarfrazZunaira SarfrazNo ratings yet

- Fixation of Stock LevelsDocument8 pagesFixation of Stock LevelsShaikh Abdur RahmanNo ratings yet

- Economics of MEG Production From Carbon DioxideDocument56 pagesEconomics of MEG Production From Carbon DioxideIntratec SolutionsNo ratings yet

- Production & Cost Estimation: Eighth EditionDocument14 pagesProduction & Cost Estimation: Eighth EditionPratama YaasyfahNo ratings yet

- Plant Design and EconomicsDocument3 pagesPlant Design and EconomicsAnonymous NayakNo ratings yet

- Macroeconomics 9th Edition Mankiw Solutions ManualDocument35 pagesMacroeconomics 9th Edition Mankiw Solutions Manualmargaretjacksonch3nin100% (29)

- Total Cost of Holding Inventory WhitepaperDocument2 pagesTotal Cost of Holding Inventory Whitepapershastri_shyam5073No ratings yet

- 5-1 Deloitte Mastering Innovation Exploiting Ideas For Profitable GrowthDocument24 pages5-1 Deloitte Mastering Innovation Exploiting Ideas For Profitable GrowthWentian HsiehNo ratings yet

- A Monopolist Faces A Market Demand Curve Given by QDocument1 pageA Monopolist Faces A Market Demand Curve Given by Qtrilocksp SinghNo ratings yet

- Bill of Quantities: Item Description QTY Unit Unit Cost AmountDocument25 pagesBill of Quantities: Item Description QTY Unit Unit Cost AmountAYSON N. DELA CRUZNo ratings yet

- Deveshi Roy - WAC Assessment 1Document3 pagesDeveshi Roy - WAC Assessment 1ajNo ratings yet

- Arithmetic (Sibanand Pattanaik)Document280 pagesArithmetic (Sibanand Pattanaik)dchinmayadas111No ratings yet

- Burlington PDFDocument5 pagesBurlington PDFAlivia HasnandaNo ratings yet

- Set 1 - Omr - Depreciation - Google FormsDocument8 pagesSet 1 - Omr - Depreciation - Google Formsshibin cpNo ratings yet

- Del MonteDocument7 pagesDel MonteGlyssa AlcantaraNo ratings yet

- Ajay Yadav, Sweta GoelDocument5 pagesAjay Yadav, Sweta GoelBickramNo ratings yet

- Standing OrderDocument28 pagesStanding Orderf999khanNo ratings yet

- Group 5 Monetary Central BankingDocument19 pagesGroup 5 Monetary Central BankingAurea Espinosa ErazoNo ratings yet

- Chapter 18Document17 pagesChapter 18Summer VongNo ratings yet

- How To Be A Property MillionaireDocument224 pagesHow To Be A Property MillionaireMey VannakNo ratings yet

- KBLM - Annual Report - 2017 - Revisi PDFDocument84 pagesKBLM - Annual Report - 2017 - Revisi PDFverlyarinNo ratings yet

- MGEA02H3 LEC01/LEC02/LEC03: Note - This Is Version ADocument21 pagesMGEA02H3 LEC01/LEC02/LEC03: Note - This Is Version AYINGWEN LINo ratings yet

- Dragon and EagleDocument20 pagesDragon and EagleChristian Anthony Gamero JorgeNo ratings yet

- Duane Weaver's Class - MARK 160 Ethics and SustainabilityDocument20 pagesDuane Weaver's Class - MARK 160 Ethics and Sustainabilityyahya khanNo ratings yet

Cotton Marketing News

Cotton Marketing News

Uploaded by

Brittany EtheridgeOriginal Description:

Original Title

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Cotton Marketing News

Cotton Marketing News

Uploaded by

Brittany EtheridgeCopyright:

