Professional Documents

Culture Documents

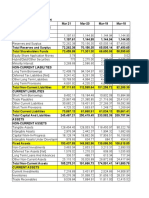

Fiscal Year Is January-December. All Values MYR Thousands. 2014 2013 2012 2011 2010

Fiscal Year Is January-December. All Values MYR Thousands. 2014 2013 2012 2011 2010

Uploaded by

Najmi Ishak0 ratings0% found this document useful (0 votes)

14 views6 pagesPenta's net cash from operating activities in 2014 was MYR 12,040,400, an increase of 117.22% from 2013. Net cash used in investing activities was MYR 2,070,400 primarily due to capital expenditures of MYR 2,125,300. Net cash used in financing activities was MYR 6,506,900 mainly from a decrease in current debt of MYR 6,381,000. As a result, Penta's net change in cash for 2014 was a positive MYR 3,483,400.

Original Description:

penta2

Original Title

penta2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPenta's net cash from operating activities in 2014 was MYR 12,040,400, an increase of 117.22% from 2013. Net cash used in investing activities was MYR 2,070,400 primarily due to capital expenditures of MYR 2,125,300. Net cash used in financing activities was MYR 6,506,900 mainly from a decrease in current debt of MYR 6,381,000. As a result, Penta's net change in cash for 2014 was a positive MYR 3,483,400.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

14 views6 pagesFiscal Year Is January-December. All Values MYR Thousands. 2014 2013 2012 2011 2010

Fiscal Year Is January-December. All Values MYR Thousands. 2014 2013 2012 2011 2010

Uploaded by

Najmi IshakPenta's net cash from operating activities in 2014 was MYR 12,040,400, an increase of 117.22% from 2013. Net cash used in investing activities was MYR 2,070,400 primarily due to capital expenditures of MYR 2,125,300. Net cash used in financing activities was MYR 6,506,900 mainly from a decrease in current debt of MYR 6,381,000. As a result, Penta's net change in cash for 2014 was a positive MYR 3,483,400.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 6

CASH FLOW - PENTA

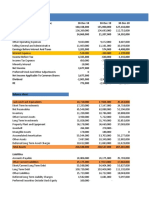

Operating Activities

Fiscal year is January-

December. All values MYR

Thousands. 2014 2013 2012 2011 2010

Net Income before

7,351.50 3,918.30 -2,083.20 2,145.10 -26,393.20

Extraordinaries

Net Income Growth 87.62% 288.09% -197.11% 108.13% -

Depreciation, Depletion &

3,927.50 6,315.20 5,544.70 7,029.30 8,911.00

Amortization

Depreciation and Depletion 2,606.20 2,714.00 2,855.20 2,941.90 5,811.30

Amortization of Intangible

1,321.30 3,601.20 2,689.60 4,087.40 3,099.80

Assets

Other Funds -151.8 -3,919.80 1,322.00 -2,127.30 20,066.70

Funds from Operations 11,127.20 6,313.80 4,783.50 7,047.10 2,584.60

Changes in Working Capital 913.2 -770.7 -8,570.60 -10,379.30 13,992.50

Receivables -2,933.50 1,546.40 -7,393.50 3,843.00 -224.9

Inventories 146.5 508.9 -6,999.00 3,784.60 324.4

Accounts Payable 3,297.70 -2,826.00 5,821.90 -18,006.90 13,893.10

Other Assets/Liabilities 402.5 - - - -

Net Operating Cash Flow 12,040.40 5,543.00 -3,787.10 -3,332.20 16,577.10

Net Operating Cash Flow

117.22% 246.37% -13.65% -120.10% -

Growth

Net Operating Cash Flow /

14.86% 8.23% -6.66% -5.27% 19.76%

Sales

Investing Activities

All values MYR Thousands. 2014 2013 2012 2011 2010

Capital Expenditures -2,125.30 -1,786.90 -64.6 - -2,753.90

Capital Expenditures (Fixed

-408.4 -229.5 -64.6 - -779.3

Assets)

Capital Expenditures (Other

-1,717.00 -1,557.40 - - -1,974.60

Assets)

