Professional Documents

Culture Documents

Meghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRV

Meghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRV

Uploaded by

YunusShaikhCopyright:

Available Formats

You might also like

- Boat Headphones PDFDocument1 pageBoat Headphones PDFAbhey Kumar13% (8)

- Unified Payments Interface (UPI)Document14 pagesUnified Payments Interface (UPI)VivekNo ratings yet

- Motivation Sticker & Stamp Catalog: Quality UpgradedDocument6 pagesMotivation Sticker & Stamp Catalog: Quality UpgradedABEELEEPEICHINGNo ratings yet

- 2019 03 31 15 05 10 049 - 1554024910049 - XXXPJ4090X - Itrv PDFDocument1 page2019 03 31 15 05 10 049 - 1554024910049 - XXXPJ4090X - Itrv PDFShivshankar RNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)santoshkumarNo ratings yet

- 2019 07 17 12 05 41 184 - 1563345341184 - XXXPG9565X - ItrvDocument1 page2019 07 17 12 05 41 184 - 1563345341184 - XXXPG9565X - ItrvsantoshkumarNo ratings yet

- Soumyadeep Chanda Itr Ay 2018Document1 pageSoumyadeep Chanda Itr Ay 2018Cajonized Guy DeepNo ratings yet

- Aman Jain Itr (A.y.2017-18)Document1 pageAman Jain Itr (A.y.2017-18)ramanNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)shalabhNo ratings yet

- Ack VDocument1 pageAck VShantanu MetayNo ratings yet

- MANI SIVASANKAR - 28-Feb-2019 - 427477180Document1 pageMANI SIVASANKAR - 28-Feb-2019 - 427477180samaadhuNo ratings yet

- 2018 03 04 21 10 37 424 - 1520178037424 - XXXPS9207X - ItrvDocument1 page2018 03 04 21 10 37 424 - 1520178037424 - XXXPS9207X - Itrvrohit sNo ratings yet

- Itr 2018-19 S B Mishra PDFDocument1 pageItr 2018-19 S B Mishra PDFJITENDRA DUBEBYNo ratings yet

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .KumarNo ratings yet

- 2019 03 12 17 56 10 874 - 1552393570874 - XXXPS8275X - ItrvDocument1 page2019 03 12 17 56 10 874 - 1552393570874 - XXXPS8275X - ItrvDhananjay JaiswalNo ratings yet

- 2019 07 03 19 45 07 276 - 1562163307276 - XXXPM2399X - ItrvDocument1 page2019 07 03 19 45 07 276 - 1562163307276 - XXXPM2399X - ItrvDedaram FulwariyaNo ratings yet

- Ack 18-19Document1 pageAck 18-19tax solutionsNo ratings yet

- Bava Bro PDFDocument1 pageBava Bro PDFSomasundara ReddyNo ratings yet

- 2018 08 31 18 26 34 022 - 1535720194022 - XXXPB3542X - ItrvDocument1 page2018 08 31 18 26 34 022 - 1535720194022 - XXXPB3542X - Itrvdibyan dasNo ratings yet

- Ack F.y.2017-18Document1 pageAck F.y.2017-18NishantNo ratings yet

- Sukhjeet Singh 2018-19 (Itr) PDFDocument1 pageSukhjeet Singh 2018-19 (Itr) PDFAnonymous XgLFw9IcQNo ratings yet

- Letsgettin Fraud CompanyDocument1 pageLetsgettin Fraud CompanyAnonymous A3CiCzvNo ratings yet

- 2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - ItrvDocument1 page2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - Itrvpoluri vinayNo ratings yet

- PDF 759518980120718Document1 pagePDF 759518980120718HARDIK BANSALNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagehealth with wealthNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Nida KhanNo ratings yet

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .Balkar BhullerNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAditya SharmaNo ratings yet

- 2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFDocument1 page2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFAkshya BhoiNo ratings yet

- 2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvDocument1 page2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvHARI KRISHAN PALNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarNo ratings yet