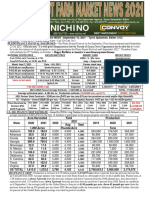

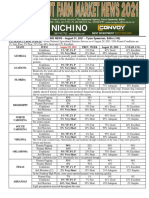

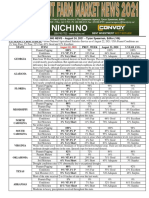

REPRESENTING COTTON GROWERS THROUGHOUT ALABAMA, FLORIDA, GEORGIA, NORTH CAROLINA, SOUTH CAROLINA, AND VIRGINIA

COTTON MARKETING NEWS

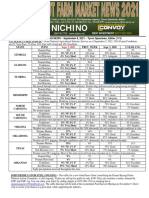

Volume 17, No. 4 April 11, 2019

201919

The first USDA estimate of acres actually planted is released at the

Sponsored by end of June. The June estimate has been higher than the March

number in 2 of the last 3 year. Actual acres planted (the final

number) has been higher than the March number and the June

Market Improves But Future Unknown as Planting Approaches estimate for each of the last 3 years.

In my previous (March 14) comments to you, the title was “Cotton Looking overall at just the 17 reported cotton-producing states

Continues to Need Clarity”. I’m not sure much has changed in that only, corn is expected to gain acres while cotton, grain sorghum,

regard. The market has certainly made nice improvement, are expected to lose acres.

however, and we can be thankful for that. There is still no word

or advance in trade talks and the March 30th Prospective Plantings In the grand scheme of things over all cotton states, peanuts may

report, in my opinion, threw more uncertainty on the market. not be significant—but they are in several states and can equate

to as much as ½ of the cotton acres. As a side note, I find it

surprising that peanuts are projected to be up. Contract prices

certainly don’t justify that and the industry and most observers

are saying that acreage needs to decrease, not increase.

But to be sure, there is always uncertainty surrounding the March

number because so many things can change that ultimately

determine what farmers will plant. Last month’s Prospective

Planting estimate was 13.78 million acres. This compared to an

earlier National Cotton Council estimate of 14.45 million acres and

most industry estimates of over 14 million—some quite a bit over Most continue to believe that acres planted will be 14 million or

14, but less than 15. more. With models predicting above normal precipitation, we

could be looking at a crop of around 22 to 23 million bales or

more—roughly 4+ million bales higher than last year.

Note that most of the improvement in prices came before the

lower than expected March number. Exports and shipments have

been good. This market is set up to move higher or have a

downward correction. Where does a grower get started on

pricing to reduce some of the downside risk while still leaving the

upside open? To each his own, but the 78-cent neighborhood

seems a reasonable start to me.

Cotton Economist- Retired

Professor Emeritus of Cotton Economics

You might also like

- Dominant Firm Competitive Fringe SolutionDocument2 pagesDominant Firm Competitive Fringe SolutionJéssica Dutra100% (1)

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument2 pagesCotton Marketing NewsMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument2 pagesCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Rev CM N 06282019Document1 pageRev CM N 06282019Brittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Newsletter July 2019Document7 pagesNewsletter July 2019Brittany EtheridgeNo ratings yet

- Cotton Payments Update-FINAL-0311Document6 pagesCotton Payments Update-FINAL-0311Brittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- CQ Perspectives Mar 2011Document4 pagesCQ Perspectives Mar 2011Crop QuestNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Doane Ag Insights WeeklyDocument7 pagesDoane Ag Insights WeeklydoaneadvisoryNo ratings yet

- Prairie Farmer, Vol. 56: No. 12, March 22, 1884 A Weekly Journal for the Farm, Orchard and FiresideFrom EverandPrairie Farmer, Vol. 56: No. 12, March 22, 1884 A Weekly Journal for the Farm, Orchard and FiresideNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- AgricultureDocument21 pagesAgriculturekrmanu2804No ratings yet

- USGC Market Perspectives ReportDocument14 pagesUSGC Market Perspectives Reportajdcavalcante78No ratings yet

- CQ Perspectives Jan 2005Document4 pagesCQ Perspectives Jan 2005Crop QuestNo ratings yet