Capital Expenditures Growth -18.94% -2665.05% 0.00% 0.00% -

Capital Expenditures / Sales -2.62% -2.65% -0.11% 0.00% -3.28%

Sale of Fixed Assets &

54.9 5.8 28 48,298.00 377

Businesses

Other Sources - 408 - - -

Net Investing Cash Flow -2,070.40 -1,373.10 -36.6 48,298.00 -2,376.90

Net Investing Cash Flow

-50.78% -3649.13% -100.08% 2131.96% -

Growth

Net Investing Cash Flow /

-2.55% -2.04% -0.06% 76.38% -2.83%

Sales

Financing Activities

All values MYR Thousands. 2014 2013 2012 2011 2010

Issuance/Reduction of Debt,

-6,506.90 -4,331.70 2,985.30 -45,133.90 -12,747.30

Net

Change in Current Debt -6,381.00 -4,261.00 6,367.70 -4,757.20 -6,618.10

Change in Long-Term Debt -125.9 -70.7 -3,382.40 -40,376.70 -6,129.20

Reduction in Long-Term Debt -125.9 -70.7 -3,382.40 -40,376.70 -6,129.20

Net Financing Cash Flow -6,506.90 -4,331.70 2,985.30 -45,133.90 -12,747.30

Net Financing Cash Flow

-50.21% -245.10% 106.61% -254.07% -

Growth

Net Financing Cash Flow /

-8.03% -6.43% 5.25% -71.37% -15.19%

Sales

Exchange Rate Effect 20.2 -40.1 0 -40.2 -4

Miscellaneous Funds 0 0 0 0 0 -

Net Change in Cash 3,483.40 -201.9 -838.4 -208.4 1,448.90

Free Cash Flow 11,632.10 5,313.60 -3,851.70 -3,332.20 15,797.80

Free Cash Flow Growth 118.91% 237.95% -15.59% -121.09% -

Free Cash Flow Yield 23.28% - - - -

-

You might also like

- Standalone Kitchen Model WorkingDocument3 pagesStandalone Kitchen Model WorkingSujith psNo ratings yet

- Road Safety Audit GuidelinesDocument20 pagesRoad Safety Audit GuidelinesNajmi Ishak100% (3)

- AvantGarde Systems Solutions Nigeria LTD Company ProfileDocument18 pagesAvantGarde Systems Solutions Nigeria LTD Company ProfileGboyegaAboderinNo ratings yet

- Honeywell Automation India LTD.: Net Cash Flow From Operating ActivitiesDocument2 pagesHoneywell Automation India LTD.: Net Cash Flow From Operating ActivitiesArshad MohammedNo ratings yet

- Maruti Suzuki Financial Statment NewDocument4 pagesMaruti Suzuki Financial Statment NewMasoud Afzali100% (1)

- Financial StatementDocument2 pagesFinancial StatementAlisha OberoiNo ratings yet

- Financial Ratio AnalysisDocument6 pagesFinancial Ratio AnalysisSatishNo ratings yet

- AnandamDocument12 pagesAnandamNarinderNo ratings yet

- Akshat SarvaiyaDocument36 pagesAkshat SarvaiyaAchal SharmaNo ratings yet

- Tata Motors DCFDocument11 pagesTata Motors DCFChirag SharmaNo ratings yet

- Company Name: Reneta LTD.: Group MemberDocument19 pagesCompany Name: Reneta LTD.: Group MemberMehenaj Sultana BithyNo ratings yet

- Earnings Quality Score % 84 72: PT Kalbe Farma TBKDocument5 pagesEarnings Quality Score % 84 72: PT Kalbe Farma TBKHari HikmawanNo ratings yet

- Hindustan Unilever LTD.: Cash Flow Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. MillionDocument2 pagesHindustan Unilever LTD.: Cash Flow Summary: Mar 2010 - Mar 2019: Non-Annualised: Rs. Millionandrew garfieldNo ratings yet

- AVIS CarsDocument10 pagesAVIS CarsSheikhFaizanUl-HaqueNo ratings yet

- in Rs. Cr.Document20 pagesin Rs. Cr.tanuj_mohantyNo ratings yet

- Shree Cement DCF ValuationDocument71 pagesShree Cement DCF ValuationPrabhdeep DadyalNo ratings yet