- 2020 09 09 13 45 31 911 - 1599639331911 - XXXPM4309X - Itrv PDFDocument1 page2020 09 09 13 45 31 911 - 1599639331911 - XXXPM4309X - Itrv PDFMd Ali MujawarNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Pravin MasalgeNo ratings yet

- 2019 08 29 00 39 44 009 - 1567019384009 - XXXPK4733X - ItrvDocument1 page2019 08 29 00 39 44 009 - 1567019384009 - XXXPK4733X - Itrvramesh jothyNo ratings yet

- Edjpb0287g Itrv PDFDocument1 pageEdjpb0287g Itrv PDFArun BhatnagarNo ratings yet

- 2020 11 30 19 02 08 649 - 1606743128649 - XXXPM4571X - ItrvDocument1 page2020 11 30 19 02 08 649 - 1606743128649 - XXXPM4571X - ItrvSahana SkNo ratings yet

- Ack FY 17-18-Ramesh BDocument1 pageAck FY 17-18-Ramesh BMurthy KarumuriNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageCA Jitu DashNo ratings yet

- A.Y. 2019-20 ItrvunlDocument1 pageA.Y. 2019-20 Itrvunlkishan bhalodiyaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageBibhu Datta SenapatiNo ratings yet

- 2019 07 17 16 27 54 965 - 1563361074965 - XXXPD0630X - ItrvDocument1 page2019 07 17 16 27 54 965 - 1563361074965 - XXXPD0630X - ItrvAbhiraj dodNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDhanu goswamiNo ratings yet

- Itr-V Ajqpy0100n 2017-18 775756550170517Document1 pageItr-V Ajqpy0100n 2017-18 775756550170517Raj RajNo ratings yet

- Anuj ASAPM2826N ITR-VDocument1 pageAnuj ASAPM2826N ITR-Vapi-27088128No ratings yet

- 2019 07 17 13 29 12 415 - 1563350352415 - XXXPM7581X - Itrv PDFDocument1 page2019 07 17 13 29 12 415 - 1563350352415 - XXXPM7581X - Itrv PDFAnil AnnajiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnsar ValiNo ratings yet

- 2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFDocument1 page2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFakshay guptaNo ratings yet

- 2019 08 21 12 13 35 858 - 1566369815858 - XXXPC1439X - Itrv PDFDocument1 page2019 08 21 12 13 35 858 - 1566369815858 - XXXPC1439X - Itrv PDFSrishti Abhishek JainNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruZa HidNo ratings yet

- Itr 19-20 PDFDocument1 pageItr 19-20 PDFAnonymous fM5CtB8Qm7No ratings yet

- Itr-V Bogpp6352h 2017-18 225020870280917Document1 pageItr-V Bogpp6352h 2017-18 225020870280917DEVIL RDXNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageLingesh MaharajanNo ratings yet

- 2020 01 02 15 41 29 892 - 1577959889892 - XXXPT8767X - AcknowledgementDocument1 page2020 01 02 15 41 29 892 - 1577959889892 - XXXPT8767X - AcknowledgementKanahiya TandonNo ratings yet

- 2020 07 28 17 40 29 427 - 1595938229427 - XXXPG8558X - ItrvDocument1 page2020 07 28 17 40 29 427 - 1595938229427 - XXXPG8558X - ItrvPANKAJ KUMAR GIRINo ratings yet

- 2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvDocument1 page2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvIshaan ChawlaNo ratings yet

- RSM Itrv 2019-20Document1 pageRSM Itrv 2019-20Rajesh KumarNo ratings yet

- 2019 07 22 18 47 23 855 - 1563801443855 - XXXPS3282X - Itrv PDFDocument1 page2019 07 22 18 47 23 855 - 1563801443855 - XXXPS3282X - Itrv PDFsselvhakumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageTaiyabaNo ratings yet

- 2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFDocument1 page2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFAnupam GauravNo ratings yet

- It 18-19Document1 pageIt 18-19mohdmoin0493No ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSai SanthoshNo ratings yet

- Acct Statement XX7262 19032023Document47 pagesAcct Statement XX7262 19032023SangeethaNo ratings yet