- PEANUT MARKETING NEWS - August 17, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - August 17, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Mushrooms Get Popular: Conserving Soil Increases YieldsDocument8 pagesMushrooms Get Popular: Conserving Soil Increases YieldsMwape Martin WakamaiNo ratings yet

- In 1983 The Reagan Administration Introduced A New Agricultural ProgramDocument1 pageIn 1983 The Reagan Administration Introduced A New Agricultural Programtrilocksp SinghNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Corn Fact Book 2010Document28 pagesCorn Fact Book 2010National Corn Growers AssociationNo ratings yet

- Economics of Ginger Root Production in Hawaii: Cooperative Extension ServiceDocument7 pagesEconomics of Ginger Root Production in Hawaii: Cooperative Extension ServiceAlexNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- South America To Dominate SoybeansDocument2 pagesSouth America To Dominate SoybeansSamyakNo ratings yet

- Sec 5.3 MC Three Applications of Supply, Demand, and ElasticityDocument9 pagesSec 5.3 MC Three Applications of Supply, Demand, and ElasticityLại Nguyễn Hoàng Phương VyNo ratings yet

- American Economic Association The American Economic ReviewDocument8 pagesAmerican Economic Association The American Economic ReviewBajram MorinaNo ratings yet

- Hemp FarmsDocument4 pagesHemp FarmsLogan CampbellNo ratings yet

- Crop Production and Management Farm ReportDocument4 pagesCrop Production and Management Farm Reportapi-252447938No ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- 121020-Ecowrap 20201012Document5 pages121020-Ecowrap 20201012DEVA NAIKNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- ID Analisis Komparatif Tingkat Pendapatan Petani Sayuran Di Kabupaten Tanah Datar KDocument17 pagesID Analisis Komparatif Tingkat Pendapatan Petani Sayuran Di Kabupaten Tanah Datar KNanangKuswantoNo ratings yet

- Overview of Agricultural MarketingDocument61 pagesOverview of Agricultural MarketingGedionNo ratings yet

- Shelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Document1 pageShelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Brittany EtheridgeNo ratings yet

- MONSANTO, THE LEADING Producer of Genetically Modified Plant SeedDocument3 pagesMONSANTO, THE LEADING Producer of Genetically Modified Plant Seeddestiny710No ratings yet

- Focus On Ag: August 26, 2019 2019 Crop Yields Remain A Big QuestionDocument2 pagesFocus On Ag: August 26, 2019 2019 Crop Yields Remain A Big QuestionFluenceMediaNo ratings yet

- Corporate Farming Vis-A-Vis Contract Farming in India: A Critical PerspectiveDocument12 pagesCorporate Farming Vis-A-Vis Contract Farming in India: A Critical PerspectiveastuteNo ratings yet

- PEANUT MARKETING NEWS - May 29, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 29, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Focus On Ag (4-02-18)Document2 pagesFocus On Ag (4-02-18)FluenceMediaNo ratings yet

- Productivity.: Are Nignet Governiue Foodgrain) Coopera Salmon. EqualsDocument1 pageProductivity.: Are Nignet Governiue Foodgrain) Coopera Salmon. Equalsdon504No ratings yet

- Plant Growth Regulators - PGR - MarketDocument15 pagesPlant Growth Regulators - PGR - MarketAgricultureNo ratings yet

- Hampton Roads Americas Alliance MarketBeat Retail Q12018Document2 pagesHampton Roads Americas Alliance MarketBeat Retail Q12018Anonymous Feglbx5No ratings yet

- U.S Corn Preciso MaízDocument7 pagesU.S Corn Preciso MaízAnonymous TApDKFNo ratings yet

- Focus On Ag: Written by Kent Thiesse Farm Management Analyst and Vice President, Minnstar BankDocument2 pagesFocus On Ag: Written by Kent Thiesse Farm Management Analyst and Vice President, Minnstar BankFluenceMediaNo ratings yet

- Micro Final 4Document8 pagesMicro Final 4Muhammad Moavia Ramzan FAST NU LHRNo ratings yet