- Analisis KeuanganDocument13 pagesAnalisis KeuanganMichael SaragiNo ratings yet

- Balance Sheet: Sources of FundsDocument6 pagesBalance Sheet: Sources of FundsTarun GuptaNo ratings yet

- Wipro: Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05 Mar ' 04 Owner's FundDocument4 pagesWipro: Mar ' 08 Mar ' 07 Mar ' 06 Mar ' 05 Mar ' 04 Owner's FundManikantha PatnaikNo ratings yet

- Fa - Assignment LaxmiDocument36 pagesFa - Assignment Laxmilaxmi joshiNo ratings yet

- Maruti Suzuki (Latest)Document44 pagesMaruti Suzuki (Latest)utskjdfsjkghfndbhdfnNo ratings yet

- Consolidated Balance Sheet: Wipro TCS InfosysDocument4 pagesConsolidated Balance Sheet: Wipro TCS Infosysvineel kumarNo ratings yet

- Financial Ratio Analysis - BMDocument18 pagesFinancial Ratio Analysis - BMKrishnamoorthy VijayalakshmiNo ratings yet

- Vertical Analysis To Financial StatementsDocument8 pagesVertical Analysis To Financial StatementsumeshNo ratings yet

- 11 - Eshaan Chhagotra - Maruti Suzuki Ltd.Document8 pages11 - Eshaan Chhagotra - Maruti Suzuki Ltd.rajat_singlaNo ratings yet

- Source of Growth in in ComeDocument2 pagesSource of Growth in in ComesettiNo ratings yet

- Consolidated Balance Sheet (Rs. in MN)Document24 pagesConsolidated Balance Sheet (Rs. in MN)prernagadiaNo ratings yet

- DR Reddy Lab 5 Year DataDocument4 pagesDR Reddy Lab 5 Year Datashishir5087No ratings yet

- WiproDocument9 pagesWiprorastehertaNo ratings yet

- All Number in Thousands)Document7 pagesAll Number in Thousands)Lauren LoshNo ratings yet

- Avis and Herz CarDocument11 pagesAvis and Herz CarSheikhFaizanUl-HaqueNo ratings yet

- Infosys Excel FinalDocument44 pagesInfosys Excel FinalAnanthkrishnanNo ratings yet

- HYUNDAI Motors Balance SheetDocument4 pagesHYUNDAI Motors Balance Sheetsarmistha guduliNo ratings yet

- Bhushan Steel LTD (BHUS IN) - Balance SheetDocument4 pagesBhushan Steel LTD (BHUS IN) - Balance SheetVamsi GunturuNo ratings yet

- UntitledDocument8 pagesUntitledShubham SarafNo ratings yet

- Comparitive Financial Statement of Reliance Industries For Last 5 YearsDocument33 pagesComparitive Financial Statement of Reliance Industries For Last 5 YearsPushkraj TalwadkarNo ratings yet

- Cash Flow Statement For AAPLDocument2 pagesCash Flow Statement For AAPLEzequiel FriossoNo ratings yet

- Shivam JN23PgDocument32 pagesShivam JN23Pggaurav.jain.25nNo ratings yet

- Onsolidated Balance Sheet of Jet Airways - in Rs. Cr.Document11 pagesOnsolidated Balance Sheet of Jet Airways - in Rs. Cr.Anuj SharmaNo ratings yet

- Asian PaintsDocument38 pagesAsian PaintsKartikai MehtaNo ratings yet

- LDG - Financial TemplateDocument20 pagesLDG - Financial TemplateQuan LeNo ratings yet

- Reliance Industries LTD.: Assignment 2Document27 pagesReliance Industries LTD.: Assignment 2Vishal RajNo ratings yet

- Shell Financial Data BloombergDocument48 pagesShell Financial Data BloombergShardul MudeNo ratings yet

- Tata SteelDocument10 pagesTata SteelSakshi ShahNo ratings yet

- M Saeed 20-26 ProjectDocument30 pagesM Saeed 20-26 ProjectMohammed Saeed 20-26No ratings yet

- DR ReddyDocument30 pagesDR ReddySanjana SinghNo ratings yet

- Financial Statements of WiproDocument2 pagesFinancial Statements of WiprohoppoosanaullahNo ratings yet