- Account Name Account Number Transaction Date Year TIN Transaction AmountDocument6 pagesAccount Name Account Number Transaction Date Year TIN Transaction AmountSahara ReportersNo ratings yet

- Print - ANAND VIHAR TRM (ANVT) - PATNA JN (PNBE) - 2149856314Document1 pagePrint - ANAND VIHAR TRM (ANVT) - PATNA JN (PNBE) - 2149856314Akash NandanNo ratings yet

- Payroll ResultsDocument10 pagesPayroll ResultsMuhammad JaveedNo ratings yet

- EPG REST Integration v.1.3.1Document37 pagesEPG REST Integration v.1.3.1Sain S - iRoid0% (1)

- Automatic PaymentsDocument12 pagesAutomatic PaymentsfinerpmanyamNo ratings yet

- PFMS Generated Print Payment Advice: To, The Branch HeadDocument1 pagePFMS Generated Print Payment Advice: To, The Branch HeadHarsh VarshneyNo ratings yet

- Revenue Memorandum Circular 36-2021 v2Document32 pagesRevenue Memorandum Circular 36-2021 v2lizzyNo ratings yet

- Negotiable Instruments Law: CASES: Phil. Educ. Co., Inc. vs. Soriano, 39 SCRA 587 Tibajia, Jr. vs. CA, 223 SCRADocument8 pagesNegotiable Instruments Law: CASES: Phil. Educ. Co., Inc. vs. Soriano, 39 SCRA 587 Tibajia, Jr. vs. CA, 223 SCRAdnel13No ratings yet

- AC 3101 CHAPTER 10 NotesDocument2 pagesAC 3101 CHAPTER 10 NotesKemuel TantuanNo ratings yet

- Lotto For Deaf PeopleDocument11 pagesLotto For Deaf PeoplePREMIUM LANo ratings yet

- Collection O 64556 Nimisha Jail RD Near Bada Hanuman Mandir, SitapurDocument1 pageCollection O 64556 Nimisha Jail RD Near Bada Hanuman Mandir, SitapurAmaan HussainNo ratings yet

- Public Finance and Taxation AssignemetDocument3 pagesPublic Finance and Taxation AssignemetEmebet TesemaNo ratings yet

- Valuation, Composition and ITCDocument1 pageValuation, Composition and ITCsowmithNo ratings yet

- Cta 2D CV 08551 D 2015oct02 Ass PDFDocument37 pagesCta 2D CV 08551 D 2015oct02 Ass PDFMonica SorianoNo ratings yet

- LC For Akij Biax Films Limited: CO2012102 0 December 22, 2020Document2 pagesLC For Akij Biax Films Limited: CO2012102 0 December 22, 2020Mahadi Hassan ShemulNo ratings yet

- Bir TaxDocument97 pagesBir TaxVincent De VeraNo ratings yet

- Business Taxation Past Paper 2019 PDFDocument2 pagesBusiness Taxation Past Paper 2019 PDFNouman BaigNo ratings yet

- Estate TaxDocument8 pagesEstate TaxAngel Alejo AcobaNo ratings yet

- Complying With Country Requirements Using Financials CloudDocument45 pagesComplying With Country Requirements Using Financials CloudRavi MaratheNo ratings yet

- Collection of HC and SC DecisionsDocument63 pagesCollection of HC and SC DecisionsDayavantiNo ratings yet

- 4 - Class 4Document13 pages4 - Class 4M Almas MalikNo ratings yet

- Basic Principles of A Sound Tax SystemDocument6 pagesBasic Principles of A Sound Tax SystemhppddlNo ratings yet

- Pillar 2Document30 pagesPillar 2Joel IsabiryeNo ratings yet

- Canara Credit Cards User Manual - For WebsiteDocument11 pagesCanara Credit Cards User Manual - For WebsiteSuperdudeGauravNo ratings yet

- English For Academic Purposes (EAP) : Humber - Ca/myhumberDocument4 pagesEnglish For Academic Purposes (EAP) : Humber - Ca/myhumberRodrigo MartinezNo ratings yet

Meghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRV

Meghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRV

Uploaded by

YunusShaikhOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Meghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRV

Meghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRV

Uploaded by

YunusShaikhCopyright:

Available Formats

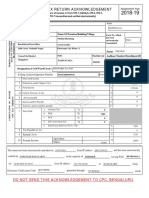

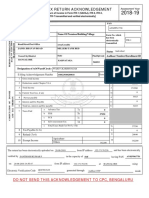

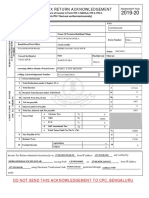

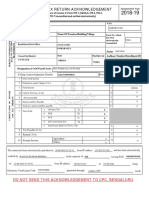

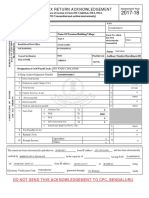

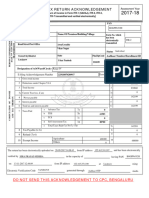

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

FORM 2018-19

ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-4(SUGAM), ITR-5, ITR-7 transmitted electronically without digital signature] .

(Please see Rule 12 of the Income-tax Rules, 1962)

Name PAN

MEGHANA CHANDRAKANT MAMUNKAR

PERSONAL INFORMATION AND THE

BJLPM8241G

Form No. which

DATE OF ELECTRONIC

Flat/Door/Block No Name Of Premises/Building/Village

has been ITR-2

TRANSMISSION

ROOM NO 1, 4TH FLOOR PLOT NO 507, SAIDEEP APT

electronically

transmitted

Road/Street/Post Office Area/Locality

JUHU GAON VASHI Individual

Status

Town/City/District State Pin/ZipCode Aadhaar Number/ Enrollment ID

THANE

MAHARASHTRA 400705 XXXX XXXX 1295

Designation of AO (Ward / Circle) WARD 28(2)(2), MUMBAI Original or Revised ORIGINAL

E-filing Acknowledgement Number 453886750300319 Date(DD-MM-YYYY) 30-03-2019

1 Gross Total Income 1 275698

2 Deductions under Chapter-VI-A 2 0

3 Total Income 3 275700

COMPUTATION OF INCOME

a Current Year loss, if any 3a 0

4

AND TAX THEREON

4 Net Tax Payable 0

5 Interest and Fee Payable 5 1000

6 Total Tax, Interest and Fee Payable 6 1000

7 Taxes Paid

a Advance Tax 7a 0

b TDS 7b 0

c TCS 7c 0

d Self Assessment Tax 7d 1000

e Total Taxes Paid (7a+7b+7c +7d) 7e 1000

8 Tax Payable (6-7e) 8 0

9 Refund (7e-6) 9 0

10 Exempt Income Agriculture

10

Others

VERIFICATION

I, MEGHANA CHANDRAKANT MAMUNKAR son/ daughter of KASHINATH SHINDE , holding Permanent Account Number BJLPM8241G

solemnly declare to the best of my knowledge and belief, the information given in the return and the schedules thereto which have been transmitted

electronically by me vide acknowledgement number mentioned above is correct and complete and that the amount of total income and other particulars

shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to income-tax for

the previous year relevant to the assessment year 2018-19. I further declare that I am making this return in my capacity as

Self and I am also competent to make this return and verify it.

Sign here Date 30-03-2019 Place THANE

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

Identification No. of TRP Name of TRP Counter Signature of TRP

For Office Use Only

Receipt No Filed from IP address 49.248.147.186

Date

Seal and signature of BJLPM8241G0245388675030031994E504D10285D9AA565D44FAD99D08B17AA237B9

receiving official

Please send the duly signed Form ITR-V to “Centralized Processing Centre, Income Tax Department, Bengaluru 560500”, by ORDINARY

POST OR SPEED POST ONLY, within 120 days from date of transmitting the data electronically. Form ITR-V shall not be received in any other

office of the Income-tax Department or in any other manner. The confirmation of receipt of this Form ITR-V at ITD-CPC will be sent to the e-mail

address yrsshaikh1988@gmail.com

You might also like

- Boat Headphones PDFDocument1 pageBoat Headphones PDFAbhey Kumar13% (8)

