Professional Documents

Culture Documents

A-3 Capital Budgeting

A-3 Capital Budgeting

Uploaded by

UTkarsh DOgraCopyright:

Available Formats

You might also like

- Capital Budgeting: Payback PeriodDocument4 pagesCapital Budgeting: Payback PeriodPooja SunkiNo ratings yet

- 4.unit-4 Capital BudgetingDocument51 pages4.unit-4 Capital BudgetingGaganGabriel100% (1)

- Q No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyDocument3 pagesQ No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyMuneeb Qureshi0% (1)

- CH 3 - ProblemsDocument7 pagesCH 3 - ProblemsEspace NuvemNo ratings yet

- Invesrment Decision Problems Only QuestionsDocument7 pagesInvesrment Decision Problems Only QuestionsDivyasree DsNo ratings yet

- Capital Budgeting For MSC Finance Basic Revision SumsDocument5 pagesCapital Budgeting For MSC Finance Basic Revision SumskimjethaNo ratings yet

- Capital BudgetingDocument8 pagesCapital BudgetingArun AntonyNo ratings yet

- Assignment - 1 (Capital Budgeting)Document3 pagesAssignment - 1 (Capital Budgeting)AnusreeNo ratings yet

- 10 Capital Budgetting Techniques of Evolution PDFDocument57 pages10 Capital Budgetting Techniques of Evolution PDFVishesh GuptaNo ratings yet

- FM - Assignment 2 (Capital Budgeting) - 2019-2021Document3 pagesFM - Assignment 2 (Capital Budgeting) - 2019-2021dangerous saif100% (1)

- Numericals On Capital BudgetingDocument3 pagesNumericals On Capital BudgetingRevati ShindeNo ratings yet

- Capital Budgeting CW FMPDocument6 pagesCapital Budgeting CW FMPSufyan Ashraf100% (1)

- Capital Budgeting Numericals and CasesDocument5 pagesCapital Budgeting Numericals and CasesAnkur ShuklaNo ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- Capital Budgeting IiiDocument25 pagesCapital Budgeting IiiRanu AgrawalNo ratings yet

- Capital BudgetingDocument4 pagesCapital BudgetingShaji Kutty0% (1)

- UNIT-II-Problems On Capital BudgetingDocument2 pagesUNIT-II-Problems On Capital BudgetingGlyding FlyerNo ratings yet

- Capital Budgeting NotesDocument3 pagesCapital Budgeting NotesSahil RupaniNo ratings yet

- Investment DecisionsDocument4 pagesInvestment DecisionsDevadutt M.SNo ratings yet

- Capital BudgetingDocument8 pagesCapital BudgetingKhushi RaniNo ratings yet

- MAS Part II Illustrative Examples (Capital Budgeting)Document2 pagesMAS Part II Illustrative Examples (Capital Budgeting)Princess SalvadorNo ratings yet

- 06 Investment DecisionsDocument23 pages06 Investment Decisionsnsm2zmvnbbNo ratings yet

- HW3MGT517Document3 pagesHW3MGT517Jaya PaudwalNo ratings yet

- Management Accounting Exam S2 2022Document6 pagesManagement Accounting Exam S2 2022bonaventure chipetaNo ratings yet

- Capital BudgetingDocument9 pagesCapital BudgetingAnoop SinghNo ratings yet

- Worksheet 18Document2 pagesWorksheet 18Trianbh SharmaNo ratings yet

- Project Planning and Capital BudgetingDocument16 pagesProject Planning and Capital BudgetingtoabhishekpalNo ratings yet

- Simsr2 Mba B III FM Quep 1Document4 pagesSimsr2 Mba B III FM Quep 1Priyanka ReddyNo ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- NPVDocument3 pagesNPVaishwarya raikarNo ratings yet

- AssignmentDocument5 pagesAssignmentAsmita MoonNo ratings yet

- Assignment Problems On Cap BudDocument3 pagesAssignment Problems On Cap BudSunil TripathiNo ratings yet

- Capital Budgeting Problems 1Document5 pagesCapital Budgeting Problems 1Juber AhamadNo ratings yet

- Paper - 8: Financial Management & Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument32 pagesPaper - 8: Financial Management & Economics For Finance Part A: Financial Management Questions Ratio AnalysisVarun MurthyNo ratings yet