- Kshitij Goyal FM Ass 1 MARUTI SUZUKI INDIA LTDDocument7 pagesKshitij Goyal FM Ass 1 MARUTI SUZUKI INDIA LTDAngle PriyaNo ratings yet

- Seema Ma'amDocument14 pagesSeema Ma'ampranav chauhanNo ratings yet

- SurajDocument9 pagesSurajUjjwalNo ratings yet

- Asian Paints DCF ValuationDocument64 pagesAsian Paints DCF Valuationsanket patilNo ratings yet

- Accounts Cia: Submitted By: RISHIKESH DHIR (1923649) PARKHI GUPTA (1923643)Document12 pagesAccounts Cia: Submitted By: RISHIKESH DHIR (1923649) PARKHI GUPTA (1923643)RISHIKESH DHIR 1923649No ratings yet

- Cashflow of PowergridDocument2 pagesCashflow of PowergridSunil RathodNo ratings yet

- Tata Steel FinancialsDocument8 pagesTata Steel FinancialsManan GuptaNo ratings yet

- Medical Shop Business PlanDocument16 pagesMedical Shop Business PlanPrajwal Vemala JagadeeshwaraNo ratings yet

- Annual Results in BriefDocument8 pagesAnnual Results in BriefPrashanthDalawaiNo ratings yet

- Annual Financials For Tata Motors LTD: All Amounts in Millions Except Per Share AmountsDocument8 pagesAnnual Financials For Tata Motors LTD: All Amounts in Millions Except Per Share AmountsPawanLUMBANo ratings yet

- Singtel 2007 - 2008 Financial Report AnalysisDocument23 pagesSingtel 2007 - 2008 Financial Report Analysisthanhha19850% (1)

- Financial Statements of WiproDocument2 pagesFinancial Statements of WiproPraveen Reddy100% (1)

- Financial StatementsDocument14 pagesFinancial Statementsthenal kulandaianNo ratings yet

- Ratio Analysis of Engro Vs NestleDocument24 pagesRatio Analysis of Engro Vs NestleMuhammad SalmanNo ratings yet

- Bursa Anywhere Is Bursa Malaysia Depository's Electronic Platform That Enables The Depositors To Access, Manage, Execute CDS Transactions and Receive CDS Notifications ElectronicallyDocument11 pagesBursa Anywhere Is Bursa Malaysia Depository's Electronic Platform That Enables The Depositors To Access, Manage, Execute CDS Transactions and Receive CDS Notifications ElectronicallyNajmi IshakNo ratings yet

- RHB Islamic Bond Fund - FFS - 0220 PDFDocument2 pagesRHB Islamic Bond Fund - FFS - 0220 PDFNajmi IshakNo ratings yet

- Wahed FTSE USA Shariah ETF: FactsheetDocument4 pagesWahed FTSE USA Shariah ETF: FactsheetNajmi IshakNo ratings yet

- Prospectus 07 10 2019 Wahed Definitive Prospectus FINAL PublicDocument15 pagesProspectus 07 10 2019 Wahed Definitive Prospectus FINAL PublicNajmi IshakNo ratings yet

- Kimlun Corporation (BUY EPS ) : HLIB ResearchDocument2 pagesKimlun Corporation (BUY EPS ) : HLIB ResearchNajmi IshakNo ratings yet

- Weight Loss Monitoring: August Weight September Weight 1 1 2 2 3 3 4 4 5 5 6 6 7 7 8 8 9 9Document9 pagesWeight Loss Monitoring: August Weight September Weight 1 1 2 2 3 3 4 4 5 5 6 6 7 7 8 8 9 9Najmi Ishak100% (1)

- Esh Legal Requirement: Activity/ Incident Requirement ClauseDocument3 pagesEsh Legal Requirement: Activity/ Incident Requirement ClauseNajmi IshakNo ratings yet

- CHP 4 Conception and DesignDocument37 pagesCHP 4 Conception and DesignNajmi IshakNo ratings yet

- GuidelinesOnTheEstimationProceduresForTrafficManageme PDFDocument52 pagesGuidelinesOnTheEstimationProceduresForTrafficManageme PDFNajmi IshakNo ratings yet

- Resipi Nasi Goreng PakapauDocument2 pagesResipi Nasi Goreng PakapauNajmi IshakNo ratings yet