- Unified Payments Interface (UPI)Document14 pagesUnified Payments Interface (UPI)VivekNo ratings yet

- Motivation Sticker & Stamp Catalog: Quality UpgradedDocument6 pagesMotivation Sticker & Stamp Catalog: Quality UpgradedABEELEEPEICHINGNo ratings yet

- 2019 03 31 15 05 10 049 - 1554024910049 - XXXPJ4090X - Itrv PDFDocument1 page2019 03 31 15 05 10 049 - 1554024910049 - XXXPJ4090X - Itrv PDFShivshankar RNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)santoshkumarNo ratings yet

- 2019 07 17 12 05 41 184 - 1563345341184 - XXXPG9565X - ItrvDocument1 page2019 07 17 12 05 41 184 - 1563345341184 - XXXPG9565X - ItrvsantoshkumarNo ratings yet

- Soumyadeep Chanda Itr Ay 2018Document1 pageSoumyadeep Chanda Itr Ay 2018Cajonized Guy DeepNo ratings yet

- Aman Jain Itr (A.y.2017-18)Document1 pageAman Jain Itr (A.y.2017-18)ramanNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)shalabhNo ratings yet

- Ack VDocument1 pageAck VShantanu MetayNo ratings yet

- MANI SIVASANKAR - 28-Feb-2019 - 427477180Document1 pageMANI SIVASANKAR - 28-Feb-2019 - 427477180samaadhuNo ratings yet

- 2018 03 04 21 10 37 424 - 1520178037424 - XXXPS9207X - ItrvDocument1 page2018 03 04 21 10 37 424 - 1520178037424 - XXXPS9207X - Itrvrohit sNo ratings yet

- Itr 2018-19 S B Mishra PDFDocument1 pageItr 2018-19 S B Mishra PDFJITENDRA DUBEBYNo ratings yet

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .KumarNo ratings yet

- 2019 03 12 17 56 10 874 - 1552393570874 - XXXPS8275X - ItrvDocument1 page2019 03 12 17 56 10 874 - 1552393570874 - XXXPS8275X - ItrvDhananjay JaiswalNo ratings yet

- 2019 07 03 19 45 07 276 - 1562163307276 - XXXPM2399X - ItrvDocument1 page2019 07 03 19 45 07 276 - 1562163307276 - XXXPM2399X - ItrvDedaram FulwariyaNo ratings yet

- Ack 18-19Document1 pageAck 18-19tax solutionsNo ratings yet

- Bava Bro PDFDocument1 pageBava Bro PDFSomasundara ReddyNo ratings yet

- 2018 08 31 18 26 34 022 - 1535720194022 - XXXPB3542X - ItrvDocument1 page2018 08 31 18 26 34 022 - 1535720194022 - XXXPB3542X - Itrvdibyan dasNo ratings yet

- Ack F.y.2017-18Document1 pageAck F.y.2017-18NishantNo ratings yet

- Sukhjeet Singh 2018-19 (Itr) PDFDocument1 pageSukhjeet Singh 2018-19 (Itr) PDFAnonymous XgLFw9IcQNo ratings yet

- Letsgettin Fraud CompanyDocument1 pageLetsgettin Fraud CompanyAnonymous A3CiCzvNo ratings yet

- 2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - ItrvDocument1 page2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - Itrvpoluri vinayNo ratings yet

- PDF 759518980120718Document1 pagePDF 759518980120718HARDIK BANSALNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagehealth with wealthNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Nida KhanNo ratings yet

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .Balkar BhullerNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageAditya SharmaNo ratings yet

- 2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFDocument1 page2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFAkshya BhoiNo ratings yet

- 2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvDocument1 page2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvHARI KRISHAN PALNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarNo ratings yet