- Adobe Scan 01 Jul 2023Document5 pagesAdobe Scan 01 Jul 2023Faisal NawazNo ratings yet

- Investment Appraisal/capital Investment: Page 1 of 20Document20 pagesInvestment Appraisal/capital Investment: Page 1 of 20parwez_0505No ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- CAPITAL BUDGETING AssignmentDocument4 pagesCAPITAL BUDGETING Assignmentqurban baloch100% (1)

- Tybms Sem Vi SFM AsssignmentDocument1 pageTybms Sem Vi SFM AsssignmentGauri SawantNo ratings yet

- Chapter 6 - Capital BudgetingDocument12 pagesChapter 6 - Capital BudgetingParth GargNo ratings yet

- Capital Budgeting-ProblemsDocument5 pagesCapital Budgeting-ProblemsUday Gowda50% (2)

- Capital Budgeting: Ravi Kanth MiriyalaDocument20 pagesCapital Budgeting: Ravi Kanth MiriyalaBonkyNo ratings yet

- Bcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Document5 pagesBcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Shrikant AvzekarNo ratings yet

- Capital Budgeting 1Document3 pagesCapital Budgeting 1maha SriNo ratings yet

- VND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1Document4 pagesVND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1Rohit Singh RajputNo ratings yet

- Costing MTP g1Document198 pagesCosting MTP g1Jattu TatiNo ratings yet

- Cap Evaluation Methods QuestionsDocument4 pagesCap Evaluation Methods QuestionsSrijan AcharyaNo ratings yet

- 620669c280570504de6f585f Office DocumentDocument3 pages620669c280570504de6f585f Office DocumentParas RastogiNo ratings yet

- Part A: DE3J 35: Preparing Financial ForecastsDocument5 pagesPart A: DE3J 35: Preparing Financial ForecastsShu LaiNo ratings yet

- Capital Budgeting: Even Cash Flow Uneven Cash FlowDocument2 pagesCapital Budgeting: Even Cash Flow Uneven Cash FlowKeno OcampoNo ratings yet

- Quiz On Cap BudgDocument3 pagesQuiz On Cap BudgjjjjjjjjNo ratings yet

- 15-Mca-Nr-Accounting and Financial ManagementDocument4 pages15-Mca-Nr-Accounting and Financial ManagementSRINIVASA RAO GANTA0% (2)

- Unit III-PROBLEMSDocument6 pagesUnit III-PROBLEMSPranav GaikwadNo ratings yet

- Solved Answers For Payback PeriodDocument9 pagesSolved Answers For Payback Periodwihanga100% (2)

- Problems CF2Document7 pagesProblems CF2TrinhNo ratings yet

- Fin Mang 2020Document3 pagesFin Mang 2020vinayakraj jamreNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- TRM, New Instruments, Accounting Enhancements, ReportingDocument8 pagesTRM, New Instruments, Accounting Enhancements, ReportingGK SKNo ratings yet

- Ignacy Jan Paderewski A Discography of His European RecordingsDocument9 pagesIgnacy Jan Paderewski A Discography of His European RecordingsCody NguyenNo ratings yet

- Offer Letter - Naveen NarayananDocument15 pagesOffer Letter - Naveen NarayananNaveen NarayananNo ratings yet

- Debebe SeifuDocument170 pagesDebebe SeifuObsaa JirraNo ratings yet

- Table of FIDIC Cases - 03 07 2023Document49 pagesTable of FIDIC Cases - 03 07 2023Vyom VakhariyaNo ratings yet

- Rename Lagu Karaoke-MandarinDocument6 pagesRename Lagu Karaoke-MandarinMia KhalystaNo ratings yet

- 2 Jurnal Jenis RacunDocument17 pages2 Jurnal Jenis RacunRifky NovanNo ratings yet

- Gifted Identification MatrixDocument2 pagesGifted Identification MatrixMike EskilsonNo ratings yet

- Online Gambling Company Fights Iroquois' War of Words - Growth Capitalist 6.11.2014Document4 pagesOnline Gambling Company Fights Iroquois' War of Words - Growth Capitalist 6.11.2014Teri BuhlNo ratings yet

- GP Sheet Stock HosurDocument4 pagesGP Sheet Stock HosurSURANA1973No ratings yet

- NiCad Trans 11 - A03Document4 pagesNiCad Trans 11 - A03danielliram993No ratings yet