- FDI in Retail: Some Unanswered Questions: Mahazareen DasturDocument8 pagesFDI in Retail: Some Unanswered Questions: Mahazareen DasturShweta SrivastavaNo ratings yet

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Document2 pagesHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5No ratings yet

- National Posted Price Shelled MKT Price Market Loan Weekly PricesDocument1 pageNational Posted Price Shelled MKT Price Market Loan Weekly PricesBrittany EtheridgeNo ratings yet

- Lecture Note 3 Market EquilibriumDocument6 pagesLecture Note 3 Market EquilibriumManish PandeyNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- Said Jeremy Mayes, General Manager For American Peanut Growers IngredientsDocument1 pageSaid Jeremy Mayes, General Manager For American Peanut Growers IngredientsBrittany EtheridgeNo ratings yet

- October 24, 2021Document1 pageOctober 24, 2021Brittany Etheridge100% (1)

- U.S. PEANUT EXPORTS - TOP 10 - From USDA/Foreign Agricultural Service (American Peanut Council)Document1 pageU.S. PEANUT EXPORTS - TOP 10 - From USDA/Foreign Agricultural Service (American Peanut Council)Brittany EtheridgeNo ratings yet

- October 17, 2021Document1 pageOctober 17, 2021Brittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument2 pagesCotton Marketing NewsBrittany EtheridgeNo ratings yet

- October 10, 2021Document1 pageOctober 10, 2021Brittany EtheridgeNo ratings yet

- Sept. 12, 2021Document1 pageSept. 12, 2021Brittany EtheridgeNo ratings yet

- 1,000 Acres Pounds/Acre TonsDocument1 page1,000 Acres Pounds/Acre TonsBrittany EtheridgeNo ratings yet

- Sept. 26, 2021Document1 pageSept. 26, 2021Brittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last WeekDocument1 pageShelled MKT Price Weekly Prices: Same As Last WeekBrittany EtheridgeNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsBrittany EtheridgeNo ratings yet

- World Agricultural Supply and Demand EstimatesDocument40 pagesWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeNo ratings yet

- Sept. 19, 2021Document1 pageSept. 19, 2021Brittany EtheridgeNo ratings yet

- Dairy Market Report - September 2021Document5 pagesDairy Market Report - September 2021Brittany EtheridgeNo ratings yet

- 2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingDocument1 page2021 Export Update - Chinese Future Prices Have Gotten Weaker. This Is Not SurprisingBrittany EtheridgeNo ratings yet

- October 3, 2021Document1 pageOctober 3, 2021Brittany EtheridgeNo ratings yet

- YieldDocument1 pageYieldBrittany EtheridgeNo ratings yet

- NicholasDocument1 pageNicholasBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbBrittany EtheridgeNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 11.8 % Down - 16.1%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 11.8 % Down - 16.1%Brittany EtheridgeNo ratings yet

- World Agricultural Supply and Demand EstimatesDocument40 pagesWorld Agricultural Supply and Demand EstimatesBrittany EtheridgeNo ratings yet

- FPAC Honeybee Brochure August2021Document4 pagesFPAC Honeybee Brochure August2021Brittany EtheridgeNo ratings yet

- August 29, 2021Document1 pageAugust 29, 2021Brittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.6ct/lbDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.6ct/lbBrittany EtheridgeNo ratings yet

- August 22, 2021Document1 pageAugust 22, 2021Brittany EtheridgeNo ratings yet

- Sept. 5, 2021Document1 pageSept. 5, 2021Brittany EtheridgeNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 10.8 % Down - 15.0%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) : Down - 10.8 % Down - 15.0%Brittany EtheridgeNo ratings yet

- AGECON-502 Macro Economics and PolicyDocument5 pagesAGECON-502 Macro Economics and PolicyAishwarya JillellaNo ratings yet

- 1311 Remuneration Structures Study en 0Document187 pages1311 Remuneration Structures Study en 0Andrei SavvaNo ratings yet