- 2020 09 09 13 45 31 911 - 1599639331911 - XXXPM4309X - Itrv PDFDocument1 page2020 09 09 13 45 31 911 - 1599639331911 - XXXPM4309X - Itrv PDFMd Ali MujawarNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Pravin MasalgeNo ratings yet

- 2019 08 29 00 39 44 009 - 1567019384009 - XXXPK4733X - ItrvDocument1 page2019 08 29 00 39 44 009 - 1567019384009 - XXXPK4733X - Itrvramesh jothyNo ratings yet

- Edjpb0287g Itrv PDFDocument1 pageEdjpb0287g Itrv PDFArun BhatnagarNo ratings yet

- 2020 11 30 19 02 08 649 - 1606743128649 - XXXPM4571X - ItrvDocument1 page2020 11 30 19 02 08 649 - 1606743128649 - XXXPM4571X - ItrvSahana SkNo ratings yet

- Ack FY 17-18-Ramesh BDocument1 pageAck FY 17-18-Ramesh BMurthy KarumuriNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageCA Jitu DashNo ratings yet

- A.Y. 2019-20 ItrvunlDocument1 pageA.Y. 2019-20 Itrvunlkishan bhalodiyaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageBibhu Datta SenapatiNo ratings yet

- 2019 07 17 16 27 54 965 - 1563361074965 - XXXPD0630X - ItrvDocument1 page2019 07 17 16 27 54 965 - 1563361074965 - XXXPD0630X - ItrvAbhiraj dodNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDhanu goswamiNo ratings yet

- Itr-V Ajqpy0100n 2017-18 775756550170517Document1 pageItr-V Ajqpy0100n 2017-18 775756550170517Raj RajNo ratings yet

- Anuj ASAPM2826N ITR-VDocument1 pageAnuj ASAPM2826N ITR-Vapi-27088128No ratings yet

- 2019 07 17 13 29 12 415 - 1563350352415 - XXXPM7581X - Itrv PDFDocument1 page2019 07 17 13 29 12 415 - 1563350352415 - XXXPM7581X - Itrv PDFAnil AnnajiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAnsar ValiNo ratings yet

- 2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFDocument1 page2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFakshay guptaNo ratings yet

- 2019 08 21 12 13 35 858 - 1566369815858 - XXXPC1439X - Itrv PDFDocument1 page2019 08 21 12 13 35 858 - 1566369815858 - XXXPC1439X - Itrv PDFSrishti Abhishek JainNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruZa HidNo ratings yet

- Itr 19-20 PDFDocument1 pageItr 19-20 PDFAnonymous fM5CtB8Qm7No ratings yet

- Itr-V Bogpp6352h 2017-18 225020870280917Document1 pageItr-V Bogpp6352h 2017-18 225020870280917DEVIL RDXNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageLingesh MaharajanNo ratings yet

- 2020 01 02 15 41 29 892 - 1577959889892 - XXXPT8767X - AcknowledgementDocument1 page2020 01 02 15 41 29 892 - 1577959889892 - XXXPT8767X - AcknowledgementKanahiya TandonNo ratings yet

- 2020 07 28 17 40 29 427 - 1595938229427 - XXXPG8558X - ItrvDocument1 page2020 07 28 17 40 29 427 - 1595938229427 - XXXPG8558X - ItrvPANKAJ KUMAR GIRINo ratings yet

- 2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvDocument1 page2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvIshaan ChawlaNo ratings yet

- RSM Itrv 2019-20Document1 pageRSM Itrv 2019-20Rajesh KumarNo ratings yet

- 2019 07 22 18 47 23 855 - 1563801443855 - XXXPS3282X - Itrv PDFDocument1 page2019 07 22 18 47 23 855 - 1563801443855 - XXXPS3282X - Itrv PDFsselvhakumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageTaiyabaNo ratings yet

- 2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFDocument1 page2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFAnupam GauravNo ratings yet

- It 18-19Document1 pageIt 18-19mohdmoin0493No ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSai SanthoshNo ratings yet

- Acct Statement XX7262 19032023Document47 pagesAcct Statement XX7262 19032023SangeethaNo ratings yet