- IET Automotive Cyber-Security TLR LR PDFDocument16 pagesIET Automotive Cyber-Security TLR LR PDFPanneerselvam KolandaivelNo ratings yet

- RMDocument23 pagesRMVarun MoodbidriNo ratings yet

- Sales Trading Resume TemplateDocument1 pageSales Trading Resume TemplateBlake ZhangNo ratings yet

- Figures of SpeechDocument3 pagesFigures of SpeechLyka Isabel TanNo ratings yet

- Smoking During Pregnancy FinalDocument14 pagesSmoking During Pregnancy Finalapi-232728488No ratings yet

- Waimiri Atroari GrammarDocument187 pagesWaimiri Atroari GrammarjjlajomNo ratings yet

- ADMISSION 2020-21 ADMISSION 2020-21 ADMISSION 2020-21 Deposit Slip Deposit SlipDocument2 pagesADMISSION 2020-21 ADMISSION 2020-21 ADMISSION 2020-21 Deposit Slip Deposit SlipJahanzeb Ahmed SoomroNo ratings yet

- Jaydapinketsmithenwissam AvanzadoremiDocument6 pagesJaydapinketsmithenwissam AvanzadoremiGysht HwuNo ratings yet

- Đề 1Document9 pagesĐề 1Tôm TômNo ratings yet

- Leadership AssignmentDocument4 pagesLeadership AssignmentAasha BhandariNo ratings yet

- Employment Law For Business 8th Edition Bennett Alexander Test BankDocument24 pagesEmployment Law For Business 8th Edition Bennett Alexander Test Bankrussellmatthewspctjegdyox100% (21)

- Pastor Vs Gaspar Case DigestDocument2 pagesPastor Vs Gaspar Case DigestybunNo ratings yet

- Soal AdrianiDocument3 pagesSoal AdrianiAhmad SupianNo ratings yet

- Genre Analysis On Racial StereotypeDocument4 pagesGenre Analysis On Racial Stereotypeapi-316855715No ratings yet

- Grade Five 2nd Assessment 2023Document5 pagesGrade Five 2nd Assessment 2023Chisom NwekeNo ratings yet

- TheNewLink AWESNAretreat2018ADocument32 pagesTheNewLink AWESNAretreat2018ALaurence Tabanao GayaoNo ratings yet

- 6 CultivatingDocument51 pages6 CultivatingPiyush SehgalNo ratings yet

- Ojoyoshu by Genshin, Translated From Japanese by A.K. ReischauerDocument136 pagesOjoyoshu by Genshin, Translated From Japanese by A.K. ReischauerJōshō Adrian Cirlea100% (6)

- 2019 - 1 POP Final Timetable - 0Document30 pages2019 - 1 POP Final Timetable - 0Anonymous IjhB0kuFNo ratings yet

A-3 Capital Budgeting

A-3 Capital Budgeting

Uploaded by

UTkarsh DOgraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A-3 Capital Budgeting

A-3 Capital Budgeting

Uploaded by

UTkarsh DOgraCopyright:

Available Formats

INSTITUTE OF INNOVATION IN TECHNOLOGY & MANAGEMENT

PAPER: FINANCIAL MANAGEMENT PAPER CODE: BBA 204

PROGRAMME: BBA IV SEMESTER

ASSIGNMENT-3

UNIT-2: CAPITAL BUDGETING

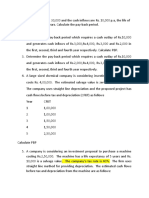

Q1: Calculate payback period, Net present value, IRR and PI for machines A and B which would you

choose? Why k=12%

Year A B

0 20,00,000 30,00,000

1 4,00,000 4,00,000

2 4,00,000 4,00,000

3 4,00,000 4,00,000

4 4,00,000 4,00,000

5 4,00,000 4,00,000

6 4,00,000 3,00,000

7 4,00,000 3,00,000

8 4,00,000 2,00,000

9 4,00,000 2,00,000

10 4,00,000 2,00,000

Answers [A= 5years, 2, 60,000, 1.13; B= 9years, 10, 52,900, 0.649]

Q2: A company plans to purchase a machine of Rs.12 lakhs.The future cash inflows are expected to be

Rs. 5 lakhs, 4 lakhs and 6 lakhs. (a) Calculate NPV and PI when minimum cost of capital is 10% and the

life of machine is 3years (b) would you still purchase the machine if the cost of capital is 12%? Answers

[a] 35,500, 1.029 [b] 8,600,0.992.