- Question 1: Score 0/1: Your Response Correct ResponseDocument50 pagesQuestion 1: Score 0/1: Your Response Correct ResponseAtarinta Dyah PitalokaNo ratings yet

- Multiple Choice Questions 1 in The Bottom Up Approach To CostDocument2 pagesMultiple Choice Questions 1 in The Bottom Up Approach To Costtrilocksp SinghNo ratings yet

- Presented by Zonaira SarfrazDocument19 pagesPresented by Zonaira SarfrazZunaira SarfrazNo ratings yet

- Fixation of Stock LevelsDocument8 pagesFixation of Stock LevelsShaikh Abdur RahmanNo ratings yet

- Economics of MEG Production From Carbon DioxideDocument56 pagesEconomics of MEG Production From Carbon DioxideIntratec SolutionsNo ratings yet

- Production & Cost Estimation: Eighth EditionDocument14 pagesProduction & Cost Estimation: Eighth EditionPratama YaasyfahNo ratings yet

- Plant Design and EconomicsDocument3 pagesPlant Design and EconomicsAnonymous NayakNo ratings yet

- Macroeconomics 9th Edition Mankiw Solutions ManualDocument35 pagesMacroeconomics 9th Edition Mankiw Solutions Manualmargaretjacksonch3nin100% (29)

- Total Cost of Holding Inventory WhitepaperDocument2 pagesTotal Cost of Holding Inventory Whitepapershastri_shyam5073No ratings yet

- 5-1 Deloitte Mastering Innovation Exploiting Ideas For Profitable GrowthDocument24 pages5-1 Deloitte Mastering Innovation Exploiting Ideas For Profitable GrowthWentian HsiehNo ratings yet

- A Monopolist Faces A Market Demand Curve Given by QDocument1 pageA Monopolist Faces A Market Demand Curve Given by Qtrilocksp SinghNo ratings yet

- Bill of Quantities: Item Description QTY Unit Unit Cost AmountDocument25 pagesBill of Quantities: Item Description QTY Unit Unit Cost AmountAYSON N. DELA CRUZNo ratings yet

- Deveshi Roy - WAC Assessment 1Document3 pagesDeveshi Roy - WAC Assessment 1ajNo ratings yet

- Arithmetic (Sibanand Pattanaik)Document280 pagesArithmetic (Sibanand Pattanaik)dchinmayadas111No ratings yet

- Burlington PDFDocument5 pagesBurlington PDFAlivia HasnandaNo ratings yet

- Set 1 - Omr - Depreciation - Google FormsDocument8 pagesSet 1 - Omr - Depreciation - Google Formsshibin cpNo ratings yet

- Del MonteDocument7 pagesDel MonteGlyssa AlcantaraNo ratings yet

- Ajay Yadav, Sweta GoelDocument5 pagesAjay Yadav, Sweta GoelBickramNo ratings yet

- Standing OrderDocument28 pagesStanding Orderf999khanNo ratings yet

- Group 5 Monetary Central BankingDocument19 pagesGroup 5 Monetary Central BankingAurea Espinosa ErazoNo ratings yet

- Chapter 18Document17 pagesChapter 18Summer VongNo ratings yet

- How To Be A Property MillionaireDocument224 pagesHow To Be A Property MillionaireMey VannakNo ratings yet

- KBLM - Annual Report - 2017 - Revisi PDFDocument84 pagesKBLM - Annual Report - 2017 - Revisi PDFverlyarinNo ratings yet

- MGEA02H3 LEC01/LEC02/LEC03: Note - This Is Version ADocument21 pagesMGEA02H3 LEC01/LEC02/LEC03: Note - This Is Version AYINGWEN LINo ratings yet

- Dragon and EagleDocument20 pagesDragon and EagleChristian Anthony Gamero JorgeNo ratings yet

- Duane Weaver's Class - MARK 160 Ethics and SustainabilityDocument20 pagesDuane Weaver's Class - MARK 160 Ethics and Sustainabilityyahya khanNo ratings yet