- Account Name Account Number Transaction Date Year TIN Transaction AmountDocument6 pagesAccount Name Account Number Transaction Date Year TIN Transaction AmountSahara ReportersNo ratings yet

- Print - ANAND VIHAR TRM (ANVT) - PATNA JN (PNBE) - 2149856314Document1 pagePrint - ANAND VIHAR TRM (ANVT) - PATNA JN (PNBE) - 2149856314Akash NandanNo ratings yet

- Payroll ResultsDocument10 pagesPayroll ResultsMuhammad JaveedNo ratings yet

- EPG REST Integration v.1.3.1Document37 pagesEPG REST Integration v.1.3.1Sain S - iRoid0% (1)

- Automatic PaymentsDocument12 pagesAutomatic PaymentsfinerpmanyamNo ratings yet

- PFMS Generated Print Payment Advice: To, The Branch HeadDocument1 pagePFMS Generated Print Payment Advice: To, The Branch HeadHarsh VarshneyNo ratings yet

- Revenue Memorandum Circular 36-2021 v2Document32 pagesRevenue Memorandum Circular 36-2021 v2lizzyNo ratings yet

- Negotiable Instruments Law: CASES: Phil. Educ. Co., Inc. vs. Soriano, 39 SCRA 587 Tibajia, Jr. vs. CA, 223 SCRADocument8 pagesNegotiable Instruments Law: CASES: Phil. Educ. Co., Inc. vs. Soriano, 39 SCRA 587 Tibajia, Jr. vs. CA, 223 SCRAdnel13No ratings yet

- AC 3101 CHAPTER 10 NotesDocument2 pagesAC 3101 CHAPTER 10 NotesKemuel TantuanNo ratings yet

- Lotto For Deaf PeopleDocument11 pagesLotto For Deaf PeoplePREMIUM LANo ratings yet

- Collection O 64556 Nimisha Jail RD Near Bada Hanuman Mandir, SitapurDocument1 pageCollection O 64556 Nimisha Jail RD Near Bada Hanuman Mandir, SitapurAmaan HussainNo ratings yet

- Public Finance and Taxation AssignemetDocument3 pagesPublic Finance and Taxation AssignemetEmebet TesemaNo ratings yet

- Valuation, Composition and ITCDocument1 pageValuation, Composition and ITCsowmithNo ratings yet

- Cta 2D CV 08551 D 2015oct02 Ass PDFDocument37 pagesCta 2D CV 08551 D 2015oct02 Ass PDFMonica SorianoNo ratings yet

- LC For Akij Biax Films Limited: CO2012102 0 December 22, 2020Document2 pagesLC For Akij Biax Films Limited: CO2012102 0 December 22, 2020Mahadi Hassan ShemulNo ratings yet

- Bir TaxDocument97 pagesBir TaxVincent De VeraNo ratings yet

- Business Taxation Past Paper 2019 PDFDocument2 pagesBusiness Taxation Past Paper 2019 PDFNouman BaigNo ratings yet

- Estate TaxDocument8 pagesEstate TaxAngel Alejo AcobaNo ratings yet

- Complying With Country Requirements Using Financials CloudDocument45 pagesComplying With Country Requirements Using Financials CloudRavi MaratheNo ratings yet

- Collection of HC and SC DecisionsDocument63 pagesCollection of HC and SC DecisionsDayavantiNo ratings yet

- 4 - Class 4Document13 pages4 - Class 4M Almas MalikNo ratings yet

- Basic Principles of A Sound Tax SystemDocument6 pagesBasic Principles of A Sound Tax SystemhppddlNo ratings yet

- Pillar 2Document30 pagesPillar 2Joel IsabiryeNo ratings yet

- Canara Credit Cards User Manual - For WebsiteDocument11 pagesCanara Credit Cards User Manual - For WebsiteSuperdudeGauravNo ratings yet

- English For Academic Purposes (EAP) : Humber - Ca/myhumberDocument4 pagesEnglish For Academic Purposes (EAP) : Humber - Ca/myhumberRodrigo MartinezNo ratings yet