Q3: Find NPV if project A and B are evaluated. Which of these should be accepted? Equipment A costs

rs.75, 000 and brings a net cash flow of Rs 20,000 per year for 6 years. A substitutes equipment B would

cost rs.50, 000 and generate net cash flow of Rs 15,000 per year for 6 years .the required rate of return for

both the equipment is 11%?

Q4: A company is contemplating to purchase a machine. Two machines A and B are available, each

costing Rs. 5 lakhs. In comparing the profitability of the machines, a discounting rate of 10% is to be used

and machine is to be written off in 5years by straight line method of depreciation with nil residual value.

Cash inflows after tax are expected as follows:

Year Machine A [in lakhs] Machine B [in lakhs]

1 1.5 0.5

2 2.0 1.5

3 2.5 2.0

4 1.5 3.0

5 1.0 2.0

Shilpa Narang Page 1

Q5: XY ltd. wants to replace its existing plant. It has received three mutually exclusive proposals are

expected to cost Rs. 2,50,000 each and have an estimated life of 5years,4years,3years respectively. The

company’s required rate of return is 10%.the anticipated net cash inflow after taxes for the three plants are

as follows:

Years Plant 1 Plant 2 Plant 3

1 80,000 1,10,000 1,30,000

2 60,000 90,000 1,10,000

3 60,000 85,000 20,000

4 60,000 35,000 -

5 1,80,000 - -

Which of the above proposals would you recommend to the management acceptance using NPV

technique for evaluation?

Years PVF[10%]

1 0.909

2 0.826

3 0.751

4 0.683

5 0.621

Q6: Payoff ltd. Is producing articles mostly by manual labour and is considering replacing it by a new

machine. There are two alternative models M and N of the new machine, prepare a statement of

profitability showing the payback period from the following information:

Particulars Machine M Machine N

Estimated life of machine 4 years 5 years

Cost of machine 9000 18000

Estimated saving in scrap 500 800

Estimated saving in direct wages 6000 8000

Additional cost of maintenance 800 1000

Additional cost of supervision 1200 1800

Ignore taxation.

Q7: ABC Company has an investment opportunity costing Rs 1 lakh with the following expected cash

inflow [i.e after taxes and before depreciation]

Years Inflows [rs]

1 17,000

2 17,000

3 17,000

4 17,000

5 17,000

6 18,000

7 20,000

8 15,000

9 14,000

10 12,000

Shilpa Narang Page 2

Using 10% as the cost of capital [rate of discount], determine the NPV and PI.

Q8: Aroma Finance co. is considering two mutually exclusive projects. The expected values for each

project’s cash flows are as follows:

year Project A Project B

0 (300,000) (300,000)

1 100,000 200,000

2 200,000 200,000

3 200,000 200,000

4 300,000 300,000

5 300,000 400,000

The company has decided to evaluate these projects using the certainty equivalent method. The certainty

equivalent coefficients for each project’s cash flow are as follows:

Year Project A Project B

0 1.00 1.00

1 0.95 0.90

2 0.90 0.80

3 0.85 0.70

4 0.80 0.60

5 0.75 0.50

Given that this company’s normal required rate of return is 15% and the after tax risk free rate is 8%,

which project should be selected?

[Answer: NPV OF project A: 406,835 and project B: 383,720]

Q9From the following data, state which project is best:

year A B

0 -10000 -10000

1 4000 5000

2 4000 6000

3 2000 3000

Riskless discount rate is 5%.project A is less risky as compare to project B. the management considers

risk premium rates at 5% and 10% respectively appropriate for discounting the cash inflows.

Shilpa Narang Page 3

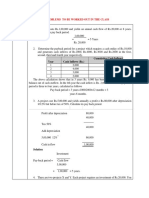

Q10: The management of P ltd is considering selecting a machine out of two mutually exclusive

machines. The company’s cost of capital is 12% and corporate tax rate for the company is 30%. Details of

the machines are as follows:

Machine 1 Machine 2

Cost of machine 1,000,000 1,500,000

Expected life 5years 6years

Annual income before tax and 345,000 455,000

depreciation

Depreciation is to be charge on straight line basis.