- Scaffolding DiagramDocument4 pagesScaffolding DiagramNajmi IshakNo ratings yet

- Click Here For The Full Text of The CaseDocument11 pagesClick Here For The Full Text of The CaseduanepoNo ratings yet

- Final ReportDocument111 pagesFinal ReportLakshmi NagurNo ratings yet

- Customer Satisfaction On Housing Loan in SBI BankDocument23 pagesCustomer Satisfaction On Housing Loan in SBI BankDebjyoti Rakshit100% (2)

- ChecklistDocument4 pagesChecklistAmar Nath PrasadNo ratings yet

- Credit Management System of IFIC Bank LTDDocument73 pagesCredit Management System of IFIC Bank LTDHasib SimantoNo ratings yet

- LIM TONG LIM Vs Phil Fishing GearDocument3 pagesLIM TONG LIM Vs Phil Fishing GearRhea Mae A. SibalaNo ratings yet

- Pure Play Method of Divisional Beta (CA 2002)Document4 pagesPure Play Method of Divisional Beta (CA 2002)So LokNo ratings yet

- Ms8-Set C Midterm - With AnswersDocument5 pagesMs8-Set C Midterm - With AnswersOscar Bocayes Jr.No ratings yet

- Development Project Proposal/Proforma (DPP)Document26 pagesDevelopment Project Proposal/Proforma (DPP)Mehedi Hasan100% (1)

- 2.recording Financial TransactionsDocument10 pages2.recording Financial TransactionsGetrude MazimbaNo ratings yet

- CmaDocument175 pagesCmasmarzooqNo ratings yet

- Unit 7Document16 pagesUnit 7Roma MunjalNo ratings yet

- How To Get Business Credit Approvals?Document6 pagesHow To Get Business Credit Approvals?smallbusinessloan100% (6)

- MGMT 3000 Assignment 2016 v9 Miri (Final) - Copy - BlackboardDocument14 pagesMGMT 3000 Assignment 2016 v9 Miri (Final) - Copy - BlackboardSahanNo ratings yet

- Feasibility StudyDocument169 pagesFeasibility StudySean Bolden100% (2)

- Affidavit of Adverse ClaimDocument2 pagesAffidavit of Adverse ClaimMagdalena TabaniagNo ratings yet

- Budget-Terminologies and Concepts: Classification of Expenditure of GovernmentDocument3 pagesBudget-Terminologies and Concepts: Classification of Expenditure of GovernmentdassreerenjiniNo ratings yet

- Trowe LoanDocument3 pagesTrowe LoanRosa Caba0% (1)

- Single Premium Endowment Plan-817Document7 pagesSingle Premium Endowment Plan-817api-257142341No ratings yet

- Accounting Sample QuestionsDocument6 pagesAccounting Sample QuestionsScholarsjunction.comNo ratings yet

- Financial MarketsDocument3 pagesFinancial MarketsMicaela EncinasNo ratings yet

- Chapter 2 Financial Statement and Cash Flow AnalysisDocument26 pagesChapter 2 Financial Statement and Cash Flow AnalysisFarooqChaudharyNo ratings yet

- PDIC Vs Philippine Countryside Rural BankDocument2 pagesPDIC Vs Philippine Countryside Rural BankLiliaAzcarraga100% (1)

- Banca San Giovanni Case Study: Fransiskus Allan Gunawan - Indra Tangkas PSDocument3 pagesBanca San Giovanni Case Study: Fransiskus Allan Gunawan - Indra Tangkas PSAllan GunawanNo ratings yet

- FromDocument44 pagesFromRam Avtar GurjarNo ratings yet

- RA 9439 Anti Hospital DetentionDocument2 pagesRA 9439 Anti Hospital DetentionAling KinaiNo ratings yet

- TA Adjestment Bill For StaffDocument5 pagesTA Adjestment Bill For StaffAnonymous m4CnyeKpNo ratings yet

- BIS Bulletin-Central Banks' Response To Covid in Advanced EconomiesDocument9 pagesBIS Bulletin-Central Banks' Response To Covid in Advanced EconomiesGABRIEL ALEXANDER ROLDAN SANCHEZNo ratings yet