You are required to:

1: calculate the discounted payback period, net present value and internal rate of return for each machine.

2: advise the management of P ltd as to which machine they should take up.

ANSWERS: [NPV: M1=86,909; M2=1,18,074] [IRR: M1=15.46%; M2=14.74%] [payback period:

M1=4.49 YRS; M2=5.41 YRS]

Q11: One out of three mutually exclusive plants A, B and C have to be purchased. The plants are

reported to cost 200,000 each and have an estimated life of 5 years, 4 years and 3 years respectively and

have no salvage value. The company’s rate of return is 10%. The anticipated cash inflows after taxes are

the 3 plants are as follows:

Year Plant A Plant B Plant C

1 50,000 80,000 1,00,000

2 50,000 80,000 1,00,000

3 50,000 80,000 10,000

4 50,000 30,000 _

5 1,90,000 _ _

Find out payback, average rate of return, NPV and profitability index.

Answers [NPV: A=76,440; B=19,370; C=18,990] [payback period: A=4 YRS; B=2.5 YRS; C=2 YRS]

[PI: A=1.3822; B=1.0968; C=0.905] [ARR: A=55.288%; B=54.843%; C=60.336%]

Shilpa Narang Page 4

You might also like

- Capital Budgeting: Payback PeriodDocument4 pagesCapital Budgeting: Payback PeriodPooja SunkiNo ratings yet

- 4.unit-4 Capital BudgetingDocument51 pages4.unit-4 Capital BudgetingGaganGabriel100% (1)

- Q No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyDocument3 pagesQ No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyMuneeb Qureshi0% (1)

- CH 3 - ProblemsDocument7 pagesCH 3 - ProblemsEspace NuvemNo ratings yet

- Invesrment Decision Problems Only QuestionsDocument7 pagesInvesrment Decision Problems Only QuestionsDivyasree DsNo ratings yet

- Capital Budgeting For MSC Finance Basic Revision SumsDocument5 pagesCapital Budgeting For MSC Finance Basic Revision SumskimjethaNo ratings yet

- Capital BudgetingDocument8 pagesCapital BudgetingArun AntonyNo ratings yet

- Assignment - 1 (Capital Budgeting)Document3 pagesAssignment - 1 (Capital Budgeting)AnusreeNo ratings yet

- 10 Capital Budgetting Techniques of Evolution PDFDocument57 pages10 Capital Budgetting Techniques of Evolution PDFVishesh GuptaNo ratings yet

- FM - Assignment 2 (Capital Budgeting) - 2019-2021Document3 pagesFM - Assignment 2 (Capital Budgeting) - 2019-2021dangerous saif100% (1)

- Numericals On Capital BudgetingDocument3 pagesNumericals On Capital BudgetingRevati ShindeNo ratings yet

- Capital Budgeting CW FMPDocument6 pagesCapital Budgeting CW FMPSufyan Ashraf100% (1)

- Capital Budgeting Numericals and CasesDocument5 pagesCapital Budgeting Numericals and CasesAnkur ShuklaNo ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- Capital Budgeting IiiDocument25 pagesCapital Budgeting IiiRanu AgrawalNo ratings yet

- Capital BudgetingDocument4 pagesCapital BudgetingShaji Kutty0% (1)

- UNIT-II-Problems On Capital BudgetingDocument2 pagesUNIT-II-Problems On Capital BudgetingGlyding FlyerNo ratings yet

- Capital Budgeting NotesDocument3 pagesCapital Budgeting NotesSahil RupaniNo ratings yet

- Investment DecisionsDocument4 pagesInvestment DecisionsDevadutt M.SNo ratings yet

- Capital BudgetingDocument8 pagesCapital BudgetingKhushi RaniNo ratings yet

- MAS Part II Illustrative Examples (Capital Budgeting)Document2 pagesMAS Part II Illustrative Examples (Capital Budgeting)Princess SalvadorNo ratings yet

- 06 Investment DecisionsDocument23 pages06 Investment Decisionsnsm2zmvnbbNo ratings yet

- HW3MGT517Document3 pagesHW3MGT517Jaya PaudwalNo ratings yet

- Management Accounting Exam S2 2022Document6 pagesManagement Accounting Exam S2 2022bonaventure chipetaNo ratings yet

- Capital BudgetingDocument9 pagesCapital BudgetingAnoop SinghNo ratings yet

- Worksheet 18Document2 pagesWorksheet 18Trianbh SharmaNo ratings yet

- Project Planning and Capital BudgetingDocument16 pagesProject Planning and Capital BudgetingtoabhishekpalNo ratings yet

- Simsr2 Mba B III FM Quep 1Document4 pagesSimsr2 Mba B III FM Quep 1Priyanka ReddyNo ratings yet

- Capital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFDocument7 pagesCapital Budgeting Sums - 16-17 (2018 - 05 - 19 12 - 01 - 33 UTC) (2019 - 01 - 22 04 - 17 - 23 UTC) (2019 - 07 - 02 05 - 43 - 05 UTC) PDFutsavNo ratings yet

- NPVDocument3 pagesNPVaishwarya raikarNo ratings yet

- AssignmentDocument5 pagesAssignmentAsmita MoonNo ratings yet

- Assignment Problems On Cap BudDocument3 pagesAssignment Problems On Cap BudSunil TripathiNo ratings yet

- Capital Budgeting Problems 1Document5 pagesCapital Budgeting Problems 1Juber AhamadNo ratings yet

- Paper - 8: Financial Management & Economics For Finance Part A: Financial Management Questions Ratio AnalysisDocument32 pagesPaper - 8: Financial Management & Economics For Finance Part A: Financial Management Questions Ratio AnalysisVarun MurthyNo ratings yet

- Adobe Scan 01 Jul 2023Document5 pagesAdobe Scan 01 Jul 2023Faisal NawazNo ratings yet

- Investment Appraisal/capital Investment: Page 1 of 20Document20 pagesInvestment Appraisal/capital Investment: Page 1 of 20parwez_0505No ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- CAPITAL BUDGETING AssignmentDocument4 pagesCAPITAL BUDGETING Assignmentqurban baloch100% (1)

- Tybms Sem Vi SFM AsssignmentDocument1 pageTybms Sem Vi SFM AsssignmentGauri SawantNo ratings yet

- Chapter 6 - Capital BudgetingDocument12 pagesChapter 6 - Capital BudgetingParth GargNo ratings yet

- Capital Budgeting-ProblemsDocument5 pagesCapital Budgeting-ProblemsUday Gowda50% (2)

- Capital Budgeting: Ravi Kanth MiriyalaDocument20 pagesCapital Budgeting: Ravi Kanth MiriyalaBonkyNo ratings yet

- Bcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Document5 pagesBcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Shrikant AvzekarNo ratings yet

- Capital Budgeting 1Document3 pagesCapital Budgeting 1maha SriNo ratings yet

- VND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1Document4 pagesVND Openxmlformats-Officedocument Wordprocessingml Document&rendition 1Rohit Singh RajputNo ratings yet

- Costing MTP g1Document198 pagesCosting MTP g1Jattu TatiNo ratings yet

- Cap Evaluation Methods QuestionsDocument4 pagesCap Evaluation Methods QuestionsSrijan AcharyaNo ratings yet

- 620669c280570504de6f585f Office DocumentDocument3 pages620669c280570504de6f585f Office DocumentParas RastogiNo ratings yet

- Part A: DE3J 35: Preparing Financial ForecastsDocument5 pagesPart A: DE3J 35: Preparing Financial ForecastsShu LaiNo ratings yet

- Capital Budgeting: Even Cash Flow Uneven Cash FlowDocument2 pagesCapital Budgeting: Even Cash Flow Uneven Cash FlowKeno OcampoNo ratings yet

- Quiz On Cap BudgDocument3 pagesQuiz On Cap BudgjjjjjjjjNo ratings yet

- 15-Mca-Nr-Accounting and Financial ManagementDocument4 pages15-Mca-Nr-Accounting and Financial ManagementSRINIVASA RAO GANTA0% (2)

- Unit III-PROBLEMSDocument6 pagesUnit III-PROBLEMSPranav GaikwadNo ratings yet

- Solved Answers For Payback PeriodDocument9 pagesSolved Answers For Payback Periodwihanga100% (2)

- Problems CF2Document7 pagesProblems CF2TrinhNo ratings yet

- Fin Mang 2020Document3 pagesFin Mang 2020vinayakraj jamreNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- TRM, New Instruments, Accounting Enhancements, ReportingDocument8 pagesTRM, New Instruments, Accounting Enhancements, ReportingGK SKNo ratings yet

- Ignacy Jan Paderewski A Discography of His European RecordingsDocument9 pagesIgnacy Jan Paderewski A Discography of His European RecordingsCody NguyenNo ratings yet

- Offer Letter - Naveen NarayananDocument15 pagesOffer Letter - Naveen NarayananNaveen NarayananNo ratings yet

- Debebe SeifuDocument170 pagesDebebe SeifuObsaa JirraNo ratings yet

- Table of FIDIC Cases - 03 07 2023Document49 pagesTable of FIDIC Cases - 03 07 2023Vyom VakhariyaNo ratings yet

- Rename Lagu Karaoke-MandarinDocument6 pagesRename Lagu Karaoke-MandarinMia KhalystaNo ratings yet

- 2 Jurnal Jenis RacunDocument17 pages2 Jurnal Jenis RacunRifky NovanNo ratings yet

- Gifted Identification MatrixDocument2 pagesGifted Identification MatrixMike EskilsonNo ratings yet

- Online Gambling Company Fights Iroquois' War of Words - Growth Capitalist 6.11.2014Document4 pagesOnline Gambling Company Fights Iroquois' War of Words - Growth Capitalist 6.11.2014Teri BuhlNo ratings yet

- GP Sheet Stock HosurDocument4 pagesGP Sheet Stock HosurSURANA1973No ratings yet

- NiCad Trans 11 - A03Document4 pagesNiCad Trans 11 - A03danielliram993No ratings yet

- IET Automotive Cyber-Security TLR LR PDFDocument16 pagesIET Automotive Cyber-Security TLR LR PDFPanneerselvam KolandaivelNo ratings yet

- RMDocument23 pagesRMVarun MoodbidriNo ratings yet

- Sales Trading Resume TemplateDocument1 pageSales Trading Resume TemplateBlake ZhangNo ratings yet

- Figures of SpeechDocument3 pagesFigures of SpeechLyka Isabel TanNo ratings yet

- Smoking During Pregnancy FinalDocument14 pagesSmoking During Pregnancy Finalapi-232728488No ratings yet

- Waimiri Atroari GrammarDocument187 pagesWaimiri Atroari GrammarjjlajomNo ratings yet

- ADMISSION 2020-21 ADMISSION 2020-21 ADMISSION 2020-21 Deposit Slip Deposit SlipDocument2 pagesADMISSION 2020-21 ADMISSION 2020-21 ADMISSION 2020-21 Deposit Slip Deposit SlipJahanzeb Ahmed SoomroNo ratings yet

- Jaydapinketsmithenwissam AvanzadoremiDocument6 pagesJaydapinketsmithenwissam AvanzadoremiGysht HwuNo ratings yet

- Đề 1Document9 pagesĐề 1Tôm TômNo ratings yet

- Leadership AssignmentDocument4 pagesLeadership AssignmentAasha BhandariNo ratings yet

- Employment Law For Business 8th Edition Bennett Alexander Test BankDocument24 pagesEmployment Law For Business 8th Edition Bennett Alexander Test Bankrussellmatthewspctjegdyox100% (21)

- Pastor Vs Gaspar Case DigestDocument2 pagesPastor Vs Gaspar Case DigestybunNo ratings yet

- Soal AdrianiDocument3 pagesSoal AdrianiAhmad SupianNo ratings yet

- Genre Analysis On Racial StereotypeDocument4 pagesGenre Analysis On Racial Stereotypeapi-316855715No ratings yet

- Grade Five 2nd Assessment 2023Document5 pagesGrade Five 2nd Assessment 2023Chisom NwekeNo ratings yet

- TheNewLink AWESNAretreat2018ADocument32 pagesTheNewLink AWESNAretreat2018ALaurence Tabanao GayaoNo ratings yet

- 6 CultivatingDocument51 pages6 CultivatingPiyush SehgalNo ratings yet

- Ojoyoshu by Genshin, Translated From Japanese by A.K. ReischauerDocument136 pagesOjoyoshu by Genshin, Translated From Japanese by A.K. ReischauerJōshō Adrian Cirlea100% (6)

- 2019 - 1 POP Final Timetable - 0Document30 pages2019 - 1 POP Final Timetable - 0Anonymous IjhB0kuFNo ratings yet